lection 4.ppt

- Количество слайдов: 19

LECTION 4. INTRODUCTION TO THE HEDGING 1. Description of hedging. 2. Key points about basis. 3. Long hedging. 4. Short hedging.

LECTION 4. INTRODUCTION TO THE HEDGING 1. Description of hedging. 2. Key points about basis. 3. Long hedging. 4. Short hedging.

1. Description of hedging. • Hedging is a component of risk management. • The primary objective of hedging is not to make money. The primary objective of hedging is to minimize price risk and this includes using hedging to minimize losses. • This same concept applies to hedging in which hedgers might be willing to give up some of the revenues for a known price, and speculators would require the opportunity for more revenue by assuming the price risk.

1. Description of hedging. • Hedging is a component of risk management. • The primary objective of hedging is not to make money. The primary objective of hedging is to minimize price risk and this includes using hedging to minimize losses. • This same concept applies to hedging in which hedgers might be willing to give up some of the revenues for a known price, and speculators would require the opportunity for more revenue by assuming the price risk.

For example, • suppose that in late April Joe Farmer plants 500 acres of corn. At this time, Joe Farmer notices that he can forward price a portion of his corn production through the futures market at $2. 80/bushel. Knowing that his cost of production is $2. 45/bushel, Joe is willing to price one-third of his anticipated production at $2. 80/bushel. That is, hedging by the agricultural producer generally involves selling the commodity at the commodity exchange market because producers want to lock in a price floor (a minimum price they will receive). Joe sells a futures contract for his corn, speculators or hedgers (entities such as grain elevators looking to lock in a price ceiling for the grain they are forward contracting) simultaneously are buying the contracts. Now, what can happen? The following analysis holds basis constant.

For example, • suppose that in late April Joe Farmer plants 500 acres of corn. At this time, Joe Farmer notices that he can forward price a portion of his corn production through the futures market at $2. 80/bushel. Knowing that his cost of production is $2. 45/bushel, Joe is willing to price one-third of his anticipated production at $2. 80/bushel. That is, hedging by the agricultural producer generally involves selling the commodity at the commodity exchange market because producers want to lock in a price floor (a minimum price they will receive). Joe sells a futures contract for his corn, speculators or hedgers (entities such as grain elevators looking to lock in a price ceiling for the grain they are forward contracting) simultaneously are buying the contracts. Now, what can happen? The following analysis holds basis constant.

The result of hedging… • • If the futures price goes higher. . . Assume the fall futures and cash price of corn goes up to $3. 00/bushel when Joe is ready to harvest the crop. Joe loses $0. 20/bushel in the futures market, but he gains this back in the cash market through the simultaneous cash price increase with the futures price. At worst, Joe receives $2. 80/bushel for his hedged grain (commissions are not used for this example which would lower the price Joe receives by a small amount). If the futures price goes lower. . . The fall futures and cash price of corn goes down to $2. 50/bushel when Joe is ready to harvest the crop. Joe gains $0. 30/bushel in the futures market, but loses in the cash market through the simultaneous price decrease with the futures price. At worst, Joe receives $2. 80/bushel for his hedged grain less commissions. If the futures price doesn't change. . . The fall futures and cash price of corn stays at $2. 80/bushel when Joe is ready to harvest the crop. Joe does not gain in either the futures or cash market except for potential basis gain or loss. At worst, Joe receives $2. 80/bushel for his hedged grain less commissions. What are the Costs of Hedging? The costs of hedging are straightforward; however, these expenses can become substantial over time. Commissions are paid to a broker for administrative costs, futures exchange operation, and futures exchange regulation. These costs can range from $9 to $35 or more per order. An order is either a buy or sell order. Therefore, to enter and exit the market the total costs can range from $18 to $70 or more.

The result of hedging… • • If the futures price goes higher. . . Assume the fall futures and cash price of corn goes up to $3. 00/bushel when Joe is ready to harvest the crop. Joe loses $0. 20/bushel in the futures market, but he gains this back in the cash market through the simultaneous cash price increase with the futures price. At worst, Joe receives $2. 80/bushel for his hedged grain (commissions are not used for this example which would lower the price Joe receives by a small amount). If the futures price goes lower. . . The fall futures and cash price of corn goes down to $2. 50/bushel when Joe is ready to harvest the crop. Joe gains $0. 30/bushel in the futures market, but loses in the cash market through the simultaneous price decrease with the futures price. At worst, Joe receives $2. 80/bushel for his hedged grain less commissions. If the futures price doesn't change. . . The fall futures and cash price of corn stays at $2. 80/bushel when Joe is ready to harvest the crop. Joe does not gain in either the futures or cash market except for potential basis gain or loss. At worst, Joe receives $2. 80/bushel for his hedged grain less commissions. What are the Costs of Hedging? The costs of hedging are straightforward; however, these expenses can become substantial over time. Commissions are paid to a broker for administrative costs, futures exchange operation, and futures exchange regulation. These costs can range from $9 to $35 or more per order. An order is either a buy or sell order. Therefore, to enter and exit the market the total costs can range from $18 to $70 or more.

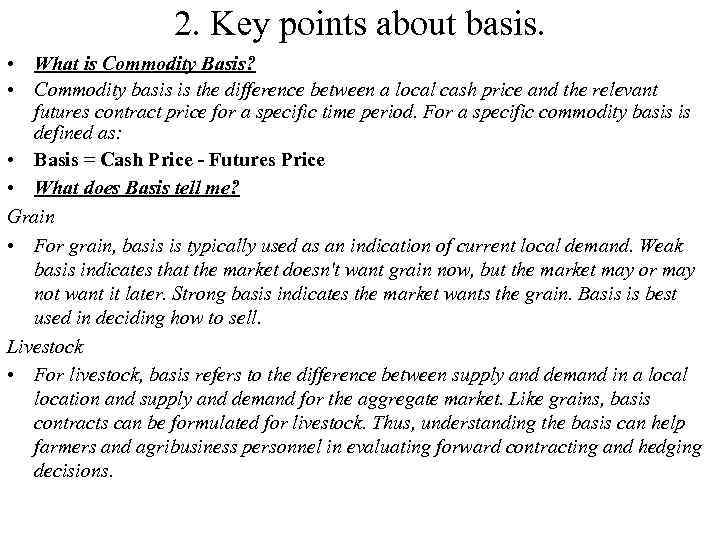

2. Key points about basis. • What is Commodity Basis? • Commodity basis is the difference between a local cash price and the relevant futures contract price for a specific time period. For a specific commodity basis is defined as: • Basis = Cash Price - Futures Price • What does Basis tell me? Grain • For grain, basis is typically used as an indication of current local demand. Weak basis indicates that the market doesn't want grain now, but the market may or may not want it later. Strong basis indicates the market wants the grain. Basis is best used in deciding how to sell. Livestock • For livestock, basis refers to the difference between supply and demand in a local location and supply and demand for the aggregate market. Like grains, basis contracts can be formulated for livestock. Thus, understanding the basis can help farmers and agribusiness personnel in evaluating forward contracting and hedging decisions.

2. Key points about basis. • What is Commodity Basis? • Commodity basis is the difference between a local cash price and the relevant futures contract price for a specific time period. For a specific commodity basis is defined as: • Basis = Cash Price - Futures Price • What does Basis tell me? Grain • For grain, basis is typically used as an indication of current local demand. Weak basis indicates that the market doesn't want grain now, but the market may or may not want it later. Strong basis indicates the market wants the grain. Basis is best used in deciding how to sell. Livestock • For livestock, basis refers to the difference between supply and demand in a local location and supply and demand for the aggregate market. Like grains, basis contracts can be formulated for livestock. Thus, understanding the basis can help farmers and agribusiness personnel in evaluating forward contracting and hedging decisions.

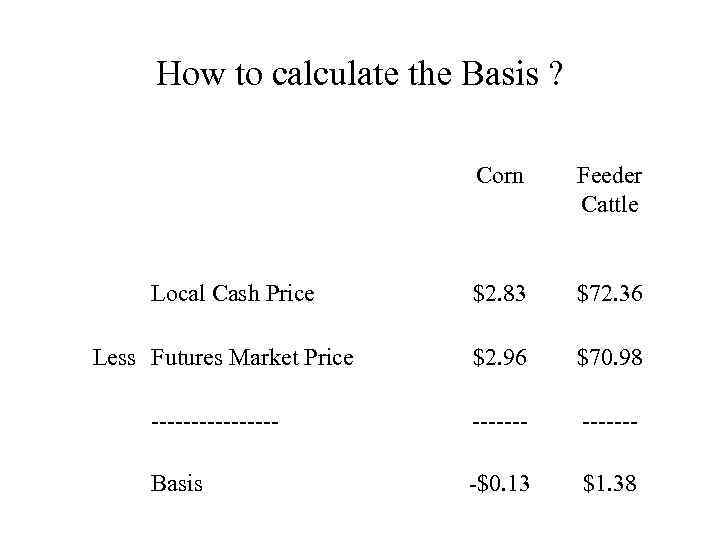

How to calculate the Basis ? Corn Feeder Cattle Local Cash Price Less Futures Market Price $2. 83 $72. 36 $2. 96 $70. 98 -------- Basis -$0. 13 $1. 38

How to calculate the Basis ? Corn Feeder Cattle Local Cash Price Less Futures Market Price $2. 83 $72. 36 $2. 96 $70. 98 -------- Basis -$0. 13 $1. 38

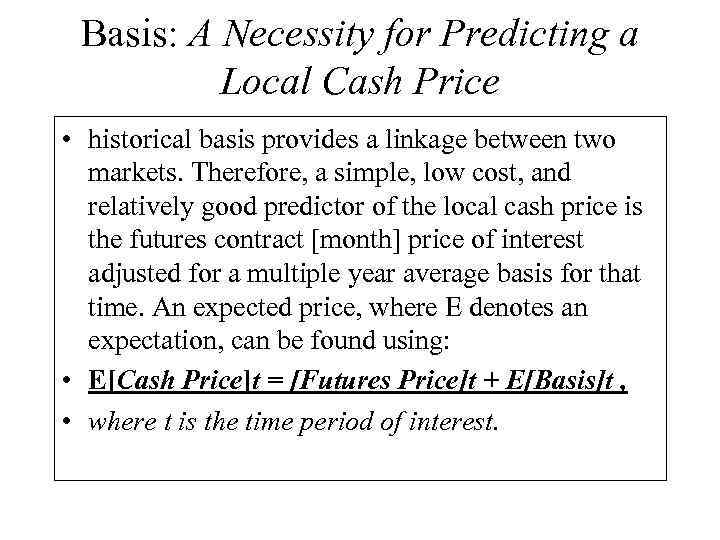

Basis: A Necessity for Predicting a Local Cash Price • historical basis provides a linkage between two markets. Therefore, a simple, low cost, and relatively good predictor of the local cash price is the futures contract [month] price of interest adjusted for a multiple year average basis for that time. An expected price, where E denotes an expectation, can be found using: • E[Cash Price]t = [Futures Price]t + E[Basis]t , • where t is the time period of interest.

Basis: A Necessity for Predicting a Local Cash Price • historical basis provides a linkage between two markets. Therefore, a simple, low cost, and relatively good predictor of the local cash price is the futures contract [month] price of interest adjusted for a multiple year average basis for that time. An expected price, where E denotes an expectation, can be found using: • E[Cash Price]t = [Futures Price]t + E[Basis]t , • where t is the time period of interest.

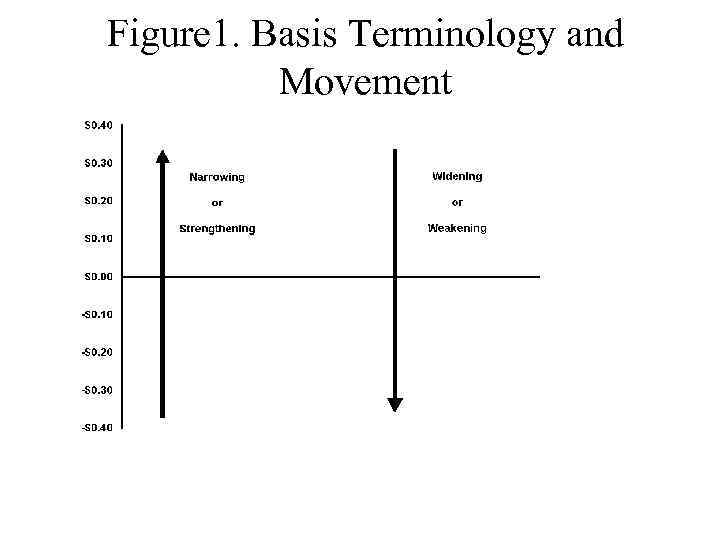

Figure 1. Basis Terminology and Movement

Figure 1. Basis Terminology and Movement

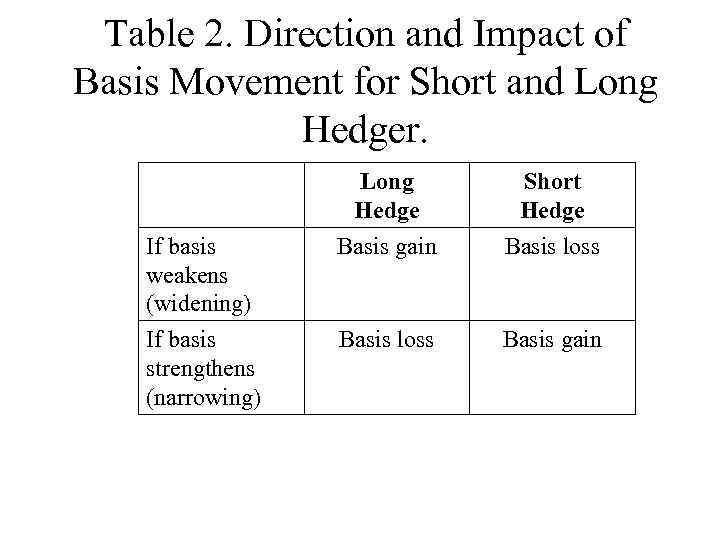

Table 2. Direction and Impact of Basis Movement for Short and Long Hedger. Long Hedge Short Hedge If basis weakens (widening) Basis gain Basis loss If basis strengthens (narrowing) Basis loss Basis gain

Table 2. Direction and Impact of Basis Movement for Short and Long Hedger. Long Hedge Short Hedge If basis weakens (widening) Basis gain Basis loss If basis strengthens (narrowing) Basis loss Basis gain

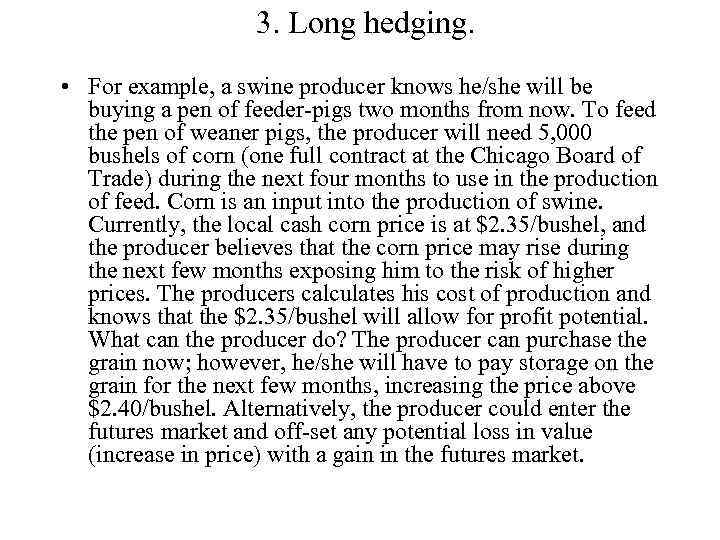

3. Long hedging. • For example, a swine producer knows he/she will be buying a pen of feeder-pigs two months from now. To feed the pen of weaner pigs, the producer will need 5, 000 bushels of corn (one full contract at the Chicago Board of Trade) during the next four months to use in the production of feed. Corn is an input into the production of swine. Currently, the local cash corn price is at $2. 35/bushel, and the producer believes that the corn price may rise during the next few months exposing him to the risk of higher prices. The producers calculates his cost of production and knows that the $2. 35/bushel will allow for profit potential. What can the producer do? The producer can purchase the grain now; however, he/she will have to pay storage on the grain for the next few months, increasing the price above $2. 40/bushel. Alternatively, the producer could enter the futures market and off-set any potential loss in value (increase in price) with a gain in the futures market.

3. Long hedging. • For example, a swine producer knows he/she will be buying a pen of feeder-pigs two months from now. To feed the pen of weaner pigs, the producer will need 5, 000 bushels of corn (one full contract at the Chicago Board of Trade) during the next four months to use in the production of feed. Corn is an input into the production of swine. Currently, the local cash corn price is at $2. 35/bushel, and the producer believes that the corn price may rise during the next few months exposing him to the risk of higher prices. The producers calculates his cost of production and knows that the $2. 35/bushel will allow for profit potential. What can the producer do? The producer can purchase the grain now; however, he/she will have to pay storage on the grain for the next few months, increasing the price above $2. 40/bushel. Alternatively, the producer could enter the futures market and off-set any potential loss in value (increase in price) with a gain in the futures market.

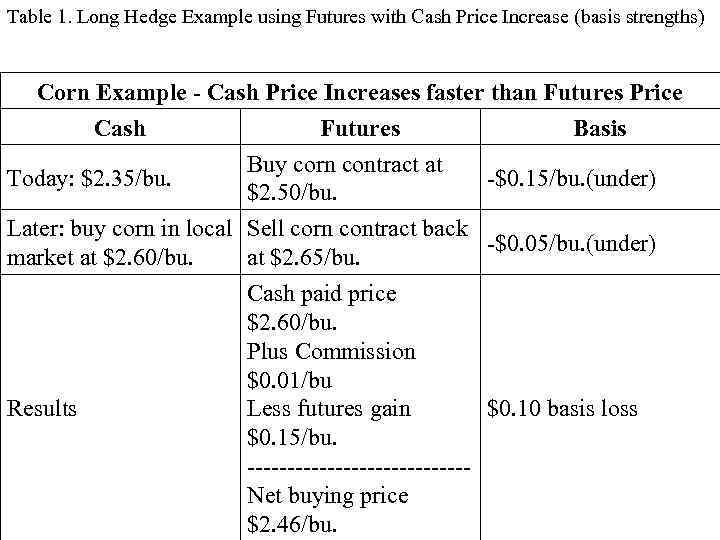

Table 1. Long Hedge Example using Futures with Cash Price Increase (basis strengths) Corn Example - Cash Price Increases faster than Futures Price Cash Futures Basis Buy corn contract at Today: $2. 35/bu. -$0. 15/bu. (under) $2. 50/bu. Later: buy corn in local Sell corn contract back -$0. 05/bu. (under) market at $2. 60/bu. at $2. 65/bu. Cash paid price $2. 60/bu. Plus Commission $0. 01/bu Results Less futures gain $0. 10 basis loss $0. 15/bu. --------------Net buying price $2. 46/bu.

Table 1. Long Hedge Example using Futures with Cash Price Increase (basis strengths) Corn Example - Cash Price Increases faster than Futures Price Cash Futures Basis Buy corn contract at Today: $2. 35/bu. -$0. 15/bu. (under) $2. 50/bu. Later: buy corn in local Sell corn contract back -$0. 05/bu. (under) market at $2. 60/bu. at $2. 65/bu. Cash paid price $2. 60/bu. Plus Commission $0. 01/bu Results Less futures gain $0. 10 basis loss $0. 15/bu. --------------Net buying price $2. 46/bu.

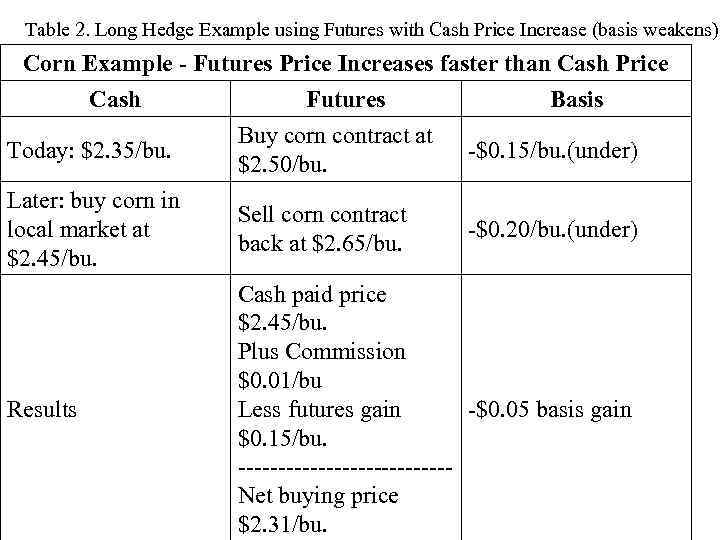

Table 2. Long Hedge Example using Futures with Cash Price Increase (basis weakens) Corn Example - Futures Price Increases faster than Cash Price Cash Futures Basis Buy corn contract at Today: $2. 35/bu. -$0. 15/bu. (under) $2. 50/bu. Later: buy corn in local market at $2. 45/bu. Sell corn contract back at $2. 65/bu. Results Cash paid price $2. 45/bu. Plus Commission $0. 01/bu Less futures gain -$0. 05 basis gain $0. 15/bu. -------------Net buying price $2. 31/bu. -$0. 20/bu. (under)

Table 2. Long Hedge Example using Futures with Cash Price Increase (basis weakens) Corn Example - Futures Price Increases faster than Cash Price Cash Futures Basis Buy corn contract at Today: $2. 35/bu. -$0. 15/bu. (under) $2. 50/bu. Later: buy corn in local market at $2. 45/bu. Sell corn contract back at $2. 65/bu. Results Cash paid price $2. 45/bu. Plus Commission $0. 01/bu Less futures gain -$0. 05 basis gain $0. 15/bu. -------------Net buying price $2. 31/bu. -$0. 20/bu. (under)

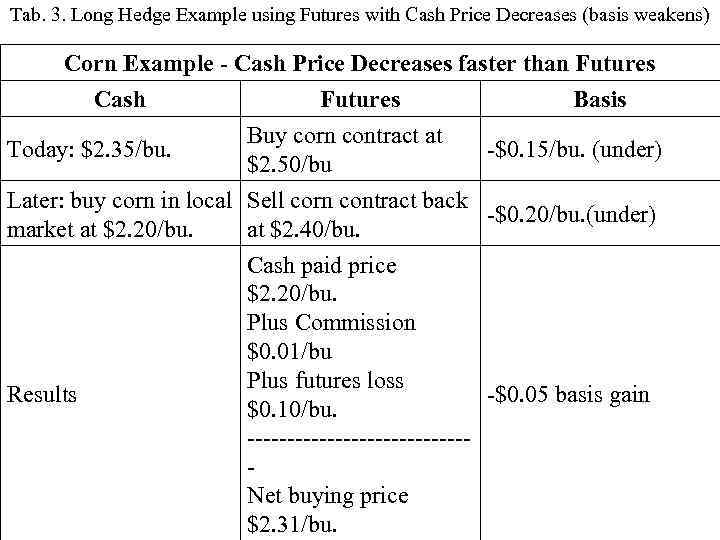

Tab. 3. Long Hedge Example using Futures with Cash Price Decreases (basis weakens) Corn Example - Cash Price Decreases faster than Futures Cash Futures Basis Buy corn contract at Today: $2. 35/bu. -$0. 15/bu. (under) $2. 50/bu Later: buy corn in local Sell corn contract back -$0. 20/bu. (under) market at $2. 20/bu. at $2. 40/bu. Results Cash paid price $2. 20/bu. Plus Commission $0. 01/bu Plus futures loss -$0. 05 basis gain $0. 10/bu. --------------Net buying price $2. 31/bu.

Tab. 3. Long Hedge Example using Futures with Cash Price Decreases (basis weakens) Corn Example - Cash Price Decreases faster than Futures Cash Futures Basis Buy corn contract at Today: $2. 35/bu. -$0. 15/bu. (under) $2. 50/bu Later: buy corn in local Sell corn contract back -$0. 20/bu. (under) market at $2. 20/bu. at $2. 40/bu. Results Cash paid price $2. 20/bu. Plus Commission $0. 01/bu Plus futures loss -$0. 05 basis gain $0. 10/bu. --------------Net buying price $2. 31/bu.

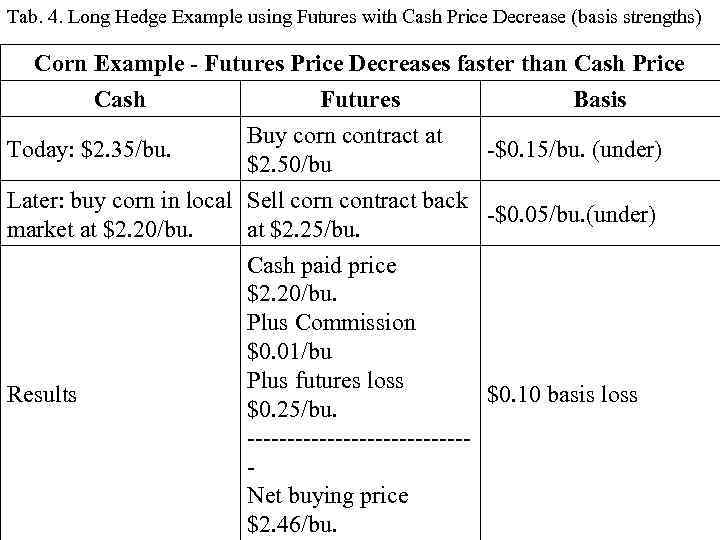

Tab. 4. Long Hedge Example using Futures with Cash Price Decrease (basis strengths) Corn Example - Futures Price Decreases faster than Cash Price Cash Futures Basis Buy corn contract at Today: $2. 35/bu. -$0. 15/bu. (under) $2. 50/bu Later: buy corn in local Sell corn contract back -$0. 05/bu. (under) market at $2. 20/bu. at $2. 25/bu. Results Cash paid price $2. 20/bu. Plus Commission $0. 01/bu Plus futures loss $0. 10 basis loss $0. 25/bu. --------------Net buying price $2. 46/bu.

Tab. 4. Long Hedge Example using Futures with Cash Price Decrease (basis strengths) Corn Example - Futures Price Decreases faster than Cash Price Cash Futures Basis Buy corn contract at Today: $2. 35/bu. -$0. 15/bu. (under) $2. 50/bu Later: buy corn in local Sell corn contract back -$0. 05/bu. (under) market at $2. 20/bu. at $2. 25/bu. Results Cash paid price $2. 20/bu. Plus Commission $0. 01/bu Plus futures loss $0. 10 basis loss $0. 25/bu. --------------Net buying price $2. 46/bu.

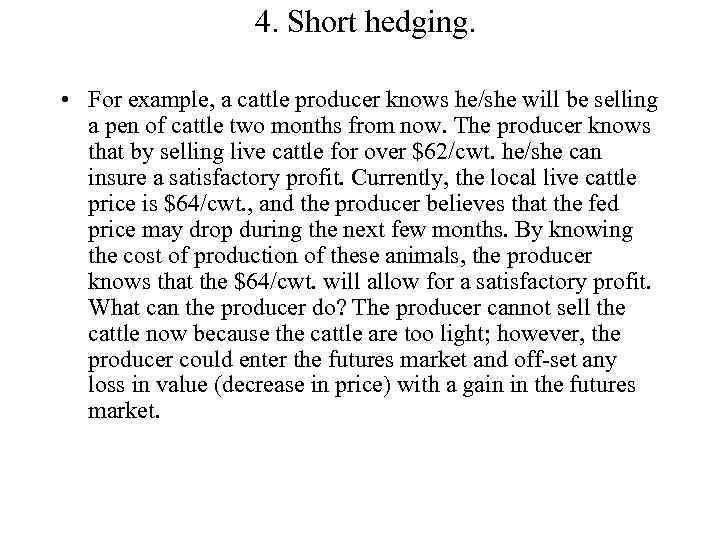

4. Short hedging. • For example, a cattle producer knows he/she will be selling a pen of cattle two months from now. The producer knows that by selling live cattle for over $62/cwt. he/she can insure a satisfactory profit. Currently, the local live cattle price is $64/cwt. , and the producer believes that the fed price may drop during the next few months. By knowing the cost of production of these animals, the producer knows that the $64/cwt. will allow for a satisfactory profit. What can the producer do? The producer cannot sell the cattle now because the cattle are too light; however, the producer could enter the futures market and off-set any loss in value (decrease in price) with a gain in the futures market.

4. Short hedging. • For example, a cattle producer knows he/she will be selling a pen of cattle two months from now. The producer knows that by selling live cattle for over $62/cwt. he/she can insure a satisfactory profit. Currently, the local live cattle price is $64/cwt. , and the producer believes that the fed price may drop during the next few months. By knowing the cost of production of these animals, the producer knows that the $64/cwt. will allow for a satisfactory profit. What can the producer do? The producer cannot sell the cattle now because the cattle are too light; however, the producer could enter the futures market and off-set any loss in value (decrease in price) with a gain in the futures market.

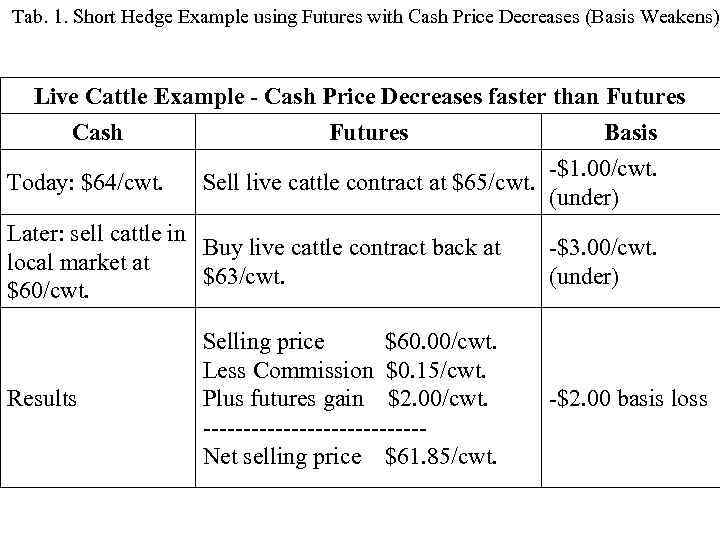

Tab. 1. Short Hedge Example using Futures with Cash Price Decreases (Basis Weakens) Live Cattle Example - Cash Price Decreases faster than Futures Cash Futures Basis -$1. 00/cwt. Today: $64/cwt. Sell live cattle contract at $65/cwt. (under) Later: sell cattle in Buy live cattle contract back at local market at $63/cwt. $60/cwt. Results Selling price $60. 00/cwt. Less Commission $0. 15/cwt. Plus futures gain $2. 00/cwt. --------------Net selling price $61. 85/cwt. -$3. 00/cwt. (under) -$2. 00 basis loss

Tab. 1. Short Hedge Example using Futures with Cash Price Decreases (Basis Weakens) Live Cattle Example - Cash Price Decreases faster than Futures Cash Futures Basis -$1. 00/cwt. Today: $64/cwt. Sell live cattle contract at $65/cwt. (under) Later: sell cattle in Buy live cattle contract back at local market at $63/cwt. $60/cwt. Results Selling price $60. 00/cwt. Less Commission $0. 15/cwt. Plus futures gain $2. 00/cwt. --------------Net selling price $61. 85/cwt. -$3. 00/cwt. (under) -$2. 00 basis loss

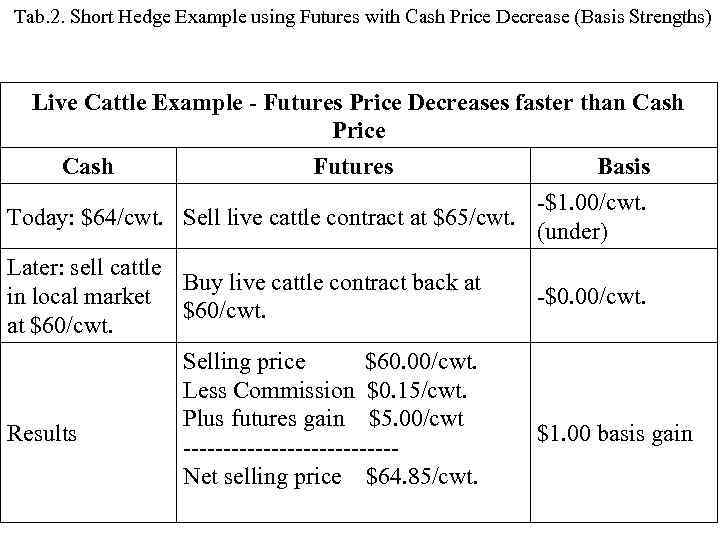

Tab. 2. Short Hedge Example using Futures with Cash Price Decrease (Basis Strengths) Live Cattle Example - Futures Price Decreases faster than Cash Price Cash Futures Basis -$1. 00/cwt. Today: $64/cwt. Sell live cattle contract at $65/cwt. (under) Later: sell cattle Buy live cattle contract back at in local market $60/cwt. at $60/cwt. Results Selling price $60. 00/cwt. Less Commission $0. 15/cwt. Plus futures gain $5. 00/cwt -------------Net selling price $64. 85/cwt. -$0. 00/cwt. $1. 00 basis gain

Tab. 2. Short Hedge Example using Futures with Cash Price Decrease (Basis Strengths) Live Cattle Example - Futures Price Decreases faster than Cash Price Cash Futures Basis -$1. 00/cwt. Today: $64/cwt. Sell live cattle contract at $65/cwt. (under) Later: sell cattle Buy live cattle contract back at in local market $60/cwt. at $60/cwt. Results Selling price $60. 00/cwt. Less Commission $0. 15/cwt. Plus futures gain $5. 00/cwt -------------Net selling price $64. 85/cwt. -$0. 00/cwt. $1. 00 basis gain

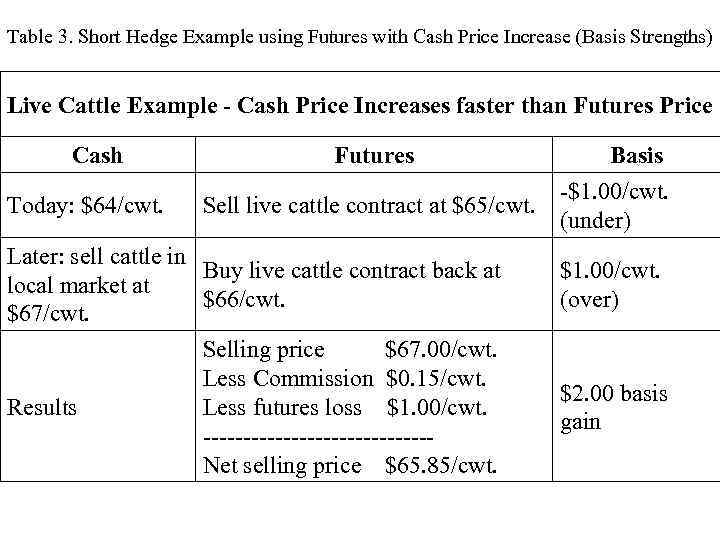

Table 3. Short Hedge Example using Futures with Cash Price Increase (Basis Strengths) Live Cattle Example - Cash Price Increases faster than Futures Price Cash Today: $64/cwt. Futures Sell live cattle contract at $65/cwt. Later: sell cattle in Buy live cattle contract back at local market at $66/cwt. $67/cwt. Selling price $67. 00/cwt. Less Commission $0. 15/cwt. Results Less futures loss $1. 00/cwt. --------------Net selling price $65. 85/cwt. Basis -$1. 00/cwt. (under) $1. 00/cwt. (over) $2. 00 basis gain

Table 3. Short Hedge Example using Futures with Cash Price Increase (Basis Strengths) Live Cattle Example - Cash Price Increases faster than Futures Price Cash Today: $64/cwt. Futures Sell live cattle contract at $65/cwt. Later: sell cattle in Buy live cattle contract back at local market at $66/cwt. $67/cwt. Selling price $67. 00/cwt. Less Commission $0. 15/cwt. Results Less futures loss $1. 00/cwt. --------------Net selling price $65. 85/cwt. Basis -$1. 00/cwt. (under) $1. 00/cwt. (over) $2. 00 basis gain

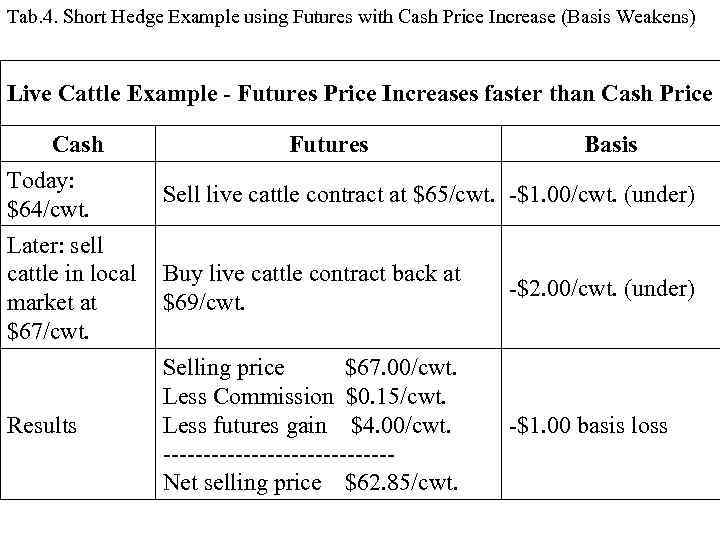

Tab. 4. Short Hedge Example using Futures with Cash Price Increase (Basis Weakens) Live Cattle Example - Futures Price Increases faster than Cash Price Cash Today: $64/cwt. Futures Basis Sell live cattle contract at $65/cwt. -$1. 00/cwt. (under) Later: sell cattle in local Buy live cattle contract back at market at $69/cwt. $67/cwt. Selling price $67. 00/cwt. Less Commission $0. 15/cwt. Results Less futures gain $4. 00/cwt. --------------Net selling price $62. 85/cwt. -$2. 00/cwt. (under) -$1. 00 basis loss

Tab. 4. Short Hedge Example using Futures with Cash Price Increase (Basis Weakens) Live Cattle Example - Futures Price Increases faster than Cash Price Cash Today: $64/cwt. Futures Basis Sell live cattle contract at $65/cwt. -$1. 00/cwt. (under) Later: sell cattle in local Buy live cattle contract back at market at $69/cwt. $67/cwt. Selling price $67. 00/cwt. Less Commission $0. 15/cwt. Results Less futures gain $4. 00/cwt. --------------Net selling price $62. 85/cwt. -$2. 00/cwt. (under) -$1. 00 basis loss