5da339126ccf8fde79bca4accdc4127b.ppt

- Количество слайдов: 28

Ⅰ. 21 st Century Knowledge-Based Economy & IPRs 1. Changes In Global Economy • Source of competitiveness: creative knowledge & information Rapid transition toward Knowledge Economy “The most important survival strategy of firms & nations is to how to secure knowledge” (Lester C. Thurow , Prof. MIT) “Wealth in 21 st century will be for those individuals, firms & nations that first secure distinctive knowledge to create values for customers”(Alvin Toffler) • Changes to major production factors - (Industrial era) land· capital· resource→(knowledge economy) knowledge, information, technology - Carnegie, the steel king, Rockefeller, the oil king→MS Bill Gates, Amazon Jeff Bezos Change to Competition Paradigm • Key factors of competitiveness - (Industrial era) tangible assets such as capital, labor, etc. → (knowledge economy) intangible assets such as technical power, design, brand, strong management system - Intangible assets represent 80% of the assets of S&P 500 companies in the U. S. (Brookings Institution) 2

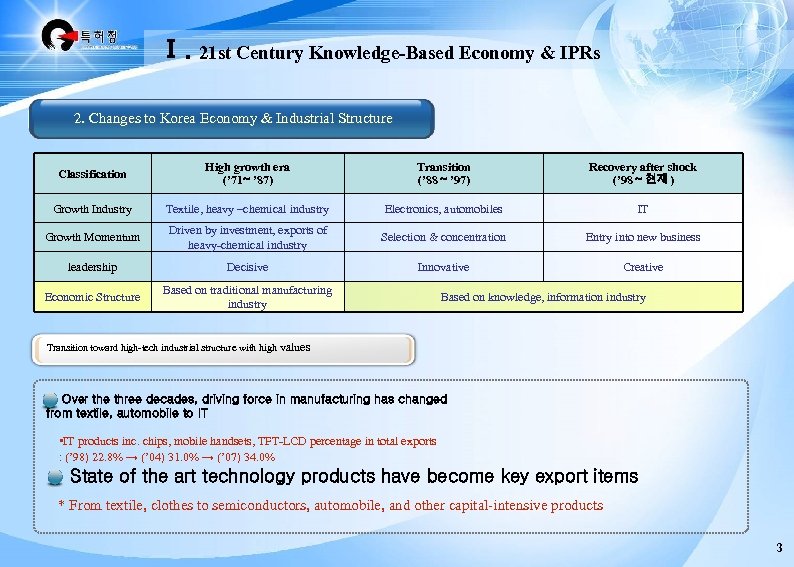

Ⅰ. 21 st Century Knowledge-Based Economy & IPRs 2. Changes to Korea Economy & Industrial Structure Classification High growth era (’ 71∼ ’ 87) Transition (’ 88 ∼ ’ 97) Recovery after shock (’ 98 ∼ 현재) Growth Industry Textile, heavy –chemical industry Electronics, automobiles IT Growth Momentum Driven by investment, exports of heavy-chemical industry Selection & concentration Entry into new business leadership Decisive Innovative Creative Economic Structure Based on traditional manufacturing industry Based on knowledge, information industry Transition toward high-tech industrial structure with high values Over the three decades, driving force in manufacturing has changed from textile, automobile to IT • IT products inc. chips, mobile handsets, TFT-LCD percentage in total exports : (’ 98) 22. 8% → (’ 04) 31. 0% → (’ 07) 34. 0% State of the art technology products have become key export items * From textile, clothes to semiconductors, automobile, and other capital-intensive products 3

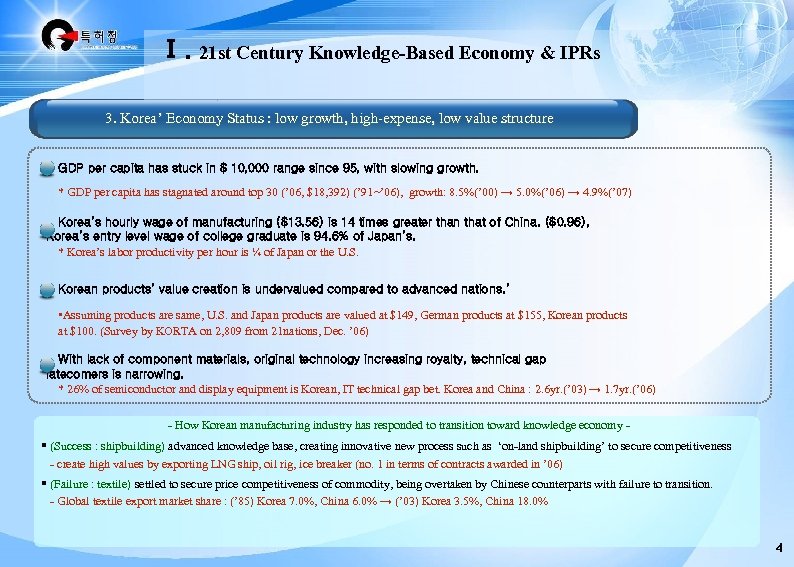

Ⅰ. 21 st Century Knowledge-Based Economy & IPRs 3. Korea’ Economy Status : low growth, high-expense, low value structure GDP per capita has stuck in $ 10, 000 range since 95, with slowing growth. * GDP per capita has stagnated around top 30 (’ 06, $18, 392) (’ 91∼’ 06), growth: 8. 5%(’ 00) → 5. 0%(’ 06) → 4. 9%(’ 07) Korea’s hourly wage of manufacturing ($13. 56) is 14 times greater than that of China. ($0. 96), Korea’s entry level wage of college graduate is 94. 6% of Japan’s. * Korea’s labor productivity per hour is ¼ of Japan or the U. S. Korean products’ value creation is undervalued compared to advanced nations. ’ • Assuming products are same, U. S. and Japan products are valued at $149, German products at $155, Korean products at $100. (Survey by KORTA on 2, 809 from 21 nations, Dec. ’ 06) With lack of component materials, original technology increasing royalty, technical gap latecomers is narrowing. * 26% of semiconductor and display equipment is Korean, IT technical gap bet. Korea and China : 2. 6 yr. (’ 03) → 1. 7 yr. (’ 06) - How Korean manufacturing industry has responded to transition toward knowledge economy - § (Success : shipbuilding) advanced knowledge base, creating innovative new process such as ‘on-land shipbuilding’ to secure competitiveness - create high values by exporting LNG ship, oil rig, ice breaker (no. 1 in terms of contracts awarded in ’ 06) § (Failure : textile) settled to secure price competitiveness of commodity, being overtaken by Chinese counterparts with failure to transition. - Global textile export market share : (’ 85) Korea 7. 0%, China 6. 0% → (’ 03) Korea 3. 5%, China 18. 0% 4

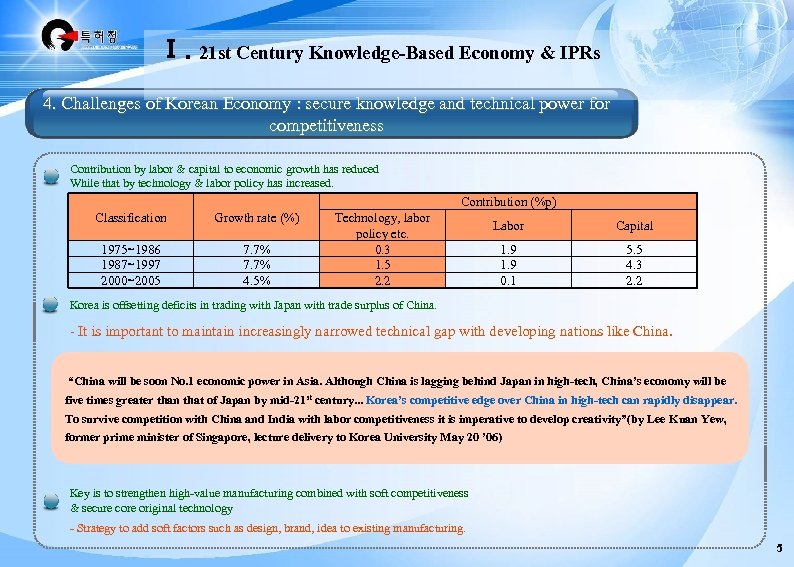

Ⅰ. 21 st Century Knowledge-Based Economy & IPRs 4. Challenges of Korean Economy : secure knowledge and technical power for competitiveness Contribution by labor & capital to economic growth has reduced While that by technology & labor policy has increased. Contribution (%p) Classification Growth rate (%) 1975∼ 1986 1987∼ 1997 2000∼ 2005 7. 7% 4. 5% Technology, labor policy etc. 0. 3 1. 5 2. 2 Labor Capital 1. 9 0. 1 5. 5 4. 3 2. 2 Korea is offsetting deficits in trading with Japan with trade surplus of China. - It is important to maintain increasingly narrowed technical gap with developing nations like China. “China will be soon No. 1 economic power in Asia. Although China is lagging behind Japan in high-tech, China’s economy will be five times greater than that of Japan by mid-21 st century. . . Korea’s competitive edge over China in high-tech can rapidly disappear. To survive competition with China and India with labor competitiveness it is imperative to develop creativity”(by Lee Kuan Yew, former prime minister of Singapore, lecture delivery to Korea University May 20 ’ 06) Key is to strengthen high-value manufacturing combined with soft competitiveness & secure core original technology - Strategy to add soft factors such as design, brand, idea to existing manufacturing. 5

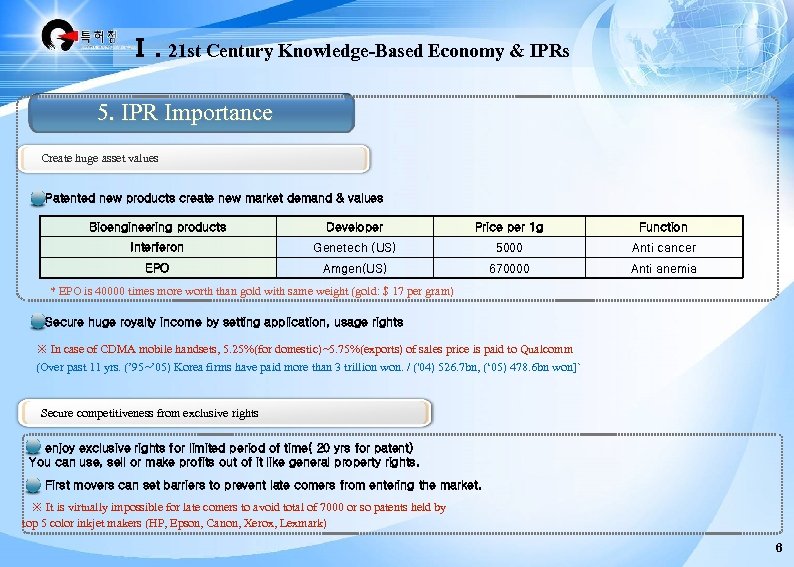

Ⅰ. 21 st Century Knowledge-Based Economy & IPRs 5. IPR Importance Create huge asset values Patented new products create new market demand & values Bioengineering products Developer Price per 1 g Function Interferon Genetech (US) 5000 Anti cancer EPO Amgen(US) 670000 Anti anemia * EPO is 40000 times more worth than gold with same weight (gold: $ 17 per gram) Secure huge royalty income by setting application, usage rights ※ In case of CDMA mobile handsets, 5. 25%(for domestic)∼ 5. 75%(exports) of sales price is paid to Qualcomm (Over past 11 yrs. (’ 95∼’ 05) Korea firms have paid more than 3 trillion won. / ('04) 526. 7 bn, (‘ 05) 478. 6 bn won]` Secure competitiveness from exclusive rights enjoy exclusive rights for limited period of time( 20 yrs for patent) You can use, sell or make profits out of it like general property rights. First movers can set barriers to prevent late comers from entering the market. ※ It is virtually impossible for late comers to avoid total of 7000 or so patents held by top 5 color inkjet makers (HP, Epson, Canon, Xerox, Lexmark) 6

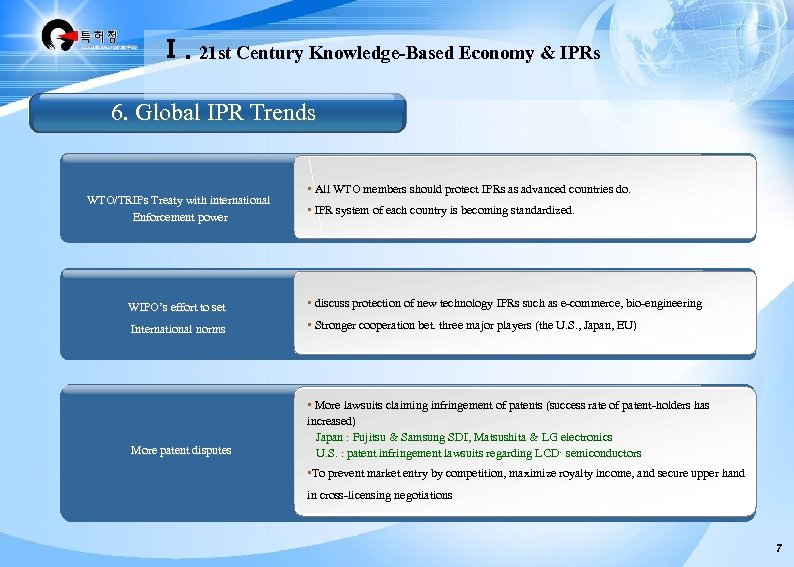

Ⅰ. 21 st Century Knowledge-Based Economy & IPRs 6. Global IPR Trends WTO/TRIPs Treaty with international Enforcement power • All WTO members should protect IPRs as advanced countries do. • IPR system of each country is becoming standardized. WIPO’s effort to set • discuss protection of new technology IPRs such as e-commerce, bio-engineering International norms • Stronger cooperation bet. three major players (the U. S. , Japan, EU) More patent disputes • More lawsuits claiming infringement of patents (success rate of patent-holders has increased) Japan : Fujitsu & Samsung SDI, Matsushita & LG electronics U. S. : patent infringement lawsuits regarding LCD· semiconductors • To prevent market entry by competition, maximize royalty income, and secure upper hand in cross-licensing negotiations 7

Ⅱ. Overview of Korea’s IP Power Big industrial rights-holder industrial rights filing has increased 1. 0% from 2007 (totaling 377000) ü ’ 07 filing (1000, growth%) : patent 170(2. 0), utility model 21(△ 36. 0), design 54(6. 0), trademark 132(8. 0) world’s no. 4 industrial-rights filer ü total industrial-rights(‘ 05, 1000) : China(1, 140), U. S. (666), Japan (613), Korea (359), Germany (201) ü patent application (’ 05, 1000) : Japan (427), U. S. (382), China(173), Korea [161], Germany (60) International patent application to WIPO by Korean residents (PCT application) World’s no. 4 ü No. of international patents(‘ 07, 1000) : U. S. (52. 3), Japan (27. 7), Germany (18. 1), Korea (7. 0), France (6. 4) Patent filing to USPTO by Korean residents World’s no. 3, to JPO world’s no. 3 (excluding home country) ü No. of patent application to USPTO(‘ 06, 1000) : Japan (76. 9), Germany (22. 3), Korea (22. 0), Taiwan (21. 2) ü No. of patent application to JPO (‘ 06, 1000) : U. S. (25. 0), EPO(23. 9), Korea (7. 2), Netherlands(3. 9) 8

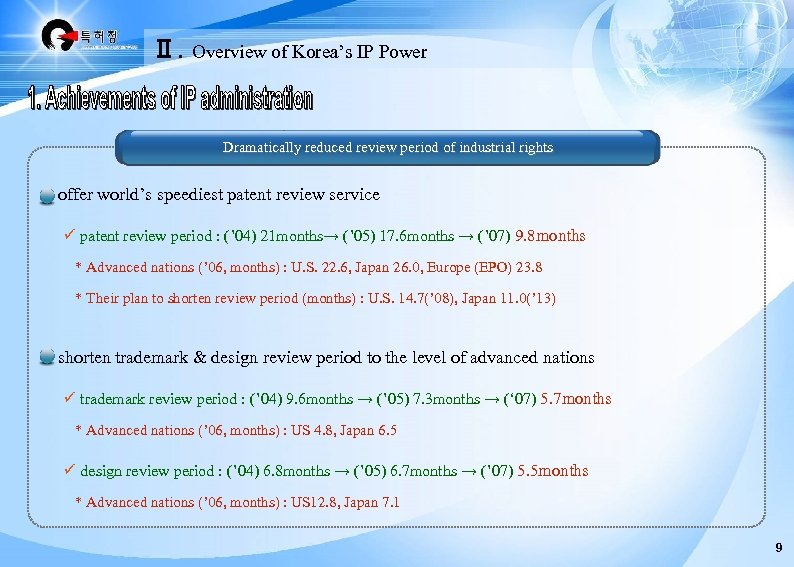

Ⅱ. Overview of Korea’s IP Power Dramatically reduced review period of industrial rights offer world’s speediest patent review service ü patent review period : (’ 04) 21 months→ (’ 05) 17. 6 months → (’ 07) 9. 8 months * Advanced nations (’ 06, months) : U. S. 22. 6, Japan 26. 0, Europe (EPO) 23. 8 * Their plan to shorten review period (months) : U. S. 14. 7(’ 08), Japan 11. 0(’ 13) shorten trademark & design review period to the level of advanced nations ü trademark review period : (’ 04) 9. 6 months → (’ 05) 7. 3 months → (‘ 07) 5. 7 months * Advanced nations (’ 06, months) : US 4. 8, Japan 6. 5 ü design review period : (’ 04) 6. 8 months → (’ 05) 6. 7 months → (’ 07) 5. 5 months * Advanced nations (’ 06, months) : US 12. 8, Japan 7. 1 9

Ⅱ. Overview of Korea’s IP Power World-class IP administration infra designated as ISA for PCT international patent applications for the 9 th times in the world, carrying out international examination and review in 8 nations (’ 99∼) ü (’ 02)Philippines, Vietnam, (’ 03)Indonesia, (’ 04)Mongolia·singapore, (’ 05)Newzealand, (’ 06)U. S. Malaysia * There are only two, EPO & KIPO which are designated as ISA, IPEA for international patent filing in the U. S. * No. of international review by foreign applicants : (‘ 05) 20 → (’ 06) 735 → (’ 07) 2, 853 develop & run world’s class patent information system (KIPOnet) (’ 99∼) ü World’s highest e-application rate : 93. 1% of industrial rights , 97. 2% of patents (’ 07) ü “KIPOnetⅡ” system open (’ 05) : non stop 24/7 e-application service, review process is open to the public in real time. ü PCT ROAD was co-developed with WIPO, being supplied to 12 nations including Canada, Israel (’ 06) For the first time, Korean has become official language of international institutions. (Sep. ’ 07, 43 rd PCT General assembly) üExcluding 6 UN languages Korean has become the 3 rd international language of PCT following Japanese and Germany (Sep. ’ 07) build database with 150 mn cases of patent information & 760 reviewers with master and PH. D 10

Ⅱ. Overview of Korea’s IP Power Rapidly and properly protect IP Rapidly securing industrial rights for technology and resolving disputes decides success or failure of R&D investment of companies and their commercialization. ü While maintaining world’s speediest review process, ü there is need to shorten dispute resolution period to 6 months with resolution process innovation. Accurate review, dispute resolution enhances stability of IPRs and reduces unnecessary disputes. ü Need to improve quality of review and dispute resolution to the level of advanced nations. IPR administration that satisfy customers is based on properation of policies and institutions that fit into IPR environment ü Need to make IPR laws & regulations more customer friendly 11

Ⅱ. Overview of Korea’s IP Power Promote creation & usage of leading IP and strengthen its protection Securing national competitiveness depends on creating & securing high-quality i. P in a knowledge economy. ü build nation wide patent information system for enhancement of R&D efficiency. ü expand the base to secure original patents, create IP by strengthening capacity of universities, public institutions and SMEs ü build a systematic education infra to grow IP professionals Commercialization and facilitation of trade of patented technology is the key in creating values by using IPRs. ü Strengthen support to facilitate commercialization of patented technology such as patent-backed loans * commercialization rate of patented technology 37. 0%, with only 7. 0% of transfer rate (’ 06 Patent survey) ü Establish a reliable base to evaluate patent technology & build a user-driven technology trading system. 지식재산권의 효과적인 보호는 지속적인 기술혁신 유인을 위한 주요 인프라 ü 위조상품 단속 강화 등 강력한 지재권 보호활동을 통해 정당한 권리자를 보호 ü 해외진출 우리기업의 지재권 보호를 위한 실효성있는 종합대응체제 마련 12

Ⅱ. Overview of Korea’s IP Power Private companies despite continuous R&D investment & patent application, in terms of quality of patents, they are not competitive. ü Secured no. 4 position in terms of U. S. patents (6, 882, ’ 06 4 ranking), meaning continuing with quantitative growth. - companies’ R&D investment ('05, YOY growth) : 18. 5642 trillion won (9. 1%) * Large companies : 14. 6472 trillion won (up 8. 8%), SME 1. 9864 trillion won (up 5. 1%), ventures 1. 9, 07 trillion won (up 15. 8%) - application growth : 17%(’ 05), 1. 2%(’ 06), top 10 companies account for 35. 2%(’ 06) of patent applications by residents. ü But, in terms of impact factor, representing qualitative competitiveness, Korea’s key industries such as semiconductor and automobiles still lack competitiveness (The Patent Scorecard 2006, ip. IQ of U. S. ) - Semiconductor : Micron (美) 1. 96, Intel 1. 74, Toshiba 1. 32, Samsung 1. 01 - Automobile : GM 1. 36, Toyota 1. 18, Nissan 1. 09, Hyundai Motors 0. 51 ü 미 · 일 · 유럽특허청 동시등록특허(3극 특허패밀리) 기준으로는 11위에 불과('06, OECD) - 3극 특허수(점유율, ’ 03년) : 1위 미국 19, 222건(36. 4%), 2위 일본 13, 564건(25. 7%), 한국 747건(1. 4%) 13

Ⅱ. Overview of Korea’s IP Power Private companies Pay huge royalty due to lack of key · original patents to foreign companies. ü technology balance of payment is gradually improving (0. 34(’ 04) → 0. 39(’ 06)) with still high overseas dependency for key technology - Deficit of technology balance of payment: △ $2 bn (’ 01) → △ $ 2. 4 bn(’ 03) → △ $2. 94 bn(’ 06) * technology balance of payment of advanced nations : Japan 3. 12(1 st), UK 2. 33(2 nd), US 2. 20(3 rd) / as of ’ 04 ü Average royalty payment by domestic firms to foreign ones is three times greater than their royalty income. (’ 06, Survey on companies IP activities) - Average income is 102 mn won, payment is 308 mn won * Japan : payment is 1. 4 times of income (’ 05, Survey on Japan’s IP activities) Fail to effectively respond to patent disputes due to lack of dedicated IP department & resources ü only 12% companies have dedicated IP department (’ 06, KOITA) - 69%, 40% of U. S. and European companies have IP department respectively (’ 03, EPO) Lack of rewarding system like functional invention reward system for research achievements ü Only 32. 3% Korean companies reward inventions by their employees (’ 06년, KIIP) - large companies 65. 3%, SME 20. 3%, venture 27. 8% / Japan 62. 1%(’ 02) 14

Ⅱ. Overview of Korea’s IP Power University & Public Research Institutes Creation of IP Patent achievements fail to reach its potential to create IP ü Although it spends 23. 1% of total national R&D investment and secures 82. 3% of Ph. D, it represents only 6. 1% of all patents filed by residents. (’ 05, KIPO) - University : spending 9. 9% of national R&D investment and securing 69. 4% of Ph. D → patent application is only 2. 4%. - Public (Research) : spending 13. 2% of national R&D and securing 12. 9% of Ph. D → patent application accounts for only 3. 7%. lack of patent information to improve R&D efficiency ü Those involved in national R&D projects, have high awareness of the need for patent information survey, (84. 2%), but only 28. 0% carry out patent information survey before their R&D projects (’ 07, KIIP) Paper-oriented research achievement scoring system undervalues efforts for patents. ü 5. 3% universities give high scores to international patents than SCI papers. ü 13. 3% universities give high scores to domestic patents than papers cited in domestic journals (Nov. ’ 05. , KAUTM) 15

Ⅱ. Overview of Korea’s IP Power Universities & Public Research Institutes Management & utilization of IPRs Industrial application such as technology transfer is improving but still has a long way to go. ü technology transfer rate including patent ownership (’ 06) : 21. 4%(universities 13. 6%, public (research) 26. 3%) - patent transfer rate : 13. 4%(universities 12. 8%, public research institutes 15. 7% / 2006 Patent Utilization Survey) ü Royalty income against R&D investment('04) : universities 0. 15%, public (research) 1. 80%( US university 2. 93%, public (research) 8. 48%) - Royalty income of Columbia university of the U. S. is 170. bn won(’ 04) → 21 times greater than that of 165 Korean universities combined (8 bn won, ’ 0) Weak internal system to strategically manage and utilize intellectual property ü Dedicated resource & expertise of patent & technology transfer function ( 0. 5 person per institute, mainly done by administrative staff) ü Give up patents without proper validation process due to soaring patent expense and lack of effective patent strategy - Average patent holding period by universities 4. 6 yrs, 37% of universities don’t have policy to maintain & give up patents [ Oct. ’ 05. 10 KIPO) ü Lack of internal incentive to facilitate technology transfer - The universities that consider technology transfer including royalty income in evaluation : 13. 7% (Nov. ’ 05, KAUTM)) 16

Ⅲ. SME Support Policy 1. Analysis of SME support Systematic support from creation ▷ utilization ▷ protection creation : creation of ideas, creation & registration of IPRs utilization : set-up business, R&D, commercialization, production, promotion/ exhibit, technology transfer etc. protection : trade secrets/security. dispute/arbitration others : consulting support, resource support, etc. 17

Ⅲ. SME Support Policy 2. Support in the stage of creating rights Customized cyber education ü Offer online contents free of charge through cyber international patent academy ü Aimed at enhancing IPR utilization capability of employees of companies Reach-out patent search service ü Support export of patent search database held by KIPO to homepage of companies free of charge Patent fee reduction project ü Reduce application, registration fees for those with less power including SMEs Support international application expense ü Support expense when applying for patents & utility model oversea (within budget after studying technology in question) 18

Ⅲ. SME Support Policy 3. Support in the stage of utilizing rights Support through patent technology commercialization committee ü collective management through the committee for commercialization of patented technology for government agencies, relevant agencies ü 33 support projects by 16 agencies including MOCIE, SMBA, KIPA Support pricing of patented technology ü Support expense to evaluate marketability and technological values of patented technology Support trading of patented technology ü online (www. ipmart. or. kr) & offline marketplace for patented technology ü Support commercialization, technology transfer, identification of sales opportunities through search and agent services of technology users want Support sales of leading patented products (e-commerce support, recommendation system for leading inventions) ü Marketing support for leading patented products by using the Internet (www. buyinvention. com) ü Recommend government agencies buy leading SME inventions 19

Ⅲ. SME Support Policy 4. Support in the stage of projection of rights Patent law support project ü Support IPR disputes & offer free consulting service for the economically weak including individual inventors, SMEs. Support patent information in preparation of international patent disputes ü Offer overseas patent dispute guidance to help better deal with international patent disputes 20

Ⅲ. SME Support Policy 5. Others (consultation, consulting project) SME IP management consulting project ü Customized consulting support for SMEs from creation, utilization to projection of rights ü KIPO reviewers visit and present solutions Comprehensive patent information project üComprehensive consulting project through IP infra within community In conjunction with municipal projects. üSupport patent information search, analysis of patents, application expense, royalty, etc. Patent consultation center composed of public patent lawyers ü Free consultation and dispute support for individuals & SMEs ü Direct support for writing application details, opinion letter, revision 21

Ⅳ. Women Invention Promotion Policy 1. Need to promote women inventions 1 -1. Need to actively utilize economically active women Women’s participation rate in economic activies(’ 06) : lower than OECD average - OECD average (56. 8%) vs Korea(53. 1%) With world’s lowest birth rate, the population is rapidly aging Alternative: utilize women & the elderly, accept immigrants Korean women is qualitatively superior. - High education attainment: more women aged 20 to 29 are educated than men (2000) - More opportunities for women to create equal values like men in knowledge economy 22

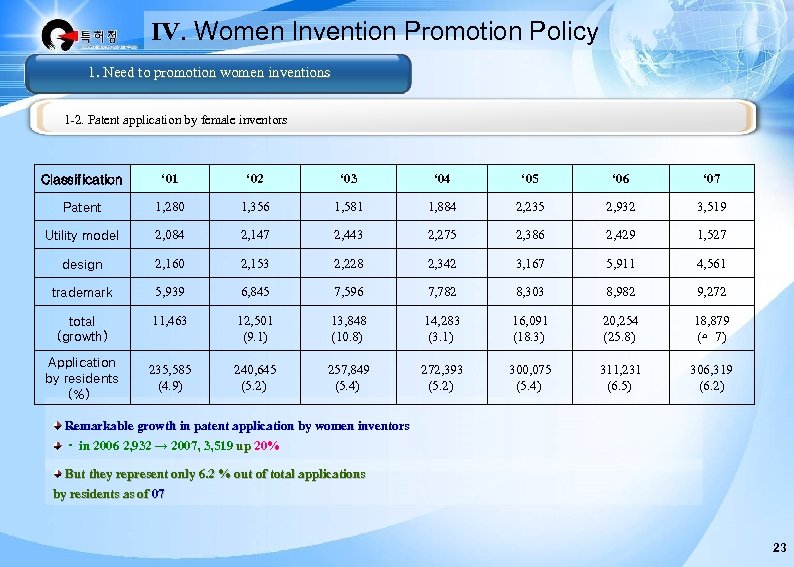

Ⅳ. Women Invention Promotion Policy 1. Need to promotion women inventions 1 -2. Patent application by female inventors Classification ‘ 01 ‘ 02 ‘ 03 ‘ 04 ‘ 05 ‘ 06 ‘ 07 Patent 1, 280 1, 356 1, 581 1, 884 2, 235 2, 932 3, 519 Utility model 2, 084 2, 147 2, 443 2, 275 2, 386 2, 429 1, 527 design 2, 160 2, 153 2, 228 2, 342 3, 167 5, 911 4, 561 trademark 5, 939 6, 845 7, 596 7, 782 8, 303 8, 982 9, 272 total (growth) 11, 463 12, 501 (9. 1) 13, 848 (10. 8) 14, 283 (3. 1) 16, 091 (18. 3) 20, 254 (25. 8) 18, 879 (△ 7) Application by residents (%) 235, 585 (4. 9) 240, 645 (5. 2) 257, 849 (5. 4) 272, 393 (5. 2) 300, 075 (5. 4) 311, 231 (6. 5) 306, 319 (6. 2) Remarkable growth in patent application by women inventors ㆍ in 2006 2, 932 → 2007, 3, 519 up 20% But they represent only 6. 2 % out of total applications by residents as of 07 23

Ⅳ. Women Invention Promotion Policy 2. KIPO’s policy to promote women inventions 2 -1. Nurture creative female inventors & create female inventor friendly environment promote interest & understanding by the public about female invention National tour presentation for female IPRs – raise awareness of female IPRs spread inventions in our daily lives Run creative schools for women inventions – raise awareness of invention by women & develop creativeness etc. Run a course to train female invention teachers- professionals who help children develop creativity and inventive ability Identify leading women inventors by facilitating invention activities - Women Invention Contest Find out new & creative female inventors through invention contest From 5 th contest (Oct. 12 ’ 07) the first prize has been elevated to presidential award strengthen international status of women inventors– Korea World’s Women Invention Contest world’s first ever international invention contest – 30 nations Women invention newsletter “Those who invent” (monthly 6, 500 copies) 24

Ⅳ. Women Invention Promotion Policy 2. KIPO’s policy to promote women inventions 2 -2. Support commercialization of women inventions spread know how of successful invention – presentation of leading women inventions Encourage more women to invent by promoting success cases find sales channels for female inventions – Women Inventions Fair Support Women Invention Fair since 2001 to identify sales channels & and promote brand awareness to help women inventors with commercialization Promotion of commercialization – support prototype development Support commercialization & promote technology development by helping to turn ideas into prototype products Give preference to women inventors for invention promotion projects including support for production of prototype products Give 3 -5 extra scores to women inventors when selecting winners for support of prototype production, overseas patent application, purchase recommendation, pricing expense 25

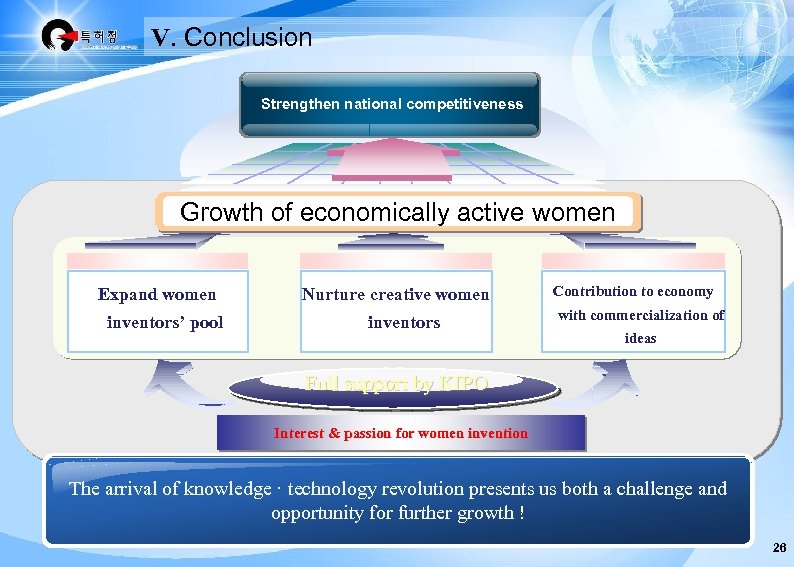

Ⅴ. Conclusion Strengthen national competitiveness Growth of economically active women Expand women inventors’ pool Nurture creative women inventors Contribution to economy with commercialization of ideas Full support by KIPO Interest & passion for women invention The arrival of knowledge · technology revolution presents us both a challenge and opportunity for further growth ! 26

5da339126ccf8fde79bca4accdc4127b.ppt