International Trade: Theory and Policy Lecture 8 November,

itt-autumn-2016-lecture-8-e.pptx

- Размер: 1.1 Мб

- Автор:

- Количество слайдов: 23

Описание презентации International Trade: Theory and Policy Lecture 8 November, по слайдам

International Trade: Theory and Policy Lecture 8 November, 2016 Instructor: Natalia Davidson Lecture is prepared by Prof. Sergey Kadochnikov, Natalia Davidson

International Trade: Theory and Policy Lecture 8 November, 2016 Instructor: Natalia Davidson Lecture is prepared by Prof. Sergey Kadochnikov, Natalia Davidson

Topic 6. Differences between countries in relative endowment of specific production factors as the reason for international trade: the Ricardo-Viner model 6. 1. Fundamental assumptions and specific features of the Ricardo-Viner model. 6. 2. Interrelation between change in the production factor quantities and final goods output. 6. 3. The pattern of international trade in the Ricardo-Viner model. 6. 4. Interrelation between change in final goods prices and production factor prices.

Topic 6. Differences between countries in relative endowment of specific production factors as the reason for international trade: the Ricardo-Viner model 6. 1. Fundamental assumptions and specific features of the Ricardo-Viner model. 6. 2. Interrelation between change in the production factor quantities and final goods output. 6. 3. The pattern of international trade in the Ricardo-Viner model. 6. 4. Interrelation between change in final goods prices and production factor prices.

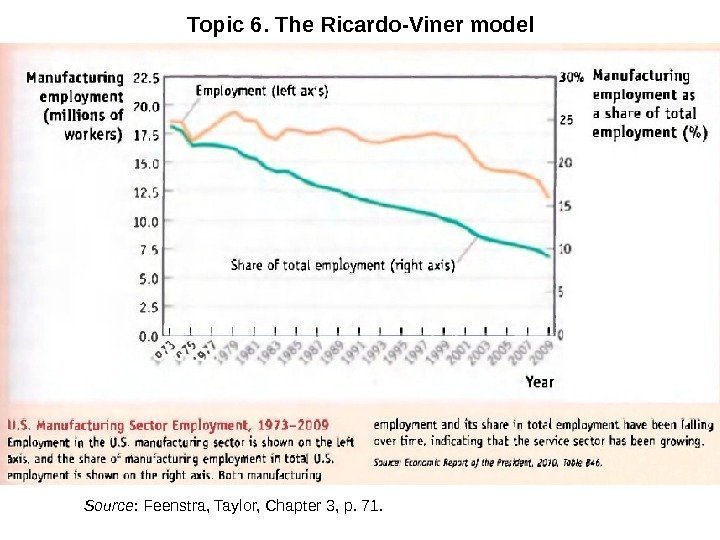

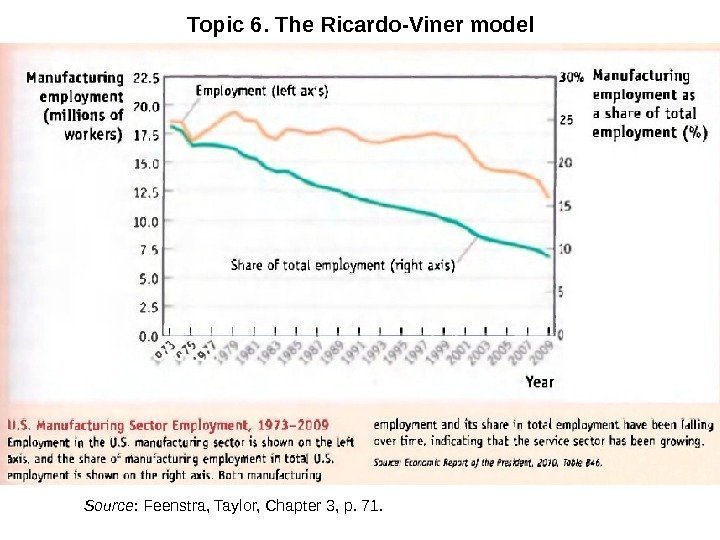

Topic 6. The Ricardo-Viner model Source : Feenstra, Taylor, Chapter 3, p. 71.

Topic 6. The Ricardo-Viner model Source : Feenstra, Taylor, Chapter 3, p. 71.

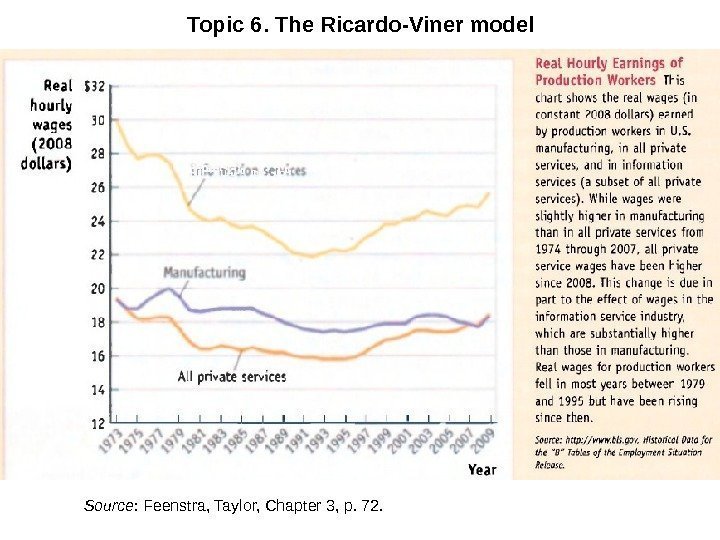

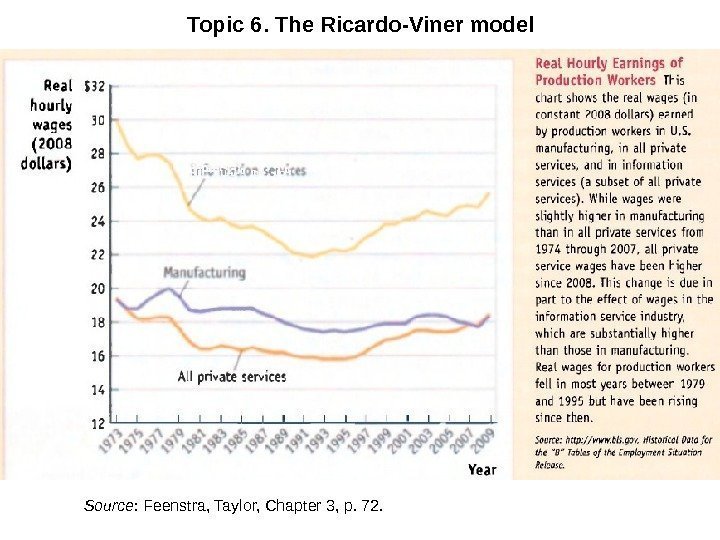

Topic 6. The Ricardo-Viner model Source : Feenstra, Taylor, Chapter 3, p. 72.

Topic 6. The Ricardo-Viner model Source : Feenstra, Taylor, Chapter 3, p. 72.

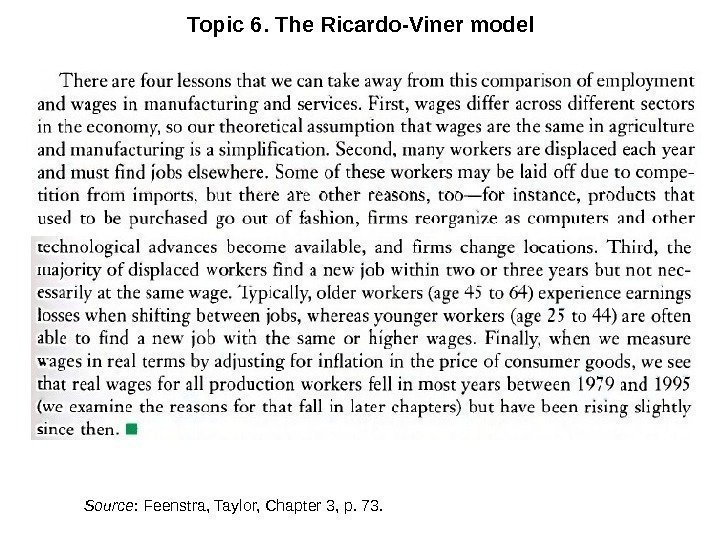

Topic 6. The Ricardo-Viner model Source : Feenstra, Taylor, Chapter 3, p. 73.

Topic 6. The Ricardo-Viner model Source : Feenstra, Taylor, Chapter 3, p. 73.

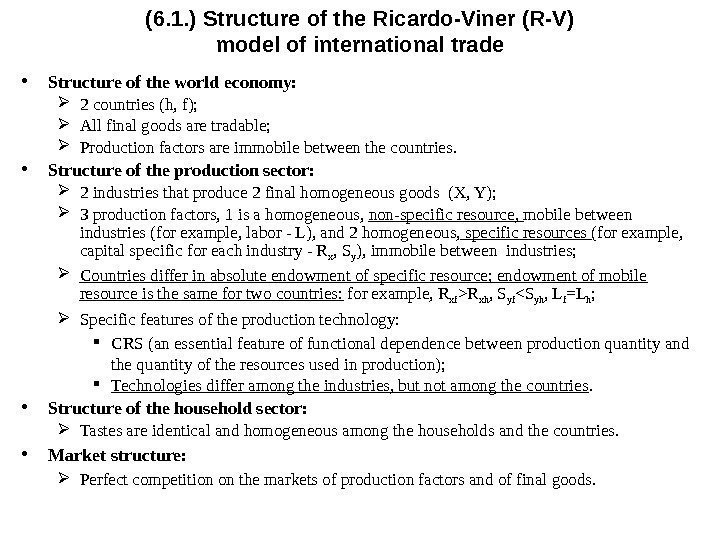

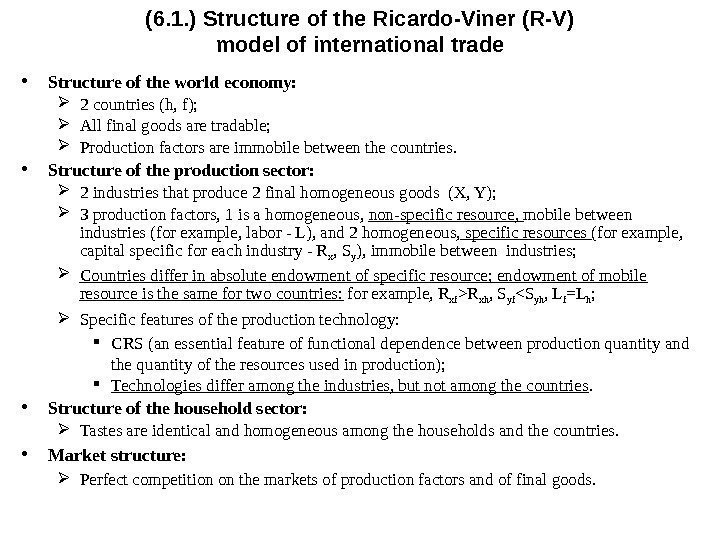

(6. 1. ) Structure of the Ricardo-Viner (R-V) model of international trade • Structure of the world economy: 2 countries (h, f); All final goods are tradable; Production factors are immobile between the countries. • Structure of the production sector: 2 industries that produce 2 final homogeneous goods (X, Y); 3 production factors, 1 is a homogeneous, non-specific resource, mobile between industries (for example, labor — L), and 2 homogeneous, specific resources (for example, capital specific for each industry — R x , S y ), immobile between industries; Countries differ in absolute endowment of specific resource; endowment of mobile resource is the same for two countries: for example, R xf >R xh , S yf <S yh , L f =L h ; Specific features of the production technology: CRS (an essential feature of functional dependence between production quantity and the quantity of the resources used in production); Technologies differ among the industries, but not among the countries. • Structure of the household sector: Tastes are identical and homogeneous among the households and the countries. • Market structure: Perfect competition on the markets of production factors and of final goods.

(6. 1. ) Structure of the Ricardo-Viner (R-V) model of international trade • Structure of the world economy: 2 countries (h, f); All final goods are tradable; Production factors are immobile between the countries. • Structure of the production sector: 2 industries that produce 2 final homogeneous goods (X, Y); 3 production factors, 1 is a homogeneous, non-specific resource, mobile between industries (for example, labor — L), and 2 homogeneous, specific resources (for example, capital specific for each industry — R x , S y ), immobile between industries; Countries differ in absolute endowment of specific resource; endowment of mobile resource is the same for two countries: for example, R xf >R xh , S yf <S yh , L f =L h ; Specific features of the production technology: CRS (an essential feature of functional dependence between production quantity and the quantity of the resources used in production); Technologies differ among the industries, but not among the countries. • Structure of the household sector: Tastes are identical and homogeneous among the households and the countries. • Market structure: Perfect competition on the markets of production factors and of final goods.

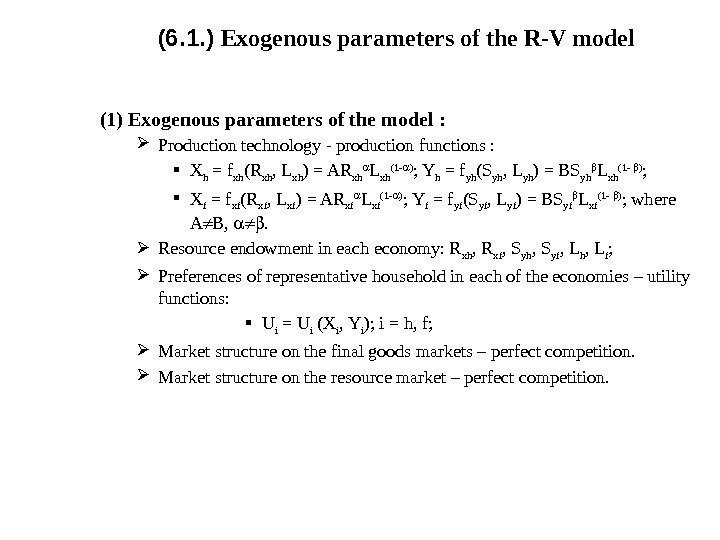

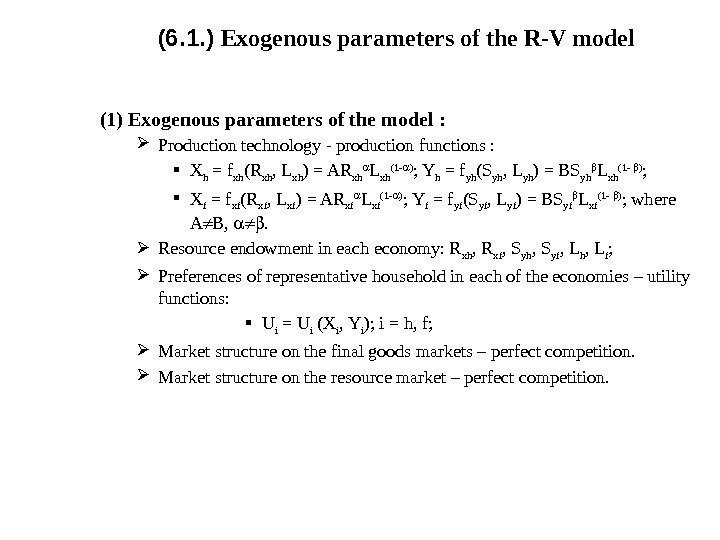

(6. 1. ) Exogenous parameters of the R-V model (1) Exogenous parameters of the model : Production technology — production functions : Х h = f xh (R xh , L xh ) = AR xh L xh (1 — ) ; Y h = f yh (S yh , L yh ) = BS yh L xh (1 — ) ; Х f = f xf (R xf , L xf ) = AR xf L xf (1 — ) ; Y f = f yf (S yf , L yf ) = BS yf L xf (1 — ) ; where А В, . Resource endowment in each economy: R xh , R xf , S yh , S yf , L h , L f ; Preferences of representative household in each of the economies – utility functions: U i = U i (X i , Y i ); i = h, f; Market structure on the final goods markets – perfect competition. Market structure on the resource market – perfect competition.

(6. 1. ) Exogenous parameters of the R-V model (1) Exogenous parameters of the model : Production technology — production functions : Х h = f xh (R xh , L xh ) = AR xh L xh (1 — ) ; Y h = f yh (S yh , L yh ) = BS yh L xh (1 — ) ; Х f = f xf (R xf , L xf ) = AR xf L xf (1 — ) ; Y f = f yf (S yf , L yf ) = BS yf L xf (1 — ) ; where А В, . Resource endowment in each economy: R xh , R xf , S yh , S yf , L h , L f ; Preferences of representative household in each of the economies – utility functions: U i = U i (X i , Y i ); i = h, f; Market structure on the final goods markets – perfect competition. Market structure on the resource market – perfect competition.

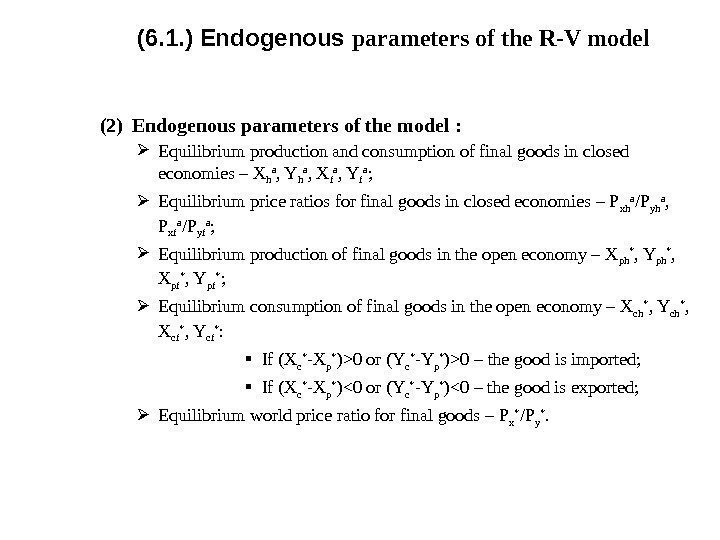

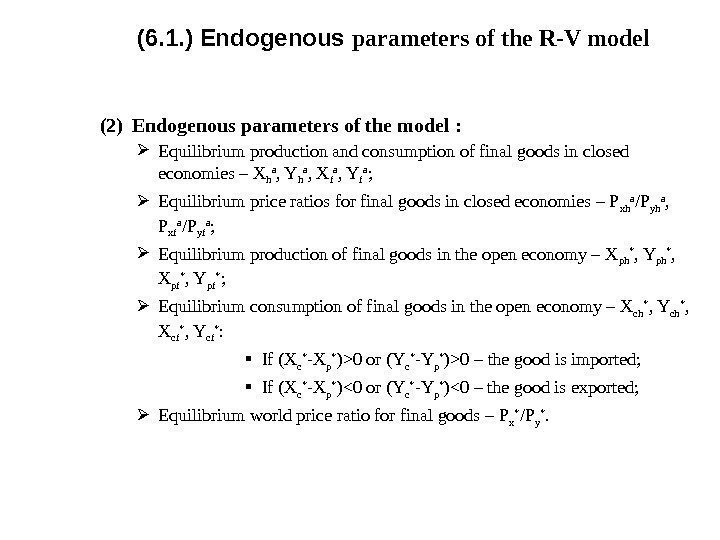

(6. 1. ) Endogenous parameters of the R-V model (2) Endogenous parameters of the model : Equilibrium production and consumption of final goods in closed economies – X h a , Y h a , X f a , Y f a ; Equilibrium price ratios for final goods in closed economies – P xh a /P yh a , P xf a /P yf a ; Equilibrium production of final goods in the open economy – X ph * , Y ph * , X pf * , Y pf * ; Equilibrium consumption of final goods in the open economy – X сh * , Y сh * , X сf * , Y сf * : If (X c * -X p * ) >0 or (Y c * -Y p * )>0 – the good is imported; If (X c * -X p * )<0 or (Y c * -Y p * )<0 – the good is exported; Equilibrium world price ratio for final goods – P x * /P y *.

(6. 1. ) Endogenous parameters of the R-V model (2) Endogenous parameters of the model : Equilibrium production and consumption of final goods in closed economies – X h a , Y h a , X f a , Y f a ; Equilibrium price ratios for final goods in closed economies – P xh a /P yh a , P xf a /P yf a ; Equilibrium production of final goods in the open economy – X ph * , Y ph * , X pf * , Y pf * ; Equilibrium consumption of final goods in the open economy – X сh * , Y сh * , X сf * , Y сf * : If (X c * -X p * ) >0 or (Y c * -Y p * )>0 – the good is imported; If (X c * -X p * )<0 or (Y c * -Y p * )<0 – the good is exported; Equilibrium world price ratio for final goods – P x * /P y *.

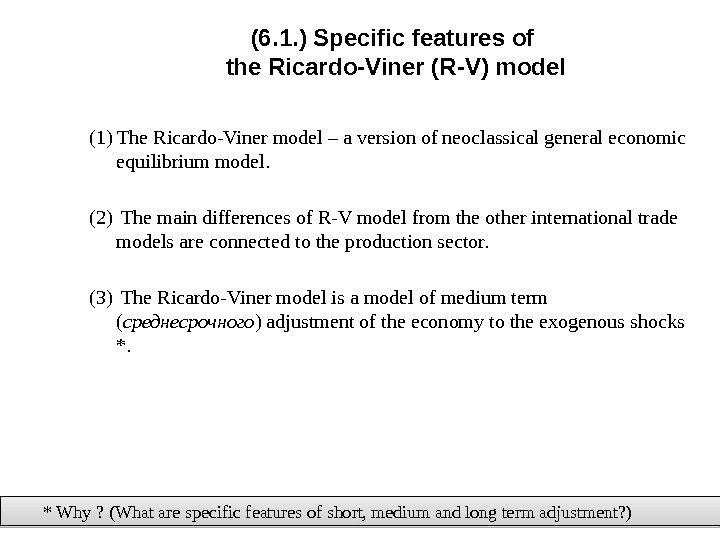

(6. 1. ) Specific features of the Ricardo-Viner (R-V) model (1) The Ricardo-Viner model – a version of neoclassical general economic equilibrium model. (2) The main differences of R-V model from the other international trade models are connected to the production sector. (3) The Ricardo-Viner model is a model of medium term ( среднесрочного ) adjustment of the economy to the exogenous shocks *. * Why ? (What are specific features of short, medium and long term adjustment? )

(6. 1. ) Specific features of the Ricardo-Viner (R-V) model (1) The Ricardo-Viner model – a version of neoclassical general economic equilibrium model. (2) The main differences of R-V model from the other international trade models are connected to the production sector. (3) The Ricardo-Viner model is a model of medium term ( среднесрочного ) adjustment of the economy to the exogenous shocks *. * Why ? (What are specific features of short, medium and long term adjustment? )

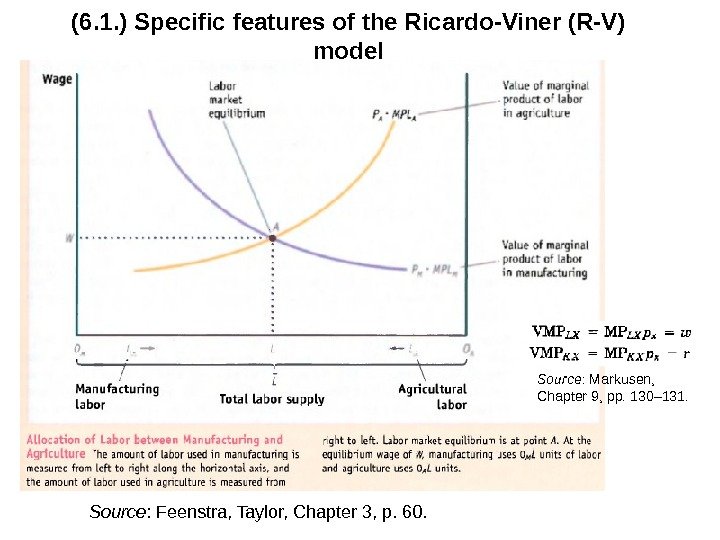

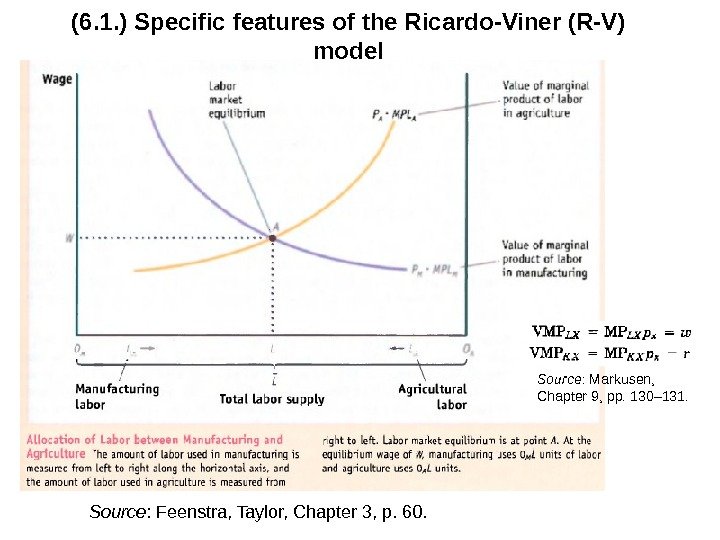

(6. 1. ) Specific features of the Ricardo-Viner (R-V) model Source : Markusen, Chapter 9, pp. 130– 131. Source : Feenstra, Taylor, Chapter 3, p. 60.

(6. 1. ) Specific features of the Ricardo-Viner (R-V) model Source : Markusen, Chapter 9, pp. 130– 131. Source : Feenstra, Taylor, Chapter 3, p. 60.

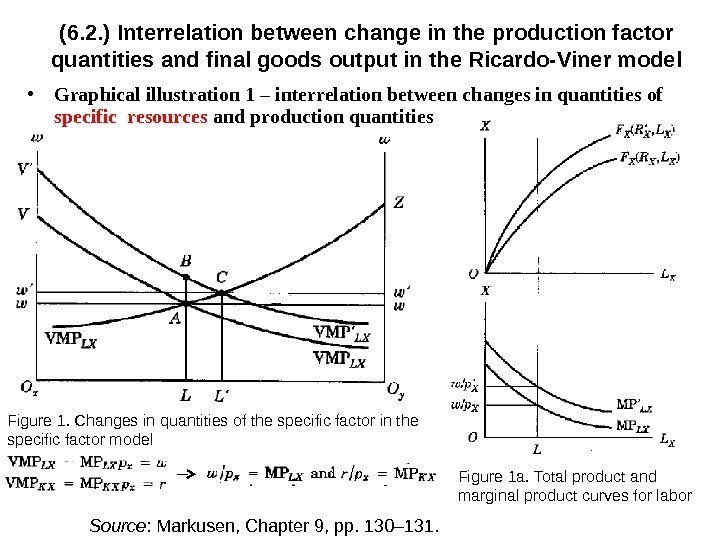

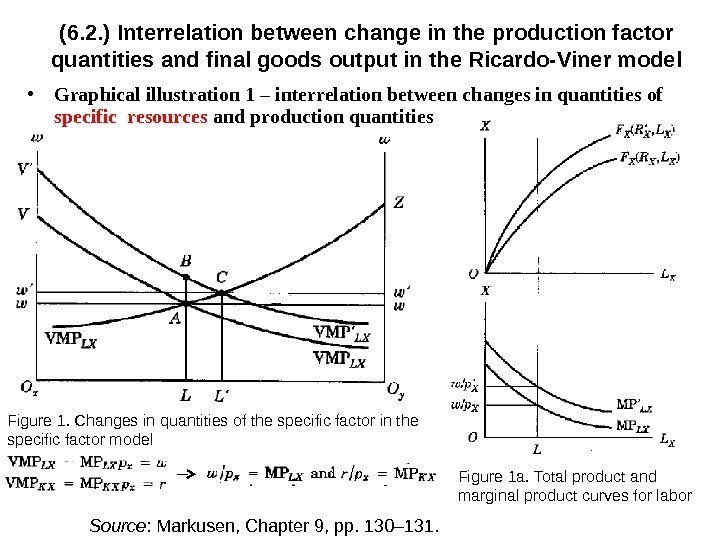

(6. 2. ) Interrelation between change in the production factor quantities and final goods output in the Ricardo-Viner model • Graphical illustration 1 – interrelation between changes in quantities of specific resources and production quantities Source : Markusen, Chapter 9, pp. 130– 131. Figure 1 a. Total product and marginal product curves for labor. Figure 1. Changes in quantities of the specific factor in the specific factor model

(6. 2. ) Interrelation between change in the production factor quantities and final goods output in the Ricardo-Viner model • Graphical illustration 1 – interrelation between changes in quantities of specific resources and production quantities Source : Markusen, Chapter 9, pp. 130– 131. Figure 1 a. Total product and marginal product curves for labor. Figure 1. Changes in quantities of the specific factor in the specific factor model

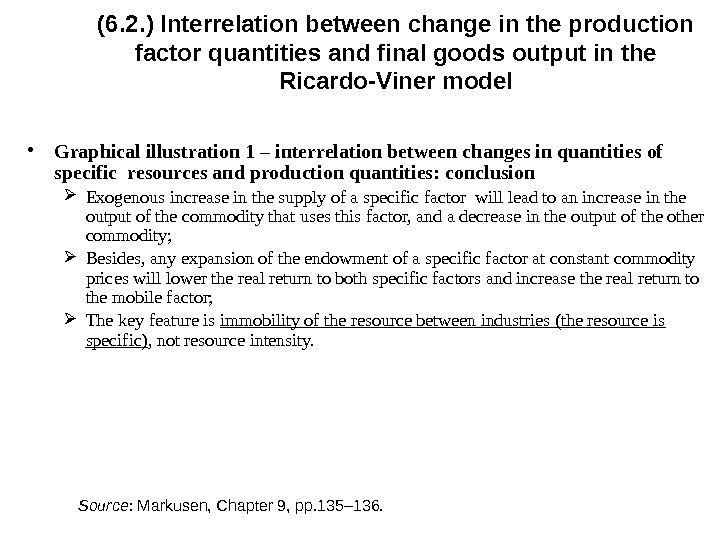

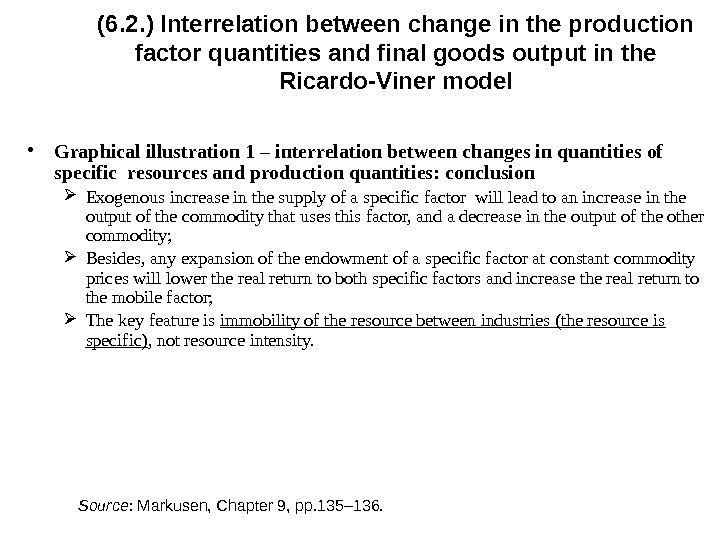

(6. 2. ) Interrelation between change in the production factor quantities and final goods output in the Ricardo-Viner model • Graphical illustration 1 – interrelation between changes in quantities of specific resources and production quantities: conclusion Exogenous increase in the supply of a specific factor will lead to an increase in the output of the commodity that uses this factor, and a decrease in the output of the other commodity; Besides, any expansion of the endowment of a specific factor at constant commodity prices will lower the real return to both specific factors and increase the real return to the mobile factor; The key feature is immobility of the resource between industries (the resource is specific) , not resource intensity. Source : Markusen, Chapter 9, pp. 135– 136.

(6. 2. ) Interrelation between change in the production factor quantities and final goods output in the Ricardo-Viner model • Graphical illustration 1 – interrelation between changes in quantities of specific resources and production quantities: conclusion Exogenous increase in the supply of a specific factor will lead to an increase in the output of the commodity that uses this factor, and a decrease in the output of the other commodity; Besides, any expansion of the endowment of a specific factor at constant commodity prices will lower the real return to both specific factors and increase the real return to the mobile factor; The key feature is immobility of the resource between industries (the resource is specific) , not resource intensity. Source : Markusen, Chapter 9, pp. 135– 136.

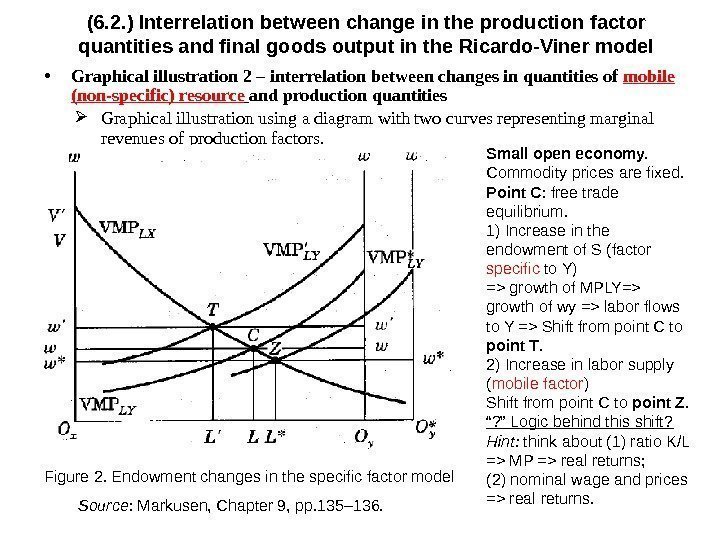

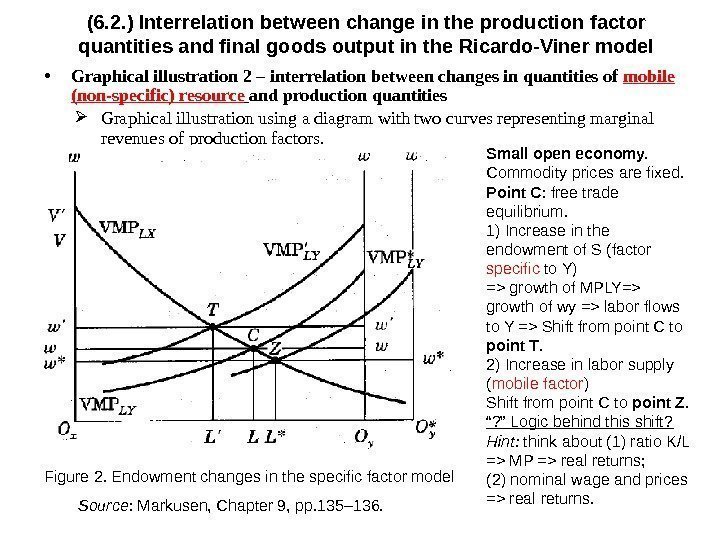

• Graphical illustration 2 – interrelation between changes in quantities of mobile (non-specific) resource and production quantities Graphical illustration using a diagram with two curves representing marginal revenues of production factors. (6. 2. ) Interrelation between change in the production factor quantities and final goods output in the Ricardo-Viner model Figure 2. Endowment changes in the specific factor model Source : Markusen, Chapter 9, pp. 135– 136. Small open economy. Commodity prices are fixed. Point C : free trade equilibrium. 1) Increase in the endowment of S (factor specific to Y) => growth of MPLY=> growth of wy => labor flows to Y => Shift from point C to point T. 2) Increase in labor supply ( mobile factor ) Shift from point C to point Z. “ ? ” Logic behind this shift? Hint: think about (1) ratio K/L => MP => real returns; (2) nominal wage and prices => real returns.

• Graphical illustration 2 – interrelation between changes in quantities of mobile (non-specific) resource and production quantities Graphical illustration using a diagram with two curves representing marginal revenues of production factors. (6. 2. ) Interrelation between change in the production factor quantities and final goods output in the Ricardo-Viner model Figure 2. Endowment changes in the specific factor model Source : Markusen, Chapter 9, pp. 135– 136. Small open economy. Commodity prices are fixed. Point C : free trade equilibrium. 1) Increase in the endowment of S (factor specific to Y) => growth of MPLY=> growth of wy => labor flows to Y => Shift from point C to point T. 2) Increase in labor supply ( mobile factor ) Shift from point C to point Z. “ ? ” Logic behind this shift? Hint: think about (1) ratio K/L => MP => real returns; (2) nominal wage and prices => real returns.

• Graphical illustration 2 – interrelation between changes in quantities of mobile (non-specific) resource and production quantities: conclusion Exogenous increase in the supply of mobile factor will lead to an increase in the output of both commodities; Besides, an increase in the endowment of the mobile factor will reduce its own real income and increase the real income of both specific factors. (6. 2. ) Interrelation between change in the production factor quantities and final goods output in the Ricardo-Viner model Look at Figures 1 and 2 and tell, if the Rybczynsky theorem holds in the Ricardo-Viner model? Explain why.

• Graphical illustration 2 – interrelation between changes in quantities of mobile (non-specific) resource and production quantities: conclusion Exogenous increase in the supply of mobile factor will lead to an increase in the output of both commodities; Besides, an increase in the endowment of the mobile factor will reduce its own real income and increase the real income of both specific factors. (6. 2. ) Interrelation between change in the production factor quantities and final goods output in the Ricardo-Viner model Look at Figures 1 and 2 and tell, if the Rybczynsky theorem holds in the Ricardo-Viner model? Explain why.

(6. 3. ) The pattern of international trade (структура международной торговли) in the Ricardo-Viner model • The main assumption for simplification of the international trade structure analysis in the Ricardo-Viner model: Countries differ in absolute endowment of specific production factors, mobile resource endowment being the same: for example, R xf >R xh , S yf <S yh , L f =L h.

(6. 3. ) The pattern of international trade (структура международной торговли) in the Ricardo-Viner model • The main assumption for simplification of the international trade structure analysis in the Ricardo-Viner model: Countries differ in absolute endowment of specific production factors, mobile resource endowment being the same: for example, R xf >R xh , S yf <S yh , L f =L h.

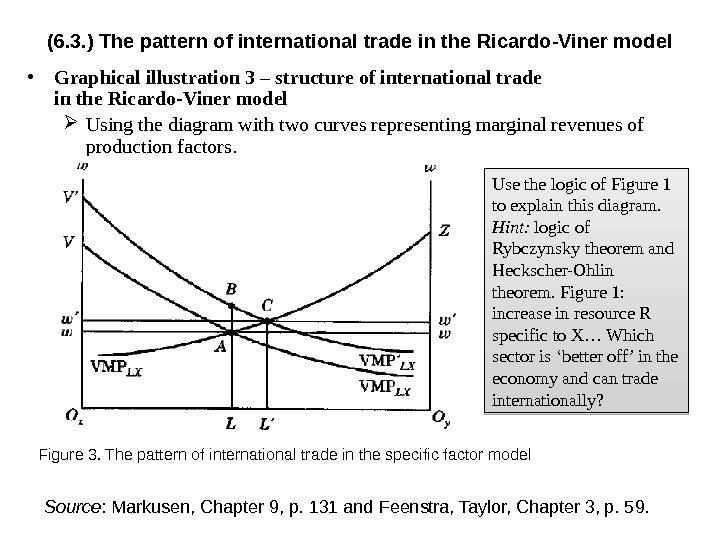

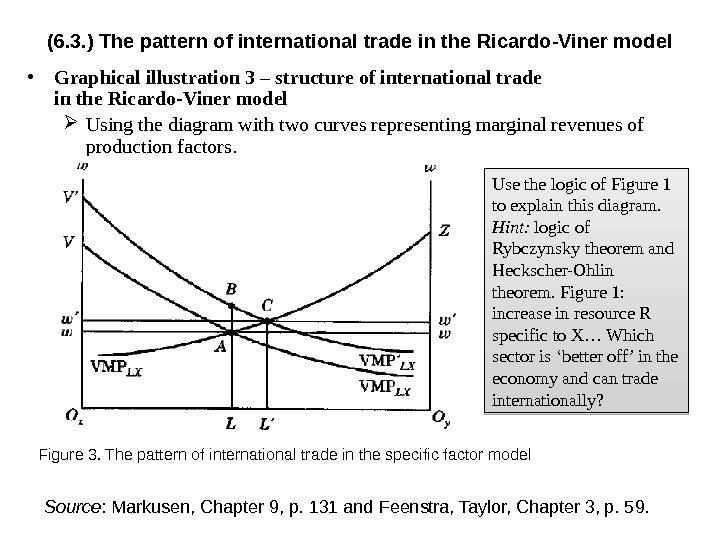

(6. 3. ) The pattern of international trade in the Ricardo-Viner model • Graphical illustration 3 – structure of international trade in the Ricardo-Viner model Using the diagram with two curves representing marginal revenues of production factors. Figure 3. The pattern of international trade in the specific factor model Source : Markusen, Chapter 9, p. 131 and Feenstra, Taylor, Chapter 3, p. 59. Use the logic of Figure 1 to explain this diagram. Hint: logic of Rybczynsky theorem and Heckscher-Ohlin theorem. Figure 1: increase in resource R specific to X… Which sector is ‘better off ’ in the economy and can trade internationally?

(6. 3. ) The pattern of international trade in the Ricardo-Viner model • Graphical illustration 3 – structure of international trade in the Ricardo-Viner model Using the diagram with two curves representing marginal revenues of production factors. Figure 3. The pattern of international trade in the specific factor model Source : Markusen, Chapter 9, p. 131 and Feenstra, Taylor, Chapter 3, p. 59. Use the logic of Figure 1 to explain this diagram. Hint: logic of Rybczynsky theorem and Heckscher-Ohlin theorem. Figure 1: increase in resource R specific to X… Which sector is ‘better off ’ in the economy and can trade internationally?

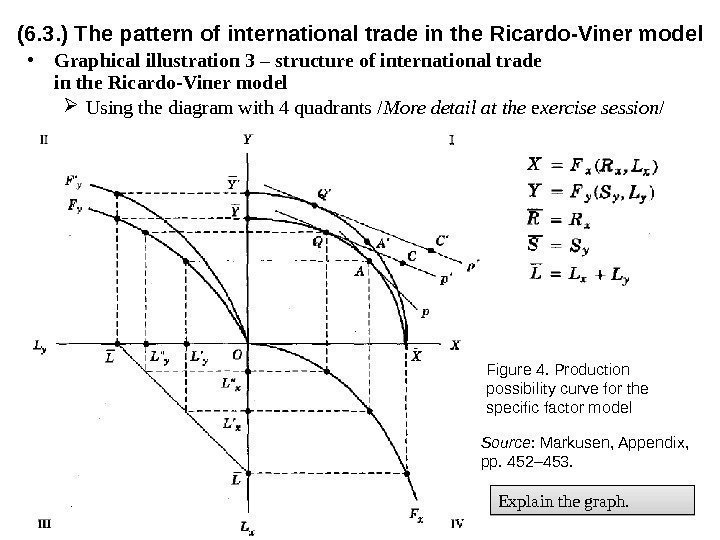

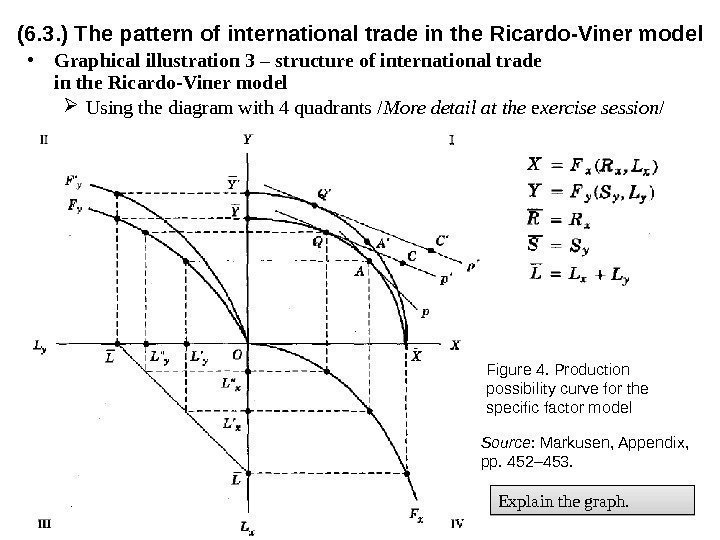

(6. 3. ) The pattern of international trade in the Ricardo-Viner model • Graphical illustration 3 – structure of international trade in the Ricardo-Viner model Using the diagram with 4 quadrants / More detail at the e xercise session / Source : Markusen, Appendix, pp. 452– 453. Figure 4. Production possibility curve for the specific factor model Explain the graph.

(6. 3. ) The pattern of international trade in the Ricardo-Viner model • Graphical illustration 3 – structure of international trade in the Ricardo-Viner model Using the diagram with 4 quadrants / More detail at the e xercise session / Source : Markusen, Appendix, pp. 452– 453. Figure 4. Production possibility curve for the specific factor model Explain the graph.

(6. 3. ) The pattern of international trade (структура международной торговли) in the Ricardo-Viner model • The pattern of international trade in the Ricardo-Viner model: conclusion In the specific-factors model, each country will export the good with the absolutely abundant stock of specific capital, assuming identical endowments of labor, the mobile factor; With differences in labor endowments, trade patterns will depend on the nature of the production functions and on the allocation of capital (that is, on the stocks of specific factors); Unlike the Heckscher-Ohlin-Samuelson model, trade structure in the Ricardo-Viner model depends on the immobile (specific) resource, not on the resource intensity *. * Which good is exported in the Heckscher-Ohlin-Samuelson model? What about Ricardo-Viner model?

(6. 3. ) The pattern of international trade (структура международной торговли) in the Ricardo-Viner model • The pattern of international trade in the Ricardo-Viner model: conclusion In the specific-factors model, each country will export the good with the absolutely abundant stock of specific capital, assuming identical endowments of labor, the mobile factor; With differences in labor endowments, trade patterns will depend on the nature of the production functions and on the allocation of capital (that is, on the stocks of specific factors); Unlike the Heckscher-Ohlin-Samuelson model, trade structure in the Ricardo-Viner model depends on the immobile (specific) resource, not on the resource intensity *. * Which good is exported in the Heckscher-Ohlin-Samuelson model? What about Ricardo-Viner model?

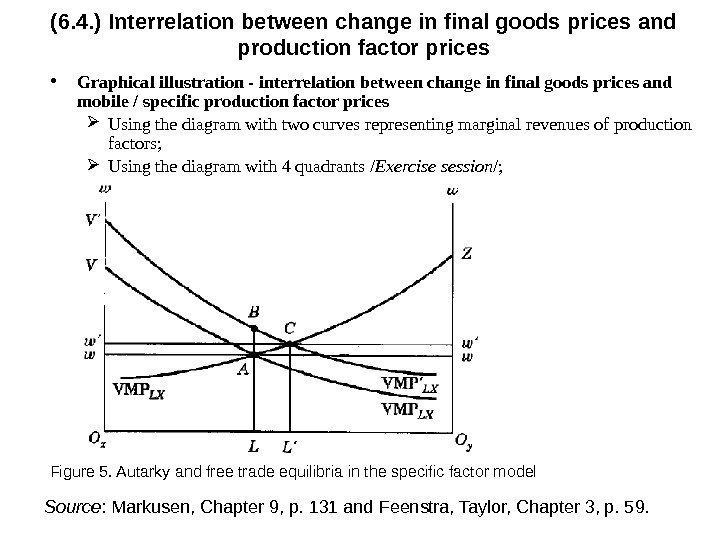

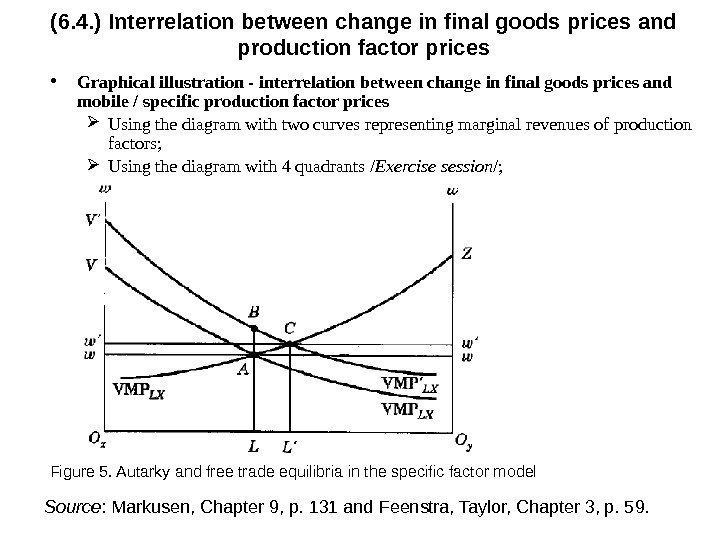

(6. 4. ) Interrelation between change in final goods prices and production factor prices • Graphical illustration — interrelation between change in final goods prices and mobile / specific production factor prices Using the diagram with two curves representing marginal revenues of production factors; Using the diagram with 4 quadrants / Exercise session /; Figure 5. Autarky and free trade equilibria in the specific factor model Source : Markusen, Chapter 9, p. 131 and Feenstra, Taylor, Chapter 3, p. 59.

(6. 4. ) Interrelation between change in final goods prices and production factor prices • Graphical illustration — interrelation between change in final goods prices and mobile / specific production factor prices Using the diagram with two curves representing marginal revenues of production factors; Using the diagram with 4 quadrants / Exercise session /; Figure 5. Autarky and free trade equilibria in the specific factor model Source : Markusen, Chapter 9, p. 131 and Feenstra, Taylor, Chapter 3, p. 59.

(6. 4. ) Interrelation between change in final goods prices and production factor prices • Graphical illustration — interrelation between change in final goods prices and mobile / specific production factor prices: conclusions Exogenous increase in the commodity relative price results into — increase in real return (real price) of the specific factor used in production of this commodity, — decrease in real price of the other specific factor and — has an indefinite impact on the real return of the mobile factor; The conclusions depend on the factor mobility versus factor specificity, rather than factor intensities as in the H-O-S model.

(6. 4. ) Interrelation between change in final goods prices and production factor prices • Graphical illustration — interrelation between change in final goods prices and mobile / specific production factor prices: conclusions Exogenous increase in the commodity relative price results into — increase in real return (real price) of the specific factor used in production of this commodity, — decrease in real price of the other specific factor and — has an indefinite impact on the real return of the mobile factor; The conclusions depend on the factor mobility versus factor specificity, rather than factor intensities as in the H-O-S model.

• Does the Stolper-Samuelson theorem hold in the Ricardo-Viner model? The essential difference between medim- and long term effects from trade liberalization policy measures from the view point of gains and losses for the owners of production factors. Explain this statement. • Does the factor price equalization theorem hold in the Ricardo-Viner model? It does not hold. Formulate factor price equalization theorem. Explain why it does not hold. (6. 4. ) Interrelation between change in final goods prices and production factor prices Source : Markusen, Chapter 9, pp. 137.

• Does the Stolper-Samuelson theorem hold in the Ricardo-Viner model? The essential difference between medim- and long term effects from trade liberalization policy measures from the view point of gains and losses for the owners of production factors. Explain this statement. • Does the factor price equalization theorem hold in the Ricardo-Viner model? It does not hold. Formulate factor price equalization theorem. Explain why it does not hold. (6. 4. ) Interrelation between change in final goods prices and production factor prices Source : Markusen, Chapter 9, pp. 137.

(1) Exercise session 5 (2) Think about topics for reports during exercise sessions; work on presentation of the paper Office hours: Friday 13: 50 – 14: 30, room 216. E-mail: natalya. davidson@gmail. com (Наталья Борисовна Давидсон) 22 Homework

(1) Exercise session 5 (2) Think about topics for reports during exercise sessions; work on presentation of the paper Office hours: Friday 13: 50 – 14: 30, room 216. E-mail: natalya. davidson@gmail. com (Наталья Борисовна Давидсон) 22 Homework

Topic 7. International trade under increasing returns to scale and imperfect competition on the markets

Topic 7. International trade under increasing returns to scale and imperfect competition on the markets