RiskManagementSlides.ppt

- Количество слайдов: 26

Project Risk Management Sections of this presentation were adapted from A Guide to the Project Management Body of Knowledge 4 th Edition, Project Management Institute Inc. , © 2008

Project Risk Management Sections of this presentation were adapted from A Guide to the Project Management Body of Knowledge 4 th Edition, Project Management Institute Inc. , © 2008

Risk Management “The process involved with identifying, analyzing, and responding to risk. It includes maximizing the results of positive risks and minimizing the consequences of negative events”

Risk Management “The process involved with identifying, analyzing, and responding to risk. It includes maximizing the results of positive risks and minimizing the consequences of negative events”

Why Do We Manage Risk? Project problems can be reduced as much as 90% by using risk analysis Positives: n n More info available during planning Improved probability of success/optimum project Negatives: n n Belief that all risks are accounted for Project cut due to risk level

Why Do We Manage Risk? Project problems can be reduced as much as 90% by using risk analysis Positives: n n More info available during planning Improved probability of success/optimum project Negatives: n n Belief that all risks are accounted for Project cut due to risk level

Key Terms Risk Tolerance – The amount of acceptable risk Risk Adverse – Someone that does not want to take risks Risk Factors n n Probability of occurrence Range of possible outcomes (impact or amount at stake Expected Timing of event Anticipated frequency of risk events from that source

Key Terms Risk Tolerance – The amount of acceptable risk Risk Adverse – Someone that does not want to take risks Risk Factors n n Probability of occurrence Range of possible outcomes (impact or amount at stake Expected Timing of event Anticipated frequency of risk events from that source

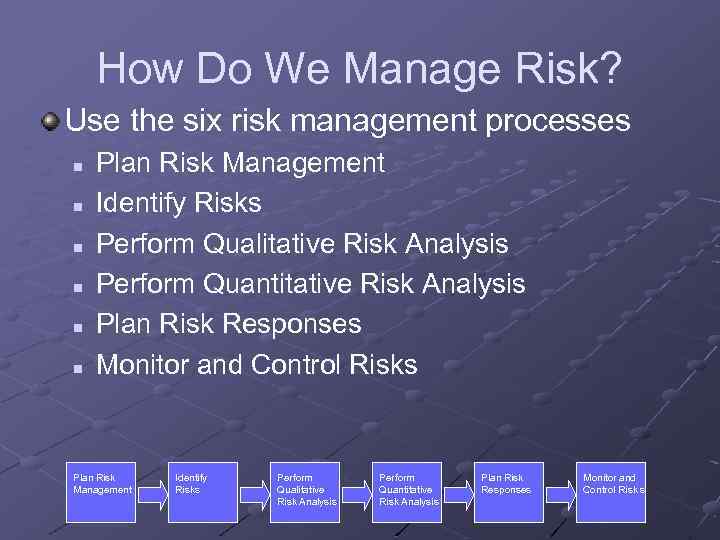

How Do We Manage Risk? Use the six risk management processes n n n Plan Risk Management Identify Risks Perform Qualitative Risk Analysis Perform Quantitative Risk Analysis Plan Risk Responses Monitor and Control Risks Plan Risk Management Identify Risks Perform Qualitative Risk Analysis Perform Quantitative Risk Analysis Plan Risk Responses Monitor and Control Risk s

How Do We Manage Risk? Use the six risk management processes n n n Plan Risk Management Identify Risks Perform Qualitative Risk Analysis Perform Quantitative Risk Analysis Plan Risk Responses Monitor and Control Risks Plan Risk Management Identify Risks Perform Qualitative Risk Analysis Perform Quantitative Risk Analysis Plan Risk Responses Monitor and Control Risk s

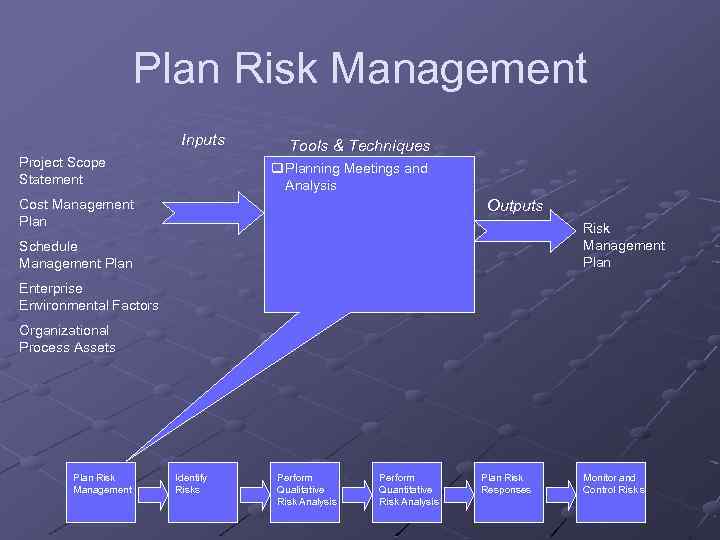

Plan Risk Management Inputs Project Scope Statement Tools & Techniques q Planning Meetings and Analysis Cost Management Plan Outputs Risk Management Plan Schedule Management Plan Enterprise Environmental Factors Organizational Process Assets Plan Risk Management Identify Risks Perform Qualitative Risk Analysis Perform Quantitative Risk Analysis Plan Risk Responses Monitor and Control Risk s

Plan Risk Management Inputs Project Scope Statement Tools & Techniques q Planning Meetings and Analysis Cost Management Plan Outputs Risk Management Plan Schedule Management Plan Enterprise Environmental Factors Organizational Process Assets Plan Risk Management Identify Risks Perform Qualitative Risk Analysis Perform Quantitative Risk Analysis Plan Risk Responses Monitor and Control Risk s

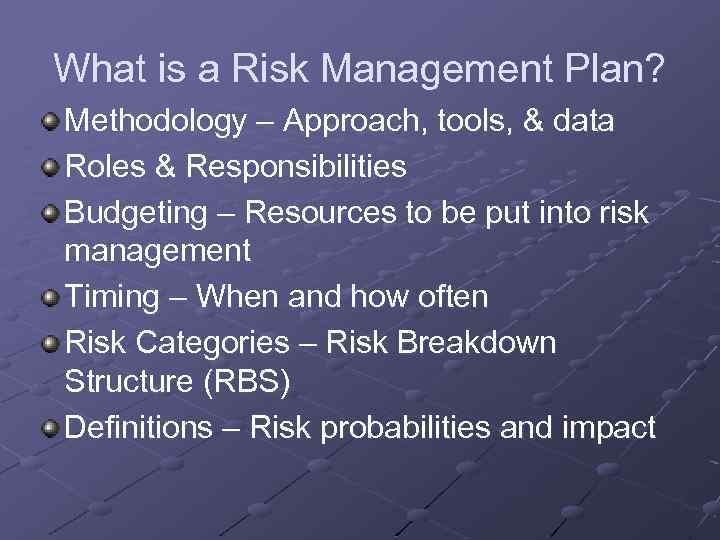

What is a Risk Management Plan? Methodology – Approach, tools, & data Roles & Responsibilities Budgeting – Resources to be put into risk management Timing – When and how often Risk Categories – Risk Breakdown Structure (RBS) Definitions – Risk probabilities and impact

What is a Risk Management Plan? Methodology – Approach, tools, & data Roles & Responsibilities Budgeting – Resources to be put into risk management Timing – When and how often Risk Categories – Risk Breakdown Structure (RBS) Definitions – Risk probabilities and impact

What is a Risk Mgmt Plan (Cont’d)? Probability and Impact Matrix Stakeholder tolerances Reporting formats Tracking

What is a Risk Mgmt Plan (Cont’d)? Probability and Impact Matrix Stakeholder tolerances Reporting formats Tracking

Risk Breakdown Structure Lists categories and subcategories where risks may arise Project Technical Organizational Project Management Limited Design Time Funding Estimates Specifications Adherence Prioritization Scheduling Resource Availability Communication

Risk Breakdown Structure Lists categories and subcategories where risks may arise Project Technical Organizational Project Management Limited Design Time Funding Estimates Specifications Adherence Prioritization Scheduling Resource Availability Communication

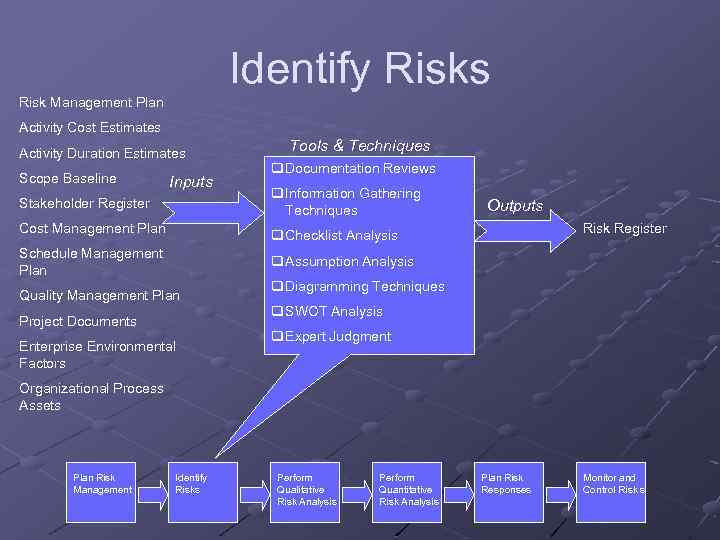

Identify Risks Risk Management Plan Activity Cost Estimates Activity Duration Estimates Scope Baseline Inputs Stakeholder Register Tools & Techniques q Documentation Reviews q Information Gathering Techniques Cost Management Plan Risk Register q Checklist Analysis Schedule Management Plan Outputs q Assumption Analysis Quality Management Plan Project Documents Enterprise Environmental Factors q Diagramming Techniques q SWOT Analysis q Expert Judgment Organizational Process Assets Plan Risk Management Identify Risks Perform Qualitative Risk Analysis Perform Quantitative Risk Analysis Plan Risk Responses Monitor and Control Risk s

Identify Risks Risk Management Plan Activity Cost Estimates Activity Duration Estimates Scope Baseline Inputs Stakeholder Register Tools & Techniques q Documentation Reviews q Information Gathering Techniques Cost Management Plan Risk Register q Checklist Analysis Schedule Management Plan Outputs q Assumption Analysis Quality Management Plan Project Documents Enterprise Environmental Factors q Diagramming Techniques q SWOT Analysis q Expert Judgment Organizational Process Assets Plan Risk Management Identify Risks Perform Qualitative Risk Analysis Perform Quantitative Risk Analysis Plan Risk Responses Monitor and Control Risk s

Information Gathering Techniques Brainstorming Delphi technique n Successive anonymous questionnaires on project risks with responses summarized for further analysis Interviewing Root cause identification Strengths, weaknesses, opportunities, and threats (SWOT) analysis

Information Gathering Techniques Brainstorming Delphi technique n Successive anonymous questionnaires on project risks with responses summarized for further analysis Interviewing Root cause identification Strengths, weaknesses, opportunities, and threats (SWOT) analysis

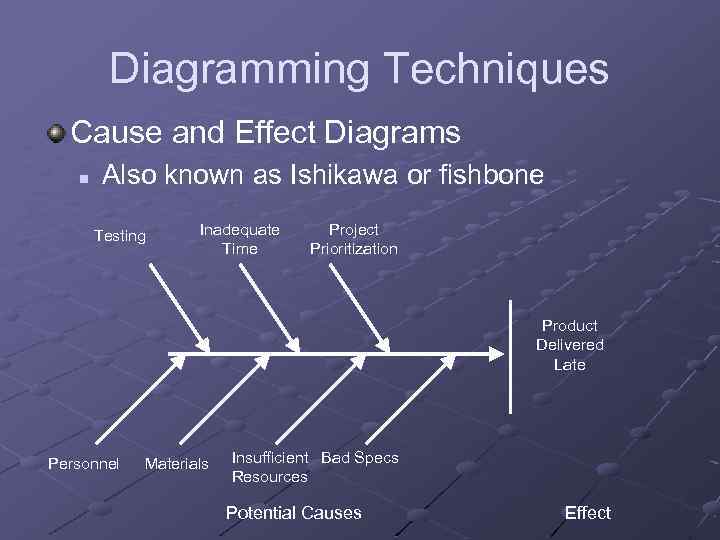

Diagramming Techniques Cause and Effect Diagrams n Also known as Ishikawa or fishbone Testing Inadequate Time Project Prioritization Product Delivered Late Personnel Materials Insufficient Bad Specs Resources Potential Causes Effect

Diagramming Techniques Cause and Effect Diagrams n Also known as Ishikawa or fishbone Testing Inadequate Time Project Prioritization Product Delivered Late Personnel Materials Insufficient Bad Specs Resources Potential Causes Effect

Risk Register List of n n n Identified risks Potential responses Root causes Updated risk categories (if required)

Risk Register List of n n n Identified risks Potential responses Root causes Updated risk categories (if required)

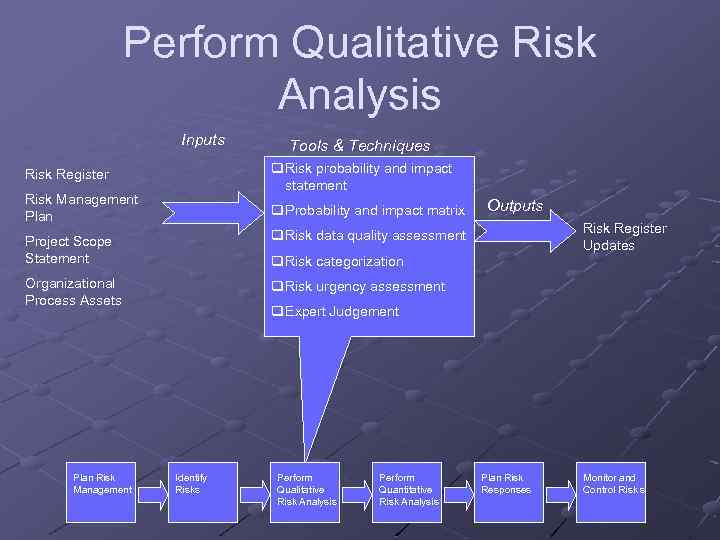

Perform Qualitative Risk Analysis Inputs Tools & Techniques q Risk probability and impact statement Risk Register Risk Management Plan q Probability and impact matrix Project Scope Statement Risk Register Updates q Risk data quality assessment Organizational Process Assets Outputs q Risk urgency assessment Plan Risk Management q Risk categorization q Expert Judgement Identify Risks Perform Qualitative Risk Analysis Perform Quantitative Risk Analysis Plan Risk Responses Monitor and Control Risk s

Perform Qualitative Risk Analysis Inputs Tools & Techniques q Risk probability and impact statement Risk Register Risk Management Plan q Probability and impact matrix Project Scope Statement Risk Register Updates q Risk data quality assessment Organizational Process Assets Outputs q Risk urgency assessment Plan Risk Management q Risk categorization q Expert Judgement Identify Risks Perform Qualitative Risk Analysis Perform Quantitative Risk Analysis Plan Risk Responses Monitor and Control Risk s

Methodologies Probability and Impact Matrix Based on Failure Modes and Effects Analysis (FMEA) n From 1950’s analysis of military systems n

Methodologies Probability and Impact Matrix Based on Failure Modes and Effects Analysis (FMEA) n From 1950’s analysis of military systems n

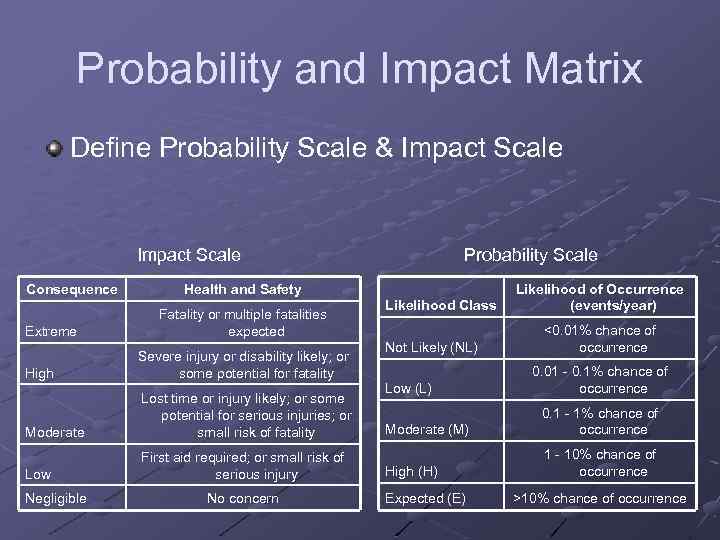

Probability and Impact Matrix Define Probability Scale & Impact Scale Consequence Extreme Health and Safety Fatality or multiple fatalities expected High Severe injury or disability likely; or some potential for fatality Moderate Lost time or injury likely; or some potential for serious injuries; or small risk of fatality Low First aid required; or small risk of serious injury Negligible Probability Scale No concern Likelihood Class Not Likely (NL) Low (L) Likelihood of Occurrence (events/year) <0. 01% chance of occurrence 0. 01 - 0. 1% chance of occurrence Moderate (M) 0. 1 - 1% chance of occurrence High (H) 1 - 10% chance of occurrence Expected (E) >10% chance of occurrence

Probability and Impact Matrix Define Probability Scale & Impact Scale Consequence Extreme Health and Safety Fatality or multiple fatalities expected High Severe injury or disability likely; or some potential for fatality Moderate Lost time or injury likely; or some potential for serious injuries; or small risk of fatality Low First aid required; or small risk of serious injury Negligible Probability Scale No concern Likelihood Class Not Likely (NL) Low (L) Likelihood of Occurrence (events/year) <0. 01% chance of occurrence 0. 01 - 0. 1% chance of occurrence Moderate (M) 0. 1 - 1% chance of occurrence High (H) 1 - 10% chance of occurrence Expected (E) >10% chance of occurrence

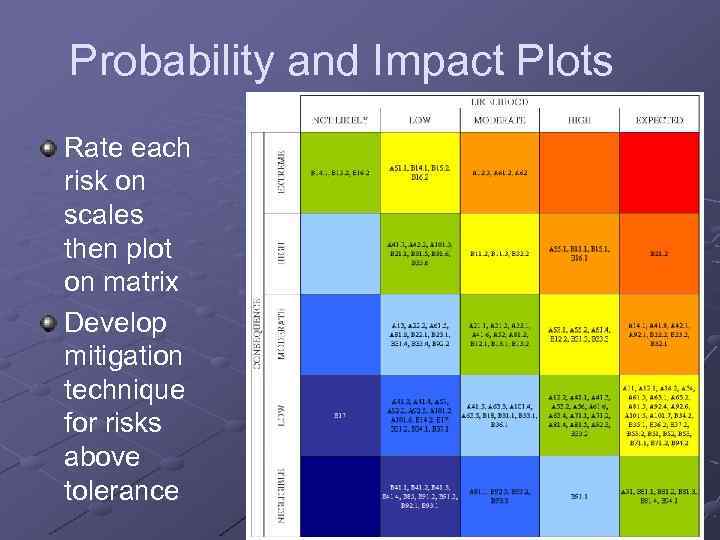

Probability and Impact Plots Rate each risk on scales then plot on matrix Develop mitigation technique for risks above tolerance

Probability and Impact Plots Rate each risk on scales then plot on matrix Develop mitigation technique for risks above tolerance

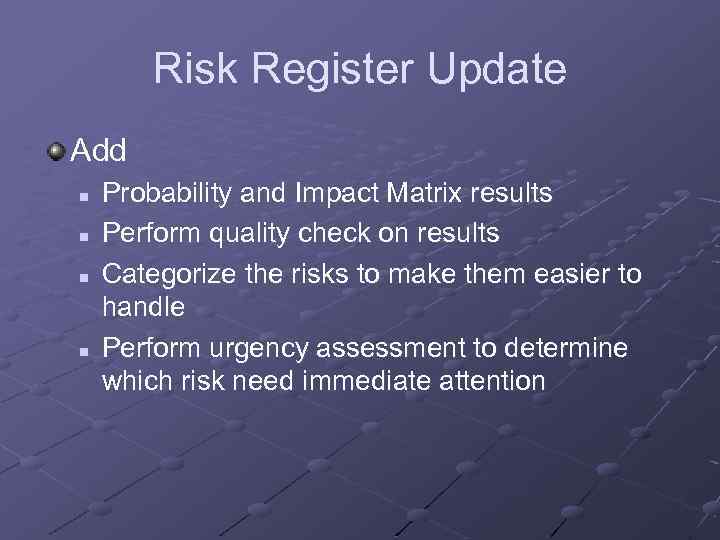

Risk Register Update Add n n Probability and Impact Matrix results Perform quality check on results Categorize the risks to make them easier to handle Perform urgency assessment to determine which risk need immediate attention

Risk Register Update Add n n Probability and Impact Matrix results Perform quality check on results Categorize the risks to make them easier to handle Perform urgency assessment to determine which risk need immediate attention

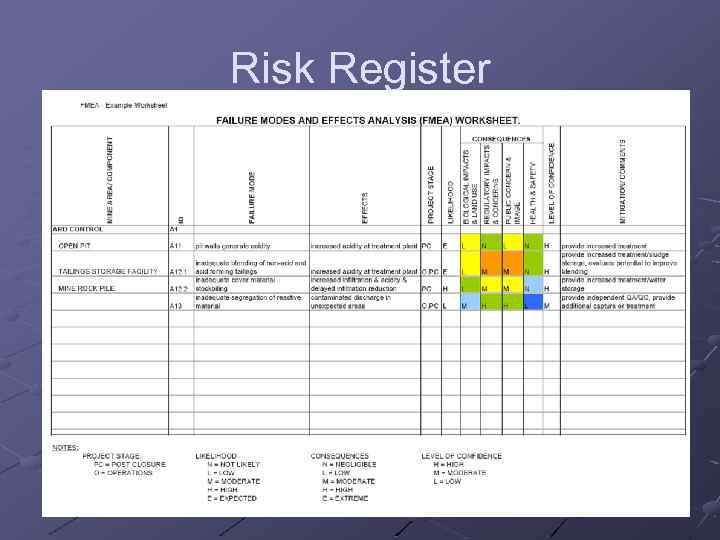

Risk Register

Risk Register

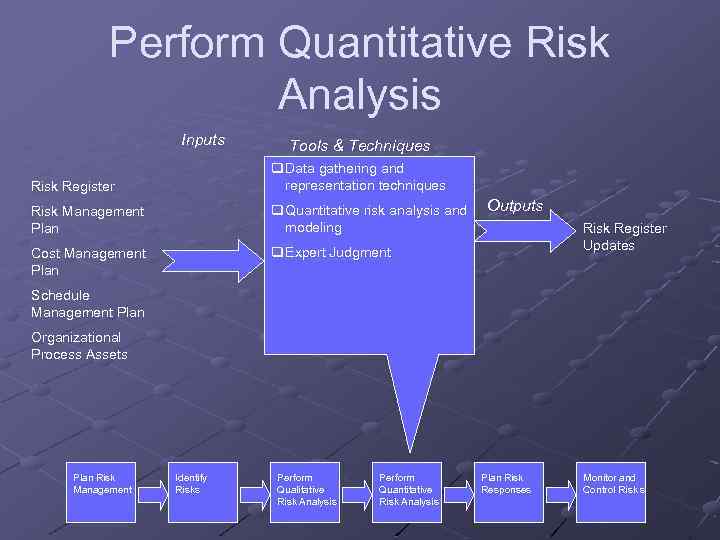

Perform Quantitative Risk Analysis Inputs Tools & Techniques Risk Register q Data gathering and representation techniques Risk Management Plan q Quantitative risk analysis and modeling Cost Management Plan q Expert Judgment Outputs Risk Register Updates Schedule Management Plan Organizational Process Assets Plan Risk Management Identify Risks Perform Qualitative Risk Analysis Perform Quantitative Risk Analysis Plan Risk Responses Monitor and Control Risk s

Perform Quantitative Risk Analysis Inputs Tools & Techniques Risk Register q Data gathering and representation techniques Risk Management Plan q Quantitative risk analysis and modeling Cost Management Plan q Expert Judgment Outputs Risk Register Updates Schedule Management Plan Organizational Process Assets Plan Risk Management Identify Risks Perform Qualitative Risk Analysis Perform Quantitative Risk Analysis Plan Risk Responses Monitor and Control Risk s

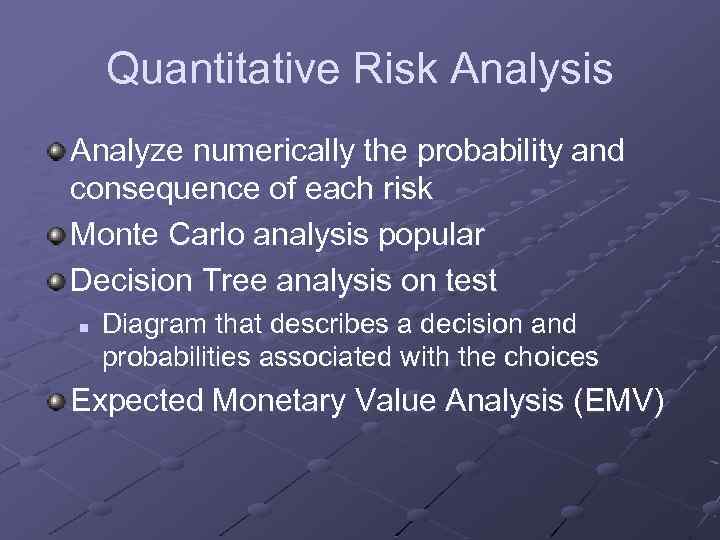

Quantitative Risk Analysis Analyze numerically the probability and consequence of each risk Monte Carlo analysis popular Decision Tree analysis on test n Diagram that describes a decision and probabilities associated with the choices Expected Monetary Value Analysis (EMV)

Quantitative Risk Analysis Analyze numerically the probability and consequence of each risk Monte Carlo analysis popular Decision Tree analysis on test n Diagram that describes a decision and probabilities associated with the choices Expected Monetary Value Analysis (EMV)

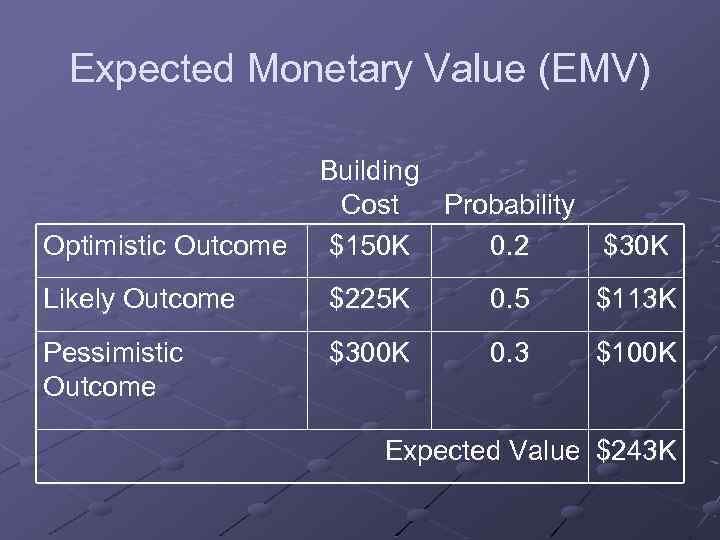

Expected Monetary Value (EMV) Optimistic Outcome Building Cost Probability $150 K 0. 2 $30 K Likely Outcome $225 K 0. 5 $113 K Pessimistic Outcome $300 K 0. 3 $100 K Expected Value $243 K

Expected Monetary Value (EMV) Optimistic Outcome Building Cost Probability $150 K 0. 2 $30 K Likely Outcome $225 K 0. 5 $113 K Pessimistic Outcome $300 K 0. 3 $100 K Expected Value $243 K

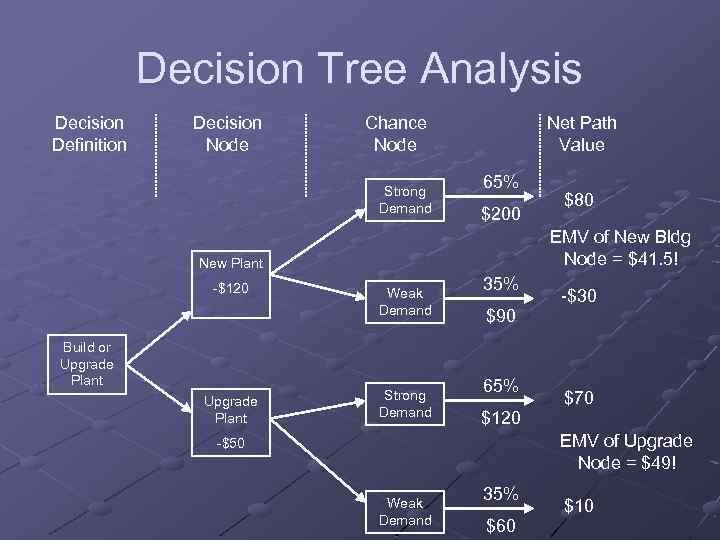

Decision Tree Analysis Decision Definition Decision Node Chance Node Strong Demand Net Path Value 65% $200 EMV of New Bldg Node = $41. 5! New Plant -$120 Build or Upgrade Plant $80 Weak Demand Strong Demand 35% -$30 $90 65% $70 $120 EMV of Upgrade Node = $49! -$50 Weak Demand 35% $60 $10

Decision Tree Analysis Decision Definition Decision Node Chance Node Strong Demand Net Path Value 65% $200 EMV of New Bldg Node = $41. 5! New Plant -$120 Build or Upgrade Plant $80 Weak Demand Strong Demand 35% -$30 $90 65% $70 $120 EMV of Upgrade Node = $49! -$50 Weak Demand 35% $60 $10

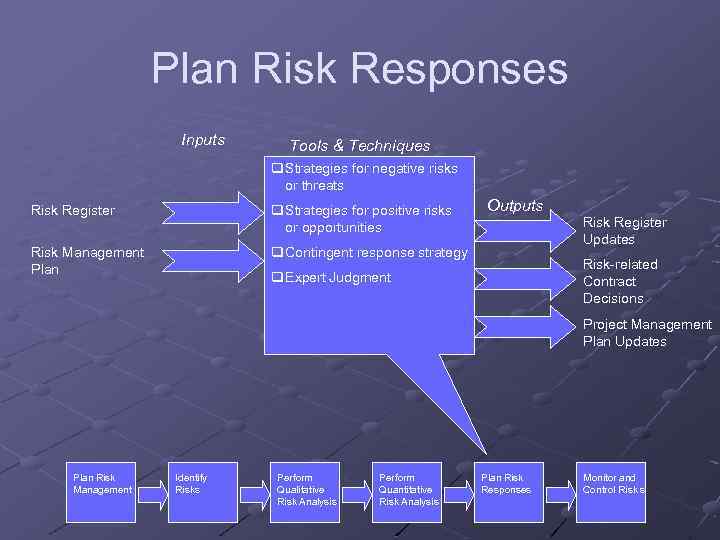

Plan Risk Responses Inputs Tools & Techniques q Strategies for negative risks or threats Risk Register q Strategies for positive risks or opportunities Risk Management Plan Outputs q Contingent response strategy Risk Register Updates Risk-related Contract Decisions q Expert Judgment Project Management Plan Updates Plan Risk Management Identify Risks Perform Qualitative Risk Analysis Perform Quantitative Risk Analysis Plan Risk Responses Monitor and Control Risk s

Plan Risk Responses Inputs Tools & Techniques q Strategies for negative risks or threats Risk Register q Strategies for positive risks or opportunities Risk Management Plan Outputs q Contingent response strategy Risk Register Updates Risk-related Contract Decisions q Expert Judgment Project Management Plan Updates Plan Risk Management Identify Risks Perform Qualitative Risk Analysis Perform Quantitative Risk Analysis Plan Risk Responses Monitor and Control Risk s

Strategies Negative Risks (or Threats) n n Avoid Transfer Mitigate Acceptance Positive Risks (or Opportunities) n n Exploit Share Enhance Acceptance

Strategies Negative Risks (or Threats) n n Avoid Transfer Mitigate Acceptance Positive Risks (or Opportunities) n n Exploit Share Enhance Acceptance

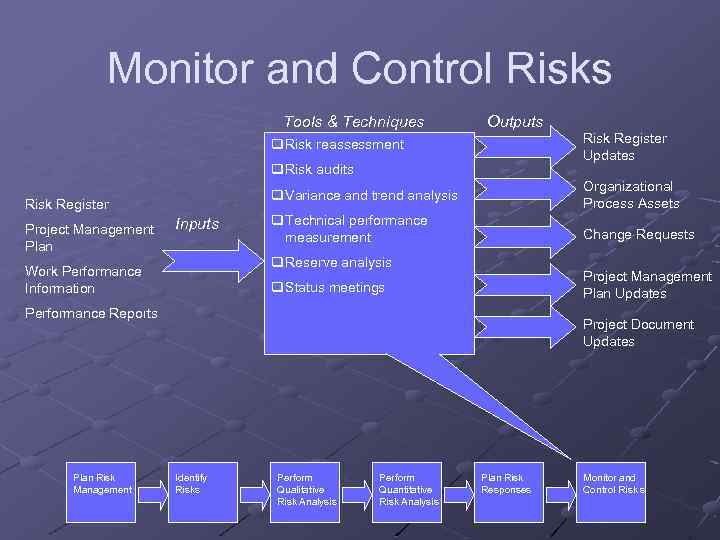

Monitor and Control Risks Tools & Techniques Outputs Risk Register Updates q Risk reassessment q Risk audits q Variance and trend analysis Risk Register Project Management Plan Inputs Organizational Process Assets q Technical performance measurement Change Requests q Reserve analysis Work Performance Information Project Management Plan Updates q Status meetings Performance Reports Plan Risk Management Project Document Updates Identify Risks Perform Qualitative Risk Analysis Perform Quantitative Risk Analysis Plan Risk Responses Monitor and Control Risk s

Monitor and Control Risks Tools & Techniques Outputs Risk Register Updates q Risk reassessment q Risk audits q Variance and trend analysis Risk Register Project Management Plan Inputs Organizational Process Assets q Technical performance measurement Change Requests q Reserve analysis Work Performance Information Project Management Plan Updates q Status meetings Performance Reports Plan Risk Management Project Document Updates Identify Risks Perform Qualitative Risk Analysis Perform Quantitative Risk Analysis Plan Risk Responses Monitor and Control Risk s