Tax systems.pptx

- Количество слайдов: 28

THE EVOLUTION OF NORWEGIAN PETROLEUM FISCAL SYSTEM

THE EVOLUTION OF NORWEGIAN PETROLEUM FISCAL SYSTEM

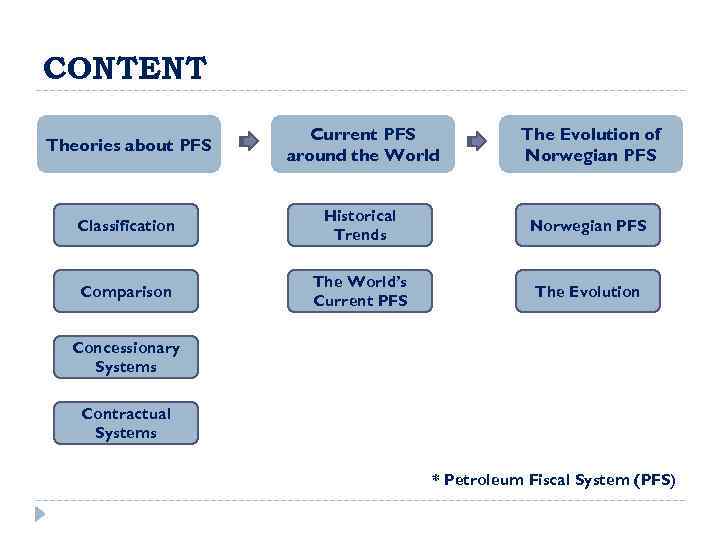

CONTENT Theories about PFS Current PFS around the World The Evolution of Norwegian PFS Classification Historical Trends Norwegian PFS Comparison The World’s Current PFS The Evolution Concessionary Systems Contractual Systems * Petroleum Fiscal System (PFS)

CONTENT Theories about PFS Current PFS around the World The Evolution of Norwegian PFS Classification Historical Trends Norwegian PFS Comparison The World’s Current PFS The Evolution Concessionary Systems Contractual Systems * Petroleum Fiscal System (PFS)

THEORIES ABOUT PETROLEUM FISCAL SYSTEMS

THEORIES ABOUT PETROLEUM FISCAL SYSTEMS

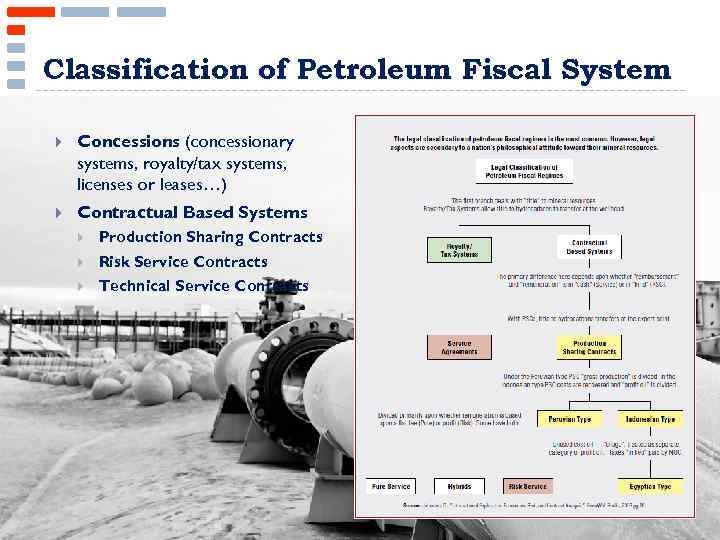

Classification of Petroleum Fiscal System Concessions (concessionary systems, royalty/tax systems, licenses or leases…) Contractual Based Systems Production Sharing Contracts Risk Service Contracts Technical Service Contracts

Classification of Petroleum Fiscal System Concessions (concessionary systems, royalty/tax systems, licenses or leases…) Contractual Based Systems Production Sharing Contracts Risk Service Contracts Technical Service Contracts

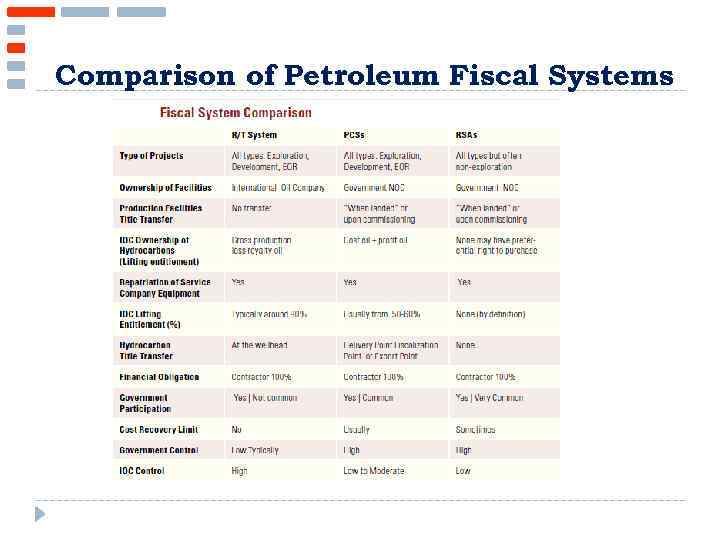

Comparison of Petroleum Fiscal Systems

Comparison of Petroleum Fiscal Systems

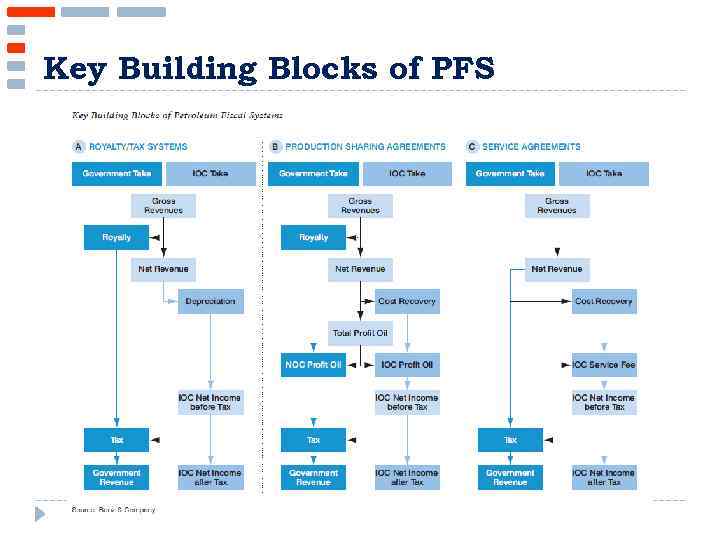

Key Building Blocks of PFS

Key Building Blocks of PFS

Concessionary Systems Governments decide whether resources are privately owned or whether they are state property. Under a concessionary system (also called a royalty/tax system), the government or land owner will transfer title of the minerals to the oil company which is then subject to the payment of royalties and taxes.

Concessionary Systems Governments decide whether resources are privately owned or whether they are state property. Under a concessionary system (also called a royalty/tax system), the government or land owner will transfer title of the minerals to the oil company which is then subject to the payment of royalties and taxes.

Concessionary Systems TAXES: Resource Rent Tax (MET) Corporate Income Tax Import and Export Duties Petroleum Special Profit Tax (Windfall or Excess) Surface Tax / Area Fee Value Added Tax Environmental Taxes, Transportation Taxes, Consumption Taxes …

Concessionary Systems TAXES: Resource Rent Tax (MET) Corporate Income Tax Import and Export Duties Petroleum Special Profit Tax (Windfall or Excess) Surface Tax / Area Fee Value Added Tax Environmental Taxes, Transportation Taxes, Consumption Taxes …

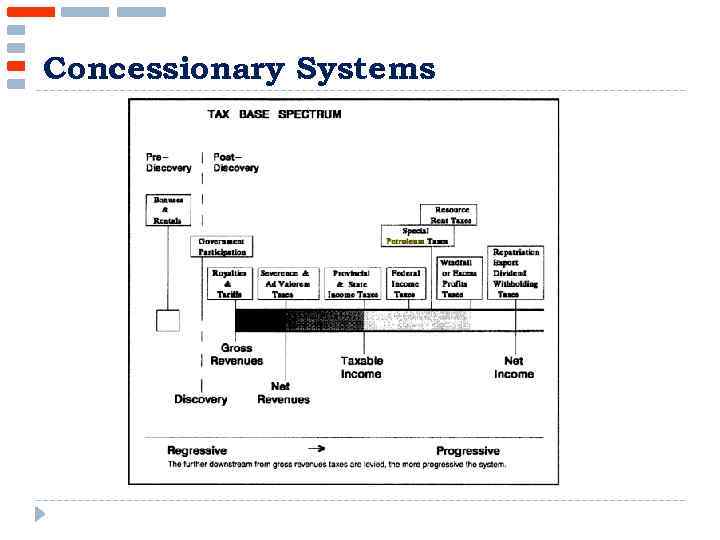

Concessionary Systems

Concessionary Systems

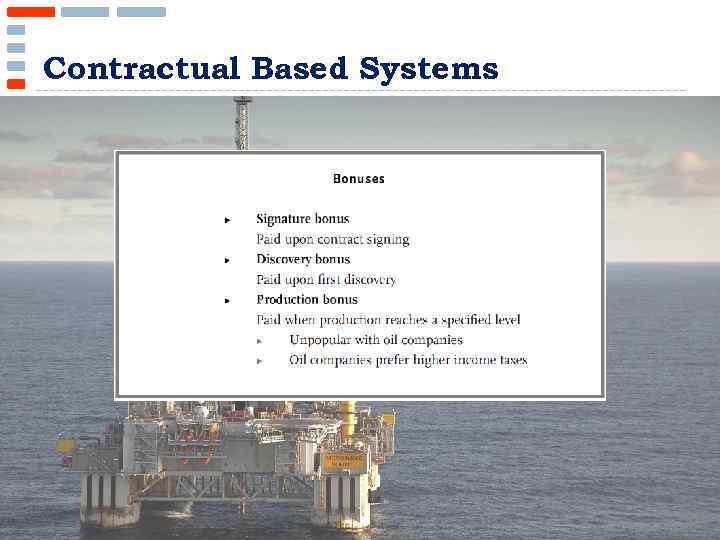

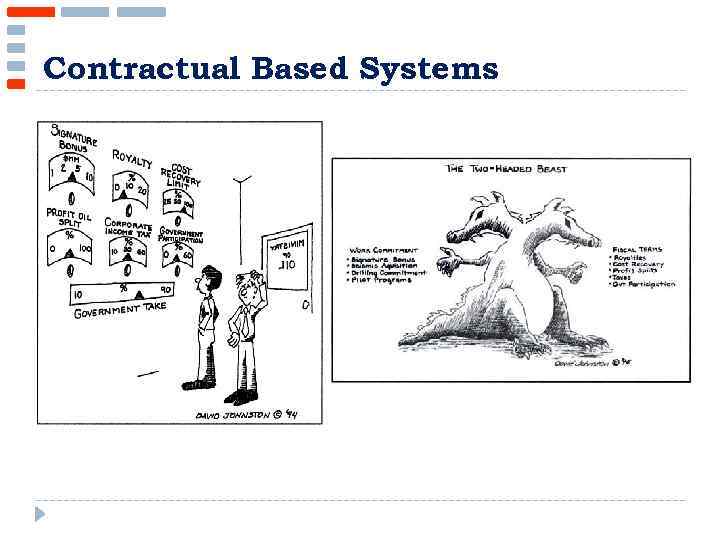

Contractual Based Systems Started in Indonesia in 1960 Work commitment Bonus payment Royalties Recovery of production cost Overall share of the host country depends on bargaining Now preferred by developing countries

Contractual Based Systems Started in Indonesia in 1960 Work commitment Bonus payment Royalties Recovery of production cost Overall share of the host country depends on bargaining Now preferred by developing countries

Contractual Based Systems

Contractual Based Systems

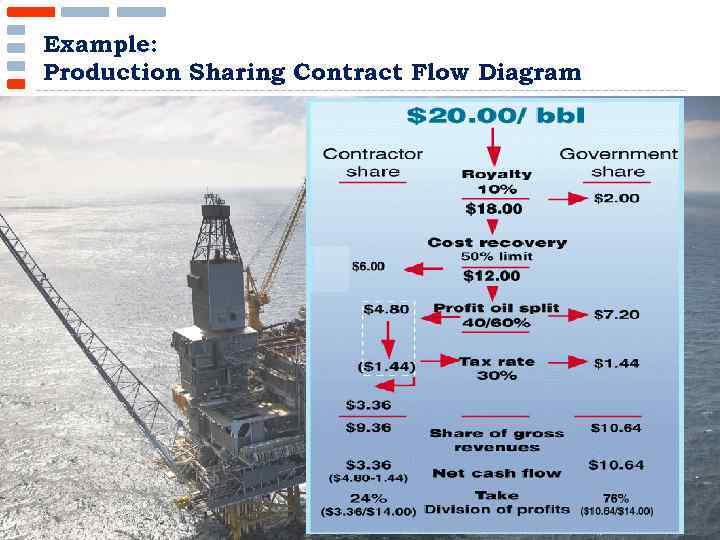

Example: Production Sharing Contract Flow Diagram

Example: Production Sharing Contract Flow Diagram

Contractual Based Systems

Contractual Based Systems

CURRENT PETOLEUM FISCAL SYSTEM AROUND THE WORLD

CURRENT PETOLEUM FISCAL SYSTEM AROUND THE WORLD

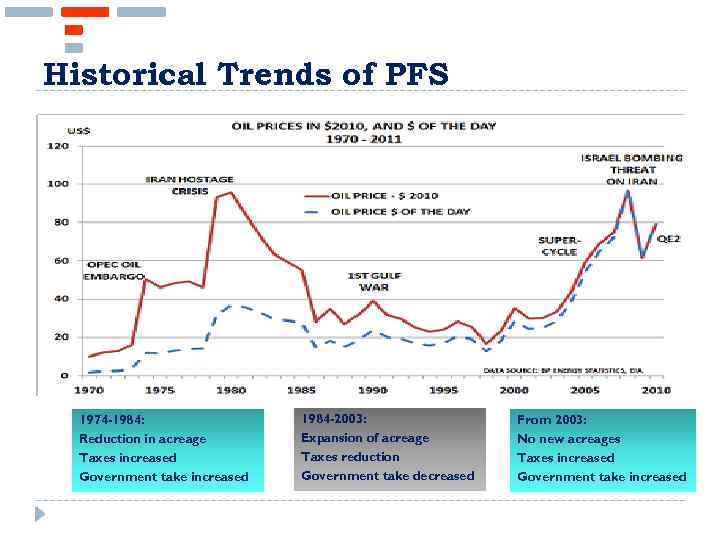

Historical Trends of PFS is changing with the oil price When oil prices are high: Host governments have a strong bargaining position, they can be more patient Host governments give priority to NOCs Taxes increased When oil prices fall: Host governments are not able to fund large investment by NOCs and are dependent on investments from IOCs At the same time, IOCs typically cut back on their investment budgets Taxes decreased

Historical Trends of PFS is changing with the oil price When oil prices are high: Host governments have a strong bargaining position, they can be more patient Host governments give priority to NOCs Taxes increased When oil prices fall: Host governments are not able to fund large investment by NOCs and are dependent on investments from IOCs At the same time, IOCs typically cut back on their investment budgets Taxes decreased

Historical Trends of PFS 1974 -1984: Reduction in acreage Taxes increased Government take increased 1984 -2003: Expansion of acreage Taxes reduction Government take decreased From 2003: No new acreages Taxes increased Government take increased

Historical Trends of PFS 1974 -1984: Reduction in acreage Taxes increased Government take increased 1984 -2003: Expansion of acreage Taxes reduction Government take decreased From 2003: No new acreages Taxes increased Government take increased

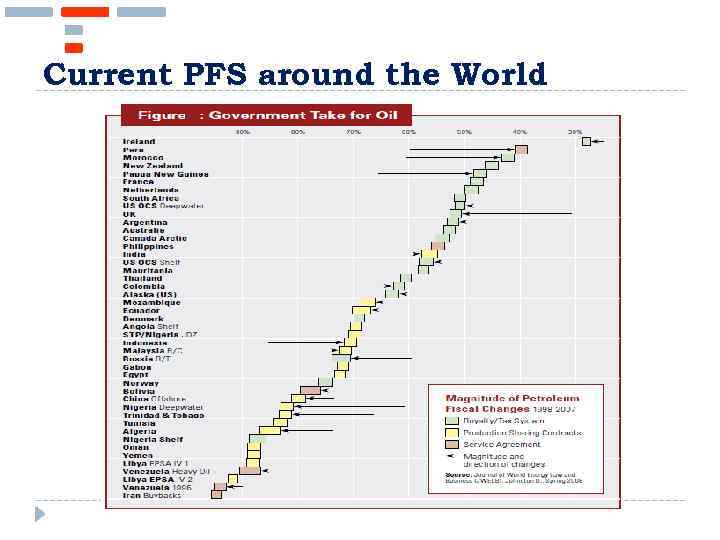

Current PFS around the World

Current PFS around the World

Current PFS around the World

Current PFS around the World

THE EVOLUTION OF NORWEGIAN PETROLEUM FISCAL SYSTEMS

THE EVOLUTION OF NORWEGIAN PETROLEUM FISCAL SYSTEMS

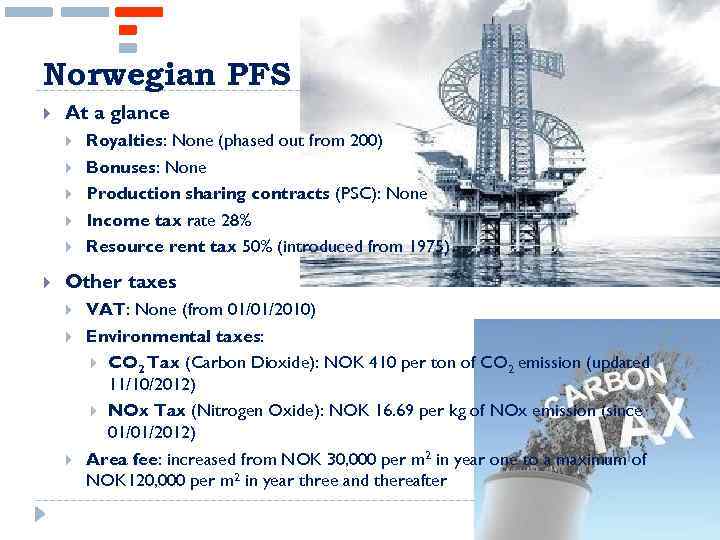

Norwegian PFS At a glance Royalties: None (phased out from 200) Bonuses: None Production sharing contracts (PSC): None Income tax rate 28% Resource rent tax 50% (introduced from 1975) Other taxes VAT: None (from 01/01/2010) Environmental taxes: CO 2 Tax (Carbon Dioxide): NOK 410 per ton of CO 2 emission (updated 11/10/2012) NOx Tax (Nitrogen Oxide): NOK 16. 69 per kg of NOx emission (since 01/01/2012) Area fee: increased from NOK 30, 000 per m 2 in year one to a maximum of NOK 120, 000 per m 2 in year three and thereafter

Norwegian PFS At a glance Royalties: None (phased out from 200) Bonuses: None Production sharing contracts (PSC): None Income tax rate 28% Resource rent tax 50% (introduced from 1975) Other taxes VAT: None (from 01/01/2010) Environmental taxes: CO 2 Tax (Carbon Dioxide): NOK 410 per ton of CO 2 emission (updated 11/10/2012) NOx Tax (Nitrogen Oxide): NOK 16. 69 per kg of NOx emission (since 01/01/2012) Area fee: increased from NOK 30, 000 per m 2 in year one to a maximum of NOK 120, 000 per m 2 in year three and thereafter

Norwegian PFS

Norwegian PFS

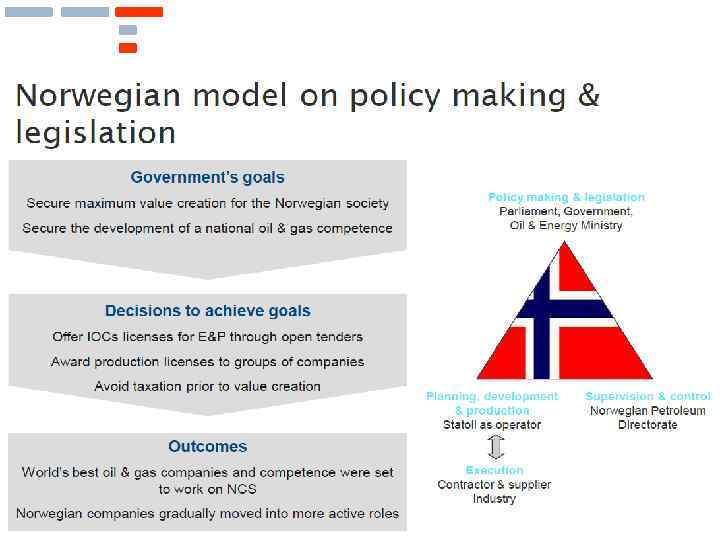

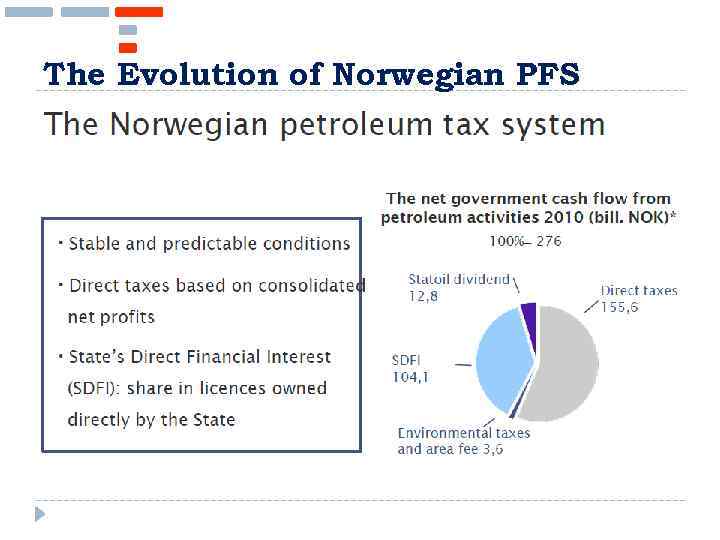

The Evolution of Norwegian PFS

The Evolution of Norwegian PFS

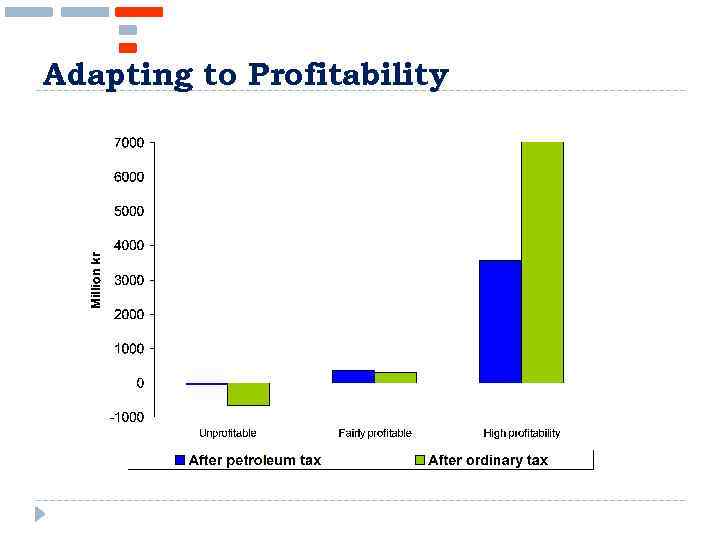

Adapting to Profitability

Adapting to Profitability

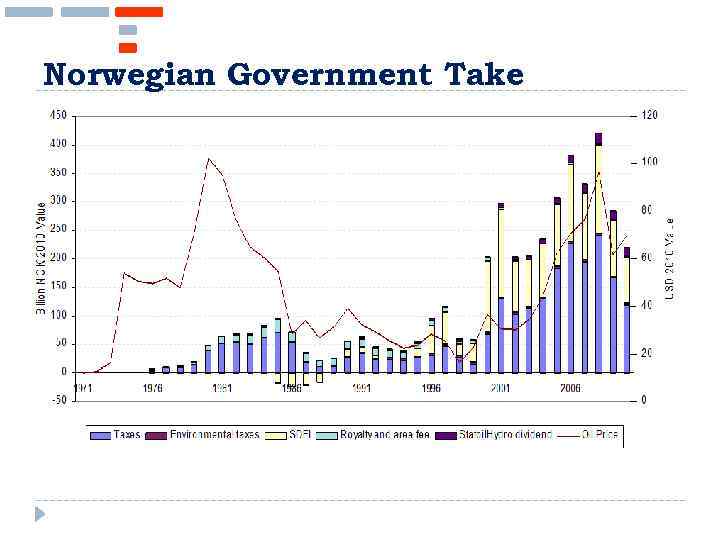

Norwegian Government Take

Norwegian Government Take

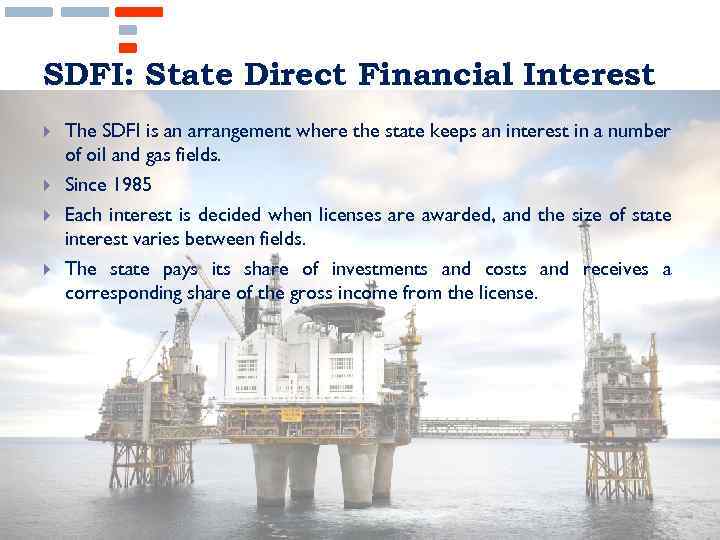

SDFI: State Direct Financial Interest The SDFI is an arrangement where the state keeps an interest in a number of oil and gas fields. Since 1985 Each interest is decided when licenses are awarded, and the size of state interest varies between fields. The state pays its share of investments and costs and receives a corresponding share of the gross income from the license.

SDFI: State Direct Financial Interest The SDFI is an arrangement where the state keeps an interest in a number of oil and gas fields. Since 1985 Each interest is decided when licenses are awarded, and the size of state interest varies between fields. The state pays its share of investments and costs and receives a corresponding share of the gross income from the license.

The Evolution of Norwegian PFS

The Evolution of Norwegian PFS