86c175bcd3f0ff26ecd3a84f523a3f8e.ppt

- Количество слайдов: 40

Panics, Stock Market Crashes and the Crises of the 19 th Century

Panics, Stock Market Crashes and the Crises of the 19 th Century

Lessons from the 19 th Century • Financial Crisis of 2008 Recession 200820? ? A full scale panic not seen in over 80 years • 19 th Century, numerous banking panics, stock market crises • Lots to be learned by comparisons • Focus on banking panics • (Definitions of a “bank run” and “banking panic”? )

Lessons from the 19 th Century • Financial Crisis of 2008 Recession 200820? ? A full scale panic not seen in over 80 years • 19 th Century, numerous banking panics, stock market crises • Lots to be learned by comparisons • Focus on banking panics • (Definitions of a “bank run” and “banking panic”? )

Some Key Questions • What happened to the banking system when it was subjected to a negative economic shocks or surprises? • Were bank runs and banking panics avoidable problems? • Did the banking system amplify economic shocks? • Was there a policy solution?

Some Key Questions • What happened to the banking system when it was subjected to a negative economic shocks or surprises? • Were bank runs and banking panics avoidable problems? • Did the banking system amplify economic shocks? • Was there a policy solution?

Two Types of Shocks • Systemic Shocks: a recession, a rise in interest rates, a rise or fall in the general price level, a rise or fall in the price of a major good (oil, wheat) that alters terms of trade, a stock market crash (or other asset market collapse like housing---an unexpected decline in wealth) • Idiosyncratic Shocks: individual firm failures, some price changes, declines in some stock prices or one local areas housing prices

Two Types of Shocks • Systemic Shocks: a recession, a rise in interest rates, a rise or fall in the general price level, a rise or fall in the price of a major good (oil, wheat) that alters terms of trade, a stock market crash (or other asset market collapse like housing---an unexpected decline in wealth) • Idiosyncratic Shocks: individual firm failures, some price changes, declines in some stock prices or one local areas housing prices

How shocks cause bank runs and panics: Asymmetric Information • A run begins when some depositors observe negative information about the value of a bank’s assets and withdraw their deposits because they fear the bank will be unable to pay out all deposits. • Depositors “run” because they believe that others will run on the bank. There is sequential payment, induces fear they will not get money out. • If Depositors cannot discriminate between sound and unsound banks and they observing others “running” , there will be “contagion, ” runs will multiply producing a “panic. ”

How shocks cause bank runs and panics: Asymmetric Information • A run begins when some depositors observe negative information about the value of a bank’s assets and withdraw their deposits because they fear the bank will be unable to pay out all deposits. • Depositors “run” because they believe that others will run on the bank. There is sequential payment, induces fear they will not get money out. • If Depositors cannot discriminate between sound and unsound banks and they observing others “running” , there will be “contagion, ” runs will multiply producing a “panic. ”

Why do depositors run? Because they perceive banks as either “Illiquid” or “Insolvent” • “Illiquid” banks cannot sell enough assets quickly enough (obtain repayment of loans or sell them) to satisfy (a sudden) demand for withdrawals • “Insolvent” bank’s assets are worth less than its liabilities. It is not a matter of time. Impossible to pay out all deposits

Why do depositors run? Because they perceive banks as either “Illiquid” or “Insolvent” • “Illiquid” banks cannot sell enough assets quickly enough (obtain repayment of loans or sell them) to satisfy (a sudden) demand for withdrawals • “Insolvent” bank’s assets are worth less than its liabilities. It is not a matter of time. Impossible to pay out all deposits

Illiquid v. Insolvent—a loss from bad loans of $15, 000 versus $30, 000 • • • ASSETS Reserves $ 5, 000 Bonds $ 5, 000 Loans $90, 000 -----------Total $100, 000 • LIABILITIES • Capital $20, 000 • Deposits $80, 000 • ------------- • Total $100, 000

Illiquid v. Insolvent—a loss from bad loans of $15, 000 versus $30, 000 • • • ASSETS Reserves $ 5, 000 Bonds $ 5, 000 Loans $90, 000 -----------Total $100, 000 • LIABILITIES • Capital $20, 000 • Deposits $80, 000 • ------------- • Total $100, 000

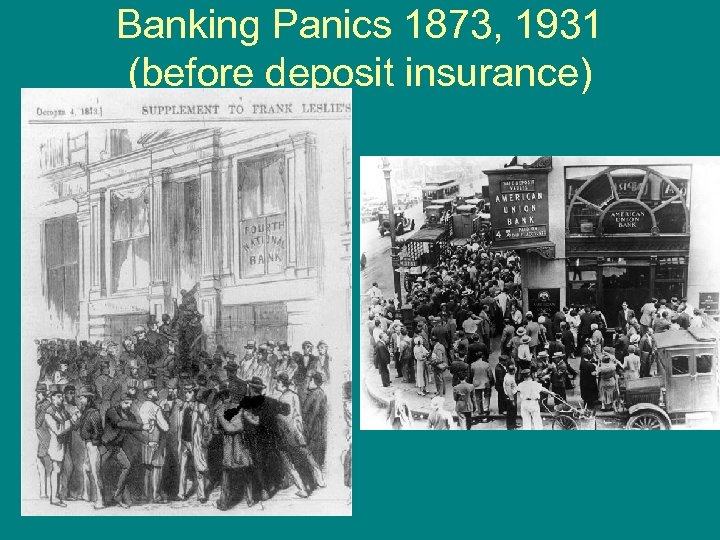

Banking Panics 1873, 1931 (before deposit insurance)

Banking Panics 1873, 1931 (before deposit insurance)

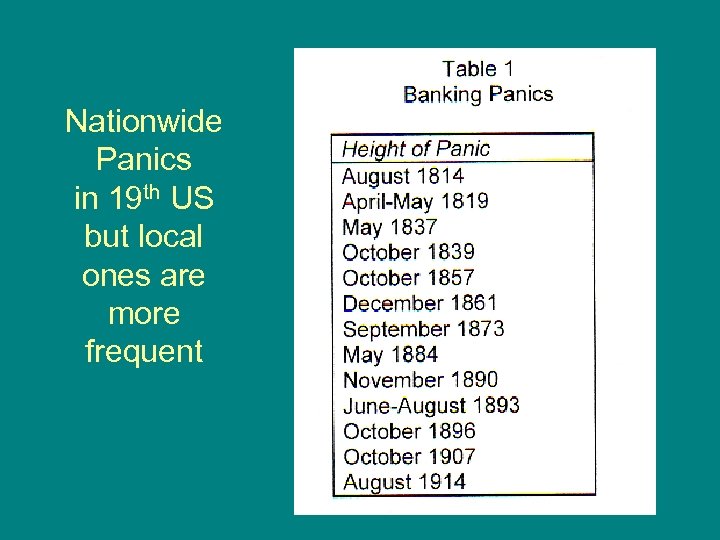

Nationwide Panics in 19 th US but local ones are more frequent

Nationwide Panics in 19 th US but local ones are more frequent

Two panics (1854 and 1857) viewed from one bank’s records • Emigrant Savings Industrial Bank (EISB) founded 1850 as a mutual savings bank. • Unique data on account books and test books— every transaction and customer characteristics • Run on the bank in 1854 when a local panic began with news that another bank was insolvent • Run on the bank in 1857 when there was a system -wide shock to the financial system

Two panics (1854 and 1857) viewed from one bank’s records • Emigrant Savings Industrial Bank (EISB) founded 1850 as a mutual savings bank. • Unique data on account books and test books— every transaction and customer characteristics • Run on the bank in 1854 when a local panic began with news that another bank was insolvent • Run on the bank in 1857 when there was a system -wide shock to the financial system

Panic of 1854 • A run starts on Knickerbocker Savings Bank December 12, 1854 when it does not provide a weekly statement for the NY Clearing House. Why? Bad loans on real estate and stock—it is insolvent. • Run spills over to other savings banks. Why? • But? Eventually those subside but Knickerbocker fails and pays out 86. 5%. • No other banks fail. • New York Times: the run on other banks “could scarcely have been more uselessly directed. ” Tribune: “senseless. ”

Panic of 1854 • A run starts on Knickerbocker Savings Bank December 12, 1854 when it does not provide a weekly statement for the NY Clearing House. Why? Bad loans on real estate and stock—it is insolvent. • Run spills over to other savings banks. Why? • But? Eventually those subside but Knickerbocker fails and pays out 86. 5%. • No other banks fail. • New York Times: the run on other banks “could scarcely have been more uselessly directed. ” Tribune: “senseless. ”

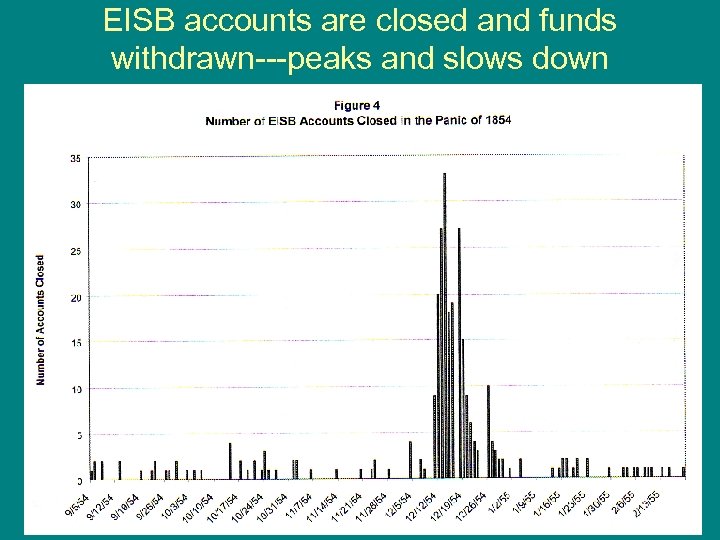

EISB accounts are closed and funds withdrawn---peaks and slows down

EISB accounts are closed and funds withdrawn---peaks and slows down

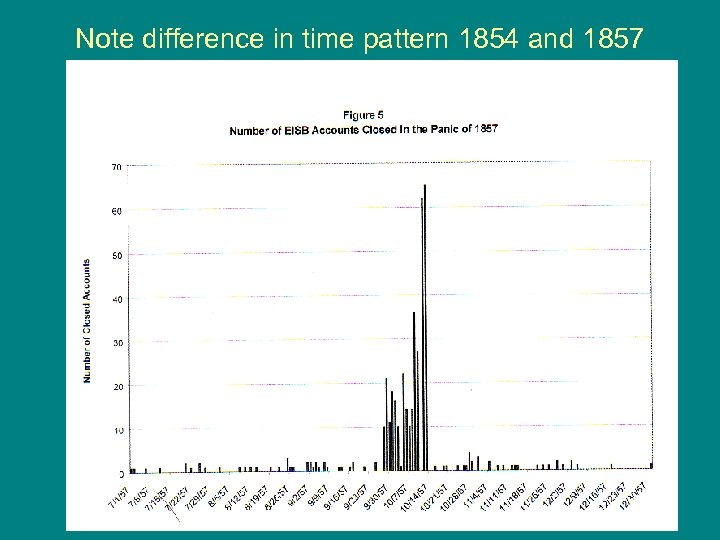

Panic of 1857 • On August 24, 1857, the Ohio Life and Trust Company— a very big bank—with offices in New York closed. It was heavily invested in speculative western land railroad securities. Collapse linked to political uncertainty over whether Kansas and Nebraska would become slave states. • Stock market drops, banks tighten credit and there is a reduction of bank loans to brokers and dealers---some of them go bankrupt and more securities are dumped. • Noteholders and depositors cash in for coin, as do banks outside of New York. Huge pressure in NYC as gold reserves decline—NYC banks cut loans. • Runs and panic in Philadelphia----banks in city suspend payment • Result: panic in NYC September 26. Bank presidents declare they will NOT suspend payment. Heavy runs, reserves decline. Erie and Central Illinois Railroads don’t make debt payments. October 14 all banks suspend payment…. continues until December 14

Panic of 1857 • On August 24, 1857, the Ohio Life and Trust Company— a very big bank—with offices in New York closed. It was heavily invested in speculative western land railroad securities. Collapse linked to political uncertainty over whether Kansas and Nebraska would become slave states. • Stock market drops, banks tighten credit and there is a reduction of bank loans to brokers and dealers---some of them go bankrupt and more securities are dumped. • Noteholders and depositors cash in for coin, as do banks outside of New York. Huge pressure in NYC as gold reserves decline—NYC banks cut loans. • Runs and panic in Philadelphia----banks in city suspend payment • Result: panic in NYC September 26. Bank presidents declare they will NOT suspend payment. Heavy runs, reserves decline. Erie and Central Illinois Railroads don’t make debt payments. October 14 all banks suspend payment…. continues until December 14

Note difference in time pattern 1854 and 1857

Note difference in time pattern 1854 and 1857

Comparison • 1854 Panic---Source: Idiosyncratic shock – Bank runs by predominantly less wealthy, less experienced and less sophisticated—”uninformed” depositors running in response to a problem at another bank. – Contagion causes runs on other banks. – EISB not overwhelmed and is able to continue making payments and eventually crisis ends • 1857 Panic---Source Systemic shock – Bank runs begun by wealthier and more informed who recognized larger problems in the financial markets. Followed by uninformed. Banking system overwhelmed and only suspension of payments by all banks prevents a total collapse from the panic.

Comparison • 1854 Panic---Source: Idiosyncratic shock – Bank runs by predominantly less wealthy, less experienced and less sophisticated—”uninformed” depositors running in response to a problem at another bank. – Contagion causes runs on other banks. – EISB not overwhelmed and is able to continue making payments and eventually crisis ends • 1857 Panic---Source Systemic shock – Bank runs begun by wealthier and more informed who recognized larger problems in the financial markets. Followed by uninformed. Banking system overwhelmed and only suspension of payments by all banks prevents a total collapse from the panic.

Are Banking Panics Natural? • Yes, this was a banking system without deposit insurance or a central bank • Asymmetric information—almost ensures some bank runs and even panics will occur. • Many shocks---big seasonal changes in the interest rates. Most panics occur in October. • BUT: are there any features of the banking or financial system that exacerbate runs and panics?

Are Banking Panics Natural? • Yes, this was a banking system without deposit insurance or a central bank • Asymmetric information—almost ensures some bank runs and even panics will occur. • Many shocks---big seasonal changes in the interest rates. Most panics occur in October. • BUT: are there any features of the banking or financial system that exacerbate runs and panics?

Two Key Problems of the 19 th century banking system that increased the probability and severity of banking panics • Money supply is exogenously determined--no means to temporarily increase liquidity in the banking system to overcome temporary liquidity problems. No central bank. • Fragmented banking system---reduces the ability of banks to diversify loans and deposits and thereby reduce probability of failure

Two Key Problems of the 19 th century banking system that increased the probability and severity of banking panics • Money supply is exogenously determined--no means to temporarily increase liquidity in the banking system to overcome temporary liquidity problems. No central bank. • Fragmented banking system---reduces the ability of banks to diversify loans and deposits and thereby reduce probability of failure

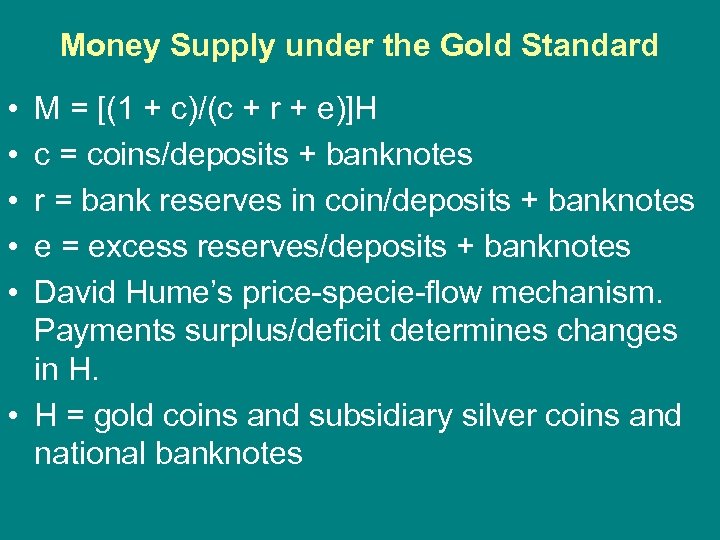

Money Supply under the Gold Standard • • • M = [(1 + c)/(c + r + e)]H c = coins/deposits + banknotes r = bank reserves in coin/deposits + banknotes e = excess reserves/deposits + banknotes David Hume’s price-specie-flow mechanism. Payments surplus/deficit determines changes in H. • H = gold coins and subsidiary silver coins and national banknotes

Money Supply under the Gold Standard • • • M = [(1 + c)/(c + r + e)]H c = coins/deposits + banknotes r = bank reserves in coin/deposits + banknotes e = excess reserves/deposits + banknotes David Hume’s price-specie-flow mechanism. Payments surplus/deficit determines changes in H. • H = gold coins and subsidiary silver coins and national banknotes

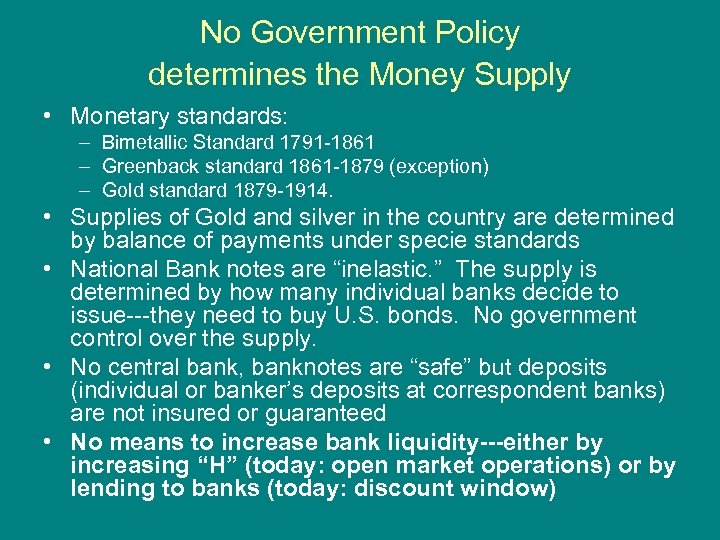

No Government Policy determines the Money Supply • Monetary standards: – Bimetallic Standard 1791 -1861 – Greenback standard 1861 -1879 (exception) – Gold standard 1879 -1914. • Supplies of Gold and silver in the country are determined by balance of payments under specie standards • National Bank notes are “inelastic. ” The supply is determined by how many individual banks decide to issue---they need to buy U. S. bonds. No government control over the supply. • No central bank, banknotes are “safe” but deposits (individual or banker’s deposits at correspondent banks) are not insured or guaranteed • No means to increase bank liquidity---either by increasing “H” (today: open market operations) or by lending to banks (today: discount window)

No Government Policy determines the Money Supply • Monetary standards: – Bimetallic Standard 1791 -1861 – Greenback standard 1861 -1879 (exception) – Gold standard 1879 -1914. • Supplies of Gold and silver in the country are determined by balance of payments under specie standards • National Bank notes are “inelastic. ” The supply is determined by how many individual banks decide to issue---they need to buy U. S. bonds. No government control over the supply. • No central bank, banknotes are “safe” but deposits (individual or banker’s deposits at correspondent banks) are not insured or guaranteed • No means to increase bank liquidity---either by increasing “H” (today: open market operations) or by lending to banks (today: discount window)

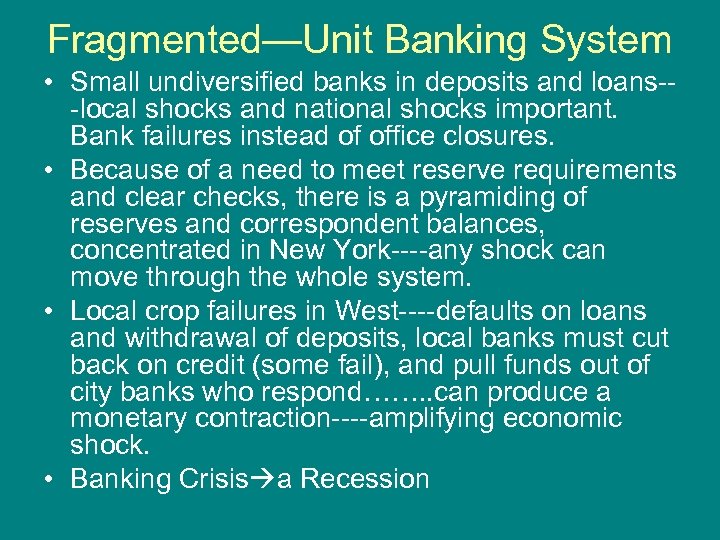

Fragmented—Unit Banking System • Small undiversified banks in deposits and loans--local shocks and national shocks important. Bank failures instead of office closures. • Because of a need to meet reserve requirements and clear checks, there is a pyramiding of reserves and correspondent balances, concentrated in New York----any shock can move through the whole system. • Local crop failures in West----defaults on loans and withdrawal of deposits, local banks must cut back on credit (some fail), and pull funds out of city banks who respond……. . can produce a monetary contraction----amplifying economic shock. • Banking Crisis a Recession

Fragmented—Unit Banking System • Small undiversified banks in deposits and loans--local shocks and national shocks important. Bank failures instead of office closures. • Because of a need to meet reserve requirements and clear checks, there is a pyramiding of reserves and correspondent balances, concentrated in New York----any shock can move through the whole system. • Local crop failures in West----defaults on loans and withdrawal of deposits, local banks must cut back on credit (some fail), and pull funds out of city banks who respond……. . can produce a monetary contraction----amplifying economic shock. • Banking Crisis a Recession

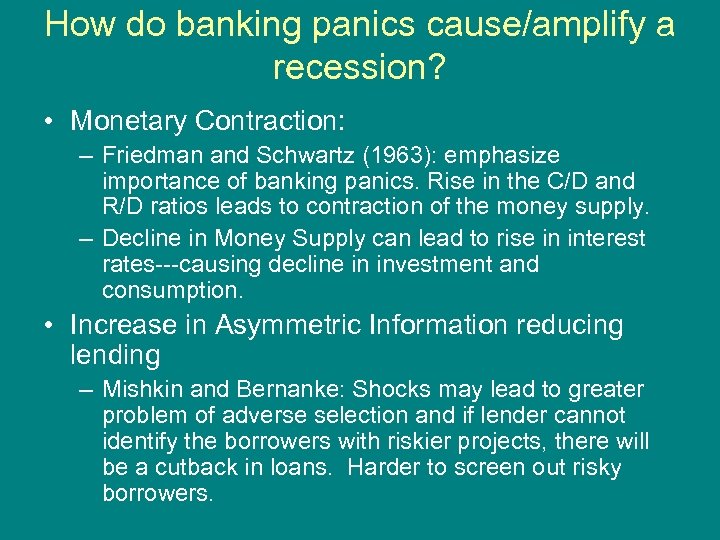

How do banking panics cause/amplify a recession? • Monetary Contraction: – Friedman and Schwartz (1963): emphasize importance of banking panics. Rise in the C/D and R/D ratios leads to contraction of the money supply. – Decline in Money Supply can lead to rise in interest rates---causing decline in investment and consumption. • Increase in Asymmetric Information reducing lending – Mishkin and Bernanke: Shocks may lead to greater problem of adverse selection and if lender cannot identify the borrowers with riskier projects, there will be a cutback in loans. Harder to screen out risky borrowers.

How do banking panics cause/amplify a recession? • Monetary Contraction: – Friedman and Schwartz (1963): emphasize importance of banking panics. Rise in the C/D and R/D ratios leads to contraction of the money supply. – Decline in Money Supply can lead to rise in interest rates---causing decline in investment and consumption. • Increase in Asymmetric Information reducing lending – Mishkin and Bernanke: Shocks may lead to greater problem of adverse selection and if lender cannot identify the borrowers with riskier projects, there will be a cutback in loans. Harder to screen out risky borrowers.

An analysis of crises and recessions Mishkin (1991) • What causes What? Recessions? Bank Panics? Stock market crashes? • Examine behavior of (1) interest rates, (2) risk premiums on interest rates (3) stock prices • (1 a) commercial paper rate (1 b) call money rate (2) Baa-Treasury rates (3) stock index • R= recession P=panic

An analysis of crises and recessions Mishkin (1991) • What causes What? Recessions? Bank Panics? Stock market crashes? • Examine behavior of (1) interest rates, (2) risk premiums on interest rates (3) stock prices • (1 a) commercial paper rate (1 b) call money rate (2) Baa-Treasury rates (3) stock index • R= recession P=panic

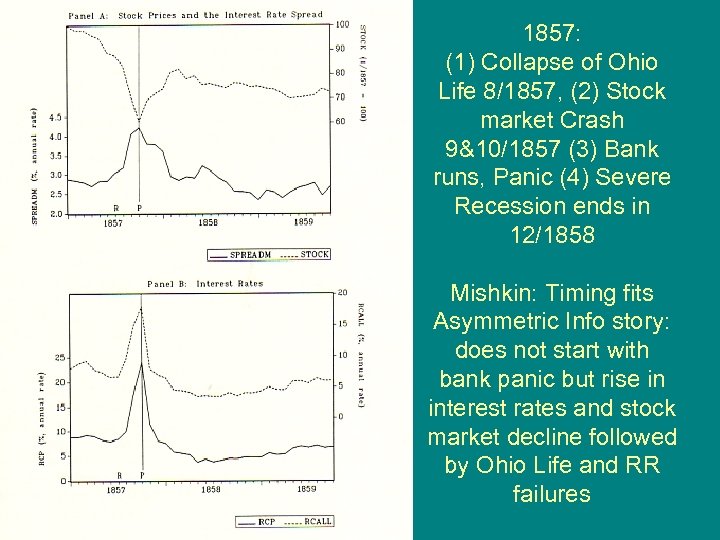

1857: (1) Collapse of Ohio Life 8/1857, (2) Stock market Crash 9&10/1857 (3) Bank runs, Panic (4) Severe Recession ends in 12/1858 Mishkin: Timing fits Asymmetric Info story: does not start with bank panic but rise in interest rates and stock market decline followed by Ohio Life and RR failures

1857: (1) Collapse of Ohio Life 8/1857, (2) Stock market Crash 9&10/1857 (3) Bank runs, Panic (4) Severe Recession ends in 12/1858 Mishkin: Timing fits Asymmetric Info story: does not start with bank panic but rise in interest rates and stock market decline followed by Ohio Life and RR failures

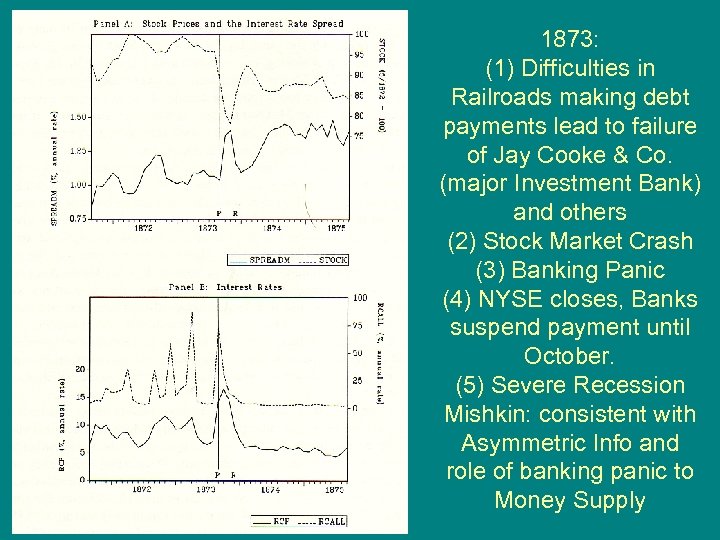

1873: (1) Difficulties in Railroads making debt payments lead to failure of Jay Cooke & Co. (major Investment Bank) and others (2) Stock Market Crash (3) Banking Panic (4) NYSE closes, Banks suspend payment until October. (5) Severe Recession Mishkin: consistent with Asymmetric Info and role of banking panic to Money Supply

1873: (1) Difficulties in Railroads making debt payments lead to failure of Jay Cooke & Co. (major Investment Bank) and others (2) Stock Market Crash (3) Banking Panic (4) NYSE closes, Banks suspend payment until October. (5) Severe Recession Mishkin: consistent with Asymmetric Info and role of banking panic to Money Supply

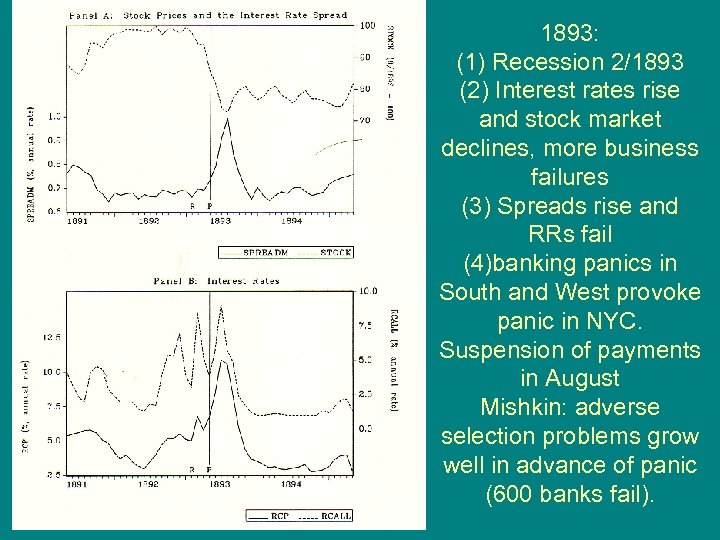

1893: (1) Recession 2/1893 (2) Interest rates rise and stock market declines, more business failures (3) Spreads rise and RRs fail (4)banking panics in South and West provoke panic in NYC. Suspension of payments in August Mishkin: adverse selection problems grow well in advance of panic (600 banks fail).

1893: (1) Recession 2/1893 (2) Interest rates rise and stock market declines, more business failures (3) Spreads rise and RRs fail (4)banking panics in South and West provoke panic in NYC. Suspension of payments in August Mishkin: adverse selection problems grow well in advance of panic (600 banks fail).

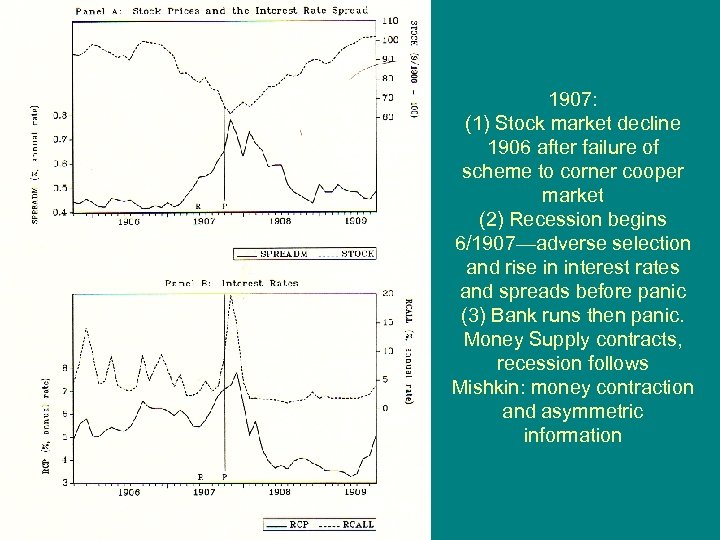

1907: (1) Stock market decline 1906 after failure of scheme to corner cooper market (2) Recession begins 6/1907—adverse selection and rise in interest rates and spreads before panic (3) Bank runs then panic. Money Supply contracts, recession follows Mishkin: money contraction and asymmetric information

1907: (1) Stock market decline 1906 after failure of scheme to corner cooper market (2) Recession begins 6/1907—adverse selection and rise in interest rates and spreads before panic (3) Bank runs then panic. Money Supply contracts, recession follows Mishkin: money contraction and asymmetric information

Mishkin concludes no single pattern • Except for 1873, panics occur after recession begins (2008? ) • Exception of 1873, stock prices decline and spreads widen before onset of panic (2008? ) • Many panics follow major failure of a financial institution, not necessarily a bank (2008: Lehman Bros. ) • Spread after panic typically declines with exceptions of most severe crises 1873, 1907 and Great Depression (Today? ) • Most severe financial crises are associated with severe contractions • Stock market crashes often appear to be a major factor in creating crisis but not always the case---depends on the initial health of the financial sector.

Mishkin concludes no single pattern • Except for 1873, panics occur after recession begins (2008? ) • Exception of 1873, stock prices decline and spreads widen before onset of panic (2008? ) • Many panics follow major failure of a financial institution, not necessarily a bank (2008: Lehman Bros. ) • Spread after panic typically declines with exceptions of most severe crises 1873, 1907 and Great Depression (Today? ) • Most severe financial crises are associated with severe contractions • Stock market crashes often appear to be a major factor in creating crisis but not always the case---depends on the initial health of the financial sector.

19 th Century • Recessions often accompanied by banking panics that can amplify a recession • Two central problems – No means to increase high-powered money to offset the panic/no central bank – Banking system fragmented by prohibition on branching creates less diversified institutions subject to panic

19 th Century • Recessions often accompanied by banking panics that can amplify a recession • Two central problems – No means to increase high-powered money to offset the panic/no central bank – Banking system fragmented by prohibition on branching creates less diversified institutions subject to panic

How do banking panics amplify a recession or other shock? • Monetary Contraction: – Friedman and Schwartz (1963): emphasize importance of banking panics. Rise in the C/D and R/D ratios leads to contraction of the money stock. – Decline in Money Supply can lead to rise in interest rates---causing decline in investment and consumption • Increase in Asymmetric Information reducing lending – Mishkin and Bernanke: Shocks may lead to greater problem of adverse selection and if lender cannot identify the borrowers with riskier projects, there will be a cutback in loans. Harder to screen out risky borrowers.

How do banking panics amplify a recession or other shock? • Monetary Contraction: – Friedman and Schwartz (1963): emphasize importance of banking panics. Rise in the C/D and R/D ratios leads to contraction of the money stock. – Decline in Money Supply can lead to rise in interest rates---causing decline in investment and consumption • Increase in Asymmetric Information reducing lending – Mishkin and Bernanke: Shocks may lead to greater problem of adverse selection and if lender cannot identify the borrowers with riskier projects, there will be a cutback in loans. Harder to screen out risky borrowers.

Common Pattern • Recession Investment falls output, employment, wages and interest rates fall. • Businesses fail and don’t repay loans, households withdraw deposists some banks fails • Bank runs Banking panics C/D, E/D rise, supply of money shrinks interest rates rise, banks may suspend payments • Recession worsens as interest rates rise and credit contracts.

Common Pattern • Recession Investment falls output, employment, wages and interest rates fall. • Businesses fail and don’t repay loans, households withdraw deposists some banks fails • Bank runs Banking panics C/D, E/D rise, supply of money shrinks interest rates rise, banks may suspend payments • Recession worsens as interest rates rise and credit contracts.

Didn’t anyone do something? • Yes, the NYC Clearing House devises a partial substitute for high powered money

Didn’t anyone do something? • Yes, the NYC Clearing House devises a partial substitute for high powered money

Clearing Houses • Clearing and Collection of Checks---banks absorb checks and sent them to all issuing banks. In NYC in 1850 s, 60 banks---rely on system of messengers running back and forth with checks and cash. Costly. They move to holding accounts with one another. Costly. • 1854 New York Clearing House founded. – – 52 banks Minimum capital of $500, 000 Books open to inspective, weekly statements End-of-day balances settled at CH with coin certificates, good for reserve requirements – Fees assessment pro-rata of clearings • Trust essential!

Clearing Houses • Clearing and Collection of Checks---banks absorb checks and sent them to all issuing banks. In NYC in 1850 s, 60 banks---rely on system of messengers running back and forth with checks and cash. Costly. They move to holding accounts with one another. Costly. • 1854 New York Clearing House founded. – – 52 banks Minimum capital of $500, 000 Books open to inspective, weekly statements End-of-day balances settled at CH with coin certificates, good for reserve requirements – Fees assessment pro-rata of clearings • Trust essential!

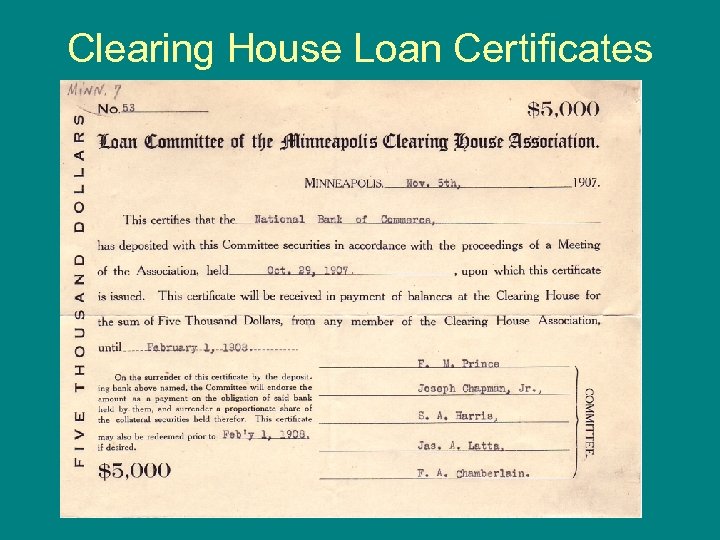

Clearing House Loan Certificates • 1857 Crisis----drain of coin reserves to country banks. Problem of CH banks to clear among themselves • Allow members to deposit bonds and some loans with CH and receive “clearinghouse loan certificates” for 75% of face value with 7% interest. Good for 30 days in clearings and reserves with members. • A substitute form of reserves---increases liquidity among members----eases constraint by exogenously determined high powered money

Clearing House Loan Certificates • 1857 Crisis----drain of coin reserves to country banks. Problem of CH banks to clear among themselves • Allow members to deposit bonds and some loans with CH and receive “clearinghouse loan certificates” for 75% of face value with 7% interest. Good for 30 days in clearings and reserves with members. • A substitute form of reserves---increases liquidity among members----eases constraint by exogenously determined high powered money

Clearing House Loan Certificates

Clearing House Loan Certificates

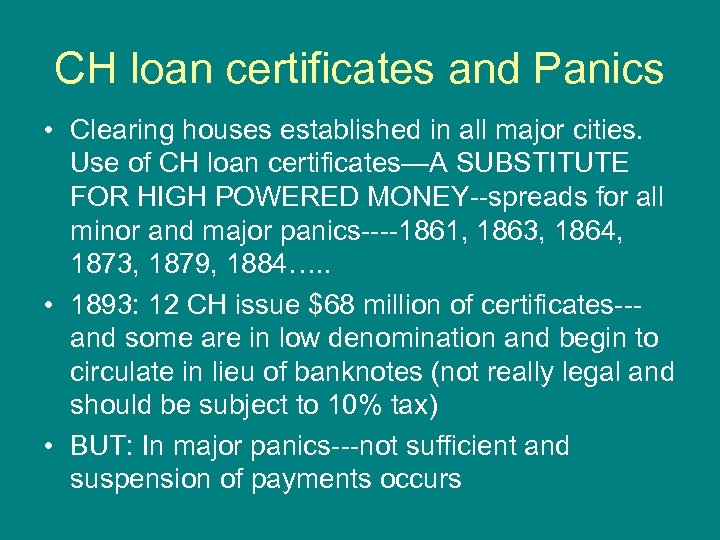

CH loan certificates and Panics • Clearing houses established in all major cities. Use of CH loan certificates—A SUBSTITUTE FOR HIGH POWERED MONEY--spreads for all minor and major panics----1861, 1863, 1864, 1873, 1879, 1884…. . • 1893: 12 CH issue $68 million of certificates--and some are in low denomination and begin to circulate in lieu of banknotes (not really legal and should be subject to 10% tax) • BUT: In major panics---not sufficient and suspension of payments occurs

CH loan certificates and Panics • Clearing houses established in all major cities. Use of CH loan certificates—A SUBSTITUTE FOR HIGH POWERED MONEY--spreads for all minor and major panics----1861, 1863, 1864, 1873, 1879, 1884…. . • 1893: 12 CH issue $68 million of certificates--and some are in low denomination and begin to circulate in lieu of banknotes (not really legal and should be subject to 10% tax) • BUT: In major panics---not sufficient and suspension of payments occurs

The severe 1907 panic forces a reexamination of the banking system and the absence of a central bank

The severe 1907 panic forces a reexamination of the banking system and the absence of a central bank

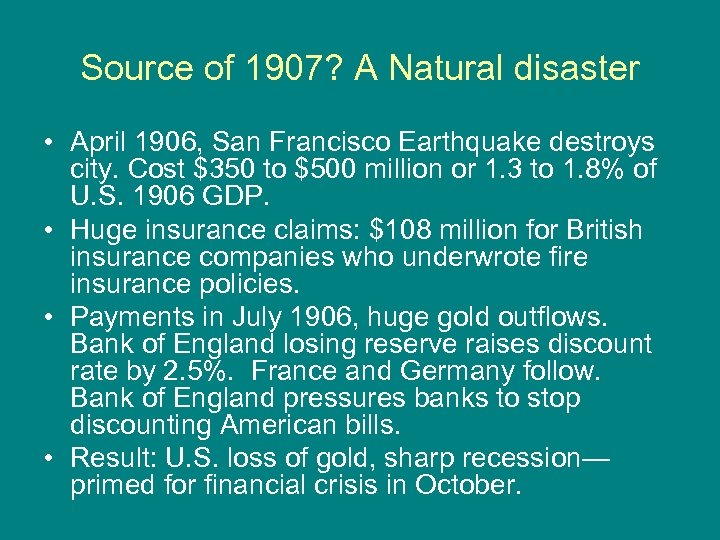

Source of 1907? A Natural disaster • April 1906, San Francisco Earthquake destroys city. Cost $350 to $500 million or 1. 3 to 1. 8% of U. S. 1906 GDP. • Huge insurance claims: $108 million for British insurance companies who underwrote fire insurance policies. • Payments in July 1906, huge gold outflows. Bank of England losing reserve raises discount rate by 2. 5%. France and Germany follow. Bank of England pressures banks to stop discounting American bills. • Result: U. S. loss of gold, sharp recession— primed for financial crisis in October.

Source of 1907? A Natural disaster • April 1906, San Francisco Earthquake destroys city. Cost $350 to $500 million or 1. 3 to 1. 8% of U. S. 1906 GDP. • Huge insurance claims: $108 million for British insurance companies who underwrote fire insurance policies. • Payments in July 1906, huge gold outflows. Bank of England losing reserve raises discount rate by 2. 5%. France and Germany follow. Bank of England pressures banks to stop discounting American bills. • Result: U. S. loss of gold, sharp recession— primed for financial crisis in October.

• The Heinze Brothers, wealthy investors, attempt a “short squeeze” to corner the market for shares in United Copper. As interest rates rise, they fail and their brokerage and bank fail---Knickerbocker Trust is implicated and a run starts on the bank. • Knickerbocker Trust– big bank--is not a member of the Clearing House because it is a trust company, lightly regulated and a rival to banks. • When the Knkickerbocker Trust fail, runs spread to other trust companies. • Local to nationwide panics Panic of 1907: a turning point

• The Heinze Brothers, wealthy investors, attempt a “short squeeze” to corner the market for shares in United Copper. As interest rates rise, they fail and their brokerage and bank fail---Knickerbocker Trust is implicated and a run starts on the bank. • Knickerbocker Trust– big bank--is not a member of the Clearing House because it is a trust company, lightly regulated and a rival to banks. • When the Knkickerbocker Trust fail, runs spread to other trust companies. • Local to nationwide panics Panic of 1907: a turning point

Panic of 1907: a turning point • U. S. Treasury deposits limited funds in banks---but there are continued runs. • J. P. Morganizes assistance but it is insufficient. • A suspension of payments by the banks is necessary to halt the panic • Severe Recession 1907 -1908

Panic of 1907: a turning point • U. S. Treasury deposits limited funds in banks---but there are continued runs. • J. P. Morganizes assistance but it is insufficient. • A suspension of payments by the banks is necessary to halt the panic • Severe Recession 1907 -1908

Consequences of 1907 Panic • Popular outrage: Something must be done. • 1. Aldrich-Vreeland Act of 1908: a stop-gap measure. Creation of associations that can legally issue temporary collateralized certificates that can be used as reserves and cash. Deployed in August 1914. • 2. National Monetary Commission established by Congress to investigate problems of the U. S. and how foreign systems operate. • 3. Money Trust Investigation led by Arsene Pujo (Pujo Investigation of 1907) • 4. Battle for Reform heats up.

Consequences of 1907 Panic • Popular outrage: Something must be done. • 1. Aldrich-Vreeland Act of 1908: a stop-gap measure. Creation of associations that can legally issue temporary collateralized certificates that can be used as reserves and cash. Deployed in August 1914. • 2. National Monetary Commission established by Congress to investigate problems of the U. S. and how foreign systems operate. • 3. Money Trust Investigation led by Arsene Pujo (Pujo Investigation of 1907) • 4. Battle for Reform heats up.