9157437a013d1c7af665a7802d483d64.ppt

- Количество слайдов: 46

Power-One (PWER) Investor Presentation TM March 2007

Power-One (PWER) Investor Presentation TM March 2007

Mission Statement To be recognized as the leader in system-level power and power management solutions from AC to the IC in the communications and hightechnology markets, utilizing our technical leadership to deliver comprehensive low-cost solutions; providing increasing value to customers, employees, and investors 2 3/15/2018

Mission Statement To be recognized as the leader in system-level power and power management solutions from AC to the IC in the communications and hightechnology markets, utilizing our technical leadership to deliver comprehensive low-cost solutions; providing increasing value to customers, employees, and investors 2 3/15/2018

Power-One Power Supplies Are Everywhere Our products convert, process & purify electricity to the high levels of quality, reliability, & precise direct current required by the digital economy Over 25 million power supplies shipped & now SILICON… 3 3/15/2018

Power-One Power Supplies Are Everywhere Our products convert, process & purify electricity to the high levels of quality, reliability, & precise direct current required by the digital economy Over 25 million power supplies shipped & now SILICON… 3 3/15/2018

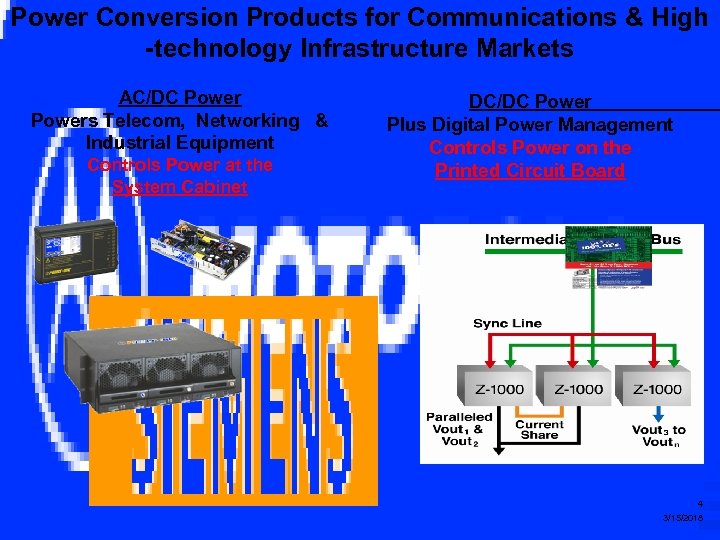

Power Conversion Products for Communications & High -technology Infrastructure Markets AC/DC Powers Telecom, Networking & Industrial Equipment Controls Power at the System Cabinet DC/DC Power Plus Digital Power Management Controls Power on the Printed Circuit Board 4 3/15/2018

Power Conversion Products for Communications & High -technology Infrastructure Markets AC/DC Powers Telecom, Networking & Industrial Equipment Controls Power at the System Cabinet DC/DC Power Plus Digital Power Management Controls Power on the Printed Circuit Board 4 3/15/2018

Power-One Today • 30+ years of success • One of the world’s top power supply companies – Broad-line power conversion supplier – 100’s of standard product families – Over 2, 500 employees (Now 4000!) – Top brand name & quality reputation – Industry leading Gross Margins • • • Five acquisitions since 1999 (Now six!) Highly-automated worldwide manufacturing Strong balance sheet (~$45 M cash, ~$80 M debt) ’ 06 Sales ~$338 M – 29% Growth ($530 -550 M in ‘ 07) Investing ~$7 M/yr in R&D for silicon design Today, Power-One is the technology leader in power; a consolidator; and a developer of silicon products 5 3/15/2018

Power-One Today • 30+ years of success • One of the world’s top power supply companies – Broad-line power conversion supplier – 100’s of standard product families – Over 2, 500 employees (Now 4000!) – Top brand name & quality reputation – Industry leading Gross Margins • • • Five acquisitions since 1999 (Now six!) Highly-automated worldwide manufacturing Strong balance sheet (~$45 M cash, ~$80 M debt) ’ 06 Sales ~$338 M – 29% Growth ($530 -550 M in ‘ 07) Investing ~$7 M/yr in R&D for silicon design Today, Power-One is the technology leader in power; a consolidator; and a developer of silicon products 5 3/15/2018

NEWS FLASH! Power-One Announced Acquisition of a Power Conversion Company • Power Electronics Group of Magnetek, Inc. for $84 M in late October ’ 06 • Expected to increase revenue by over 50% with overall purchase price of only 0. 5 x forecasted 2007 sales • The acquisition is strategic and accretive – Accretive in Q 1 of 2007 – 90% of products are digitally based with micro/DSP’s • Synergies expected to be additive to earnings per share ~$0. 07 per share in 2007 ~$0. 30 per share in 2008 • Q 4 ’ 07 exit rate: Expect sales ~ $150 M and ~ EPS $0. 10 • January ’ 07 changes: – U. S. factory will be shutdown; products moved to low cost areas – Dr. Alex Levran joins Power-One as CTO from Magnetek 6 3/15/2018

NEWS FLASH! Power-One Announced Acquisition of a Power Conversion Company • Power Electronics Group of Magnetek, Inc. for $84 M in late October ’ 06 • Expected to increase revenue by over 50% with overall purchase price of only 0. 5 x forecasted 2007 sales • The acquisition is strategic and accretive – Accretive in Q 1 of 2007 – 90% of products are digitally based with micro/DSP’s • Synergies expected to be additive to earnings per share ~$0. 07 per share in 2007 ~$0. 30 per share in 2008 • Q 4 ’ 07 exit rate: Expect sales ~ $150 M and ~ EPS $0. 10 • January ’ 07 changes: – U. S. factory will be shutdown; products moved to low cost areas – Dr. Alex Levran joins Power-One as CTO from Magnetek 6 3/15/2018

Overall Transaction Assets • Three main factories – 230 K sq. ft. in Shenzen (Bao’an) China – 180 K sq. ft. in Valdarno, Italy (Includes R&D and Admin, with low-cost “feeder plant” in Hungary) Shenzhen, China – 50 K sq. ft. in Chatsworth, CA • Best-in-class R&D Center (80+ experienced engineers) • Custom product capability • New applications, like Alternative Energy (AE) & digital control for motors Valdarno, Italy • High-volume purchasing leverage Chatsworth, California 7 3/15/2018

Overall Transaction Assets • Three main factories – 230 K sq. ft. in Shenzen (Bao’an) China – 180 K sq. ft. in Valdarno, Italy (Includes R&D and Admin, with low-cost “feeder plant” in Hungary) Shenzhen, China – 50 K sq. ft. in Chatsworth, CA • Best-in-class R&D Center (80+ experienced engineers) • Custom product capability • New applications, like Alternative Energy (AE) & digital control for motors Valdarno, Italy • High-volume purchasing leverage Chatsworth, California 7 3/15/2018

Strategic Synergies & Importance • The acquisition is strategic and accretive – Forecasting EPS in 2007 to be ~ $0. 20 per share – Expect to exit ’ 07 at a quarterly run-rate of a range around $150 million in sales and $0. 10 EPS – Primary drivers for margin improvement are synergies in purchasing and manufacturing • Size and purchasing power of larger company – Now the 7 th largest power supply company in the world – Economy-of-scale to compete with larger competitors • High-volume, low-cost China operation • Adds Custom products (largest & fastest-growing market) and augments top customer base • R&D resources and technologies • Alternative Energy initiative 8 3/15/2018

Strategic Synergies & Importance • The acquisition is strategic and accretive – Forecasting EPS in 2007 to be ~ $0. 20 per share – Expect to exit ’ 07 at a quarterly run-rate of a range around $150 million in sales and $0. 10 EPS – Primary drivers for margin improvement are synergies in purchasing and manufacturing • Size and purchasing power of larger company – Now the 7 th largest power supply company in the world – Economy-of-scale to compete with larger competitors • High-volume, low-cost China operation • Adds Custom products (largest & fastest-growing market) and augments top customer base • R&D resources and technologies • Alternative Energy initiative 8 3/15/2018

Acquisition Highlights How Power Conversion & Power Management Are Changing to Digital • Products range from smart motor driver and control circuits to large 50 KW power modules • 90% of products are digital implementations with micro/DSP and software – – – Fewer competitors - less commoditization Higher margins over time Greater functionality - market diversity Higher performance Software-driven with reduced parts count; higher reliability • Augments Power-One’s board-level One® digital power management capabilities DSP-based Motor Controls Z- Digital Smart Appliance Control & Management 9 3/15/2018

Acquisition Highlights How Power Conversion & Power Management Are Changing to Digital • Products range from smart motor driver and control circuits to large 50 KW power modules • 90% of products are digital implementations with micro/DSP and software – – – Fewer competitors - less commoditization Higher margins over time Greater functionality - market diversity Higher performance Software-driven with reduced parts count; higher reliability • Augments Power-One’s board-level One® digital power management capabilities DSP-based Motor Controls Z- Digital Smart Appliance Control & Management 9 3/15/2018

Alternative Energy Initiative In Power Inverters Using Digital Technology to Innovate Solar – Wind – Fuel Cells Compact Fuel Cell Power Conditioners • High reliability and efficiency power converters • High power-density & compact size • Primary energy source control • Grid interactive control • System level control Wind Power Converters Photovoltaic Inverters 10 3/15/2018

Alternative Energy Initiative In Power Inverters Using Digital Technology to Innovate Solar – Wind – Fuel Cells Compact Fuel Cell Power Conditioners • High reliability and efficiency power converters • High power-density & compact size • Primary energy source control • Grid interactive control • System level control Wind Power Converters Photovoltaic Inverters 10 3/15/2018

Quarterly Revenue ($M) Q 1 07 estimate range is between $125 to $135 M 11 3/15/2018

Quarterly Revenue ($M) Q 1 07 estimate range is between $125 to $135 M 11 3/15/2018

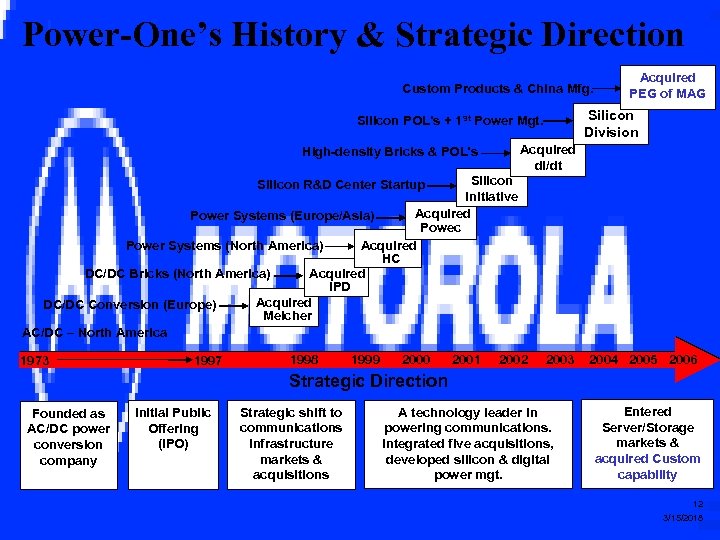

Power-One’s History & Strategic Direction Custom Products & China Mfg. Acquired PEG of MAG Silicon Division Silicon POL’s + 1 st Power Mgt. Acquired di/dt High-density Bricks & POL’s Silicon Initiative Acquired Power Systems (Europe/Asia) Powec Power Systems (North America) Acquired HC DC/DC Bricks (North America) Acquired IPD Acquired DC/DC Conversion (Europe) Melcher AC/DC – North America Silicon R&D Center Startup 1973 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 Strategic Direction Founded as AC/DC power conversion company Initial Public Offering (IPO) Strategic shift to communications infrastructure markets & acquisitions A technology leader in powering communications. Integrated five acquisitions, developed silicon & digital power mgt. Entered Server/Storage markets & acquired Custom capability 12 3/15/2018

Power-One’s History & Strategic Direction Custom Products & China Mfg. Acquired PEG of MAG Silicon Division Silicon POL’s + 1 st Power Mgt. Acquired di/dt High-density Bricks & POL’s Silicon Initiative Acquired Power Systems (Europe/Asia) Powec Power Systems (North America) Acquired HC DC/DC Bricks (North America) Acquired IPD Acquired DC/DC Conversion (Europe) Melcher AC/DC – North America Silicon R&D Center Startup 1973 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 Strategic Direction Founded as AC/DC power conversion company Initial Public Offering (IPO) Strategic shift to communications infrastructure markets & acquisitions A technology leader in powering communications. Integrated five acquisitions, developed silicon & digital power mgt. Entered Server/Storage markets & acquired Custom capability 12 3/15/2018

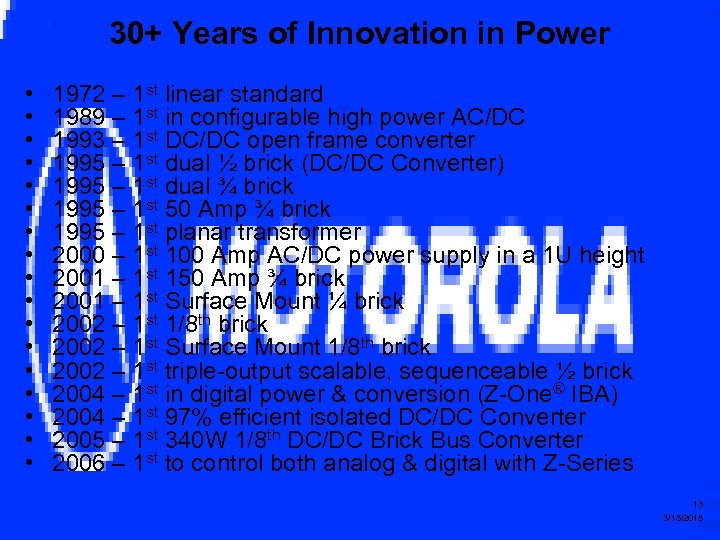

30+ Years of Innovation in Power • • • • • 1972 – 1 st linear standard 1989 – 1 st in configurable high power AC/DC 1993 – 1 st DC/DC open frame converter 1995 – 1 st dual ½ brick (DC/DC Converter) 1995 – 1 st dual ¾ brick 1995 – 1 st 50 Amp ¾ brick 1995 – 1 st planar transformer 2000 – 1 st 100 Amp AC/DC power supply in a 1 U height 2001 – 1 st 150 Amp ¾ brick 2001 – 1 st Surface Mount ¼ brick 2002 – 1 st 1/8 th brick 2002 – 1 st Surface Mount 1/8 th brick 2002 – 1 st triple-output scalable, sequenceable ½ brick 2004 – 1 st in digital power & conversion (Z-One® IBA) 2004 – 1 st 97% efficient isolated DC/DC Converter 2005 – 1 st 340 W 1/8 th DC/DC Brick Bus Converter 2006 – 1 st to control both analog & digital with Z-Series 13 3/15/2018

30+ Years of Innovation in Power • • • • • 1972 – 1 st linear standard 1989 – 1 st in configurable high power AC/DC 1993 – 1 st DC/DC open frame converter 1995 – 1 st dual ½ brick (DC/DC Converter) 1995 – 1 st dual ¾ brick 1995 – 1 st 50 Amp ¾ brick 1995 – 1 st planar transformer 2000 – 1 st 100 Amp AC/DC power supply in a 1 U height 2001 – 1 st 150 Amp ¾ brick 2001 – 1 st Surface Mount ¼ brick 2002 – 1 st 1/8 th brick 2002 – 1 st Surface Mount 1/8 th brick 2002 – 1 st triple-output scalable, sequenceable ½ brick 2004 – 1 st in digital power & conversion (Z-One® IBA) 2004 – 1 st 97% efficient isolated DC/DC Converter 2005 – 1 st 340 W 1/8 th DC/DC Brick Bus Converter 2006 – 1 st to control both analog & digital with Z-Series 13 3/15/2018

Power-One’s New Global Footprint Ireland Andover, MA San Jose, CA Chatsworth, CA Camarillo, CA Carlsbad, CA Switzerland Italy Slovakia Hungary Baoan, Shenzhen, China Shekou, Shenzhen, China Dallas, TX Dominican Rep. Penang, Malaysia Singapore Australia Manufacturing Centers R&D Centers NEW Mfg Centers NEW R&D Centers 14 3/15/2018

Power-One’s New Global Footprint Ireland Andover, MA San Jose, CA Chatsworth, CA Camarillo, CA Carlsbad, CA Switzerland Italy Slovakia Hungary Baoan, Shenzhen, China Shekou, Shenzhen, China Dallas, TX Dominican Rep. Penang, Malaysia Singapore Australia Manufacturing Centers R&D Centers NEW Mfg Centers NEW R&D Centers 14 3/15/2018

Power-One’s Customers … Acquisition Augments Premier Customer Base Bottom Row Shows Significant Additions to PWER Base 15 3/15/2018

Power-One’s Customers … Acquisition Augments Premier Customer Base Bottom Row Shows Significant Additions to PWER Base 15 3/15/2018

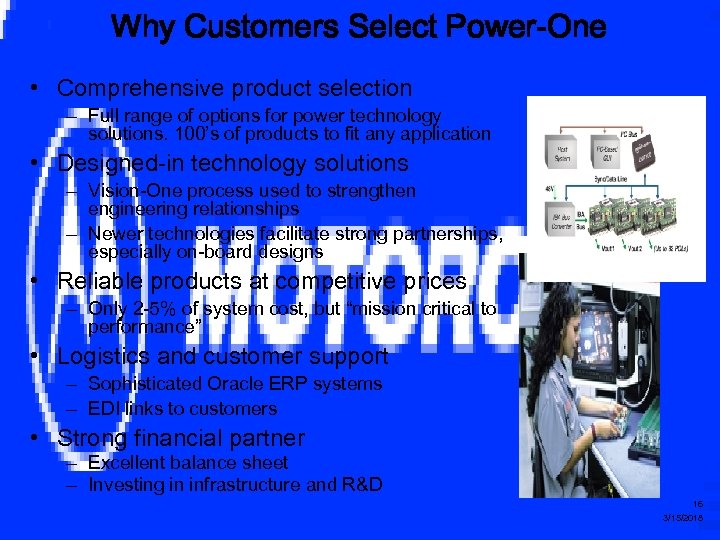

Why Customers Select Power-One • Comprehensive product selection – Full range of options for power technology solutions. 100’s of products to fit any application • Designed-in technology solutions – Vision-One process used to strengthen engineering relationships – Newer technologies facilitate strong partnerships, especially on-board designs • Reliable products at competitive prices – Only 2 -5% of system cost, but “mission critical to performance” • Logistics and customer support – Sophisticated Oracle ERP systems – EDI links to customers • Strong financial partner – Excellent balance sheet – Investing in infrastructure and R&D 16 3/15/2018

Why Customers Select Power-One • Comprehensive product selection – Full range of options for power technology solutions. 100’s of products to fit any application • Designed-in technology solutions – Vision-One process used to strengthen engineering relationships – Newer technologies facilitate strong partnerships, especially on-board designs • Reliable products at competitive prices – Only 2 -5% of system cost, but “mission critical to performance” • Logistics and customer support – Sophisticated Oracle ERP systems – EDI links to customers • Strong financial partner – Excellent balance sheet – Investing in infrastructure and R&D 16 3/15/2018

2005/2006 =Major Restructuring/Sales Growth 2007= Integration Execution and Leverage 2005: Goal of profitability achieved in Q 3 & Q 4 • Reduction of >$30 M in overhead & SG&A • High-cost Norway functions moved to low-cost Slovakia & China • Telecom Power Systems combined with embedded business 2006: Return of Growth • Return of sales growth was #1 goal • Server & Storage and Power Systems growth has been dramatic in 2006 • Original goal of 10 -15% growth in ‘ 06 was at high-end without acquisition 2007: Executing the acquisition integration plan • • • Acquisition will increase sales dramatically to $530 -550 M Material costs and synergy are highest priority to improve profits Acquisition management teams are fully operational and motivated Shutdown Chatsworth, CA facility & move products to low-cost areas Dr. Alex Levran joined as CTO in January ‘ 07 17 3/15/2018

2005/2006 =Major Restructuring/Sales Growth 2007= Integration Execution and Leverage 2005: Goal of profitability achieved in Q 3 & Q 4 • Reduction of >$30 M in overhead & SG&A • High-cost Norway functions moved to low-cost Slovakia & China • Telecom Power Systems combined with embedded business 2006: Return of Growth • Return of sales growth was #1 goal • Server & Storage and Power Systems growth has been dramatic in 2006 • Original goal of 10 -15% growth in ‘ 06 was at high-end without acquisition 2007: Executing the acquisition integration plan • • • Acquisition will increase sales dramatically to $530 -550 M Material costs and synergy are highest priority to improve profits Acquisition management teams are fully operational and motivated Shutdown Chatsworth, CA facility & move products to low-cost areas Dr. Alex Levran joined as CTO in January ‘ 07 17 3/15/2018

Core Business Successes Power Systems – Telecom & Cell Base Station Backup Power • Turned around our Telecom Systems Business to now one of the fastest growth lines in Power-One • Seeing more new opportunities & strong Bookings (esp. in Europe, Middle East, Russia). • Datacom & Telecom continue to converge – there are many more new opportunities for rectifiers with existing OEMs • Outdoor Cabinet for wireless that was developed in ’ 06 is a new market for Power-One • Gaining Market Share in Telecom Power Systems • Supply Agreement with Ericsson announced in 2006 is starting to generate sales 18 3/15/2018

Core Business Successes Power Systems – Telecom & Cell Base Station Backup Power • Turned around our Telecom Systems Business to now one of the fastest growth lines in Power-One • Seeing more new opportunities & strong Bookings (esp. in Europe, Middle East, Russia). • Datacom & Telecom continue to converge – there are many more new opportunities for rectifiers with existing OEMs • Outdoor Cabinet for wireless that was developed in ’ 06 is a new market for Power-One • Gaining Market Share in Telecom Power Systems • Supply Agreement with Ericsson announced in 2006 is starting to generate sales 18 3/15/2018

Core Business Successes Embedded Products – AC/DC Power Supplies • More aggressive in custom products business – Gained access to larger accounts in Storage/Server market – Strategy: standard platforms to develop customs, which lowers cost, risk, and time to develop • Best distribution network – Award from Arrow for largest sales of all products in the Electro-Mechanical (EM) category • Good upside when ATE/Semi Equipment market improves • New Product Introductions cement leadership, like the Best-in -Class, High-Density, Front-Ends (FNP Series of products) • Penetrated two of the largest Server/Storage companies and working on others • “Supplier of the Year” Award for ALL products from Xyratex • Sun Computer “Meritorious Achievement Award” presented to Power-One. Only 17 companies were honored 19 3/15/2018

Core Business Successes Embedded Products – AC/DC Power Supplies • More aggressive in custom products business – Gained access to larger accounts in Storage/Server market – Strategy: standard platforms to develop customs, which lowers cost, risk, and time to develop • Best distribution network – Award from Arrow for largest sales of all products in the Electro-Mechanical (EM) category • Good upside when ATE/Semi Equipment market improves • New Product Introductions cement leadership, like the Best-in -Class, High-Density, Front-Ends (FNP Series of products) • Penetrated two of the largest Server/Storage companies and working on others • “Supplier of the Year” Award for ALL products from Xyratex • Sun Computer “Meritorious Achievement Award” presented to Power-One. Only 17 companies were honored 19 3/15/2018

Core Business Successes Embedded Products – DC/DC Converters • Growing market share in our space • World-class leadership – One of the broadest DC/DC converter portfolios in the industry. We can control almost any application – High-density bricks (latest example is 1/8 th brick with 30 A and best thermal performance in its class) – “Y” POLs (standard analog) continuing to gain traction • Using standard platforms for development of custom DC/DC bricks and POLs • Reduced costs attained from moving U. S. manufacturing to Dominican Republic and Asia 20 3/15/2018

Core Business Successes Embedded Products – DC/DC Converters • Growing market share in our space • World-class leadership – One of the broadest DC/DC converter portfolios in the industry. We can control almost any application – High-density bricks (latest example is 1/8 th brick with 30 A and best thermal performance in its class) – “Y” POLs (standard analog) continuing to gain traction • Using standard platforms for development of custom DC/DC bricks and POLs • Reduced costs attained from moving U. S. manufacturing to Dominican Republic and Asia 20 3/15/2018

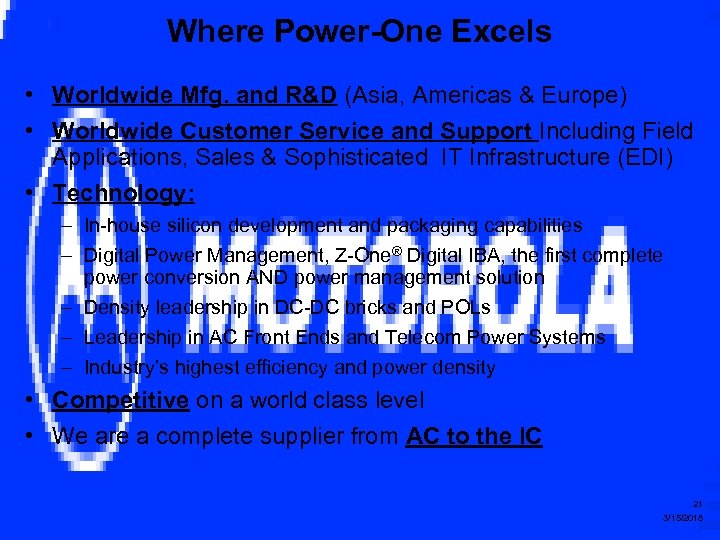

Where Power-One Excels • Worldwide Mfg. and R&D (Asia, Americas & Europe) • Worldwide Customer Service and Support Including Field Applications, Sales & Sophisticated IT Infrastructure (EDI) • Technology: – In-house silicon development and packaging capabilities – Digital Power Management, Z-One® Digital IBA, the first complete power conversion AND power management solution – Density leadership in DC-DC bricks and POLs – Leadership in AC Front Ends and Telecom Power Systems – Industry’s highest efficiency and power density • Competitive on a world class level • We are a complete supplier from AC to the IC 21 3/15/2018

Where Power-One Excels • Worldwide Mfg. and R&D (Asia, Americas & Europe) • Worldwide Customer Service and Support Including Field Applications, Sales & Sophisticated IT Infrastructure (EDI) • Technology: – In-house silicon development and packaging capabilities – Digital Power Management, Z-One® Digital IBA, the first complete power conversion AND power management solution – Density leadership in DC-DC bricks and POLs – Leadership in AC Front Ends and Telecom Power Systems – Industry’s highest efficiency and power density • Competitive on a world class level • We are a complete supplier from AC to the IC 21 3/15/2018

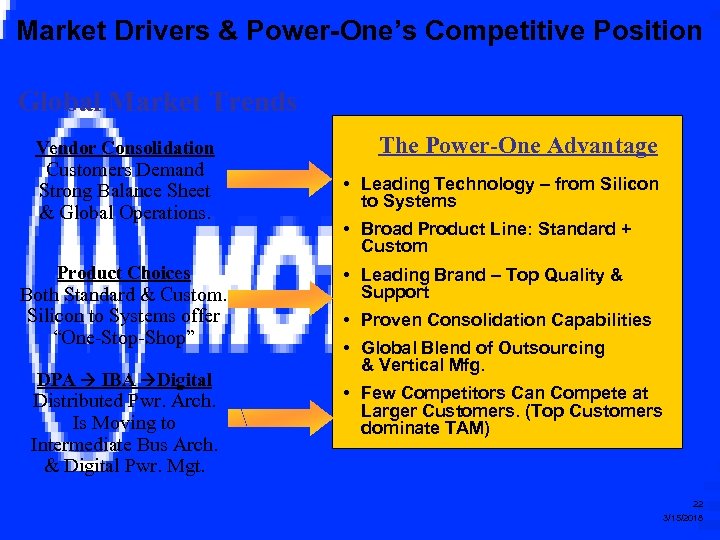

Market Drivers & Power-One’s Competitive Position Global Market Trends Vendor Consolidation Customers Demand Strong Balance Sheet & Global Operations. Product Choices Both Standard & Custom. Silicon to Systems offer “One-Stop-Shop” DPA IBA Digital Distributed Pwr. Arch. Is Moving to Intermediate Bus Arch. & Digital Pwr. Mgt. The Power-One Advantage • Leading Technology – from Silicon to Systems • Broad Product Line: Standard + Custom • Leading Brand – Top Quality & Support • Proven Consolidation Capabilities • Global Blend of Outsourcing & Vertical Mfg. • Few Competitors Can Compete at Larger Customers. (Top Customers dominate TAM) 22 3/15/2018

Market Drivers & Power-One’s Competitive Position Global Market Trends Vendor Consolidation Customers Demand Strong Balance Sheet & Global Operations. Product Choices Both Standard & Custom. Silicon to Systems offer “One-Stop-Shop” DPA IBA Digital Distributed Pwr. Arch. Is Moving to Intermediate Bus Arch. & Digital Pwr. Mgt. The Power-One Advantage • Leading Technology – from Silicon to Systems • Broad Product Line: Standard + Custom • Leading Brand – Top Quality & Support • Proven Consolidation Capabilities • Global Blend of Outsourcing & Vertical Mfg. • Few Competitors Can Compete at Larger Customers. (Top Customers dominate TAM) 22 3/15/2018

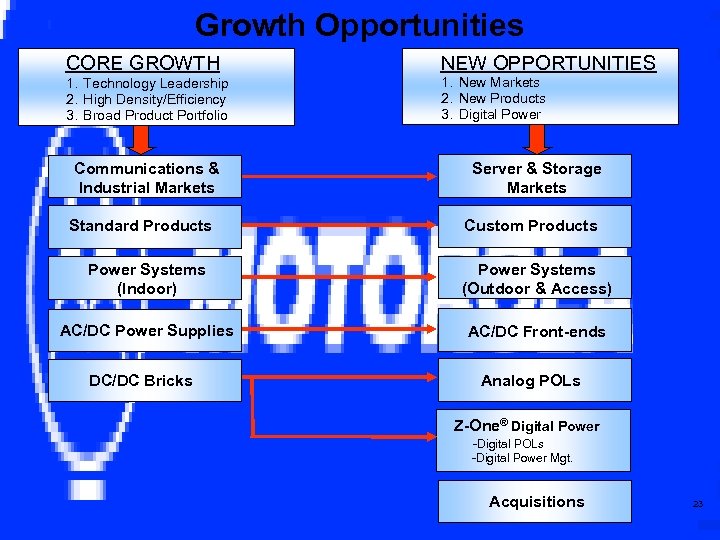

Growth Opportunities CORE GROWTH 1. Technology Leadership 2. High Density/Efficiency 3. Broad Product Portfolio Communications & Industrial Markets Standard Products NEW OPPORTUNITIES 1. New Markets 2. New Products 3. Digital Power Server & Storage Markets Custom Products Power Systems (Indoor) Power Systems (Outdoor & Access) AC/DC Power Supplies AC/DC Front-ends DC/DC Bricks Analog POLs Z-One® Digital Power -Digital POLs -Digital Power Mgt. Acquisitions 23 3/15/2018

Growth Opportunities CORE GROWTH 1. Technology Leadership 2. High Density/Efficiency 3. Broad Product Portfolio Communications & Industrial Markets Standard Products NEW OPPORTUNITIES 1. New Markets 2. New Products 3. Digital Power Server & Storage Markets Custom Products Power Systems (Indoor) Power Systems (Outdoor & Access) AC/DC Power Supplies AC/DC Front-ends DC/DC Bricks Analog POLs Z-One® Digital Power -Digital POLs -Digital Power Mgt. Acquisitions 23 3/15/2018

Digital Power Revolution--- ZZZZ TM A Digital Power Revolution Conversion … Communications… Control

Digital Power Revolution--- ZZZZ TM A Digital Power Revolution Conversion … Communications… Control

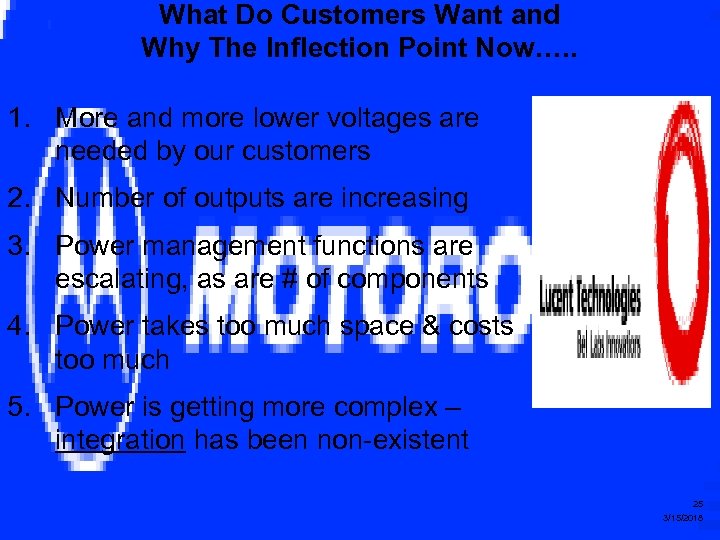

What Do Customers Want and Why The Inflection Point Now…. . 1. More and more lower voltages are needed by our customers 2. Number of outputs are increasing 3. Power management functions are escalating, as are # of components 4. Power takes too much space & costs too much 5. Power is getting more complex – integration has been non-existent 25 3/15/2018

What Do Customers Want and Why The Inflection Point Now…. . 1. More and more lower voltages are needed by our customers 2. Number of outputs are increasing 3. Power management functions are escalating, as are # of components 4. Power takes too much space & costs too much 5. Power is getting more complex – integration has been non-existent 25 3/15/2018

Power Management and Power Conversion… Two Separate Markets Conversion Control (Pwr. Mgt. ) Communication? 26 3/15/2018

Power Management and Power Conversion… Two Separate Markets Conversion Control (Pwr. Mgt. ) Communication? 26 3/15/2018

Power Management and Power Conversion Becomes One … with Digital Technology Conversion Communication Control (Pwr. Mgt. ) Goal: 20% Market Share in 5 Years 27 3/15/2018

Power Management and Power Conversion Becomes One … with Digital Technology Conversion Communication Control (Pwr. Mgt. ) Goal: 20% Market Share in 5 Years 27 3/15/2018

The “Z” Strategy & Opportunity … Win by Changing the Rules of the Game • Our Goal: Comprehensively solve our customers’ power management problems • Be first to market – and gain share • Establish leadership position … with a new approach to power management • Silicon strategy + IP for higher margins and sustainable competitive advantage • Attack new markets with disruptive technology 28 3/15/2018

The “Z” Strategy & Opportunity … Win by Changing the Rules of the Game • Our Goal: Comprehensively solve our customers’ power management problems • Be first to market – and gain share • Establish leadership position … with a new approach to power management • Silicon strategy + IP for higher margins and sustainable competitive advantage • Attack new markets with disruptive technology 28 3/15/2018

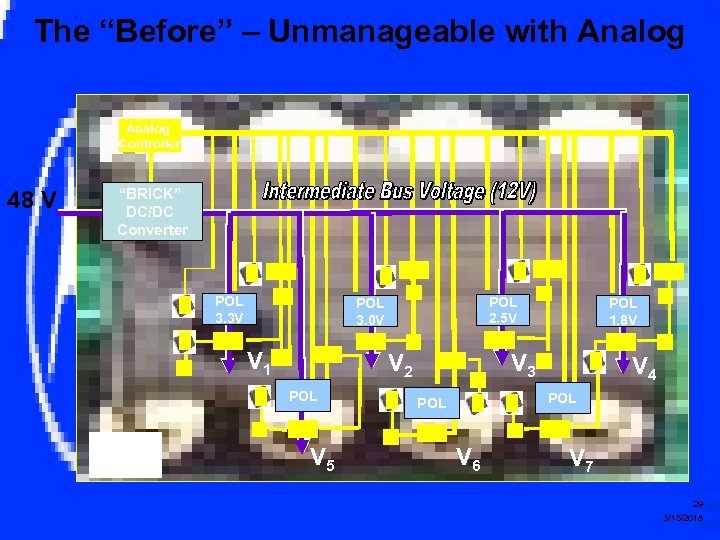

The “Before” – Unmanageable with Analog Controller 48 V “BRICK” DC/DC Converter POL 3. 3 V POL 2. 5 V POL 3. 0 V V 1 V 2 POL V 5 POL 1. 8 V V 3 V 4 POL V 6 V 7 29 3/15/2018

The “Before” – Unmanageable with Analog Controller 48 V “BRICK” DC/DC Converter POL 3. 3 V POL 2. 5 V POL 3. 0 V V 1 V 2 POL V 5 POL 1. 8 V V 3 V 4 POL V 6 V 7 29 3/15/2018

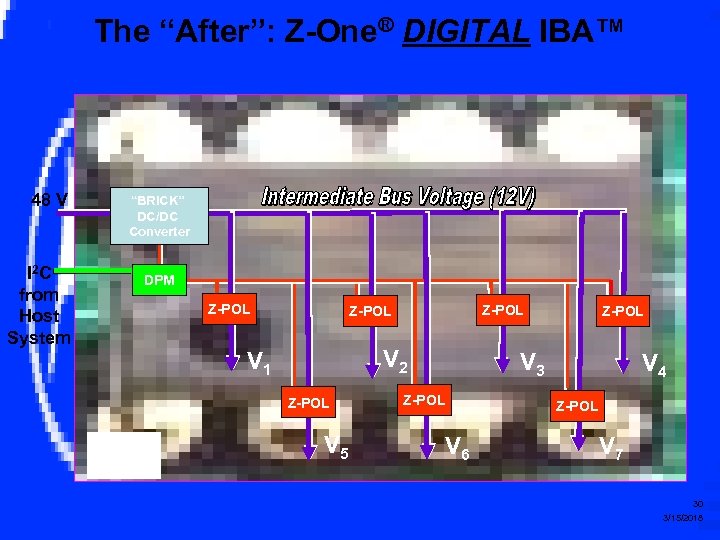

The “After”: Z-One® DIGITAL IBA™ 48 V I 2 C from Host System “BRICK” DC/DC Converter DPM Z-POL V 2 V 1 Z-POL V 5 Z-POL V 3 Z-POL V 6 V 4 Z-POL V 7 30 3/15/2018

The “After”: Z-One® DIGITAL IBA™ 48 V I 2 C from Host System “BRICK” DC/DC Converter DPM Z-POL V 2 V 1 Z-POL V 5 Z-POL V 3 Z-POL V 6 V 4 Z-POL V 7 30 3/15/2018

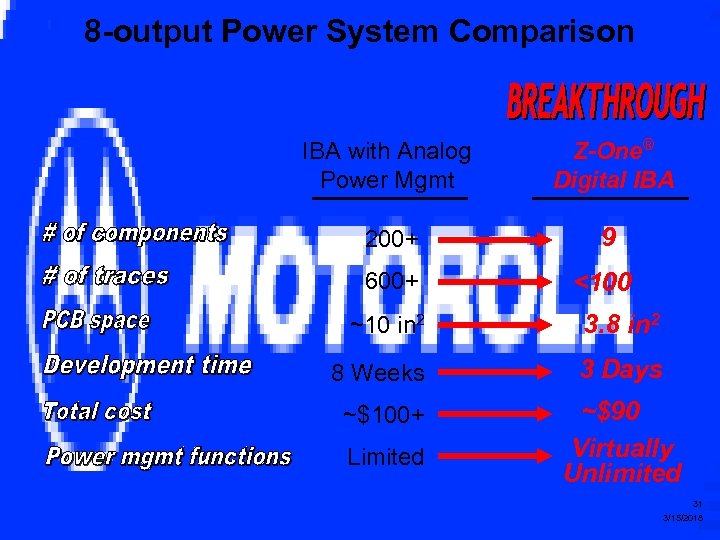

8 -output Power System Comparison IBA with Analog Power Mgmt Z-One® Digital IBA 200+ 9 600+ <100 ~10 in 2 3. 8 in 2 8 Weeks 3 Days ~$100+ ~$90 Virtually Unlimited Limited 31 3/15/2018

8 -output Power System Comparison IBA with Analog Power Mgmt Z-One® Digital IBA 200+ 9 600+ <100 ~10 in 2 3. 8 in 2 8 Weeks 3 Days ~$100+ ~$90 Virtually Unlimited Limited 31 3/15/2018

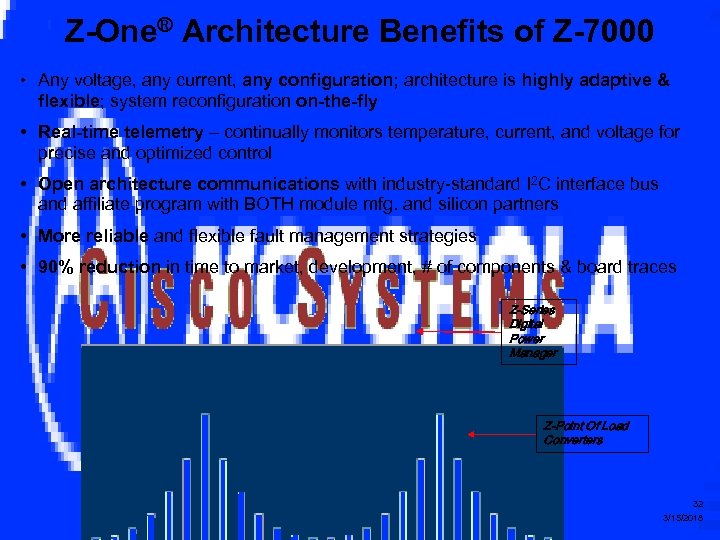

Z-One® Architecture Benefits of Z-7000 • Any voltage, any current, any configuration; architecture is highly adaptive & flexible; system reconfiguration on-the-fly • Real-time telemetry – continually monitors temperature, current, and voltage for precise and optimized control • Open architecture communications with industry-standard I 2 C interface bus and affiliate program with BOTH module mfg. and silicon partners • More reliable and flexible fault management strategies • 90% reduction in time to market, development, # of components & board traces Z-Series Digital Power Manager Z-Point Of Load Converters 32 3/15/2018

Z-One® Architecture Benefits of Z-7000 • Any voltage, any current, any configuration; architecture is highly adaptive & flexible; system reconfiguration on-the-fly • Real-time telemetry – continually monitors temperature, current, and voltage for precise and optimized control • Open architecture communications with industry-standard I 2 C interface bus and affiliate program with BOTH module mfg. and silicon partners • More reliable and flexible fault management strategies • 90% reduction in time to market, development, # of components & board traces Z-Series Digital Power Manager Z-Point Of Load Converters 32 3/15/2018

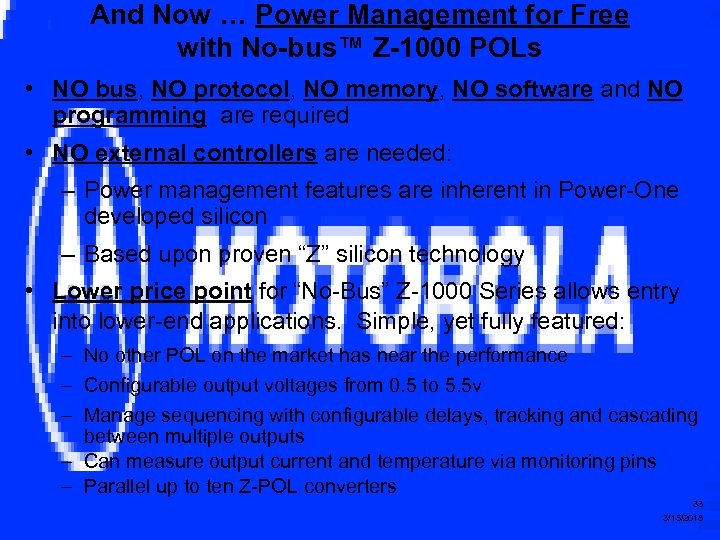

And Now … Power Management for Free with No-bus™ Z-1000 POLs • NO bus, NO protocol, NO memory, NO software and NO programming are required • NO external controllers are needed: – Power management features are inherent in Power-One developed silicon – Based upon proven “Z” silicon technology • Lower price point for “No-Bus” Z-1000 Series allows entry into lower-end applications. Simple, yet fully featured: – No other POL on the market has near the performance – Configurable output voltages from 0. 5 to 5. 5 v – Manage sequencing with configurable delays, tracking and cascading between multiple outputs – Can measure output current and temperature via monitoring pins – Parallel up to ten Z-POL converters 33 3/15/2018

And Now … Power Management for Free with No-bus™ Z-1000 POLs • NO bus, NO protocol, NO memory, NO software and NO programming are required • NO external controllers are needed: – Power management features are inherent in Power-One developed silicon – Based upon proven “Z” silicon technology • Lower price point for “No-Bus” Z-1000 Series allows entry into lower-end applications. Simple, yet fully featured: – No other POL on the market has near the performance – Configurable output voltages from 0. 5 to 5. 5 v – Manage sequencing with configurable delays, tracking and cascading between multiple outputs – Can measure output current and temperature via monitoring pins – Parallel up to ten Z-POL converters 33 3/15/2018

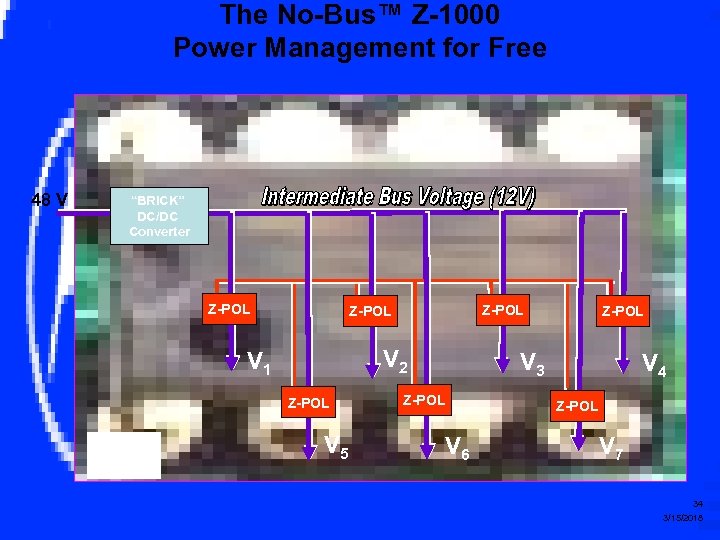

The No-Bus™ Z-1000 Power Management for Free 48 V “BRICK” DC/DC Converter Z-POL V 2 V 1 Z-POL V 5 Z-POL V 3 Z-POL V 6 V 4 Z-POL V 7 34 3/15/2018

The No-Bus™ Z-1000 Power Management for Free 48 V “BRICK” DC/DC Converter Z-POL V 2 V 1 Z-POL V 5 Z-POL V 3 Z-POL V 6 V 4 Z-POL V 7 34 3/15/2018

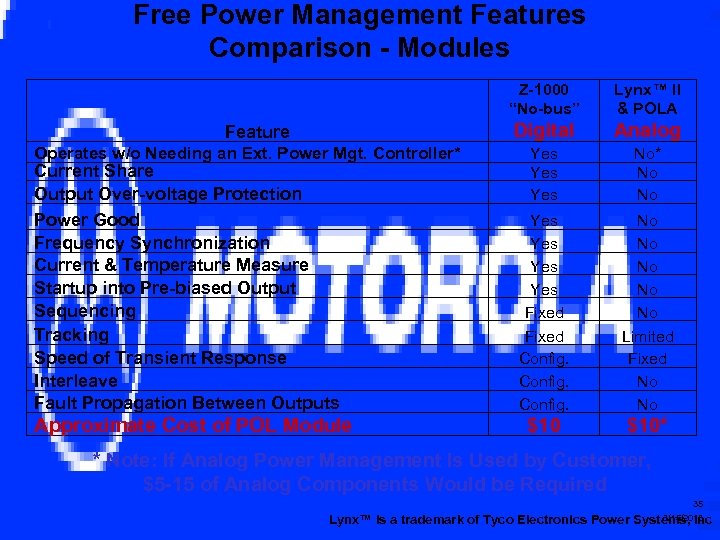

Free Power Management Features Comparison - Modules Z-1000 “No-bus” Digital Feature Operates w/o Needing an Ext. Power Mgt. Controller* Current Share Output Over-voltage Protection Power Good Frequency Synchronization Current & Temperature Measure Startup into Pre-biased Output Sequencing Tracking Speed of Transient Response Interleave Fault Propagation Between Outputs Approximate Cost of POL Module Lynx™ II & POLA Analog Yes Yes No* No No Yes Yes Fixed Config. No No No Limited Fixed No No $10* * Note: If Analog Power Management Is Used by Customer, $5 -15 of Analog Components Would be Required 35 3/15/2018 Lynx™ is a trademark of Tyco Electronics Power Systems, Inc

Free Power Management Features Comparison - Modules Z-1000 “No-bus” Digital Feature Operates w/o Needing an Ext. Power Mgt. Controller* Current Share Output Over-voltage Protection Power Good Frequency Synchronization Current & Temperature Measure Startup into Pre-biased Output Sequencing Tracking Speed of Transient Response Interleave Fault Propagation Between Outputs Approximate Cost of POL Module Lynx™ II & POLA Analog Yes Yes No* No No Yes Yes Fixed Config. No No No Limited Fixed No No $10* * Note: If Analog Power Management Is Used by Customer, $5 -15 of Analog Components Would be Required 35 3/15/2018 Lynx™ is a trademark of Tyco Electronics Power Systems, Inc

No-Bus™ Z-1000 Digital Power Advertisement TM

No-Bus™ Z-1000 Digital Power Advertisement TM

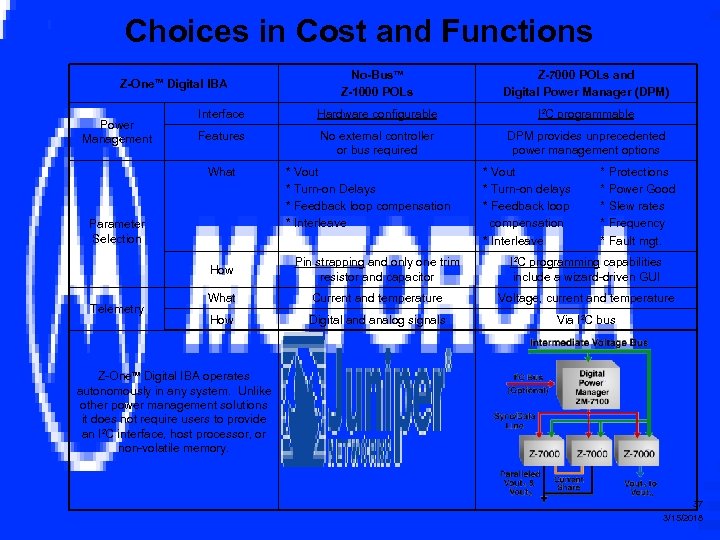

Choices in Cost and Functions No-Bus. TM Z-1000 POLs Z-7000 POLs and Digital Power Manager (DPM) Interface Hardware configurable I 2 C programmable Features No external controller or bus required DPM provides unprecedented power management options Z-One. TM Digital IBA Power Management What Parameter Selection * Vout * Turn-on Delays * Feedback loop compensation * Interleave * Vout * Turn-on delays * Feedback loop compensation * Interleave * * * Protections Power Good Slew rates Frequency Fault mgt. How Telemetry Pin strapping and only one trim resistor and capacitor I 2 C programming capabilities include a wizard-driven GUI What Current and temperature Voltage, current and temperature How Digital and analog signals Via I 2 C bus Z-One. TM Digital IBA operates autonomously in any system. Unlike other power management solutions it does not require users to provide an I 2 C interface, host processor, or non-volatile memory. 37 3/15/2018

Choices in Cost and Functions No-Bus. TM Z-1000 POLs Z-7000 POLs and Digital Power Manager (DPM) Interface Hardware configurable I 2 C programmable Features No external controller or bus required DPM provides unprecedented power management options Z-One. TM Digital IBA Power Management What Parameter Selection * Vout * Turn-on Delays * Feedback loop compensation * Interleave * Vout * Turn-on delays * Feedback loop compensation * Interleave * * * Protections Power Good Slew rates Frequency Fault mgt. How Telemetry Pin strapping and only one trim resistor and capacitor I 2 C programming capabilities include a wizard-driven GUI What Current and temperature Voltage, current and temperature How Digital and analog signals Via I 2 C bus Z-One. TM Digital IBA operates autonomously in any system. Unlike other power management solutions it does not require users to provide an I 2 C interface, host processor, or non-volatile memory. 37 3/15/2018

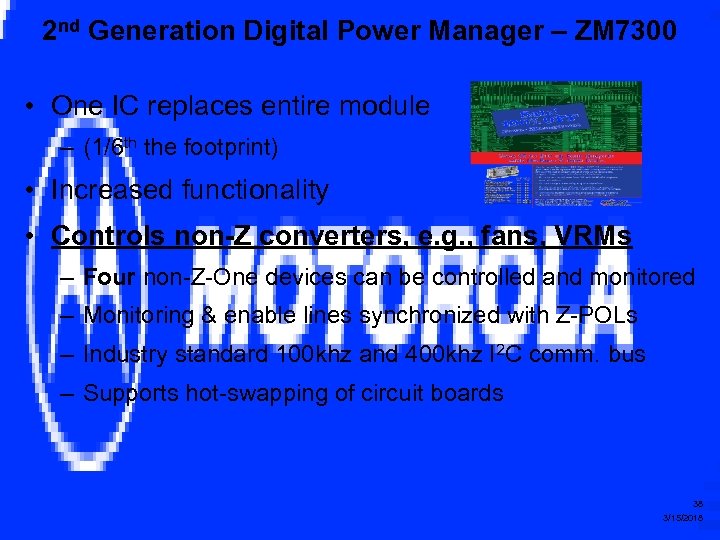

2 nd Generation Digital Power Manager – ZM 7300 • One IC replaces entire module – (1/6 th the footprint) • Increased functionality • Controls non-Z converters, e. g. , fans, VRMs – Four non-Z-One devices can be controlled and monitored – Monitoring & enable lines synchronized with Z-POLs – Industry standard 100 khz and 400 khz I 2 C comm. bus – Supports hot-swapping of circuit boards 38 3/15/2018

2 nd Generation Digital Power Manager – ZM 7300 • One IC replaces entire module – (1/6 th the footprint) • Increased functionality • Controls non-Z converters, e. g. , fans, VRMs – Four non-Z-One devices can be controlled and monitored – Monitoring & enable lines synchronized with Z-POLs – Industry standard 100 khz and 400 khz I 2 C comm. bus – Supports hot-swapping of circuit boards 38 3/15/2018

ZM 7300 Now Control Non-Z Converters! • • Four enable lines synchronized with Z-POLs Four power good inputs for monitoring of non-Z Devices Can control any converter or other device with enable signal (e. g. , fan) Enable turn-on/off delays and polarity are programmable via GUI 39 3/15/2018

ZM 7300 Now Control Non-Z Converters! • • Four enable lines synchronized with Z-POLs Four power good inputs for monitoring of non-Z Devices Can control any converter or other device with enable signal (e. g. , fan) Enable turn-on/off delays and polarity are programmable via GUI 39 3/15/2018

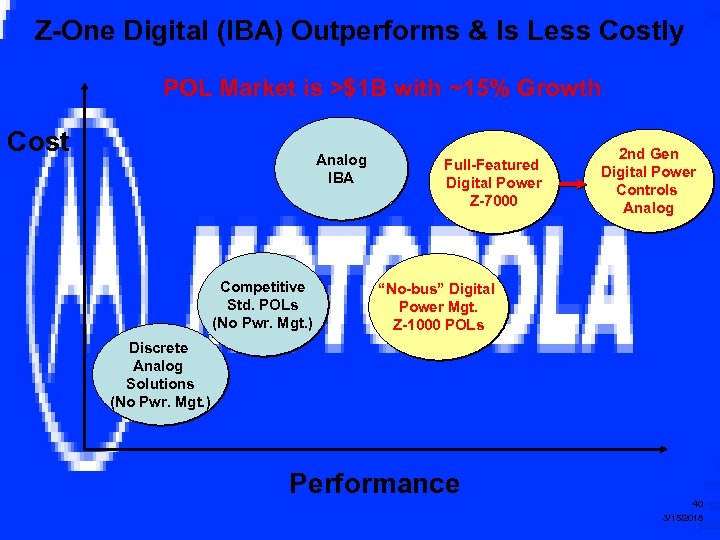

Z-One Digital (IBA) Outperforms & Is Less Costly POL Market is >$1 B with ~15% Growth Cost Analog IBA Competitive Std. POLs (No Pwr. Mgt. ) Full-Featured Digital Power Z-7000 2 nd Gen Digital Power Controls Analog “No-bus” Digital Power Mgt. Z-1000 POLs Discrete Analog Solutions (No Pwr. Mgt. ) Performance 40 3/15/2018

Z-One Digital (IBA) Outperforms & Is Less Costly POL Market is >$1 B with ~15% Growth Cost Analog IBA Competitive Std. POLs (No Pwr. Mgt. ) Full-Featured Digital Power Z-7000 2 nd Gen Digital Power Controls Analog “No-bus” Digital Power Mgt. Z-1000 POLs Discrete Analog Solutions (No Pwr. Mgt. ) Performance 40 3/15/2018

Results for Z-One Digital Power • We have a significant head-start on the competition • The Z-series disruptive architecture is a true revolution in power • Licensed technology (second sourcing) – Module 2 nd source in Dec. ’ 04 with C&D Technologies (top 5 supplier) – Semiconductor Z-affiliate announced with Atmel in July’ 05; and with Micrel LDO (Low Drop-Out) regulator IC in Sept ‘ 06 – Silicon Labs joined the Z-Alliance in August ‘ 06 – Meeting with other potential partners • Customers who implement the “Z” can offer products with additional system features and benefits; and with faster TTM (time to market) • New markets opened, e. g. , Storage & Server, Military, Aerospace & Security (total POL market exceeds $1. 0 billion) • Core business is growing as a result of the “Z” • ~80 Z-One® board-level design wins & growing (now with top-tier cust. ) • Significantly more embedded in the customers’ systems architecture 41 3/15/2018

Results for Z-One Digital Power • We have a significant head-start on the competition • The Z-series disruptive architecture is a true revolution in power • Licensed technology (second sourcing) – Module 2 nd source in Dec. ’ 04 with C&D Technologies (top 5 supplier) – Semiconductor Z-affiliate announced with Atmel in July’ 05; and with Micrel LDO (Low Drop-Out) regulator IC in Sept ‘ 06 – Silicon Labs joined the Z-Alliance in August ‘ 06 – Meeting with other potential partners • Customers who implement the “Z” can offer products with additional system features and benefits; and with faster TTM (time to market) • New markets opened, e. g. , Storage & Server, Military, Aerospace & Security (total POL market exceeds $1. 0 billion) • Core business is growing as a result of the “Z” • ~80 Z-One® board-level design wins & growing (now with top-tier cust. ) • Significantly more embedded in the customers’ systems architecture 41 3/15/2018

Strategic Initiatives Execute on acquisition implementation Invest in most advanced power technologies – – – Silicon-based products; Protect IP Leading position in DC/DC bricks; new POL converters Advanced AC/DC front-ends for DPA/IBA markets High-density Power Systems for telecom/ISP/infrastructure Alternative Energy initiative Broaden portfolio into high-end data infrastructure – Gain further traction in Storage/Server markets with the “Z” – Custom AC/DC power supplies & DC/DC converters – New Telecom Power System’s outdoor cabinet Continue to reduce overall cost structure Bottom and top-line growth 42 3/15/2018

Strategic Initiatives Execute on acquisition implementation Invest in most advanced power technologies – – – Silicon-based products; Protect IP Leading position in DC/DC bricks; new POL converters Advanced AC/DC front-ends for DPA/IBA markets High-density Power Systems for telecom/ISP/infrastructure Alternative Energy initiative Broaden portfolio into high-end data infrastructure – Gain further traction in Storage/Server markets with the “Z” – Custom AC/DC power supplies & DC/DC converters – New Telecom Power System’s outdoor cabinet Continue to reduce overall cost structure Bottom and top-line growth 42 3/15/2018

Summary & “Take-a-ways” • • • 2006 was a return to growth; 2007 is a year of execution and leverage Telecom Power Systems is now a high-growth business Server & Storage design wins have turned into revenue Z-One® digital power management gaining momentum Power-One is a consolidator and can compete with biggest competitors; now # 7 in worldwide sales. Power-One is the only significant “Pure Power” play High synergistic & strategic value in acquisition: very quickly accretive Power-One forecasts Q 1 ‘ 07 range to be between $125 -135 M with acquisition, $530 -550 M in 2007 Forecasting EPS in 2007 to be approximately $0. 20 per share Expect to exit ’ 07 at a quarterly run-rate of a range around $150 M in sales and $0. 10 EPS 43 3/15/2018

Summary & “Take-a-ways” • • • 2006 was a return to growth; 2007 is a year of execution and leverage Telecom Power Systems is now a high-growth business Server & Storage design wins have turned into revenue Z-One® digital power management gaining momentum Power-One is a consolidator and can compete with biggest competitors; now # 7 in worldwide sales. Power-One is the only significant “Pure Power” play High synergistic & strategic value in acquisition: very quickly accretive Power-One forecasts Q 1 ‘ 07 range to be between $125 -135 M with acquisition, $530 -550 M in 2007 Forecasting EPS in 2007 to be approximately $0. 20 per share Expect to exit ’ 07 at a quarterly run-rate of a range around $150 M in sales and $0. 10 EPS 43 3/15/2018

Z- Digital Power Revolution TM A Digital Power Revolution Changing the Shape of Power

Z- Digital Power Revolution TM A Digital Power Revolution Changing the Shape of Power

Thank You! TM

Thank You! TM

Disclaimer & Forward Looking Statements This presentation includes forward-looking statements within the meaning of the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995 that can be identified by the use of forward-looking words such as “will” or “estimate” or comparable words. These statements are subject to a number of factors, risks and uncertainties that could cause actual results to differ materially from those projected. Risks and uncertainties include, but are not necessarily limited to: the Company’s success in securing customer acceptance and adoption of the Company’s products and technologies; the Company’s success in integrating the newly acquired Magnetek PEG operations into the Company’s overall operations; the Company’s success in achieving anticipated cost savings from projected synergies relating to the Magnetek PEG acquisition; the size and pace of growth and improvement in target and potential markets; the Company’s success in establishing and maintaining adequate and qualified manufacturing sources for supply of products; constraints and limitations in the supply chain(s) for critical components contained in Company products; the Company’s ability to achieve and sustain gross margins at levels anticipated and noted as comparable to “silicon -based” companies; the Company’s ability to continue spending at prior or desired levels for research and development related to the products and technologies discussed in this presentation; competitor advances and successes in comparable, alternative or competing technologies; the Company’s success in securing protection for intellectual property incorporated into the Company’s products and/or enforcing such intellectual property against use of same by competitors; intellectual property claims or rights of third parties which are unknown to the Company, and/or which are asserted in the future against the Company. In addition, we refer you to the Company’s most recent SEC financial filings, to include the Company’s report(s) filed with the SEC on Form 10 -K and/or 10 -Q for disclosure and discussion, where applicable or additional risk factors. 46 3/15/2018

Disclaimer & Forward Looking Statements This presentation includes forward-looking statements within the meaning of the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995 that can be identified by the use of forward-looking words such as “will” or “estimate” or comparable words. These statements are subject to a number of factors, risks and uncertainties that could cause actual results to differ materially from those projected. Risks and uncertainties include, but are not necessarily limited to: the Company’s success in securing customer acceptance and adoption of the Company’s products and technologies; the Company’s success in integrating the newly acquired Magnetek PEG operations into the Company’s overall operations; the Company’s success in achieving anticipated cost savings from projected synergies relating to the Magnetek PEG acquisition; the size and pace of growth and improvement in target and potential markets; the Company’s success in establishing and maintaining adequate and qualified manufacturing sources for supply of products; constraints and limitations in the supply chain(s) for critical components contained in Company products; the Company’s ability to achieve and sustain gross margins at levels anticipated and noted as comparable to “silicon -based” companies; the Company’s ability to continue spending at prior or desired levels for research and development related to the products and technologies discussed in this presentation; competitor advances and successes in comparable, alternative or competing technologies; the Company’s success in securing protection for intellectual property incorporated into the Company’s products and/or enforcing such intellectual property against use of same by competitors; intellectual property claims or rights of third parties which are unknown to the Company, and/or which are asserted in the future against the Company. In addition, we refer you to the Company’s most recent SEC financial filings, to include the Company’s report(s) filed with the SEC on Form 10 -K and/or 10 -Q for disclosure and discussion, where applicable or additional risk factors. 46 3/15/2018