UA JNSD market overview 2013.pptx

- Количество слайдов: 34

JNSD Category Update 2013 Ukraine NY/2013 -12 -16

JNSD Category Update 2013 Ukraine NY/2013 -12 -16

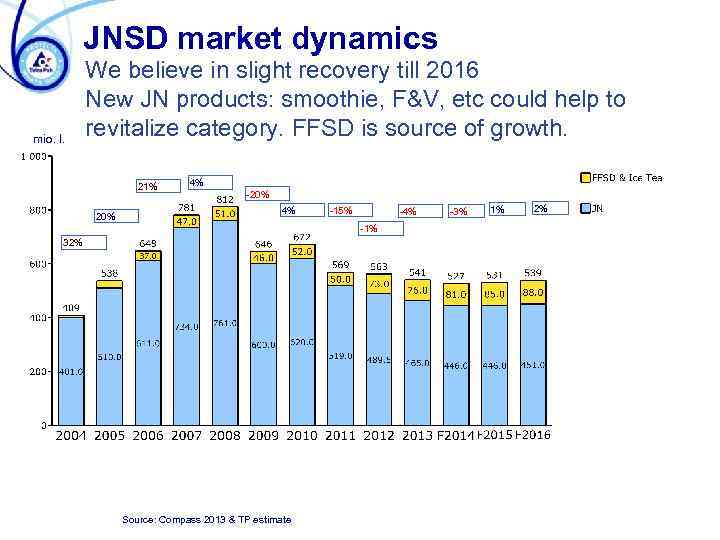

JNSD market dynamics mio. l. We believe in slight recovery till 2016 New JN products: smoothie, F&V, etc could help to revitalize category. FFSD is source of growth. 21% 20% 4% -15% -4% -1% 32% Source: Compass 2013 & TP estimate -3% 1% 2%

JNSD market dynamics mio. l. We believe in slight recovery till 2016 New JN products: smoothie, F&V, etc could help to revitalize category. FFSD is source of growth. 21% 20% 4% -15% -4% -1% 32% Source: Compass 2013 & TP estimate -3% 1% 2%

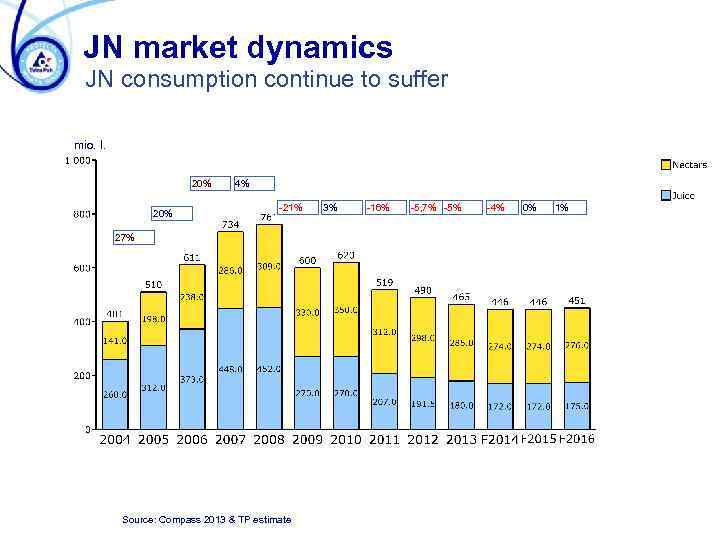

JN market dynamics JN consumption continue to suffer mio. l. 20% 4% -21% 27% Source: Compass 2013 & TP estimate 3% -16% -5, 7% -5% -4% 0% 1%

JN market dynamics JN consumption continue to suffer mio. l. 20% 4% -21% 27% Source: Compass 2013 & TP estimate 3% -16% -5, 7% -5% -4% 0% 1%

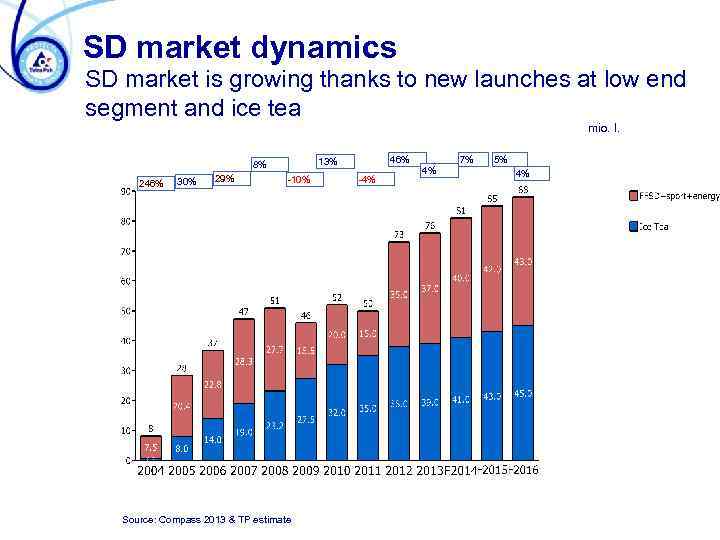

SD market dynamics SD market is growing thanks to new launches at low end segment and ice tea mio. l. 246% 30% 29% 46% 13% 8% -10% Source: Compass 2013 & TP estimate -4% 7% 4% 5% 4%

SD market dynamics SD market is growing thanks to new launches at low end segment and ice tea mio. l. 246% 30% 29% 46% 13% 8% -10% Source: Compass 2013 & TP estimate -4% 7% 4% 5% 4%

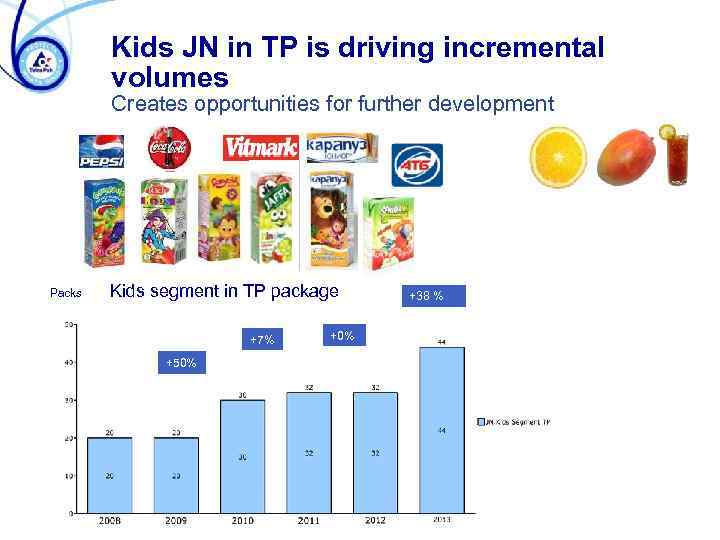

Kids JN in TP is driving incremental volumes Creates opportunities for further development Packs Kids segment in TP package +7% +50% +38 %

Kids JN in TP is driving incremental volumes Creates opportunities for further development Packs Kids segment in TP package +7% +50% +38 %

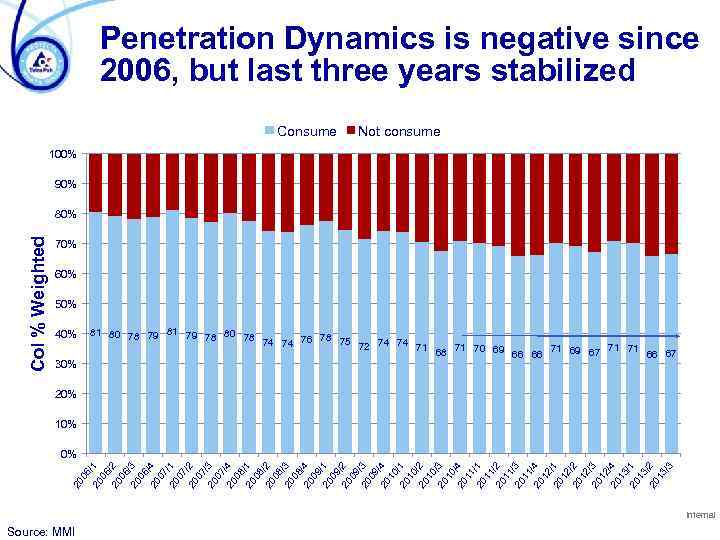

6 20 /1 06 20 /2 06 20 /3 06 20 /4 07 20 /1 07 20 /2 07 20 /3 07 20 /4 08 20 /1 08 20 /2 08 20 /3 08 2 /4 00 9 20 /1 09 20 /2 09 20 /3 09 20 /4 10 20 /1 10 20 /2 10 20 /3 10 20 /4 11 20 /1 11 20 /2 11 20 /3 11 20 /4 12 20 /1 12 20 /2 12 20 /3 12 20 /4 13 20 /1 13 20 /2 13 /3 20 0 Col % Weighted Penetration Dynamics is negative since 2006, but last three years stabilized Consume 40% 30% Source: MMI Not consume 100% 90% 80% 70% 60% 50% 81 80 78 79 81 79 78 80 78 78 75 74 74 76 72 74 74 71 71 70 69 71 69 67 71 71 68 66 67 66 66 20% 10% 0% Internal

6 20 /1 06 20 /2 06 20 /3 06 20 /4 07 20 /1 07 20 /2 07 20 /3 07 20 /4 08 20 /1 08 20 /2 08 20 /3 08 2 /4 00 9 20 /1 09 20 /2 09 20 /3 09 20 /4 10 20 /1 10 20 /2 10 20 /3 10 20 /4 11 20 /1 11 20 /2 11 20 /3 11 20 /4 12 20 /1 12 20 /2 12 20 /3 12 20 /4 13 20 /1 13 20 /2 13 /3 20 0 Col % Weighted Penetration Dynamics is negative since 2006, but last three years stabilized Consume 40% 30% Source: MMI Not consume 100% 90% 80% 70% 60% 50% 81 80 78 79 81 79 78 80 78 78 75 74 74 76 72 74 74 71 71 70 69 71 69 67 71 71 68 66 67 66 66 20% 10% 0% Internal

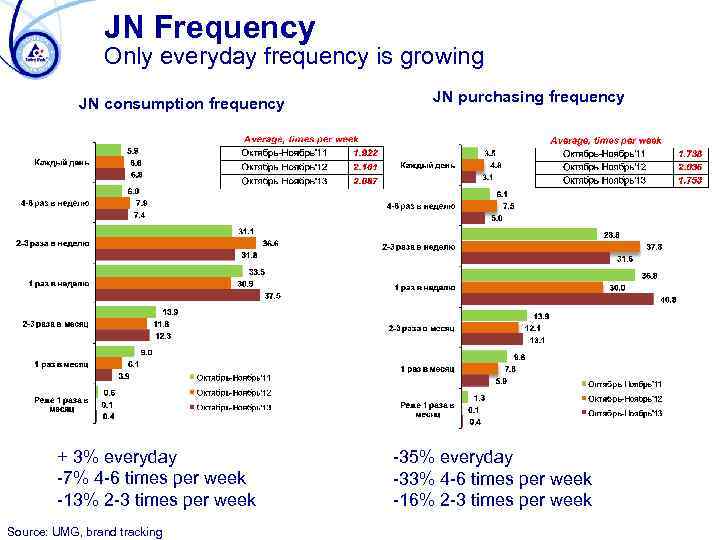

JN Frequency Only everyday frequency is growing JN consumption frequency + 3% everyday -7% 4 -6 times per week -13% 2 -3 times per week Source: UMG, brand tracking JN purchasing frequency -35% everyday -33% 4 -6 times per week -16% 2 -3 times per week

JN Frequency Only everyday frequency is growing JN consumption frequency + 3% everyday -7% 4 -6 times per week -13% 2 -3 times per week Source: UMG, brand tracking JN purchasing frequency -35% everyday -33% 4 -6 times per week -16% 2 -3 times per week

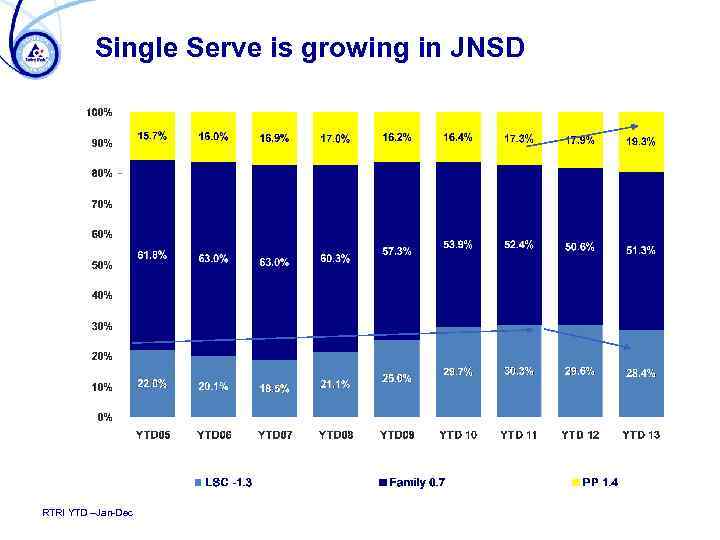

Single Serve is growing in JNSD RTRI YTD –Jan-Dec

Single Serve is growing in JNSD RTRI YTD –Jan-Dec

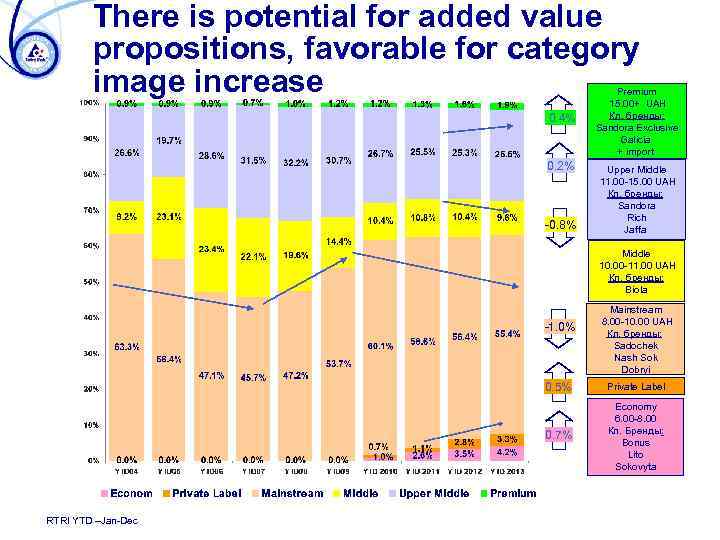

There is potential for added value propositions, favorable for category image increase 0. 4% 0. 2% -0. 8% Premium 15. 00+ UAH Кл. бренды; Sandora Exclusive Galicia + import Upper Middle 11. 00 -15. 00 UAH Кл. бренды: Sandora Rich Jaffa Middle 10. 00 -11. 00 UAH Кл. бренды: Biola -1. 0% Mainstream 8. 00 -10. 00 UAH Кл. бренды: Sadochek Nash Sok Dobryi 0. 5% 0. 7% RTRI YTD –Jan-Dec Private Label Economy 6. 00 -8. 00 Кл. Бренды: Bonus Lito Sokovyta

There is potential for added value propositions, favorable for category image increase 0. 4% 0. 2% -0. 8% Premium 15. 00+ UAH Кл. бренды; Sandora Exclusive Galicia + import Upper Middle 11. 00 -15. 00 UAH Кл. бренды: Sandora Rich Jaffa Middle 10. 00 -11. 00 UAH Кл. бренды: Biola -1. 0% Mainstream 8. 00 -10. 00 UAH Кл. бренды: Sadochek Nash Sok Dobryi 0. 5% 0. 7% RTRI YTD –Jan-Dec Private Label Economy 6. 00 -8. 00 Кл. Бренды: Bonus Lito Sokovyta

Average price per liter keeps growing…. . RTRI YTD –Jan-Dec

Average price per liter keeps growing…. . RTRI YTD –Jan-Dec

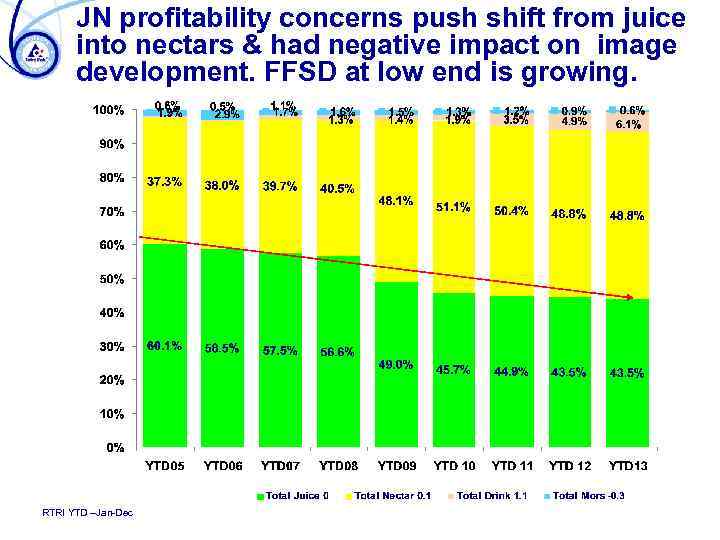

JN profitability concerns push shift from juice into nectars & had negative impact on image development. FFSD at low end is growing. RTRI YTD –Jan-Dec

JN profitability concerns push shift from juice into nectars & had negative impact on image development. FFSD at low end is growing. RTRI YTD –Jan-Dec

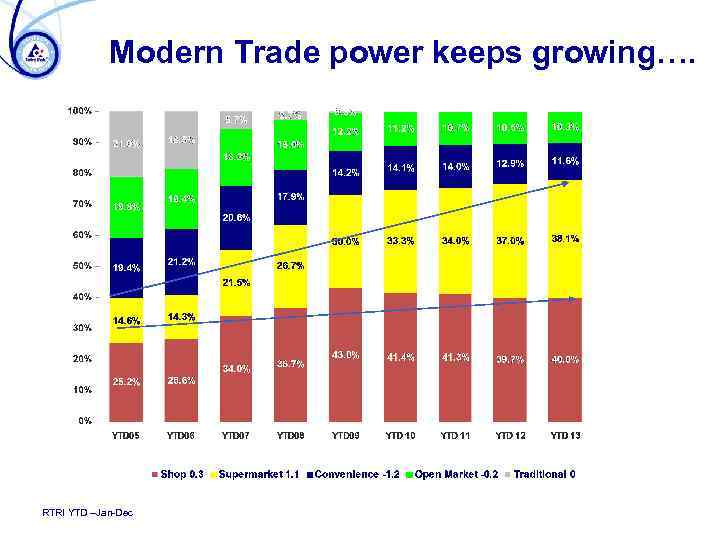

Modern Trade power keeps growing…. RTRI YTD –Jan-Dec

Modern Trade power keeps growing…. RTRI YTD –Jan-Dec

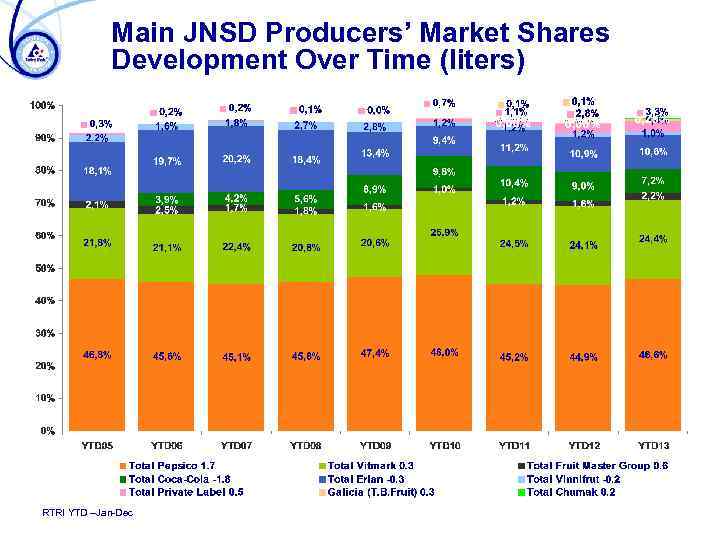

Main JNSD Producers’ Market Shares Development Over Time (liters) RTRI YTD –Jan-Dec

Main JNSD Producers’ Market Shares Development Over Time (liters) RTRI YTD –Jan-Dec

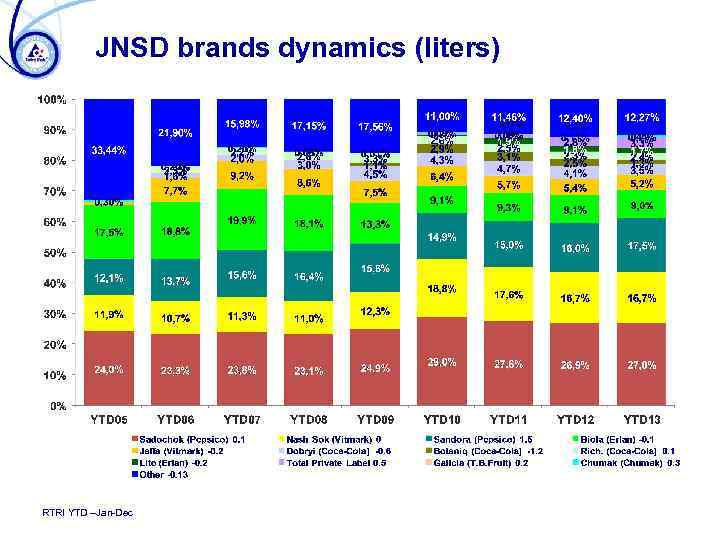

JNSD brands dynamics (liters) RTRI YTD –Jan-Dec

JNSD brands dynamics (liters) RTRI YTD –Jan-Dec

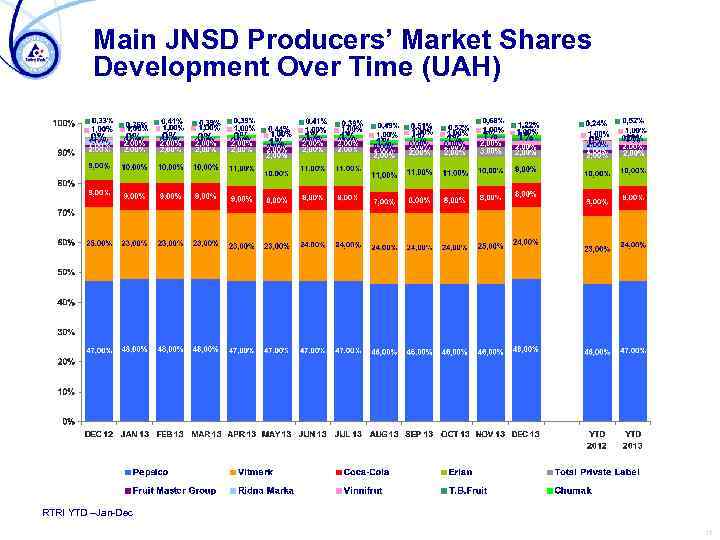

Main JNSD Producers’ Market Shares Development Over Time (UAH) RTRI YTD –Jan-Dec 17

Main JNSD Producers’ Market Shares Development Over Time (UAH) RTRI YTD –Jan-Dec 17

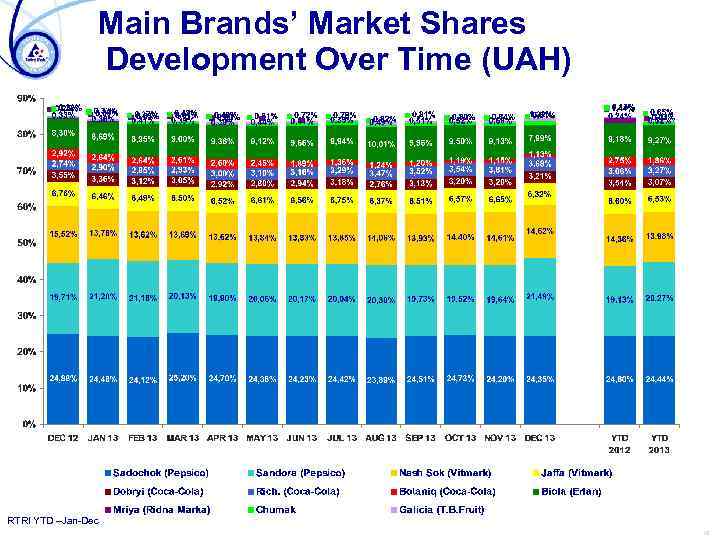

Main Brands’ Market Shares Development Over Time (UAH) RTRI YTD –Jan-Dec 18

Main Brands’ Market Shares Development Over Time (UAH) RTRI YTD –Jan-Dec 18

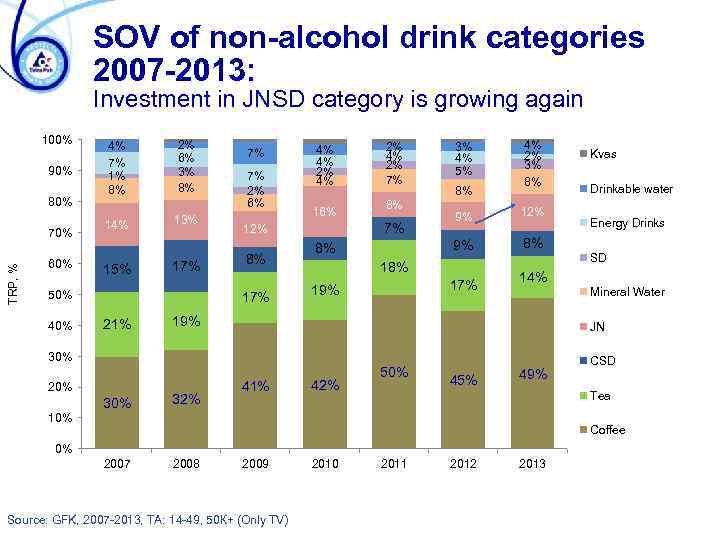

SOV of non-alcohol drink categories 2007 -2013: Investment in JNSD category is growing again 100% 90% 80% TRP, % 70% 60% 4% 7% 1% 8% 14% 15% 2% 6% 3% 8% 13% 17% 50% 40% 7% 7% 2% 6% 16% 8% 2% 4% 2% 7% 8% 3% 4% 5% 8% 4% 2% 3% 8% 8% 9% 12% 9% 7% 12% 17% 21% 4% 4% 2% 4% 8% 17% 19% 30% Energy Drinks SD Mineral Water 19% 32% Drinkable water 14% JN 30% 20% Kvas 41% 42% 50% 45% 49% CSD Tea 10% Coffee 0% 2007 2008 2009 Source: GFK, 2007 -2013, TA: 14 -49, 50 К+ (Only TV) 2010 2011 2012 2013

SOV of non-alcohol drink categories 2007 -2013: Investment in JNSD category is growing again 100% 90% 80% TRP, % 70% 60% 4% 7% 1% 8% 14% 15% 2% 6% 3% 8% 13% 17% 50% 40% 7% 7% 2% 6% 16% 8% 2% 4% 2% 7% 8% 3% 4% 5% 8% 4% 2% 3% 8% 8% 9% 12% 9% 7% 12% 17% 21% 4% 4% 2% 4% 8% 17% 19% 30% Energy Drinks SD Mineral Water 19% 32% Drinkable water 14% JN 30% 20% Kvas 41% 42% 50% 45% 49% CSD Tea 10% Coffee 0% 2007 2008 2009 Source: GFK, 2007 -2013, TA: 14 -49, 50 К+ (Only TV) 2010 2011 2012 2013

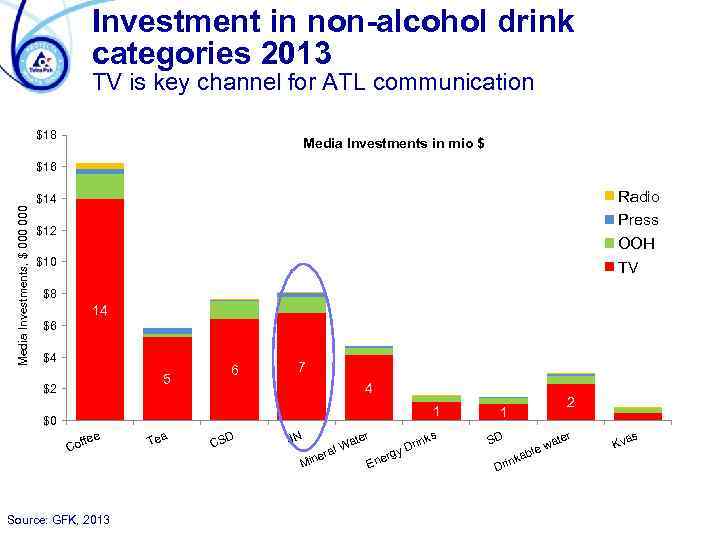

Investment in non-alcohol drink categories 2013 TV is key channel for ATL communication $18 Media Investments in mio $ Media Investments, $ 000 $16 Radio Press ООН TV $14 $12 $10 $8 14 $6 $4 6 5 $2 7 4 1 s SD $0 ffee Co Source: GFK, 2013 Tea D CS JN ter er Min a al W rink y D g r Ene 2 1 r b nka Dri ate le w s Kva

Investment in non-alcohol drink categories 2013 TV is key channel for ATL communication $18 Media Investments in mio $ Media Investments, $ 000 $16 Radio Press ООН TV $14 $12 $10 $8 14 $6 $4 6 5 $2 7 4 1 s SD $0 ffee Co Source: GFK, 2013 Tea D CS JN ter er Min a al W rink y D g r Ene 2 1 r b nka Dri ate le w s Kva

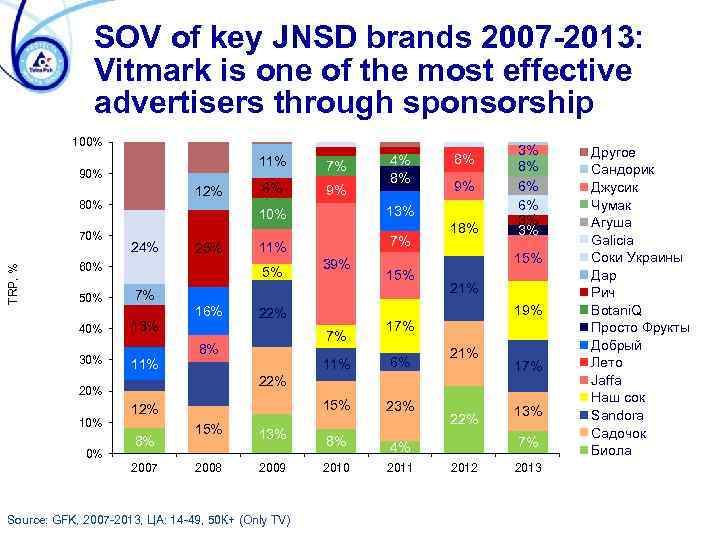

SOV of key JNSD brands 2007 -2013: Vitmark is one of the most effective advertisers through sponsorship 100% 11% 90% 12% 80% TRP, % 70% 40% 30% 24% 25% 0% 9% 11% 7% 39% 13% 11% 9% 15% 21% 19% 22% 7% 8% 17% 11% 6% 15% 23% 8% 21% 4% 22% 12% 8% 2007 15% 2008 13% 2009 Source: GFK, 2007 -2013, ЦА: 14 -49, 50 К+ (Only TV) 3% 8% 6% 6% 3% 3% 15% 7% 16% 8% 13% 5% 20% 10% 60% 50% 7% 4% 8% 2010 2011 22% 17% 13% 7% 2012 2013 Другое Сандорик Джусик Чумак Агуша Galicia Соки Украины Дар Рич Botani. Q Просто Фрукты Добрый Лето Jaffa Наш сок Sandora Садочок Биола

SOV of key JNSD brands 2007 -2013: Vitmark is one of the most effective advertisers through sponsorship 100% 11% 90% 12% 80% TRP, % 70% 40% 30% 24% 25% 0% 9% 11% 7% 39% 13% 11% 9% 15% 21% 19% 22% 7% 8% 17% 11% 6% 15% 23% 8% 21% 4% 22% 12% 8% 2007 15% 2008 13% 2009 Source: GFK, 2007 -2013, ЦА: 14 -49, 50 К+ (Only TV) 3% 8% 6% 6% 3% 3% 15% 7% 16% 8% 13% 5% 20% 10% 60% 50% 7% 4% 8% 2010 2011 22% 17% 13% 7% 2012 2013 Другое Сандорик Джусик Чумак Агуша Galicia Соки Украины Дар Рич Botani. Q Просто Фрукты Добрый Лето Jaffa Наш сок Sandora Садочок Биола

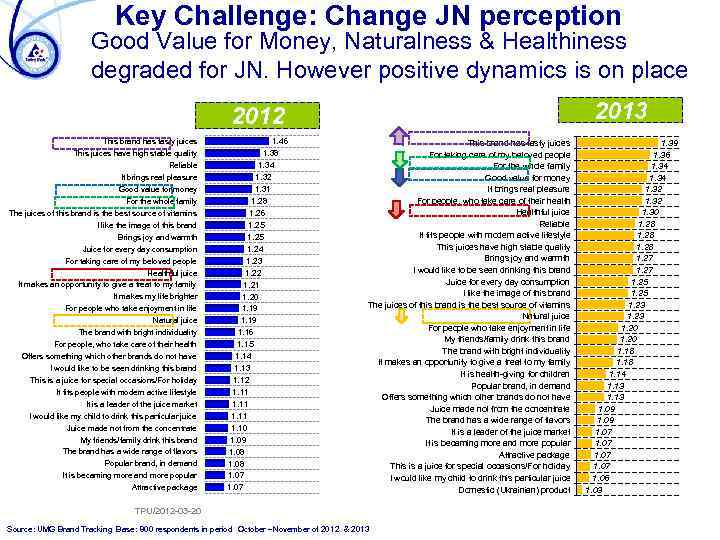

Key Challenge: Change JN perception Good Value for Money, Naturalness & Healthiness degraded for JN. However positive dynamics is on place 2013 2012 This brand has tasty juices This juices have high stable quality Reliable It brings real pleasure Good value for money For the whole family The juices of this brand is the best source of vitamins I like the image of this brand Brings joy and warmth Juice for every day consumption For taking care of my beloved people Healthful juice It makes an opportunity to give a treat to my family It makes my life brighter For people who take enjoyment in life Natural juice The brand with bright individuality For people, who take care of their health Offers something which other brands do not have I would like to be seen drinking this brand This is a juice for special occasions/For holiday It fits people with modern active lifestyle It is a leader of the juice market I would like my child to drink this particular juice Juice made not from the concentrate My friends/family drink this brand The brand has a wide range of flavors Popular brand, in demand It is becaming more and more popular Attractive package 1. 46 1. 38 1. 34 1. 32 1. 31 1. 28 1. 26 1. 25 1. 24 1. 23 1. 22 1. 21 1. 20 1. 19 1. 16 1. 15 1. 14 1. 13 1. 12 1. 11 1. 10 1. 09 1. 08 1. 07 This brand has tasty juices For taking care of my beloved people For the whole family Good value for money It brings real pleasure For people, who take care of their health Healthful juice Reliable It fits people with modern active lifestyle This juices have high stable quality Brings joy and warmth I would like to be seen drinking this brand Juice for every day consumption I like the image of this brand The juices of this brand is the best source of vitamins Natural juice For people who take enjoyment in life My friends/family drink this brand The brand with bright individuality It makes an opportunity to give a treat to my family It is health-giving for children Popular brand, in demand Offers something which other brands do not have Juice made not from the concentrate The brand has a wide range of flavors It is a leader of the juice market It is becaming more and more popular Attractive package This is a juice for special occasions/For holiday I would like my child to drink this particular juice Domestic (Ukrainian) product TPU/2012 -03 -20 Source: UMG Brand Tracking Base: 800 respondents in period October –November of 2012 & 2013 1. 39 1. 36 1. 34 1. 32 1. 30 1. 28 1. 27 1. 25 1. 23 1. 20 1. 18 1. 14 1. 13 1. 09 1. 07 1. 06 1. 03

Key Challenge: Change JN perception Good Value for Money, Naturalness & Healthiness degraded for JN. However positive dynamics is on place 2013 2012 This brand has tasty juices This juices have high stable quality Reliable It brings real pleasure Good value for money For the whole family The juices of this brand is the best source of vitamins I like the image of this brand Brings joy and warmth Juice for every day consumption For taking care of my beloved people Healthful juice It makes an opportunity to give a treat to my family It makes my life brighter For people who take enjoyment in life Natural juice The brand with bright individuality For people, who take care of their health Offers something which other brands do not have I would like to be seen drinking this brand This is a juice for special occasions/For holiday It fits people with modern active lifestyle It is a leader of the juice market I would like my child to drink this particular juice Juice made not from the concentrate My friends/family drink this brand The brand has a wide range of flavors Popular brand, in demand It is becaming more and more popular Attractive package 1. 46 1. 38 1. 34 1. 32 1. 31 1. 28 1. 26 1. 25 1. 24 1. 23 1. 22 1. 21 1. 20 1. 19 1. 16 1. 15 1. 14 1. 13 1. 12 1. 11 1. 10 1. 09 1. 08 1. 07 This brand has tasty juices For taking care of my beloved people For the whole family Good value for money It brings real pleasure For people, who take care of their health Healthful juice Reliable It fits people with modern active lifestyle This juices have high stable quality Brings joy and warmth I would like to be seen drinking this brand Juice for every day consumption I like the image of this brand The juices of this brand is the best source of vitamins Natural juice For people who take enjoyment in life My friends/family drink this brand The brand with bright individuality It makes an opportunity to give a treat to my family It is health-giving for children Popular brand, in demand Offers something which other brands do not have Juice made not from the concentrate The brand has a wide range of flavors It is a leader of the juice market It is becaming more and more popular Attractive package This is a juice for special occasions/For holiday I would like my child to drink this particular juice Domestic (Ukrainian) product TPU/2012 -03 -20 Source: UMG Brand Tracking Base: 800 respondents in period October –November of 2012 & 2013 1. 39 1. 36 1. 34 1. 32 1. 30 1. 28 1. 27 1. 25 1. 23 1. 20 1. 18 1. 14 1. 13 1. 09 1. 07 1. 06 1. 03

OOH JNSD Campaign 2013

OOH JNSD Campaign 2013

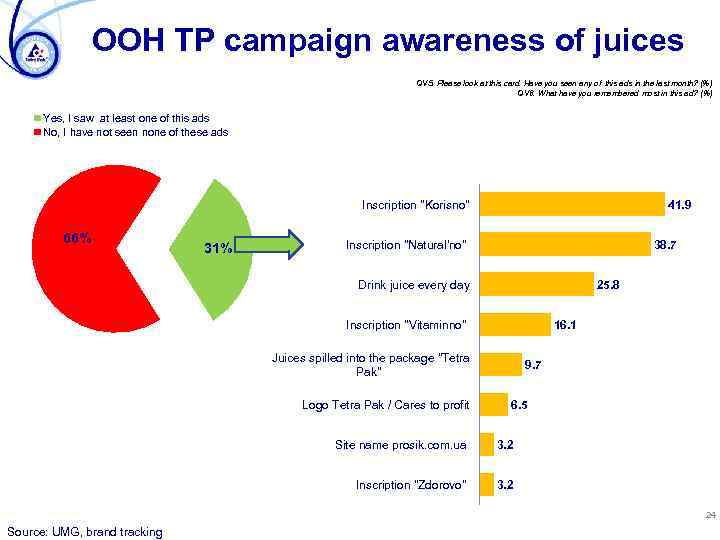

OOH TP campaign awareness of juices QV 5. Please look at this card. Have you seen any of this ads in the last month? (%) QV 6. What have you remembered most in this ad? (%) Yes, I saw at least one of this ads No, I have not seen none of these ads Inscription "Korisno" 66% 31% 41. 9 Inscription "Natural'no" 38. 7 Drink juice every day 25. 8 Inscription "Vіtamіnno" 16. 1 Juices spilled into the package "Tetra Pak" Logo Tetra Pak / Cares to profit 9. 7 6. 5 Site name prosik. com. ua 3. 2 Inscription "Zdorovo" 3. 2 24 Source: UMG, brand tracking

OOH TP campaign awareness of juices QV 5. Please look at this card. Have you seen any of this ads in the last month? (%) QV 6. What have you remembered most in this ad? (%) Yes, I saw at least one of this ads No, I have not seen none of these ads Inscription "Korisno" 66% 31% 41. 9 Inscription "Natural'no" 38. 7 Drink juice every day 25. 8 Inscription "Vіtamіnno" 16. 1 Juices spilled into the package "Tetra Pak" Logo Tetra Pak / Cares to profit 9. 7 6. 5 Site name prosik. com. ua 3. 2 Inscription "Zdorovo" 3. 2 24 Source: UMG, brand tracking

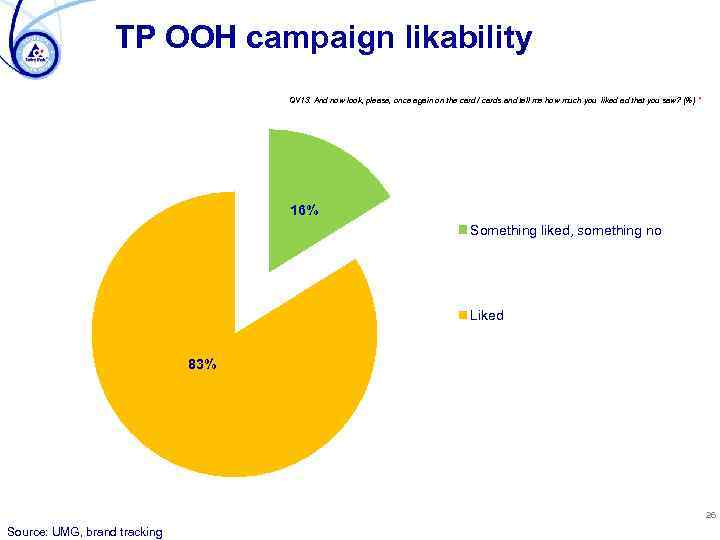

TP OOH campaign likability QV 13. And now look, please, once again on the card / cards and tell me how much you liked ad that you saw? (%) * 16% Something liked, something no Liked 83% 26 Source: UMG, brand tracking

TP OOH campaign likability QV 13. And now look, please, once again on the card / cards and tell me how much you liked ad that you saw? (%) * 16% Something liked, something no Liked 83% 26 Source: UMG, brand tracking

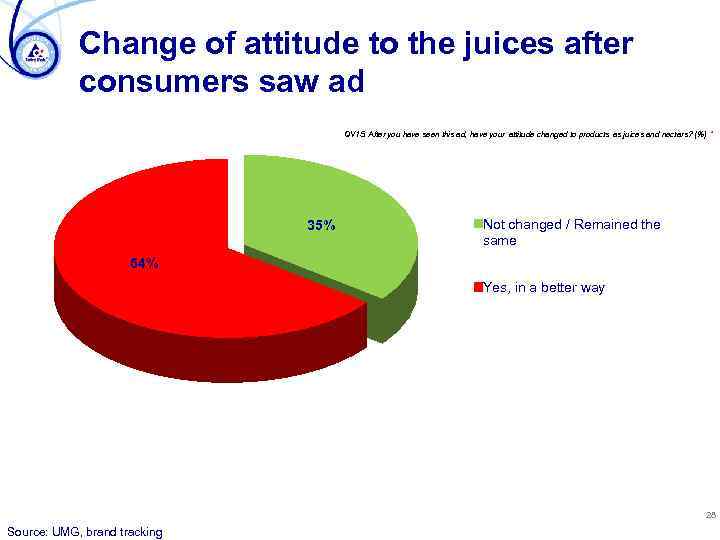

Change of attitude to the juices after consumers saw ad QV 15. After you have seen this ad, have your attitude changed to products as juices and nectars? (%) * 35% Not changed / Remained the same 64% Yes, in a better way 28 Source: UMG, brand tracking

Change of attitude to the juices after consumers saw ad QV 15. After you have seen this ad, have your attitude changed to products as juices and nectars? (%) * 35% Not changed / Remained the same 64% Yes, in a better way 28 Source: UMG, brand tracking

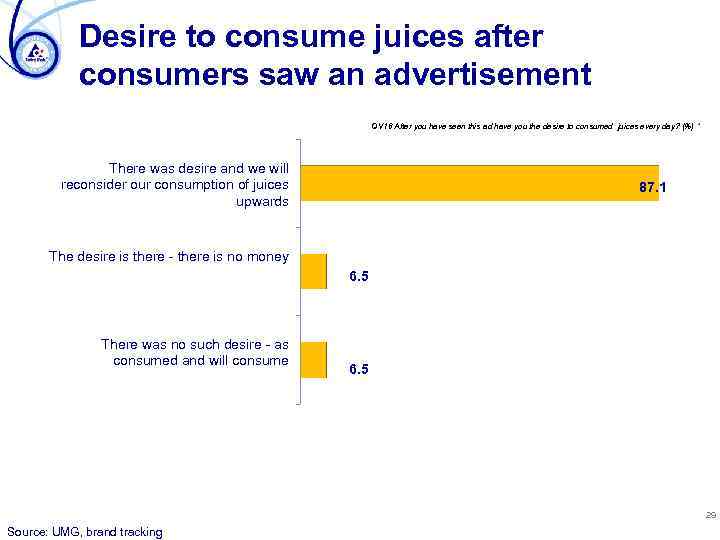

Desire to consume juices after consumers saw an advertisement QV 16 After you have seen this ad have you the desire to consumed juices every day? (%) * There was desire and we will reconsider our consumption of juices upwards 87. 1 The desire is there - there is no money 6. 5 There was no such desire - as consumed and will consume 6. 5 29 Source: UMG, brand tracking

Desire to consume juices after consumers saw an advertisement QV 16 After you have seen this ad have you the desire to consumed juices every day? (%) * There was desire and we will reconsider our consumption of juices upwards 87. 1 The desire is there - there is no money 6. 5 There was no such desire - as consumed and will consume 6. 5 29 Source: UMG, brand tracking

Category Campaign 2013: TV ü Tag-on к роликам: § 6 TVC Sadochek & Sandora § 23 weeks on air § 6 199 GRPs in 2013 ü PR TV reports with doctors & specialists, which recommends to drink Juice Every Day www. sandora. ua

Category Campaign 2013: TV ü Tag-on к роликам: § 6 TVC Sadochek & Sandora § 23 weeks on air § 6 199 GRPs in 2013 ü PR TV reports with doctors & specialists, which recommends to drink Juice Every Day www. sandora. ua

Category Campaign 2013: Press ü Period: April-December 2013 üNumber of publications: 62 § Drink Juice Everyday: 6 § Juice for Breakfast: 9 § Vitamin С: 7 § Mors from apple & cranberry : 10 § Vegetable Juices : 12 § Birch-Apple Juice: 1 § NFC Juices: 15 www. sandora. ua

Category Campaign 2013: Press ü Period: April-December 2013 üNumber of publications: 62 § Drink Juice Everyday: 6 § Juice for Breakfast: 9 § Vitamin С: 7 § Mors from apple & cranberry : 10 § Vegetable Juices : 12 § Birch-Apple Juice: 1 § NFC Juices: 15 www. sandora. ua

Category Campaign 2013: Press www. sandora. ua

Category Campaign 2013: Press www. sandora. ua

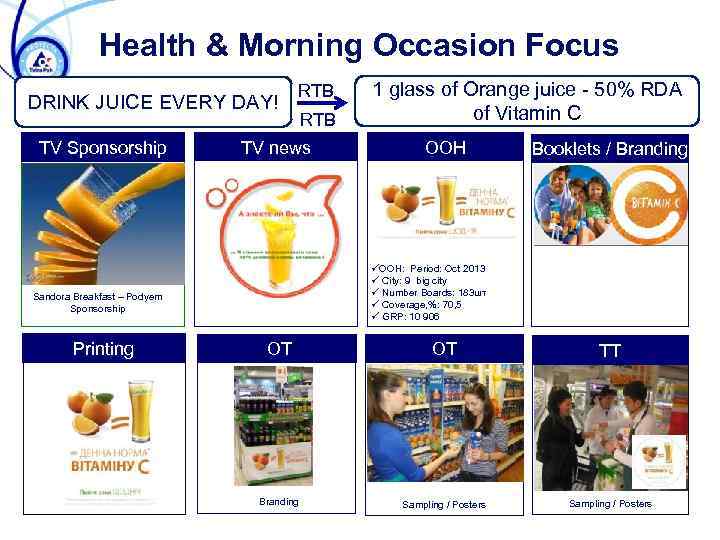

Health & Morning Occasion Focus DRINK JUICE EVERY DAY! TV Sponsorship RTB TV news OOH Booklets / Branding üOOH: Period: Oct 2013 ü City: 9 big city ü Number Boards: 183 шт ü Coverage, %: 70, 5 ü GRP: 10 906 Sandora Breakfast – Podyem Sponsorship Printing RTB 1 glass of Orange juice - 50% RDA of Vitamin C OT OT TT Branding Sampling / Posters

Health & Morning Occasion Focus DRINK JUICE EVERY DAY! TV Sponsorship RTB TV news OOH Booklets / Branding üOOH: Period: Oct 2013 ü City: 9 big city ü Number Boards: 183 шт ü Coverage, %: 70, 5 ü GRP: 10 906 Sandora Breakfast – Podyem Sponsorship Printing RTB 1 glass of Orange juice - 50% RDA of Vitamin C OT OT TT Branding Sampling / Posters

Category Campaign 2013 OOH: Vitamins C

Category Campaign 2013 OOH: Vitamins C

International Juice Day in Kiev ü Date: 26 of May 2013 ü Place: Maydan, Kiev ü Format: The biggest degustation of Juice ü Juice which was consumed during the event: 775 liters ü Press: 16 publications

International Juice Day in Kiev ü Date: 26 of May 2013 ü Place: Maydan, Kiev ü Format: The biggest degustation of Juice ü Juice which was consumed during the event: 775 liters ü Press: 16 publications

Key JNSD Achievements 2013 New launches are aimed to develop high quality juices in the upper middle, kids segment, OTG consumption, new consumption occasions and FSC as environmental leadership Vitmark : Jaffa Kinder with Licensed Characters Vitmark : Prosto Frukty re-design Vitmark : NFC Launch & TGA for Nash Sok Coca-Cola: Rich kids relaunch 200 S Pepsi. Co: Sadochek NFC & AB TBA 1000 S Pepsi. Co: Sandora Vegetable TPA 1000 Sq Pepsi. Co: Sandora & Sadochek FSC YD: Galicia NFC TGA 1000 Sq & TGA 500 Sq

Key JNSD Achievements 2013 New launches are aimed to develop high quality juices in the upper middle, kids segment, OTG consumption, new consumption occasions and FSC as environmental leadership Vitmark : Jaffa Kinder with Licensed Characters Vitmark : Prosto Frukty re-design Vitmark : NFC Launch & TGA for Nash Sok Coca-Cola: Rich kids relaunch 200 S Pepsi. Co: Sadochek NFC & AB TBA 1000 S Pepsi. Co: Sandora Vegetable TPA 1000 Sq Pepsi. Co: Sandora & Sadochek FSC YD: Galicia NFC TGA 1000 Sq & TGA 500 Sq

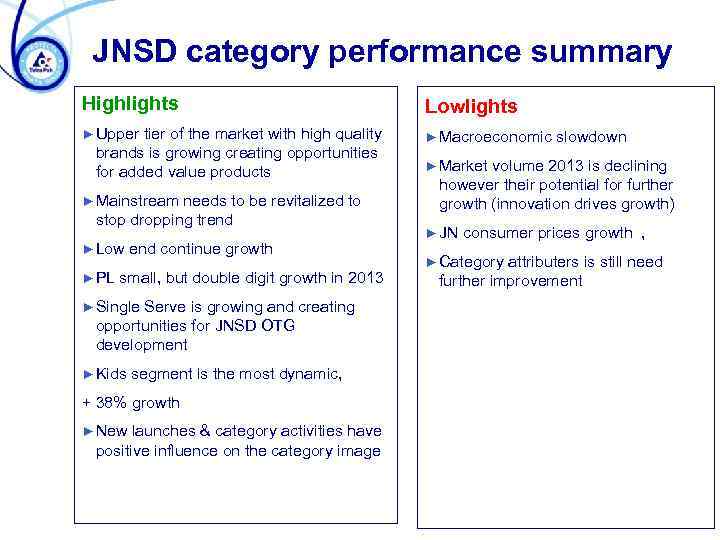

JNSD category performance summary Highlights Lowlights ► Upper tier of the market with high quality ► Macroeconomic slowdown brands is growing creating opportunities for added value products ► Mainstream needs to be revitalized to stop dropping trend ► Low end continue growth ► PL small, but double digit growth in 2013 ► Single Serve is growing and creating opportunities for JNSD OTG development ► Kids segment is the most dynamic, + 38% growth ► New launches & category activities have positive influence on the category image ► Market volume 2013 is declining however their potential for further growth (innovation drives growth) ► JN consumer prices growth , ► Category attributers is still need further improvement

JNSD category performance summary Highlights Lowlights ► Upper tier of the market with high quality ► Macroeconomic slowdown brands is growing creating opportunities for added value products ► Mainstream needs to be revitalized to stop dropping trend ► Low end continue growth ► PL small, but double digit growth in 2013 ► Single Serve is growing and creating opportunities for JNSD OTG development ► Kids segment is the most dynamic, + 38% growth ► New launches & category activities have positive influence on the category image ► Market volume 2013 is declining however their potential for further growth (innovation drives growth) ► JN consumer prices growth , ► Category attributers is still need further improvement

Thank you!

Thank you!