70c3f811af26490054ca25442321196e.ppt

- Количество слайдов: 154

国际企业管理 International business

国际企业管理 International business v. John D. Daniels International business. Environments and Operations 《国际商务-环境 与运作》,机械 业出版社,2009 v杜奇华《跨国公司与跨国经营》电子 业出 版社,2008 v. Charles W. L. Hill. Global Business Today, 5 th edition, The Mc. Graw-Hill Companies, Inc. 2008

国际企业管理 International business What will we learn? • Globalization and International Business 全球化与国 际企业 • Environmental Framework 国际环境 • International Trade Theory 国际贸易理论(跨国公司 投资动因) • The Political Economy of International Trade 国际贸 易政策(政治经济性) • Regional Economic Integration 区域经济一体化 • Foreign Direct Investment 对外直接投资

国际企业管理 International business What will we learn? • The Strategy of International Business 国际企业的全球 化战略 • Entering Foreign Market 进入国外市场 • Exporting, importing and countertrade 进出口和对等贸 易 • The Organization of International Business 国际企业的 组织机构 • Marketing Globally 国际企业的营销策略 • Global Manufacturing and Supply Chain Management 国际企业的跨国生产和供应链

Chapter One Globalization and International Business 第一章 全球化和国际企业 Objectives: ØTo define international business ØTo understand why companies engage in international business ØTo become familiar with different modes a company can use to accomplish its global objectives

Globalization and International Business 1. International business: all commercial transactions-private and governmental; sales, investments and transportation-that take place between two or more countries. 国际商务:在两个或者两个以上国家里进行 销售、投资和运输等经营活动 It may take many forms: multinational enterprises (MNE), multinational corporations (MNC), transnational corporations (TNC): 国际 企业、跨国公司、多国公司

Globalization and International Business v Citigroup credit cards v Coca-Cola soft drinks v Sony Play. Station video games v Mc. Donald’s hamburgers v Starbucks coffee v IKEA furniture v Wal-Mart supermarket v Microsoft windows v Procter & Gamble

Globalization and International Business 2. The forces behind globalization: 推动国际化的因素 ØThe “made in” label (globalization of production): what is their origin ØTechnology is expanding, especially in transportation and communications. Only about a century and a quarter ago, Verne fantasized about people traveling around the world in just 80 days. Now, we take it for granted. ØInstitutions provide services. (bank, insurance company) ØGovernments are removing international restrictions. ØConsumers know about and want foreign goods and services.

Globalization and International Business 3. Why companies engage in international business 企业国际化的原因: ØTo expand sales: sales is dependent on the customers’ interest and their willingness and ability to buy. There are obviously more people in the world than in any single country. ØTo acquire resources ØTo minimize risk: in the early 21 st century, Nestle experienced slower growth in Western Europe and US, but this slower growth was offset by higher growth in Asia, Eastern Europe and Latin America.

Globalization and International Business Case: Disney Theme Parks • Tokyo Disneyland (opened in 1983; the Oriental Land Company of Japan owns the park; Disney provided master planning, design, manufacturing and training services during construction, and consultation after completion. Disney receives royalties from admissions and from merchandise and food sales. The amusement park is somewhat a paradox, a replica of Disneyland while a few adaptations; ) • Tokyo Disney. Sea • Disneyland Paris (a failure at the beginning; opened in 1992; belief in its destruction of French culture, farmer’s anger) • Hong Kong Disneyland (reason for Disney’s interest: population, China’s one child per family policy, better infrastructure, largest tourism destination) • Walt Disneyland Studio • Disneyland Shanghai will be ready

Globalization and International Business Case: Disney Theme Parks Question: what factors in the external environment have contributed to Disney’s success, failure, and adjustments in foreign theme park operations?

Globalization and International Business 4. Modes of International Business: (1) Merchandise exports and imports (visible export and import) 商品进出口 Merchandise exports: tangible products-goodssent out of a country Merchandise imports: goods brought into a country For most countries, exporting and importing of goods are the major sources of international revenue and expenditures.

Globalization and International Business 4. Modes of International Business: (2) Service exports and imports 服务贸易进出口: tourism and transportation, project contracting (BOT build-operate-transfer, Turnkey operation), franchising and licensing, management contract, technology transfer, information technology, banking and insurance 旅游和运输、 程承包(BOT、交钥匙 程)、特许 经营和许可、管理合约、技术转让、信息技术、金融 和保险

Globalization and International Business Turnkey operation 交钥匙 程: Ø defined as a product or service concept that is complete, installed and ready to use upon delivery or installation. The product or service is then leased or sold to an individual to run as his/her own venture. Ø a deal where a company takes all responsibility for constructing, fitting and staffing a building (such as a school, hospital or factory) so that it is completely ready for the purchaser to take over.

Globalization and International Business BOT build-operate-transfer 建设-运营-移交: Ø a form of project financing, wherein a private entity receives a concession from the private or public sector to finance, design, construct, and operate a facility stated in the concession contract. Ø Traditionally, such projects provide for the infrastructure to be transferred to the government at the end of the concession period. 是政府同私营机构的项目公司签订合同,由项目公司融资和建设基 础设施项目。项目公司在协议期内拥有、运营和维护这项设施,通 过收取使用费或服务费回收投资,并取得合理利润,协议期满后这 项设施的所有权无偿移交给政府。

Globalization and International Business Technology transfer 技术转让: the process of skill transferring, knowledge, technologies, methods of manufacturing, samples of manufacturing and facilities among governments and other institutions to ensure that scientific and technological developments are accessible to a wider range of users who can then further develop and exploit the technology into new products, processes, applications, materials or services.

Globalization and International Business Franchising 特许经营: Ø a mode of business in which one party (the franchisor) allows another party (the franchisee) to use a trademark that is an essential asset for the franchisee’s business. Ø The franchisor, such as Mc. Donald, also assists on a continuing basis in the operation of the business- for example, by providing components, management services, and technology.

Globalization and International Business Licensing 许可: Ø an authorization (by the licensor) to use the licensed material (by the licensee) Ø When companies allow others to use their assets, such as trademarks, patents, copyrights, or expertise under contracts, also known as licensing agreements, they receive earnings called royalties.

Globalization and International Business Management contract 管理合约: Ø Arrangements in which one company provides personnel to perform general or specialized management functions for another company. Ø Disney receives management fees from managing theme parks in France and Japan.

Globalization and International Business 4. Modes of International Business: (3) Investments 投资: Direct investment (foreign direct investment FDI 对外直接投资):the net inflows of investment to acquire a lasting management interest (10 percent or more of voting stock) in an enterprise operating in an economy.

Globalization and International Business 4. Modes of International Business: (3) Investments 投资: Foreign direct investment FDI 对外直接投资 The foreign direct investor may acquire voting power of an enterprise in an economy through any of the following methods: • by incorporating a wholly owned subsidiary or company 独资 • by acquiring shares in an associated enterprise 获取股份 • through a merger or an acquisition of an unrelated enterprise 兼并 收购 • participating in an equity joint venture with another investor or enterprise 合资

Globalization and International Business 4. Modes of International Business: (3) Investments 投资: Portfolio investment 投资组合:noncontrolling interest in a company or ownership of a loan to another party. 非控制性股权 It may take one of two forms: Ø stock in a company 股票 Ø loans to a company or country in the form of bonds, bills, or notes that the investor purchases. 债 券、票据

Chapter Two Environmental Framework 第二章 国际环境 Objectives: ØThe cultural and social environment ØThe political and legal environment ØThe economic environment

Environmental Framework 1. Cultural and social environment: (1) Cultural awareness: Ø Language Ø Religion Ø Performance orientation: competition or cooperation Ø Gender Ø Age Ø Family Ø Occupation

Environmental Framework 1. Cultural and social environment: (1) Cultural awareness Work motivation: Ø Materialism and leisure Ø Expectation of success and reward Ø Assertiveness Ø Need hierarchy

Environmental Framework 1. Cultural and social environment: (1) Cultural awareness Relationship preferences: Ø Power distance Ø Individualism vs collectivism Risk-taking behavior Ø Uncertainty avoidance Ø Trust Ø Future orientation Ø Fatalism

Environmental Framework 1. Cultural and social environment: (1) Cultural awareness Communication: Ø Spoken and written language Ø Silent language

Environmental Framework 1. Cultural and social environment: (2) Social Stratification and Social Mobility v All societies are stratified on a hierarchical basis into social categories—that is, into social strata. v These strata are typically defined on the basis of characteristics such as family background, occupation, and income. Individuals are born into a particular stratum. They become a member of the social category to which their parents belong.

Environmental Framework 1. Cultural and social environment: (2) Social Stratification and Social Mobility v Social mobility refers to the extent to which individuals can move out of the strata into which they are born.

Environmental Framework 2. The political and legal environment: (1) DEMOCRACY AND TOTALITARIANISM: v Democracy refers to a political system in which government is by the people, exercised either directly or through elected representatives. v Totalitarianism is a form of government in which one person or political party exercises absolute control over all spheres of human life and prohibits opposing political parties.

Environmental Framework 2. The political and legal environment: (1) DEMOCRACY AND TOTALITARIANISM: v PROPERTY RIGHTS AND CORRUPTION: Property rights can be violated in two ways—through private action and through public action v Private action v Public action can be done through legal mechanisms such as levying excessive taxation, requiring expensive licenses or permits from property holders, taking assets into state ownership without compensating the owners, or redistributing assets without compensating the prior owners. It can also be done through illegal means, or corruption, by demanding bribes from businesses in return for the rights to operate in a country, industry, or location.

Environmental Framework 2. The political and legal environment: (2) Economic Systems: MARKET ECONOMY. In a pure market economy, all productive activities are privately owned, as opposed to being owned by the state. The goods and services that a country produces are not planned by anyone. Production is determined by the interaction of supply and demand signaled to producers through the price system. In this system consumers are sovereign. The purchasing patterns of consumers, as signaled to producers through the mechanism of the price system, determine what is produced and in what quantity.

Environmental Framework 2. The political and legal environment: (2) Economic Systems: COMMAND ECONOMY. In a pure command economy, the government plans the goods and services that a country produces, the quantity in which they are produced, and the prices at which they are sold.

Environmental Framework 2. The political and legal environment: (2) Economic Systems: MIXED ECONOMY In a mixed economy, certain sectors of the economy are left to private ownership and free market mechanisms while other sectors have significant state ownership and government planning.

Environmental Framework 2. The political and legal environment: (3) Intellectual property Property that is the product of intellectual activity, such as computer software, a screenplay, a music score, or the chemical formula for a new drug. Patents, copyrights, and trademarks establish ownership rights over intellectual property. The philosophy behind intellectual property laws is to reward the originator of a new invention, book, musical record, clothes design, restaurant chain, and the like, for his or her idea and effort. Such laws stimulate innovation and creative work.

Environmental Framework 3. The economic environment: (1) DIFFERENCES IN ECONOMIC DEVELOPMENT v One common measure of economic development is a country’s gross national income (GNI) per head of population. v To account for differences in the cost of living, one can adjust GNI per capita by purchasing power. Referred to as a purchasing power parity (PPP) adjustment, it allows for a more direct comparison of living standards in different countries.

Environmental Framework 3. The economic environment: (2) FEATURES OF AN ECONOMY v Inflation is the pervasive and sustained rise in the aggregate level of prices measured by an index of the cost of various goods and services. v Unemployment rate is the number of unemployed workers divided by the total civilian labor force, which includes both the unemployed and those with jobs. v Debt, the sum total of a government’s financial obligations, measures the state’s borrowing from its population, from foreign organizations, from foreign governments, and from international institutions.

Environmental Framework 3. The economic environment: (2) FEATURES OF AN ECONOMY v Income distribution describes what share of income goes to what segments of the population. v 20 percent of the world population claims roughly 86 percent of the world’s income, whereas the bottom 20 percent has about 1 percent. v China projects urban income will be seven times as much as rural income in 2020.

Environmental Framework 3. The economic environment: (2) FEATURES OF AN ECONOMY v The balance of payments: the Statement of International Trade – – – Balance of payments: a record of a country’s international transactions Current account: trade on goods and services and income from assets abroad Capital account: transactions in real or financial assets between countries, such as the sale of real estate to a foreign investor Merchandise trade balance: the net balance of exports minus imports of merchandise Deficit: imports exceed exports; Surplus: export exceeds imports;

Environmental Framework 3. The economic environment: (3) TRANSITION TO A MARKET ECONOMY v Deregulation involves removing legal restrictions to the free play of markets, the establishment of private enterprises, and the manner in which private enterprises operate. v Privatization, transfers the ownership of state property into the hands of private individuals, frequently by the sale of state assets through an auction. v Antitrust laws that encourage the development of industries with as many competing businesses.

Chapter Three International Trade Theory 第三章 国际贸易理论 Objectives: ØTo understand theories of why countries should trade ØTo become familiar with factors affecting countries’ trade patterns

International Trade Theory Basic concept: v Balance of trade 1. Trade Surplus(Exports>Imports,Favorable Balance of Trade) 2. Trade Deficit (Exports<Imports,Unfavorable Balance of Trade) 3. Trade Balance (Exports = Imports) v Trade Structure 1. Commodity Structure 2. Geographical Structure v Dependency of Trade

1. Mercantilism 重商主义

1. Mercantilism (重商主义): n Mercantilism, emerged in England in the midsixteenth century. n What is most important to national wealth and essential to vigorous commerce? The answer is silver and gold. n At that time, gold and silver were the currency of trade between countries; n It was in a country’s best interests to maintain a trade surplus(贸易盈余), to export more than it imported. By doing so, a country would accumulate gold and silver and, consequently, increase its

1. Mercantilism: n n If England had a balance-of-trade surplus with France (it exported more than it imported), the resulting inflow of gold and silver would swell the domestic money supply and generate inflation in England. In France, however, the outflow of gold and silver would have the opposite effect. France’s money supply would contract, and its prices would fall. This change in relative prices between France and England would encourage the French to buy fewer English goods (because they were becoming more expensive) and the English to buy more French goods (because they were becoming cheaper). The result would be a deterioration in the English balance of trade and an improvement in France’s trade balance, until the English surplus was eliminated. Hence, in the long run no country could sustain a surplus in the balance of trade and so accumulate gold and silver as the mercantilists had envisaged.

1. Mercantilism: n n The flaw with mercantilism was that it viewed trade as a zero-sum game (零和博弈). (A zero-sum game is one in which a gain by one country results in a loss by another. ) Neo-mercantilists (新重商主义)equate political power with economic power and economic power with a balance-of trade surplus.

2. Absolute advantage (absolute cost)

Theory of Absolute Advantage Ø Introduced by Adam Smith in his “Wealth of Nations” Ø Absolute Advantage is when one country is more efficient than any other country in producing a particular product.

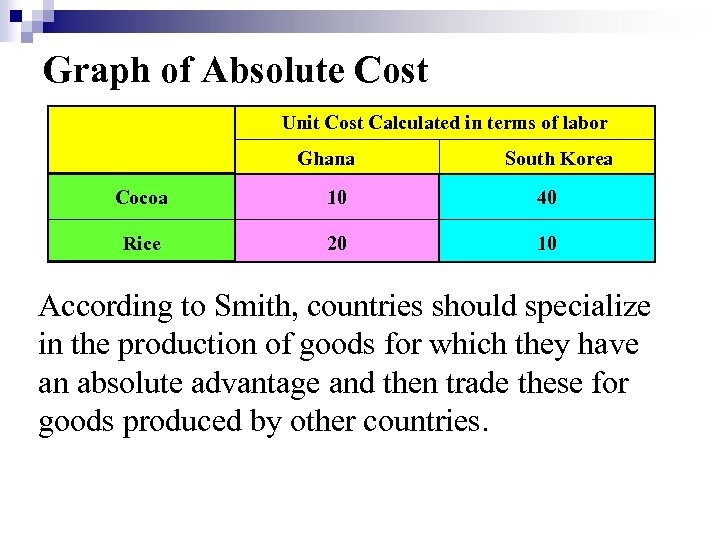

Graph of Absolute Cost Unit Cost Calculated in terms of labor Ghana South Korea Cocoa 10 40 Rice 20 10 According to Smith, countries should specialize in the production of goods for which they have an absolute advantage and then trade these for goods produced by other countries.

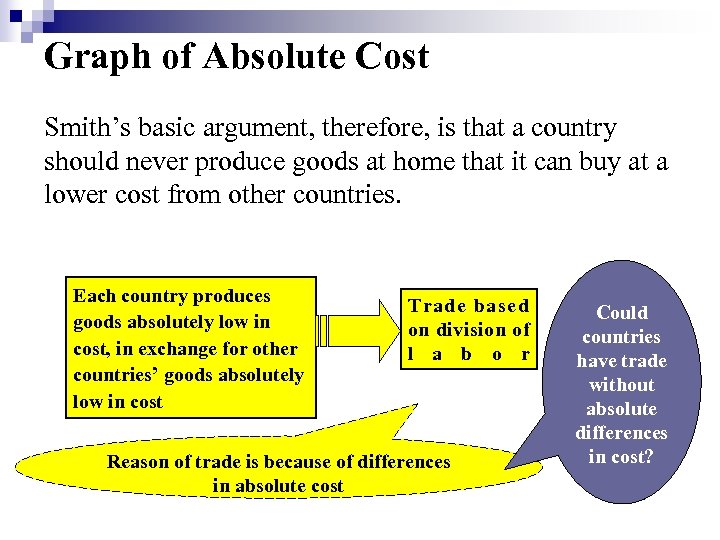

Graph of Absolute Cost Smith’s basic argument, therefore, is that a country should never produce goods at home that it can buy at a lower cost from other countries. Each country produces goods absolutely low in cost, in exchange for other countries’ goods absolutely low in cost Trade based on division of l a b o r Reason of trade is because of differences in absolute cost Could countries have trade without absolute differences in cost?

3. Comparative advantage (comparative cost)

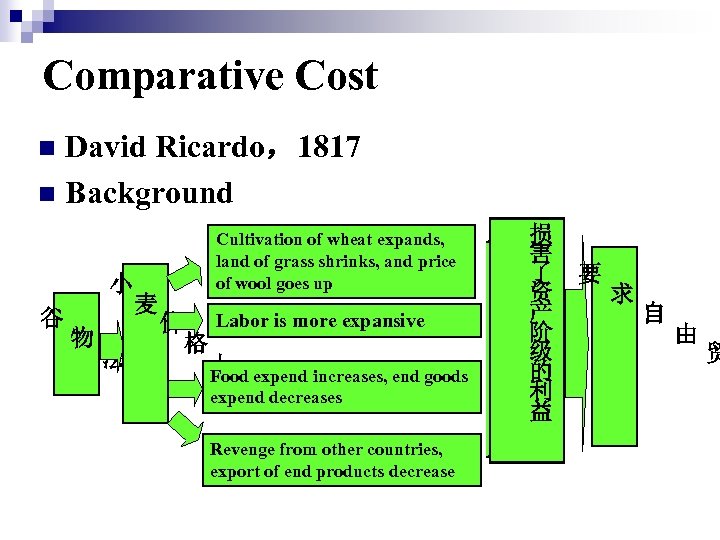

Comparative Cost David Ricardo,1817 n Background n 小 谷 物 法 麦 Cultivation of wheat expands, land of grass shrinks, and price of wool goes up 价 格 Labor is more expansive 上 expend increases, end goods Food 涨 expend decreases Revenge from other countries, export of end products decrease 损 害 了 资 产 阶 级 的 利 益 要 求 自 由 贸

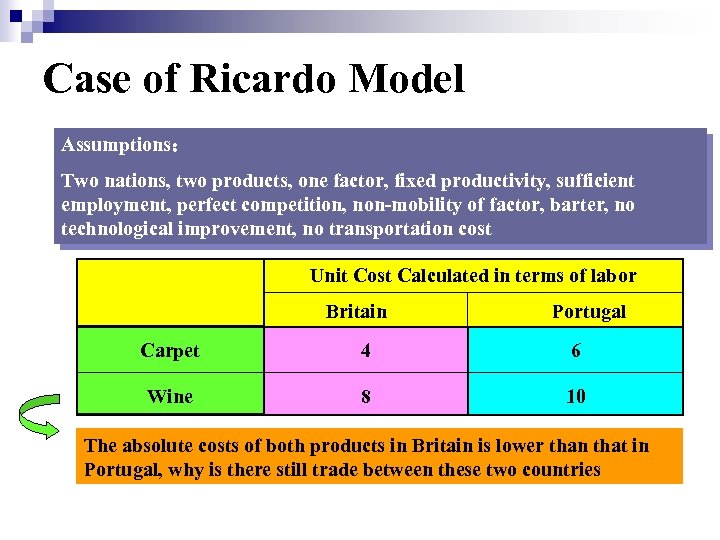

Case of Ricardo Model Assumptions: Two nations, two products, one factor, fixed productivity, sufficient employment, perfect competition, non-mobility of factor, barter, no technological improvement, no transportation cost Unit Cost Calculated in terms of labor Britain Portugal Carpet 4 6 Wine 8 10 The absolute costs of both products in Britain is lower than that in Portugal, why is there still trade between these two countries

A necessary condition of international trade: Comparative cost difference A sufficient condition of international trade: international exchange rate is between domestic exchange rates in both countries. There is benefit from trade Limitation:Why there is comparative cost ?

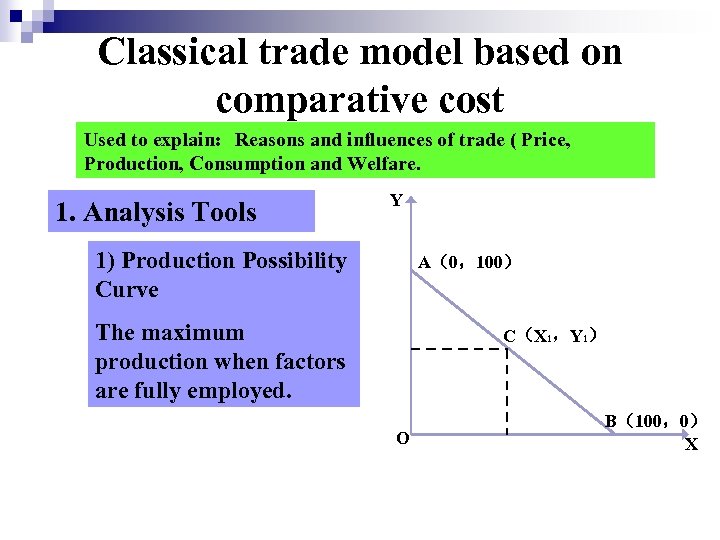

Classical trade model based on comparative cost Used to explain:Reasons and influences of trade ( Price, Production, Consumption and Welfare. 1. Analysis Tools Y 1) Production Possibility Curve A(0,100) The maximum production when factors are fully employed. C(X 1,Y 1) O B(100,0) X

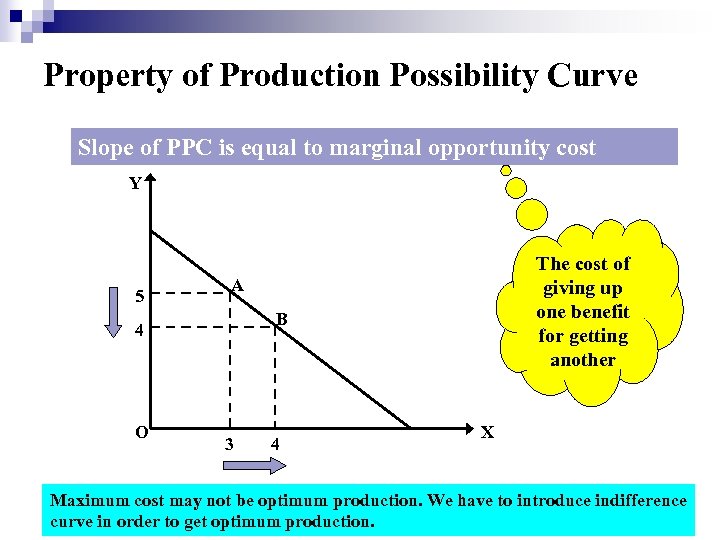

Property of Production Possibility Curve Slope of PPC is equal to marginal opportunity cost Y 5 A B 4 O The cost of giving up one benefit for getting another 3 4 X Maximum cost may not be optimum production. We have to introduce indifference curve in order to get optimum production.

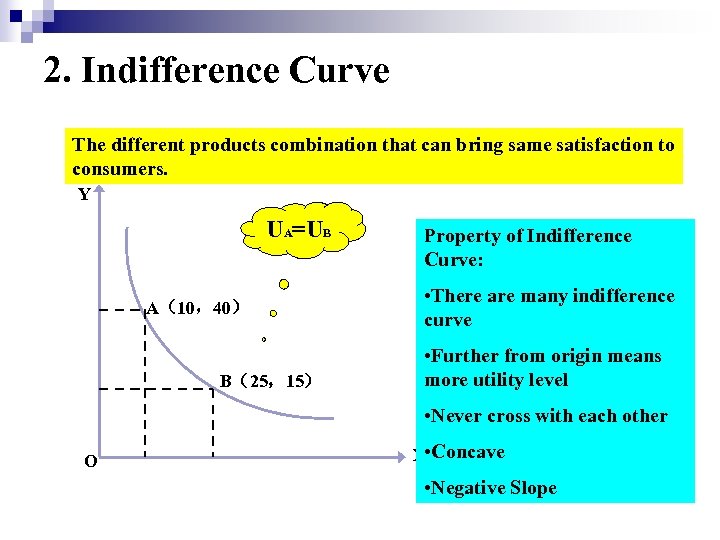

2. Indifference Curve The different products combination that can bring same satisfaction to consumers. Y UA=UB A(10,40) B(25,15) Property of Indifference Curve: • There are many indifference curve • Further from origin means more utility level • Never cross with each other O X • Concave • Negative Slope

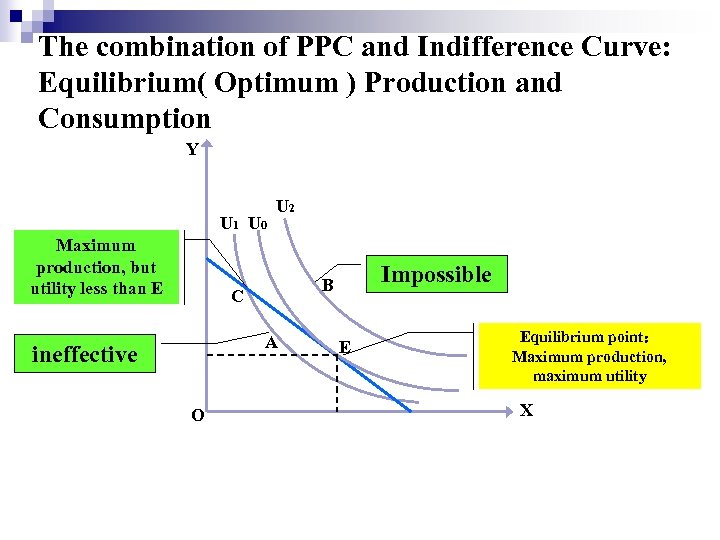

The combination of PPC and Indifference Curve: Equilibrium( Optimum ) Production and Consumption Y U 1 U 0 Maximum production, but utility less than E U 2 C A ineffective O Impossible B E Equilibrium point: Maximum production, maximum utility X

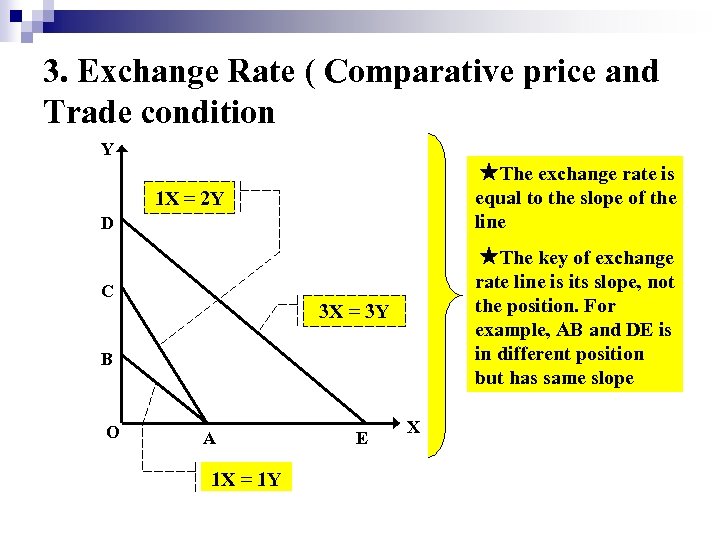

3. Exchange Rate ( Comparative price and Trade condition Y ★The exchange rate is equal to the slope of the line 1 X = 2 Y D C ★The key of exchange rate line is its slope, not the position. For example, AB and DE is in different position but has same slope 3 X = 3 Y B O A 1 X = 1 Y E X

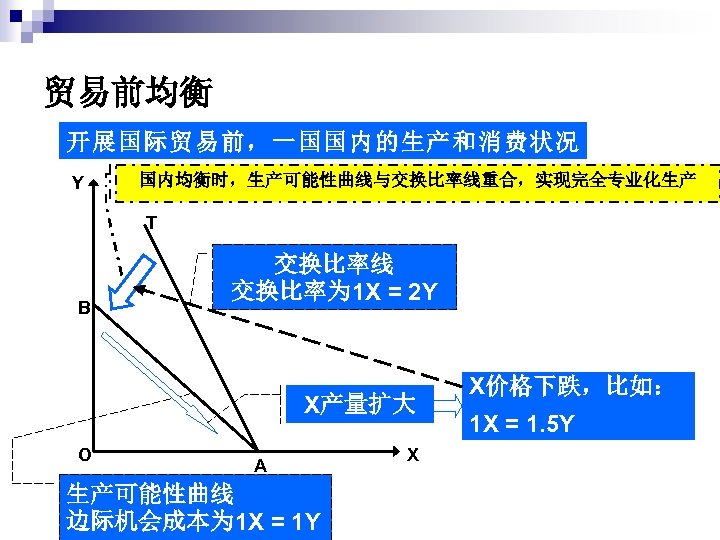

贸易前均衡 开展国际贸易前,一国国内的生产和消费状况 Y 国内均衡时,生产可能性曲线与交换比率线重合,实现完全专业化生产 T B 交换比率线 交换比率为 1 X = 2 Y X产量扩大 O A 生产可能性曲线 边际机会成本为 1 X = 1 Y X X价格下跌,比如: 1 X = 1. 5 Y

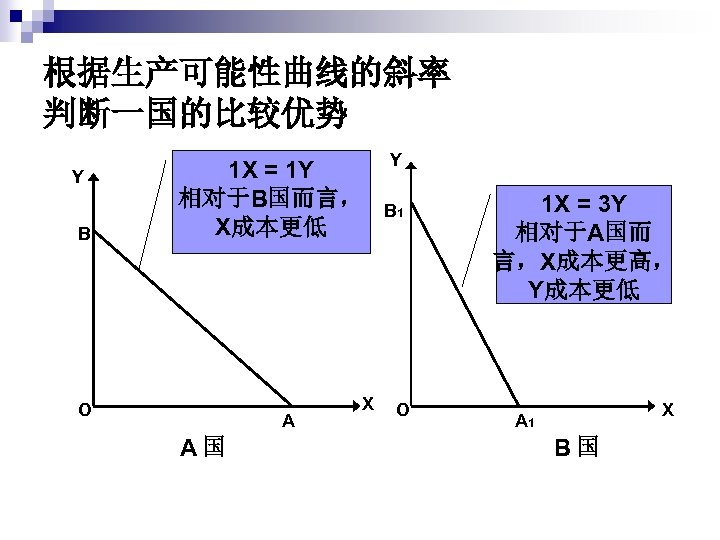

根据生产可能性曲线的斜率 判断一国的比较优势 Y B 1 X = 1 Y 相对于B国而言, X成本更低 O A A国 X Y B 1 O 1 X = 3 Y 相对于A国而 言,X成本更高, Y成本更低 X A 1 B国

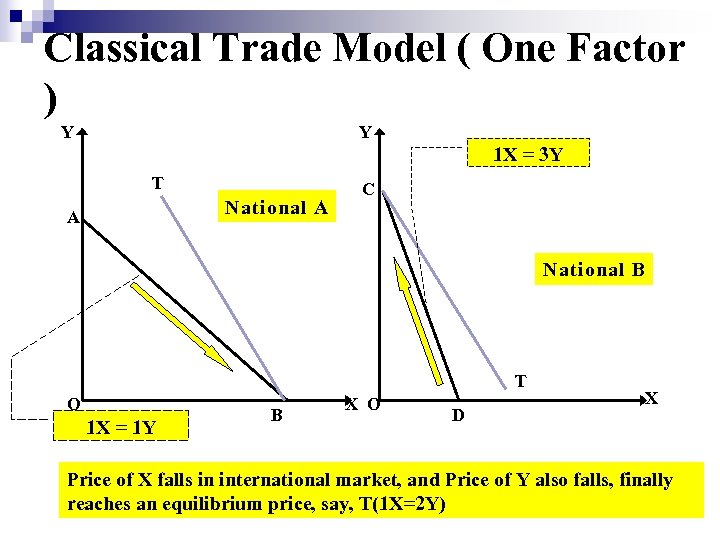

Classical Trade Model ( One Factor ) Y Y 1 X = 3 Y T National A A C National B T O 1 X = 1 Y B X O D X Price of X falls in international market, and Price of Y also falls, finally reaches an equilibrium price, say, T(1 X=2 Y)

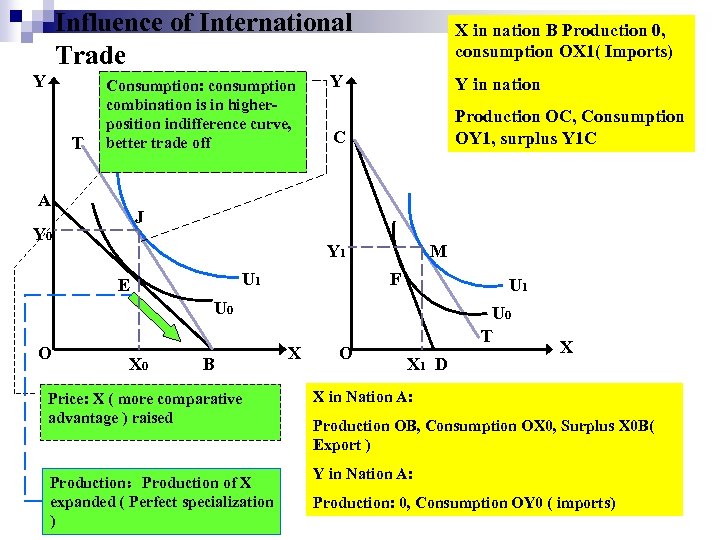

Influence of International Trade Y T Consumption: consumption combination is in higherposition indifference curve, better trade off A X in nation B Production 0, consumption OX 1( Imports) Y Y in nation C Production OC, Consumption OY 1, surplus Y 1 C J Y 0 Y 1 U 1 E M F U 1 U 0 O X 0 B Price: X ( more comparative advantage ) raised Production:Production of X expanded ( Perfect specialization ) X O U 0 T X 1 D X X in Nation A: Production OB, Consumption OX 0, Surplus X 0 B( Export ) Y in Nation A: Production: 0, Consumption OY 0 ( imports)

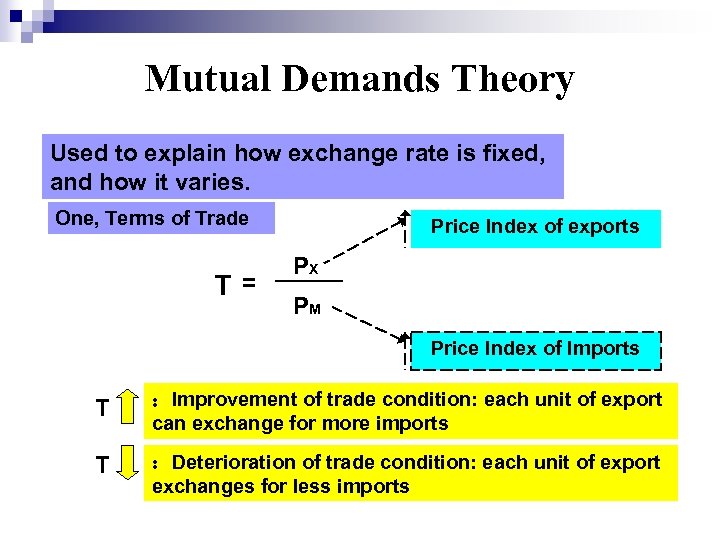

4. Mutual Demands Theory

Mutual Demands Theory Used to explain how exchange rate is fixed, and how it varies. One, Terms of Trade T = Price Index of exports PX PM Price Index of Imports T :Improvement of trade condition: each unit of export can exchange for more imports T :Deterioration of trade condition: each unit of export exchanges for less imports

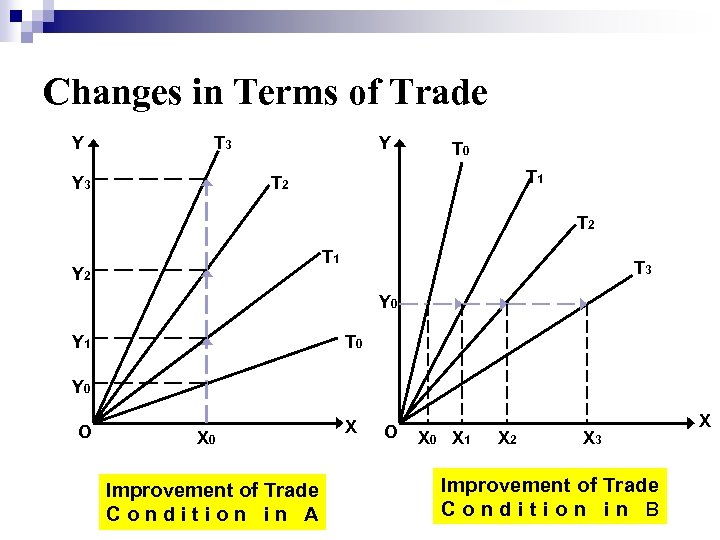

Changes in Terms of Trade Y T 3 Y T 0 T 1 T 2 T 1 Y 2 T 3 Y 0 Y 1 T 0 Y 0 O X 0 Improvement of Trade Condition in A X O X 0 X 1 X 2 X 3 Improvement of Trade Condition in B X

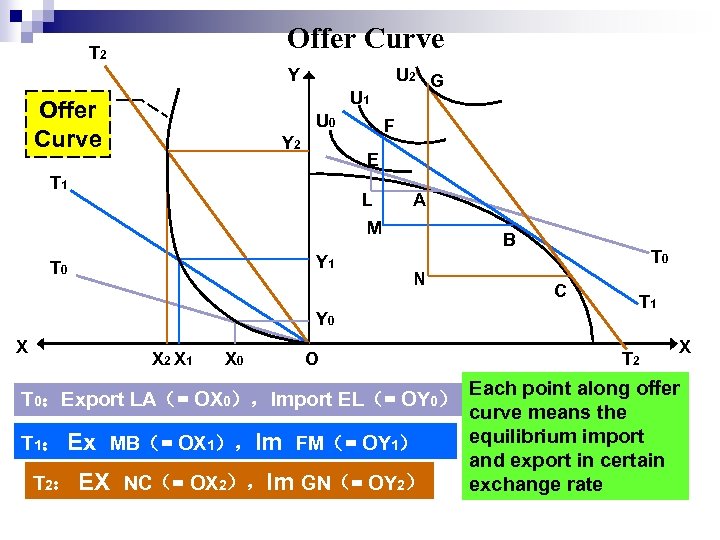

Offer Curve T 2 Y U 2 G U 1 Offer Curve U 0 Y 2 F E T 1 L A M Y 1 T 0 B N Y 0 X X 2 X 1 X 0 O T 0:Export LA(= OX 0),Import EL(= OY 0) T 1: Ex MB(= OX 1),Im FM(= OY 1) T 2: EX NC(= OX 2),Im GN(= OY 2) T 0 C T 1 T 2 X Each point along offer curve means the equilibrium import and export in certain exchange rate

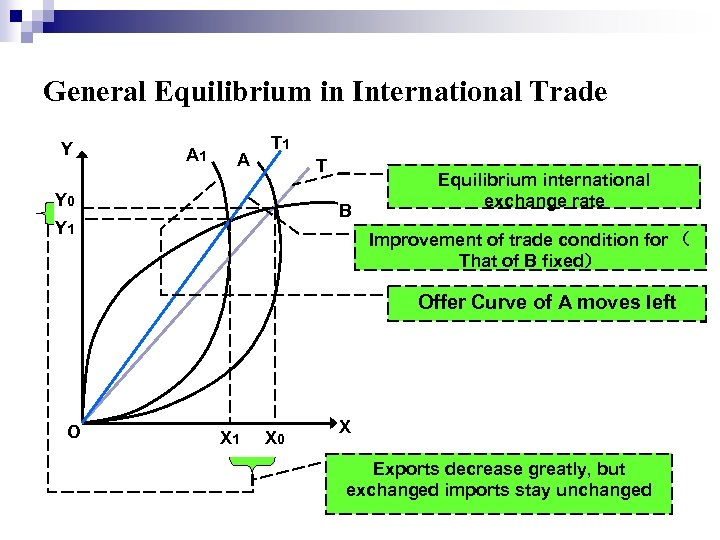

General Equilibrium in International Trade Y A 1 A T 1 T Y 0 B Y 1 Equilibrium international exchange rate Improvement of trade condition for ( That of B fixed) Offer Curve of A moves left O X 1 X 0 X Exports decrease greatly, but exchanged imports stay unchanged

5. Factor Endowment

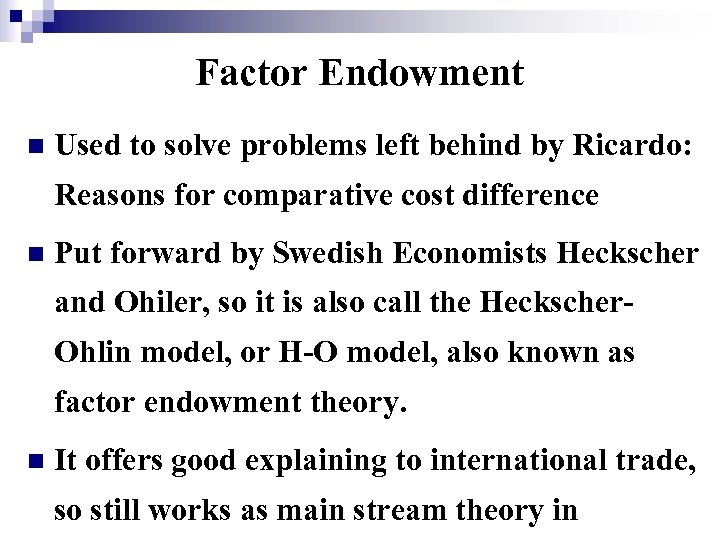

Factor Endowment n Used to solve problems left behind by Ricardo: Reasons for comparative cost difference n Put forward by Swedish Economists Heckscher and Ohiler, so it is also call the Heckscher. Ohlin model, or H-O model, also known as factor endowment theory. n It offers good explaining to international trade, so still works as main stream theory in

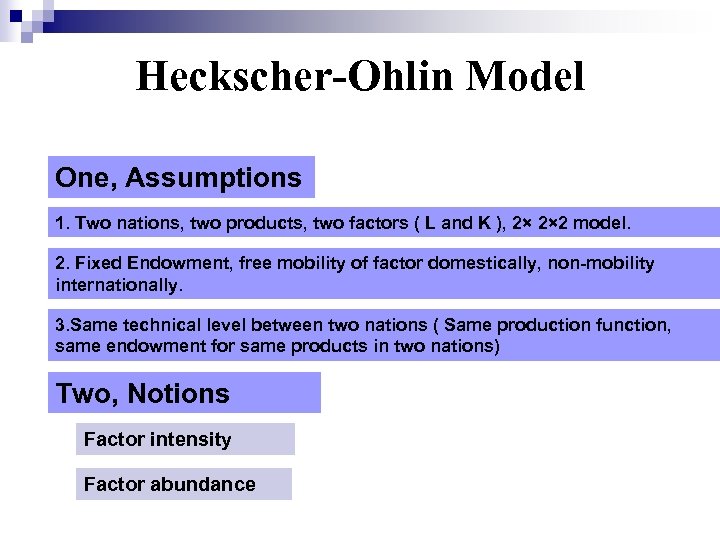

Heckscher-Ohlin Model One, Assumptions 1. Two nations, two products, two factors ( L and K ), 2× 2× 2 model. 2. Fixed Endowment, free mobility of factor domestically, non-mobility internationally. 3. Same technical level between two nations ( Same production function, same endowment for same products in two nations) Two, Notions Factor intensity Factor abundance

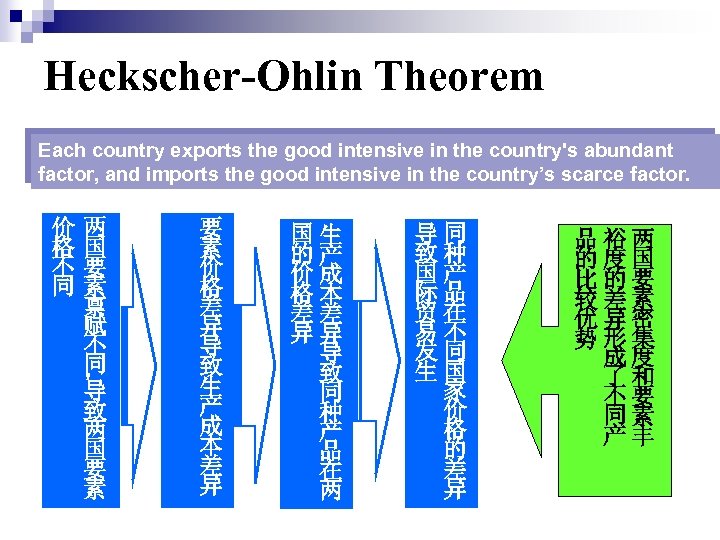

Heckscher-Ohlin Theorem Each country exports the good intensive in the country's abundant factor, and imports the good intensive in the country’s scarce factor. 价 格 不 同 两 国 要 素 禀 赋 不 同 , 导 致 两 国 要 素 价 格 差 异 导 致 生 产 成 本 差 异 国生 的产 价成 格本 差差 异异 导 致 同 种 产 品 在 两 导同 致种 国产 际品 贸在 易不 发同 生国 家 价 格 的 差 异 品裕两 的度国 比的要 较差素 优异密 势形集 成度 了和 不要 同素 产丰

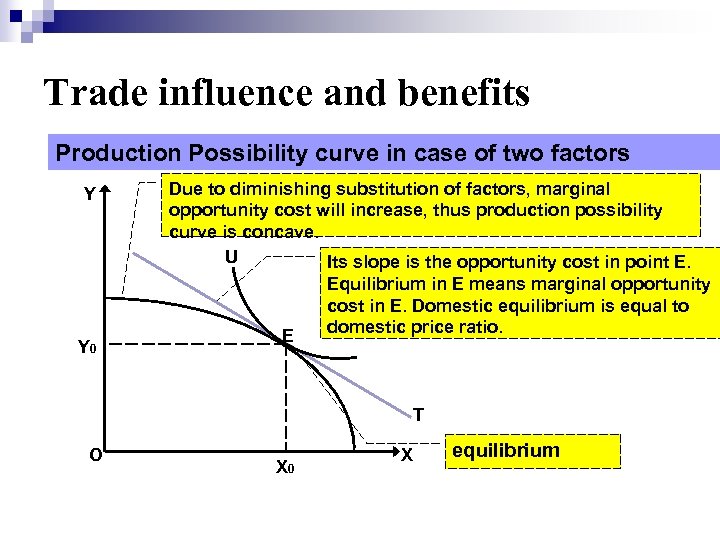

Trade influence and benefits Production Possibility curve in case of two factors Y Y 0 Due to diminishing substitution of factors, marginal opportunity cost will increase, thus production possibility curve is concave. U Its slope is the opportunity cost in point E. E Equilibrium in E means marginal opportunity cost in E. Domestic equilibrium is equal to domestic price ratio. T O X 0 X equilibrium

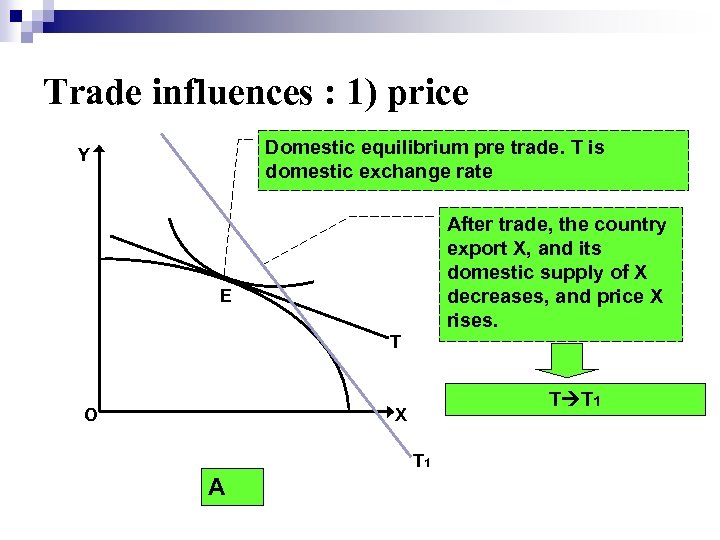

Trade influences : 1) price Domestic equilibrium pre trade. T is domestic exchange rate Y After trade, the country export X, and its domestic supply of X decreases, and price X rises. E T O T T 1 X T 1 A

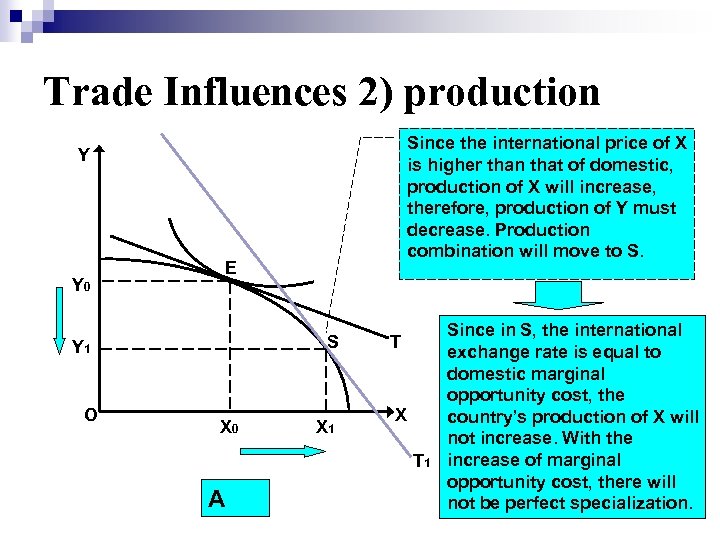

Trade Influences 2) production Since the international price of X is higher than that of domestic, production of X will increase, therefore, production of Y must decrease. Production combination will move to S. Y Y 0 E S Y 1 O X 0 X 1 T X T 1 A Since in S, the international exchange rate is equal to domestic marginal opportunity cost, the country’s production of X will not increase. With the increase of marginal opportunity cost, there will not be perfect specialization.

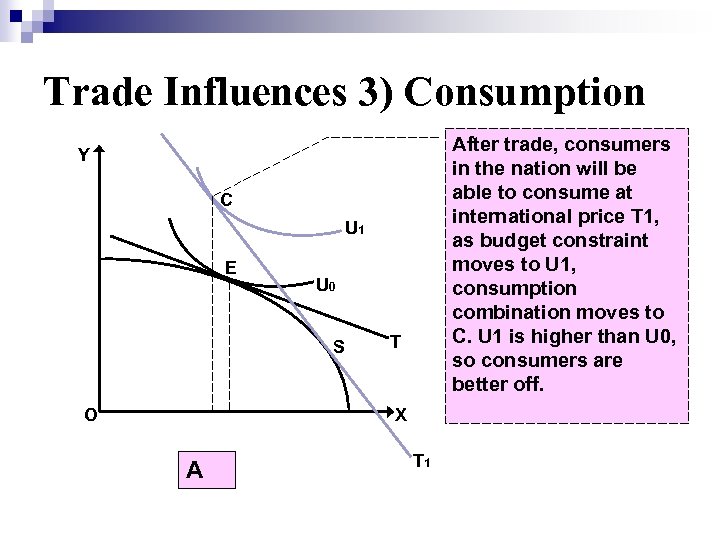

Trade Influences 3) Consumption After trade, consumers in the nation will be able to consume at international price T 1, as budget constraint moves to U 1, consumption combination moves to C. U 1 is higher than U 0, so consumers are better off. Y C U 1 E U 0 S O T X A T 1

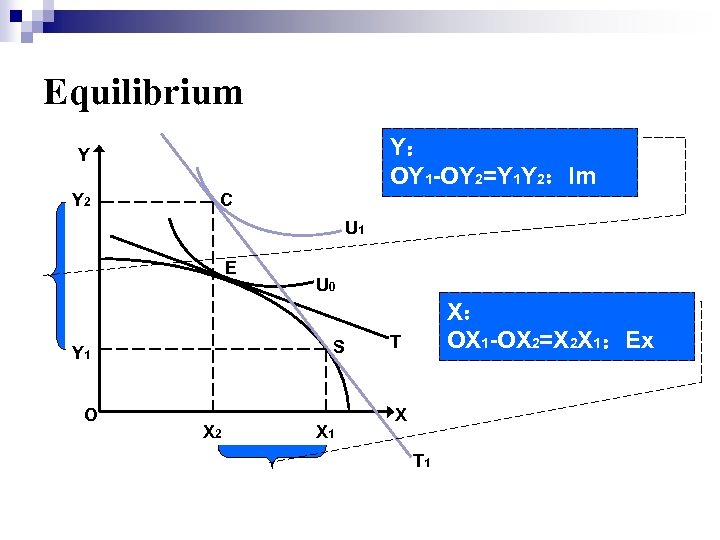

Equilibrium Y: OY 1 -OY 2=Y 1 Y 2:Im Y Y 2 C U 1 E S Y 1 O U 0 X 2 X 1 X: OX 1 -OX 2=X 2 X 1:Ex T X T 1

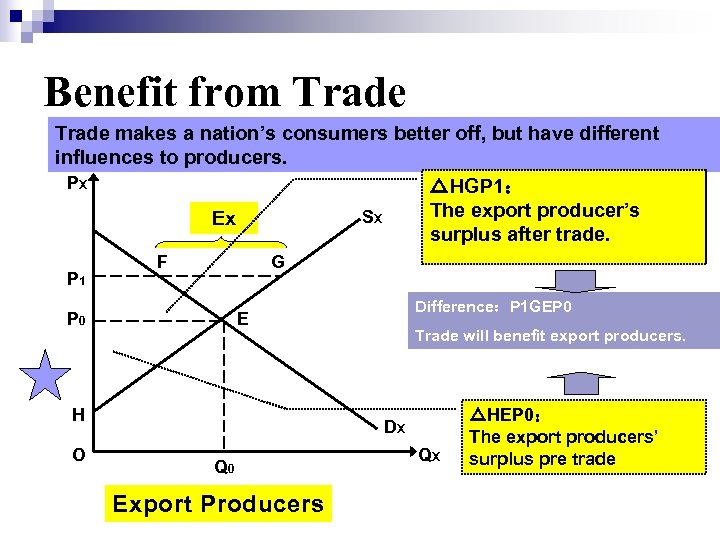

Benefit from Trade makes a nation’s consumers better off, but have different influences to producers. PX △HGP 1: The export producer’s SX Ex surplus after trade. P 1 F G P 0 E H O Difference:P 1 GEP 0 Trade will benefit export producers. DX Q 0 Export Producers QX △HEP 0: The export producers’ surplus pre trade

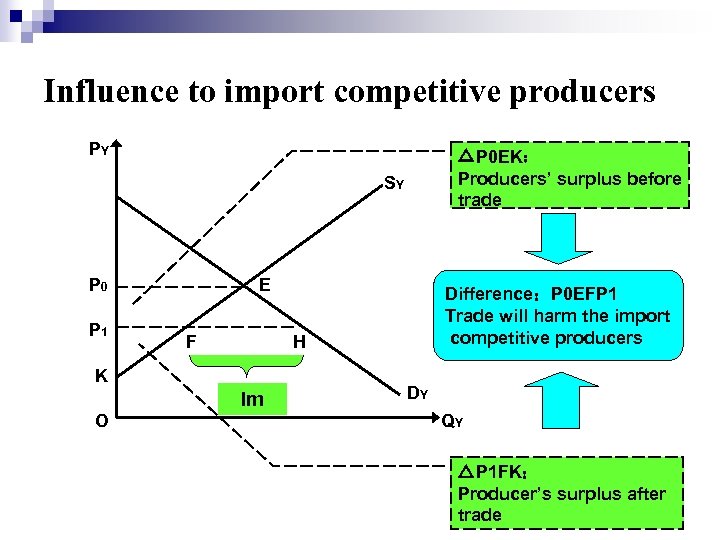

Influence to import competitive producers PY △P 0 EK: Producers’ surplus before trade SY P 0 P 1 E F H K Im O Difference:P 0 EFP 1 Trade will harm the import competitive producers DY QY △P 1 FK: Producer’s surplus after trade

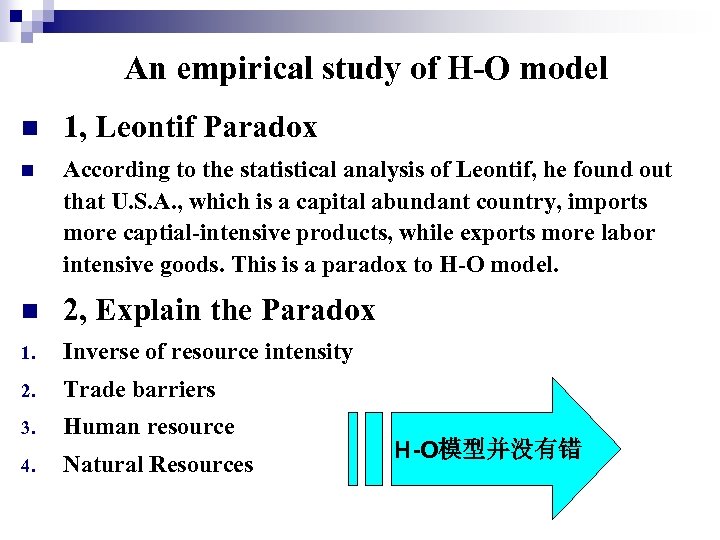

An empirical study of H-O model n 1, Leontif Paradox n According to the statistical analysis of Leontif, he found out that U. S. A. , which is a capital abundant country, imports more captial-intensive products, while exports more labor intensive goods. This is a paradox to H-O model. n 2, Explain the Paradox 1. Inverse of resource intensity 2. Trade barriers 3. Human resource 4. Natural Resources H-O模型并没有错

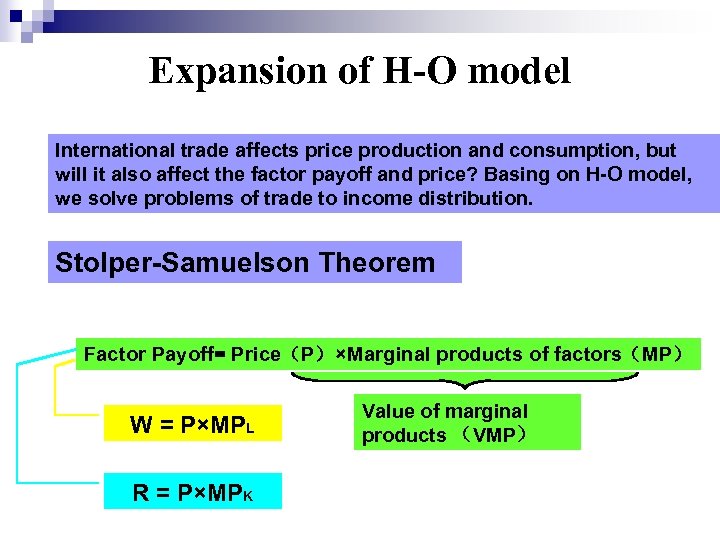

Expansion of H-O model International trade affects price production and consumption, but will it also affect the factor payoff and price? Basing on H-O model, we solve problems of trade to income distribution. Stolper-Samuelson Theorem Factor Payoff= Price(P)×Marginal products of factors(MP) W = P×MPL R = P×MPK Value of marginal products (VMP)

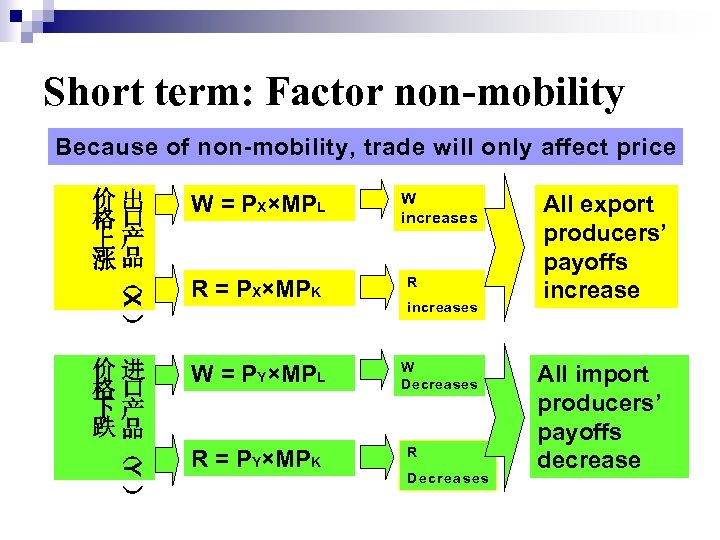

Short term: Factor non-mobility Because of non-mobility, trade will only affect price 价出 格口 上产 涨品 W = PX×MPL ( ) X R = PX×MPK 价进 格口 下产 跌品 W = PY×MPL ( ) Y R = PY×MPK W increases R increases W Decreases R Decreases All export producers’ payoffs increase All import producers’ payoffs decrease

Long term: Because factors are mobile, trade not only affects price, but also the marginal products. 劳 资 本 相 对 过 剩 , 价 格 降 低 劳各 动行 比业 率投 提入 高更 多 资 本 , 资 本 / 多出进 动 素资 劳 的口 密 向本 动 资竞 集出 密 相 本争 行集 对 口 比行 行的 稀 型 劳业 出 缺 业的 动流 , 流进 口 价 行 动口 格 业 出 竞 提 多的 报 争 高 劳口 酬 行 动行 提 业 比业 高 的 资需 要 本要 劳 动 生 的劳 产边 动 率 际的 提 产 边 高, 品际 减产 少品 增 加 , 资 本

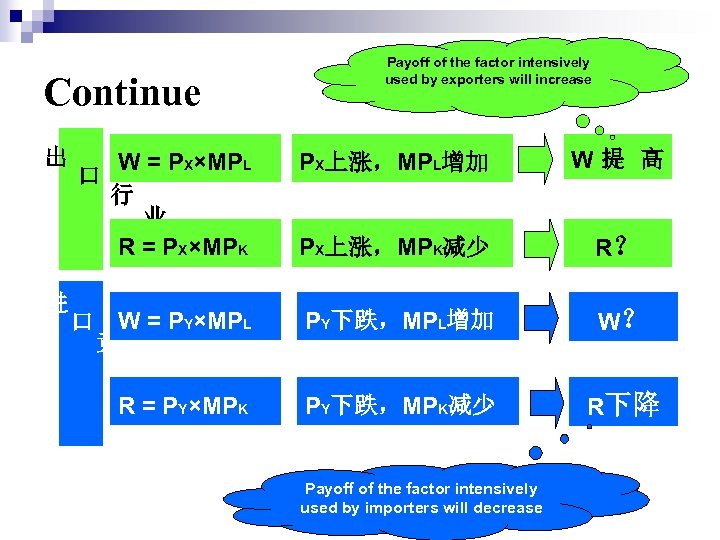

Continue 出 进 Payoff of the factor intensively used by exporters will increase W = PX×MPL 口 行 业 R = PX×MPK PX上涨,MPL增加 W提 高 PX上涨,MPK减少 R? 口 W = PY×MPL 竞 争 行 R = P业 Y×MPK PY下跌,MPL增加 W? PY下跌,MPK减少 R下降 Payoff of the factor intensively used by importers will decrease

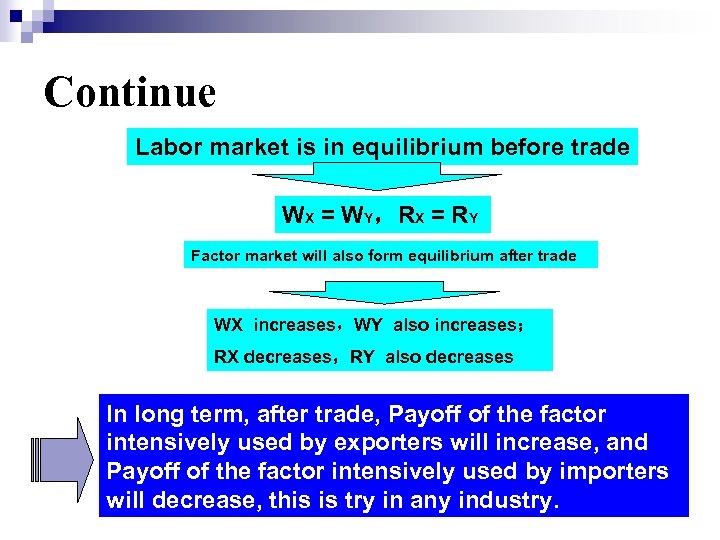

Continue Labor market is in equilibrium before trade WX = WY,RX = RY Factor market will also form equilibrium after trade WX increases,WY also increases; RX decreases,RY also decreases In long term, after trade, Payoff of the factor intensively used by exporters will increase, and Payoff of the factor intensively used by importers will decrease, this is try in any industry.

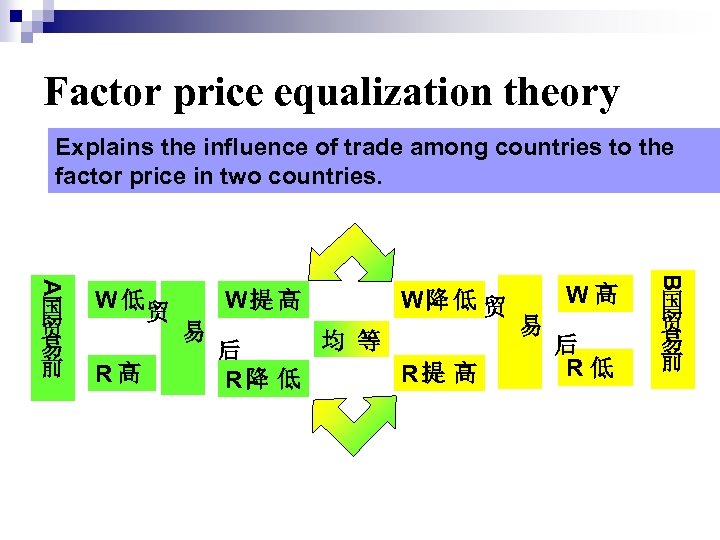

Factor price equalization theory Explains the influence of trade among countries to the factor price in two countries. R高 贸 W提 高 易 W降 低 贸 均 等 后 R提 高 R降 低 W高 易 后 R低 B A 国 贸 易 前 W低 国 贸 易 前

6. New Trade Theory

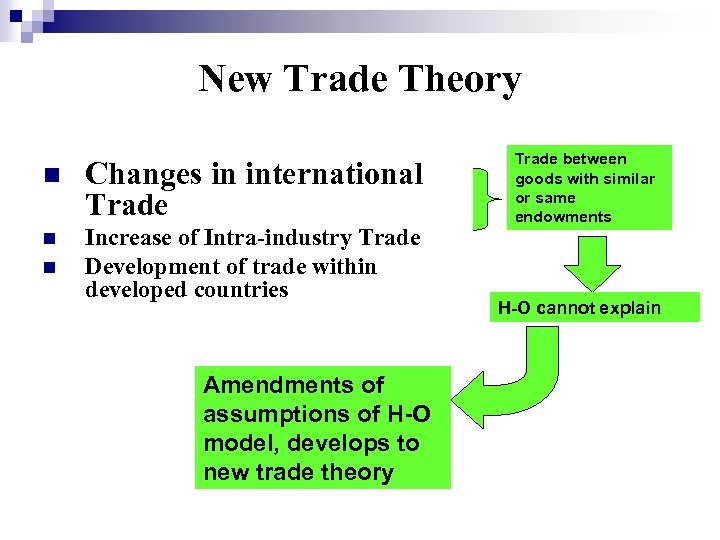

New Trade Theory n Changes in international Trade n Increase of Intra-industry Trade Development of trade within developed countries n Amendments of assumptions of H-O model, develops to new trade theory Trade between goods with similar or same endowments H-O cannot explain

General points of new trade theories n Imperfect Competition 1. Differentiated products (Intra-industry trade) 2. Monopoly power ( price difference) n Large – Scale Economy 1. Internal ( enterprises) 2. External ( Industry)

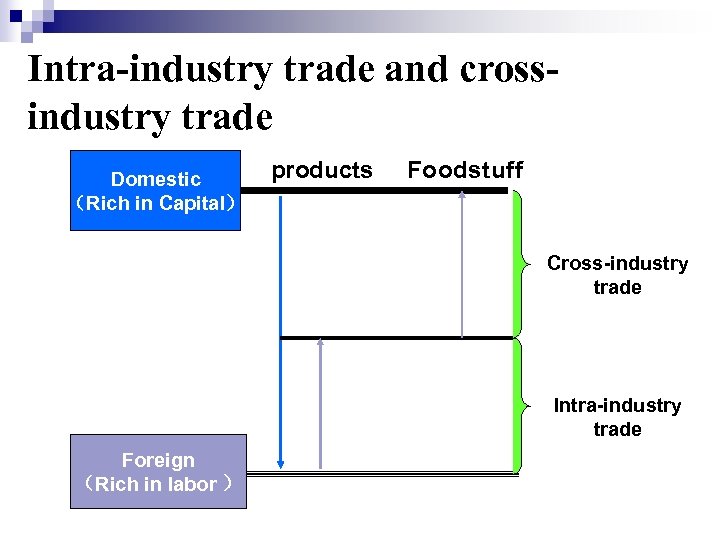

Intra-industry trade and crossindustry trade Domestic (Rich in Capital) products Foodstuff Cross-industry trade Intra-industry trade Foreign (Rich in labor )

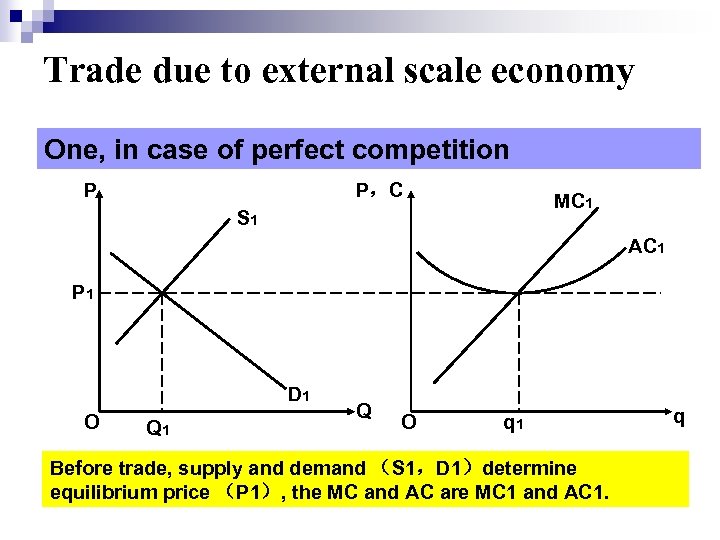

Trade due to external scale economy One, in case of perfect competition P P,C MC 1 S 1 AC 1 P 1 D 1 O Q 1 Q O q 1 Before trade, supply and demand (S 1,D 1)determine equilibrium price (P 1), the MC and AC are MC 1 and AC 1. q

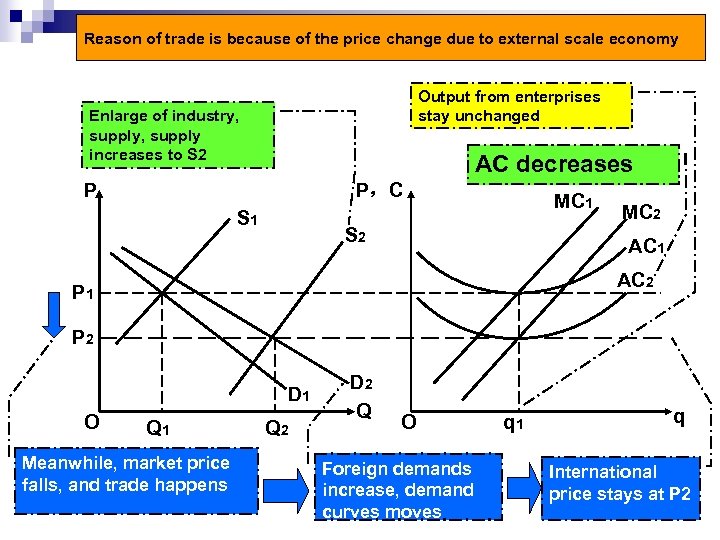

Reason of trade is because of the price change due to external scale economy Output from enterprises stay unchanged Enlarge of industry, supply increases to S 2 AC decreases P P,C S 1 MC 1 S 2 MC 2 AC 1 AC 2 P 1 P 2 D 1 O Q 1 Meanwhile, market price falls, and trade happens Q 2 D 2 Q O Foreign demands increase, demand curves moves q 1 q International price stays at P 2

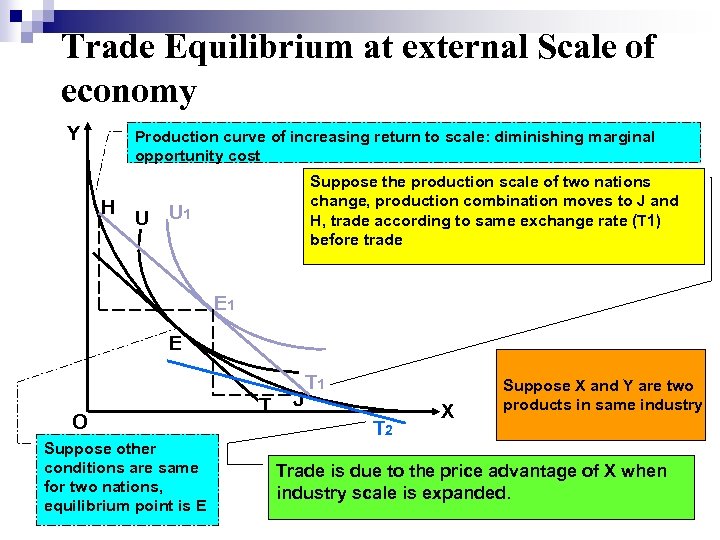

Trade Equilibrium at external Scale of economy Y Production curve of increasing return to scale: diminishing marginal opportunity cost H Suppose the production scale of two nations change, production combination moves to J and H, trade according to same exchange rate (T 1) before trade U U 1 E O Suppose other conditions are same for two nations, equilibrium point is E T J T 1 T 2 X Suppose X and Y are two products in same industry Trade is due to the price advantage of X when industry scale is expanded.

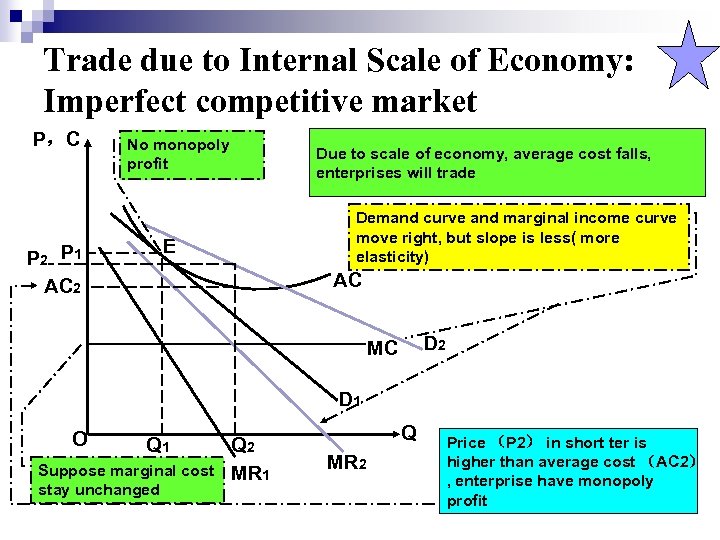

Trade due to Internal Scale of Economy: Imperfect competitive market P,C P 2 P 1 AC 2 No monopoly profit Due to scale of economy, average cost falls, enterprises will trade Demand curve and marginal income curve move right, but slope is less( more elasticity) E AC D 2 MC D 1 O Q 1 Suppose marginal cost stay unchanged Q 2 MR 1 Q MR 2 Price (P 2) in short ter is higher than average cost (AC 2) , enterprise have monopoly profit

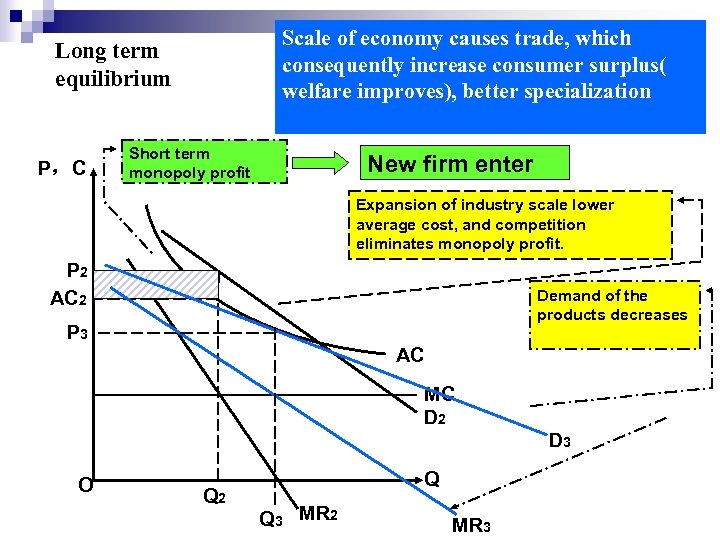

Scale of economy causes trade, which consequently increase consumer surplus( welfare improves), better specialization Long term equilibrium P,C Short term monopoly profit New firm enter Expansion of industry scale lower average cost, and competition eliminates monopoly profit. P 2 AC 2 Demand of the products decreases P 3 AC MC D 2 D 3 O Q 2 Q Q 3 MR 2 MR 3

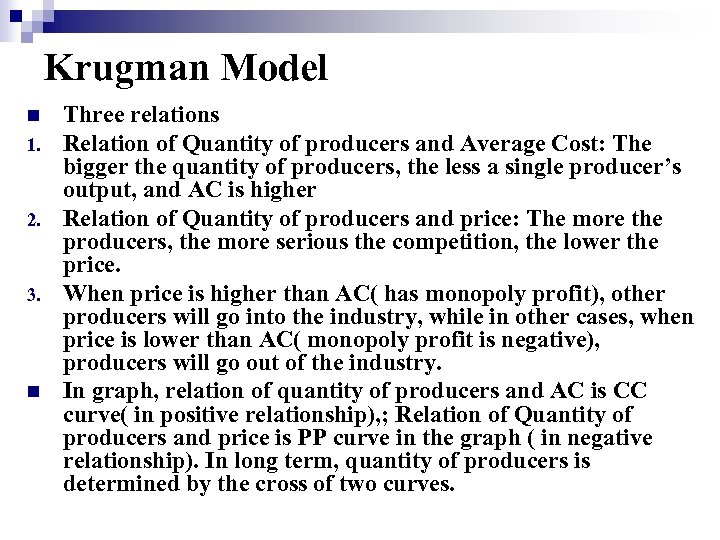

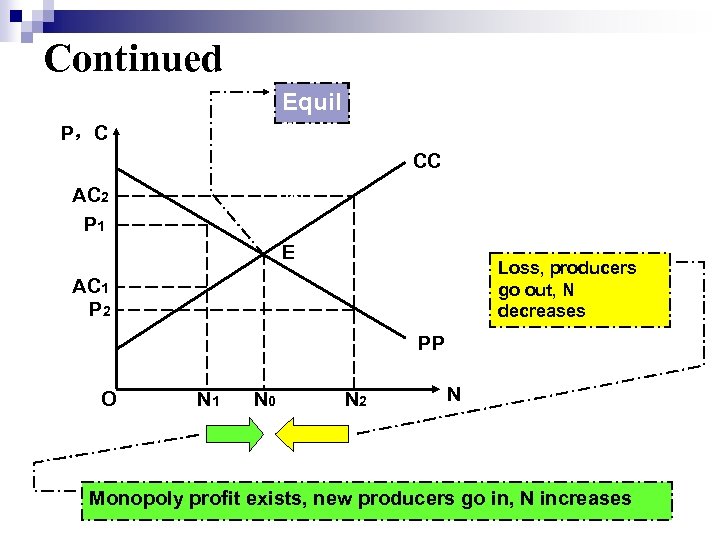

Krugman Model n 1. 2. 3. n Three relations Relation of Quantity of producers and Average Cost: The bigger the quantity of producers, the less a single producer’s output, and AC is higher Relation of Quantity of producers and price: The more the producers, the more serious the competition, the lower the price. When price is higher than AC( has monopoly profit), other producers will go into the industry, while in other cases, when price is lower than AC( monopoly profit is negative), producers will go out of the industry. In graph, relation of quantity of producers and AC is CC curve( in positive relationship), ; Relation of Quantity of producers and price is PP curve in the graph ( in negative relationship). In long term, quantity of producers is determined by the cross of two curves.

Continued Equil ibriu m均 衡 P,C AC 2 P 1 CC E Loss, producers go out, N decreases AC 1 P 2 PP O N 1 N 0 N 2 N Monopoly profit exists, new producers go in, N increases

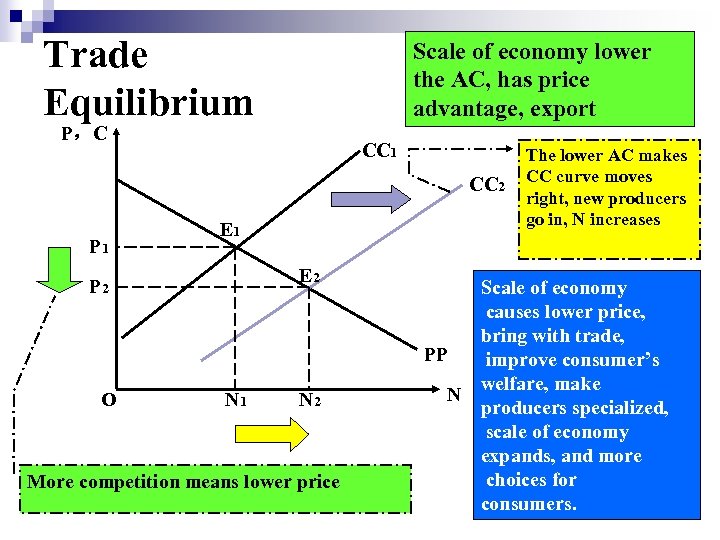

Trade Equilibrium Scale of economy lower the AC, has price advantage, export P,C CC 1 CC 2 P 1 E 2 P 2 O N 1 N 2 More competition means lower price The lower AC makes CC curve moves right, new producers go in, N increases Scale of economy causes lower price, bring with trade, PP improve consumer’s welfare, make N producers specialized, scale of economy expands, and more choices for consumers.

7. Product cycle model

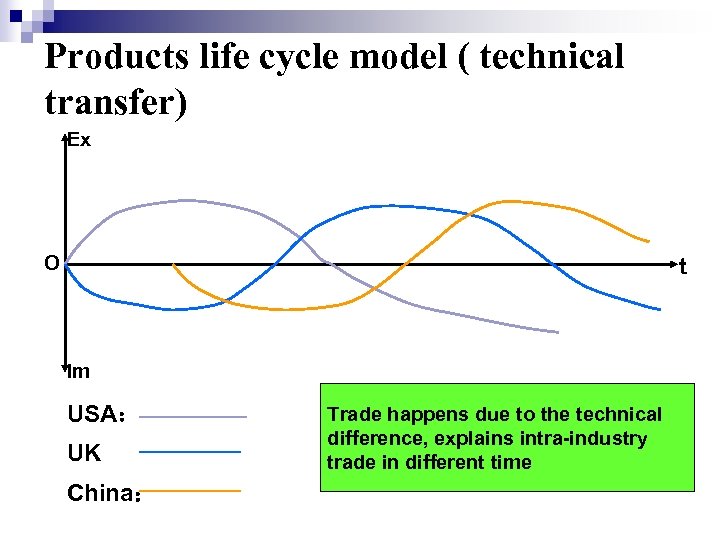

Products life cycle model ( technical transfer) Ex O t Im USA: UK China: Trade happens due to the technical difference, explains intra-industry trade in different time

Chapter Four The Political Economy of International Trade 第四章 国际贸易政策 Objectives: 1. Describe the policy instruments used by governments to influence international trade flows. 2. Understand why governments sometimes intervene in international trade. 3. Explain the arguments against strategic trade policy. 4. Describe the development of the world trading system and the current trade issues. 5. Explain the implications for managers of developments in the world trading system.

The Political Economy of International Trade 1. Instruments of Trade Policy 国际贸易政策: (1) TARIFFS 关税:a tax levied on imports or exports. 对进出口商所征收的税收。Export tariffs are far less common than import tariffs. ØSpecific tariffs are levied as a fixed charge for each unit of a good imported. 从量税 ØAd valorem tariffs are levied as a proportion of the value of the imported good. 从价税 Note:The important thing to understand about a tariff is who suffers and who gains.

The Political Economy of International Trade 1. Instruments of Trade Policy 国际贸易政策: (1) TARIFFS 关税: ØWhen shipments of goods arrive at a border crossing or port, customs officers inspect the contents and charge a tax according to the tariff formula. Since the goods cannot continue on their way until the duty is paid, it is the easiest duty to collect, and the cost of collection is small. Traders seeking to evade tariffs are known as smugglers.

The Political Economy of International Trade 1. Instruments of Trade Policy 国际贸易政策: (1) TARIFFS 关税:Types: ØA REVENUE tariff is a set of rates designed primarily to raise money for the government. 财政关税 ØA RETALIATORY tariff is one placed against a country who already charges tariffs against the country charging the retaliatory tariff 报复性关税 ØA PROTECTIVE tariff is intended to artificially inflate prices of imports and protect domestic industries from foreign competition. (A PROHIBITIVE tariff is one so high that nearly no one imports any of that item. )保护关税

The Political Economy of International Trade 1. Instruments of Trade Policy 国际贸易政策: (1) TARIFFS 关税: Types: Import Surtax 进口附加税: ØCounter-Veiling Duty (anti-subsidy duty) trade import duties imposed under WTO Rules to neutralize the negative effects of subsidies. 反补贴税 ØAnti-Dumping Duty. 反倾销税

The Political Economy of International Trade 1. Instruments of Trade Policy 国际贸易政策: (1) TARIFFS 关税: Types: Generalized System of Preferences(GSP) 普遍优惠制关税 Ø A formal system of exemption from the more general rules of the World Trade Organization (WTO). Ø Specifically, it's a system of exemption from the most favored nation principle (MFN) that obliges WTO member countries to treat the imports of all other WTO member countries no worse than they treat the imports of their "most favored" trading partner. 业发达国家承诺对来自发展中国家的某些商品,特别是制成品 或半制成品给予普遍的关税减免优惠的制度。

The Political Economy of International Trade 1. Instruments of Trade Policy 国际贸易政策: (1) TARIFFS 关税: Types: Generalized System of Preferences (GSP) 普遍优 惠制关税 Ø Rule of origin 原产地原则 Ø Most GSP programs are not completely generalized with respect to products. They don‘t cover products of greatest export interest to low-income developing countries lacking natural resources. Textiles, leather goods, ceramics, glass and steel are excluded. 受惠商品范围

The Political Economy of International Trade 1. Instruments of Trade Policy 国际贸易政策: (1) TARIFFS Tax levy 征税标准 v从量税(Specific Duties):以商品的重量、数量、长度、容积、 面积等计量单位为标准计征的关税。 v从价税(Ad Value Duties):按进口商品的价格为标准计征的关 税,其税率表现为货物价格的百分率。 v混合税(Mixed or Compound Duties):对同一种商品,同时采 用从量、从价两种标准征收关税的一种方法。 v选择税(Alternative Duties):对同一物品,同时订有从价税、 从量税和混合税税率,征税时由海关选择,通常是按税额较高的 一种征收。

The Political Economy of International Trade 1. Instruments of Trade Policy 国际贸易政策: (1) TARIFFS Tax levy 征税标准 v滑动关税(Sliding Duties):根据商品的市场行情相 应调整关税税率的一种方法。 v差价税/差额税(Variable Levy:按照进口商品价格低 于国内市场同种商品价格的差额征关税。

The Political Economy of International Trade 1. Instruments of Trade Policy 国际贸易政策: (1) TARIFFS Who suffers and who gains? ØTariffs are placed on imports to protect domestic producers from foreign competition by raising the price of imported goods. ØThe government gains. Tariffs produce revenue for the government. Ø Domestic producers gain, because the tariff affords them some protection against foreign competitors by increasing the cost of imported foreign goods.

The Political Economy of International Trade 1. Instruments of Trade Policy 国际贸易政策: (1) TARIFFS Who suffers and who gains? Ø Consumers lose because they must pay more for certain imports. Ø Tariffs are unambiguously pro-producer and anticonsumer. While they protect producers from foreign competitors, this restriction of supply also raises domestic prices. Ø Import tariffs reduce the overall efficiency of the world economy.

The Political Economy of International Trade 1. Instruments of Trade Policy 国际贸易政策: (2) Non-tariff Barriers Non-tariff barriers to trade (NTBs) are trade barriers that restrict imports but are not in the usual form of a tariff. Some common examples of NTB's are anti-dumping measures and countervailing duties, which, although they are called "non-tariff" barriers, have the effect of tariffs once they are enacted.

The Political Economy of International Trade 1. Instruments of Trade Policy 国际贸易政策: (2) Non-tariff Barriers a. Specific Limitations on Trade: – Quotas 配额 – Import Licensing requirements 进口许可 – Proportion restrictions of foreign to domestic goods (local content requirements) 进口产品成分限制 – Minimum import price limits 最低进口价格限制 – Embargoes 禁运

The Political Economy of International Trade 1. Instruments of Trade Policy 国际贸易政策: (2) Non-tariff Barriers b. Customs and Administrative Entry Procedures: 海关和 行政手续 – Valuation systems 海关估值 – Antidumping practices – Tariff classifications – Documentation requirements – Fees

The Political Economy of International Trade 1. Instruments of Trade Policy 国际贸易政策: (2) Non-tariff Barriers c. Standards: – Standard disparities 双重标准 – Intergovernmental acceptances of testing methods and standards – Packaging, labeling, and marking

The Political Economy of International Trade 1. Instruments of Trade Policy 国际贸易政策: (2) Non-tariff Barriers d. Government Participation in Trade: – Government procurement policies – Export subsidies – Countervailing duties – Domestic assistance programs

The Political Economy of International Trade 1. Instruments of Trade Policy 国际贸易政策: (2) Non-tariff Barriers e. Charges on imports: – Prior import deposit 进口前交付的定金 – Administrative fees 行政费用 – Special supplementary duties 附加税 – Import credit discriminations 进口信贷 – Variable levies 差额税 – Border taxes 过境税

The Political Economy of International Trade 1. Instruments of Trade Policy 国际贸易政策: (2) Non-tariff Barriers g. Others: – Voluntary export restraints 自愿出口限制 – Orderly marketing agreements 有秩序的销售协定 – Occupational safety and health – Rules of origin

The Political Economy of International Trade 1. Instruments of Trade Policy 国际贸易政策: (2) Non-tariff Barriers Subsidies: 补贴 A subsidy is a government payment to a domestic producer. Subsidies take many forms, including cash grants拨款, low-interest loans低息贷款, tax breaks税项 减免, and government equity participation in domestic firms政府参股出资. Ø direct subsidies 直接补贴 Ø indirect subsidies 间接补贴

The Political Economy of International Trade 1. Instruments of Trade Policy 国际贸易政策: (2) Non-tariff Barriers Subsidies: 补贴 Ø Agriculture tends to be one of the largest beneficiaries of subsidies in most countries. Ø Nonagricultural subsidies are much lower, but they are still significant. Ø To help domestic firms achieve a dominant position in those industries in which economies of scale are important and the world market is not large enough to profitably support more than a few firms (e. g. , aerospace, semiconductors).

The Political Economy of International Trade 1. Instruments of Trade Policy 国际贸易政策: (2) Non-tariff Barriers Import quota: 进口配额 Ø A direct restriction on the quantity of some good that may be imported into a country. Ø The restriction is usually enforced by issuing import licenses to a group of individuals or firms.

The Political Economy of International Trade 1. Instruments of Trade Policy 国际贸易政策: (2) Non-tariff Barriers Import quota: 进口配额 Ø Absolute quota 绝对配额:超过即不能进口 Ø Tariff rate quota, a lower tariff rate is applied to imports within the quota than those over the quota. 关 税配额 Ø Global Quotas 全球配额: Ø Country Quotas 国别配额:

The Political Economy of International Trade 1. Instruments of Trade Policy 国际贸易政策: (2) Non-tariff Barriers Voluntary Export Restraint 自愿出口限制 Ø A quota on trade imposed by the exporting country, typically at the request of the importing country’s government. Ø 出口国家或地区在进口国的要求或压力下,“自 动”规定某一时期内(一般为五年),限制该国某 些商品出口的数量或金额,在限定的配额内自行 控制出口,超过配额即禁止出口。

The Political Economy of International Trade 1. Instruments of Trade Policy 国际贸易政策: (2) Non-tariff Barriers Voluntary Export Restraint 自愿出口限制 Ø As with tariffs and subsidies, both import quotas and VERs benefit domestic producers by limiting import competition. Ø As with all restrictions on trade, quotas do not benefit consumers. An import quota or VER always raises the domestic price of an imported good.

The Political Economy of International Trade 1. Instruments of Trade Policy 国际贸易政策: (2) Non-tariff Barriers Local Content Requirement Ø A requirement that some specific fraction of a good be produced domestically. Ø The requirement can be expressed either in physical terms or in value terms Ø Widely used by developing countries to shift their manufacturing base from the simple assembly of products whose parts are manufactured elsewhere into the local manufacture of component parts. Ø They have also been used in developed countries to try to protect local jobs and industry from foreign competition.

The Political Economy of International Trade 1. Instruments of Trade Policy 国际贸易政策: (2) Non-tariff Barriers ADMINISTRATIVE POLICIES Ø Bureaucratic rules designed to make it difficult for imports to enter a country. Ø As with all instruments of trade policy, administrative instruments benefit producers and hurt consumers, who are denied access to possibly superior foreign products.

The Political Economy of International Trade 1. Instruments of Trade Policy 国际贸易政策: (2) Non-tariff Barriers ANTIDUMPING POLICIES Ø Dumping is variously defined as selling goods in a foreign market at below their costs of production or at below their “fair” market value. Ø Antidumping policies are designed to punish foreign firms that engage in dumping. The ultimate objective is to protect domestic producers from unfair foreign competition.

The Political Economy of International Trade 1. Instruments of Trade Policy 国际贸易政策: (2) Non-tariff Barriers Import deposits 进口押金 Ø Import deposits is a form of deposit, which the importer must pay the bank for a definite period of time (non-interest bearing deposit) in an amount equal to all or part of the cost of imported goods. Ø 进口存款制,是一种通过支付制度限制进口的措施。

The Political Economy of International Trade 1. Instruments of Trade Policy 国际贸易政策: (2) Non-tariff Barriers Standards (Technical Barriers to Trade) Ø Standards take a special place among non-tariff barriers. Ø Countries usually impose standards on classification, labeling and testing of products in order to be able to sell domestic products, but also to block sales of products of foreign manufacture. Ø These standards are sometimes entered under the pretext of protecting the safety and health of local populations.

The Political Economy of International Trade 1. Instruments of Trade Policy 国际贸易政策: (2) Non-tariff Barriers Standards (Technical Barriers to Trade ) Ø Technical Standards 技术标准即 业产品的技 术标准 Ø Health and Sanitary Regulation 卫生检疫措施和 动植物卫生检疫措施 Ø Packaging and Labeling Regulation 商品包装和 标签规定

The Political Economy of International Trade 1. Instruments of Trade Policy 国际贸易政策: (2) Non-tariff Barriers Social Accountability 8000:社会责任标准 Customs Valuation 海关估价:从价征收关税时, 由海关 根据国家的规定,确定进口商品完税价格,并以海关估 定的完税价格作为计征关税的基础。 Embargo 禁运:embargoes may be imposed on imports or exports of particular goods, regardless of destination, in respect of certain goods supplied to specific countries, or in respect of all goods shipped to certain countries.

The Political Economy of International Trade 1. Instruments of Trade Policy 国际贸易政策: (2) Non-tariff Barriers Government Procurement:政府制定政策或通过制定购 买本国货法(Buy National Act)规定,国家行政部门在 采购时必须优先购买本国产品 Administrative and bureaucratic delays at the entrance 产 品入境时采取行政手段延长时间:increase uncertainty and the cost of maintaining inventory

The Political Economy of International Trade Arguments for government intervention take two paths: political and economic 2. POLITICAL ARGUMENTS FOR INTERVENTION: protecting the interests of certain groups within a nation (normally producers), often at the expense of other groups (normally consumers). 3. ECONOMIC ARGUMENTS FOR INTERVENTION: boosting the overall wealth of a nation (to the benefit of all, both producers and consumers).

The Political Economy of International Trade 2. POLITICAL ARGUMENTS FOR INTERVENTION: 从政治角度看待政府干预 (1) Protecting Jobs and Industries It is necessary for protecting jobs and industries from unfair foreign competition. Mercantilism: emerged in England in the midsixteenth century. 重商主义 What is most important to national wealth and essential to vigorous commerce?

The Political Economy of International Trade 2. POLITICAL ARGUMENTS FOR INTERVENTION: 从政治角度看待政府干预 (1) Protecting Jobs and Industries What is most important to national wealth and essential to vigorous commerce? Silver and gold.

The Political Economy of International Trade 2. POLITICAL ARGUMENTS FOR INTERVENTION: 从政治角度看待政府干预 (1) Protecting Jobs and Industries It was in a country’s best interests to maintain a trade surplus(贸易盈余), to export more than it imported. By doing so, a country would accumulate gold and silver and, consequently, increase its national wealth, prestige, and power. 重商主义保护贸易的政策确实能够保证经济繁荣,扩 大就业。古典学派的贸易理论已经过时了。理论前提 条件,即充分就业事实上并不存在,现实社会存在着 大量的失业现象。

The Political Economy of International Trade 2. POLITICAL ARGUMENTS FOR INTERVENTION: 从政治角度看待政府干预 (2) National Security • Countries sometimes argue that it is necessary to protect certain industries because they are important for national security. • Defense-related industries often get this kind of attention.

The Political Economy of International Trade 2. POLITICAL ARGUMENTS FOR INTERVENTION: 从政治角度看待政府干预 (3) Retaliation 报复手段 Some argue that governments should use threat to intervene in trade policy as a bargaining tool to help open foreign markets and force trading partners to “play by the rules of the game. ” Punitive trade sanctions 贸易制裁

The Political Economy of International Trade 2. POLITICAL ARGUMENTS FOR INTERVENTION: 从政治角度看待政府干预 (4) Protecting Consumers Many governments have long had regulations to protect consumers from unsafe products. The indirect effect of such regulations often is to limit or ban the importation of such products.

The Political Economy of International Trade 2. POLITICAL ARGUMENTS FOR INTERVENTION: 从政治角度看待政府干预 (5) Protecting Human Rights Beijing’s Tiananmen Square, a tangible reminder of China’s history of human rights abuses.

The Political Economy of International Trade 2. POLITICAL ARGUMENTS FOR INTERVENTION: 从政治角度看待政府干预 (6) Furthering Foreign Policy Objectives v A government may grant preferential trade terms to a country with which it wants to build strong relations. v Governments sometimes use trade policy to try to improve the human rights policies of trading partners.

The Political Economy of International Trade 3. ECONOMIC ARGUMENTS FOR INTERVENTION: 从经济角度看待政府干预 (1) The infant industry 幼稚 业: Many developing countries have a potential comparative advantage in manufacturing, but new manufacturing industries cannot initially compete with established industries in developed countries. To allow manufacturing to get a toehold, governments should temporarily support new industries (with tariffs, import quotas, and subsidies) until they have grown strong enough to meet international competition.

The Political Economy of International Trade 3. ECONOMIC ARGUMENTS FOR INTERVENTION: 从经济角度看待政府干预 (2) Strategic Trade Policy 战略贸易政策: • By appropriate actions, a government can help raise national income if it can somehow ensure that the firm or firms that gain first-mover advantages in an industry are domestic rather than foreign enterprises. • Thus, according to the strategic trade policy argument, a government should use subsidies to support promising firms that are active in newly emerging industries.

The Political Economy of International Trade 3. ECONOMIC ARGUMENTS FOR INTERVENTION: 从经济角度看待政府干预 (2) Strategic Trade Policy 战略贸易政策: • It might pay a government to intervene in an industry by helping domestic firms overcome the barriers to entry created by foreign firms that have already reaped first-mover advantages.

The Political Economy of International Trade 4. Development of the World Trading System: 世界贸易体制 (1) Development • FROM SMITH TO THE GREAT DEPRESSION Free trade dates to the late eighteenth century and the work of Adam Smith and David Ricardo. Free trade as a government policy was first officially embraced by Great Britain in 1846, when the British Parliament repealed the Corn Laws.

The Political Economy of International Trade 4. Development of the World Trading System: 世界贸易体制 (1) Development • 1947– 1979: GATT(General Agreement on Tariffs and Trade), Trade Liberalization and Economic Growth After the debacle of the Great Depression, opinion in the U. S. Congress had swung strongly in favor of free trade. Under U. S. leadership, the GATT was established in 1947.

The Political Economy of International Trade 4. Development of the World Trading System: 世界贸易体制 (1) Development • 1980– 1993: PROTECTIONIST TRENDS During the 1980 s and early 1990 s, the world trading system erected by the GATT came under strain as pressures for greater protectionism increased around the world.

The Political Economy of International Trade 4. Development of the World Trading System: 世 界贸易体制 (1) Development • 1980– 1993: PROTECTIONIST TRENDS First, the economic success of Japan strained the world trading system. Second, the world trading system was strained by the persistent trade deficit in the world’s largest economy, the United States. A third reason for the trend toward greater protectionism was that many countries found ways to get around GATT regulations.

The Political Economy of International Trade 4. Development of the World Trading System: 世 界贸易体制 (1) Development • THE URUGUAY ROUND AND THE WORLD TRADE ORGANIZATION Against the background of rising pressures for protectionism, in 1986 GATT members embarked on their eighth round of negotiations to reduce tariffs, the Uruguay Round. The Uruguay Round dragged on for seven years before an agreement was reached December 15, 1993. It went into effect July 1, 1995.

The Political Economy of International Trade 4. Development of the World Trading System: 世 界贸易体制 (1) Development • THE URUGUAY ROUND AND THE WORLD TRADE ORGANIZATION 1. Tariffs on industrial goods were to be reduced by more than one-third, and tariffs were to be scrapped on more than 40 percent of manufactured goods. 2. Average tariff rates imposed by developed nations on manufactured goods were to be reduced to less than 4 percent of value, the lowest level in modern history. 3. Agricultural subsidies were to be substantially reduced.

The Political Economy of International Trade 4. Development of the World Trading System: 世 界贸易体制 (1) Development • THE URUGUAY ROUND AND THE WORLD TRADE ORGANIZATION 4. GATT fair trade and market access rules were to be extended to cover a wide range of services. 5. GATT rules also were to be extended to provide enhanced protection for patents, copyrights, and trademarks (intellectual property). 6. Barriers on trade in textiles were to be significantly reduced over 10 years. 7. The World Trade Organization was to be created to implement the GATT agreement.

The Political Economy of International Trade 4. Development of the World Trading System: 世界贸易体制 (1) Development The World Trade Organization: v. THE FUTURE OF THE WTO: unresolved issues and the Doha round v世界贸易组织于2001年 11月在卡塔尔首都多哈 举行的世界贸易组织第四次部级会议中开始的新 一轮多边贸易谈判。议程原定于2005年 1月1日前 全面结束谈判,但至 2005年底为止仍未能达成协 议,最终于2006年 7月22日世界贸易组织总理事 会的批准下正式中止。

70c3f811af26490054ca25442321196e.ppt