ded110b5f0b1bc25985d3290319f7e65.ppt

- Количество слайдов: 31

This material is not for circulation to retail investors INVESTMENT UPDATE FOR FINANCIAL ADVISERS Superannuation Products 31 December 2017

This material is not for circulation to retail investors INVESTMENT UPDATE FOR FINANCIAL ADVISERS Superannuation Products 31 December 2017

Important information The information in this presentation has been provided by NULIS Nominees (Australia) Limited (ABN 80 008 515 633, AFSL 236465) , a member of the National Australia Bank Limited (ABN 12 004 044 937, AFSL 230686) group of companies (NAB Group), 105– 153 Miller Street, North Sydney 2060. NAB does not guarantee or otherwise accept any liability in respect of any financial product referred to in this presentation. This presentation has been prepared for licensed financial advisers only. This document must not be distributed to “retail clients” (as defined in the Corporations Act 2001 (Cth)) or any other persons. This information is directed to and prepared for Australian residents only. This information may constitute general advice. It has been prepared without taking account of an investor’s objectives, financial situation or needs and because of that an investor should, before acting on the advice, consider the appropriateness of the advice having regard to their personal objectives, financial situation and needs. YOU SHOULD OBTAIN A PRODUCT DISCLOSURE STATEMENT (PDS) RELATING TO THE FINANCIAL PRODUCTS MENTIONED IN THIS COMMUNICATION ISSUED BY NULIS NOMINEES (AUSTRALIA) LIMITED AS TRUSTEE OF THE MLC SUPER FUND (ABN 70 732 426 024), AND CONSIDER IT BEFORE MAKING ANY DECISION ABOUT WHETHER TO ACQUIRE OR CONTINUE TO HOLD THESE PRODUCTS. A COPY OF THE PDS IS AVAILABLE UPON REQUEST BY PHONING THE MLC CALL CENTRE ON 132 652 OR ON OUR WEBSITE AT MLC. COM. AU PAST PERFORMANCE IS NOT A RELIABLE INDICATOR OF FUTURE PERFORMANCE. THE VALUE OF AN INVESTMENT MAY RISE OR FALL WITH THE CHANGES IN THE MARKET. THE PERFORMANCE RETURNS IN THIS COMMUNICATION ARE REPORTED BEFORE DEDUCTING MANAGEMENT FEES AND TAXES UNLESS OTHERWISE STATED. ACTUAL RETURNS MAY VARY FROM ANY TARGET RETURN DESCRIBED IN THIS PRESENTATION AND THERE IS A RISK THAT THE INVESTMENT MAY ACHIEVE LOWER THAN EXPECTED RETURNS. Any opinions expressed in this presentation constitute our judgement at the time of issue and are subject to change. We believe that the information contained in this presentation is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made at the time of compilation. However, no warranty is made as to their accuracy or reliability (which may change without notice) or other information contained in this presentation. NULIS Nominees (Australia) Limited may use the services of NAB Group companies where it makes good business sense to do so and will benefit customers. Amounts paid for these services are always negotiated on an arm’s length basis. Bloomberg Finance L. P. and its affiliates (collectively, “Bloomberg”) do not approve or endorse any information included in this material and disclaim all liability for any loss or damage of any kind arising out of the use of all or any part of this material. The funds referred to herein are not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to any such fund. 2

Important information The information in this presentation has been provided by NULIS Nominees (Australia) Limited (ABN 80 008 515 633, AFSL 236465) , a member of the National Australia Bank Limited (ABN 12 004 044 937, AFSL 230686) group of companies (NAB Group), 105– 153 Miller Street, North Sydney 2060. NAB does not guarantee or otherwise accept any liability in respect of any financial product referred to in this presentation. This presentation has been prepared for licensed financial advisers only. This document must not be distributed to “retail clients” (as defined in the Corporations Act 2001 (Cth)) or any other persons. This information is directed to and prepared for Australian residents only. This information may constitute general advice. It has been prepared without taking account of an investor’s objectives, financial situation or needs and because of that an investor should, before acting on the advice, consider the appropriateness of the advice having regard to their personal objectives, financial situation and needs. YOU SHOULD OBTAIN A PRODUCT DISCLOSURE STATEMENT (PDS) RELATING TO THE FINANCIAL PRODUCTS MENTIONED IN THIS COMMUNICATION ISSUED BY NULIS NOMINEES (AUSTRALIA) LIMITED AS TRUSTEE OF THE MLC SUPER FUND (ABN 70 732 426 024), AND CONSIDER IT BEFORE MAKING ANY DECISION ABOUT WHETHER TO ACQUIRE OR CONTINUE TO HOLD THESE PRODUCTS. A COPY OF THE PDS IS AVAILABLE UPON REQUEST BY PHONING THE MLC CALL CENTRE ON 132 652 OR ON OUR WEBSITE AT MLC. COM. AU PAST PERFORMANCE IS NOT A RELIABLE INDICATOR OF FUTURE PERFORMANCE. THE VALUE OF AN INVESTMENT MAY RISE OR FALL WITH THE CHANGES IN THE MARKET. THE PERFORMANCE RETURNS IN THIS COMMUNICATION ARE REPORTED BEFORE DEDUCTING MANAGEMENT FEES AND TAXES UNLESS OTHERWISE STATED. ACTUAL RETURNS MAY VARY FROM ANY TARGET RETURN DESCRIBED IN THIS PRESENTATION AND THERE IS A RISK THAT THE INVESTMENT MAY ACHIEVE LOWER THAN EXPECTED RETURNS. Any opinions expressed in this presentation constitute our judgement at the time of issue and are subject to change. We believe that the information contained in this presentation is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made at the time of compilation. However, no warranty is made as to their accuracy or reliability (which may change without notice) or other information contained in this presentation. NULIS Nominees (Australia) Limited may use the services of NAB Group companies where it makes good business sense to do so and will benefit customers. Amounts paid for these services are always negotiated on an arm’s length basis. Bloomberg Finance L. P. and its affiliates (collectively, “Bloomberg”) do not approve or endorse any information included in this material and disclaim all liability for any loss or damage of any kind arising out of the use of all or any part of this material. The funds referred to herein are not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to any such fund. 2

Table of contents 1. Market performance 2. Scenario insights and portfolio positioning 3. More analysis of returns 4. Where to find client tools 3

Table of contents 1. Market performance 2. Scenario insights and portfolio positioning 3. More analysis of returns 4. Where to find client tools 3

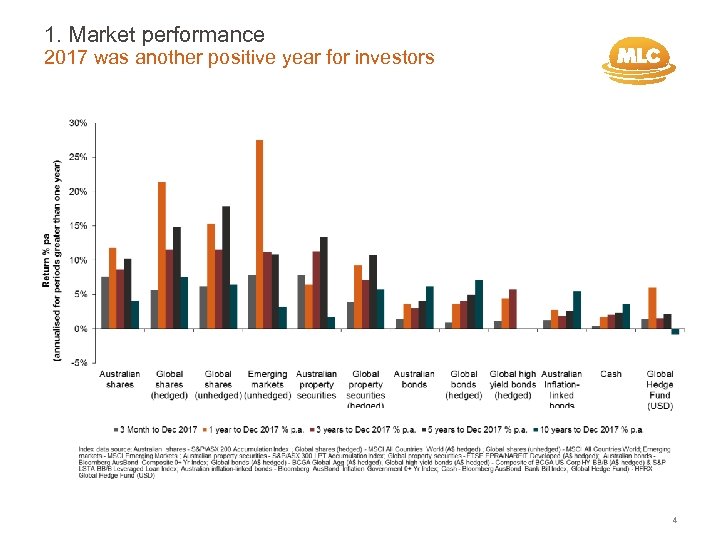

1. Market performance 2017 was another positive year for investors 4

1. Market performance 2017 was another positive year for investors 4

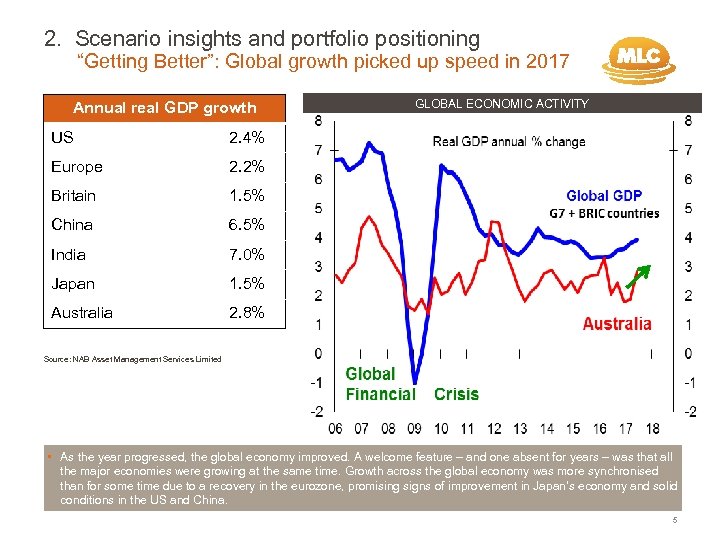

2. Scenario insights and portfolio positioning “Getting Better”: Global growth picked up speed in 2017 Annual real GDP growth US 2. 4% Europe 2. 2% Britain 1. 5% China 6. 5% India 7. 0% Japan 1. 5% Australia GLOBAL ECONOMIC ACTIVITY 2. 8% Source: NAB Asset Management Services Limited • As the year progressed, the global economy improved. A welcome feature ‒ and one absent for years ‒ was that all the major economies were growing at the same time. Growth across the global economy was more synchronised than for some time due to a recovery in the eurozone, promising signs of improvement in Japan’s economy and solid conditions in the US and China. 5

2. Scenario insights and portfolio positioning “Getting Better”: Global growth picked up speed in 2017 Annual real GDP growth US 2. 4% Europe 2. 2% Britain 1. 5% China 6. 5% India 7. 0% Japan 1. 5% Australia GLOBAL ECONOMIC ACTIVITY 2. 8% Source: NAB Asset Management Services Limited • As the year progressed, the global economy improved. A welcome feature ‒ and one absent for years ‒ was that all the major economies were growing at the same time. Growth across the global economy was more synchronised than for some time due to a recovery in the eurozone, promising signs of improvement in Japan’s economy and solid conditions in the US and China. 5

1. Market performance Returns were strong across major share markets this year Market 3 months to 31 Dec 2017 1 year to 31 Dec 2017 USA – S&P 500 6. 5% 21. 1% Germany – DAX 0. 7% 12. 5% France – CAC 40 0. 0% 12. 7% UK – FTSE 100 5. 0% 11. 9% Japan – Nikkei 12. 0% 21. 3% Hong Kong – Hang Seng 8. 6% 36. 0% China – Shanghai Composite -1. 3% 6. 6% Australia – ASX 200 Accumulation 7. 6% 11. 8% Australia – All Industrials 6. 0% 9. 0% Australia – All Resources 15. 6% 25. 9% Source: NAB Asset Management Services Limited. Returns are in local currency terms. • The global economy’s strength and consequent recovery in corporate earnings was very positive for share market returns in both the developed and emerging world. 6

1. Market performance Returns were strong across major share markets this year Market 3 months to 31 Dec 2017 1 year to 31 Dec 2017 USA – S&P 500 6. 5% 21. 1% Germany – DAX 0. 7% 12. 5% France – CAC 40 0. 0% 12. 7% UK – FTSE 100 5. 0% 11. 9% Japan – Nikkei 12. 0% 21. 3% Hong Kong – Hang Seng 8. 6% 36. 0% China – Shanghai Composite -1. 3% 6. 6% Australia – ASX 200 Accumulation 7. 6% 11. 8% Australia – All Industrials 6. 0% 9. 0% Australia – All Resources 15. 6% 25. 9% Source: NAB Asset Management Services Limited. Returns are in local currency terms. • The global economy’s strength and consequent recovery in corporate earnings was very positive for share market returns in both the developed and emerging world. 6

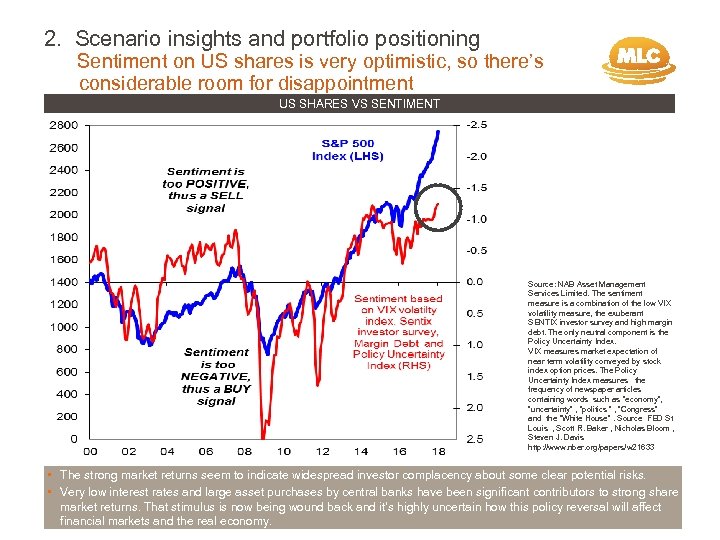

2. Scenario insights and portfolio positioning Sentiment on US shares is very optimistic, so there’s considerable room for disappointment US SHARES VS SENTIMENT Source: NAB Asset Management Services Limited. The sentiment measure is a combination of the low VIX volatility measure, the exuberant SENTIX investor survey and high margin debt. The only neutral component is the Policy Uncertainty Index. VIX measures market expectation of near term volatility conveyed by stock index option prices. The Policy Uncertainty Index measures the frequency of newspaper articles containing words such as “economy”, “uncertainty” , “politics “ , “Congress” and the “White House”. Source FED St Louis , Scott R. Baker , Nicholas Bloom , Steven J. Davis http: //www. nber. org/papers/w 21633 • The strong market returns seem to indicate widespread investor complacency about some clear potential risks. • Very low interest rates and large asset purchases by central banks have been significant contributors to strong share market returns. That stimulus is now being wound back and it’s highly uncertain how this policy reversal will affect 7 financial markets and the real economy.

2. Scenario insights and portfolio positioning Sentiment on US shares is very optimistic, so there’s considerable room for disappointment US SHARES VS SENTIMENT Source: NAB Asset Management Services Limited. The sentiment measure is a combination of the low VIX volatility measure, the exuberant SENTIX investor survey and high margin debt. The only neutral component is the Policy Uncertainty Index. VIX measures market expectation of near term volatility conveyed by stock index option prices. The Policy Uncertainty Index measures the frequency of newspaper articles containing words such as “economy”, “uncertainty” , “politics “ , “Congress” and the “White House”. Source FED St Louis , Scott R. Baker , Nicholas Bloom , Steven J. Davis http: //www. nber. org/papers/w 21633 • The strong market returns seem to indicate widespread investor complacency about some clear potential risks. • Very low interest rates and large asset purchases by central banks have been significant contributors to strong share market returns. That stimulus is now being wound back and it’s highly uncertain how this policy reversal will affect 7 financial markets and the real economy.

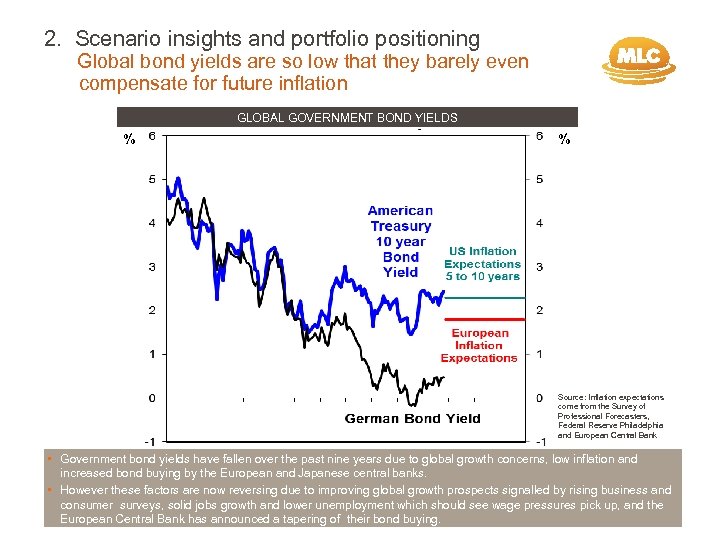

2. Scenario insights and portfolio positioning Global bond yields are so low that they barely even compensate for future inflation GLOBAL GOVERNMENT BOND YIELDS % % Source: Inflation expectations come from the Survey of Professional Forecasters, Federal Reserve Philadelphia and European Central Bank • Government bond yields have fallen over the past nine years due to global growth concerns, low inflation and increased bond buying by the European and Japanese central banks. • However these factors are now reversing due to improving global growth prospects signalled by rising business and consumer surveys, solid jobs growth and lower unemployment which should see wage pressures pick up, and the European Central Bank has announced a tapering of their bond buying. 8

2. Scenario insights and portfolio positioning Global bond yields are so low that they barely even compensate for future inflation GLOBAL GOVERNMENT BOND YIELDS % % Source: Inflation expectations come from the Survey of Professional Forecasters, Federal Reserve Philadelphia and European Central Bank • Government bond yields have fallen over the past nine years due to global growth concerns, low inflation and increased bond buying by the European and Japanese central banks. • However these factors are now reversing due to improving global growth prospects signalled by rising business and consumer surveys, solid jobs growth and lower unemployment which should see wage pressures pick up, and the European Central Bank has announced a tapering of their bond buying. 8

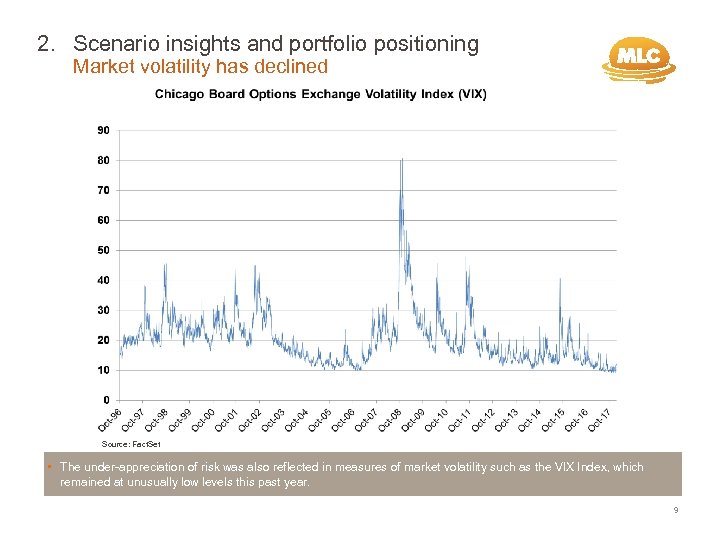

2. Scenario insights and portfolio positioning Market volatility has declined Source: Fact. Set • The under-appreciation of risk was also reflected in measures of market volatility such as the VIX Index, which remained at unusually low levels this past year. 9

2. Scenario insights and portfolio positioning Market volatility has declined Source: Fact. Set • The under-appreciation of risk was also reflected in measures of market volatility such as the VIX Index, which remained at unusually low levels this past year. 9

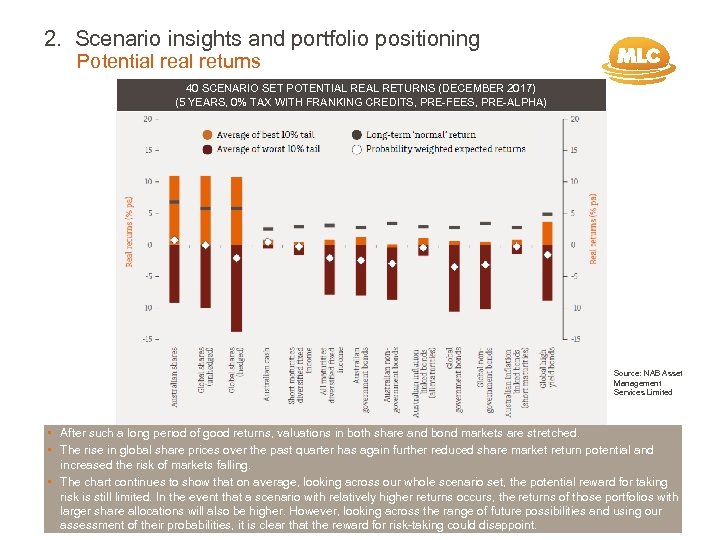

2. Scenario insights and portfolio positioning Potential returns 40 SCENARIO SET POTENTIAL RETURNS (DECEMBER 2017) (5 YEARS, 0% TAX WITH FRANKING CREDITS, PRE-FEES, PRE-ALPHA) Source: NAB Asset Management Services Limited • After such a long period of good returns, valuations in both share and bond markets are stretched. • The rise in global share prices over the past quarter has again further reduced share market return potential and increased the risk of markets falling. • The chart continues to show that on average, looking across our whole scenario set, the potential reward for taking risk is still limited. In the event that a scenario with relatively higher returns occurs, the returns of those portfolios with larger share allocations will also be higher. However, looking across the range of future possibilities and using our 10 assessment of their probabilities, it is clear that the reward for risk-taking could disappoint.

2. Scenario insights and portfolio positioning Potential returns 40 SCENARIO SET POTENTIAL RETURNS (DECEMBER 2017) (5 YEARS, 0% TAX WITH FRANKING CREDITS, PRE-FEES, PRE-ALPHA) Source: NAB Asset Management Services Limited • After such a long period of good returns, valuations in both share and bond markets are stretched. • The rise in global share prices over the past quarter has again further reduced share market return potential and increased the risk of markets falling. • The chart continues to show that on average, looking across our whole scenario set, the potential reward for taking risk is still limited. In the event that a scenario with relatively higher returns occurs, the returns of those portfolios with larger share allocations will also be higher. However, looking across the range of future possibilities and using our 10 assessment of their probabilities, it is clear that the reward for risk-taking could disappoint.

2. Scenario insights and portfolio positioning Things we think about Consequences of monetary policy normalisation – end of an era? Growth vs inflation outcomes – reform and productivity vs rising inflation US economy and policy – early signs of rising wage pressure, but political risks remain Geopolitics – heightened uncertainty and challenging global tensions US corporate profits – pressure from rising wages Slowing China moderates Australia’s export demand terms of trade. Risk scenario if impacts confidence and coincides with unravelling of over-extended property market Eurozone – above trend growth, easing political worries Japan’s growth robust, labour shortages encouraging corporate change and higher wages Most asset classes are expensive – lack of safe haven assets UK – Brexit uncertainties still remain unresolved 11

2. Scenario insights and portfolio positioning Things we think about Consequences of monetary policy normalisation – end of an era? Growth vs inflation outcomes – reform and productivity vs rising inflation US economy and policy – early signs of rising wage pressure, but political risks remain Geopolitics – heightened uncertainty and challenging global tensions US corporate profits – pressure from rising wages Slowing China moderates Australia’s export demand terms of trade. Risk scenario if impacts confidence and coincides with unravelling of over-extended property market Eurozone – above trend growth, easing political worries Japan’s growth robust, labour shortages encouraging corporate change and higher wages Most asset classes are expensive – lack of safe haven assets UK – Brexit uncertainties still remain unresolved 11

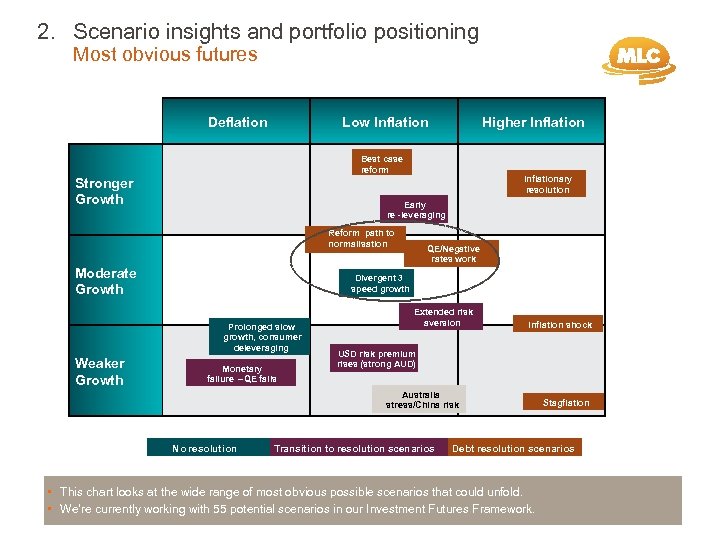

2. Scenario insights and portfolio positioning Most obvious futures Deflation Low Inflation Higher Inflation Best case reform Stronger Growth Inflationary resolution Early re - leveraging Reform path to normalisation Moderate Growth Divergent 3 speed growth Prolonged slow growth, consumer deleveraging Weaker Growth QE/Negative rates work Monetary failure –QE fails Extended risk aversion Inflation shock USD risk premium rises (strong AUD) Australia stress/China risk No resolution Transition to resolution scenarios Stagflation Debt resolution scenarios • This chart looks at the wide range of most obvious possible scenarios that could unfold. • We’re currently working with 55 potential scenarios in our Investment Futures Framework.

2. Scenario insights and portfolio positioning Most obvious futures Deflation Low Inflation Higher Inflation Best case reform Stronger Growth Inflationary resolution Early re - leveraging Reform path to normalisation Moderate Growth Divergent 3 speed growth Prolonged slow growth, consumer deleveraging Weaker Growth QE/Negative rates work Monetary failure –QE fails Extended risk aversion Inflation shock USD risk premium rises (strong AUD) Australia stress/China risk No resolution Transition to resolution scenarios Stagflation Debt resolution scenarios • This chart looks at the wide range of most obvious possible scenarios that could unfold. • We’re currently working with 55 potential scenarios in our Investment Futures Framework.

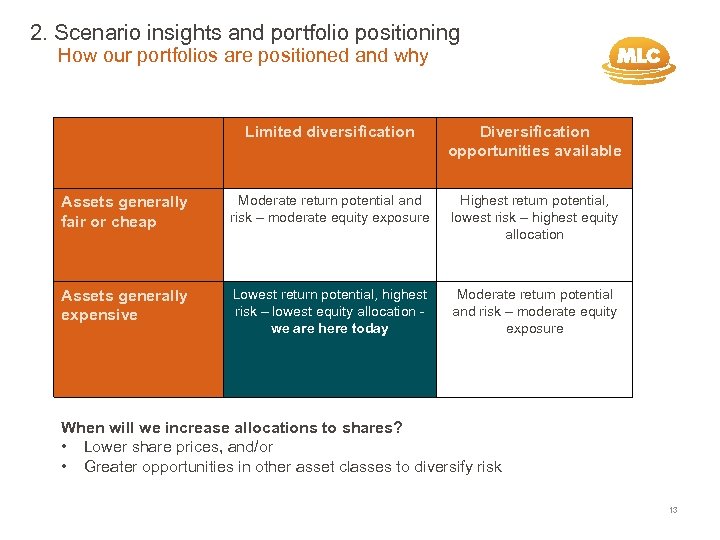

2. Scenario insights and portfolio positioning How our portfolios are positioned and why Limited diversification Diversification opportunities available Assets generally fair or cheap Moderate return potential and risk – moderate equity exposure Highest return potential, lowest risk – highest equity allocation Assets generally expensive Lowest return potential, highest risk – lowest equity allocation - we are here today Moderate return potential and risk – moderate equity exposure When will we increase allocations to shares? • Lower share prices, and/or • Greater opportunities in other asset classes to diversify risk 13

2. Scenario insights and portfolio positioning How our portfolios are positioned and why Limited diversification Diversification opportunities available Assets generally fair or cheap Moderate return potential and risk – moderate equity exposure Highest return potential, lowest risk – highest equity allocation Assets generally expensive Lowest return potential, highest risk – lowest equity allocation - we are here today Moderate return potential and risk – moderate equity exposure When will we increase allocations to shares? • Lower share prices, and/or • Greater opportunities in other asset classes to diversify risk 13

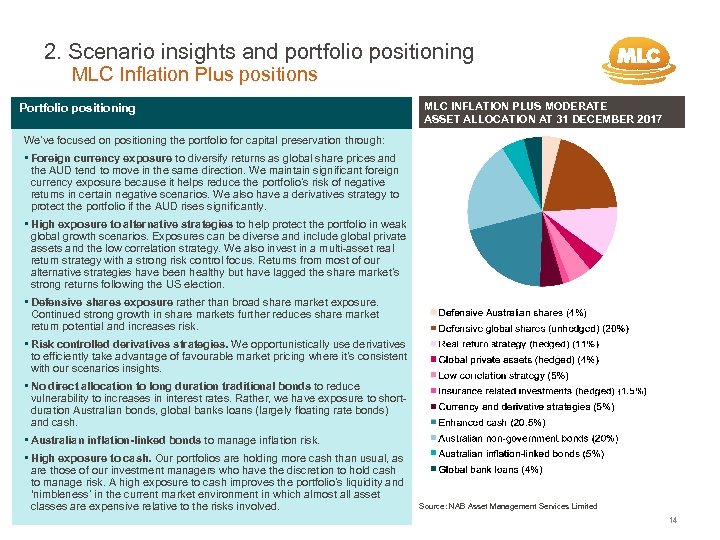

2. Scenario insights and portfolio positioning MLC Inflation Plus positions Portfolio positioning MLC INFLATION PLUS MODERATE ASSET ALLOCATION AT 31 DECEMBER 2017 We’ve focused on positioning the portfolio for capital preservation through: • Foreign currency exposure to diversify returns as global share prices and the AUD tend to move in the same direction. We maintain significant foreign currency exposure because it helps reduce the portfolio’s risk of negative returns in certain negative scenarios. We also have a derivatives strategy to protect the portfolio if the AUD rises significantly. • High exposure to alternative strategies to help protect the portfolio in weak global growth scenarios. Exposures can be diverse and include global private assets and the low correlation strategy. We also invest in a multi-asset real return strategy with a strong risk control focus. Returns from most of our alternative strategies have been healthy but have lagged the share market’s strong returns following the US election. • Defensive shares exposure rather than broad share market exposure. Continued strong growth in share markets further reduces share market return potential and increases risk. • Risk controlled derivatives strategies. We opportunistically use derivatives to efficiently take advantage of favourable market pricing where it’s consistent with our scenarios insights. • No direct allocation to long duration traditional bonds to reduce vulnerability to increases in interest rates. Rather, we have exposure to shortduration Australian bonds, global banks loans (largely floating rate bonds) and cash. • Australian inflation-linked bonds to manage inflation risk. • High exposure to cash. Our portfolios are holding more cash than usual, as are those of our investment managers who have the discretion to hold cash to manage risk. A high exposure to cash improves the portfolio’s liquidity and ‘nimbleness’ in the current market environment in which almost all asset classes are expensive relative to the risks involved. Source: NAB Asset Management Services Limited 14

2. Scenario insights and portfolio positioning MLC Inflation Plus positions Portfolio positioning MLC INFLATION PLUS MODERATE ASSET ALLOCATION AT 31 DECEMBER 2017 We’ve focused on positioning the portfolio for capital preservation through: • Foreign currency exposure to diversify returns as global share prices and the AUD tend to move in the same direction. We maintain significant foreign currency exposure because it helps reduce the portfolio’s risk of negative returns in certain negative scenarios. We also have a derivatives strategy to protect the portfolio if the AUD rises significantly. • High exposure to alternative strategies to help protect the portfolio in weak global growth scenarios. Exposures can be diverse and include global private assets and the low correlation strategy. We also invest in a multi-asset real return strategy with a strong risk control focus. Returns from most of our alternative strategies have been healthy but have lagged the share market’s strong returns following the US election. • Defensive shares exposure rather than broad share market exposure. Continued strong growth in share markets further reduces share market return potential and increases risk. • Risk controlled derivatives strategies. We opportunistically use derivatives to efficiently take advantage of favourable market pricing where it’s consistent with our scenarios insights. • No direct allocation to long duration traditional bonds to reduce vulnerability to increases in interest rates. Rather, we have exposure to shortduration Australian bonds, global banks loans (largely floating rate bonds) and cash. • Australian inflation-linked bonds to manage inflation risk. • High exposure to cash. Our portfolios are holding more cash than usual, as are those of our investment managers who have the discretion to hold cash to manage risk. A high exposure to cash improves the portfolio’s liquidity and ‘nimbleness’ in the current market environment in which almost all asset classes are expensive relative to the risks involved. Source: NAB Asset Management Services Limited 14

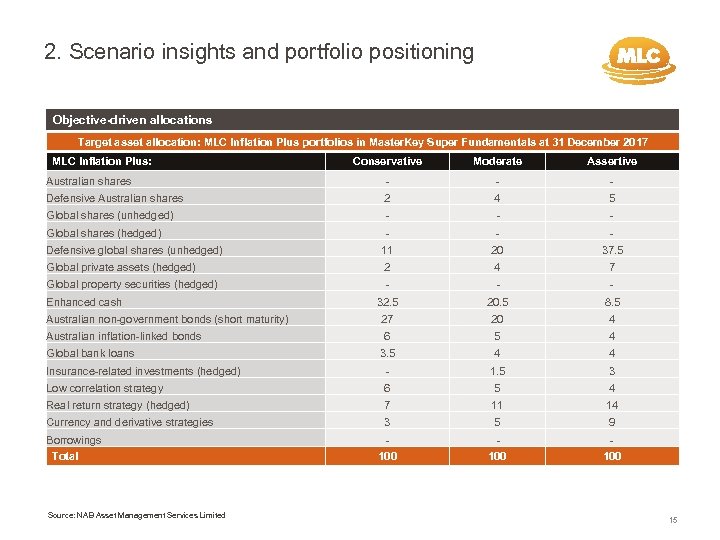

2. Scenario insights and portfolio positioning Objective-driven allocations Target asset allocation: MLC Inflation Plus portfolios in Master. Key Super Fundamentals at 31 December 2017 MLC Inflation Plus: Conservative Moderate Assertive Australian shares - - - Defensive Australian shares 2 4 5 Global shares (unhedged) - - - Global shares (hedged) - - - Defensive global shares (unhedged) 11 20 37. 5 Global private assets (hedged) 2 4 7 Global property securities (hedged) - - - 32. 5 20. 5 8. 5 Australian non-government bonds (short maturity) 27 20 4 Australian inflation-linked bonds 6 5 4 3. 5 4 4 Insurance-related investments (hedged) - 1. 5 3 Low correlation strategy 6 5 4 Real return strategy (hedged) 7 11 14 Currency and derivative strategies 3 5 9 100 100 Enhanced cash Global bank loans Borrowings Total Source: NAB Asset Management Services Limited 15

2. Scenario insights and portfolio positioning Objective-driven allocations Target asset allocation: MLC Inflation Plus portfolios in Master. Key Super Fundamentals at 31 December 2017 MLC Inflation Plus: Conservative Moderate Assertive Australian shares - - - Defensive Australian shares 2 4 5 Global shares (unhedged) - - - Global shares (hedged) - - - Defensive global shares (unhedged) 11 20 37. 5 Global private assets (hedged) 2 4 7 Global property securities (hedged) - - - 32. 5 20. 5 8. 5 Australian non-government bonds (short maturity) 27 20 4 Australian inflation-linked bonds 6 5 4 3. 5 4 4 Insurance-related investments (hedged) - 1. 5 3 Low correlation strategy 6 5 4 Real return strategy (hedged) 7 11 14 Currency and derivative strategies 3 5 9 100 100 Enhanced cash Global bank loans Borrowings Total Source: NAB Asset Management Services Limited 15

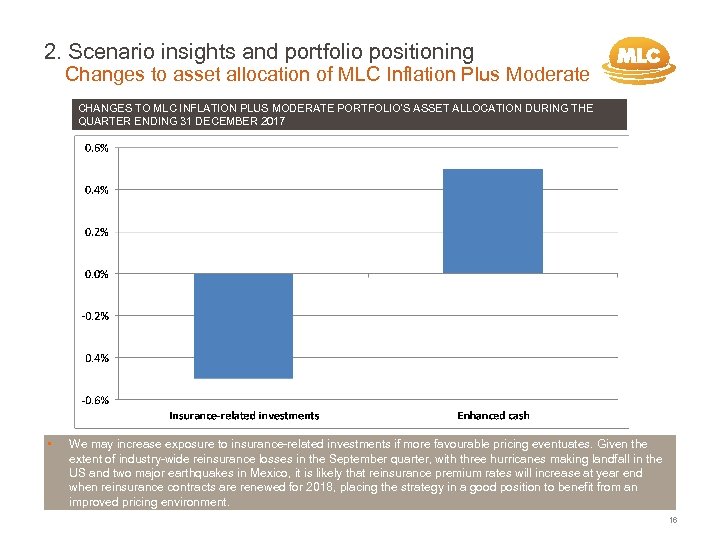

2. Scenario insights and portfolio positioning Changes to asset allocation of MLC Inflation Plus Moderate CHANGES TO MLC INFLATION PLUS MODERATE PORTFOLIO’S ASSET ALLOCATION DURING THE QUARTER ENDING 31 DECEMBER 2017 • We may increase exposure to insurance-related investments if more favourable pricing eventuates. Given the extent of industry-wide reinsurance losses in the September quarter, with three hurricanes making landfall in the US and two major earthquakes in Mexico, it is likely that reinsurance premium rates will increase at year end when reinsurance contracts are renewed for 2018, placing the strategy in a good position to benefit from an improved pricing environment. 16 16

2. Scenario insights and portfolio positioning Changes to asset allocation of MLC Inflation Plus Moderate CHANGES TO MLC INFLATION PLUS MODERATE PORTFOLIO’S ASSET ALLOCATION DURING THE QUARTER ENDING 31 DECEMBER 2017 • We may increase exposure to insurance-related investments if more favourable pricing eventuates. Given the extent of industry-wide reinsurance losses in the September quarter, with three hurricanes making landfall in the US and two major earthquakes in Mexico, it is likely that reinsurance premium rates will increase at year end when reinsurance contracts are renewed for 2018, placing the strategy in a good position to benefit from an improved pricing environment. 16 16

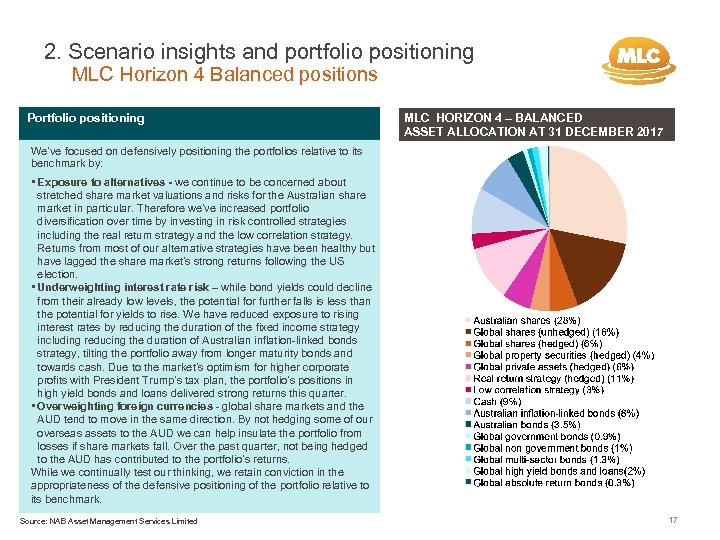

2. Scenario insights and portfolio positioning MLC Horizon 4 Balanced positions Portfolio positioning MLC HORIZON 4 – BALANCED ASSET ALLOCATION AT 31 DECEMBER 2017 We’ve focused on defensively positioning the portfolios relative to its benchmark by: • Exposure to alternatives - we continue to be concerned about stretched share market valuations and risks for the Australian share market in particular. Therefore we’ve increased portfolio diversification over time by investing in risk controlled strategies including the real return strategy and the low correlation strategy. Returns from most of our alternative strategies have been healthy but have lagged the share market’s strong returns following the US election. • Underweighting interest rate risk – while bond yields could decline from their already low levels, the potential for further falls is less than the potential for yields to rise. We have reduced exposure to rising interest rates by reducing the duration of the fixed income strategy including reducing the duration of Australian inflation-linked bonds strategy, tilting the portfolio away from longer maturity bonds and towards cash. Due to the market’s optimism for higher corporate profits with President Trump’s tax plan, the portfolio’s positions in high yield bonds and loans delivered strong returns this quarter. • Overweighting foreign currencies - global share markets and the AUD tend to move in the same direction. By not hedging some of our overseas assets to the AUD we can help insulate the portfolio from losses if share markets fall. Over the past quarter, not being hedged to the AUD has contributed to the portfolio’s returns. While we continually test our thinking, we retain conviction in the appropriateness of the defensive positioning of the portfolio relative to its benchmark. Source: NAB Asset Management Services Limited 17

2. Scenario insights and portfolio positioning MLC Horizon 4 Balanced positions Portfolio positioning MLC HORIZON 4 – BALANCED ASSET ALLOCATION AT 31 DECEMBER 2017 We’ve focused on defensively positioning the portfolios relative to its benchmark by: • Exposure to alternatives - we continue to be concerned about stretched share market valuations and risks for the Australian share market in particular. Therefore we’ve increased portfolio diversification over time by investing in risk controlled strategies including the real return strategy and the low correlation strategy. Returns from most of our alternative strategies have been healthy but have lagged the share market’s strong returns following the US election. • Underweighting interest rate risk – while bond yields could decline from their already low levels, the potential for further falls is less than the potential for yields to rise. We have reduced exposure to rising interest rates by reducing the duration of the fixed income strategy including reducing the duration of Australian inflation-linked bonds strategy, tilting the portfolio away from longer maturity bonds and towards cash. Due to the market’s optimism for higher corporate profits with President Trump’s tax plan, the portfolio’s positions in high yield bonds and loans delivered strong returns this quarter. • Overweighting foreign currencies - global share markets and the AUD tend to move in the same direction. By not hedging some of our overseas assets to the AUD we can help insulate the portfolio from losses if share markets fall. Over the past quarter, not being hedged to the AUD has contributed to the portfolio’s returns. While we continually test our thinking, we retain conviction in the appropriateness of the defensive positioning of the portfolio relative to its benchmark. Source: NAB Asset Management Services Limited 17

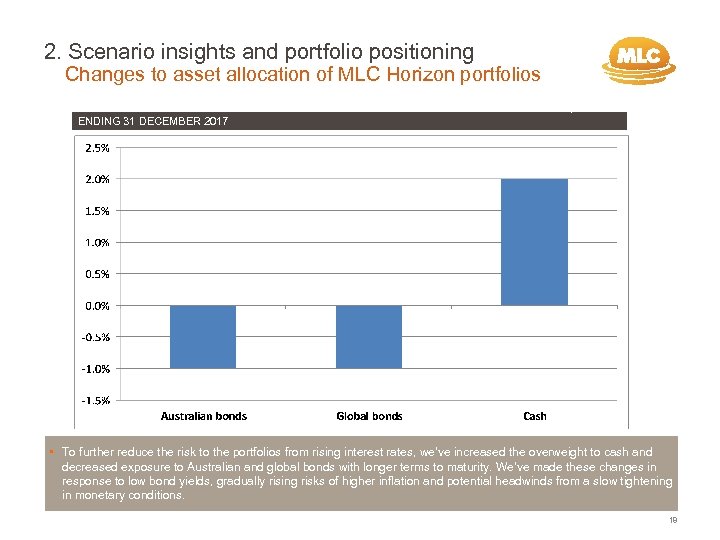

2. Scenario insights and portfolio positioning Changes to asset allocation of MLC Horizon portfolios CHANGES TO MLC HORIZON 4 BALANCED PORTFOLIO’S ASSET ALLOCATION DURING THE QUARTER ENDING 31 DECEMBER 2017 • To further reduce the risk to the portfolios from rising interest rates, we’ve increased the overweight to cash and decreased exposure to Australian and global bonds with longer terms to maturity. We’ve made these changes in response to low bond yields, gradually rising risks of higher inflation and potential headwinds from a slow tightening in monetary conditions. 18 18

2. Scenario insights and portfolio positioning Changes to asset allocation of MLC Horizon portfolios CHANGES TO MLC HORIZON 4 BALANCED PORTFOLIO’S ASSET ALLOCATION DURING THE QUARTER ENDING 31 DECEMBER 2017 • To further reduce the risk to the portfolios from rising interest rates, we’ve increased the overweight to cash and decreased exposure to Australian and global bonds with longer terms to maturity. We’ve made these changes in response to low bond yields, gradually rising risks of higher inflation and potential headwinds from a slow tightening in monetary conditions. 18 18

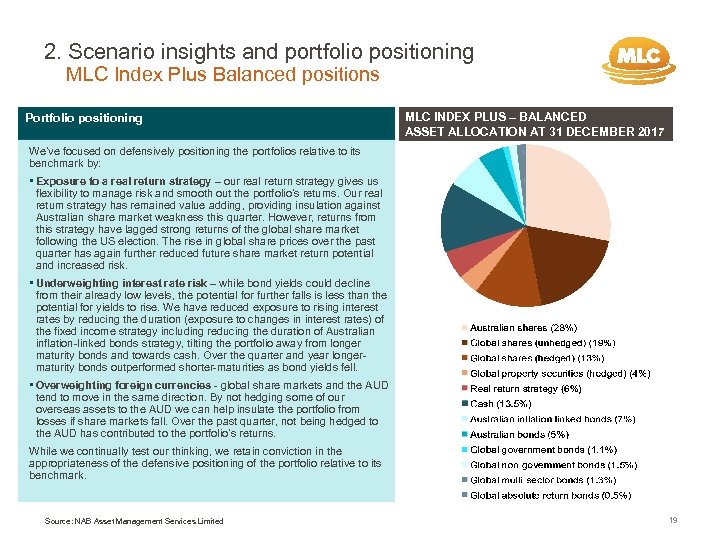

2. Scenario insights and portfolio positioning MLC Index Plus Balanced positions Portfolio positioning MLC INDEX PLUS – BALANCED ASSET ALLOCATION AT 31 DECEMBER 2017 We’ve focused on defensively positioning the portfolios relative to its benchmark by: • Exposure to a real return strategy – our real return strategy gives us flexibility to manage risk and smooth out the portfolio’s returns. Our real return strategy has remained value adding, providing insulation against Australian share market weakness this quarter. However, returns from this strategy have lagged strong returns of the global share market following the US election. The rise in global share prices over the past quarter has again further reduced future share market return potential and increased risk. • Underweighting interest rate risk – while bond yields could decline from their already low levels, the potential for further falls is less than the potential for yields to rise. We have reduced exposure to rising interest rates by reducing the duration (exposure to changes in interest rates) of the fixed income strategy including reducing the duration of Australian inflation-linked bonds strategy, tilting the portfolio away from longer maturity bonds and towards cash. Over the quarter and year longermaturity bonds outperformed shorter-maturities as bond yields fell. • Overweighting foreign currencies - global share markets and the AUD tend to move in the same direction. By not hedging some of our overseas assets to the AUD we can help insulate the portfolio from losses if share markets fall. Over the past quarter, not being hedged to the AUD has contributed to the portfolio’s returns. While we continually test our thinking, we retain conviction in the appropriateness of the defensive positioning of the portfolio relative to its benchmark. Source: NAB Asset Management Services Limited 19

2. Scenario insights and portfolio positioning MLC Index Plus Balanced positions Portfolio positioning MLC INDEX PLUS – BALANCED ASSET ALLOCATION AT 31 DECEMBER 2017 We’ve focused on defensively positioning the portfolios relative to its benchmark by: • Exposure to a real return strategy – our real return strategy gives us flexibility to manage risk and smooth out the portfolio’s returns. Our real return strategy has remained value adding, providing insulation against Australian share market weakness this quarter. However, returns from this strategy have lagged strong returns of the global share market following the US election. The rise in global share prices over the past quarter has again further reduced future share market return potential and increased risk. • Underweighting interest rate risk – while bond yields could decline from their already low levels, the potential for further falls is less than the potential for yields to rise. We have reduced exposure to rising interest rates by reducing the duration (exposure to changes in interest rates) of the fixed income strategy including reducing the duration of Australian inflation-linked bonds strategy, tilting the portfolio away from longer maturity bonds and towards cash. Over the quarter and year longermaturity bonds outperformed shorter-maturities as bond yields fell. • Overweighting foreign currencies - global share markets and the AUD tend to move in the same direction. By not hedging some of our overseas assets to the AUD we can help insulate the portfolio from losses if share markets fall. Over the past quarter, not being hedged to the AUD has contributed to the portfolio’s returns. While we continually test our thinking, we retain conviction in the appropriateness of the defensive positioning of the portfolio relative to its benchmark. Source: NAB Asset Management Services Limited 19

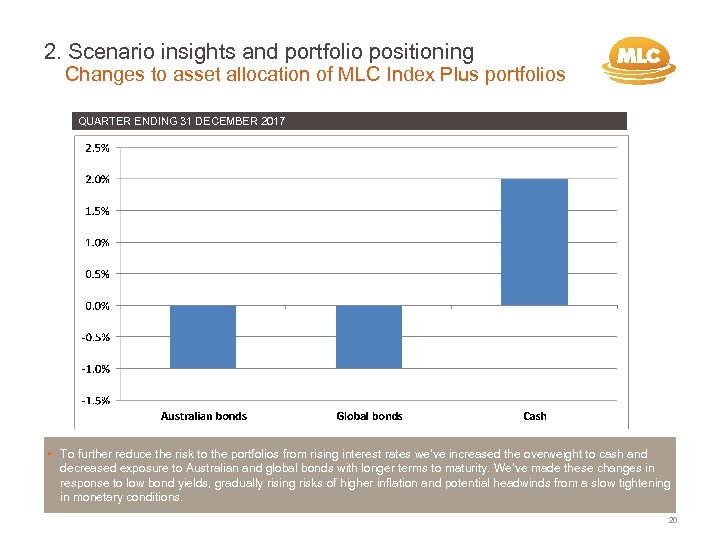

2. Scenario insights and portfolio positioning Changes to asset allocation of MLC Index Plus portfolios CHANGES TO MLC INDEX PLUS BALANCED PORTFOLIO’S ASSET ALLOCATION DURING THE QUARTER ENDING 31 DECEMBER 2017 • To further reduce the risk to the portfolios from rising interest rates we’ve increased the overweight to cash and decreased exposure to Australian and global bonds with longer terms to maturity. We’ve made these changes in response to low bond yields, gradually rising risks of higher inflation and potential headwinds from a slow tightening in monetary conditions. 20 20

2. Scenario insights and portfolio positioning Changes to asset allocation of MLC Index Plus portfolios CHANGES TO MLC INDEX PLUS BALANCED PORTFOLIO’S ASSET ALLOCATION DURING THE QUARTER ENDING 31 DECEMBER 2017 • To further reduce the risk to the portfolios from rising interest rates we’ve increased the overweight to cash and decreased exposure to Australian and global bonds with longer terms to maturity. We’ve made these changes in response to low bond yields, gradually rising risks of higher inflation and potential headwinds from a slow tightening in monetary conditions. 20 20

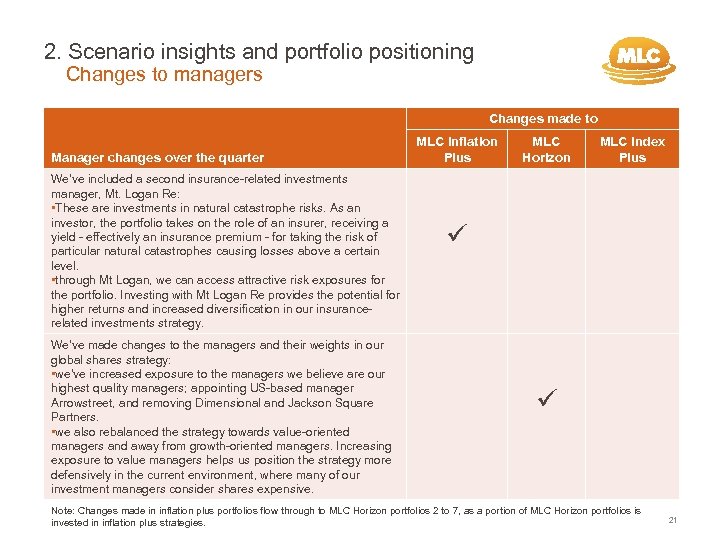

2. Scenario insights and portfolio positioning Changes to managers Changes made to Manager changes over the quarter We’ve included a second insurance-related investments manager, Mt. Logan Re: • These are investments in natural catastrophe risks. As an investor, the portfolio takes on the role of an insurer, receiving a yield - effectively an insurance premium - for taking the risk of particular natural catastrophes causing losses above a certain level. • through Mt Logan, we can access attractive risk exposures for the portfolio. Investing with Mt Logan Re provides the potential for higher returns and increased diversification in our insurancerelated investments strategy. We’ve made changes to the managers and their weights in our global shares strategy: • we’ve increased exposure to the managers we believe are our highest quality managers; appointing US-based manager Arrowstreet, and removing Dimensional and Jackson Square Partners. • we also rebalanced the strategy towards value-oriented managers and away from growth-oriented managers. Increasing exposure to value managers helps us position the strategy more defensively in the current environment, where many of our investment managers consider shares expensive. MLC Inflation Plus MLC Horizon MLC Index Plus Note: Changes made in inflation plus portfolios flow through to MLC Horizon portfolios 2 to 7, as a portion of MLC Horizon portfolios is invested in inflation plus strategies. 21

2. Scenario insights and portfolio positioning Changes to managers Changes made to Manager changes over the quarter We’ve included a second insurance-related investments manager, Mt. Logan Re: • These are investments in natural catastrophe risks. As an investor, the portfolio takes on the role of an insurer, receiving a yield - effectively an insurance premium - for taking the risk of particular natural catastrophes causing losses above a certain level. • through Mt Logan, we can access attractive risk exposures for the portfolio. Investing with Mt Logan Re provides the potential for higher returns and increased diversification in our insurancerelated investments strategy. We’ve made changes to the managers and their weights in our global shares strategy: • we’ve increased exposure to the managers we believe are our highest quality managers; appointing US-based manager Arrowstreet, and removing Dimensional and Jackson Square Partners. • we also rebalanced the strategy towards value-oriented managers and away from growth-oriented managers. Increasing exposure to value managers helps us position the strategy more defensively in the current environment, where many of our investment managers consider shares expensive. MLC Inflation Plus MLC Horizon MLC Index Plus Note: Changes made in inflation plus portfolios flow through to MLC Horizon portfolios 2 to 7, as a portion of MLC Horizon portfolios is invested in inflation plus strategies. 21

3. More analysis of returns A. RETURNS FOR ALL MULTI-ASSET PORTFOLIOS B. MLC INFLATION PLUS PORTFOLIO RETURNS Relative to benchmark Contributors to returns C. MLC HORIZON PORTFOLIO RETURNS Contributors to returns Relative to peers D. MLC INDEX PLUS PORTFOLIO RETURNS Contributors to returns E. ASSET CLASS FUND RETURNS Relative to benchmark 22

3. More analysis of returns A. RETURNS FOR ALL MULTI-ASSET PORTFOLIOS B. MLC INFLATION PLUS PORTFOLIO RETURNS Relative to benchmark Contributors to returns C. MLC HORIZON PORTFOLIO RETURNS Contributors to returns Relative to peers D. MLC INDEX PLUS PORTFOLIO RETURNS Contributors to returns E. ASSET CLASS FUND RETURNS Relative to benchmark 22

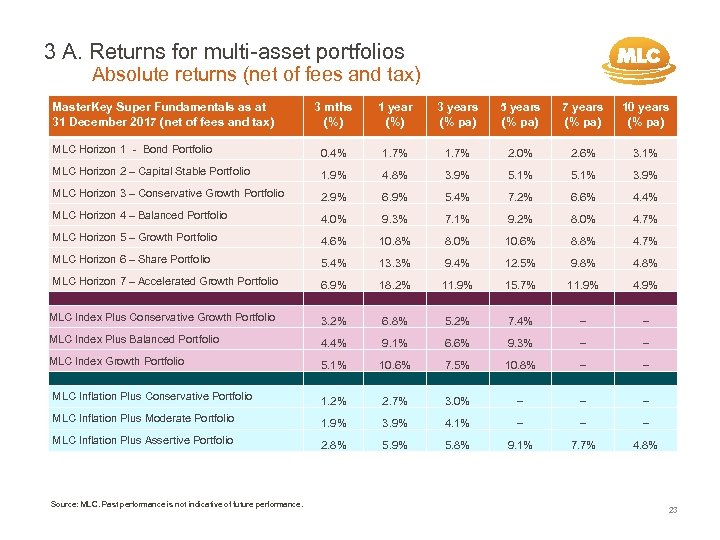

3 A. Returns for multi-asset portfolios Absolute returns (net of fees and tax) Master. Key Super Fundamentals as at 31 December 2017 (net of fees and tax) 3 mths (%) 1 year (%) 3 years (% pa) 5 years (% pa) 7 years (% pa) 10 years (% pa) MLC Horizon 1 ‐ Bond Portfolio 0. 4% 1. 7% 2. 0% 2. 6% 3. 1% MLC Horizon 2 – Capital Stable Portfolio 1. 9% 4. 8% 3. 9% 5. 1% 3. 9% MLC Horizon 3 – Conservative Growth Portfolio 2. 9% 6. 9% 5. 4% 7. 2% 6. 6% 4. 4% MLC Horizon 4 – Balanced Portfolio 4. 0% 9. 3% 7. 1% 9. 2% 8. 0% 4. 7% MLC Horizon 5 – Growth Portfolio 4. 6% 10. 8% 8. 0% 10. 6% 8. 8% 4. 7% MLC Horizon 6 – Share Portfolio 5. 4% 13. 3% 9. 4% 12. 5% 9. 8% 4. 8% MLC Horizon 7 – Accelerated Growth Portfolio 6. 9% 18. 2% 11. 9% 15. 7% 11. 9% 4. 9% MLC Index Plus Conservative Growth Portfolio 3. 2% 6. 8% 5. 2% 7. 4% MLC Index Plus Balanced Portfolio 4. 4% 9. 1% 6. 6% 9. 3% MLC Index Growth Portfolio 5. 1% 10. 6% 7. 5% 10. 8% MLC Inflation Plus Conservative Portfolio 1. 2% 2. 7% 3. 0% MLC Inflation Plus Moderate Portfolio 1. 9% 3. 9% 4. 1% MLC Inflation Plus Assertive Portfolio 2. 8% 5. 9% 5. 8% 9. 1% 7. 7% 4. 8% Source: MLC. Past performance is not indicative of future performance. 23

3 A. Returns for multi-asset portfolios Absolute returns (net of fees and tax) Master. Key Super Fundamentals as at 31 December 2017 (net of fees and tax) 3 mths (%) 1 year (%) 3 years (% pa) 5 years (% pa) 7 years (% pa) 10 years (% pa) MLC Horizon 1 ‐ Bond Portfolio 0. 4% 1. 7% 2. 0% 2. 6% 3. 1% MLC Horizon 2 – Capital Stable Portfolio 1. 9% 4. 8% 3. 9% 5. 1% 3. 9% MLC Horizon 3 – Conservative Growth Portfolio 2. 9% 6. 9% 5. 4% 7. 2% 6. 6% 4. 4% MLC Horizon 4 – Balanced Portfolio 4. 0% 9. 3% 7. 1% 9. 2% 8. 0% 4. 7% MLC Horizon 5 – Growth Portfolio 4. 6% 10. 8% 8. 0% 10. 6% 8. 8% 4. 7% MLC Horizon 6 – Share Portfolio 5. 4% 13. 3% 9. 4% 12. 5% 9. 8% 4. 8% MLC Horizon 7 – Accelerated Growth Portfolio 6. 9% 18. 2% 11. 9% 15. 7% 11. 9% 4. 9% MLC Index Plus Conservative Growth Portfolio 3. 2% 6. 8% 5. 2% 7. 4% MLC Index Plus Balanced Portfolio 4. 4% 9. 1% 6. 6% 9. 3% MLC Index Growth Portfolio 5. 1% 10. 6% 7. 5% 10. 8% MLC Inflation Plus Conservative Portfolio 1. 2% 2. 7% 3. 0% MLC Inflation Plus Moderate Portfolio 1. 9% 3. 9% 4. 1% MLC Inflation Plus Assertive Portfolio 2. 8% 5. 9% 5. 8% 9. 1% 7. 7% 4. 8% Source: MLC. Past performance is not indicative of future performance. 23

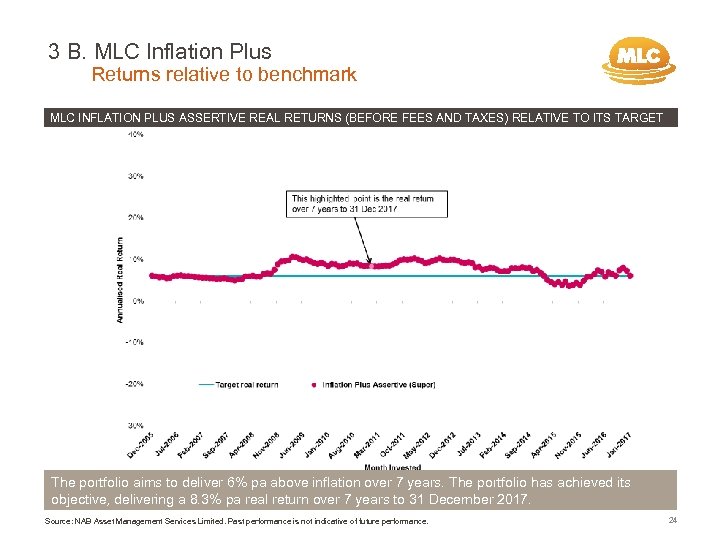

3 B. MLC Inflation Plus Returns relative to benchmark MLC INFLATION PLUS ASSERTIVE REAL RETURNS (BEFORE FEES AND TAXES) RELATIVE TO ITS TARGET The portfolio aims to deliver 6% pa above inflation over 7 years. The portfolio has achieved its objective, delivering a 8. 3% pa real return over 7 years to 31 December 2017. Source: NAB Asset Management Services Limited. Past performance is not indicative of future performance. 24

3 B. MLC Inflation Plus Returns relative to benchmark MLC INFLATION PLUS ASSERTIVE REAL RETURNS (BEFORE FEES AND TAXES) RELATIVE TO ITS TARGET The portfolio aims to deliver 6% pa above inflation over 7 years. The portfolio has achieved its objective, delivering a 8. 3% pa real return over 7 years to 31 December 2017. Source: NAB Asset Management Services Limited. Past performance is not indicative of future performance. 24

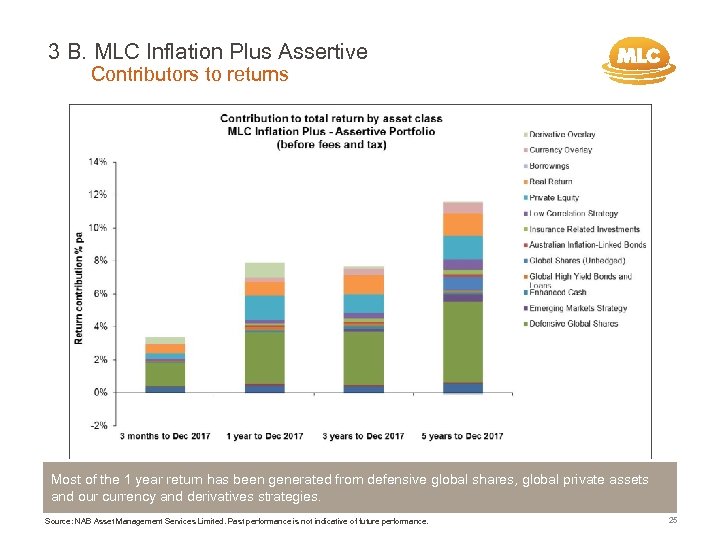

3 B. MLC Inflation Plus Assertive Contributors to returns Most of the 1 year return has been generated from defensive global shares, global private assets and our currency and derivatives strategies. Source: NAB Asset Management Services Limited. Past performance is not indicative of future performance. 25

3 B. MLC Inflation Plus Assertive Contributors to returns Most of the 1 year return has been generated from defensive global shares, global private assets and our currency and derivatives strategies. Source: NAB Asset Management Services Limited. Past performance is not indicative of future performance. 25

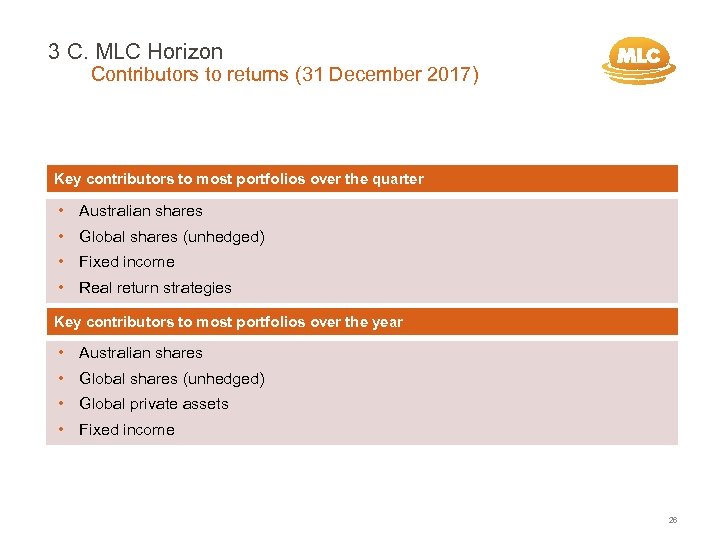

3 C. MLC Horizon Contributors to returns (31 December 2017) Key contributors to most portfolios over the quarter • Australian shares • Global shares (unhedged) • Fixed income • Real return strategies Key contributors to most portfolios over the year • Australian shares • Global shares (unhedged) • Global private assets • Fixed income 26

3 C. MLC Horizon Contributors to returns (31 December 2017) Key contributors to most portfolios over the quarter • Australian shares • Global shares (unhedged) • Fixed income • Real return strategies Key contributors to most portfolios over the year • Australian shares • Global shares (unhedged) • Global private assets • Fixed income 26

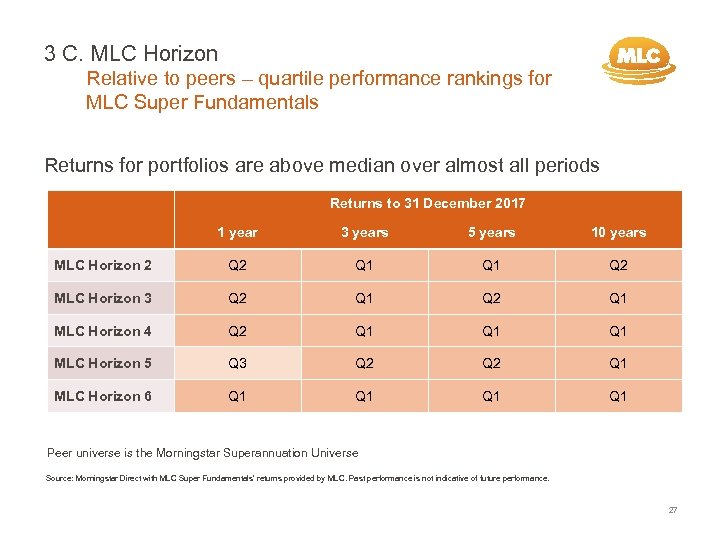

3 C. MLC Horizon Relative to peers – quartile performance rankings for MLC Super Fundamentals Returns for portfolios are above median over almost all periods Returns to 31 December 2017 1 year 3 years 5 years 10 years MLC Horizon 2 Q 1 Q 2 MLC Horizon 3 Q 2 Q 1 MLC Horizon 4 Q 2 Q 1 Q 1 MLC Horizon 5 Q 3 Q 2 Q 1 MLC Horizon 6 Q 1 Q 1 Peer universe is the Morningstar Superannuation Universe Source: Morningstar Direct with MLC Super Fundamentals’ returns provided by MLC. Past performance is not indicative of future performance. 27

3 C. MLC Horizon Relative to peers – quartile performance rankings for MLC Super Fundamentals Returns for portfolios are above median over almost all periods Returns to 31 December 2017 1 year 3 years 5 years 10 years MLC Horizon 2 Q 1 Q 2 MLC Horizon 3 Q 2 Q 1 MLC Horizon 4 Q 2 Q 1 Q 1 MLC Horizon 5 Q 3 Q 2 Q 1 MLC Horizon 6 Q 1 Q 1 Peer universe is the Morningstar Superannuation Universe Source: Morningstar Direct with MLC Super Fundamentals’ returns provided by MLC. Past performance is not indicative of future performance. 27

3 C. MLC Horizon Relative to peers Most MLC Horizon portfolios have outperformed peers this year MLC Horizon 4’s one year peer relative return is above median. The main reasons are due to the portfolio's: • HIGHER ALLOCATION TO GLOBAL PRIVATE ASSETS THAN COMPETITORS. RETURNS FROM THESE ASSETS HAVE BEEN VERY STRONG OVER THE PAST YEAR. • AUSTRALIAN SHARES STRATEGY OUTPERFORMING ITS BENCHMARK THIS YEAR. • ZERO DIRECT ALLOCATION TO AUSTRALIAN REITS, WHICH HAVE PRODUCED WEAKER RETURNS THAN OTHER GROWTH ASSET CLASSES THIS YEAR. Source: NAB Asset Management Services Limited. Past performance is not indicative of future performance. 28

3 C. MLC Horizon Relative to peers Most MLC Horizon portfolios have outperformed peers this year MLC Horizon 4’s one year peer relative return is above median. The main reasons are due to the portfolio's: • HIGHER ALLOCATION TO GLOBAL PRIVATE ASSETS THAN COMPETITORS. RETURNS FROM THESE ASSETS HAVE BEEN VERY STRONG OVER THE PAST YEAR. • AUSTRALIAN SHARES STRATEGY OUTPERFORMING ITS BENCHMARK THIS YEAR. • ZERO DIRECT ALLOCATION TO AUSTRALIAN REITS, WHICH HAVE PRODUCED WEAKER RETURNS THAN OTHER GROWTH ASSET CLASSES THIS YEAR. Source: NAB Asset Management Services Limited. Past performance is not indicative of future performance. 28

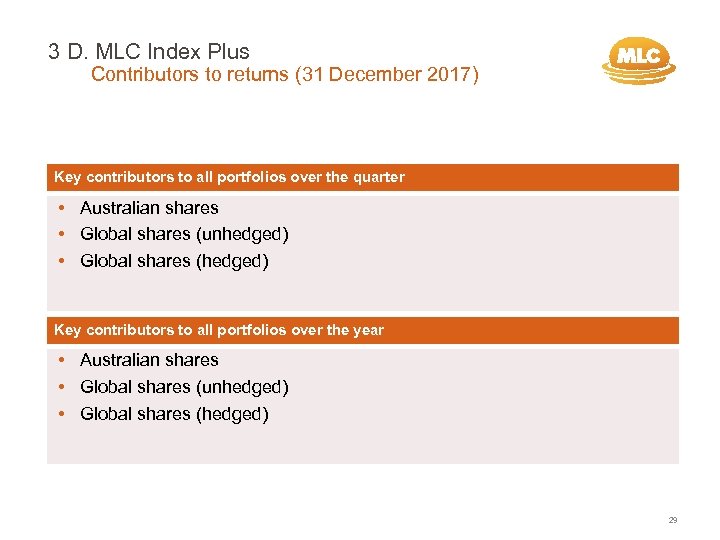

3 D. MLC Index Plus Contributors to returns (31 December 2017) Key contributors to all portfolios over the quarter • Australian shares • Global shares (unhedged) • Global shares (hedged) Key contributors to all portfolios over the year • Australian shares • Global shares (unhedged) • Global shares (hedged) 29

3 D. MLC Index Plus Contributors to returns (31 December 2017) Key contributors to all portfolios over the quarter • Australian shares • Global shares (unhedged) • Global shares (hedged) Key contributors to all portfolios over the year • Australian shares • Global shares (unhedged) • Global shares (hedged) 29

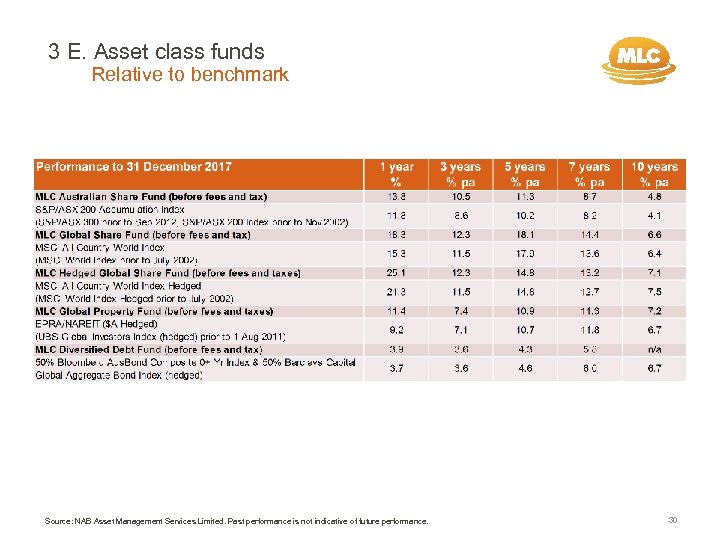

3 E. Asset class funds Relative to benchmark Source: NAB Asset Management Services Limited. Past performance is not indicative of future performance. 30 30

3 E. Asset class funds Relative to benchmark Source: NAB Asset Management Services Limited. Past performance is not indicative of future performance. 30 30

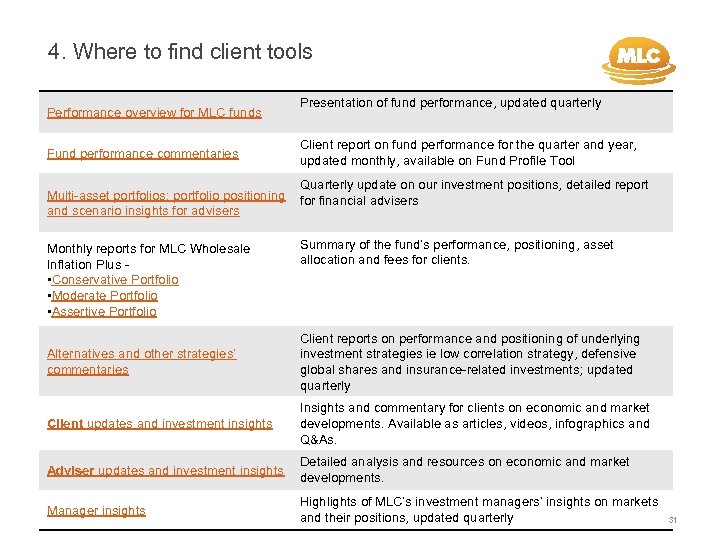

4. Where to find client tools Performance overview for MLC funds Fund performance commentaries Presentation of fund performance, updated quarterly Client report on fund performance for the quarter and year, updated monthly, available on Fund Profile Tool Quarterly update on our investment positions, detailed report Multi-asset portfolios: portfolio positioning for financial advisers and scenario insights for advisers Monthly reports for MLC Wholesale Inflation Plus - • Conservative Portfolio • Moderate Portfolio • Assertive Portfolio Summary of the fund’s performance, positioning, asset allocation and fees for clients. Alternatives and other strategies’ commentaries Client reports on performance and positioning of underlying investment strategies ie low correlation strategy, defensive global shares and insurance-related investments; updated quarterly Client updates and investment insights Insights and commentary for clients on economic and market developments. Available as articles, videos, infographics and Q&As. Adviser updates and investment insights Detailed analysis and resources on economic and market developments. Manager insights Highlights of MLC’s investment managers’ insights on markets and their positions, updated quarterly 31

4. Where to find client tools Performance overview for MLC funds Fund performance commentaries Presentation of fund performance, updated quarterly Client report on fund performance for the quarter and year, updated monthly, available on Fund Profile Tool Quarterly update on our investment positions, detailed report Multi-asset portfolios: portfolio positioning for financial advisers and scenario insights for advisers Monthly reports for MLC Wholesale Inflation Plus - • Conservative Portfolio • Moderate Portfolio • Assertive Portfolio Summary of the fund’s performance, positioning, asset allocation and fees for clients. Alternatives and other strategies’ commentaries Client reports on performance and positioning of underlying investment strategies ie low correlation strategy, defensive global shares and insurance-related investments; updated quarterly Client updates and investment insights Insights and commentary for clients on economic and market developments. Available as articles, videos, infographics and Q&As. Adviser updates and investment insights Detailed analysis and resources on economic and market developments. Manager insights Highlights of MLC’s investment managers’ insights on markets and their positions, updated quarterly 31