4a2d9daf3cf448c58b2475ffaf79f8a5.ppt

- Количество слайдов: 27

公司 徽标 俄罗斯的石油出口 Russia's oil exports & 卢克石油公司 Luke petroleum Company

The Outline

Russia & The oil

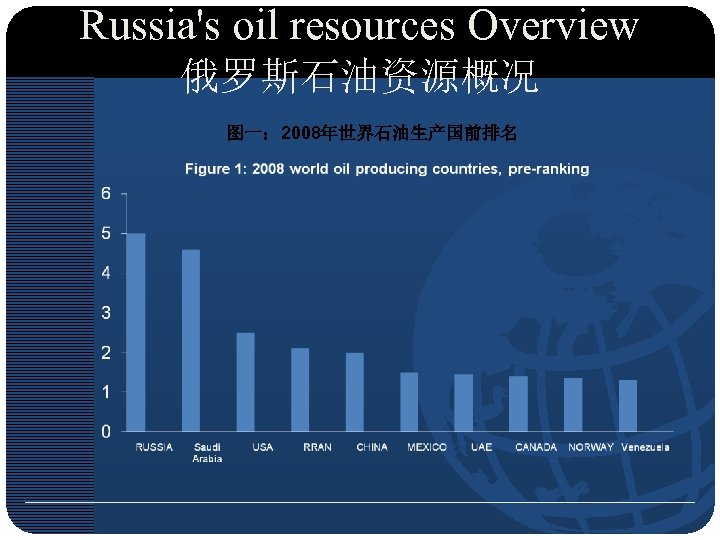

Russia's oil resources Overview 俄罗斯石油资源概况 • Proved reserves of 6. 5 billion tons of oil, accounting for 12 -13% of the world's proven reserves, Russia has the world's major oil resources in the country, ranking second in the world oil production, oil reserves, the eighth largest in the world, oil consumption is highest in the world 5, the oil export volume ranks second in the world.

Russia's oil resources Overview 俄罗斯石油资源概况 图一: 2008年世界石油生产国前排名

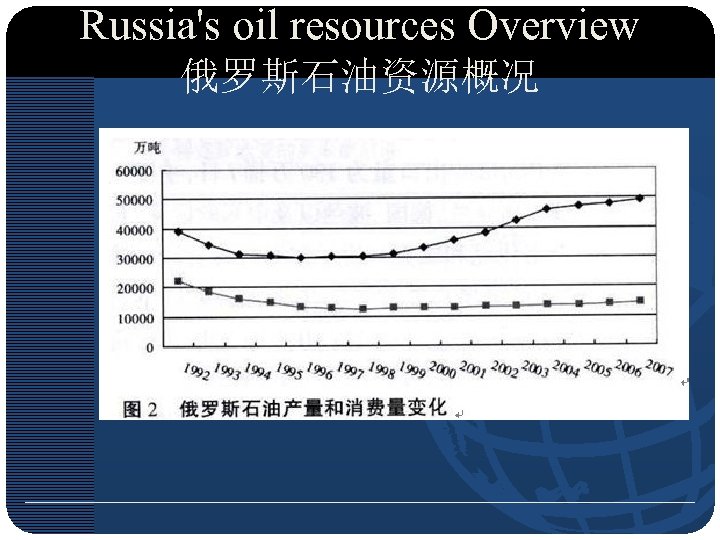

Russia's oil resources Overview 俄罗斯石油资源概况

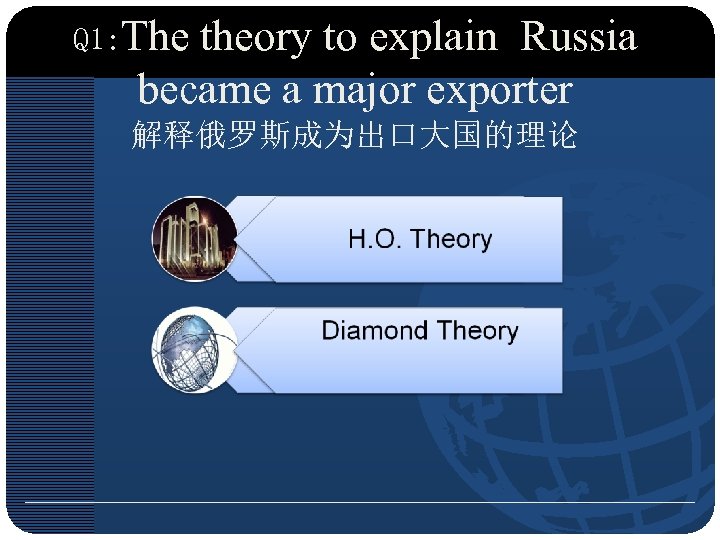

Q 1: The theory to explain Russia became a major exporter 解释俄罗斯成为出口大国的理论

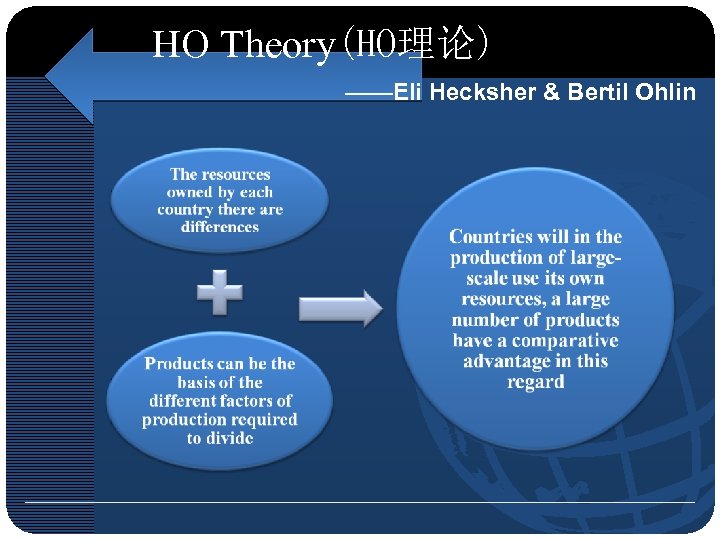

HO Theory(HO理论) ——Eli Hecksher & Bertil Ohlin

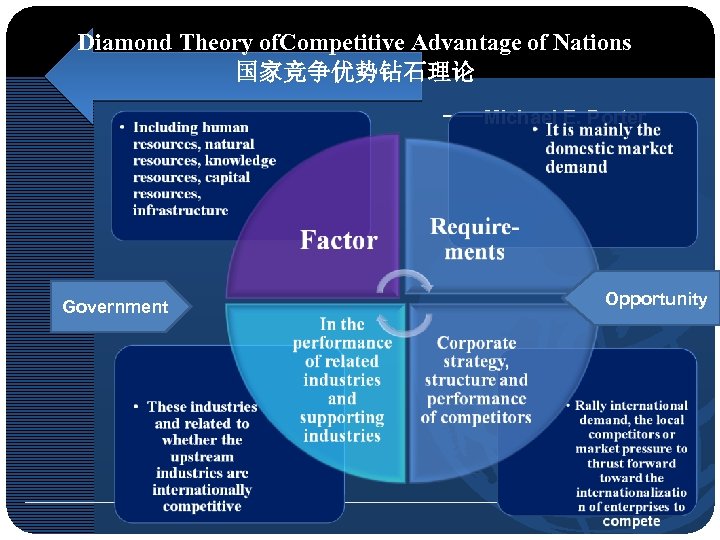

Diamond Theory of. Competitive Advantage of Nations 国家竞争优势钻石理论 ——Michael E. Porter Government Opportunity

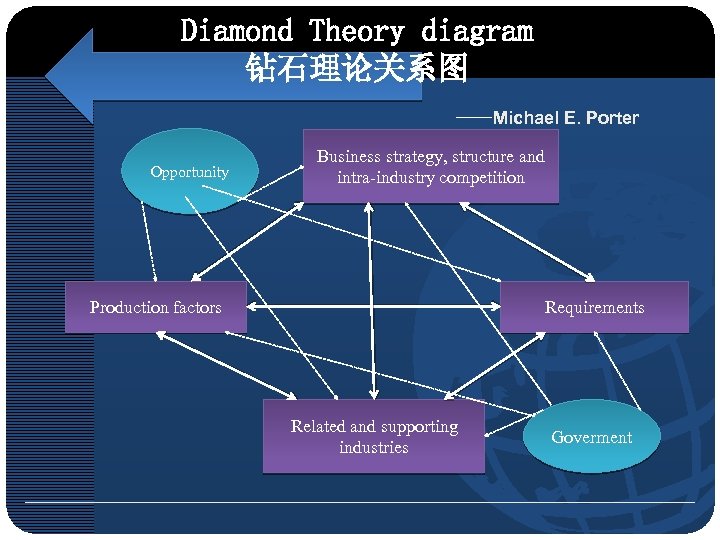

Diamond Theory diagram 钻石理论关系图 ——Michael E. Porter Opportunity Business strategy, structure and intra-industry competition Requirements Production factors Related and supporting industries Goverment

Lukoil Introduction 卢克石油公司简介 • Russia's Lukoil(OAO Lukoil Holdings) From Western. Siberia, Kogalymneftegaz and Kogalymneftegaz three big oil merger of gas producers, Lukoil is the world's largest vertically integrated oil and gas companies, the world's second-largest private oil companies. Russia's oil products accounted for 18% and 19% of Russian oil refining industry.

LUK’S GLOBAL BUSINESS 卢克在全球的业务 • The company's sales network all over the world in 17 countries, including Russia, the CIS countries (Azerbaijan, Belarus, Georgia, Moldova, Ukraine), the European countries (Bulgaria, Hungary, Belgium, Latvia, Lithuania, Poland, Serbia , Romania, Czech Republic, Estonia) and the United States, a total of 199 oil and 5405 stations. In Russia the company has 10 branches, scope of business throughout the Russian Federation, the main body 59.

LUKoil's international 卢克石油公司的国际化

LUKoil's international 卢克石油公司的国际化 • In 2001, the acquisition of the U. S. 19 th largest retailer, Getty Oil, taking the first step towards the U. S. market. • In 2004, the acquisition of the 800 separated from the Mobil service stations, access to greater market share • In September 2004, Conoco. Phillips acquired 7. 6% stake in Luke, and market access to finance and technical support.

Promotion of a favorable market situation in the operation Luke 有利的市场局势推动卢克的经营 • From the beginning of the 21 st century, due to OPEC oil output is reduced, as well as weather conditions and strong demand, only from January 1999 to September 2000, world oil price tripled. • Although the 9. 11 increase in oil prices dropped almost 1 / 2, but the situation in Venezuela, unrest, the Iraq war, China's economic growth and OPEC oil production continued to decline, making oil prices has been growing. • The end result is that Lukoil's export volume will continue to grow and the sales price is much higher than before it received adequate funding.

Russian oil and the world economic development 俄罗斯石油和世界经济发展 Russia has rich oil resources and, ultimately recoverable resources of conventional volume 36. 19 billion tons (including condensate). Its oil reserves, accounting for 6. 1% of the world, mining accounted for 10. 9% of the world's major oil resources in the country, ranking second in the world oil production, oil reserves, the eighth largest in the world, oil consumption ranks fifth in the world, oil exports ranks second in the world? F F The oil crisis or a sharp price fluctuations in varying degrees, affect the inter-state economic volatility which led to the world economic cycle, or non-cyclical fluctuations, such as the U. S. post -war economic cycles, several economic crisis, most of them and the oil crisis-related.

Russian oil and the world economic development 俄罗斯石油和世界经济发展 FIn the 21 st century will continue to be the world's major energy sources of oil. From the reserves of view, OPEC's reserves are the most abundant, while the United Kingdom, Norway in the North Sea reserves are very limited, if it continues to be the brink of a large number of mining depletion, thus ultimately affecting the Organization of Petroleum Exporting Countries oil price will remain an important force.

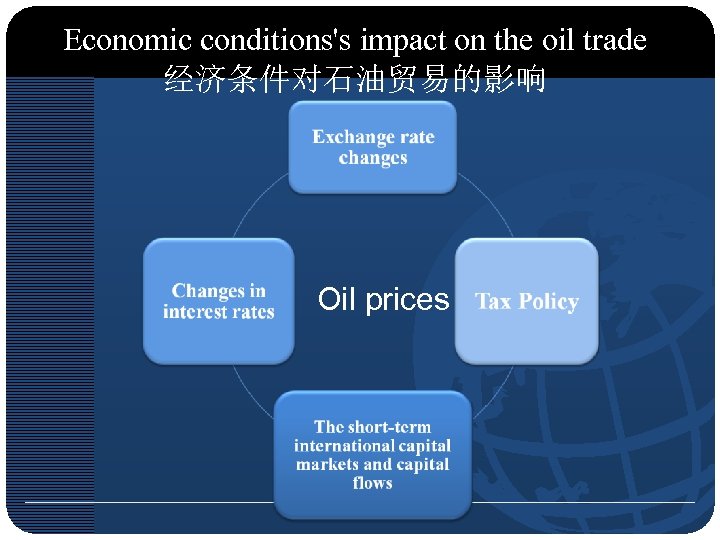

Economic conditions's impact on the oil trade 经济条件对石油贸易的影响 Oil prices

Financial crisis on oil trade impact 金融危机对石油贸易的影响 • International crude oil market in the summer of 2007 before the outbreak of the U. S. sub-prime mortgage crisis in a relatively stable state, but the sub-prime crisis and the depreciation of the dollar led to a lot of money into oil and other commodity markets, market speculation driving up oil prices as an important reason. • The U. S. sub-prime crisis, the U. S. dollar depreciation and market speculation, the existence of three closely linked factors that pushed up at least 40 dollars per barrel.

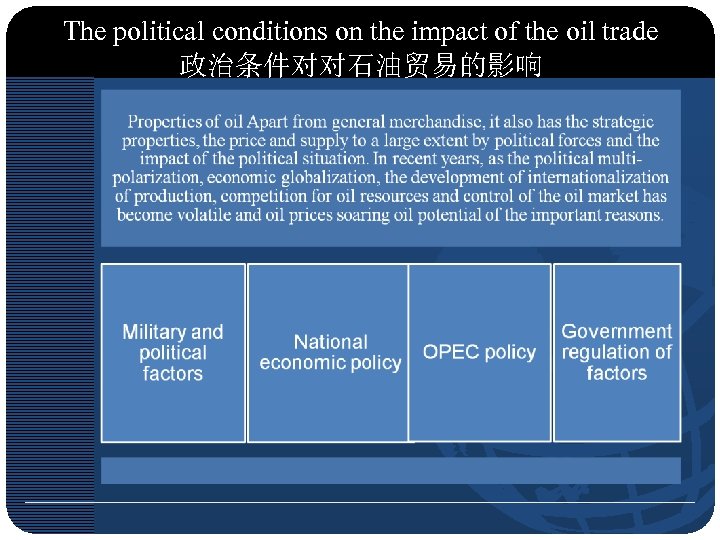

The political conditions on the impact of the oil trade 政治条件对对石油贸易的影响

The political conditions on the impact of the oil trade 政治条件对对石油贸易的影响 • In the history, the three recognized oil crisis is occurred in 1973, 1979 and 1990. 1. 1973 energy crisis - reason: a major force in oil-exporting Arab countries, they are not satisfied with the Western countries supporting Israel to take the oil embargo. 2. 1979 energy crisis - Cause: the Iranian revolution broke out. Surge in oil prices in 3. 1990 - reason: the Persian Gulf War.

Factor mobility concepts 要素流动相关概念

Lukoil's production advantages of factors 卢克石油公司的生产要素优势

The performance of capital flows in Lukoil 卢克石油公司资本流动的表现 • By the end of 2000, Lukoil acquired Getty United States 19 th largest oil retailer, the company, by the Getty in the U. S. Northeast and Midwest have 1, 300 gas stations, Luke has successfully owned oil retail network • In 2004, Luke from the Conoco. Phillips acquisition of 800 gas stations. • In September 2004, Conoco. Phillips (Conoco. Phillips) to spend 1. 98 billion U. S. dollars acquisition of Lukoil's 7. 59 percent stake, becoming the largest U. S. companies investing in Russia

The relationship between the elements of capital flows and exports 资本要素流动和出口的关系 • Factor mobility promote the exports. Through the direct acquisition of foreign companies to expand the company's size and area, so that is conducive to the promotion of the company's export. • Through export to obtain a more abundant funds. The increase in exports the company earned huge profits, so that is conducive to the accumulation of company funds. • M & A to introduce advanced management mode and experience in other companies access to experienced staff, technology and know-how.

The relationship between the elements of capital flows and exports 资本要素流动和出口的关系 • Capital element of maximizing risk-averse profit-driven nature and characteristics, forcing all stakeholders to intensify the competition for economic benefits, causing changes in the capital market supply and demand factors, leading to the capital element of high risk from lowincome areas and departments flow of incomehigh-and low-risk areas and departments • In short, factor mobility and exports are complementary and mutually reinforcing

公司 徽标

4a2d9daf3cf448c58b2475ffaf79f8a5.ppt