9b924d511f506446411cb82b2bca0714.ppt

- Количество слайдов: 23

Network Issues Chapter 24: Network Issues 1

Network Issues Chapter 24: Network Issues 1

Introduction • Some products are popular with individual consumers precisely because each consumer places a value on others using the same good – A telephone is only valuable if others have one, too – Each user of Microsoft Windows benefits from having lots of other Windows users • Users can run applications, e. g. , Word on each other’s computers • More applications are written for systems with many users • Network Effects or network externalities reflect such situations in which each consumer’s willingness to pay for a product rises as more consumers buy it • Strategic interaction in a market with network effects is complicated Chapter 24: Network Issues 2

Introduction • Some products are popular with individual consumers precisely because each consumer places a value on others using the same good – A telephone is only valuable if others have one, too – Each user of Microsoft Windows benefits from having lots of other Windows users • Users can run applications, e. g. , Word on each other’s computers • More applications are written for systems with many users • Network Effects or network externalities reflect such situations in which each consumer’s willingness to pay for a product rises as more consumers buy it • Strategic interaction in a market with network effects is complicated Chapter 24: Network Issues 2

Monopoly Provision of a Network Service • An early model by Rohlfs (1974) illustrates many of the issues that surround markets with network effects – Imagine some service, say a cable network, where consumers “hook” up to the system but the cost of providing them service after that is effectively zero • Provider is a monopolist charging a “hook up” fee but no other payment • The basic valuation of the product vi is uniformly distributed across consumers from 0 to $100. Consumer willingness to pay is fvi where f is the fraction of the consumer population that is served • The ith’s consumer’s demand is: qi. D = Chapter 24: Network Issues 0 if fvi < p 1 if fvi p 3

Monopoly Provision of a Network Service • An early model by Rohlfs (1974) illustrates many of the issues that surround markets with network effects – Imagine some service, say a cable network, where consumers “hook” up to the system but the cost of providing them service after that is effectively zero • Provider is a monopolist charging a “hook up” fee but no other payment • The basic valuation of the product vi is uniformly distributed across consumers from 0 to $100. Consumer willingness to pay is fvi where f is the fraction of the consumer population that is served • The ith’s consumer’s demand is: qi. D = Chapter 24: Network Issues 0 if fvi < p 1 if fvi p 3

Monopoly Provision of a Network 2 • Consider the marginal consumer with basic valuation • The firm will serve all consumers with valuations • Solving for the fraction f of the market served we have: f=1 - = 1 – p/100 f • So, the inverse demand function is: Chapter 24: Network Issues p = 100 f(1 – f) 4

Monopoly Provision of a Network 2 • Consider the marginal consumer with basic valuation • The firm will serve all consumers with valuations • Solving for the fraction f of the market served we have: f=1 - = 1 – p/100 f • So, the inverse demand function is: Chapter 24: Network Issues p = 100 f(1 – f) 4

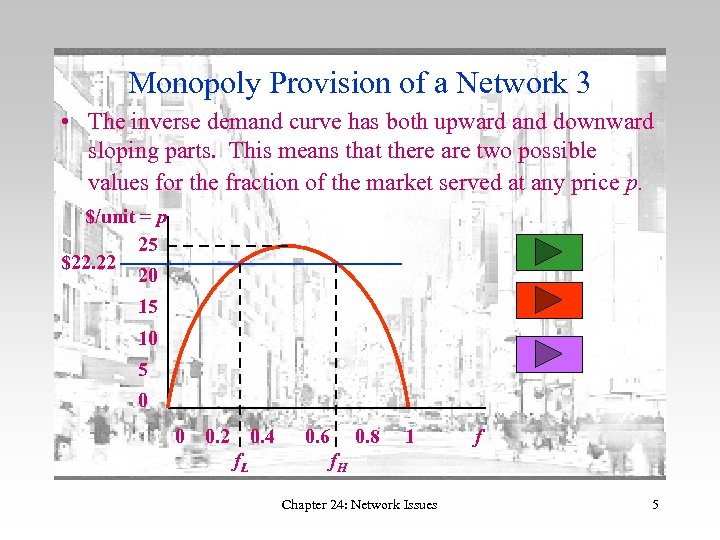

Monopoly Provision of a Network 3 • The inverse demand curve has both upward and downward sloping parts. This means that there are two possible values for the fraction of the market served at any price p. $/unit = p 25 $22. 22 20 15 10 5 0 0 0. 2 0. 4 f. L 0. 6 0. 8 1 f f. H Chapter 24: Network Issues 5

Monopoly Provision of a Network 3 • The inverse demand curve has both upward and downward sloping parts. This means that there are two possible values for the fraction of the market served at any price p. $/unit = p 25 $22. 22 20 15 10 5 0 0 0. 2 0. 4 f. L 0. 6 0. 8 1 f f. H Chapter 24: Network Issues 5

Monopoly Provision of a Network 4 • The Rohlfs model makes clear many of the potential problems that can arise in markets with network effects • 1. The market may fail altogether – Suppose the firm must set a fee over $30 perhaps to cover fixed costs – Network will fail even though it is socially efficient • When half the market is served, the customers hooking up have vi ‘s that range from $50 to $100 or fvi values that range from $25 to $50 • Average value is then $37. 50, well above $30 • But as p rises to $30, f falls and so does average willingness to pay • There is no price at which sufficient numbers of consumers sign on that yields an average willingness to pay of $30 Chapter 24: Network Issues 6

Monopoly Provision of a Network 4 • The Rohlfs model makes clear many of the potential problems that can arise in markets with network effects • 1. The market may fail altogether – Suppose the firm must set a fee over $30 perhaps to cover fixed costs – Network will fail even though it is socially efficient • When half the market is served, the customers hooking up have vi ‘s that range from $50 to $100 or fvi values that range from $25 to $50 • Average value is then $37. 50, well above $30 • But as p rises to $30, f falls and so does average willingness to pay • There is no price at which sufficient numbers of consumers sign on that yields an average willingness to pay of $30 Chapter 24: Network Issues 6

Monopoly Provision of a Network 5 • 2. There are multiple equilibria – At p < $25, there is more than one equilibrium value of f – At p = $22. 22 both f. L(p) = 1/3 and f. H(p) = 2/3 are possible f values – Lower fraction may be unstable (tipping) • This group is comprised of consumer with top one-third of vi values • The addition of one more consumer will raise willingness to pay sufficiently that consumers with the next highest third of vi values will be willing to pay and we will move to the f. H equilibrium • The loss of one consumer will lower the willingness to pay of that same top one-third and demand will fall to zero at p = $22. 22 Chapter 24: Network Issues 7

Monopoly Provision of a Network 5 • 2. There are multiple equilibria – At p < $25, there is more than one equilibrium value of f – At p = $22. 22 both f. L(p) = 1/3 and f. H(p) = 2/3 are possible f values – Lower fraction may be unstable (tipping) • This group is comprised of consumer with top one-third of vi values • The addition of one more consumer will raise willingness to pay sufficiently that consumers with the next highest third of vi values will be willing to pay and we will move to the f. H equilibrium • The loss of one consumer will lower the willingness to pay of that same top one-third and demand will fall to zero at p = $22. 22 Chapter 24: Network Issues 7

Monopoly Provision of a Network 6 – If the firm needs to serve more than one-third of consumers at a price of $22. 22, f. L is called a critical mass. • Low or free introductory pricing • Lease and guarantee that if critical mass is not reached, refund given • Target large consumers with internal networks first Chapter 24: Network Issues 8

Monopoly Provision of a Network 6 – If the firm needs to serve more than one-third of consumers at a price of $22. 22, f. L is called a critical mass. • Low or free introductory pricing • Lease and guarantee that if critical mass is not reached, refund given • Target large consumers with internal networks first Chapter 24: Network Issues 8

Networks, Complementary Services & Competition 2 • Rohlfs model is a monopoly model but has clear insights for oligopoly setting – Market may fail – Competition will be fierce—a firm that fails to reach a critical mass isn’t just smaller than its rival—it dies – Multiple Equilibria are possible—Betamax versus VHS or Blu-Ray versus AOD DVD format—either system may win – Winning system is not necessarily the best one Chapter 24: Network Issues 9

Networks, Complementary Services & Competition 2 • Rohlfs model is a monopoly model but has clear insights for oligopoly setting – Market may fail – Competition will be fierce—a firm that fails to reach a critical mass isn’t just smaller than its rival—it dies – Multiple Equilibria are possible—Betamax versus VHS or Blu-Ray versus AOD DVD format—either system may win – Winning system is not necessarily the best one Chapter 24: Network Issues 9

Systems and Standards Competition • Competition between networks does not always lead to one survivor • Each network may have its own system —Compatibility issues —What is gained and lost when consumers cannot use their brand of the product on other systems? • Competition to be the Industry Standard —Firms may compete to have their system adopted as the industry standard —What are the implications of standards competition? Chapter 24: Network Issues 10

Systems and Standards Competition • Competition between networks does not always lead to one survivor • Each network may have its own system —Compatibility issues —What is gained and lost when consumers cannot use their brand of the product on other systems? • Competition to be the Industry Standard —Firms may compete to have their system adopted as the industry standard —What are the implications of standards competition? Chapter 24: Network Issues 10

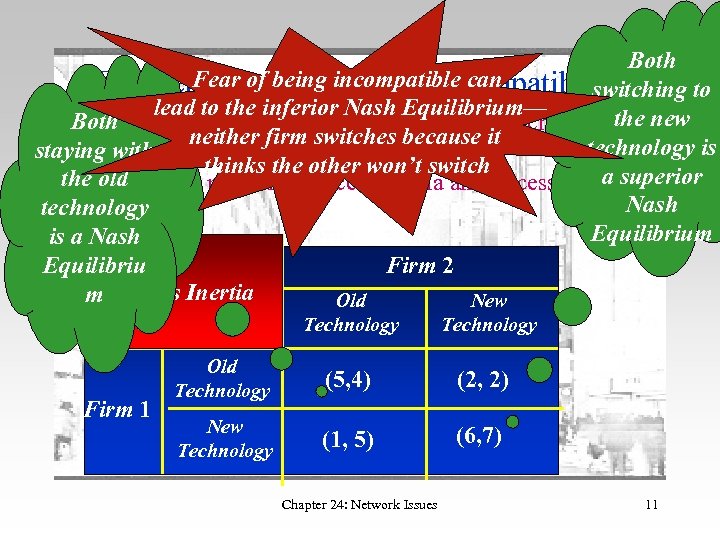

Both Fear of being incompatible can Competition and Technical Compatibility switching to lead to the inferior Nash Equilibrium— Bothfight over compatibility can lead to poor technical the new The neither firm switches because it choices technology is staying withoverall thinks the other won’t switch a superior the old Two possible problems: Excess Inertia and Excess Momentum Nash technology Equilibrium is a Nash Firm 2 Equilibriu m Excess Inertia Old New Technology Firm 1 Technology Old Technology (5, 4) (2, 2) New Technology (1, 5) (6, 7) Chapter 24: Network Issues 11

Both Fear of being incompatible can Competition and Technical Compatibility switching to lead to the inferior Nash Equilibrium— Bothfight over compatibility can lead to poor technical the new The neither firm switches because it choices technology is staying withoverall thinks the other won’t switch a superior the old Two possible problems: Excess Inertia and Excess Momentum Nash technology Equilibrium is a Nash Firm 2 Equilibriu m Excess Inertia Old New Technology Firm 1 Technology Old Technology (5, 4) (2, 2) New Technology (1, 5) (6, 7) Chapter 24: Network Issues 11

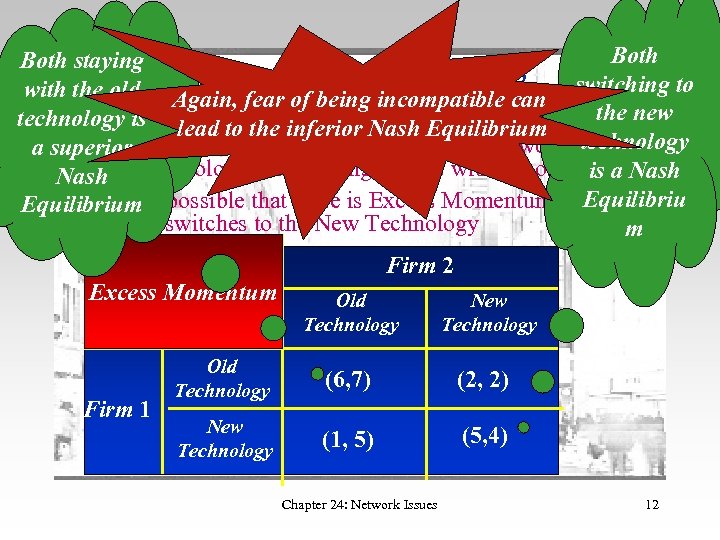

Both staying Technical Compatibility 2 with the old Again, fear of being incompatible can switching to technologycase of excess inertia, each firm. Equilibrium the same In the is lead to the inferior Nash wants to adopt the new technology as its rival but, fearful that the rival won’t switch to a superior the new Nash technology, each wrongly stays with the old is a Nash Equilibriu It is also Equilibrium possible that there is Excess Momentum and each wrongly switches to the New Technology m Firm 2 Excess Momentum Firm 1 Old Technology New Technology Old Technology (6, 7) (2, 2) New Technology (1, 5) (5, 4) Chapter 24: Network Issues 12

Both staying Technical Compatibility 2 with the old Again, fear of being incompatible can switching to technologycase of excess inertia, each firm. Equilibrium the same In the is lead to the inferior Nash wants to adopt the new technology as its rival but, fearful that the rival won’t switch to a superior the new Nash technology, each wrongly stays with the old is a Nash Equilibriu It is also Equilibrium possible that there is Excess Momentum and each wrongly switches to the New Technology m Firm 2 Excess Momentum Firm 1 Old Technology New Technology Old Technology (6, 7) (2, 2) New Technology (1, 5) (5, 4) Chapter 24: Network Issues 12

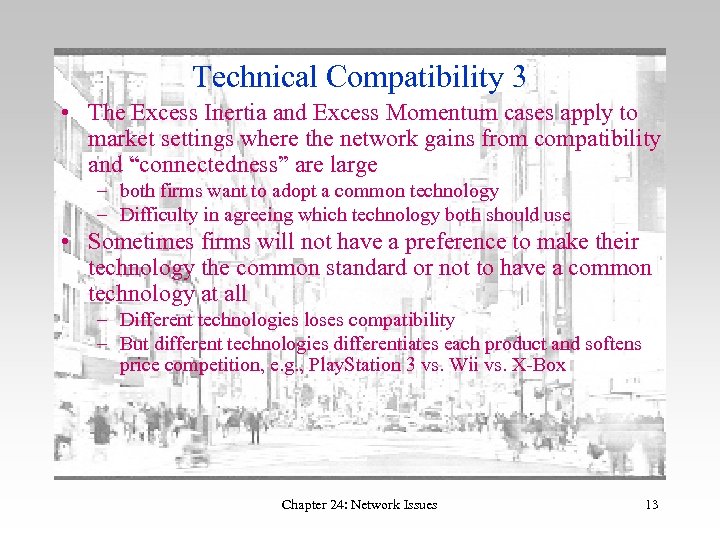

Technical Compatibility 3 • The Excess Inertia and Excess Momentum cases apply to market settings where the network gains from compatibility and “connectedness” are large – both firms want to adopt a common technology – Difficulty in agreeing which technology both should use • Sometimes firms will not have a preference to make their technology the common standard or not to have a common technology at all – Different technologies loses compatibility – But different technologies differentiates each product and softens price competition, e. g. , Play. Station 3 vs. Wii vs. X-Box Chapter 24: Network Issues 13

Technical Compatibility 3 • The Excess Inertia and Excess Momentum cases apply to market settings where the network gains from compatibility and “connectedness” are large – both firms want to adopt a common technology – Difficulty in agreeing which technology both should use • Sometimes firms will not have a preference to make their technology the common standard or not to have a common technology at all – Different technologies loses compatibility – But different technologies differentiates each product and softens price competition, e. g. , Play. Station 3 vs. Wii vs. X-Box Chapter 24: Network Issues 13

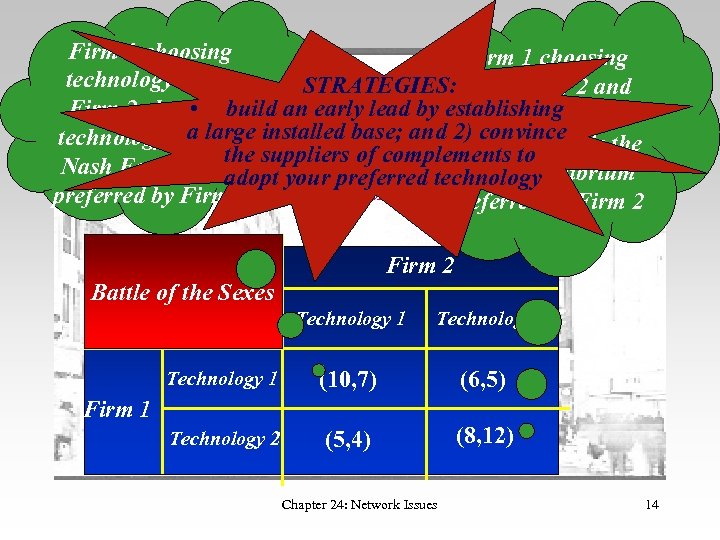

Firm 1 choosing technology 1 Technical Compatibility 4 and STRATEGIES: technology 2 and Firm 2 choosing • build an early Firm 1’s technology Assume there are two technologies, lead by establishing 1 and Firm 2 choosing 2) convince Firm 2’s technology 2 technology 1 a large installed base; and technology 2 is the the of complements to Nash Equilibrium suppliers agree thattechnology be a common In Battle of the Sexes firms still Nash Equilibrium adopt your preferred there should standard by each 1 to be the by Firm preferred but Firmwants its own technologypreferredstandard 2 Firm 2 Battle of the Sexes Technology 1 Technology 2 Technology 1 (10, 7) (6, 5) Technology 2 (5, 4) (8, 12) Firm 1 Chapter 24: Network Issues 14

Firm 1 choosing technology 1 Technical Compatibility 4 and STRATEGIES: technology 2 and Firm 2 choosing • build an early Firm 1’s technology Assume there are two technologies, lead by establishing 1 and Firm 2 choosing 2) convince Firm 2’s technology 2 technology 1 a large installed base; and technology 2 is the the of complements to Nash Equilibrium suppliers agree thattechnology be a common In Battle of the Sexes firms still Nash Equilibrium adopt your preferred there should standard by each 1 to be the by Firm preferred but Firmwants its own technologypreferredstandard 2 Firm 2 Battle of the Sexes Technology 1 Technology 2 Technology 1 (10, 7) (6, 5) Technology 2 (5, 4) (8, 12) Firm 1 Chapter 24: Network Issues 14

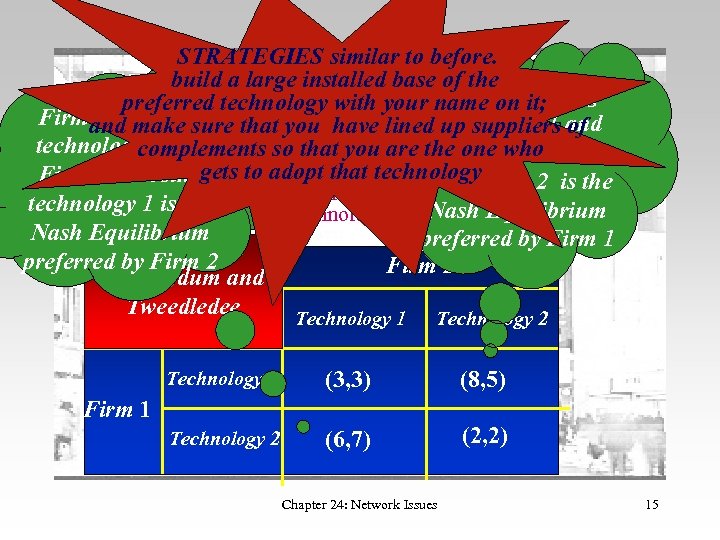

STRATEGIES similar to before. build a large installed base of the 5 Technical Compatibility choosing Firm on preferred technology with your name 1 it; and Again, there are technology Firmandassume sure thattwo technologies, technology 1 and 1 choosing 1 make you is probably better technology 2, but technology 1 have lined up suppliers of technology 2 and complements so that you are the one who Firm 2 choosing In 2 choosinggets Tweedledee, technology Firm Tweedledum and to adopt thatthe firms want to differentiate technology 2 is their products by choosing different strategies but each wants to be technologywith the superior technology 1 Nash Equilibrium the one 1 is the Nash Equilibrium preferred by Firm 1 preferred by Firm 2 Tweedledum and Tweedledee Technology 1 Technology 2 Technology 1 (3, 3) (8, 5) Technology 2 (6, 7) (2, 2) Firm 1 Chapter 24: Network Issues 15

STRATEGIES similar to before. build a large installed base of the 5 Technical Compatibility choosing Firm on preferred technology with your name 1 it; and Again, there are technology Firmandassume sure thattwo technologies, technology 1 and 1 choosing 1 make you is probably better technology 2, but technology 1 have lined up suppliers of technology 2 and complements so that you are the one who Firm 2 choosing In 2 choosinggets Tweedledee, technology Firm Tweedledum and to adopt thatthe firms want to differentiate technology 2 is their products by choosing different strategies but each wants to be technologywith the superior technology 1 Nash Equilibrium the one 1 is the Nash Equilibrium preferred by Firm 1 preferred by Firm 2 Tweedledum and Tweedledee Technology 1 Technology 2 Technology 1 (3, 3) (8, 5) Technology 2 (6, 7) (2, 2) Firm 1 Chapter 24: Network Issues 15

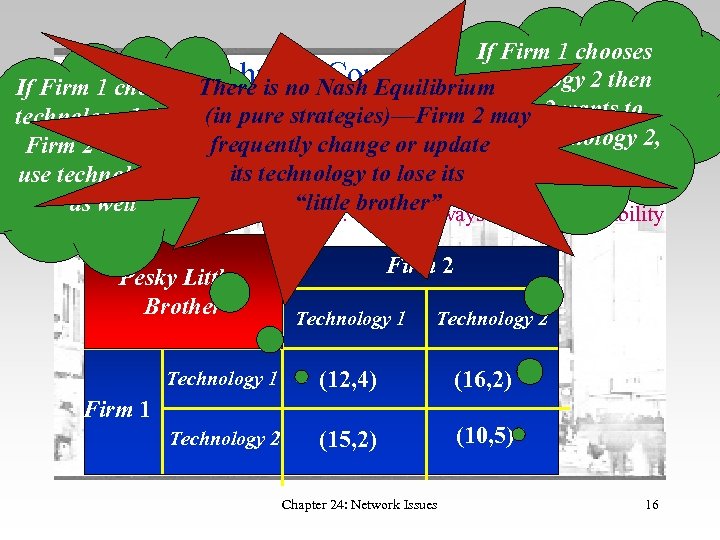

If Firm 1 chooses technology There is no Compatibility 6 If Firm 1 chooses Technical. Nash Equilibrium superior 2 then In Tweedledum and Tweedledee each firm wants Firm 2 wants to technology 1 then really care strategies)—Firm 2 their products by technology but (in pure about differentiating may adopt technology 2, choosing different technologies Firm 2 wants to frequently change or update too In Pesky Little its technology to lose its use technology 1, Brother, Firm 1 is the dominant firm (big brother) thatwell to limit competition from Firm 2 (little brother) by “little Firm 2 always wants compatibility as wants different technology. brother” adopting a Pesky Little Brother Firm 2 Technology 1 Technology 2 Technology 1 (12, 4) (16, 2) Technology 2 (15, 2) (10, 5) Firm 1 Chapter 24: Network Issues 16

If Firm 1 chooses technology There is no Compatibility 6 If Firm 1 chooses Technical. Nash Equilibrium superior 2 then In Tweedledum and Tweedledee each firm wants Firm 2 wants to technology 1 then really care strategies)—Firm 2 their products by technology but (in pure about differentiating may adopt technology 2, choosing different technologies Firm 2 wants to frequently change or update too In Pesky Little its technology to lose its use technology 1, Brother, Firm 1 is the dominant firm (big brother) thatwell to limit competition from Firm 2 (little brother) by “little Firm 2 always wants compatibility as wants different technology. brother” adopting a Pesky Little Brother Firm 2 Technology 1 Technology 2 Technology 1 (12, 4) (16, 2) Technology 2 (15, 2) (10, 5) Firm 1 Chapter 24: Network Issues 16

Public Policy and Systems/Standards Competition • Public policy in the presence of strong networkk externalities is complicated • Low introductory pricing and bundling of complements may look like anticompetitive practices but are really just necessary to survive • Decreeing a common standard forces government to choose the winning standard. Governments are not necessarily good at picking winners • Should governments try to coordinate technology choices or, instead, “let a thousand flowers bloom” Chapter 24: Network Issues 17

Public Policy and Systems/Standards Competition • Public policy in the presence of strong networkk externalities is complicated • Low introductory pricing and bundling of complements may look like anticompetitive practices but are really just necessary to survive • Decreeing a common standard forces government to choose the winning standard. Governments are not necessarily good at picking winners • Should governments try to coordinate technology choices or, instead, “let a thousand flowers bloom” Chapter 24: Network Issues 17

Empirical Application: Network Effects in Software—The Case of Spreadsheets • Computer software is probably among those products with important network features, e. g. , the more people that use Excel or Power. Point the more usable and valuable they are to any one consumer • Can we identify network features empirically? • A relatively early attempt is Gandal’s (1994) investigation of spreadsheet program pricing Chapter 24: Network Issues 18

Empirical Application: Network Effects in Software—The Case of Spreadsheets • Computer software is probably among those products with important network features, e. g. , the more people that use Excel or Power. Point the more usable and valuable they are to any one consumer • Can we identify network features empirically? • A relatively early attempt is Gandal’s (1994) investigation of spreadsheet program pricing Chapter 24: Network Issues 18

Empirical Application: Network Effects in Spreadsheet Programs 2 • A spreadsheet is a long-established business planning tool – Originally a pencil-and-paper operation with sheets organized into many rows and columns that could be summed either vertically or horizontally to trace the impact of individual factors – Computerized versions began to appear in 1980 • By the mid-1980’s there were eight or more different spreadsheet programs on the market – The dominant product was Lotus 1 -2 -3 – Each product had different features, e. g. , • Graphing • Ability to link entries in one spreadsheet to those in another • Lotus compatibility Chapter 24: Network Issues 19

Empirical Application: Network Effects in Spreadsheet Programs 2 • A spreadsheet is a long-established business planning tool – Originally a pencil-and-paper operation with sheets organized into many rows and columns that could be summed either vertically or horizontally to trace the impact of individual factors – Computerized versions began to appear in 1980 • By the mid-1980’s there were eight or more different spreadsheet programs on the market – The dominant product was Lotus 1 -2 -3 – Each product had different features, e. g. , • Graphing • Ability to link entries in one spreadsheet to those in another • Lotus compatibility Chapter 24: Network Issues 19

Empirical Application: Network Effects in Spreadsheet Programs 3 • A hedonic regression is a model of price determination that explains a product price as a result of its key features rather than explicitly model supply and demand • Gandal (1994) estimates an hedonic regression for spreadsheet progams over the years 1986 to 1991 – Postulates key characteristics that should affect spreadsheet price – Identifies which characteriscs are network features – Explicitly considers the role of time and technical progress so that a spreadsheet price index may be constructed Chapter 24: Network Issues 20

Empirical Application: Network Effects in Spreadsheet Programs 3 • A hedonic regression is a model of price determination that explains a product price as a result of its key features rather than explicitly model supply and demand • Gandal (1994) estimates an hedonic regression for spreadsheet progams over the years 1986 to 1991 – Postulates key characteristics that should affect spreadsheet price – Identifies which characteriscs are network features – Explicitly considers the role of time and technical progress so that a spreadsheet price index may be constructed Chapter 24: Network Issues 20

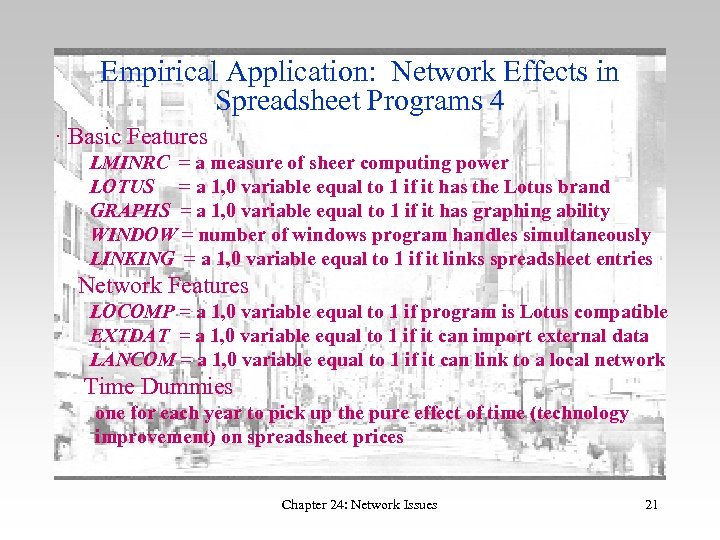

Empirical Application: Network Effects in Spreadsheet Programs 4 · Basic Features LMINRC = a measure of sheer computing power LOTUS = a 1, 0 variable equal to 1 if it has the Lotus brand GRAPHS = a 1, 0 variable equal to 1 if it has graphing ability WINDOW = number of windows program handles simultaneously LINKING = a 1, 0 variable equal to 1 if it links spreadsheet entries Network Features LOCOMP = a 1, 0 variable equal to 1 if program is Lotus compatible EXTDAT = a 1, 0 variable equal to 1 if it can import external data LANCOM = a 1, 0 variable equal to 1 if it can link to a local network Time Dummies one for each year to pick up the pure effect of time (technology improvement) on spreadsheet prices Chapter 24: Network Issues 21

Empirical Application: Network Effects in Spreadsheet Programs 4 · Basic Features LMINRC = a measure of sheer computing power LOTUS = a 1, 0 variable equal to 1 if it has the Lotus brand GRAPHS = a 1, 0 variable equal to 1 if it has graphing ability WINDOW = number of windows program handles simultaneously LINKING = a 1, 0 variable equal to 1 if it links spreadsheet entries Network Features LOCOMP = a 1, 0 variable equal to 1 if program is Lotus compatible EXTDAT = a 1, 0 variable equal to 1 if it can import external data LANCOM = a 1, 0 variable equal to 1 if it can link to a local network Time Dummies one for each year to pick up the pure effect of time (technology improvement) on spreadsheet prices Chapter 24: Network Issues 21

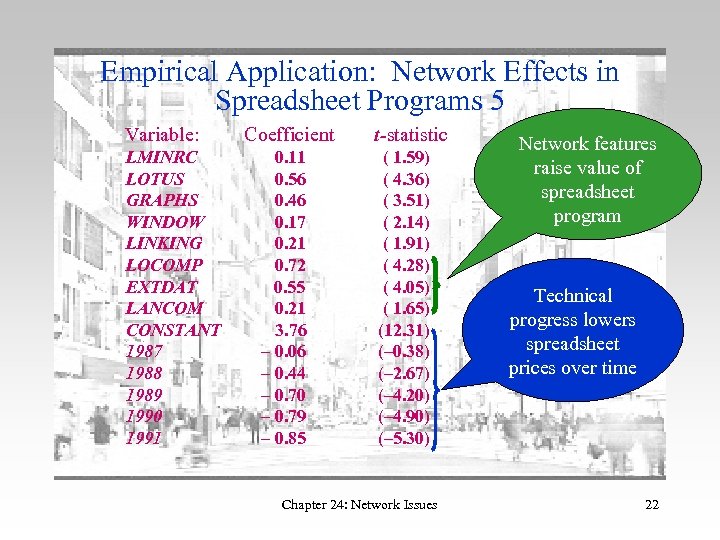

Empirical Application: Network Effects in Spreadsheet Programs 5 Variable: LMINRC LOTUS GRAPHS WINDOW LINKING LOCOMP EXTDAT LANCOM CONSTANT 1987 1988 1989 1990 1991 Coefficient 0. 11 0. 56 0. 46 0. 17 0. 21 0. 72 0. 55 0. 21 3. 76 – 0. 06 – 0. 44 – 0. 70 – 0. 79 – 0. 85 t-statistic ( 1. 59) ( 4. 36) ( 3. 51) ( 2. 14) ( 1. 91) ( 4. 28) ( 4. 05) ( 1. 65) (12. 31) (– 0. 38) (– 2. 67) (– 4. 20) (– 4. 90) (– 5. 30) Chapter 24: Network Issues Network features raise value of spreadsheet program Technical progress lowers spreadsheet prices over time 22

Empirical Application: Network Effects in Spreadsheet Programs 5 Variable: LMINRC LOTUS GRAPHS WINDOW LINKING LOCOMP EXTDAT LANCOM CONSTANT 1987 1988 1989 1990 1991 Coefficient 0. 11 0. 56 0. 46 0. 17 0. 21 0. 72 0. 55 0. 21 3. 76 – 0. 06 – 0. 44 – 0. 70 – 0. 79 – 0. 85 t-statistic ( 1. 59) ( 4. 36) ( 3. 51) ( 2. 14) ( 1. 91) ( 4. 28) ( 4. 05) ( 1. 65) (12. 31) (– 0. 38) (– 2. 67) (– 4. 20) (– 4. 90) (– 5. 30) Chapter 24: Network Issues Network features raise value of spreadsheet program Technical progress lowers spreadsheet prices over time 22

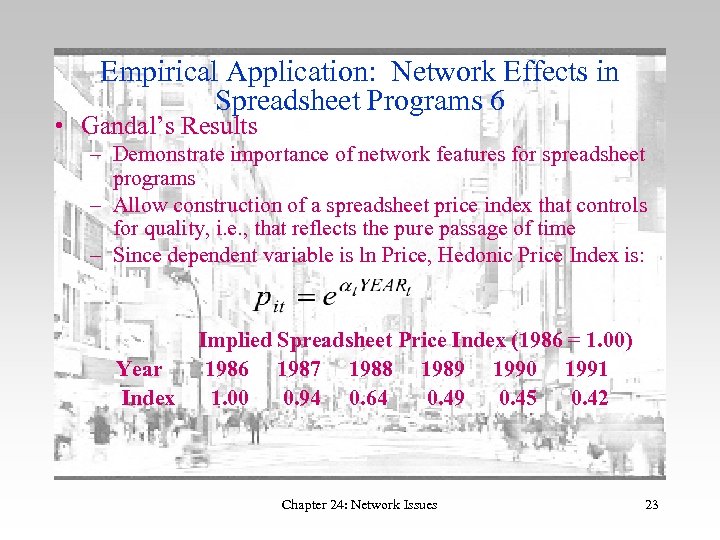

Empirical Application: Network Effects in Spreadsheet Programs 6 • Gandal’s Results – Demonstrate importance of network features for spreadsheet programs – Allow construction of a spreadsheet price index that controls for quality, i. e. , that reflects the pure passage of time – Since dependent variable is ln Price, Hedonic Price Index is: Year Index Implied Spreadsheet Price Index (1986 = 1. 00) 1986 1987 1988 1989 1990 1991 1. 00 0. 94 0. 64 0. 49 0. 45 0. 42 Chapter 24: Network Issues 23

Empirical Application: Network Effects in Spreadsheet Programs 6 • Gandal’s Results – Demonstrate importance of network features for spreadsheet programs – Allow construction of a spreadsheet price index that controls for quality, i. e. , that reflects the pure passage of time – Since dependent variable is ln Price, Hedonic Price Index is: Year Index Implied Spreadsheet Price Index (1986 = 1. 00) 1986 1987 1988 1989 1990 1991 1. 00 0. 94 0. 64 0. 49 0. 45 0. 42 Chapter 24: Network Issues 23