18e1270d088895b55650e03d7915f921.ppt

- Количество слайдов: 30

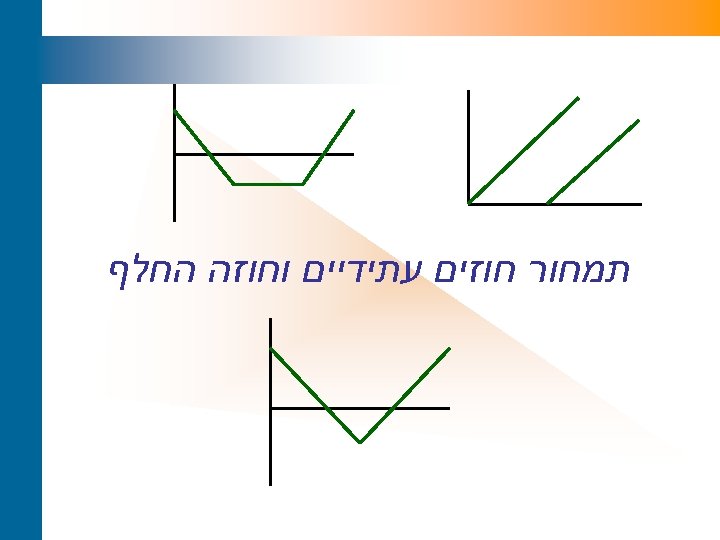

תמחור חוזים עתידיים וחוזה החלף

תמחור חוזים עתידיים וחוזה החלף

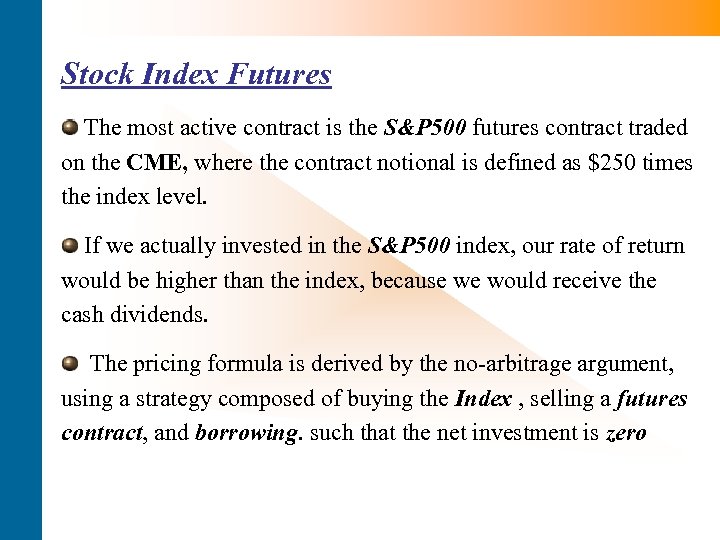

Stock Index Futures The most active contract is the S&P 500 futures contract traded on the CME, where the contract notional is defined as $250 times the index level. If we actually invested in the S&P 500 index, our rate of return would be higher than the index, because we would receive the cash dividends. The pricing formula is derived by the no-arbitrage argument, using a strategy composed of buying the Index , selling a futures contract, and borrowing. such that the net investment is zero

Stock Index Futures The most active contract is the S&P 500 futures contract traded on the CME, where the contract notional is defined as $250 times the index level. If we actually invested in the S&P 500 index, our rate of return would be higher than the index, because we would receive the cash dividends. The pricing formula is derived by the no-arbitrage argument, using a strategy composed of buying the Index , selling a futures contract, and borrowing. such that the net investment is zero

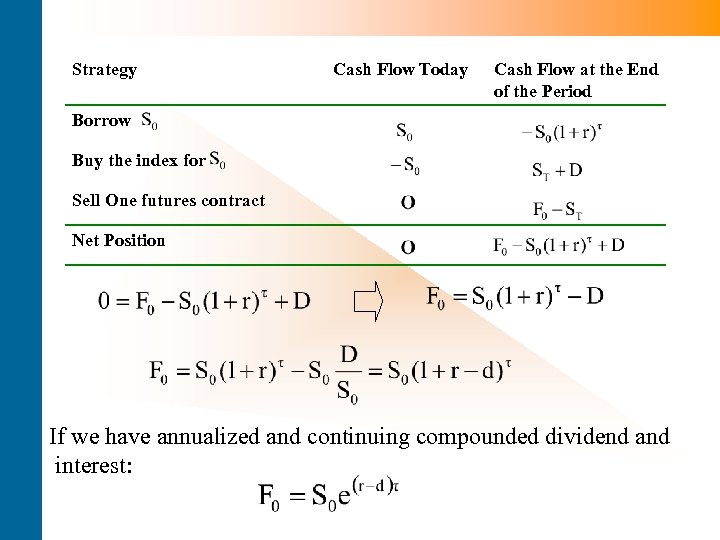

Strategy Cash Flow Today Cash Flow at the End of the Period Borrow Buy the index for Sell One futures contract Net Position If we have annualized and continuing compounded dividend and interest:

Strategy Cash Flow Today Cash Flow at the End of the Period Borrow Buy the index for Sell One futures contract Net Position If we have annualized and continuing compounded dividend and interest:

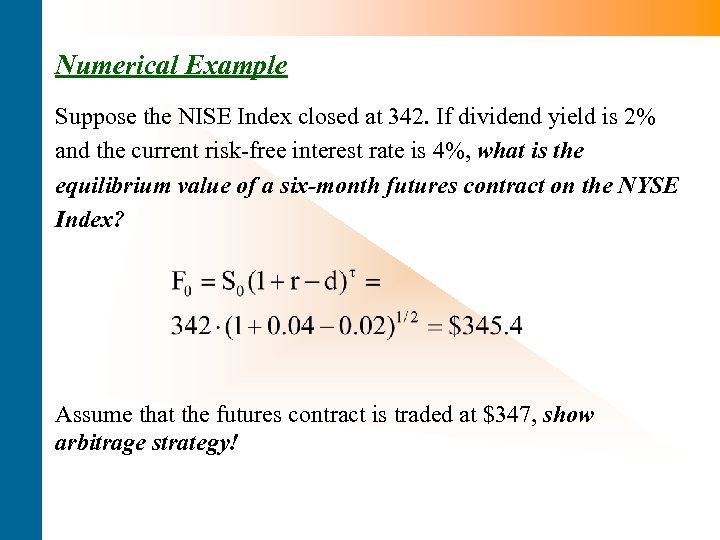

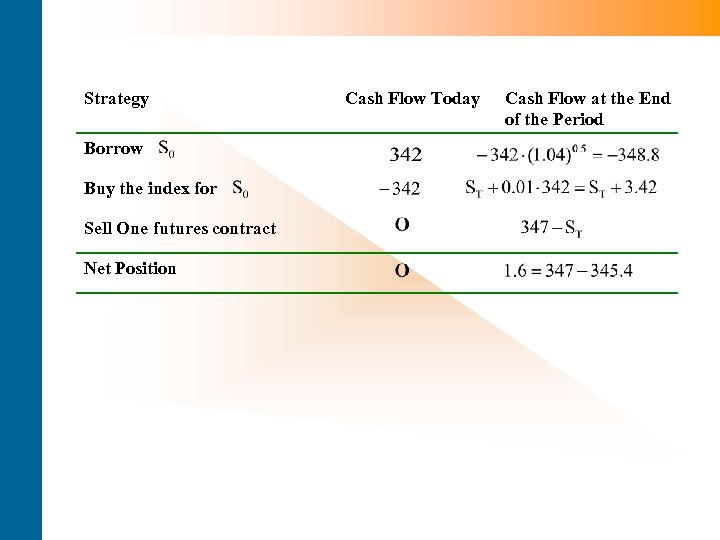

Numerical Example Suppose the NISE Index closed at 342. If dividend yield is 2% and the current risk-free interest rate is 4%, what is the equilibrium value of a six-month futures contract on the NYSE Index? Assume that the futures contract is traded at $347, show arbitrage strategy!

Numerical Example Suppose the NISE Index closed at 342. If dividend yield is 2% and the current risk-free interest rate is 4%, what is the equilibrium value of a six-month futures contract on the NYSE Index? Assume that the futures contract is traded at $347, show arbitrage strategy!

Strategy Borrow Buy the index for Sell One futures contract Net Position Cash Flow Today Cash Flow at the End of the Period

Strategy Borrow Buy the index for Sell One futures contract Net Position Cash Flow Today Cash Flow at the End of the Period

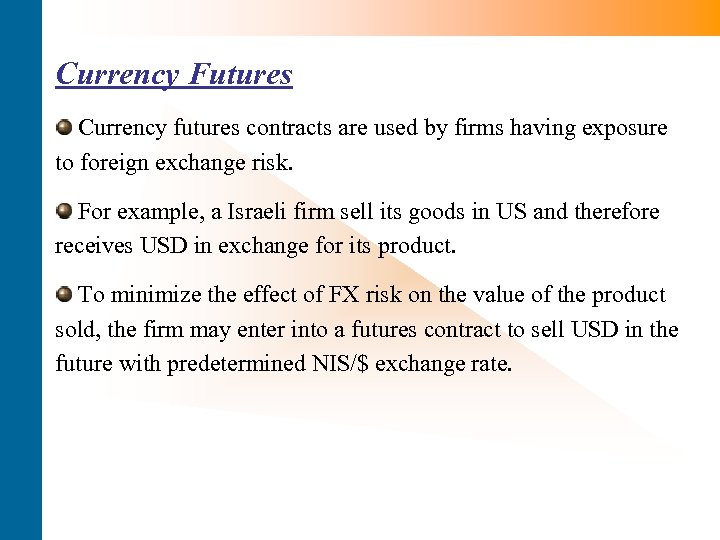

Currency Futures Currency futures contracts are used by firms having exposure to foreign exchange risk. For example, a Israeli firm sell its goods in US and therefore receives USD in exchange for its product. To minimize the effect of FX risk on the value of the product sold, the firm may enter into a futures contract to sell USD in the future with predetermined NIS/$ exchange rate.

Currency Futures Currency futures contracts are used by firms having exposure to foreign exchange risk. For example, a Israeli firm sell its goods in US and therefore receives USD in exchange for its product. To minimize the effect of FX risk on the value of the product sold, the firm may enter into a futures contract to sell USD in the future with predetermined NIS/$ exchange rate.

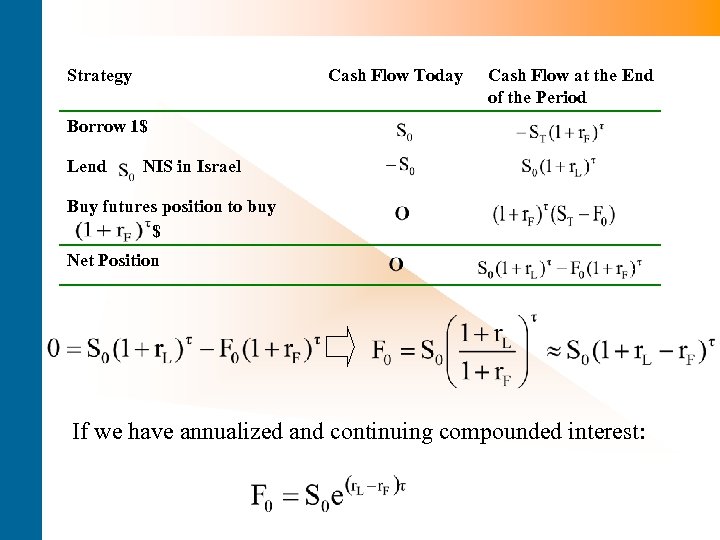

Strategy Cash Flow Today Cash Flow at the End of the Period Borrow 1$ Lend NIS in Israel Buy futures position to buy $ Net Position If we have annualized and continuing compounded interest:

Strategy Cash Flow Today Cash Flow at the End of the Period Borrow 1$ Lend NIS in Israel Buy futures position to buy $ Net Position If we have annualized and continuing compounded interest:

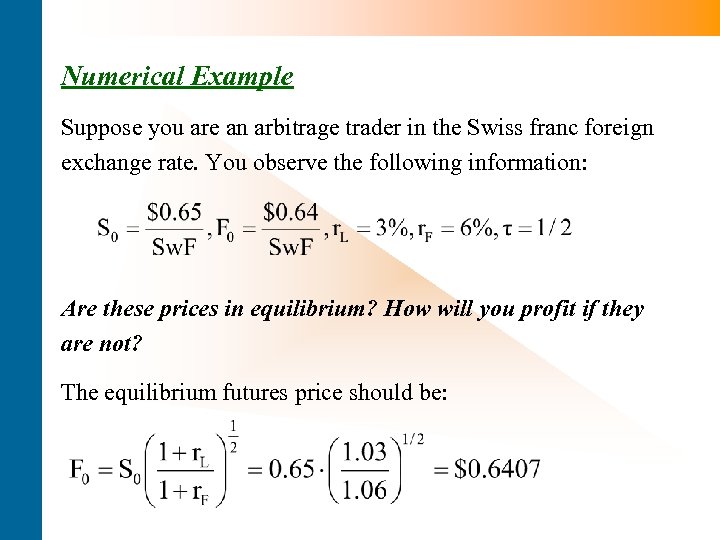

Numerical Example Suppose you are an arbitrage trader in the Swiss franc foreign exchange rate. You observe the following information: Are these prices in equilibrium? How will you profit if they are not? The equilibrium futures price should be:

Numerical Example Suppose you are an arbitrage trader in the Swiss franc foreign exchange rate. You observe the following information: Are these prices in equilibrium? How will you profit if they are not? The equilibrium futures price should be:

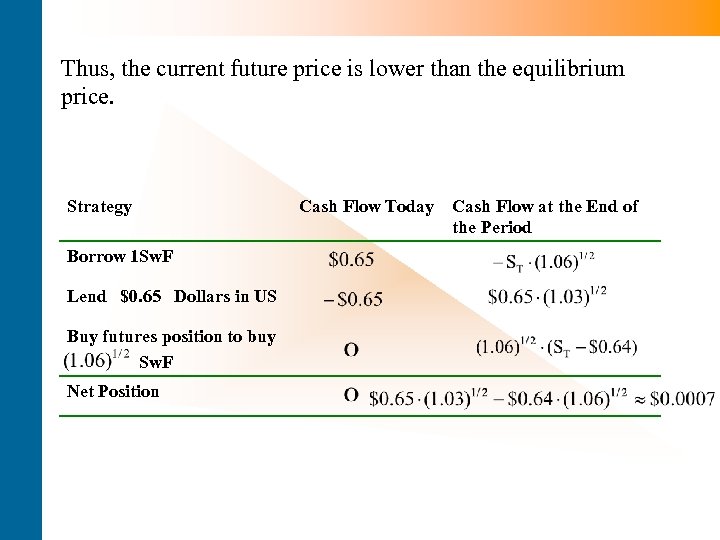

Thus, the current future price is lower than the equilibrium price. Strategy Borrow 1 Sw. F Lend $0. 65 Dollars in US Buy futures position to buy Sw. F Net Position Cash Flow Today Cash Flow at the End of the Period

Thus, the current future price is lower than the equilibrium price. Strategy Borrow 1 Sw. F Lend $0. 65 Dollars in US Buy futures position to buy Sw. F Net Position Cash Flow Today Cash Flow at the End of the Period

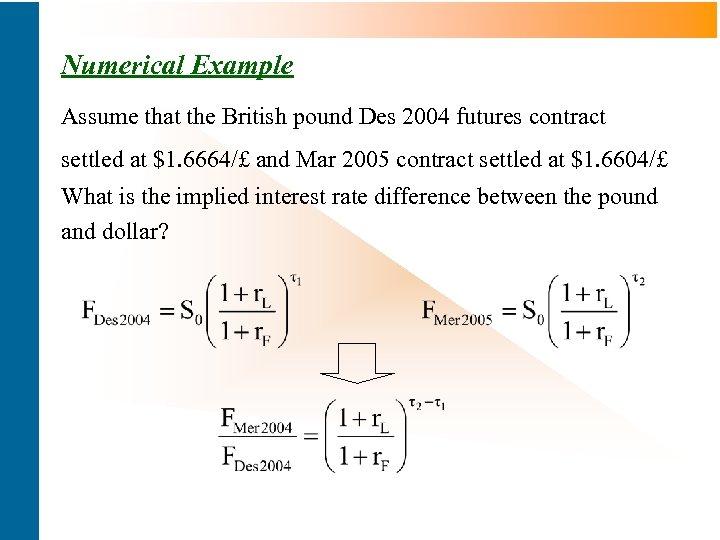

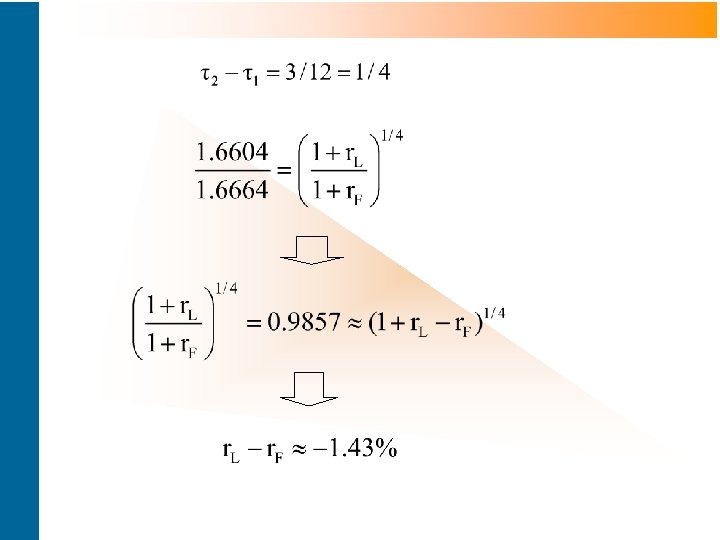

Numerical Example Assume that the British pound Des 2004 futures contract settled at $1. 6664/£ and Mar 2005 contract settled at $1. 6604/£ What is the implied interest rate difference between the pound and dollar?

Numerical Example Assume that the British pound Des 2004 futures contract settled at $1. 6664/£ and Mar 2005 contract settled at $1. 6604/£ What is the implied interest rate difference between the pound and dollar?

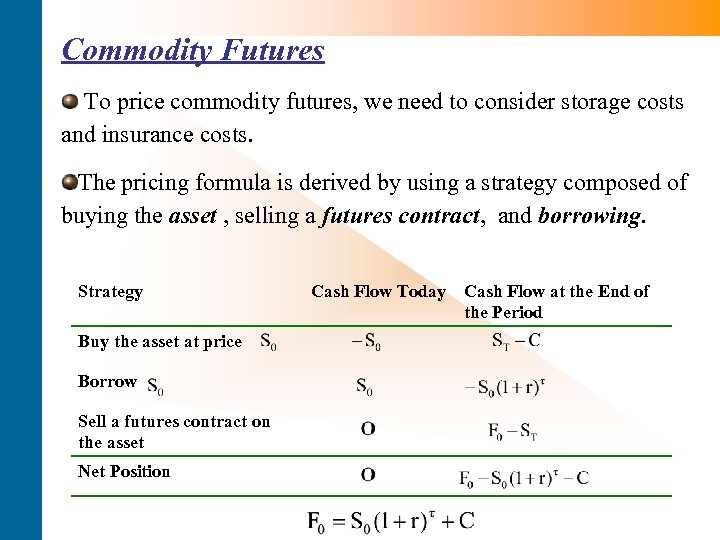

Commodity Futures To price commodity futures, we need to consider storage costs and insurance costs. The pricing formula is derived by using a strategy composed of buying the asset , selling a futures contract, and borrowing. Strategy Buy the asset at price Borrow Sell a futures contract on the asset Net Position Cash Flow Today Cash Flow at the End of the Period

Commodity Futures To price commodity futures, we need to consider storage costs and insurance costs. The pricing formula is derived by using a strategy composed of buying the asset , selling a futures contract, and borrowing. Strategy Buy the asset at price Borrow Sell a futures contract on the asset Net Position Cash Flow Today Cash Flow at the End of the Period

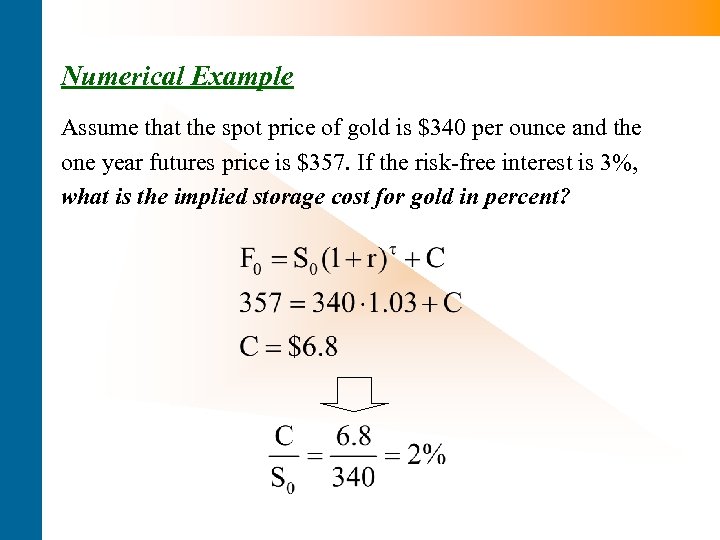

Numerical Example Assume that the spot price of gold is $340 per ounce and the one year futures price is $357. If the risk-free interest is 3%, what is the implied storage cost for gold in percent?

Numerical Example Assume that the spot price of gold is $340 per ounce and the one year futures price is $357. If the risk-free interest is 3%, what is the implied storage cost for gold in percent?

Swap Contracts Swap contracts are OTC agreements to exchange a series of cash flow according to some pre-specified terms. The underlying asset can be : an interest rate, an exchange rate, an equity, a commodity price or any other index. The most common swap contracts are: an Interest Rate Swap (IRS), a Foreign Exchange Swap (FES) and a Credit Default Swap (CDS)

Swap Contracts Swap contracts are OTC agreements to exchange a series of cash flow according to some pre-specified terms. The underlying asset can be : an interest rate, an exchange rate, an equity, a commodity price or any other index. The most common swap contracts are: an Interest Rate Swap (IRS), a Foreign Exchange Swap (FES) and a Credit Default Swap (CDS)

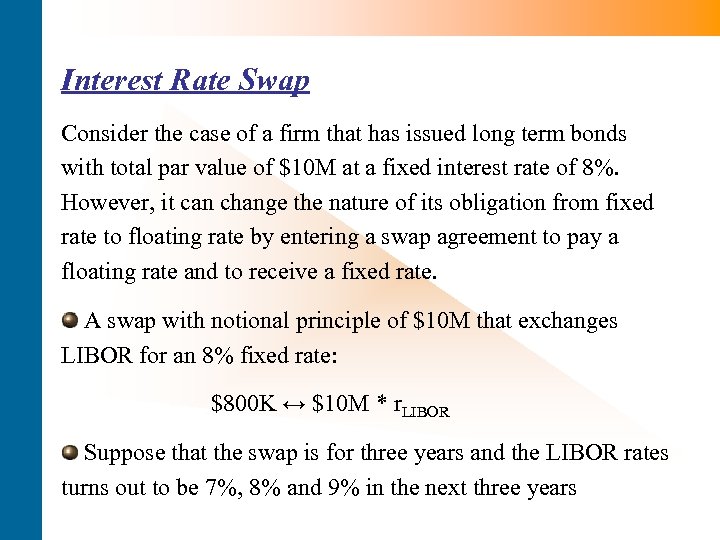

Interest Rate Swap Consider the case of a firm that has issued long term bonds with total par value of $10 M at a fixed interest rate of 8%. However, it can change the nature of its obligation from fixed rate to floating rate by entering a swap agreement to pay a floating rate and to receive a fixed rate. A swap with notional principle of $10 M that exchanges LIBOR for an 8% fixed rate: $800 K ↔ $10 M * r. LIBOR Suppose that the swap is for three years and the LIBOR rates turns out to be 7%, 8% and 9% in the next three years

Interest Rate Swap Consider the case of a firm that has issued long term bonds with total par value of $10 M at a fixed interest rate of 8%. However, it can change the nature of its obligation from fixed rate to floating rate by entering a swap agreement to pay a floating rate and to receive a fixed rate. A swap with notional principle of $10 M that exchanges LIBOR for an 8% fixed rate: $800 K ↔ $10 M * r. LIBOR Suppose that the swap is for three years and the LIBOR rates turns out to be 7%, 8% and 9% in the next three years

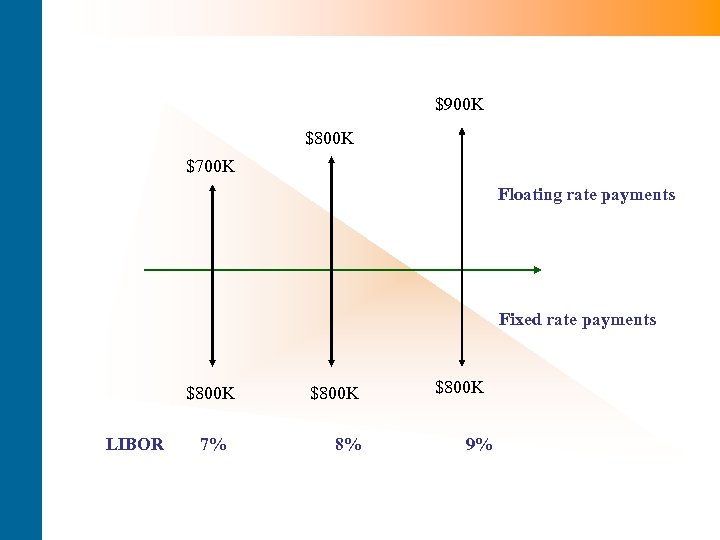

$900 K $800 K $700 K Floating rate payments Fixed rate payments $800 K LIBOR 7% $800 K 8% $800 K 9%

$900 K $800 K $700 K Floating rate payments Fixed rate payments $800 K LIBOR 7% $800 K 8% $800 K 9%

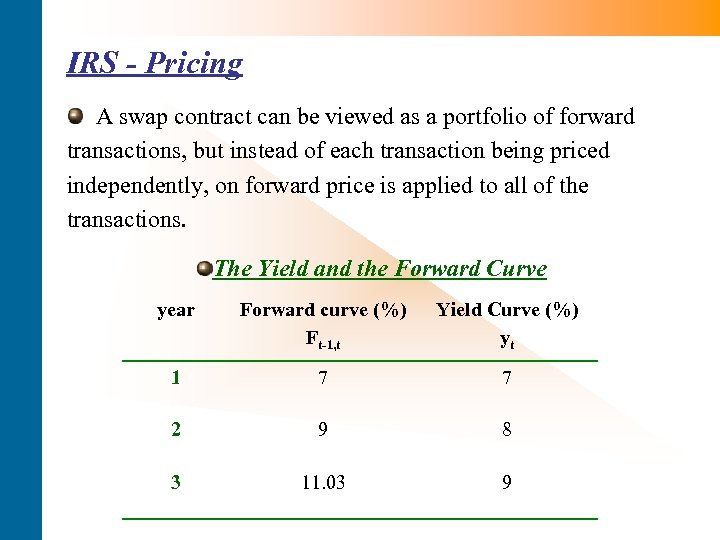

IRS - Pricing A swap contract can be viewed as a portfolio of forward transactions, but instead of each transaction being priced independently, on forward price is applied to all of the transactions. The Yield and the Forward Curve year Forward curve (%) Ft-1, t Yield Curve (%) yt 1 7 7 2 9 8 3 11. 03 9

IRS - Pricing A swap contract can be viewed as a portfolio of forward transactions, but instead of each transaction being priced independently, on forward price is applied to all of the transactions. The Yield and the Forward Curve year Forward curve (%) Ft-1, t Yield Curve (%) yt 1 7 7 2 9 8 3 11. 03 9

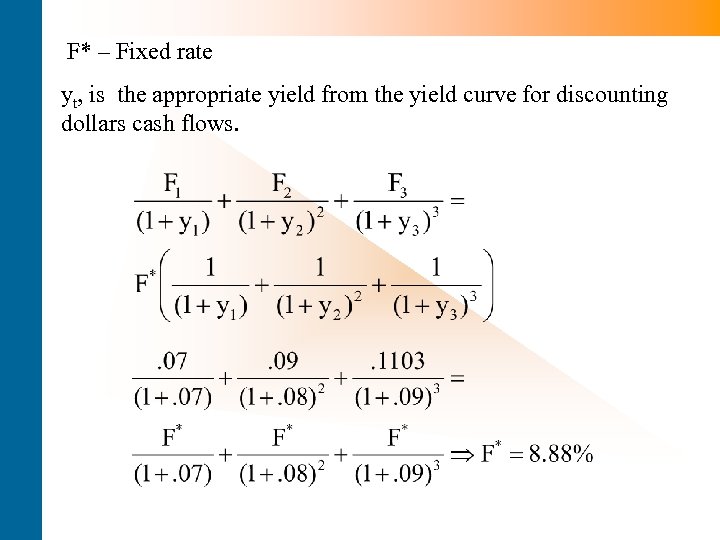

F* – Fixed rate yt, is the appropriate yield from the yield curve for discounting dollars cash flows.

F* – Fixed rate yt, is the appropriate yield from the yield curve for discounting dollars cash flows.

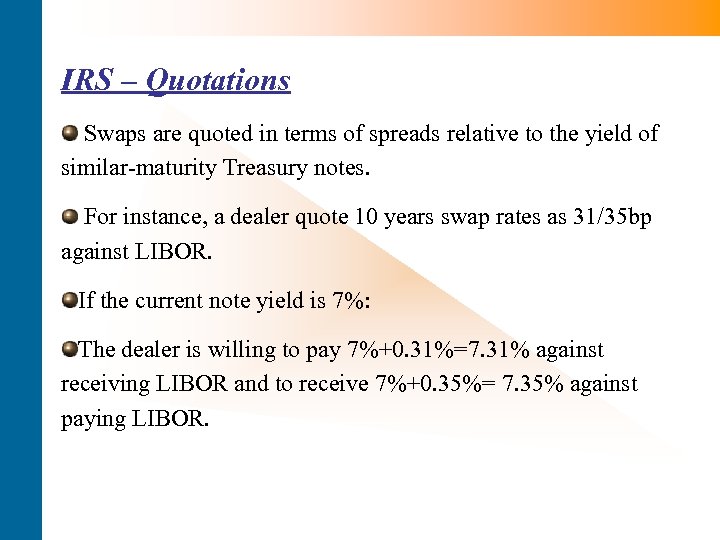

IRS – Quotations Swaps are quoted in terms of spreads relative to the yield of similar-maturity Treasury notes. For instance, a dealer quote 10 years swap rates as 31/35 bp against LIBOR. If the current note yield is 7%: The dealer is willing to pay 7%+0. 31%=7. 31% against receiving LIBOR and to receive 7%+0. 35%= 7. 35% against paying LIBOR.

IRS – Quotations Swaps are quoted in terms of spreads relative to the yield of similar-maturity Treasury notes. For instance, a dealer quote 10 years swap rates as 31/35 bp against LIBOR. If the current note yield is 7%: The dealer is willing to pay 7%+0. 31%=7. 31% against receiving LIBOR and to receive 7%+0. 35%= 7. 35% against paying LIBOR.

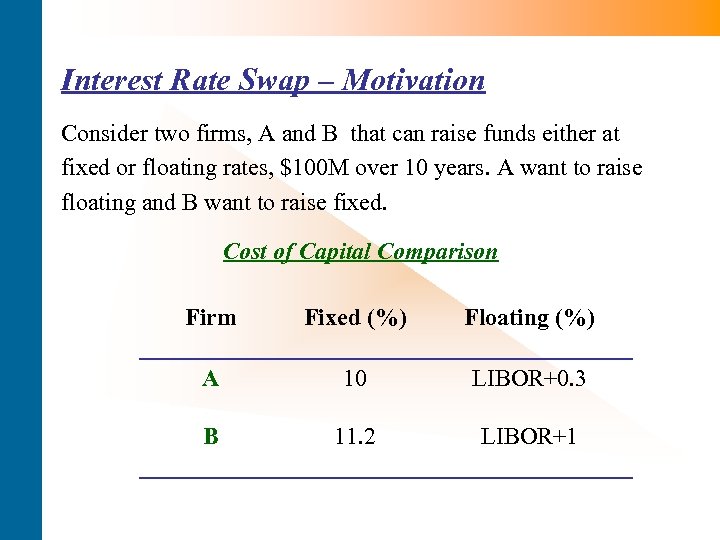

Interest Rate Swap – Motivation Consider two firms, A and B that can raise funds either at fixed or floating rates, $100 M over 10 years. A want to raise floating and B want to raise fixed. Cost of Capital Comparison Firm Fixed (%) Floating (%) A 10 LIBOR+0. 3 B 11. 2 LIBOR+1

Interest Rate Swap – Motivation Consider two firms, A and B that can raise funds either at fixed or floating rates, $100 M over 10 years. A want to raise floating and B want to raise fixed. Cost of Capital Comparison Firm Fixed (%) Floating (%) A 10 LIBOR+0. 3 B 11. 2 LIBOR+1

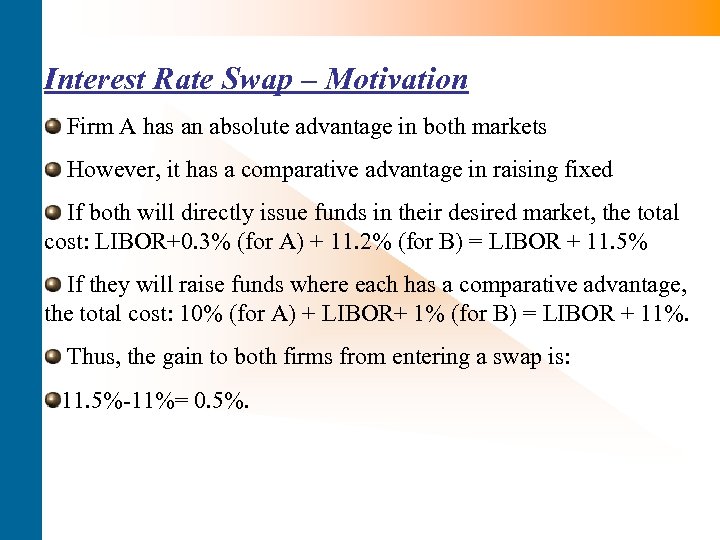

Interest Rate Swap – Motivation Firm A has an absolute advantage in both markets However, it has a comparative advantage in raising fixed If both will directly issue funds in their desired market, the total cost: LIBOR+0. 3% (for A) + 11. 2% (for B) = LIBOR + 11. 5% If they will raise funds where each has a comparative advantage, the total cost: 10% (for A) + LIBOR+ 1% (for B) = LIBOR + 11%. Thus, the gain to both firms from entering a swap is: 11. 5%-11%= 0. 5%.

Interest Rate Swap – Motivation Firm A has an absolute advantage in both markets However, it has a comparative advantage in raising fixed If both will directly issue funds in their desired market, the total cost: LIBOR+0. 3% (for A) + 11. 2% (for B) = LIBOR + 11. 5% If they will raise funds where each has a comparative advantage, the total cost: 10% (for A) + LIBOR+ 1% (for B) = LIBOR + 11%. Thus, the gain to both firms from entering a swap is: 11. 5%-11%= 0. 5%.

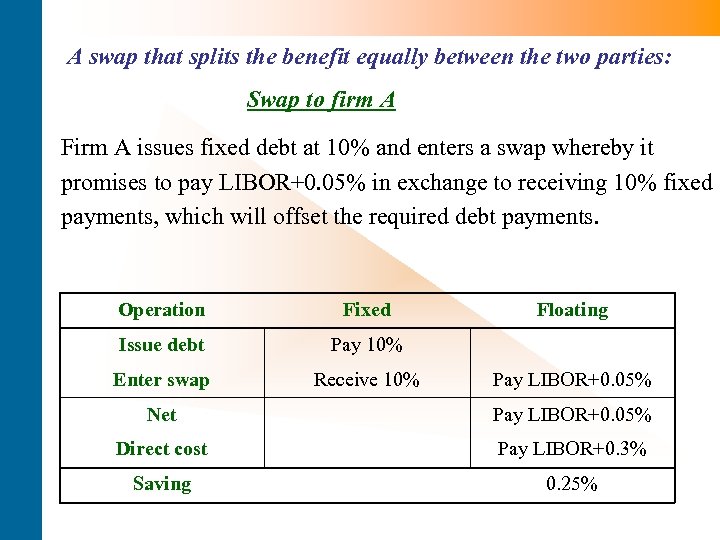

A swap that splits the benefit equally between the two parties: Swap to firm A Firm A issues fixed debt at 10% and enters a swap whereby it promises to pay LIBOR+0. 05% in exchange to receiving 10% fixed payments, which will offset the required debt payments. Operation Fixed Issue debt Pay 10% Enter swap Receive 10% Floating Pay LIBOR+0. 05% Net Pay LIBOR+0. 05% Direct cost Pay LIBOR+0. 3% Saving 0. 25%

A swap that splits the benefit equally between the two parties: Swap to firm A Firm A issues fixed debt at 10% and enters a swap whereby it promises to pay LIBOR+0. 05% in exchange to receiving 10% fixed payments, which will offset the required debt payments. Operation Fixed Issue debt Pay 10% Enter swap Receive 10% Floating Pay LIBOR+0. 05% Net Pay LIBOR+0. 05% Direct cost Pay LIBOR+0. 3% Saving 0. 25%

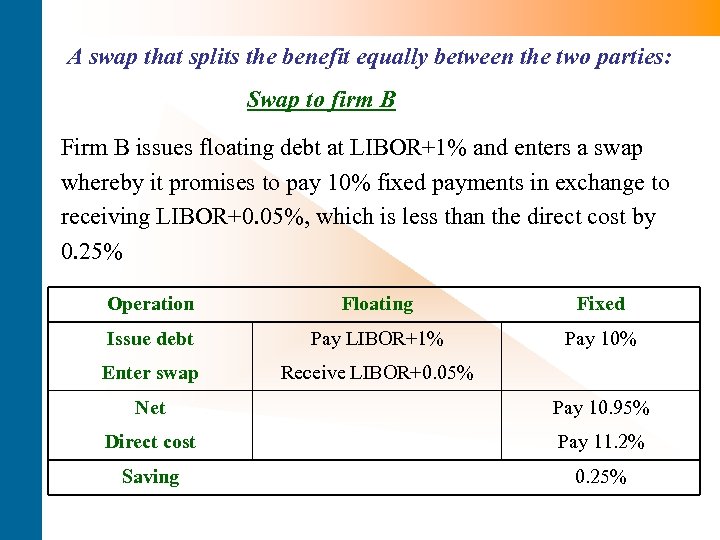

A swap that splits the benefit equally between the two parties: Swap to firm B Firm B issues floating debt at LIBOR+1% and enters a swap whereby it promises to pay 10% fixed payments in exchange to receiving LIBOR+0. 05%, which is less than the direct cost by 0. 25% Operation Floating Fixed Issue debt Pay LIBOR+1% Pay 10% Enter swap Receive LIBOR+0. 05% Net Pay 10. 95% Direct cost Pay 11. 2% Saving 0. 25%

A swap that splits the benefit equally between the two parties: Swap to firm B Firm B issues floating debt at LIBOR+1% and enters a swap whereby it promises to pay 10% fixed payments in exchange to receiving LIBOR+0. 05%, which is less than the direct cost by 0. 25% Operation Floating Fixed Issue debt Pay LIBOR+1% Pay 10% Enter swap Receive LIBOR+0. 05% Net Pay 10. 95% Direct cost Pay 11. 2% Saving 0. 25%

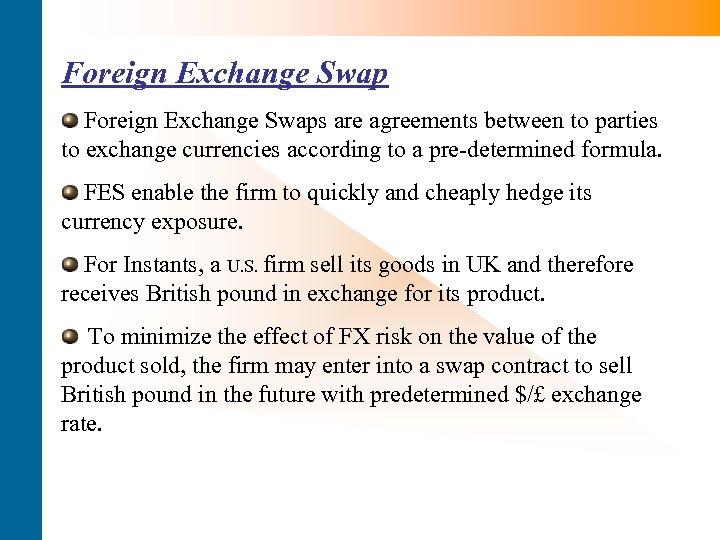

Foreign Exchange Swaps are agreements between to parties to exchange currencies according to a pre-determined formula. FES enable the firm to quickly and cheaply hedge its currency exposure. For Instants, a U. S. firm sell its goods in UK and therefore receives British pound in exchange for its product. To minimize the effect of FX risk on the value of the product sold, the firm may enter into a swap contract to sell British pound in the future with predetermined $/£ exchange rate.

Foreign Exchange Swaps are agreements between to parties to exchange currencies according to a pre-determined formula. FES enable the firm to quickly and cheaply hedge its currency exposure. For Instants, a U. S. firm sell its goods in UK and therefore receives British pound in exchange for its product. To minimize the effect of FX risk on the value of the product sold, the firm may enter into a swap contract to sell British pound in the future with predetermined $/£ exchange rate.

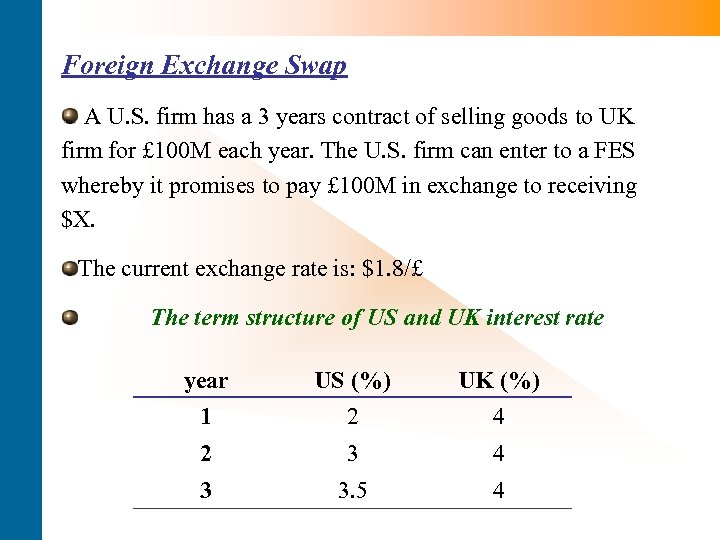

Foreign Exchange Swap A U. S. firm has a 3 years contract of selling goods to UK firm for £ 100 M each year. The U. S. firm can enter to a FES whereby it promises to pay £ 100 M in exchange to receiving $X. The current exchange rate is: $1. 8/£ The term structure of US and UK interest rate year 1 US (%) 2 UK (%) 4 2 3 4 3 3. 5 4

Foreign Exchange Swap A U. S. firm has a 3 years contract of selling goods to UK firm for £ 100 M each year. The U. S. firm can enter to a FES whereby it promises to pay £ 100 M in exchange to receiving $X. The current exchange rate is: $1. 8/£ The term structure of US and UK interest rate year 1 US (%) 2 UK (%) 4 2 3 4 3 3. 5 4

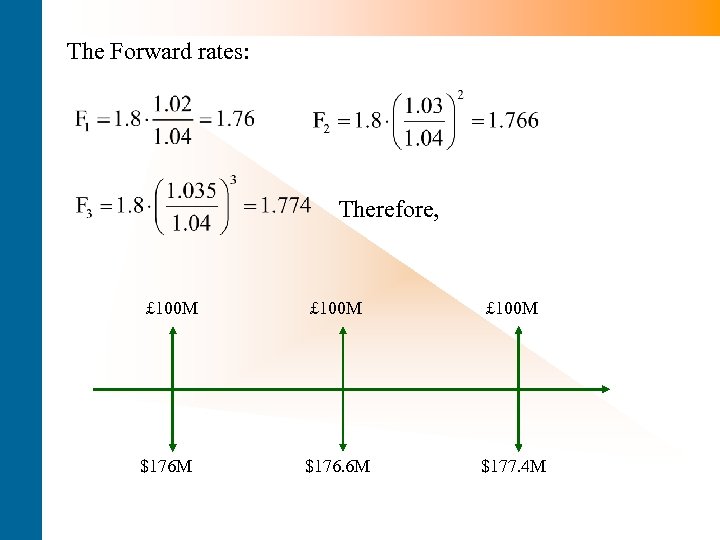

The Forward rates: Therefore, £ 100 M $176 M £ 100 M $176. 6 M $177. 4 M

The Forward rates: Therefore, £ 100 M $176 M £ 100 M $176. 6 M $177. 4 M

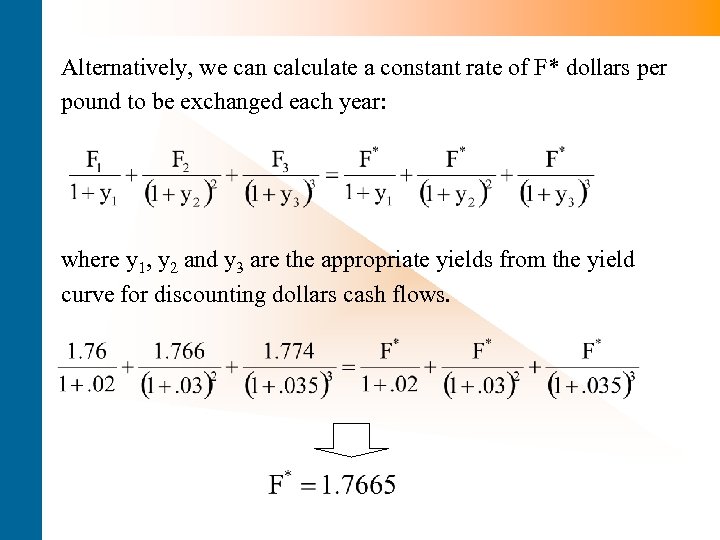

Alternatively, we can calculate a constant rate of F* dollars per pound to be exchanged each year: where y 1, y 2 and y 3 are the appropriate yields from the yield curve for discounting dollars cash flows.

Alternatively, we can calculate a constant rate of F* dollars per pound to be exchanged each year: where y 1, y 2 and y 3 are the appropriate yields from the yield curve for discounting dollars cash flows.

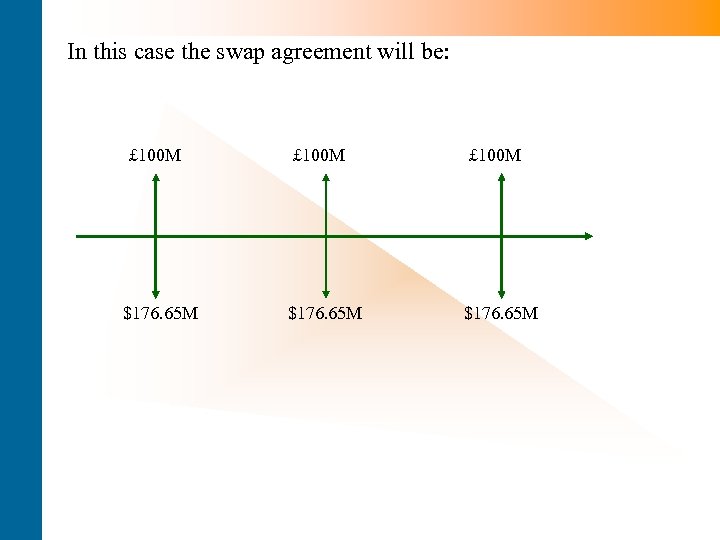

In this case the swap agreement will be: £ 100 M $176. 65 M

In this case the swap agreement will be: £ 100 M $176. 65 M

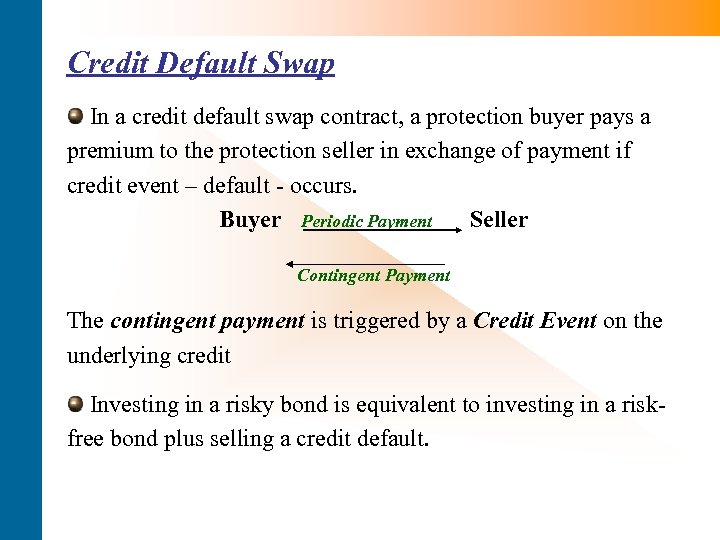

Credit Default Swap In a credit default swap contract, a protection buyer pays a premium to the protection seller in exchange of payment if credit event – default - occurs. Buyer Periodic Payment Seller Contingent Payment The contingent payment is triggered by a Credit Event on the underlying credit Investing in a risky bond is equivalent to investing in a riskfree bond plus selling a credit default.

Credit Default Swap In a credit default swap contract, a protection buyer pays a premium to the protection seller in exchange of payment if credit event – default - occurs. Buyer Periodic Payment Seller Contingent Payment The contingent payment is triggered by a Credit Event on the underlying credit Investing in a risky bond is equivalent to investing in a riskfree bond plus selling a credit default.

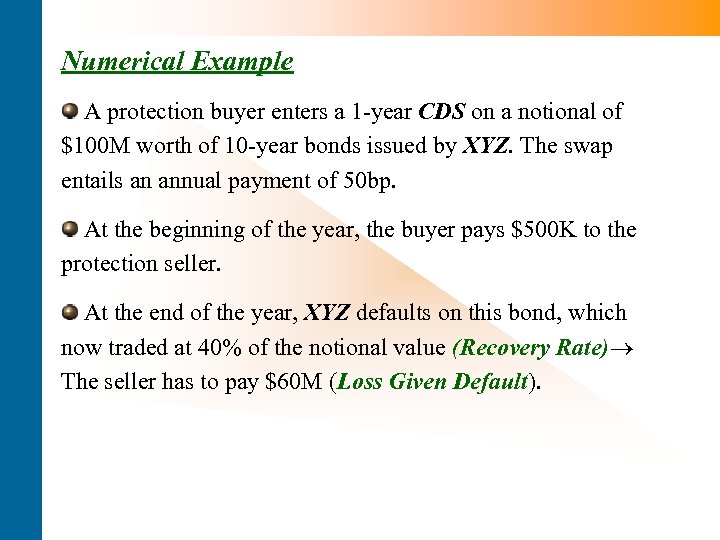

Numerical Example A protection buyer enters a 1 -year CDS on a notional of $100 M worth of 10 -year bonds issued by XYZ. The swap entails an annual payment of 50 bp. At the beginning of the year, the buyer pays $500 K to the protection seller. At the end of the year, XYZ defaults on this bond, which now traded at 40% of the notional value (Recovery Rate) The seller has to pay $60 M (Loss Given Default).

Numerical Example A protection buyer enters a 1 -year CDS on a notional of $100 M worth of 10 -year bonds issued by XYZ. The swap entails an annual payment of 50 bp. At the beginning of the year, the buyer pays $500 K to the protection seller. At the end of the year, XYZ defaults on this bond, which now traded at 40% of the notional value (Recovery Rate) The seller has to pay $60 M (Loss Given Default).