STRATEGIC MANAGEMENT . Theme Porter’s competitive strategies. Cost

41164-kozlov_sm_12_06_12_cl_focus.ppt

- Количество слайдов: 33

STRATEGIC MANAGEMENT . Theme Porter’s competitive strategies. Cost leadership and Focus. Dr. Prof. Aleksandr Kozlov 05/12/2016

STRATEGIC MANAGEMENT . Theme Porter’s competitive strategies. Cost leadership and Focus. Dr. Prof. Aleksandr Kozlov 05/12/2016

2 Focus Focus on customer segment Investment into exploring of target customers behavior and buying motivation Development of products satisfying the real needs of target customer Construction of own outlets to “keep hand” on customer pulse

2 Focus Focus on customer segment Investment into exploring of target customers behavior and buying motivation Development of products satisfying the real needs of target customer Construction of own outlets to “keep hand” on customer pulse

Segmentation criteria for consumer markets Geographic Demographic Psychographic Behavioral

Segmentation criteria for consumer markets Geographic Demographic Psychographic Behavioral

Segmentation criteria for industrial customers (1) Macro-segmentation Company size Industry Geographic location Purpose of buying Product Value for customer

Segmentation criteria for industrial customers (1) Macro-segmentation Company size Industry Geographic location Purpose of buying Product Value for customer

Segmentation criteria for industrial customers (2) Micro-segmentation Buying decision criteria Purchasing strategy (preference for familiar supplier, for the first one that fulfils the buying criteria ) Structure of the decision-making process

Segmentation criteria for industrial customers (2) Micro-segmentation Buying decision criteria Purchasing strategy (preference for familiar supplier, for the first one that fulfils the buying criteria ) Structure of the decision-making process

Customer segments: samples DINKY - Double income no kids SOHO - Small Office, Home Office VSB - Very Small Business SMB - Small Medium Business /SME - Small and medium enterprise VALS - Values Attitude and Life-Styles LOHAS - Lifestyles of Health and Sustainability LOVOS - Lifestyle of voluntary simplicity SAM - Segmented Addressable Market VLE - Very Large Enterprise

Customer segments: samples DINKY - Double income no kids SOHO - Small Office, Home Office VSB - Very Small Business SMB - Small Medium Business /SME - Small and medium enterprise VALS - Values Attitude and Life-Styles LOHAS - Lifestyles of Health and Sustainability LOVOS - Lifestyle of voluntary simplicity SAM - Segmented Addressable Market VLE - Very Large Enterprise

7 Focus: Russian aspects Focus strategy before crisis of the year 1998 was not popular because of needs in diversification to keep stability. At the moment the process of focus and concentration is going intensively in markets of services (market researches, training, legal advices, etc) .

7 Focus: Russian aspects Focus strategy before crisis of the year 1998 was not popular because of needs in diversification to keep stability. At the moment the process of focus and concentration is going intensively in markets of services (market researches, training, legal advices, etc) .

8 Focus: Russian aspects Retail Stores and Russian Consumers Household spending habits for Russia's urban populations, particularly for such consumer goods as food, cosmetics/toiletries, and household supplies, illustrate the role of the primary retail channels in Russia's grocery stores, produce markets, and supermarkets. Currently, some 37 percent of such spending takes place at small, multipurpose grocery stores, while "wholesale" produce markets (or farmers' markets) account for 24 percent of such spending, and another 12 percent of these purchases are made at large-scale grocery stores, or supermarkets.

8 Focus: Russian aspects Retail Stores and Russian Consumers Household spending habits for Russia's urban populations, particularly for such consumer goods as food, cosmetics/toiletries, and household supplies, illustrate the role of the primary retail channels in Russia's grocery stores, produce markets, and supermarkets. Currently, some 37 percent of such spending takes place at small, multipurpose grocery stores, while "wholesale" produce markets (or farmers' markets) account for 24 percent of such spending, and another 12 percent of these purchases are made at large-scale grocery stores, or supermarkets.

9 Focus: Russian aspects Retail Stores and Russian Consumers Retail trends suggest that large-scale stores will become increasingly popular. However, most Russians outside Moscow and other major cities still do their shopping at small grocery or convenience stores or other specialized stores because of their convenient location, as well as at consumer goods markets, because of low prices. At the same time, Russia is witnessing the rise of a new consumer channel--medium-sized discount supermarkets, such as Piaterochka, Kopeika, and Aldi in Moscow.

9 Focus: Russian aspects Retail Stores and Russian Consumers Retail trends suggest that large-scale stores will become increasingly popular. However, most Russians outside Moscow and other major cities still do their shopping at small grocery or convenience stores or other specialized stores because of their convenient location, as well as at consumer goods markets, because of low prices. At the same time, Russia is witnessing the rise of a new consumer channel--medium-sized discount supermarkets, such as Piaterochka, Kopeika, and Aldi in Moscow.

10 Focus: Russian aspects Regions versus Moscow The growing number of regions beyond Moscow considered to have relatively high business development potential--including St. Petersburg, Rostov, Krasnodar, Nizhny Novgorod, Tatarstan, Bashkortostan, Samara, Yekaterinburg, Krasnoyarsk, and Irkutsk.

10 Focus: Russian aspects Regions versus Moscow The growing number of regions beyond Moscow considered to have relatively high business development potential--including St. Petersburg, Rostov, Krasnodar, Nizhny Novgorod, Tatarstan, Bashkortostan, Samara, Yekaterinburg, Krasnoyarsk, and Irkutsk.

11 Focus: Russian aspects Regions versus Moscow The real differences between neighboring regions in Russia may be greater than between neighboring European countries. Companies considering entry into the Russian market in several regions should prepare not just one nationwide plan, but several business plans or a multifaceted plan to reflect the unique aspects and demands of different regions. Russia’s current experience suggests that those who go to the regions first and use local resources effectively are most likely to become market leaders

11 Focus: Russian aspects Regions versus Moscow The real differences between neighboring regions in Russia may be greater than between neighboring European countries. Companies considering entry into the Russian market in several regions should prepare not just one nationwide plan, but several business plans or a multifaceted plan to reflect the unique aspects and demands of different regions. Russia’s current experience suggests that those who go to the regions first and use local resources effectively are most likely to become market leaders

12 Focus: Russian aspects Segmentation of Russian goods consumers for foreign firms entering the market (most promising segments in Moscow) “Innovators" -. This group has higher than average consumer potential. Most of the group is under 30 years old, are business people and white-collar employees, live in major cities, and exhibit innovative consumer behavior. They prefer to spend their free time involved in sports activities and "active" leisure, and eat out in restaurants featuring exotic cuisines.

12 Focus: Russian aspects Segmentation of Russian goods consumers for foreign firms entering the market (most promising segments in Moscow) “Innovators" -. This group has higher than average consumer potential. Most of the group is under 30 years old, are business people and white-collar employees, live in major cities, and exhibit innovative consumer behavior. They prefer to spend their free time involved in sports activities and "active" leisure, and eat out in restaurants featuring exotic cuisines.

13 Focus: Russian aspects Segmentation of Russian goods consumers for foreign firms entering the market (most promising segments in Moscow) “Spontaneous”- Single men who often buy goods impulsively dominate this group “Ambitious" - Their consumer behavior is strongly inclined to innovations, although their consumer potential is much more moderate than the above groups. These consumers rely on advertising when looking for a product

13 Focus: Russian aspects Segmentation of Russian goods consumers for foreign firms entering the market (most promising segments in Moscow) “Spontaneous”- Single men who often buy goods impulsively dominate this group “Ambitious" - Their consumer behavior is strongly inclined to innovations, although their consumer potential is much more moderate than the above groups. These consumers rely on advertising when looking for a product

14 Focus: Russian aspects Segmentation of Russian goods consumers for foreign firms entering the market (most promising segments in Moscow) ”Тraditionalists”. Their consumer potential is comparatively low, as consumer behavior is strongly traditional. Half of the group is comprised of retired individuals. The majority of these consumers are regular customers of retail outlets that have survived since the Soviet times.

14 Focus: Russian aspects Segmentation of Russian goods consumers for foreign firms entering the market (most promising segments in Moscow) ”Тraditionalists”. Their consumer potential is comparatively low, as consumer behavior is strongly traditional. Half of the group is comprised of retired individuals. The majority of these consumers are regular customers of retail outlets that have survived since the Soviet times.

15 Focus: Russian aspects Segmentation of Russian goods consumers for foreign firms entering the market (most promising segments in Moscow) "Self-realized" Their consumer behavior is as traditional as that of the Traditionalists, but their consumer potential is high. These are mainly mature-age people. The women’s share is slightly greater. This cluster has the largest share of people disturbed or annoyed by advertising. These consumers value reliability and quality of goods. They pay great attention to health care.

15 Focus: Russian aspects Segmentation of Russian goods consumers for foreign firms entering the market (most promising segments in Moscow) "Self-realized" Their consumer behavior is as traditional as that of the Traditionalists, but their consumer potential is high. These are mainly mature-age people. The women’s share is slightly greater. This cluster has the largest share of people disturbed or annoyed by advertising. These consumers value reliability and quality of goods. They pay great attention to health care.

16 Focus: Russian aspects Segmentation of Russian goods consumers for foreign firms entering the market (most promising segments in Moscow). “Settled” Their consumer potential is average or above-average. Their consumer behavior is rather traditional: novel products do not interest them too much, and their consumer preferences are already distributed among brands. Women dominate this cluster. Age and education corresponds to the sample’s average level.

16 Focus: Russian aspects Segmentation of Russian goods consumers for foreign firms entering the market (most promising segments in Moscow). “Settled” Their consumer potential is average or above-average. Their consumer behavior is rather traditional: novel products do not interest them too much, and their consumer preferences are already distributed among brands. Women dominate this cluster. Age and education corresponds to the sample’s average level.

17 Focus: Russian aspects Segmentation of Russian goods consumers for foreign firms entering the market (most promising segments in Moscow). “Thrifty” Their consumer potential is the lowest of all. Their consumer behavior is closer to being traditional. Half of them are above 50 years old, and their education level is lower than the sample’s average. For the most part the cluster consists of village and small town residents. The most significant argument for or against buying a product is the price factor. They can go through many retail outlets in search of the smallest discount. Another characteristic is that they often buy goods spontaneously.

17 Focus: Russian aspects Segmentation of Russian goods consumers for foreign firms entering the market (most promising segments in Moscow). “Thrifty” Their consumer potential is the lowest of all. Their consumer behavior is closer to being traditional. Half of them are above 50 years old, and their education level is lower than the sample’s average. For the most part the cluster consists of village and small town residents. The most significant argument for or against buying a product is the price factor. They can go through many retail outlets in search of the smallest discount. Another characteristic is that they often buy goods spontaneously.

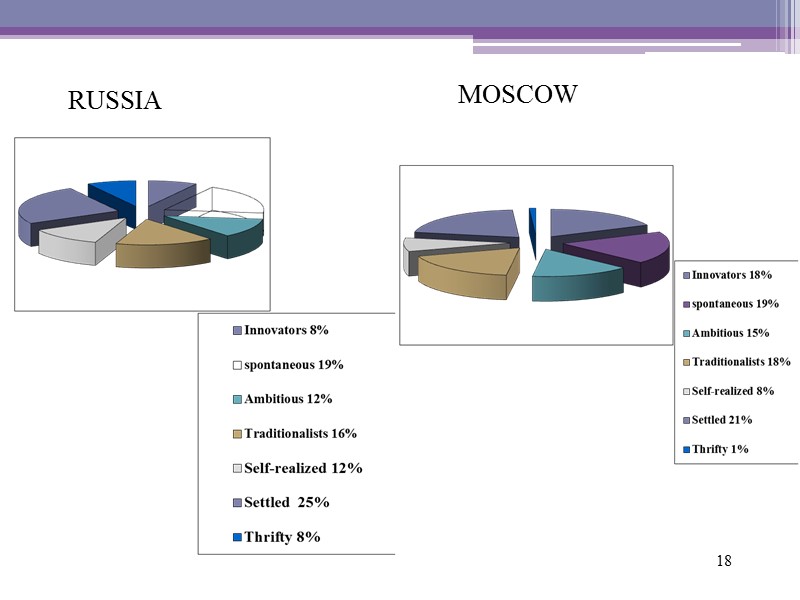

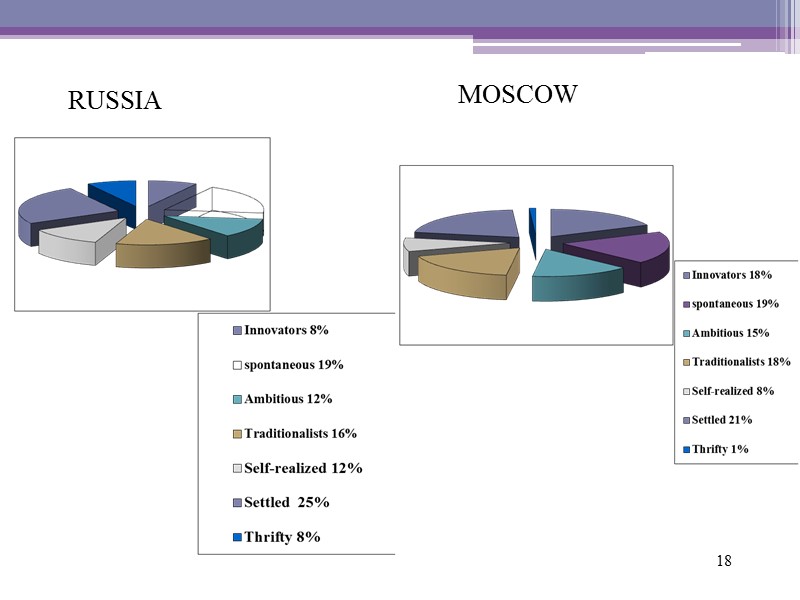

18 RUSSIA MOSCOW

18 RUSSIA MOSCOW

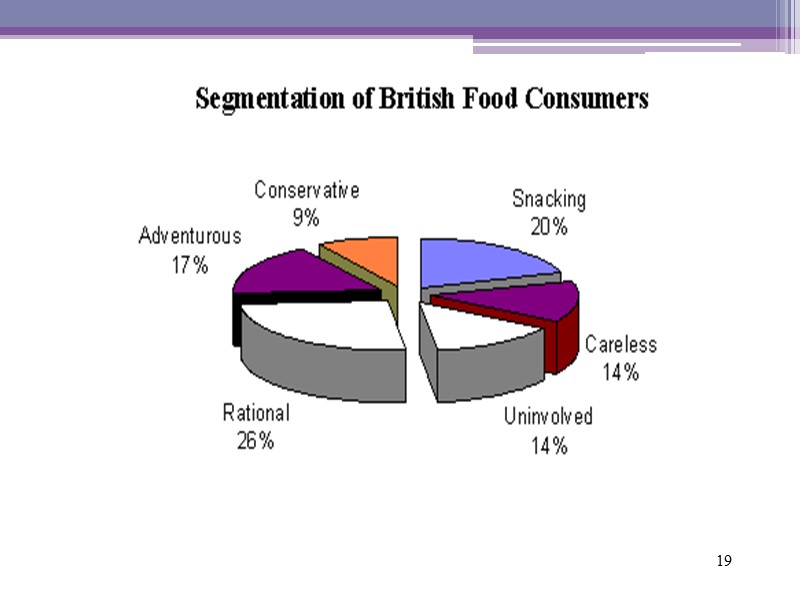

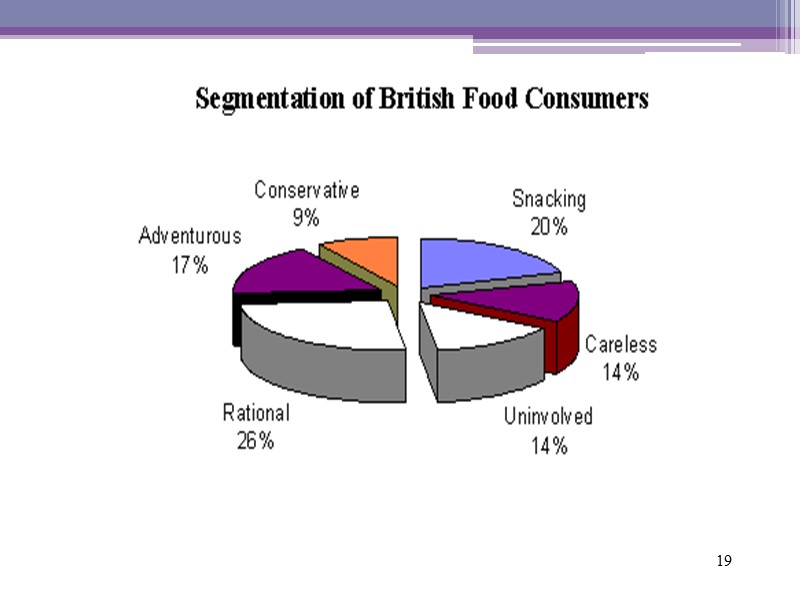

19

19

A heat pipe or heat pin is a heat-transfer device that combines the principles of both thermal conductivity and phase transition to efficiently manage the transfer of heat between two solid interfaces At the hot interface of a heat pipe a liquid in contact with a thermally conductive solid surface turns into vapor by absorbing heat from that surface.

A heat pipe or heat pin is a heat-transfer device that combines the principles of both thermal conductivity and phase transition to efficiently manage the transfer of heat between two solid interfaces At the hot interface of a heat pipe a liquid in contact with a thermally conductive solid surface turns into vapor by absorbing heat from that surface.

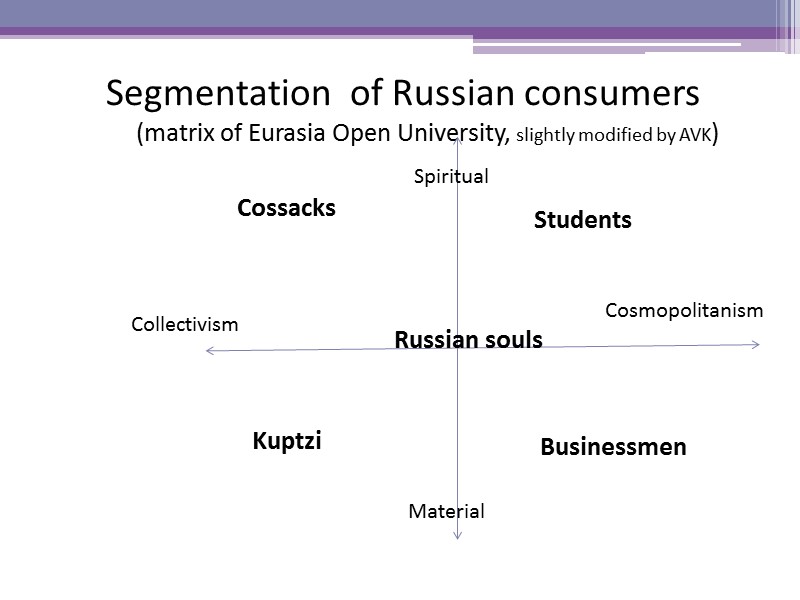

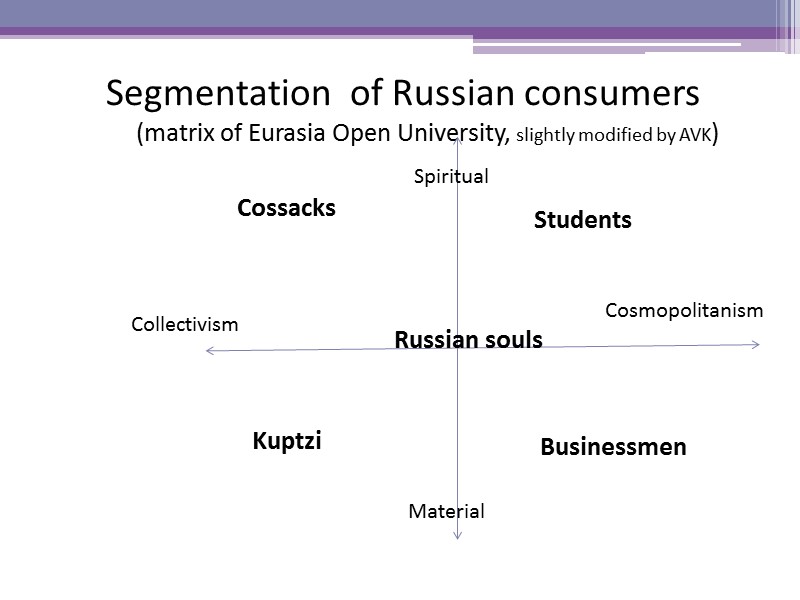

Segmentation of Russian consumers (matrix of Eurasia Open University, slightly modified by AVK) Russian souls Cossacks Businessmen Students Kuptzi Spiritual Material Collectivism Cosmopolitanism

Segmentation of Russian consumers (matrix of Eurasia Open University, slightly modified by AVK) Russian souls Cossacks Businessmen Students Kuptzi Spiritual Material Collectivism Cosmopolitanism

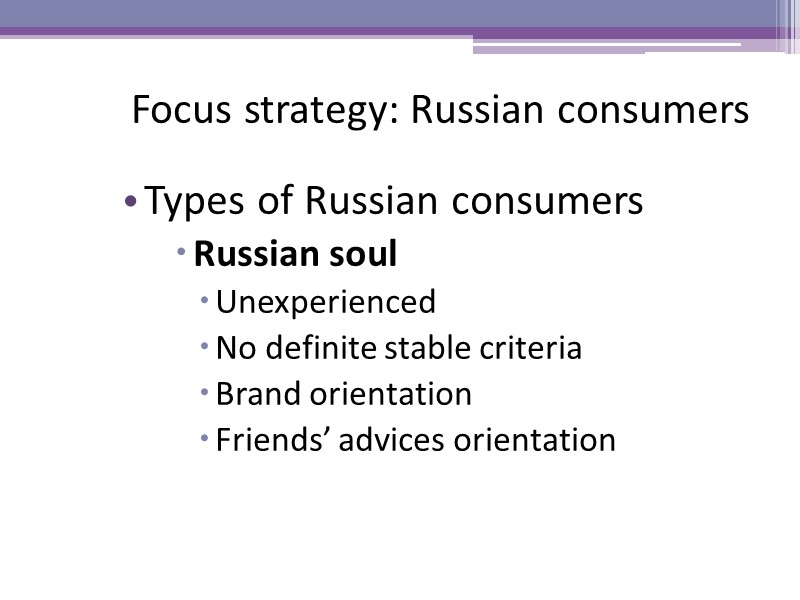

Focus strategy: Russian consumers Types of Russian consumers Russian soul Unexperienced No definite stable criteria Brand orientation Friends’ advices orientation

Focus strategy: Russian consumers Types of Russian consumers Russian soul Unexperienced No definite stable criteria Brand orientation Friends’ advices orientation

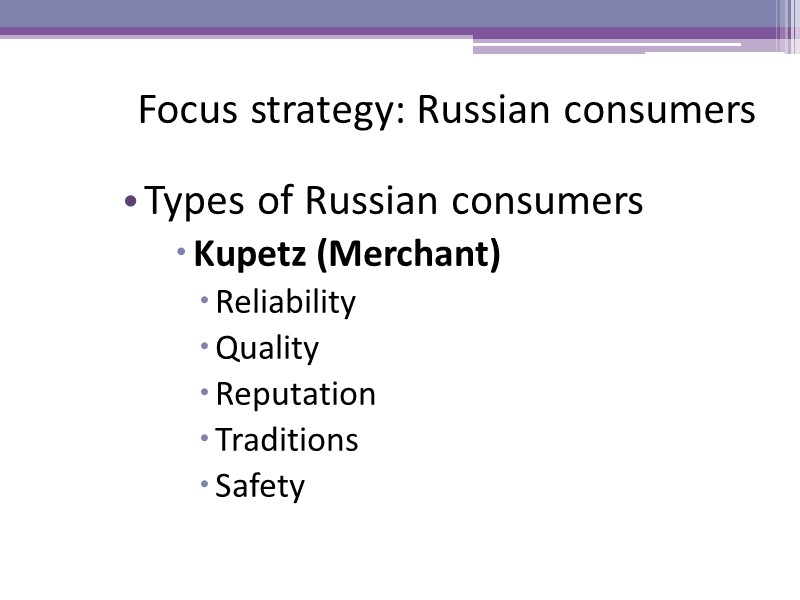

Focus strategy: Russian consumers Types of Russian consumers Kupetz (Merchant) Reliability Quality Reputation Traditions Safety

Focus strategy: Russian consumers Types of Russian consumers Kupetz (Merchant) Reliability Quality Reputation Traditions Safety

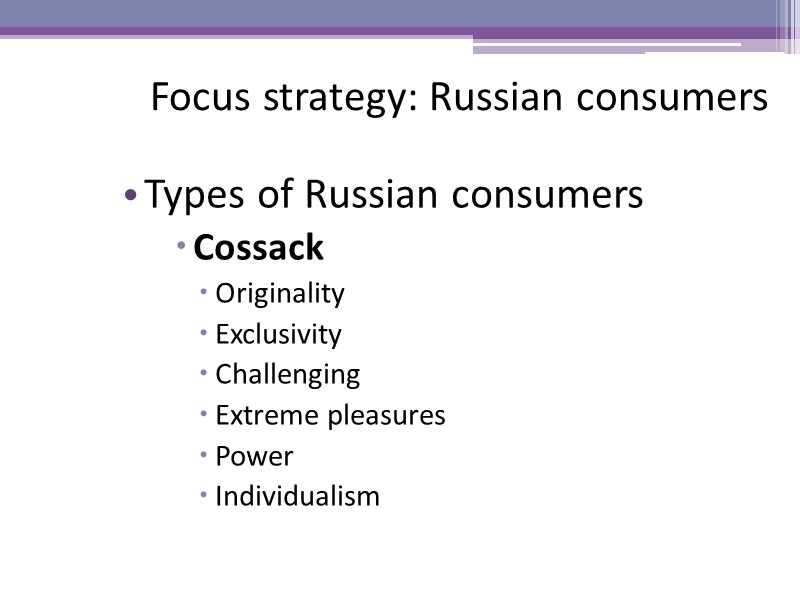

Focus strategy: Russian consumers Types of Russian consumers Cossack Originality Exclusivity Challenging Extreme pleasures Power Individualism

Focus strategy: Russian consumers Types of Russian consumers Cossack Originality Exclusivity Challenging Extreme pleasures Power Individualism

Focus strategy: Russian consumers Types of Russian consumers Student Enthusiasm Trustfulness Collectivism Joy AVK

Focus strategy: Russian consumers Types of Russian consumers Student Enthusiasm Trustfulness Collectivism Joy AVK

Focus strategy: Russian consumers Types of Russian consumers Businessman Innovations Achievements Dynamics Cognition

Focus strategy: Russian consumers Types of Russian consumers Businessman Innovations Achievements Dynamics Cognition

Cost leadership Requires Construction of efficient scale facilities Pursuit of cost reductions and cost minimisation everywhere (R&D, service, sales, purchasing) Tight overhead control Serving of all major customer groups High market share Simple design for ease of operating

Cost leadership Requires Construction of efficient scale facilities Pursuit of cost reductions and cost minimisation everywhere (R&D, service, sales, purchasing) Tight overhead control Serving of all major customer groups High market share Simple design for ease of operating

28 Cost leadership Involves Investment in latest equipment Aggressive pricing Start up losses to build market share Economies of purchasing from high market share Usage of cost advantages (Russian aspects)

28 Cost leadership Involves Investment in latest equipment Aggressive pricing Start up losses to build market share Economies of purchasing from high market share Usage of cost advantages (Russian aspects)

29 Sources of low cost operations There are two sources of cost leadership Economy of scale Cheap resources (only temporary, short term advantage)

29 Sources of low cost operations There are two sources of cost leadership Economy of scale Cheap resources (only temporary, short term advantage)

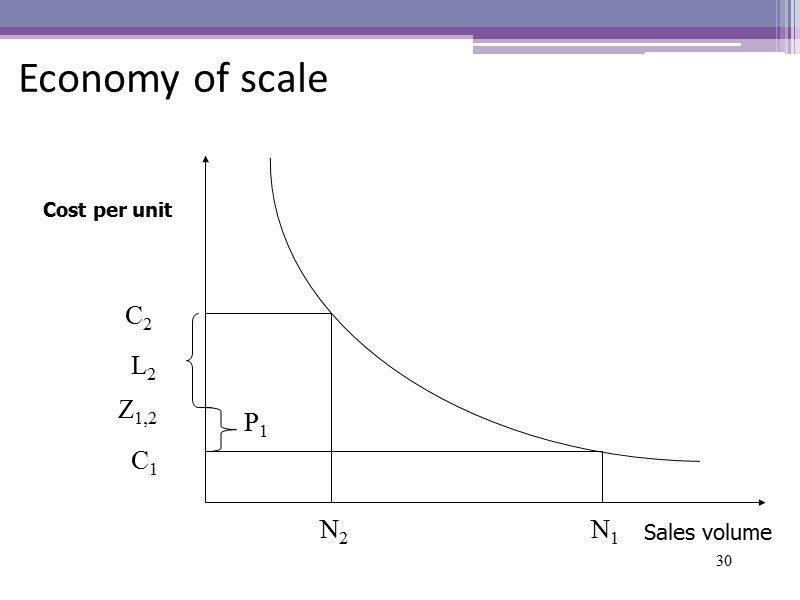

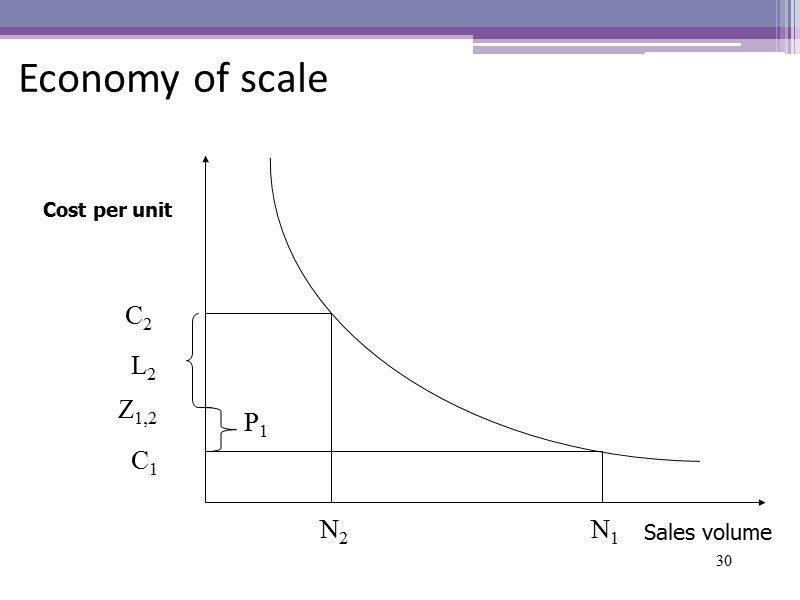

30 Economy of scale Cost per unit Sales volume N1 C1 N2 C2 Z1,2 P1 L2

30 Economy of scale Cost per unit Sales volume N1 C1 N2 C2 Z1,2 P1 L2

31 Cost leadership Russian internal market On the first stage (90th) – kiosks on market places, small car repair stations (cost advantages in: low cost labor, poor and cheap premises, shadow cash-flow, avoiding taxes) Currently – retail chains, big food processing companies (cost advantages in economy of scale); regional producers (food, furniture etc., cost advantages in: low cost labor, cheap premises, local tax privileges)

31 Cost leadership Russian internal market On the first stage (90th) – kiosks on market places, small car repair stations (cost advantages in: low cost labor, poor and cheap premises, shadow cash-flow, avoiding taxes) Currently – retail chains, big food processing companies (cost advantages in economy of scale); regional producers (food, furniture etc., cost advantages in: low cost labor, cheap premises, local tax privileges)

32 Cost leadership for Russian goods International markets Undifferentiated products Steel production Pipes Metal processing works in construction Transportation (by tracks and aircrafts) Differentiated products Software development R&D in some scientific areas

32 Cost leadership for Russian goods International markets Undifferentiated products Steel production Pipes Metal processing works in construction Transportation (by tracks and aircrafts) Differentiated products Software development R&D in some scientific areas

Cost Leadership: Risks Technological innovations in product manufacturing abolish competitive advantage and devalue investments into existing manufacturing lines. Entering of new powerful competitors. Changes in consumers preferences.

Cost Leadership: Risks Technological innovations in product manufacturing abolish competitive advantage and devalue investments into existing manufacturing lines. Entering of new powerful competitors. Changes in consumers preferences.