Lecture The International Trade Theory 1. The International

11686-lecture_7___the_international_trade_theory.ppt

- Количество слайдов: 14

Lecture The International Trade Theory

Lecture The International Trade Theory

1. The International Trade and it's Basic Theories 2. The Balance of Payments 3. The Exchange Rates

1. The International Trade and it's Basic Theories 2. The Balance of Payments 3. The Exchange Rates

Balance of Payments (BOP) – платіжний баланс Foreign Exchange Reserves – валютні резерви Foreign Exchange Rates – валютні курс

Balance of Payments (BOP) – платіжний баланс Foreign Exchange Reserves – валютні резерви Foreign Exchange Rates – валютні курс

International trade is exchange of capital, goods, and services across international borders or territories. In most countries, it represents a significant share of gross domestic product (GDP). In order to understand how international trade increases the welfare of its citizens we need to consider why trade takes place. To do this the principles of absolute and comparative advantage should be considered.

International trade is exchange of capital, goods, and services across international borders or territories. In most countries, it represents a significant share of gross domestic product (GDP). In order to understand how international trade increases the welfare of its citizens we need to consider why trade takes place. To do this the principles of absolute and comparative advantage should be considered.

The Principle of Absolute Advantage The main concept of absolute advantage is generally attributed to Adam Smith for his 1776 publication An Inquiry into the Nature and Causes of the Wealth of Nations. A country has an absolute advantage over it trading partners if it is able to produce more of a good or service with the same amount of resources or the same amount of a good or service with fewer resources.

The Principle of Absolute Advantage The main concept of absolute advantage is generally attributed to Adam Smith for his 1776 publication An Inquiry into the Nature and Causes of the Wealth of Nations. A country has an absolute advantage over it trading partners if it is able to produce more of a good or service with the same amount of resources or the same amount of a good or service with fewer resources.

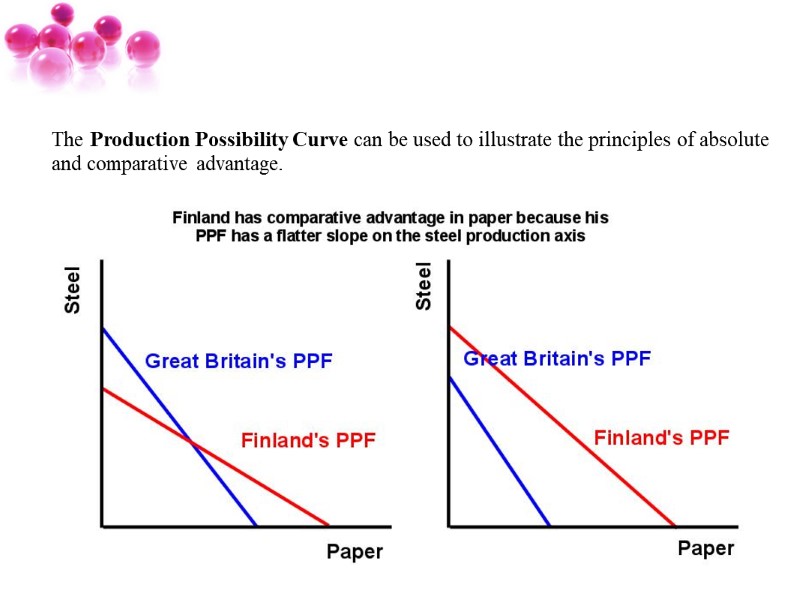

The Principle of Comparative Advantage The Ricardian model focuses on comparative advantage. In a Ricardian model, countries specialize in producing what they produce best. A country has a comparative advantage in the production of a good or service that it produces at a lower opportunity cost than its trading partners. Some countries have an absolute advantage in the production of many goods relative to their trading partners. Some have an absolute disadvantage. They are inefficient in producing anything, relative to their trading partners. The theory of comparative costs argues that, it is better for a country that is inefficient at producing a good or service to specialise in the production of that good it is least inefficient at, compared with producing other goods.

The Principle of Comparative Advantage The Ricardian model focuses on comparative advantage. In a Ricardian model, countries specialize in producing what they produce best. A country has a comparative advantage in the production of a good or service that it produces at a lower opportunity cost than its trading partners. Some countries have an absolute advantage in the production of many goods relative to their trading partners. Some have an absolute disadvantage. They are inefficient in producing anything, relative to their trading partners. The theory of comparative costs argues that, it is better for a country that is inefficient at producing a good or service to specialise in the production of that good it is least inefficient at, compared with producing other goods.

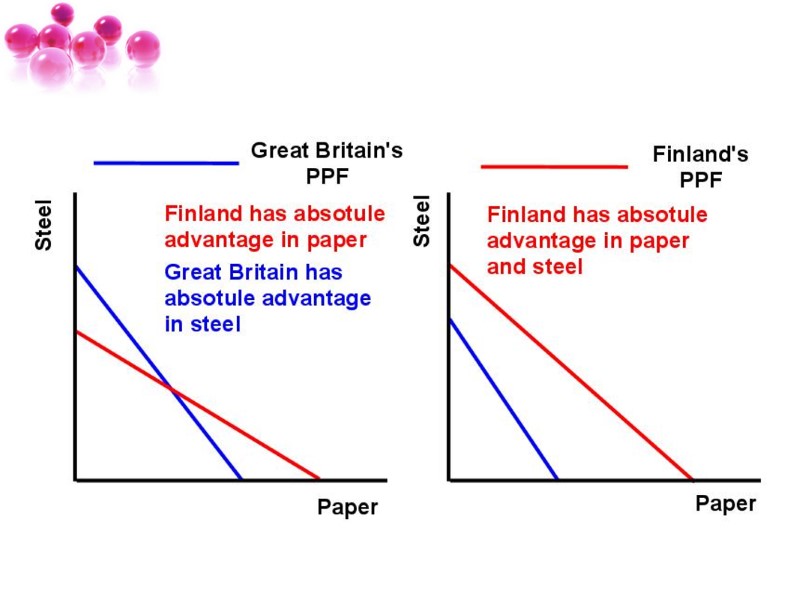

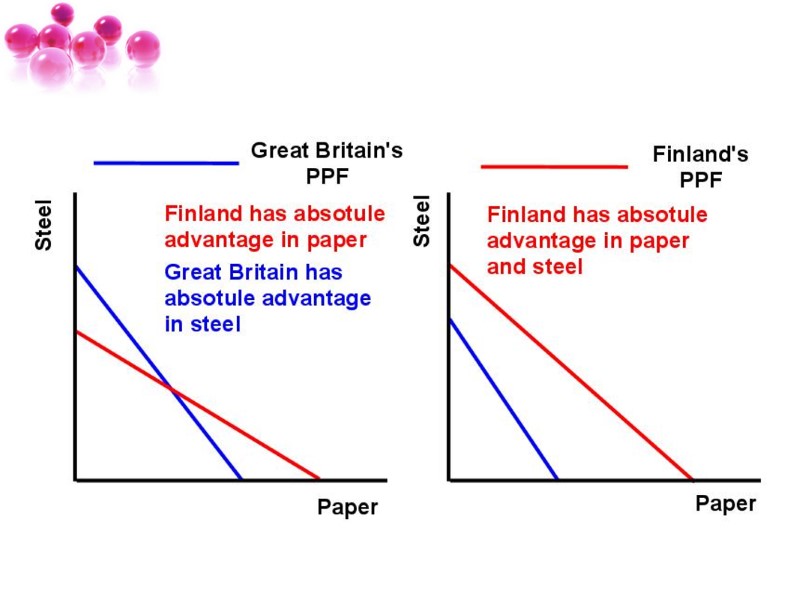

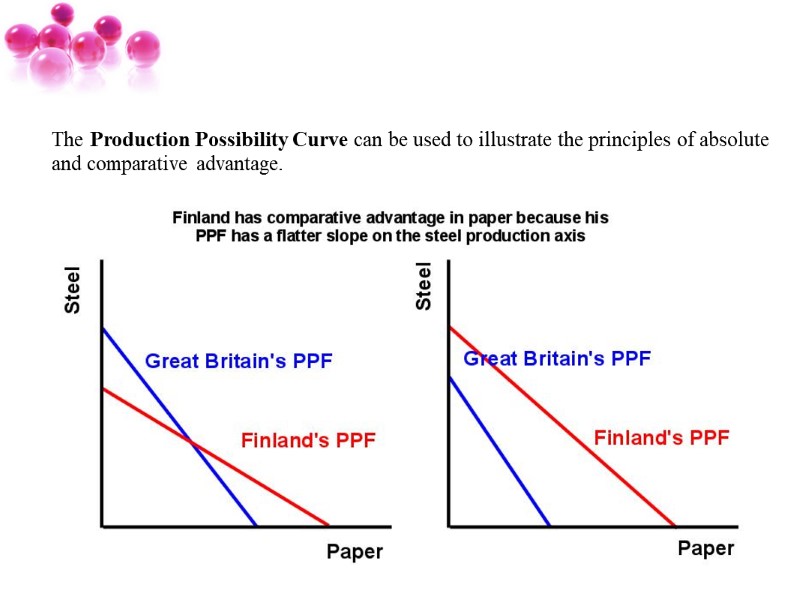

The Production Possibility Curve can be used to illustrate the principles of absolute and comparative advantage.

The Production Possibility Curve can be used to illustrate the principles of absolute and comparative advantage.

The balance of payments (BOP) sheet is an accounting record of all monetary transactions between a country and the rest of the world. These transactions include payments for the country's exports and imports of goods, services, and financial capital, as well as financial transfers. Sources of funds for a nation, such as exports or the receipts of loans and investments, are recorded as positive or surplus items. Uses of funds, such as for imports or to invest in foreign countries, are recorded as a negative or deficit item.

The balance of payments (BOP) sheet is an accounting record of all monetary transactions between a country and the rest of the world. These transactions include payments for the country's exports and imports of goods, services, and financial capital, as well as financial transfers. Sources of funds for a nation, such as exports or the receipts of loans and investments, are recorded as positive or surplus items. Uses of funds, such as for imports or to invest in foreign countries, are recorded as a negative or deficit item.

The exchange rates (also known as the foreign-exchange rate, forex rate or FX rate) between two currencies specify how much one currency is worth in terms of the other. It is the value of a foreign nation’s currency in terms of the home nation’s currency. When we say exchange rate we usually mean nominal exchange rate. The "real exchange rate" (RER) is the purchasing power of two currencies relative to one another. It is based on the GDP deflator measurement of the price level in the domestic and foreign countries (P,Pf), which is arbitrarily set equal to 1 in a given base year.

The exchange rates (also known as the foreign-exchange rate, forex rate or FX rate) between two currencies specify how much one currency is worth in terms of the other. It is the value of a foreign nation’s currency in terms of the home nation’s currency. When we say exchange rate we usually mean nominal exchange rate. The "real exchange rate" (RER) is the purchasing power of two currencies relative to one another. It is based on the GDP deflator measurement of the price level in the domestic and foreign countries (P,Pf), which is arbitrarily set equal to 1 in a given base year.

Floating Rates Floating rates are the main type of foreign exchange rates and the primary reason for currency fluctuations in foreign exchange markets. All major economies from developed countries allow the value of their currencies to float freely under market forces. Floating rates are preferable if a country's economy is strong enough to withstand the constant change in the value of its currency.

Floating Rates Floating rates are the main type of foreign exchange rates and the primary reason for currency fluctuations in foreign exchange markets. All major economies from developed countries allow the value of their currencies to float freely under market forces. Floating rates are preferable if a country's economy is strong enough to withstand the constant change in the value of its currency.

Fixed Rates The smaller economies of developing countries use fixed foreign exchange rates to promote trade and attract foreign investments. For example, by fixing its currency against the currencies of other countries, a country keeps export prices affordable to foreign buyers and accumulates trade surplus over time. Fixed currency rates also allow a country to assure foreign investors of the stable value of their investments in the country.

Fixed Rates The smaller economies of developing countries use fixed foreign exchange rates to promote trade and attract foreign investments. For example, by fixing its currency against the currencies of other countries, a country keeps export prices affordable to foreign buyers and accumulates trade surplus over time. Fixed currency rates also allow a country to assure foreign investors of the stable value of their investments in the country.

Pegged Rates Pegged foreign exchange rates are a compromise between floating rates and fixed rates. Under pegged rates, a country allows its currency to fluctuate within a fixed band around a periodically adjusted central value. Pegged rates are more appropriate for a transitioning, developing economy. They allow both stability and a certain degree of market adjustments. While no artificial exchange rates, fixed or pegged, can fix economic problems single-handed, they do provide an opportunity for growth. Countries hope that economic improvements can bring in the foreign currency reserves required to keep the stated rates.

Pegged Rates Pegged foreign exchange rates are a compromise between floating rates and fixed rates. Under pegged rates, a country allows its currency to fluctuate within a fixed band around a periodically adjusted central value. Pegged rates are more appropriate for a transitioning, developing economy. They allow both stability and a certain degree of market adjustments. While no artificial exchange rates, fixed or pegged, can fix economic problems single-handed, they do provide an opportunity for growth. Countries hope that economic improvements can bring in the foreign currency reserves required to keep the stated rates.

Dollarization Dollarization occurs when the inhabitants of a country use foreign currency in parallel to or instead of the domestic currency. The term is not only applied to usage of the United States dollar, but generally to the use of any foreign currency as the national currency.

Dollarization Dollarization occurs when the inhabitants of a country use foreign currency in parallel to or instead of the domestic currency. The term is not only applied to usage of the United States dollar, but generally to the use of any foreign currency as the national currency.