Week 5_Mergers and Antitrust.ppt

- Количество слайдов: 22

Mergers and Antitrust Instructor: Zhanar Dessyupova, MPA

Mergers and Antitrust Instructor: Zhanar Dessyupova, MPA

Major Topics Merger defined Reasons for Merger 3 types of mergers Antitrust Regulation Case studies P&G and Gillette Boeing and Mc. Donnell Douglas

Major Topics Merger defined Reasons for Merger 3 types of mergers Antitrust Regulation Case studies P&G and Gillette Boeing and Mc. Donnell Douglas

Questions What is merger? What is the difference between merger and takeover? Can you provide any example of merger in Kazakhstan? Can you divide in 2 groups and write as many as possible reasons for merger?

Questions What is merger? What is the difference between merger and takeover? Can you provide any example of merger in Kazakhstan? Can you divide in 2 groups and write as many as possible reasons for merger?

Mergers A merger is a transaction that results in the transfer of ownership and control of a corporation. If it is done voluntary - a ‘merger’ If it is forced - a ‘takeover’

Mergers A merger is a transaction that results in the transfer of ownership and control of a corporation. If it is done voluntary - a ‘merger’ If it is forced - a ‘takeover’

Reasons for merger Monopoly Firms want to monopolize market and control prices E. g. J. P. Morgan’s series of mergers leading to formation of US Steel Economies Pecuniary – monetary saving from buying goods and service more cheaply Real economies – coordination of work with better allocation of tasks, elimination of inefficiencies and increase in output

Reasons for merger Monopoly Firms want to monopolize market and control prices E. g. J. P. Morgan’s series of mergers leading to formation of US Steel Economies Pecuniary – monetary saving from buying goods and service more cheaply Real economies – coordination of work with better allocation of tasks, elimination of inefficiencies and increase in output

Reasons for merger Other motives Financial distress Retirements of owner To stabilize earnings “Empire –building” to compete with larger firms or eliminate competition

Reasons for merger Other motives Financial distress Retirements of owner To stabilize earnings “Empire –building” to compete with larger firms or eliminate competition

Economies of Scale There are several types of economy of scale: technical economies, when producing the good by using expensive machinery intensively managerial economies, by employing specialist managers financial economies, by borrowing at lower rates of interest

Economies of Scale There are several types of economy of scale: technical economies, when producing the good by using expensive machinery intensively managerial economies, by employing specialist managers financial economies, by borrowing at lower rates of interest

Economies of Scale commercial economies, by buying materials in bulk marketing economies, spreading the cost of advertising and promotion research and development economies, from developing better products

Economies of Scale commercial economies, by buying materials in bulk marketing economies, spreading the cost of advertising and promotion research and development economies, from developing better products

Economies of Scale There are sometimes problems that can affect integrated firms. These are known as ‘diseconomies of scale’ firms are too big to operate effectively decisions take too long to make poor communication occurs

Economies of Scale There are sometimes problems that can affect integrated firms. These are known as ‘diseconomies of scale’ firms are too big to operate effectively decisions take too long to make poor communication occurs

3 Types of Mergers Economists distinguish between three types of mergers: Horizontal Vertical Conglomerate

3 Types of Mergers Economists distinguish between three types of mergers: Horizontal Vertical Conglomerate

Horizontal mergers A horizontal merger results in the consolidation of firms that are direct rivals in the same market merge. Not all horizontal mergers harm competition. However, the potential to harm is clear since the result is to reduce the number of rivals.

Horizontal mergers A horizontal merger results in the consolidation of firms that are direct rivals in the same market merge. Not all horizontal mergers harm competition. However, the potential to harm is clear since the result is to reduce the number of rivals.

Horizontal mergers This type of merger can either have a very large effect or little to no effect on the market. When two extremely small companies combine, or horizontally merge, the results of the merger are less noticeable. If a small local drug store were to horizontally merge with another local drugstore, the effect of this merger on the drugstore market would be minimal.

Horizontal mergers This type of merger can either have a very large effect or little to no effect on the market. When two extremely small companies combine, or horizontally merge, the results of the merger are less noticeable. If a small local drug store were to horizontally merge with another local drugstore, the effect of this merger on the drugstore market would be minimal.

Horizontal mergers In a large horizontal merger, however, the resulting ripple effects can be felt throughout the market sector and sometimes throughout the whole economy. E. g. : Merger of two aircraft companies Boeing-Mc. Donnell Douglas. Or if say, Mc. Donald's were to merge with Burger King

Horizontal mergers In a large horizontal merger, however, the resulting ripple effects can be felt throughout the market sector and sometimes throughout the whole economy. E. g. : Merger of two aircraft companies Boeing-Mc. Donnell Douglas. Or if say, Mc. Donald's were to merge with Burger King

Vertical Mergers The merger of firms that have actual or potential buyer-seller relationships Examples: The acquisition of Detroit Steel Corporation by Cleveland - Cliffs Iron (a supplier of iron ore).

Vertical Mergers The merger of firms that have actual or potential buyer-seller relationships Examples: The acquisition of Detroit Steel Corporation by Cleveland - Cliffs Iron (a supplier of iron ore).

Conglomerate mergers Consolidated firms may sell related products, share marketing and distribution channels and perhaps production processes; or they may be wholly unrelated.

Conglomerate mergers Consolidated firms may sell related products, share marketing and distribution channels and perhaps production processes; or they may be wholly unrelated.

Conglomerate mergers Product extension conglomerate mergers involve firms that sell noncompeting products use related marketing channels of production processes. Examples: Citicorp-Travelers Insurance; Pepsico-Pizza Hut; Proctor & Gamble-Clorox.

Conglomerate mergers Product extension conglomerate mergers involve firms that sell noncompeting products use related marketing channels of production processes. Examples: Citicorp-Travelers Insurance; Pepsico-Pizza Hut; Proctor & Gamble-Clorox.

Conglomerate mergers • Market extension conglomerate mergers join together firms that sell competing products in separate geographic markets. Example: Acquisition by a chain of supermarkets in Almaty of a supermarket chain in Astana

Conglomerate mergers • Market extension conglomerate mergers join together firms that sell competing products in separate geographic markets. Example: Acquisition by a chain of supermarkets in Almaty of a supermarket chain in Astana

Conglomerate mergers A pure conglomerate merger unites firms that have no obvious relationship of any kind. Examples: Bank. Corp of America. Hughes Electronics ; AT&T-Hartford Insurance

Conglomerate mergers A pure conglomerate merger unites firms that have no obvious relationship of any kind. Examples: Bank. Corp of America. Hughes Electronics ; AT&T-Hartford Insurance

Public Policy Toward Mergers Clayton 7 as amended by the Celler. Kefauver Act: “No corporation engaged in commerce shall acquire… the whole or any part of the stock or other share capital of another corporation engaged also in commerce, …. If the effect of such acquisition may be substantially to lessen competition, or to tend to create a monopoly.

Public Policy Toward Mergers Clayton 7 as amended by the Celler. Kefauver Act: “No corporation engaged in commerce shall acquire… the whole or any part of the stock or other share capital of another corporation engaged also in commerce, …. If the effect of such acquisition may be substantially to lessen competition, or to tend to create a monopoly.

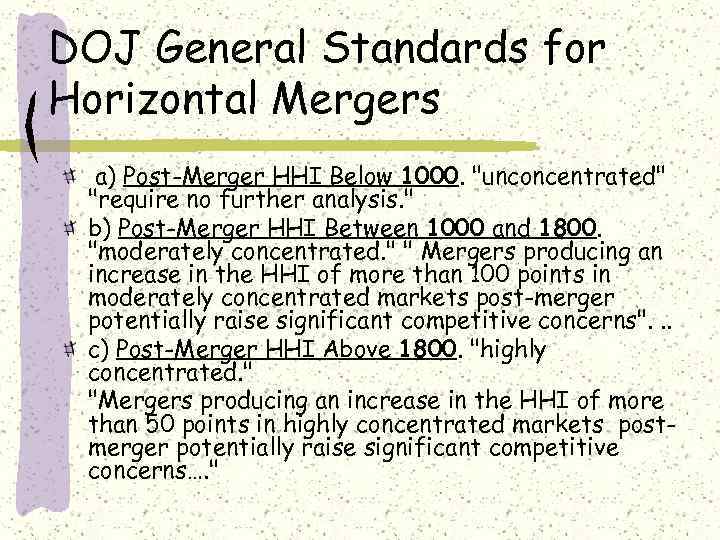

DOJ General Standards for Horizontal Mergers a) Post-Merger HHI Below 1000. "unconcentrated" "require no further analysis. " b) Post-Merger HHI Between 1000 and 1800. "moderately concentrated. " " Mergers producing an increase in the HHI of more than 100 points in moderately concentrated markets post-merger potentially raise significant competitive concerns". . . c) Post-Merger HHI Above 1800. "highly concentrated. " "Mergers producing an increase in the HHI of more than 50 points in highly concentrated markets postmerger potentially raise significant competitive concerns…. "

DOJ General Standards for Horizontal Mergers a) Post-Merger HHI Below 1000. "unconcentrated" "require no further analysis. " b) Post-Merger HHI Between 1000 and 1800. "moderately concentrated. " " Mergers producing an increase in the HHI of more than 100 points in moderately concentrated markets post-merger potentially raise significant competitive concerns". . . c) Post-Merger HHI Above 1800. "highly concentrated. " "Mergers producing an increase in the HHI of more than 50 points in highly concentrated markets postmerger potentially raise significant competitive concerns…. "

Conclusion It would seem that horizontal mergers would invariably be welfare-reducing. However, if the consolidation of direct rivals leads to greater cost efficiency, then a horizontal merger could (in theory at least) be welfare-enhancing

Conclusion It would seem that horizontal mergers would invariably be welfare-reducing. However, if the consolidation of direct rivals leads to greater cost efficiency, then a horizontal merger could (in theory at least) be welfare-enhancing

Thank you for attention!!!!

Thank you for attention!!!!