Topic 1. General characteristics of mergers and acquisitions

14242-topic_1.ppt

- Количество слайдов: 41

Topic 1. General characteristics of mergers and acquisitions What are mergers and acquisitions? M&A market: waves and tendencies The objectives of M&A

Topic 1. General characteristics of mergers and acquisitions What are mergers and acquisitions? M&A market: waves and tendencies The objectives of M&A

What are mergers and acquisitions? 09.12.2017 2

What are mergers and acquisitions? 09.12.2017 2

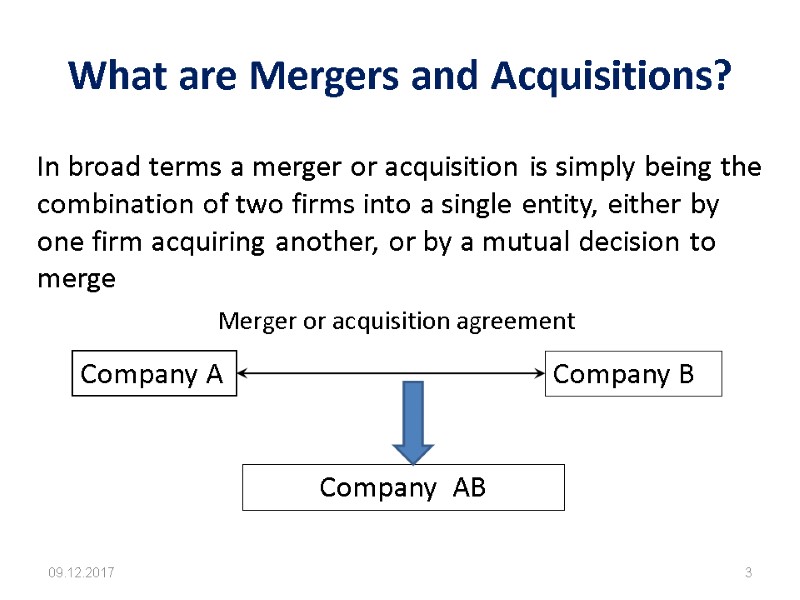

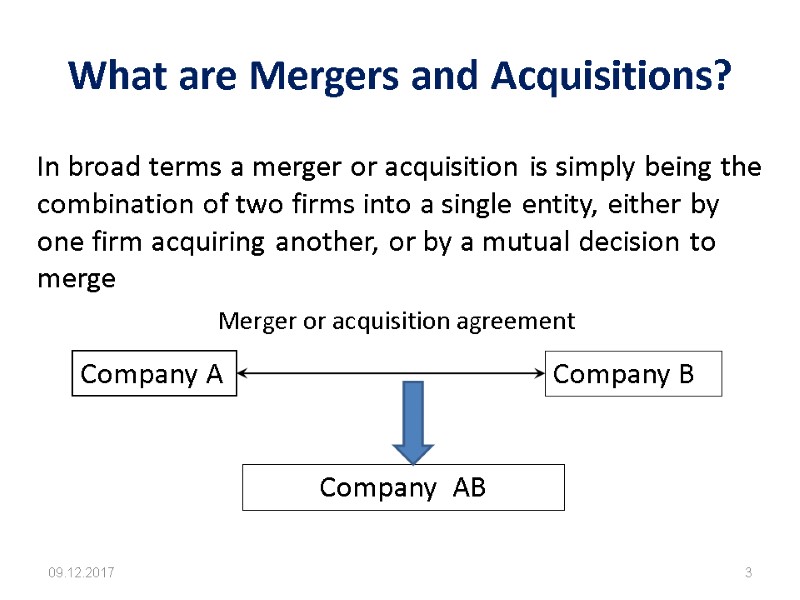

What are Mergers and Acquisitions? 09.12.2017 3 In broad terms a merger or acquisition is simply being the combination of two firms into a single entity, either by one firm acquiring another, or by a mutual decision to merge Company A Company B Merger or acquisition agreement Company AB

What are Mergers and Acquisitions? 09.12.2017 3 In broad terms a merger or acquisition is simply being the combination of two firms into a single entity, either by one firm acquiring another, or by a mutual decision to merge Company A Company B Merger or acquisition agreement Company AB

A Merger 09.12.2017 4 A merger (or consolidation) is an agreement between two companies to combine in to a single company. The merger has a friendly nature The merger is completed by issuing new share certificates to the shareholders of both companies, so no external funds required. A typical feature of a merger is that there is an agreement between the boards of the two companies on the terms of the merger. The two companies exchange their shares for shares in the newly formed company. Often the identities of the original companies disappear.

A Merger 09.12.2017 4 A merger (or consolidation) is an agreement between two companies to combine in to a single company. The merger has a friendly nature The merger is completed by issuing new share certificates to the shareholders of both companies, so no external funds required. A typical feature of a merger is that there is an agreement between the boards of the two companies on the terms of the merger. The two companies exchange their shares for shares in the newly formed company. Often the identities of the original companies disappear.

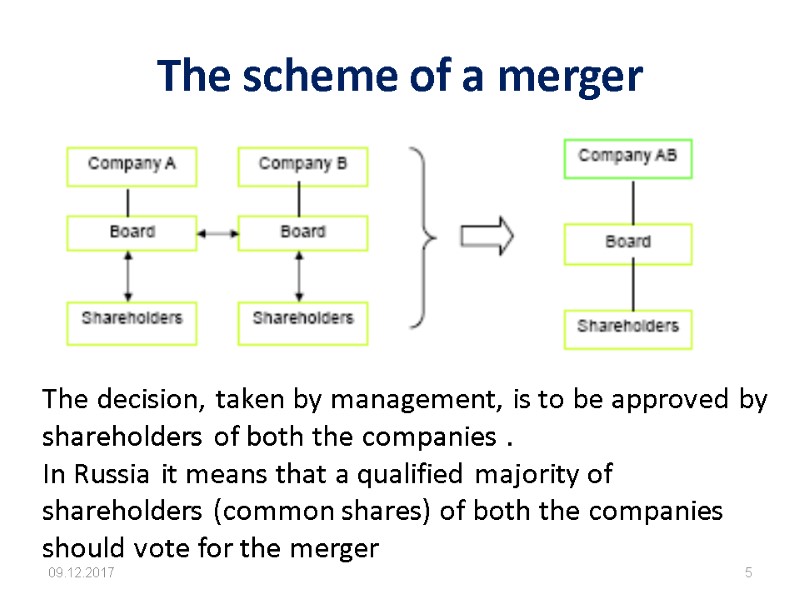

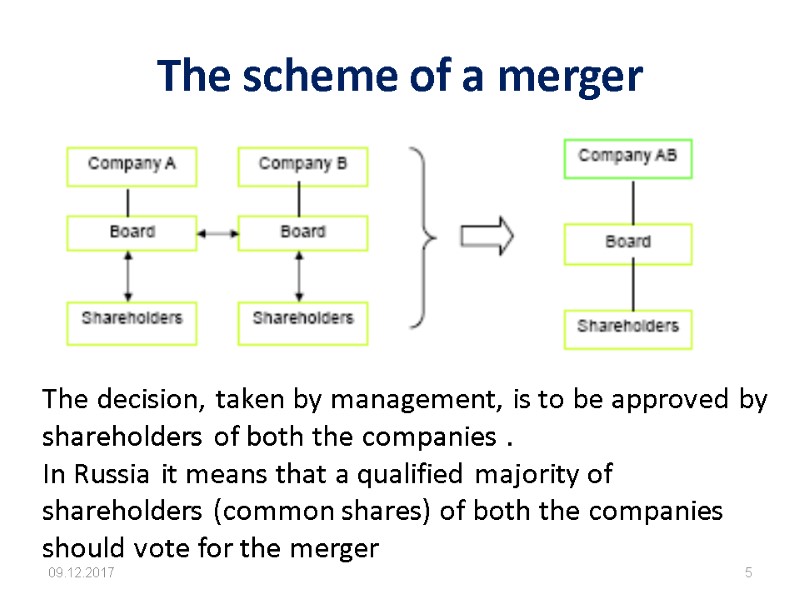

The scheme of a merger 09.12.2017 5 The decision, taken by management, is to be approved by shareholders of both the companies . In Russia it means that a qualified majority of shareholders (common shares) of both the companies should vote for the merger

The scheme of a merger 09.12.2017 5 The decision, taken by management, is to be approved by shareholders of both the companies . In Russia it means that a qualified majority of shareholders (common shares) of both the companies should vote for the merger

An Acquisition (takeover) An acquisition means the taking the corporate control upon one company (target, acquiring company) by the other one (bidding company, acquirer, raider) The level of corporate control may vary from the full control (100% of shares) to an interest in the company (a reasonable deal of shares to have an impact) The decision is also to be approved by the qualified majorities of both the companies 09.12.2017 6

An Acquisition (takeover) An acquisition means the taking the corporate control upon one company (target, acquiring company) by the other one (bidding company, acquirer, raider) The level of corporate control may vary from the full control (100% of shares) to an interest in the company (a reasonable deal of shares to have an impact) The decision is also to be approved by the qualified majorities of both the companies 09.12.2017 6

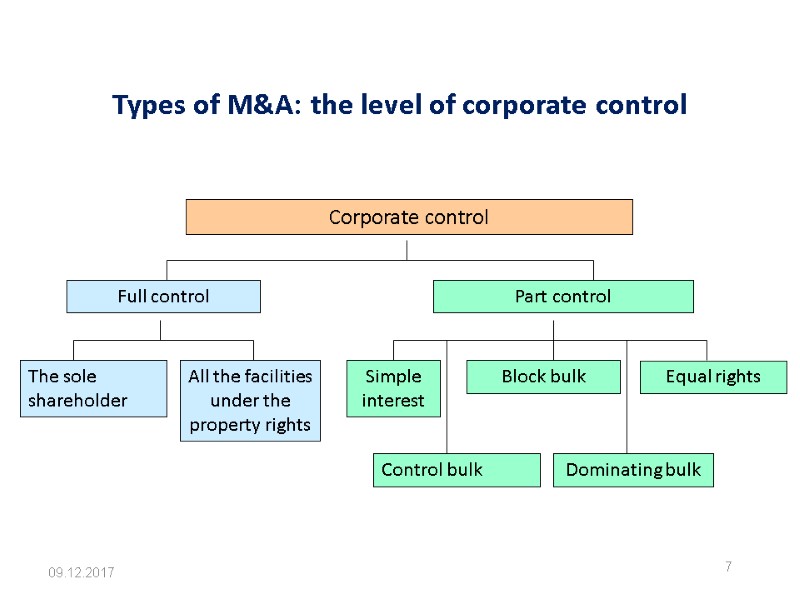

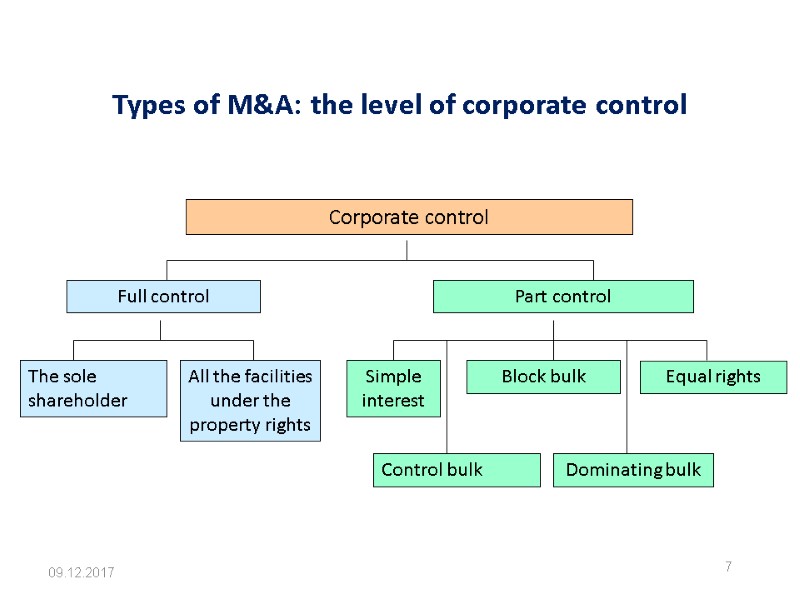

Types of M&A: the level of corporate control 09.12.2017 7

Types of M&A: the level of corporate control 09.12.2017 7

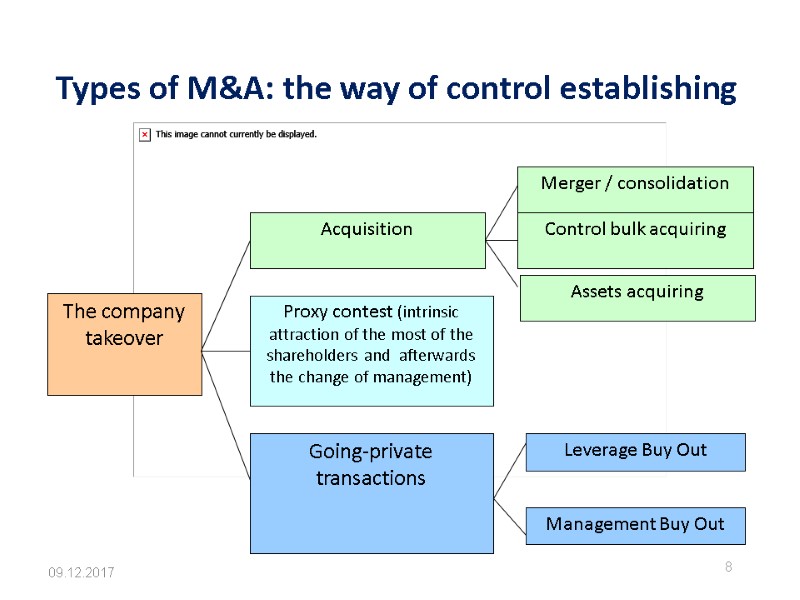

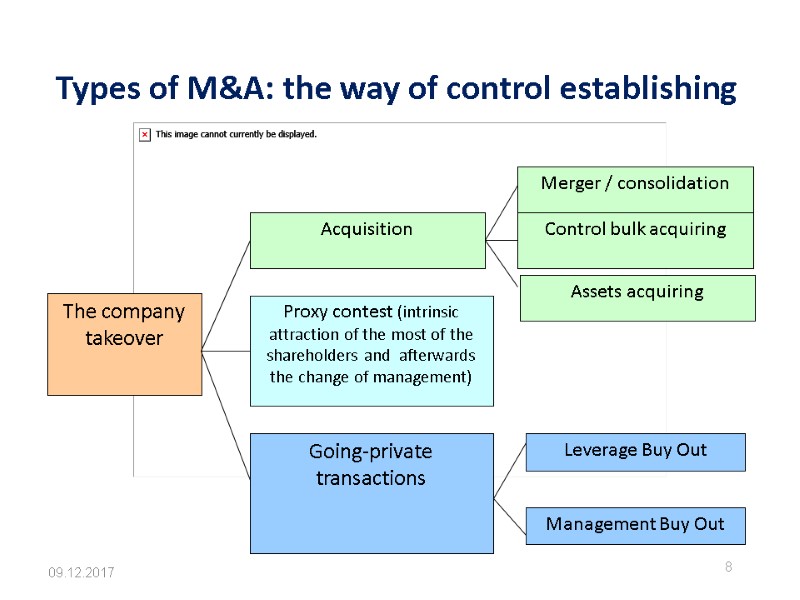

Types of M&A: the way of control establishing 09.12.2017 8

Types of M&A: the way of control establishing 09.12.2017 8

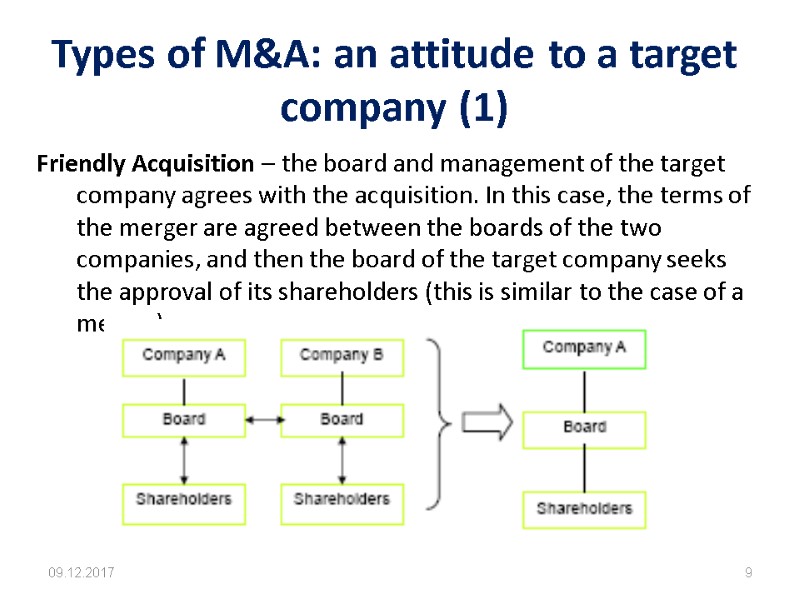

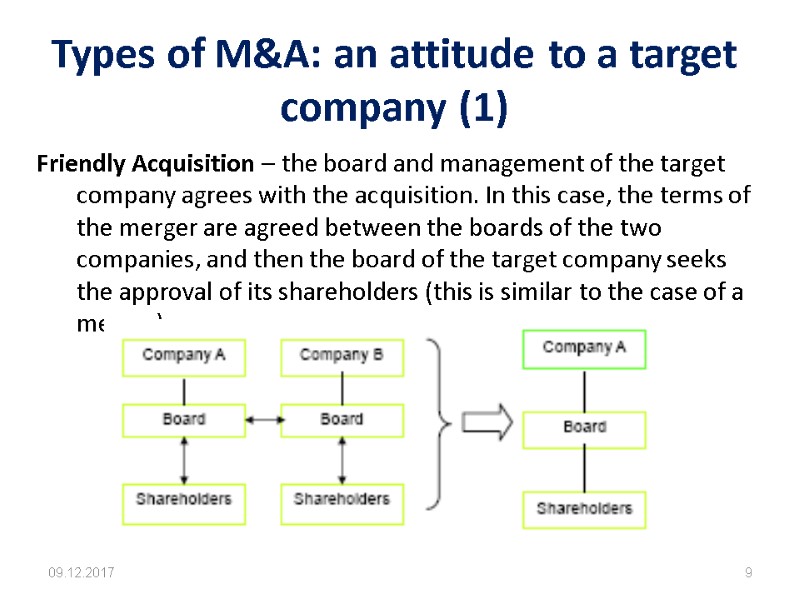

Types of M&A: an attitude to a target company (1) 09.12.2017 9 Friendly Acquisition – the board and management of the target company agrees with the acquisition. In this case, the terms of the merger are agreed between the boards of the two companies, and then the board of the target company seeks the approval of its shareholders (this is similar to the case of a merger):

Types of M&A: an attitude to a target company (1) 09.12.2017 9 Friendly Acquisition – the board and management of the target company agrees with the acquisition. In this case, the terms of the merger are agreed between the boards of the two companies, and then the board of the target company seeks the approval of its shareholders (this is similar to the case of a merger):

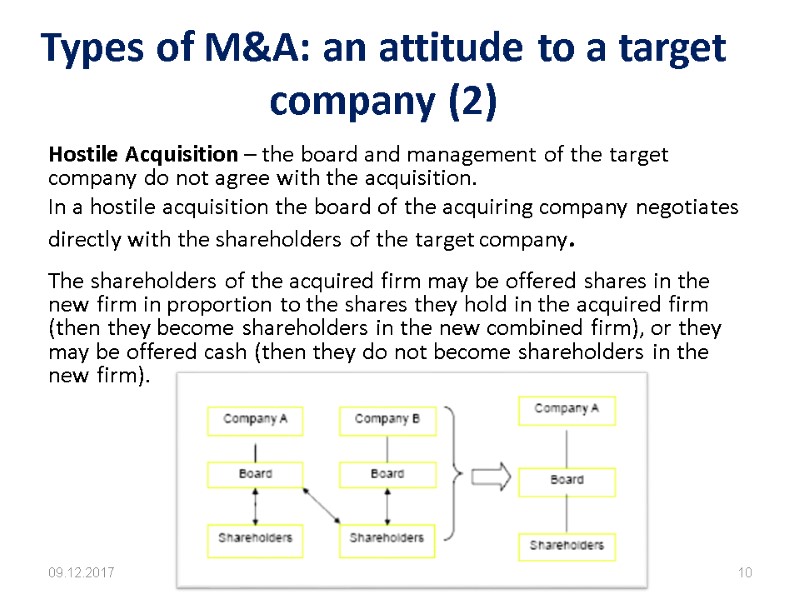

Types of M&A: an attitude to a target company (2) Hostile Acquisition – the board and management of the target company do not agree with the acquisition. In a hostile acquisition the board of the acquiring company negotiates directly with the shareholders of the target company. The shareholders of the acquired firm may be offered shares in the new firm in proportion to the shares they hold in the acquired firm (then they become shareholders in the new combined firm), or they may be offered cash (then they do not become shareholders in the new firm). 09.12.2017 10

Types of M&A: an attitude to a target company (2) Hostile Acquisition – the board and management of the target company do not agree with the acquisition. In a hostile acquisition the board of the acquiring company negotiates directly with the shareholders of the target company. The shareholders of the acquired firm may be offered shares in the new firm in proportion to the shares they hold in the acquired firm (then they become shareholders in the new combined firm), or they may be offered cash (then they do not become shareholders in the new firm). 09.12.2017 10

Types of M&A: the business processes organization 09.12.2017 11 The main type of M&A are: Horizontal M&A These place between two companies in the same industry, at the same stage of production: For example, Daimler Benz and Chrysler; BP and Amoco. In Russia: Borlas and IBS, RusAl and SibAL Vertical mergers These take place between two companies in the same industry, at different stages of production: For example, RusAL and Glencore, Vympelcom and Golden Telecom. Conglomerate mergers These take place between two companies that are in unrelated industries: For example, AFK Systema and Detskyi Mir, Bazel and Rospechat.

Types of M&A: the business processes organization 09.12.2017 11 The main type of M&A are: Horizontal M&A These place between two companies in the same industry, at the same stage of production: For example, Daimler Benz and Chrysler; BP and Amoco. In Russia: Borlas and IBS, RusAl and SibAL Vertical mergers These take place between two companies in the same industry, at different stages of production: For example, RusAL and Glencore, Vympelcom and Golden Telecom. Conglomerate mergers These take place between two companies that are in unrelated industries: For example, AFK Systema and Detskyi Mir, Bazel and Rospechat.

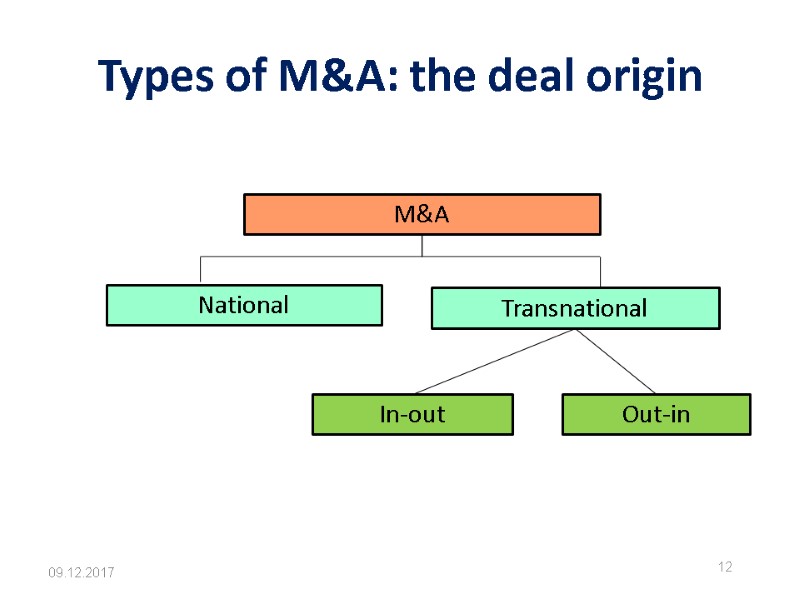

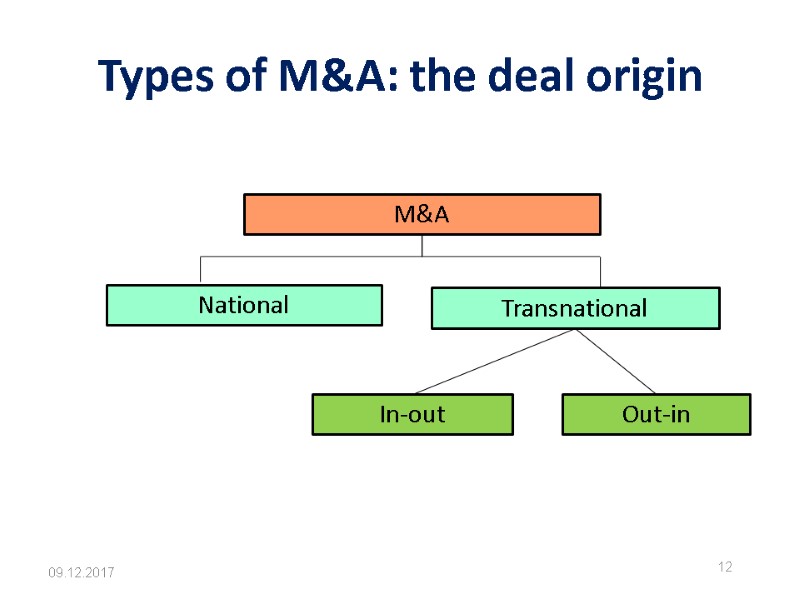

Types of M&A: the deal origin 09.12.2017 12 M&A National Transnational In-out Out-in

Types of M&A: the deal origin 09.12.2017 12 M&A National Transnational In-out Out-in

Russian legislation 09.12.2017 13 Strictly speaking, there is no the term as “mergers and acquisitions”. The term “re-organisation” is used which means such forms as: merger, joining, dividing, defining and change.

Russian legislation 09.12.2017 13 Strictly speaking, there is no the term as “mergers and acquisitions”. The term “re-organisation” is used which means such forms as: merger, joining, dividing, defining and change.

Слияния в российском законодательстве 09.12.2017 14 Слиянием обществ признается возникновение нового общества путем передачи ему всех прав и обязанностей двух или нескольких обществ с прекращением последних. Общества, участвующие в слиянии, заключают договор о слиянии, в котором определяются порядок и условия слияния, а также порядок конвертации акций каждого общества в акции нового общества. Совет директоров (наблюдательный совет) общества выносит на решение общего собрания акционеров каждого общества, участвующего в слиянии, вопрос о реорганизации в форме слияния, об утверждении договора о слиянии, устава общества, создаваемого в результате слияния, и об утверждении передаточного акта.

Слияния в российском законодательстве 09.12.2017 14 Слиянием обществ признается возникновение нового общества путем передачи ему всех прав и обязанностей двух или нескольких обществ с прекращением последних. Общества, участвующие в слиянии, заключают договор о слиянии, в котором определяются порядок и условия слияния, а также порядок конвертации акций каждого общества в акции нового общества. Совет директоров (наблюдательный совет) общества выносит на решение общего собрания акционеров каждого общества, участвующего в слиянии, вопрос о реорганизации в форме слияния, об утверждении договора о слиянии, устава общества, создаваемого в результате слияния, и об утверждении передаточного акта.

Слияния в российском законодательстве (продолжение) 09.12.2017 15 Образование органов вновь возникающего общества проводится на совместном общем собрании акционеров обществ, участвующих в слиянии. Порядок голосования на совместном общем собрании акционеров может быть определен договором о слиянии обществ. При слиянии обществ акции общества, принадлежащие другому обществу, участвующему в слиянии, а также собственные акции, принадлежащие участвующему в слиянии обществу, погашаются. При слиянии обществ все права и обязанности каждого из них переходят к вновь возникшему обществу в соответствии с передаточным актом.

Слияния в российском законодательстве (продолжение) 09.12.2017 15 Образование органов вновь возникающего общества проводится на совместном общем собрании акционеров обществ, участвующих в слиянии. Порядок голосования на совместном общем собрании акционеров может быть определен договором о слиянии обществ. При слиянии обществ акции общества, принадлежащие другому обществу, участвующему в слиянии, а также собственные акции, принадлежащие участвующему в слиянии обществу, погашаются. При слиянии обществ все права и обязанности каждого из них переходят к вновь возникшему обществу в соответствии с передаточным актом.

Присоединения 09.12.2017 16 Под присоединением общества понимается прекращение деятельности одного или нескольких обществ с передачей всех их прав и обязанностей другому. Присоединяемое общество и общество, к которому осуществляется присоединение, заключают договор о присоединении, в котором определяются порядок и условия присоединения, а также порядок конвертации акций присоединяемого общества в акции общества, к которому осуществляется присоединение. Совет директоров (наблюдательный совет) каждого общества выносит на решение общего собрания акционеров своего общества, участвующего в присоединении, вопрос о реорганизации в форме присоединения и об утверждении договора о присоединении. Совет директоров (наблюдательный совет) присоединяемого общества выносит на решение общего собрания акционеров вопрос об утверждении передаточного акта.

Присоединения 09.12.2017 16 Под присоединением общества понимается прекращение деятельности одного или нескольких обществ с передачей всех их прав и обязанностей другому. Присоединяемое общество и общество, к которому осуществляется присоединение, заключают договор о присоединении, в котором определяются порядок и условия присоединения, а также порядок конвертации акций присоединяемого общества в акции общества, к которому осуществляется присоединение. Совет директоров (наблюдательный совет) каждого общества выносит на решение общего собрания акционеров своего общества, участвующего в присоединении, вопрос о реорганизации в форме присоединения и об утверждении договора о присоединении. Совет директоров (наблюдательный совет) присоединяемого общества выносит на решение общего собрания акционеров вопрос об утверждении передаточного акта.

Присоединения (продолжение) 09.12.2017 17 Совместное общее собрание акционеров указанных обществ принимает решение о внесении изменений и дополнений в устав и в случае необходимости по иным вопросам. Порядок голосования на совместном общем собрании акционеров определяется договором о присоединении. При присоединении общества акции присоединяемого общества, принадлежащие обществу, к которому осуществляется присоединение, а также собственные акции, принадлежащие присоединяемому обществу, погашаются. При присоединении одного общества к другому к последнему переходят все права и обязанности присоединяемого общества в соответствии с передаточным актом.

Присоединения (продолжение) 09.12.2017 17 Совместное общее собрание акционеров указанных обществ принимает решение о внесении изменений и дополнений в устав и в случае необходимости по иным вопросам. Порядок голосования на совместном общем собрании акционеров определяется договором о присоединении. При присоединении общества акции присоединяемого общества, принадлежащие обществу, к которому осуществляется присоединение, а также собственные акции, принадлежащие присоединяемому обществу, погашаются. При присоединении одного общества к другому к последнему переходят все права и обязанности присоединяемого общества в соответствии с передаточным актом.

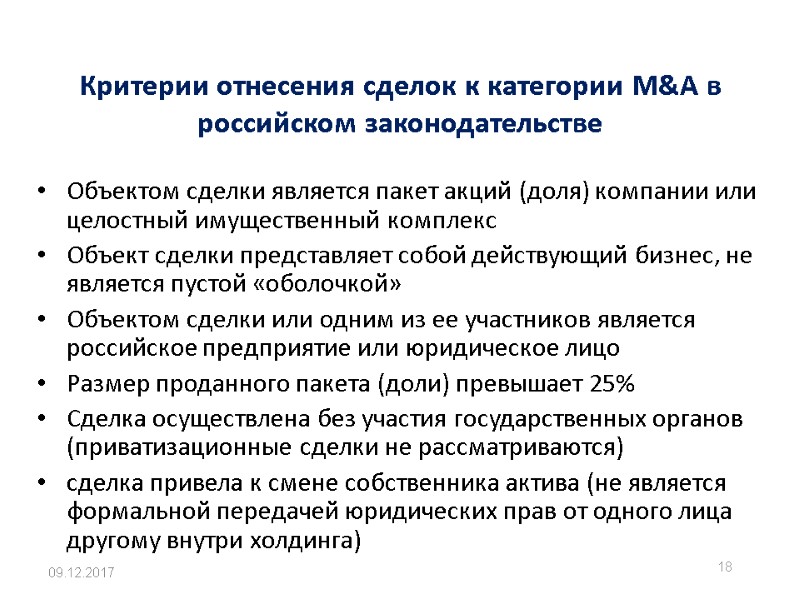

Критерии отнесения сделок к категории M&A в российском законодательстве 09.12.2017 18 Объектом сделки является пакет акций (доля) компании или целостный имущественный комплекс Объект сделки представляет собой действующий бизнес, не является пустой «оболочкой» Объектом сделки или одним из ее участников является российское предприятие или юридическое лицо Размер проданного пакета (доли) превышает 25% Сделка осуществлена без участия государственных органов (приватизационные сделки не рассматриваются) сделка привела к смене собственника актива (не является формальной передачей юридических прав от одного лица другому внутри холдинга)

Критерии отнесения сделок к категории M&A в российском законодательстве 09.12.2017 18 Объектом сделки является пакет акций (доля) компании или целостный имущественный комплекс Объект сделки представляет собой действующий бизнес, не является пустой «оболочкой» Объектом сделки или одним из ее участников является российское предприятие или юридическое лицо Размер проданного пакета (доли) превышает 25% Сделка осуществлена без участия государственных органов (приватизационные сделки не рассматриваются) сделка привела к смене собственника актива (не является формальной передачей юридических прав от одного лица другому внутри холдинга)

M&A market: waves and tendencies 09.12.2017 19

M&A market: waves and tendencies 09.12.2017 19

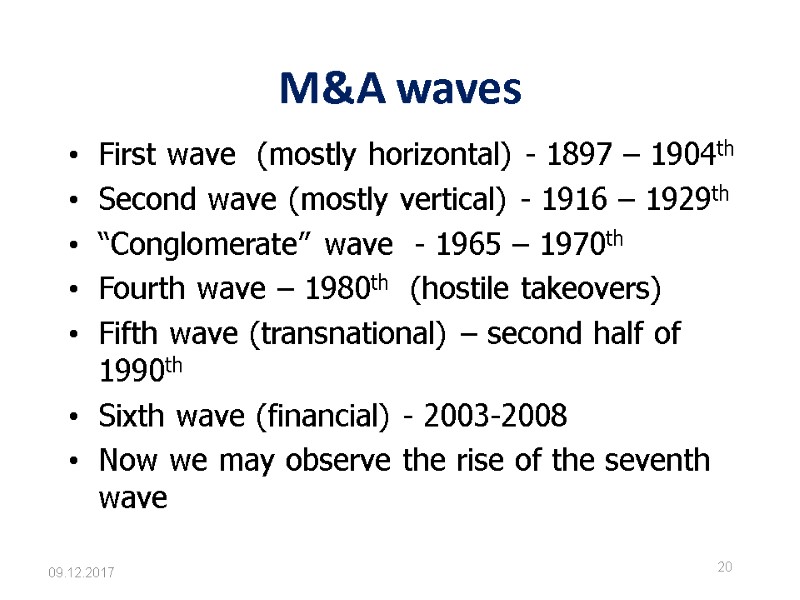

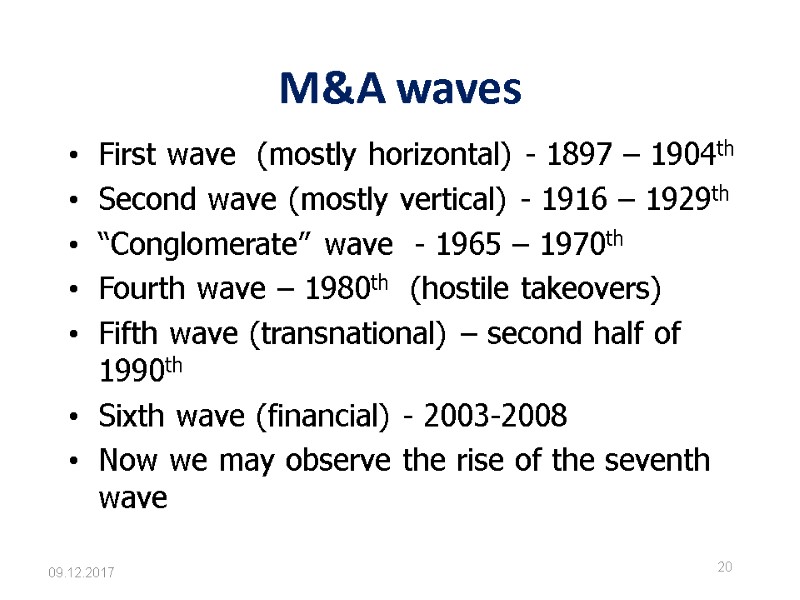

09.12.2017 20 M&A waves First wave (mostly horizontal) - 1897 – 1904th Second wave (mostly vertical) - 1916 – 1929th “Conglomerate” wave - 1965 – 1970th Fourth wave – 1980th (hostile takeovers) Fifth wave (transnational) – second half of 1990th Sixth wave (financial) - 2003-2008 Now we may observe the rise of the seventh wave

09.12.2017 20 M&A waves First wave (mostly horizontal) - 1897 – 1904th Second wave (mostly vertical) - 1916 – 1929th “Conglomerate” wave - 1965 – 1970th Fourth wave – 1980th (hostile takeovers) Fifth wave (transnational) – second half of 1990th Sixth wave (financial) - 2003-2008 Now we may observe the rise of the seventh wave

09.12.2017 21 M&A in Russia 1993-1998 – privatization processes and “voucher-based” deals. Classic methods are very rare 1999-2002 – hostile takeovers with very specific features Since 2003 – markets consolidation in most of the spheres, classic approaches development

09.12.2017 21 M&A in Russia 1993-1998 – privatization processes and “voucher-based” deals. Classic methods are very rare 1999-2002 – hostile takeovers with very specific features Since 2003 – markets consolidation in most of the spheres, classic approaches development

The reasons for the market growth in Russia High rates of economy growth Integration of Russian economy into the world community The problem of the low efficiency and thus – of low competitiveness The favorable situation with world prices on raw resources The need on the business “lightening” Others… 09.12.2017 22

The reasons for the market growth in Russia High rates of economy growth Integration of Russian economy into the world community The problem of the low efficiency and thus – of low competitiveness The favorable situation with world prices on raw resources The need on the business “lightening” Others… 09.12.2017 22

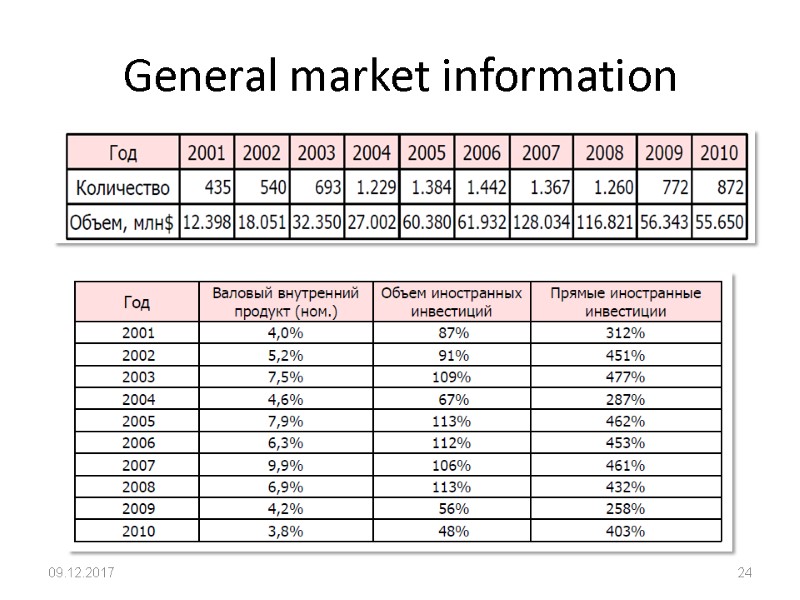

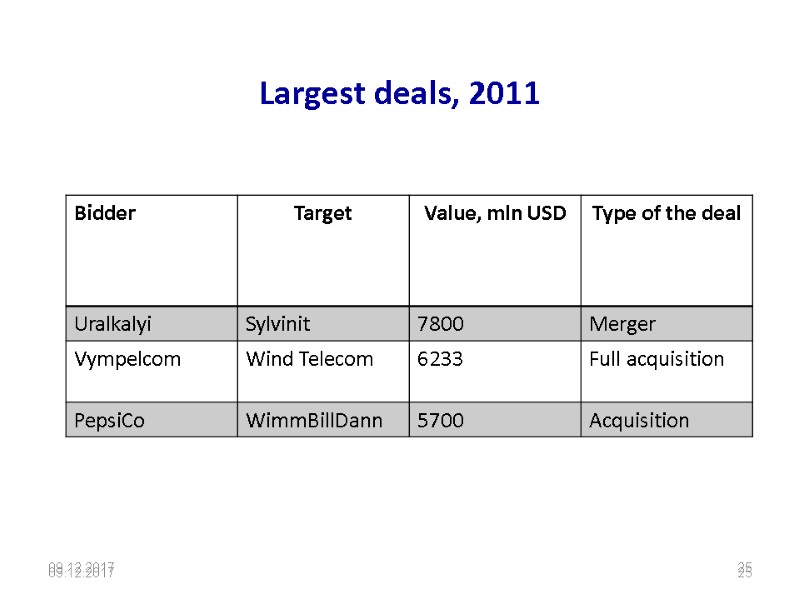

Russian М&A market, 2011 Total deals - 1070 (exceeds the 2010 indicator at 20% The total value of deals – $ 90,3 bn The average deal value - $ 100,4 mln (21% higher than in 2009) The number of deals with the value > $ 100 mln – 110 The contribution to the Russian GDP – 5% (as at pre-crisis period) The share of МВО deals was 2,6% in the whole bulk (1,1 % of the total value) 32% of the total value and 20% of the total quantity are the deals in ICT and oil processing and oil-based chemistry 41% of total value and 18% of total quantity are the deals of diversification 09.12.2017 23

Russian М&A market, 2011 Total deals - 1070 (exceeds the 2010 indicator at 20% The total value of deals – $ 90,3 bn The average deal value - $ 100,4 mln (21% higher than in 2009) The number of deals with the value > $ 100 mln – 110 The contribution to the Russian GDP – 5% (as at pre-crisis period) The share of МВО deals was 2,6% in the whole bulk (1,1 % of the total value) 32% of the total value and 20% of the total quantity are the deals in ICT and oil processing and oil-based chemistry 41% of total value and 18% of total quantity are the deals of diversification 09.12.2017 23

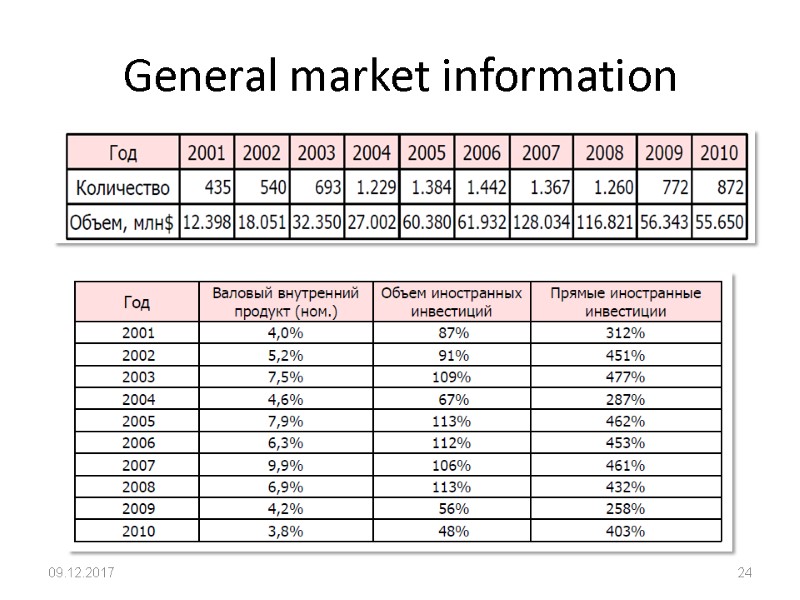

General market information 09.12.2017 24

General market information 09.12.2017 24

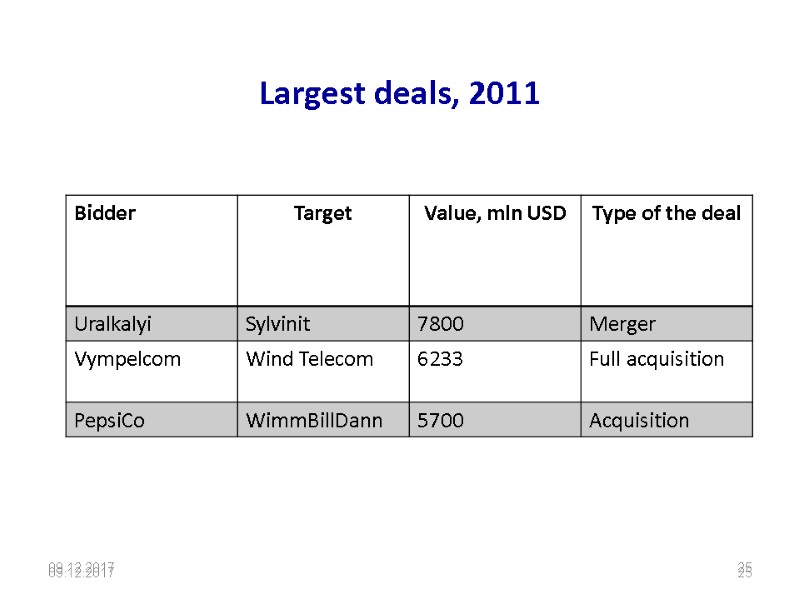

09.12.2017 25 09.12.2017 25 Largest deals, 2011

09.12.2017 25 09.12.2017 25 Largest deals, 2011

The historical largest deals 09.12.2017 26

The historical largest deals 09.12.2017 26

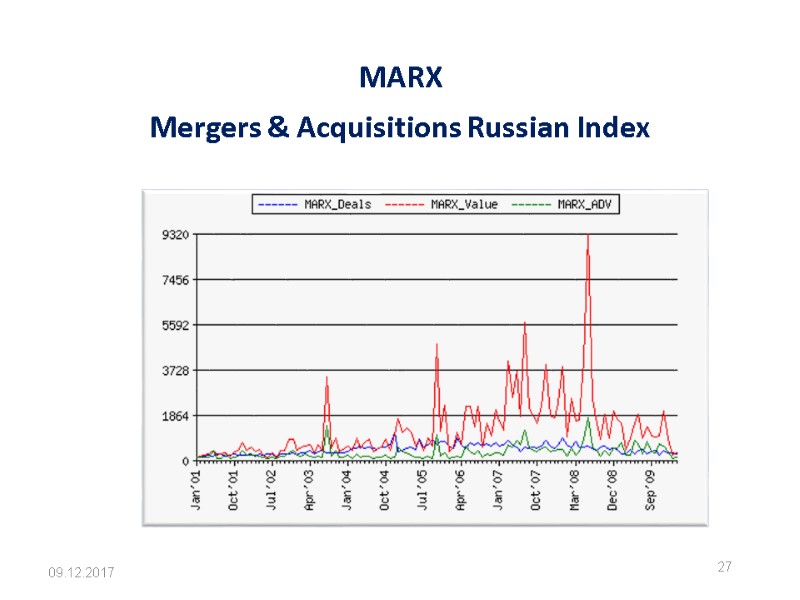

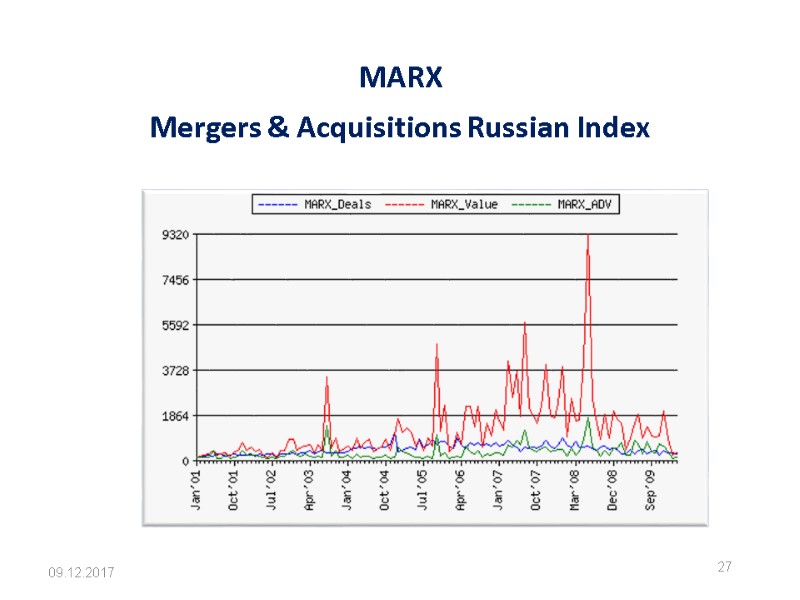

MARX Mergers & Acquisitions Russian Index 09.12.2017 27

MARX Mergers & Acquisitions Russian Index 09.12.2017 27

The specifics of the Russian M&A market 09.12.2017 28 The dominance of horizontal deals The sectoral differences in M&A strategies The stable leadership of some industries (oil and gas extracting, processing and transportation; energy production and distribution; metallurgy; ICT; food processing) The modest share of MBO deals and other modern modes of dealing The large-scale prevailing of hostile takeovers with very specific instruments especially to medium-sized enterprises The government and local authorities intervention

The specifics of the Russian M&A market 09.12.2017 28 The dominance of horizontal deals The sectoral differences in M&A strategies The stable leadership of some industries (oil and gas extracting, processing and transportation; energy production and distribution; metallurgy; ICT; food processing) The modest share of MBO deals and other modern modes of dealing The large-scale prevailing of hostile takeovers with very specific instruments especially to medium-sized enterprises The government and local authorities intervention

The objectives of M&A 09.12.2017 29

The objectives of M&A 09.12.2017 29

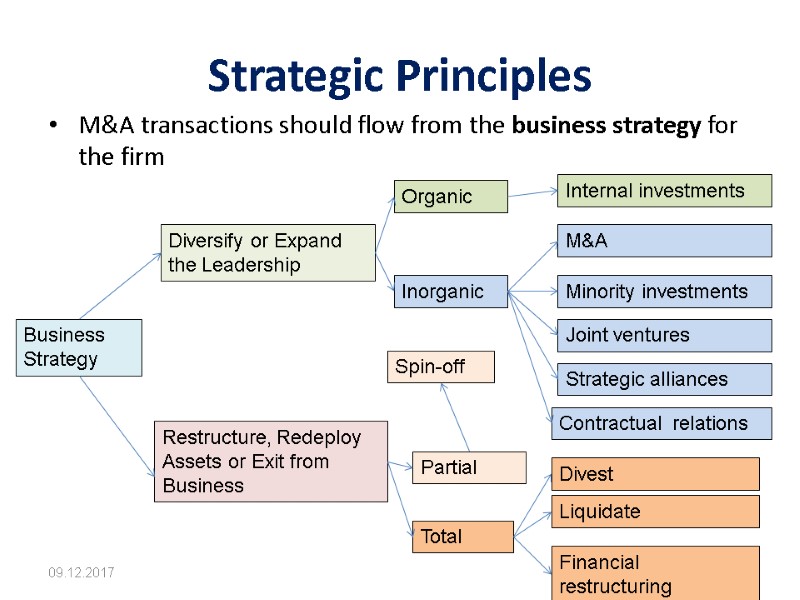

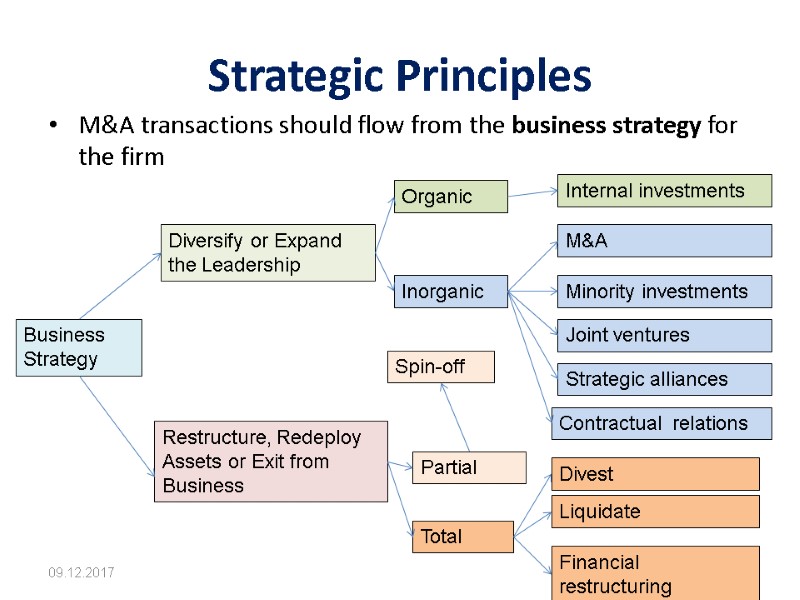

Strategic Principles M&A transactions should flow from the business strategy for the firm 09.12.2017 30 Business Strategy Diversify or Expand the Leadership Restructure, Redeploy Assets or Exit from Business Organic Inorganic Internal investments M&A Minority investments Joint ventures Strategic alliances Contractual relations Partial Total Divest Liquidate Financial restructuring Spin-off

Strategic Principles M&A transactions should flow from the business strategy for the firm 09.12.2017 30 Business Strategy Diversify or Expand the Leadership Restructure, Redeploy Assets or Exit from Business Organic Inorganic Internal investments M&A Minority investments Joint ventures Strategic alliances Contractual relations Partial Total Divest Liquidate Financial restructuring Spin-off

5 main reasons why firms pursue inorganic growth Maturing product line Regulatory and antitrust limits Value creation through horizontal and vertical integration Acquisition of resources and capabilities Value creation through diversification 09.12.2017 31

5 main reasons why firms pursue inorganic growth Maturing product line Regulatory and antitrust limits Value creation through horizontal and vertical integration Acquisition of resources and capabilities Value creation through diversification 09.12.2017 31

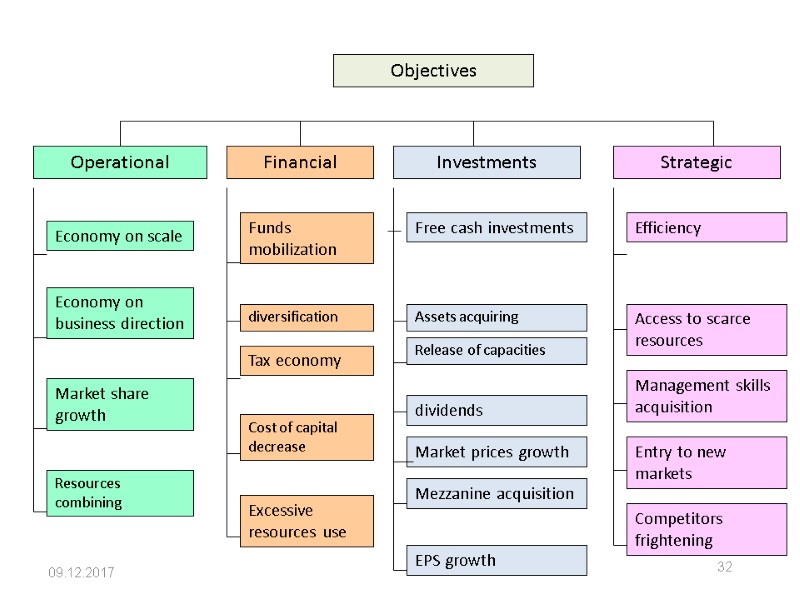

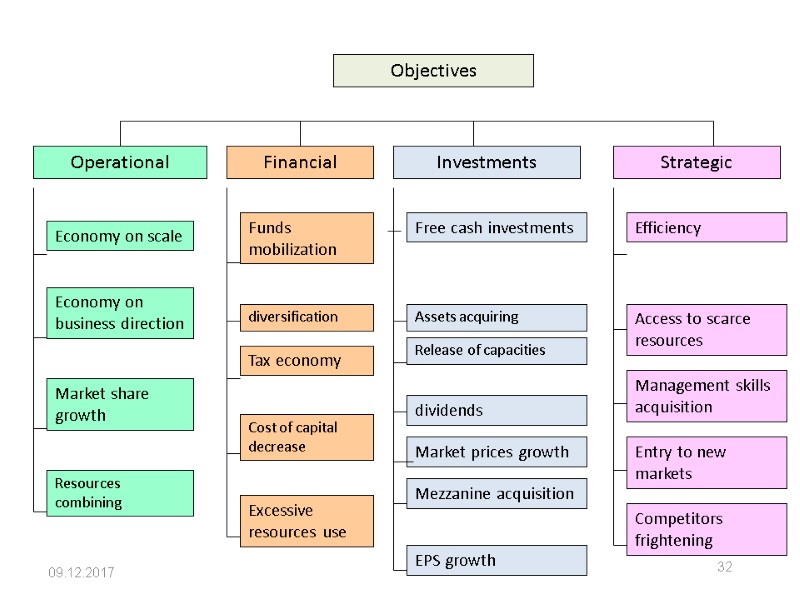

09.12.2017 32

09.12.2017 32

Why Engage in M&A? 09.12.2017 33 Theories as to why firms merge: Synergy theory: firms merge because the value of the new, combined, firm is greater than the sum of the two individual firms. Undervaluation theory: Firms merge because one firm is undervalued. Agency theory: Firms merge to resolve conflicts between shareholders and managers. Market power theory: Firms merge to increase market share and thus profit. Diversification theory: Firms merge to reduce business risk. Growth theory: firms merge in increase earnings growth.

Why Engage in M&A? 09.12.2017 33 Theories as to why firms merge: Synergy theory: firms merge because the value of the new, combined, firm is greater than the sum of the two individual firms. Undervaluation theory: Firms merge because one firm is undervalued. Agency theory: Firms merge to resolve conflicts between shareholders and managers. Market power theory: Firms merge to increase market share and thus profit. Diversification theory: Firms merge to reduce business risk. Growth theory: firms merge in increase earnings growth.

Why Merge: Synergy Theory 09.12.2017 34 The synergy theory Firms merge because the value of the combined firm is greater than the sum of the values of the individual firms. The shareholders of the two firms will potentially benefit because they are able to share the increase in value that results from the merger. These synergies are of two types: Operating synergies occur when a merger between two firms reduces the average cost of production. Financial synergies occur when a merger between two companies reduces the average cost of financing the firms’ activities

Why Merge: Synergy Theory 09.12.2017 34 The synergy theory Firms merge because the value of the combined firm is greater than the sum of the values of the individual firms. The shareholders of the two firms will potentially benefit because they are able to share the increase in value that results from the merger. These synergies are of two types: Operating synergies occur when a merger between two firms reduces the average cost of production. Financial synergies occur when a merger between two companies reduces the average cost of financing the firms’ activities

Why Merge: Undervaluation theory 09.12.2017 35 The undervaluation theory says that firms merge because one firm is undervalued, MV(A)

Why Merge: Undervaluation theory 09.12.2017 35 The undervaluation theory says that firms merge because one firm is undervalued, MV(A)

Why Merge: The Agency Theory 09.12.2017 36 The agency theory says that firms merge to resolve the conflicts of interest that exist between shareholders and managers. The managers of a firm may act in such a way that reduces the value of the firm. In an efficient market, the market value of a firm will reflect the consequences of the managers’ actions: Firms with bad management will generally be cheaper than those with good management. This will increase the probability that the firms with bad management are acquired by other firms. The managers of a firm know that if the firm is acquired by another firm, they may lose their jobs; this should ensure that they will act in the interests of their shareholders. M&A serves to keep managers acting in the interests of their shareholders

Why Merge: The Agency Theory 09.12.2017 36 The agency theory says that firms merge to resolve the conflicts of interest that exist between shareholders and managers. The managers of a firm may act in such a way that reduces the value of the firm. In an efficient market, the market value of a firm will reflect the consequences of the managers’ actions: Firms with bad management will generally be cheaper than those with good management. This will increase the probability that the firms with bad management are acquired by other firms. The managers of a firm know that if the firm is acquired by another firm, they may lose their jobs; this should ensure that they will act in the interests of their shareholders. M&A serves to keep managers acting in the interests of their shareholders

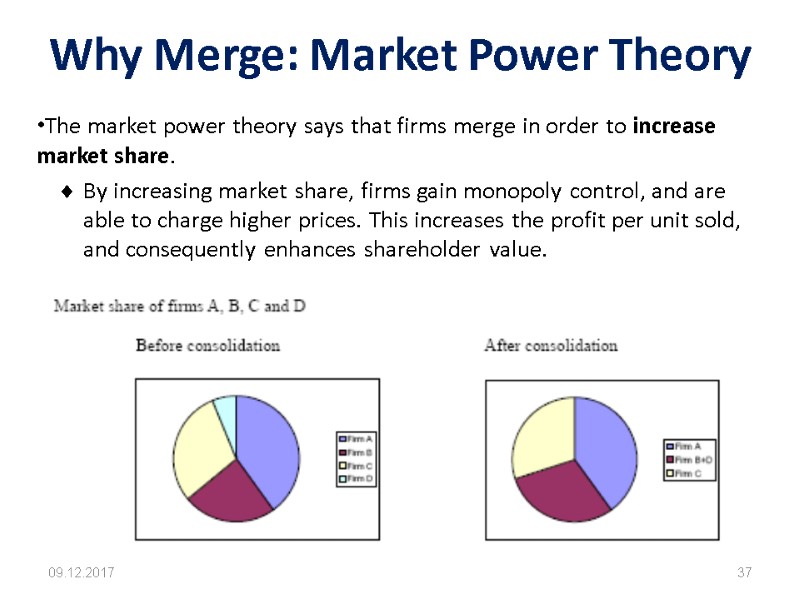

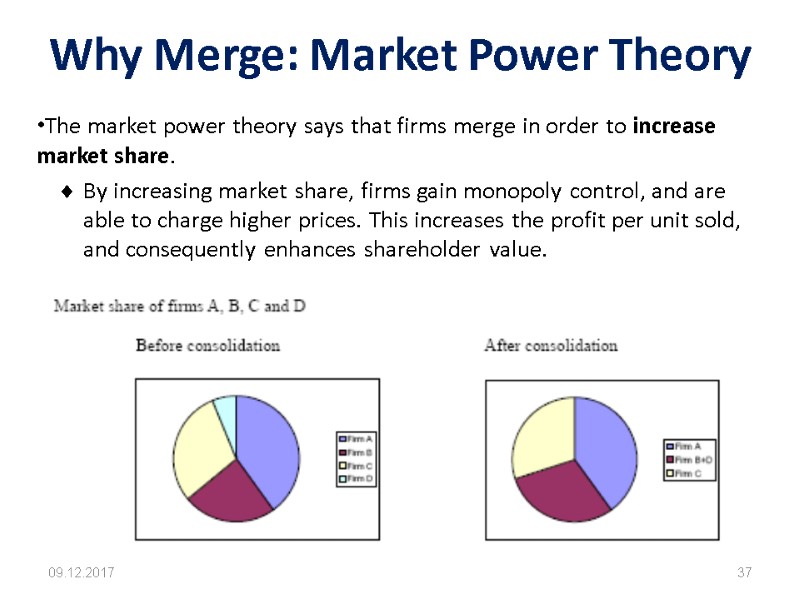

Why Merge: Market Power Theory 09.12.2017 37 The market power theory says that firms merge in order to increase market share. By increasing market share, firms gain monopoly control, and are able to charge higher prices. This increases the profit per unit sold, and consequently enhances shareholder value.

Why Merge: Market Power Theory 09.12.2017 37 The market power theory says that firms merge in order to increase market share. By increasing market share, firms gain monopoly control, and are able to charge higher prices. This increases the profit per unit sold, and consequently enhances shareholder value.

Why Merge: Diversification Theory 09.12.2017 38 The diversification theory says that firms merge to reduce business risk through diversification of the firm’s activities. This would be particularly true of conglomerate mergers. However, shareholders can diversify risk much more cheaply than firms simply by buying shares in the two companies. Alternatively other stakeholders in the firm (such as managers and employees) may not be able to diversify risk as easily as shareholders and so merging may be optimal for them. Bondholders, will also benefit from diversification, since it will reduce the probability of bankruptcy.

Why Merge: Diversification Theory 09.12.2017 38 The diversification theory says that firms merge to reduce business risk through diversification of the firm’s activities. This would be particularly true of conglomerate mergers. However, shareholders can diversify risk much more cheaply than firms simply by buying shares in the two companies. Alternatively other stakeholders in the firm (such as managers and employees) may not be able to diversify risk as easily as shareholders and so merging may be optimal for them. Bondholders, will also benefit from diversification, since it will reduce the probability of bankruptcy.

Why merge: specific motives The managers’ power increase The defense Too big to fail 09.12.2017 39

Why merge: specific motives The managers’ power increase The defense Too big to fail 09.12.2017 39

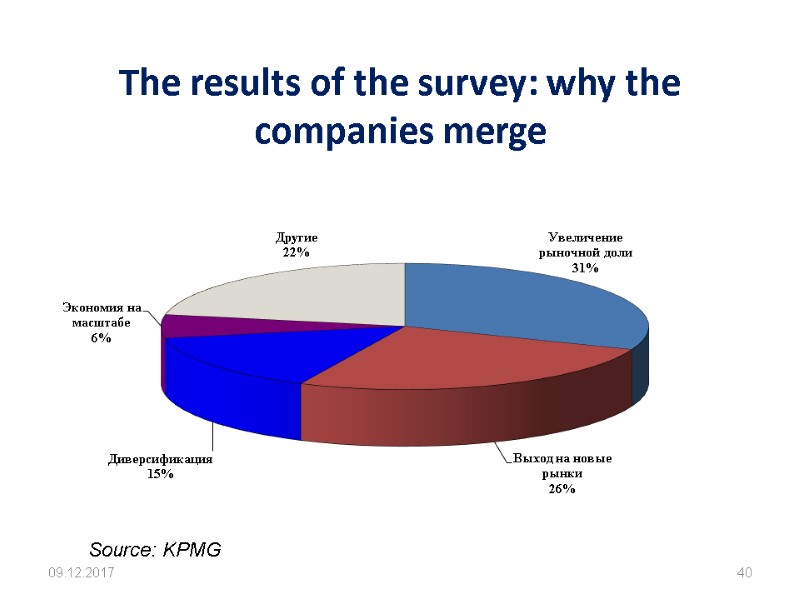

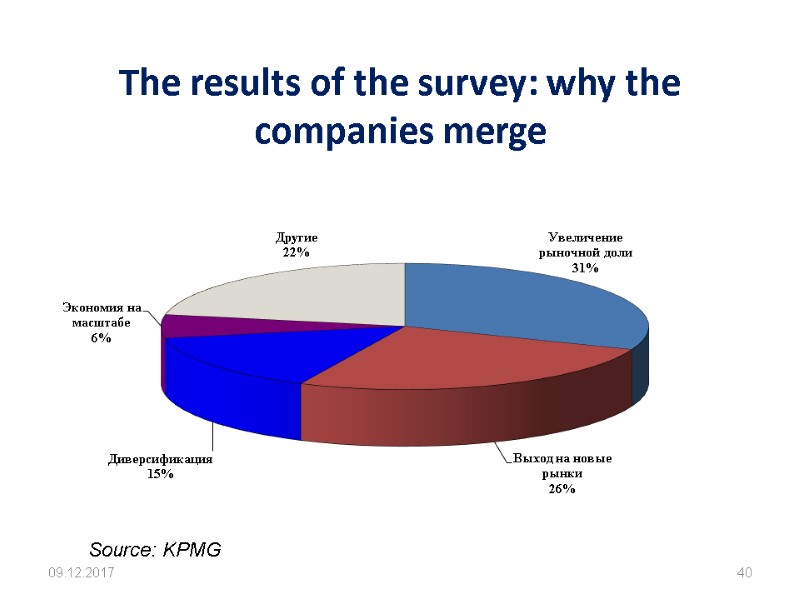

09.12.2017 40 The results of the survey: why the companies merge Source: KPMG

09.12.2017 40 The results of the survey: why the companies merge Source: KPMG

Thank you for your attention! 09.12.2017 41

Thank you for your attention! 09.12.2017 41