8903709dca84a5c12e5c876e33cf0839.ppt

- Количество слайдов: 44

Interpretation and Application of UCP 600 – Part 1 XXV Latin American Foreign Trade Congress - CLACE Guatemala June 3 -5, 2009 Gary Collyer Consulting LLP 1

Interpretation and Application of UCP 600 – Part 1 XXV Latin American Foreign Trade Congress - CLACE Guatemala June 3 -5, 2009 Gary Collyer Consulting LLP 1

Applying UCP 600 and ISBP Understanding the main rules of UCP 600 and a review of the important and critical opinions given under UCP 600 2

Applying UCP 600 and ISBP Understanding the main rules of UCP 600 and a review of the important and critical opinions given under UCP 600 2

Applying UCP 600 and ISBP UCP 600 article 1 - Application of UCP o o Concept of “Modify or Exclude”; No reference to “unless otherwise stipulated in the credit” throughout UCP 600; UCP applicable when the LC expressly indicates that it is subject to these “rules”; and Retention of Standby Letters of Credit. There is a need to understand the concept of modification and exclusion and when it is appropriate or not. 3

Applying UCP 600 and ISBP UCP 600 article 1 - Application of UCP o o Concept of “Modify or Exclude”; No reference to “unless otherwise stipulated in the credit” throughout UCP 600; UCP applicable when the LC expressly indicates that it is subject to these “rules”; and Retention of Standby Letters of Credit. There is a need to understand the concept of modification and exclusion and when it is appropriate or not. 3

Applying UCP 600 and ISBP UCP 600 article 2 - Definitions Negotiation: the purchase by the nominated bank of drafts (drawn on a bank other than the nominated bank) and/or documents under a complying presentation, by advancing or agreeing to advance funds to the beneficiary on or before the banking day on which reimbursement is due to the nominated bank. Q. Q. Q. What is agreeing to advance? Why no reference to recourse? Why “on or before the banking day reimbursement is due …. ”? 4

Applying UCP 600 and ISBP UCP 600 article 2 - Definitions Negotiation: the purchase by the nominated bank of drafts (drawn on a bank other than the nominated bank) and/or documents under a complying presentation, by advancing or agreeing to advance funds to the beneficiary on or before the banking day on which reimbursement is due to the nominated bank. Q. Q. Q. What is agreeing to advance? Why no reference to recourse? Why “on or before the banking day reimbursement is due …. ”? 4

Applying UCP 600 and ISBP Understanding recourse o Having confirmed a LC, the confirming bank has no right of recourse to the beneficiary in the event of default by the issuing bank, or the issuing bank subsequently identifying discrepancies that were not determined by the confirming bank. But what form of recourse is available where the documentary credit is not confirmed? o Recourse when the issuing bank fails to provide reimbursement according to the terms of the credit citing bankruptcy, lack of foreign exchange, Government intervention etc. and (? ) o When the issuing bank identifies discrepancies in documents that the nominated bank failed to determine. 5

Applying UCP 600 and ISBP Understanding recourse o Having confirmed a LC, the confirming bank has no right of recourse to the beneficiary in the event of default by the issuing bank, or the issuing bank subsequently identifying discrepancies that were not determined by the confirming bank. But what form of recourse is available where the documentary credit is not confirmed? o Recourse when the issuing bank fails to provide reimbursement according to the terms of the credit citing bankruptcy, lack of foreign exchange, Government intervention etc. and (? ) o When the issuing bank identifies discrepancies in documents that the nominated bank failed to determine. 5

Applying UCP 600 and ISBP Understanding recourse – LC available by “Honour” with a nominated bank (not confirmed) Honour is to: o Pay, if the LC is available by sight payment; o Accept a draft drawn on the bank, if the LC is available by acceptance; or o Incur a deferred payment undertaking, if the LC is available by deferred payment. To pay, accept or incur a deferred payment undertaking is a commitment on the part of the nominated bank and is considered without recourse to the Beneficiary. For payment LCs a separate recourse agreement may, however, be made with the beneficiary 6

Applying UCP 600 and ISBP Understanding recourse – LC available by “Honour” with a nominated bank (not confirmed) Honour is to: o Pay, if the LC is available by sight payment; o Accept a draft drawn on the bank, if the LC is available by acceptance; or o Incur a deferred payment undertaking, if the LC is available by deferred payment. To pay, accept or incur a deferred payment undertaking is a commitment on the part of the nominated bank and is considered without recourse to the Beneficiary. For payment LCs a separate recourse agreement may, however, be made with the beneficiary 6

Applying UCP 600 and ISBP UCP 600 article 6 - Availability, Expiry Date and Place for Presentation Sub-article 6 (a): A credit must state the bank with which it is available or whether it is available with any bank. A credit available with a nominated bank is also available with the issuing bank. Q. Q. Q. Why allow any form of LC to be available with any bank? Is it really possible under each type of availability for a LC to be available with any bank? What is the value to a beneficiary of a LC available with any bank? 7

Applying UCP 600 and ISBP UCP 600 article 6 - Availability, Expiry Date and Place for Presentation Sub-article 6 (a): A credit must state the bank with which it is available or whether it is available with any bank. A credit available with a nominated bank is also available with the issuing bank. Q. Q. Q. Why allow any form of LC to be available with any bank? Is it really possible under each type of availability for a LC to be available with any bank? What is the value to a beneficiary of a LC available with any bank? 7

Applying UCP 600 and ISBP Understanding the correct form of availability o with an issuing bank; o with a confirming bank; o with a nominated bank; o with an issuing bank and confirming/nominated bank; o with issuing/confirming bank for expiry and nominated bank for honour or negotiation; o for presentation only. Banks need to understand ‘availability’ and what it means in each transaction. 8

Applying UCP 600 and ISBP Understanding the correct form of availability o with an issuing bank; o with a confirming bank; o with a nominated bank; o with an issuing bank and confirming/nominated bank; o with issuing/confirming bank for expiry and nominated bank for honour or negotiation; o for presentation only. Banks need to understand ‘availability’ and what it means in each transaction. 8

Applying UCP 600 and ISBP Sub-article 7 (c) – ICC Opinion TA. 674 approved March 2009 The conclusion to this opinion (as to the effect of extending a maturity date of a draft or deferred payment undertaking) includes: “Whether a replacement draft or new deferred payment undertaking is required will be determined by local law at the place of acceptance or where the deferred payment undertaking is incurred. ” if not required then “the draft must be re-accepted to mature on the new agreed maturity date (where the credit is available by acceptance with the confirming bank); or a new or amended deferred payment undertaking must be incurred to reflect the new agreed maturity date (where the credit is available by deferred payment with the confirming bank). ” continued 9

Applying UCP 600 and ISBP Sub-article 7 (c) – ICC Opinion TA. 674 approved March 2009 The conclusion to this opinion (as to the effect of extending a maturity date of a draft or deferred payment undertaking) includes: “Whether a replacement draft or new deferred payment undertaking is required will be determined by local law at the place of acceptance or where the deferred payment undertaking is incurred. ” if not required then “the draft must be re-accepted to mature on the new agreed maturity date (where the credit is available by acceptance with the confirming bank); or a new or amended deferred payment undertaking must be incurred to reflect the new agreed maturity date (where the credit is available by deferred payment with the confirming bank). ” continued 9

Applying UCP 600 and ISBP Sub-article 7 (c) – ICC Opinion TA. 674 approved March 2009 The conclusion to this opinion (as to the effect of extending a maturity date of a draft or deferred payment undertaking) concludes by saying: “By complying with the above, and in line with the definition of honour in article 2, i. e. , “b. to incur a deferred payment undertaking and pay at maturity if the credit is available by deferred payment”; and “c. to accept a bill of exchange (“draft”) drawn by the beneficiary and pay at maturity if the credit is available by acceptance, the obligation of the issuing bank to reimburse the nominated (confirming) bank, according to sub-article 7 (c), extends to the new agreed maturity date. ” 10

Applying UCP 600 and ISBP Sub-article 7 (c) – ICC Opinion TA. 674 approved March 2009 The conclusion to this opinion (as to the effect of extending a maturity date of a draft or deferred payment undertaking) concludes by saying: “By complying with the above, and in line with the definition of honour in article 2, i. e. , “b. to incur a deferred payment undertaking and pay at maturity if the credit is available by deferred payment”; and “c. to accept a bill of exchange (“draft”) drawn by the beneficiary and pay at maturity if the credit is available by acceptance, the obligation of the issuing bank to reimburse the nominated (confirming) bank, according to sub-article 7 (c), extends to the new agreed maturity date. ” 10

Applying UCP 600 and ISBP Understanding the risks when acting in a non-nominated capacity It is often the case that a bank will act for its client under a transaction where they are not stated to be the nominated bank or the LC is not designated as being ‘available with any bank’. o The issuing bank must still honour a complying presentation made by that ‘non-nominated’ bank, but the issuing bank may seek confirmation from a named nominated bank (of no prior payment) before honouring; o The non-nominated bank has no greater protection from UCP 600 as does the beneficiary in the delivery of documents to the issuing bank – article 35 would not apply. o The examination of documents by the non-nominated bank carries no value within the context of UCP 600 and any settlement thereunder is outside the scope of UCP 600. 11

Applying UCP 600 and ISBP Understanding the risks when acting in a non-nominated capacity It is often the case that a bank will act for its client under a transaction where they are not stated to be the nominated bank or the LC is not designated as being ‘available with any bank’. o The issuing bank must still honour a complying presentation made by that ‘non-nominated’ bank, but the issuing bank may seek confirmation from a named nominated bank (of no prior payment) before honouring; o The non-nominated bank has no greater protection from UCP 600 as does the beneficiary in the delivery of documents to the issuing bank – article 35 would not apply. o The examination of documents by the non-nominated bank carries no value within the context of UCP 600 and any settlement thereunder is outside the scope of UCP 600. 11

Applying UCP 600 and ISBP Adding confirmation – what is possible and what needs to be observed o considerations to add confirmation; o reduced expiry; o reduced amount; o determining confirmation of 100% where a split schedule is included in the LC; o more than one confirming bank. The basic rule for a bank requested to confirm is “do I understand what I am confirming and the risks that I am undertaking” 12

Applying UCP 600 and ISBP Adding confirmation – what is possible and what needs to be observed o considerations to add confirmation; o reduced expiry; o reduced amount; o determining confirmation of 100% where a split schedule is included in the LC; o more than one confirming bank. The basic rule for a bank requested to confirm is “do I understand what I am confirming and the risks that I am undertaking” 12

Applying UCP 600 and ISBP UCP 600 article 9 - Advising of Credits and Amendments o o o Concept of 2 nd Advising Bank; Bank now “satisfies itself” as to the apparent authenticity; and Advice of LC or amendment “accurately reflects” the terms and conditions of the LC or amendment received. Are instructions to confirm addressed to the advising bank and/or the second advising bank that is stated in the LC? What is ‘satisfying itself’ as to the apparent authenticity? What are the risks of not passing to the beneficiary what was received? 13

Applying UCP 600 and ISBP UCP 600 article 9 - Advising of Credits and Amendments o o o Concept of 2 nd Advising Bank; Bank now “satisfies itself” as to the apparent authenticity; and Advice of LC or amendment “accurately reflects” the terms and conditions of the LC or amendment received. Are instructions to confirm addressed to the advising bank and/or the second advising bank that is stated in the LC? What is ‘satisfying itself’ as to the apparent authenticity? What are the risks of not passing to the beneficiary what was received? 13

Applying UCP 600 and ISBP UCP 600 article 10 – Amendments Sub-article 10 (c): The terms and conditions of the original credit (or a credit incorporating previously accepted amendments will remain in force for the beneficiary until the beneficiary communicates its acceptance of the amendment to the bank that advised such amendment. The beneficiary should give notification of acceptance or rejection of an amendment. If the beneficiary fails to give such notification, a presentation that complies with the credit and to any not yet accepted amendment will be deemed to be notification of acceptance by the beneficiary of such amendment. As of that moment the credit will be amended. Q. Effect of banks requesting a beneficiary certificate certifying as to which amendments have been accepted or rejected. 14

Applying UCP 600 and ISBP UCP 600 article 10 – Amendments Sub-article 10 (c): The terms and conditions of the original credit (or a credit incorporating previously accepted amendments will remain in force for the beneficiary until the beneficiary communicates its acceptance of the amendment to the bank that advised such amendment. The beneficiary should give notification of acceptance or rejection of an amendment. If the beneficiary fails to give such notification, a presentation that complies with the credit and to any not yet accepted amendment will be deemed to be notification of acceptance by the beneficiary of such amendment. As of that moment the credit will be amended. Q. Effect of banks requesting a beneficiary certificate certifying as to which amendments have been accepted or rejected. 14

Applying UCP 600 and ISBP UCP 600 article 10 - Amendments Let us review the circumstances of a LC: LC issued for USD 25, 000 covering shipment of nuts and bolts. Partial shipment allowed. Amendment received reducing amount to USD 15, 000 Beneficiary subsequently presents documents for USD 15, 000 and the LC is valid for another 5 weeks. Has the amendment been accepted or has a partial shipment been effected? 15

Applying UCP 600 and ISBP UCP 600 article 10 - Amendments Let us review the circumstances of a LC: LC issued for USD 25, 000 covering shipment of nuts and bolts. Partial shipment allowed. Amendment received reducing amount to USD 15, 000 Beneficiary subsequently presents documents for USD 15, 000 and the LC is valid for another 5 weeks. Has the amendment been accepted or has a partial shipment been effected? 15

Applying UCP 600 and ISBP Nomination and acting under a nomination Consider the UCP 600 position in article 12: Nominated bank may obligate itself under an unconfirmed credit if expressly communicated to beneficiary. Receipt or examination and forwarding of documents does not constitute honour or negotiation. Q. what is nomination? Q. what is “a nominated bank acting on its nomination”? 16

Applying UCP 600 and ISBP Nomination and acting under a nomination Consider the UCP 600 position in article 12: Nominated bank may obligate itself under an unconfirmed credit if expressly communicated to beneficiary. Receipt or examination and forwarding of documents does not constitute honour or negotiation. Q. what is nomination? Q. what is “a nominated bank acting on its nomination”? 16

Applying UCP 600 and ISBP What constitutes an ‘express communication to the beneficiary’? o Silent Confirmation agreement o Agreement or Commitment to Negotiate/Purchase/Honour etc. o An indication, in any ‘written’ communication to the beneficiary, that the bank “will” honour or negotiate - as opposed to a statement on a covering advice to the LC that states something like “This credit is available with us by negotiation”. 17

Applying UCP 600 and ISBP What constitutes an ‘express communication to the beneficiary’? o Silent Confirmation agreement o Agreement or Commitment to Negotiate/Purchase/Honour etc. o An indication, in any ‘written’ communication to the beneficiary, that the bank “will” honour or negotiate - as opposed to a statement on a covering advice to the LC that states something like “This credit is available with us by negotiation”. 17

Applying UCP 600 and ISBP UCP 600 article 12 - Nomination Sub-article 12 (b): By nominating a bank to accept a draft or incur a deferred payment undertaking, an issuing bank authorizes that nominated bank to prepay or purchase a draft accepted or a deferred payment undertaking incurred by that nominated bank. Note: Only applicable where nominated bank accepts a draft or incurs a deferred payment undertaking. An authorization not an obligation to prepay or purchase. 18

Applying UCP 600 and ISBP UCP 600 article 12 - Nomination Sub-article 12 (b): By nominating a bank to accept a draft or incur a deferred payment undertaking, an issuing bank authorizes that nominated bank to prepay or purchase a draft accepted or a deferred payment undertaking incurred by that nominated bank. Note: Only applicable where nominated bank accepts a draft or incurs a deferred payment undertaking. An authorization not an obligation to prepay or purchase. 18

Applying UCP 600 and ISBP UCP 600 article 14 - Standard for Examination of Documents Sub-article 14 (a): A nominated bank acting on its nomination, a confirming bank, if any, and the issuing bank must examine a presentation to determine, on the basis of the documents alone, whether or not the documents appear on their face to constitute a complying presentation. Q. What is the scope of “check on the basis of the documents alone”? 19

Applying UCP 600 and ISBP UCP 600 article 14 - Standard for Examination of Documents Sub-article 14 (a): A nominated bank acting on its nomination, a confirming bank, if any, and the issuing bank must examine a presentation to determine, on the basis of the documents alone, whether or not the documents appear on their face to constitute a complying presentation. Q. What is the scope of “check on the basis of the documents alone”? 19

Applying UCP 600 and ISBP UCP 600 article 14 - Standard for Examination of Documents Sub-article 14 (b): A nominated bank acting on its nomination, a confirming bank, if any, and the issuing bank shall each have a maximum of five banking days following the day of presentation to determine if a presentation is complying. This period is not curtailed or otherwise affected by the occurrence on or after the date of presentation of any expiry date or last day for presentation. Q. Q. Removal of “reasonable time” but does not maximum give a ‘reasonable time’? Can a beneficiary hold a nominated bank responsible if the documents are presented 2 days prior to expiry but examined 2 days after expiry and discrepancies are found that the beneficiary is now unable to correct? 20

Applying UCP 600 and ISBP UCP 600 article 14 - Standard for Examination of Documents Sub-article 14 (b): A nominated bank acting on its nomination, a confirming bank, if any, and the issuing bank shall each have a maximum of five banking days following the day of presentation to determine if a presentation is complying. This period is not curtailed or otherwise affected by the occurrence on or after the date of presentation of any expiry date or last day for presentation. Q. Q. Removal of “reasonable time” but does not maximum give a ‘reasonable time’? Can a beneficiary hold a nominated bank responsible if the documents are presented 2 days prior to expiry but examined 2 days after expiry and discrepancies are found that the beneficiary is now unable to correct? 20

Applying UCP 600 and ISBP UCP 600 article 14 - Standard for Examination of Documents Sub-article 14 (d): Data in a document, when read in context with the credit, the document itself and international standard banking practice, need not be identical to, but must not conflict with, data in that document, any other stipulated document or the credit. Note: No reference to inconsistency. Data need not be identical, but must not conflict. 21

Applying UCP 600 and ISBP UCP 600 article 14 - Standard for Examination of Documents Sub-article 14 (d): Data in a document, when read in context with the credit, the document itself and international standard banking practice, need not be identical to, but must not conflict with, data in that document, any other stipulated document or the credit. Note: No reference to inconsistency. Data need not be identical, but must not conflict. 21

Applying UCP 600 and ISBP UCP 600 article 14 - Standard for Examination of Documents Sub-article 14 (d): LC calls for shipment of 5000 MT Stainless Steel Coils Invoice states 5000 MT Stainless Steel Coils Certificate of Origin states Stainless Steel Coils Bill of Lading states 5000 MT Coils Data is not identical but is it conflicting? 22

Applying UCP 600 and ISBP UCP 600 article 14 - Standard for Examination of Documents Sub-article 14 (d): LC calls for shipment of 5000 MT Stainless Steel Coils Invoice states 5000 MT Stainless Steel Coils Certificate of Origin states Stainless Steel Coils Bill of Lading states 5000 MT Coils Data is not identical but is it conflicting? 22

Applying UCP 600 and ISBP UCP 600 article 14 - Standard for Examination of Documents Sub-article 14 (d): LC calls for shipment of 5000 MT Stainless Steel Coils Invoice states 5000 MT Stainless Steel Coils Certificate of Origin states Stainless Steel Coils Bill of Lading states 5000 MT Aluminium Coils Data is not identical but is it conflicting? 23

Applying UCP 600 and ISBP UCP 600 article 14 - Standard for Examination of Documents Sub-article 14 (d): LC calls for shipment of 5000 MT Stainless Steel Coils Invoice states 5000 MT Stainless Steel Coils Certificate of Origin states Stainless Steel Coils Bill of Lading states 5000 MT Aluminium Coils Data is not identical but is it conflicting? 23

Applying UCP 600 and ISBP UCP 600 article 14 - Standard for Examination of Documents Sub-article 14 (d): LC calls for shipment of 5000 MT Rice of Indian and Sri Lankan origin Partial shipments allowed First drawing: Invoice states 3500 MT Rice Indian Origin Certificate of Origin states Rice Indian Origin Bill of Lading states 3500 MT Rice Data is not identical but is it conflicting? 24

Applying UCP 600 and ISBP UCP 600 article 14 - Standard for Examination of Documents Sub-article 14 (d): LC calls for shipment of 5000 MT Rice of Indian and Sri Lankan origin Partial shipments allowed First drawing: Invoice states 3500 MT Rice Indian Origin Certificate of Origin states Rice Indian Origin Bill of Lading states 3500 MT Rice Data is not identical but is it conflicting? 24

Applying UCP 600 and ISBP UCP 600 article 14 - Standard for Examination of Documents Sub-article 14 (f): If a credit requires presentation of a document other than a transport document, insurance document or commercial invoice, without stipulating by whom the document is to be issued or its data content, banks will accept the document as presented if its content appears to fulfil the function of the required document and otherwise complies with sub-article 14 (d). Q. Q. What are the requirements for a document to appear to fulfil its function? Are document checkers supposed to become experts in documentation? 25

Applying UCP 600 and ISBP UCP 600 article 14 - Standard for Examination of Documents Sub-article 14 (f): If a credit requires presentation of a document other than a transport document, insurance document or commercial invoice, without stipulating by whom the document is to be issued or its data content, banks will accept the document as presented if its content appears to fulfil the function of the required document and otherwise complies with sub-article 14 (d). Q. Q. What are the requirements for a document to appear to fulfil its function? Are document checkers supposed to become experts in documentation? 25

Applying UCP 600 and ISBP UCP 600 article 14 - Standard for Examination of Documents Sub-article 14 (f): How to determine a document fulfils the function of the required document? LC requires presentation of Inspection Certificate and Certificate of Analysis (no other details given). Inspection Certificates states “We hereby certify that we have inspected [STOP RIGHT HERE] …” Analysis Certificate states “We have analysed the consignment [STOP RIGHT HERE] …” the documents fulfil the function by the opening statements. The remainder of the document is subject to review according to sub-article 14 (d). 26

Applying UCP 600 and ISBP UCP 600 article 14 - Standard for Examination of Documents Sub-article 14 (f): How to determine a document fulfils the function of the required document? LC requires presentation of Inspection Certificate and Certificate of Analysis (no other details given). Inspection Certificates states “We hereby certify that we have inspected [STOP RIGHT HERE] …” Analysis Certificate states “We have analysed the consignment [STOP RIGHT HERE] …” the documents fulfil the function by the opening statements. The remainder of the document is subject to review according to sub-article 14 (d). 26

Applying UCP 600 and ISBP UCP 600 article 14 – Standard for Examination of Documents Sub-article 14 (h) If a credit contains a condition without stipulating the document to indicate compliance with the condition, banks will deem such condition as not stated and will disregard it. Issues: 1. Understanding the impact on the applicant 2. Ability of the issuing bank to enhance the wording in the LC 3. Action required by the beneficiary 4. Examination of such terms by a nominated bank 27

Applying UCP 600 and ISBP UCP 600 article 14 – Standard for Examination of Documents Sub-article 14 (h) If a credit contains a condition without stipulating the document to indicate compliance with the condition, banks will deem such condition as not stated and will disregard it. Issues: 1. Understanding the impact on the applicant 2. Ability of the issuing bank to enhance the wording in the LC 3. Action required by the beneficiary 4. Examination of such terms by a nominated bank 27

Applying UCP 600 and ISBP Sub-article 14 (h) – ICC Opinion TA. 644 approved April 2008 The conclusion to this opinion (as to the effects of a non-documentary condition that is misstated in one or more documents) includes: “According to sub-article 14 (h), banks will deem a non-documentary condition as not stated, (on the basis that there is no necessity for the beneficiary to provide any evidence of compliance) and will disregard it. Should the beneficiary, nevertheless, elect to insert such data on any other stipulated document then they must ensure that it does not conflict with the data in the credit. The view of the Banking Commission is that sub-article 14 (h) is not absolute and is qualified by the content of sub-article 14 (d). ” 28

Applying UCP 600 and ISBP Sub-article 14 (h) – ICC Opinion TA. 644 approved April 2008 The conclusion to this opinion (as to the effects of a non-documentary condition that is misstated in one or more documents) includes: “According to sub-article 14 (h), banks will deem a non-documentary condition as not stated, (on the basis that there is no necessity for the beneficiary to provide any evidence of compliance) and will disregard it. Should the beneficiary, nevertheless, elect to insert such data on any other stipulated document then they must ensure that it does not conflict with the data in the credit. The view of the Banking Commission is that sub-article 14 (h) is not absolute and is qualified by the content of sub-article 14 (d). ” 28

Applying UCP 600 and ISBP Sub-article 14 (h) – ICC Opinion TA. 644 approved April 2008 Simple examples to demonstrate the effect of the opinion given in TA. 644: LC states in additional conditions: Vessel must be less than 25 years old. Goods must be packed in 25 KG steel drums with red stripe Bill of Lading includes within the body of the document “Vessel built in 1980” Packing list states “Goods packed in heavy duty plastic drums with red stripe” In both instances, the documents would be discrepant. 29

Applying UCP 600 and ISBP Sub-article 14 (h) – ICC Opinion TA. 644 approved April 2008 Simple examples to demonstrate the effect of the opinion given in TA. 644: LC states in additional conditions: Vessel must be less than 25 years old. Goods must be packed in 25 KG steel drums with red stripe Bill of Lading includes within the body of the document “Vessel built in 1980” Packing list states “Goods packed in heavy duty plastic drums with red stripe” In both instances, the documents would be discrepant. 29

Applying UCP 600 and ISBP UCP 600 article 14 - Standard for Examination of Documents Sub-article 14 (j): When the addresses of the beneficiary and the applicant appear in any stipulated document, they need not be the same as those stated in the credit or in any other stipulated document, but must be within the same country as the respective addresses mentioned in the credit. Contact details (telefax, telephone, email and the like) stated as part of the beneficiary’s and the applicant’s address will be disregarded. However, when the address and contact details of the applicant appear as part of the consignee or notify party details on a transport document subject to articles 19, 20, 21, 22, 23, 24 or 25, they must be as stated in the credit. Q. Addresses must appear on every document, even if different? Q. Is any address required at all? 30

Applying UCP 600 and ISBP UCP 600 article 14 - Standard for Examination of Documents Sub-article 14 (j): When the addresses of the beneficiary and the applicant appear in any stipulated document, they need not be the same as those stated in the credit or in any other stipulated document, but must be within the same country as the respective addresses mentioned in the credit. Contact details (telefax, telephone, email and the like) stated as part of the beneficiary’s and the applicant’s address will be disregarded. However, when the address and contact details of the applicant appear as part of the consignee or notify party details on a transport document subject to articles 19, 20, 21, 22, 23, 24 or 25, they must be as stated in the credit. Q. Addresses must appear on every document, even if different? Q. Is any address required at all? 30

Applying UCP 600 and ISBP UCP 600 article 19 - ICC Opinion TA. 650 approved April 2008 The conclusion to this opinion (enquiring as to the need for an on board notation on a MMTD type document) includes: “A dated on board notation is clearly required when the credit so requests. It is also required when the document evidences the first leg of the carriage as a sea shipment from the place stated in the credit. Where a transport document is pre-printed shipped on board then the date of issuance would be deemed to be the date of shipment. When the document evidences the first leg of the carriage as a sea shipment from the place stated in the credit, there is a need for evidence of the date the goods were shipped on board i. e. , pre-printed or by notation. ” 31

Applying UCP 600 and ISBP UCP 600 article 19 - ICC Opinion TA. 650 approved April 2008 The conclusion to this opinion (enquiring as to the need for an on board notation on a MMTD type document) includes: “A dated on board notation is clearly required when the credit so requests. It is also required when the document evidences the first leg of the carriage as a sea shipment from the place stated in the credit. Where a transport document is pre-printed shipped on board then the date of issuance would be deemed to be the date of shipment. When the document evidences the first leg of the carriage as a sea shipment from the place stated in the credit, there is a need for evidence of the date the goods were shipped on board i. e. , pre-printed or by notation. ” 31

Applying UCP 600 and ISBP UCP 600 - ICC Opinion TA. 675 approved March 2009 regarding release of cargo clauses This opinion draws a line between the data that is to be examined for compliance and that data which is considered to be terms and conditions of carriage. For example, data referring to the on board nature of the bill of lading is to be examined. However, data referring to the action of the carrier in the release of the cargo is considered to be terms and conditions of carriage. 32

Applying UCP 600 and ISBP UCP 600 - ICC Opinion TA. 675 approved March 2009 regarding release of cargo clauses This opinion draws a line between the data that is to be examined for compliance and that data which is considered to be terms and conditions of carriage. For example, data referring to the on board nature of the bill of lading is to be examined. However, data referring to the action of the carrier in the release of the cargo is considered to be terms and conditions of carriage. 32

Applying UCP 600 and ISBP UCP 600 article 20 - ICC Opinions TA. 635 approved October 2007 and TA. 665 & 667 approved October 2008 There is no wording in UCP 600 that is similar to that which appeared in UCP 500 sub-article 23 (a) (ii), but ………. The conclusions to the above opinions include: “Unless it is evident from the bill of lading that the shipped on board statement applies to the vessel and the port of loading, the bill of lading will require an on board notation showing the port of loading and the name of the vessel, even if the goods are loaded on the vessel named in the bill of lading. ” 33

Applying UCP 600 and ISBP UCP 600 article 20 - ICC Opinions TA. 635 approved October 2007 and TA. 665 & 667 approved October 2008 There is no wording in UCP 600 that is similar to that which appeared in UCP 500 sub-article 23 (a) (ii), but ………. The conclusions to the above opinions include: “Unless it is evident from the bill of lading that the shipped on board statement applies to the vessel and the port of loading, the bill of lading will require an on board notation showing the port of loading and the name of the vessel, even if the goods are loaded on the vessel named in the bill of lading. ” 33

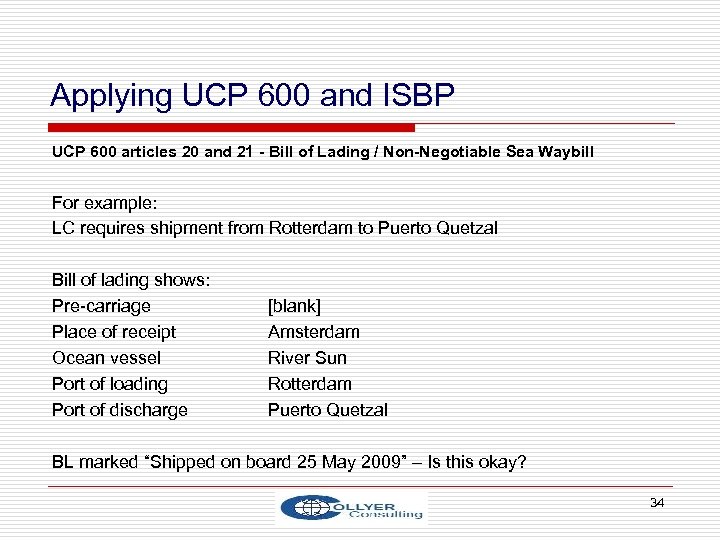

Applying UCP 600 and ISBP UCP 600 articles 20 and 21 - Bill of Lading / Non-Negotiable Sea Waybill For example: LC requires shipment from Rotterdam to Puerto Quetzal Bill of lading shows: Pre-carriage Place of receipt Ocean vessel Port of loading Port of discharge [blank] Amsterdam River Sun Rotterdam Puerto Quetzal BL marked “Shipped on board 25 May 2009” – Is this okay? 34

Applying UCP 600 and ISBP UCP 600 articles 20 and 21 - Bill of Lading / Non-Negotiable Sea Waybill For example: LC requires shipment from Rotterdam to Puerto Quetzal Bill of lading shows: Pre-carriage Place of receipt Ocean vessel Port of loading Port of discharge [blank] Amsterdam River Sun Rotterdam Puerto Quetzal BL marked “Shipped on board 25 May 2009” – Is this okay? 34

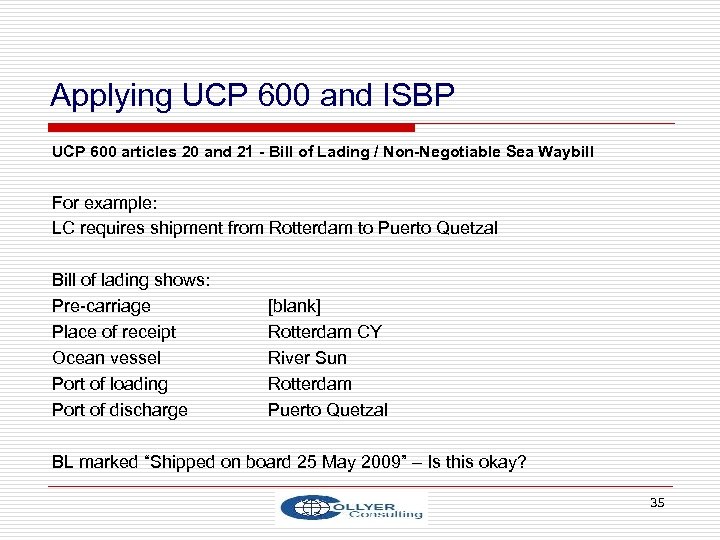

Applying UCP 600 and ISBP UCP 600 articles 20 and 21 - Bill of Lading / Non-Negotiable Sea Waybill For example: LC requires shipment from Rotterdam to Puerto Quetzal Bill of lading shows: Pre-carriage Place of receipt Ocean vessel Port of loading Port of discharge [blank] Rotterdam CY River Sun Rotterdam Puerto Quetzal BL marked “Shipped on board 25 May 2009” – Is this okay? 35

Applying UCP 600 and ISBP UCP 600 articles 20 and 21 - Bill of Lading / Non-Negotiable Sea Waybill For example: LC requires shipment from Rotterdam to Puerto Quetzal Bill of lading shows: Pre-carriage Place of receipt Ocean vessel Port of loading Port of discharge [blank] Rotterdam CY River Sun Rotterdam Puerto Quetzal BL marked “Shipped on board 25 May 2009” – Is this okay? 35

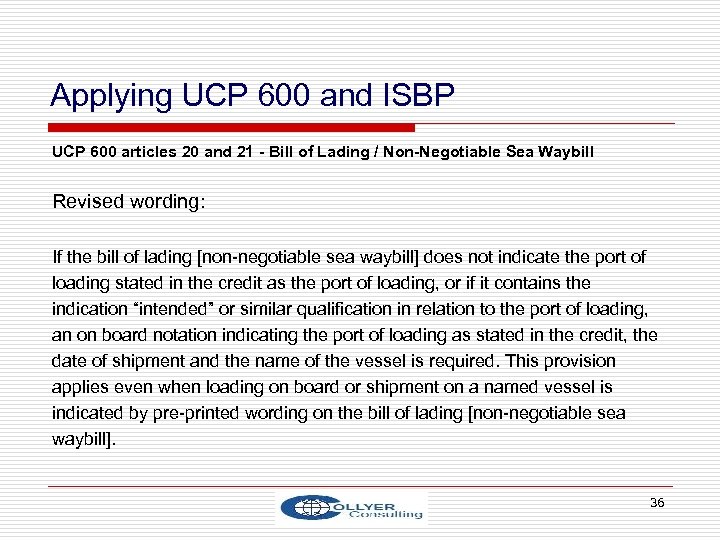

Applying UCP 600 and ISBP UCP 600 articles 20 and 21 - Bill of Lading / Non-Negotiable Sea Waybill Revised wording: If the bill of lading [non-negotiable sea waybill] does not indicate the port of loading stated in the credit as the port of loading, or if it contains the indication “intended” or similar qualification in relation to the port of loading, an on board notation indicating the port of loading as stated in the credit, the date of shipment and the name of the vessel is required. This provision applies even when loading on board or shipment on a named vessel is indicated by pre-printed wording on the bill of lading [non-negotiable sea waybill]. 36

Applying UCP 600 and ISBP UCP 600 articles 20 and 21 - Bill of Lading / Non-Negotiable Sea Waybill Revised wording: If the bill of lading [non-negotiable sea waybill] does not indicate the port of loading stated in the credit as the port of loading, or if it contains the indication “intended” or similar qualification in relation to the port of loading, an on board notation indicating the port of loading as stated in the credit, the date of shipment and the name of the vessel is required. This provision applies even when loading on board or shipment on a named vessel is indicated by pre-printed wording on the bill of lading [non-negotiable sea waybill]. 36

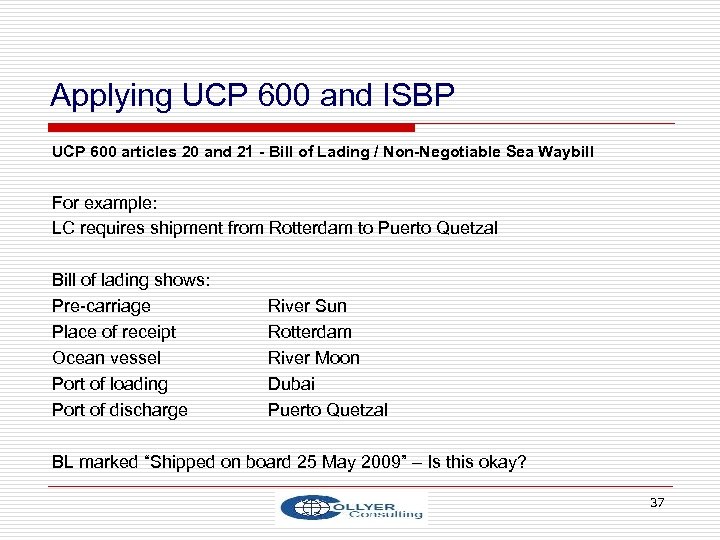

Applying UCP 600 and ISBP UCP 600 articles 20 and 21 - Bill of Lading / Non-Negotiable Sea Waybill For example: LC requires shipment from Rotterdam to Puerto Quetzal Bill of lading shows: Pre-carriage Place of receipt Ocean vessel Port of loading Port of discharge River Sun Rotterdam River Moon Dubai Puerto Quetzal BL marked “Shipped on board 25 May 2009” – Is this okay? 37

Applying UCP 600 and ISBP UCP 600 articles 20 and 21 - Bill of Lading / Non-Negotiable Sea Waybill For example: LC requires shipment from Rotterdam to Puerto Quetzal Bill of lading shows: Pre-carriage Place of receipt Ocean vessel Port of loading Port of discharge River Sun Rotterdam River Moon Dubai Puerto Quetzal BL marked “Shipped on board 25 May 2009” – Is this okay? 37

Applying UCP 600 and ISBP UCP 600 article 22 - ICC Opinion TA. 662 approved October 2008 The conclusion to this opinion states that any indication of a charter party will be considered as making the transport document a charter party bill of lading for the purposes of UCP 600. This applies even if the transport document otherwise complies with article 20. For example, wordings such as: o “Issued pursuant to charter party dated …… [no date]” o “Freight paid as per charter party” will be considered as evidence of an indication of a charter party even if the charter party reference or date is not inserted. 38

Applying UCP 600 and ISBP UCP 600 article 22 - ICC Opinion TA. 662 approved October 2008 The conclusion to this opinion states that any indication of a charter party will be considered as making the transport document a charter party bill of lading for the purposes of UCP 600. This applies even if the transport document otherwise complies with article 20. For example, wordings such as: o “Issued pursuant to charter party dated …… [no date]” o “Freight paid as per charter party” will be considered as evidence of an indication of a charter party even if the charter party reference or date is not inserted. 38

Applying UCP 600 and ISBP UCP 600 article 22 - ICC Opinion TA. 683 approved April 2009 Does a credit that requires the presentation of a charter party bill of lading and the respective charter party contract modify the rule in sub-article 22 (b) that says “A bank will not examine charter party contracts, even if they are required to be presented by the terms of the credit”? Is a bank required to examine, cursorily or otherwise, to establish that the contract relates to the charter party bill of lading? The conclusion to both these questions was NO. The objective of sub-article 22 (b) is to discourage the requirement for the contract to be presented in the first place. 39

Applying UCP 600 and ISBP UCP 600 article 22 - ICC Opinion TA. 683 approved April 2009 Does a credit that requires the presentation of a charter party bill of lading and the respective charter party contract modify the rule in sub-article 22 (b) that says “A bank will not examine charter party contracts, even if they are required to be presented by the terms of the credit”? Is a bank required to examine, cursorily or otherwise, to establish that the contract relates to the charter party bill of lading? The conclusion to both these questions was NO. The objective of sub-article 22 (b) is to discourage the requirement for the contract to be presented in the first place. 39

Applying UCP 600 and ISBP Documentary Credits allowing different forms of transport/transport document The conclusion to ICC opinion TA. 641 refers to situations where the LC allows for various forms of transport document i. e. , in the case of the opinion, consignment notes, bill of lading or forwarding agents receipt evidencing shipment from Gdynia, Gdansk or Swinoujscie to Russia, and states: “It should be noted that the credit, in allowing for different forms of delivery, should have provided for the individual requirements where consignment notes, bills of lading or a goods receipt were to be presented. ” 40

Applying UCP 600 and ISBP Documentary Credits allowing different forms of transport/transport document The conclusion to ICC opinion TA. 641 refers to situations where the LC allows for various forms of transport document i. e. , in the case of the opinion, consignment notes, bill of lading or forwarding agents receipt evidencing shipment from Gdynia, Gdansk or Swinoujscie to Russia, and states: “It should be noted that the credit, in allowing for different forms of delivery, should have provided for the individual requirements where consignment notes, bills of lading or a goods receipt were to be presented. ” 40

Applying UCP 600 and ISBP UCP 600 article 31 - Partial Drawings or Shipments A presentation consisting of more than one set of transport documents evidencing shipment commencing on the same means of conveyance and for the same journey, provided they indicate the same destination, will not be regarded as covering a partial shipment, even if they indicate different dates of shipment or different ports of loading, places of taking in charge or dispatch. o (b) Clarification given that in the case of multiple presentations, on same means of conveyance and same journey, latest date = date of shipment; and o (b) Clarification where more than one means of conveyance used within the same mode of transport (i. e. , 2 trucks) and one or more sets of transport documents presented = partial shipment. 41

Applying UCP 600 and ISBP UCP 600 article 31 - Partial Drawings or Shipments A presentation consisting of more than one set of transport documents evidencing shipment commencing on the same means of conveyance and for the same journey, provided they indicate the same destination, will not be regarded as covering a partial shipment, even if they indicate different dates of shipment or different ports of loading, places of taking in charge or dispatch. o (b) Clarification given that in the case of multiple presentations, on same means of conveyance and same journey, latest date = date of shipment; and o (b) Clarification where more than one means of conveyance used within the same mode of transport (i. e. , 2 trucks) and one or more sets of transport documents presented = partial shipment. 41

Applying UCP 600 and ISBP UCP 600 article 35 – Disclaimer on Transmission and Translation If a nominated bank determines ……. . an issuing bank or confirming bank must honour or negotiate, or reimburse ……. , even when the documents have been lost in transit between the nominated bank and the issuing bank or confirming bank, or between the confirming bank and the issuing bank. Q. Q. Q. Honour without documents? Insist on replacement originals? Insist on copies being provided? 42

Applying UCP 600 and ISBP UCP 600 article 35 – Disclaimer on Transmission and Translation If a nominated bank determines ……. . an issuing bank or confirming bank must honour or negotiate, or reimburse ……. , even when the documents have been lost in transit between the nominated bank and the issuing bank or confirming bank, or between the confirming bank and the issuing bank. Q. Q. Q. Honour without documents? Insist on replacement originals? Insist on copies being provided? 42

Applying UCP 600 and ISBP Documentary Credits stating that issuing bank charges are for account of the beneficiary The conclusion to ICC opinion TA. 659 states, where a credit specifies that the issuing bank’s charges (except issuance fees) are also for account of the beneficiary: “The credit stated that all banking charges except those related to the opening were for the account of the beneficiary. If the issuing bank wishes to make a deduction from the proceeds in respect of their fees, then the credit should clearly indicate the amount or percentage of charges that will be deducted. It will then be for the beneficiary to decide whether it will perform under the credit with such a charge for its account. ” 43

Applying UCP 600 and ISBP Documentary Credits stating that issuing bank charges are for account of the beneficiary The conclusion to ICC opinion TA. 659 states, where a credit specifies that the issuing bank’s charges (except issuance fees) are also for account of the beneficiary: “The credit stated that all banking charges except those related to the opening were for the account of the beneficiary. If the issuing bank wishes to make a deduction from the proceeds in respect of their fees, then the credit should clearly indicate the amount or percentage of charges that will be deducted. It will then be for the beneficiary to decide whether it will perform under the credit with such a charge for its account. ” 43

Applying UCP 600 and ISBP Thank You Contact : Gary Collyer, Collyer Consulting LLP Email : gary@collyerconsulting. com 44

Applying UCP 600 and ISBP Thank You Contact : Gary Collyer, Collyer Consulting LLP Email : gary@collyerconsulting. com 44