International tax planning Moscow 2012 I N S

lec_1_anh_eng.ppt

- Количество слайдов: 27

International tax planning Moscow 2012 I N S T I T U T E OF BUSINESS STUDIES RUSSIAN GOVERNMENT ACADEMY OF THE NATIONAL ECONOMY

International tax planning Moscow 2012 I N S T I T U T E OF BUSINESS STUDIES RUSSIAN GOVERNMENT ACADEMY OF THE NATIONAL ECONOMY

11/25/2017 Topic 1 Slide 2 Objectives and tasks of the course Objective Study the theoretical basis and acquire practical skills of applying international legal rules of taxation. Master contemporary methods and forms of international taxation, and approaches to taxation in accordance with international and Russian legal rules. Assessment of knowledge acquired to be performed by A test

11/25/2017 Topic 1 Slide 2 Objectives and tasks of the course Objective Study the theoretical basis and acquire practical skills of applying international legal rules of taxation. Master contemporary methods and forms of international taxation, and approaches to taxation in accordance with international and Russian legal rules. Assessment of knowledge acquired to be performed by A test

Topic 1: An introduction to international tax planning Irina G. Rousakova, PhD in Economics International tax planning January 2012

Topic 1: An introduction to international tax planning Irina G. Rousakova, PhD in Economics International tax planning January 2012

11/25/2017 Topic 1 Slide 4 What does "international taxation" mean? The tax law of a country is an independent legal environment. However, given the mobility of modern businesses and individuals, their activity and lives often go beyond the legal framework of one country, and come under the legal rules of another. International Domestic At some point, countries come together in their efforts to create instruments of international law (which prevail over domestic law, as you are aware), define and divide the tax jurisdiction and avoid disputes. This results in the creation of a new, international environment, called INTERNATIONAL taxation.

11/25/2017 Topic 1 Slide 4 What does "international taxation" mean? The tax law of a country is an independent legal environment. However, given the mobility of modern businesses and individuals, their activity and lives often go beyond the legal framework of one country, and come under the legal rules of another. International Domestic At some point, countries come together in their efforts to create instruments of international law (which prevail over domestic law, as you are aware), define and divide the tax jurisdiction and avoid disputes. This results in the creation of a new, international environment, called INTERNATIONAL taxation.

Key issues of international taxation (1) Double taxation: legal and economic economic double taxation is encountered in situations where several recipients of income pay tax on one and the same income. This conflict generally arises within the tax system of any country. legal double taxation arises in situations when one and the same taxpayer is taxed with respect to one and the same tax base in two or more countries. This is the main conflict within international double taxation. 11/25/2017 Topic 1 Slide 5

Key issues of international taxation (1) Double taxation: legal and economic economic double taxation is encountered in situations where several recipients of income pay tax on one and the same income. This conflict generally arises within the tax system of any country. legal double taxation arises in situations when one and the same taxpayer is taxed with respect to one and the same tax base in two or more countries. This is the main conflict within international double taxation. 11/25/2017 Topic 1 Slide 5

11/25/2017 Topic 1 Slide 6 Key issues of international taxation (2) Double "non-taxation" may be encountered in situations when a taxpayer's income is free from tax liability in two or more countries, and tax is not collected at all. During this course we will address these matters in detail. These aspects are always under the scrutiny of international tax planning professionals, and also are of concern to financial managers.

11/25/2017 Topic 1 Slide 6 Key issues of international taxation (2) Double "non-taxation" may be encountered in situations when a taxpayer's income is free from tax liability in two or more countries, and tax is not collected at all. During this course we will address these matters in detail. These aspects are always under the scrutiny of international tax planning professionals, and also are of concern to financial managers.

International tax planning (1) Tax planning is based on the principle that a taxpayer may use all legal means, methods and techniques to minimise its tax costs. Taxes are the mandatory payments or costs of a company. Any business enterprise seeks to generate maximum profits and incur minimum costs – this is the rationale behind a business. But if a businessman buys cheaper raw materials or introduces a new technology, then what should he do about taxes, which are, after all, mandatory, and can lead to criminal liability if they are not paid? 11/25/2017 Topic 1 Slide 7

International tax planning (1) Tax planning is based on the principle that a taxpayer may use all legal means, methods and techniques to minimise its tax costs. Taxes are the mandatory payments or costs of a company. Any business enterprise seeks to generate maximum profits and incur minimum costs – this is the rationale behind a business. But if a businessman buys cheaper raw materials or introduces a new technology, then what should he do about taxes, which are, after all, mandatory, and can lead to criminal liability if they are not paid? 11/25/2017 Topic 1 Slide 7

International tax planning (2) The main goal of tax planning is to build the operational process in such a way that obligations to a country are honoured in good faith, and at the same time excessive tax costs, which adversely affect business performance indicators, are avoided. International tax planning falls outside the legal framework of one country. It uses (among others) instruments of international tax relationships for the achievement of the same goals, but on a macro-level. 11/25/2017 Topic 1 Slide 8

International tax planning (2) The main goal of tax planning is to build the operational process in such a way that obligations to a country are honoured in good faith, and at the same time excessive tax costs, which adversely affect business performance indicators, are avoided. International tax planning falls outside the legal framework of one country. It uses (among others) instruments of international tax relationships for the achievement of the same goals, but on a macro-level. 11/25/2017 Topic 1 Slide 8

Who is engaged in international tax planning? Financial director… Financial controller… Accountant… …? The right answer is tax consultant. A tax consultant by profession is like a doctor. The main task of both is to help a client resolve a problem, and even more importantly, prevent a problem occurring for the client by using pre-emptive measures while at the same time understanding how the whole system works. 11/25/2017 Topic 1 Slide 9

Who is engaged in international tax planning? Financial director… Financial controller… Accountant… …? The right answer is tax consultant. A tax consultant by profession is like a doctor. The main task of both is to help a client resolve a problem, and even more importantly, prevent a problem occurring for the client by using pre-emptive measures while at the same time understanding how the whole system works. 11/25/2017 Topic 1 Slide 9

Who is engaged in international tax planning? (2) The key and most important traits of a tax consultant: Professionalism and knowledge ▪ Diplomacy Flexible thinking ▪ Knowledge of the client's business Ability to work in a team ▪ Positive attitude Ability to listen ▪ Commitment Ability to engage in conversation ▪ Setting an example Creativity ▪ Precision Tact ▪ Integrity 11/25/2017 Topic 1 Slide 10

Who is engaged in international tax planning? (2) The key and most important traits of a tax consultant: Professionalism and knowledge ▪ Diplomacy Flexible thinking ▪ Knowledge of the client's business Ability to work in a team ▪ Positive attitude Ability to listen ▪ Commitment Ability to engage in conversation ▪ Setting an example Creativity ▪ Precision Tact ▪ Integrity 11/25/2017 Topic 1 Slide 10

11/25/2017 Topic 1 Slide 11 Development of the tax consultant profession in Russia History of the development of the tax consultant profession in Russia Tax consultant: accountant or lawyer? Tax law Legal framework in Russia International documents International organisations: IFA, IBFD, OECD, UN

11/25/2017 Topic 1 Slide 11 Development of the tax consultant profession in Russia History of the development of the tax consultant profession in Russia Tax consultant: accountant or lawyer? Tax law Legal framework in Russia International documents International organisations: IFA, IBFD, OECD, UN

Key principles of international taxation (1) Universality and equality Taxes must only be established by law Unity of the tax system A tax law that worsens a taxpayer's position must not be retroactive Fairness Clarity Transparency 11/25/2017 Topic 1 Slide 12

Key principles of international taxation (1) Universality and equality Taxes must only be established by law Unity of the tax system A tax law that worsens a taxpayer's position must not be retroactive Fairness Clarity Transparency 11/25/2017 Topic 1 Slide 12

11/25/2017 Topic 1 Slide 13 Key elements of international taxation (2) Tax rules, applied to economic events, affect the interests of more than one country. Taxes are established by countries, and international taxation is aimed at supporting the objectives and tasks of each individual tax system by: Facilitating a fair redistribution of income through the equal taxation of taxpayers with a similar income; Promoting economic growth; Implementing the equal taxation of cross-border transactions; Contributing to a balance between the export and import of capital by means of tax neutrality.

11/25/2017 Topic 1 Slide 13 Key elements of international taxation (2) Tax rules, applied to economic events, affect the interests of more than one country. Taxes are established by countries, and international taxation is aimed at supporting the objectives and tasks of each individual tax system by: Facilitating a fair redistribution of income through the equal taxation of taxpayers with a similar income; Promoting economic growth; Implementing the equal taxation of cross-border transactions; Contributing to a balance between the export and import of capital by means of tax neutrality.

11/25/2017 Topic 1 Slide 14 Key elements of international taxation (3) The international tax neutrality of countries is a concept which means achieving such a level of integration between the tax systems of different countries, when the tax framework of each individual taxpayer becomes equally-effective in any jurisdiction. Business decisions are based on economic factors and not tax advantages.

11/25/2017 Topic 1 Slide 14 Key elements of international taxation (3) The international tax neutrality of countries is a concept which means achieving such a level of integration between the tax systems of different countries, when the tax framework of each individual taxpayer becomes equally-effective in any jurisdiction. Business decisions are based on economic factors and not tax advantages.

11/25/2017 Topic 1 Slide 15 Key elements of international taxation (4) Tax equality of countries means that taxes collected from income derived through a taxpayer's international activity must be divided equally between the countries concerned. The fairness and efficiency of all tax systems depend on the cumulative effect of the tax systems of all these countries, rather than on the individual tax laws of different countries. An important factor in achieving these results is efficient interaction between tax systems. Each country individually establishes its own tax laws, which inevitably affect international flows of capital and can result in overtaxation or the absence of taxation, thereby creating a competitive tax environment.

11/25/2017 Topic 1 Slide 15 Key elements of international taxation (4) Tax equality of countries means that taxes collected from income derived through a taxpayer's international activity must be divided equally between the countries concerned. The fairness and efficiency of all tax systems depend on the cumulative effect of the tax systems of all these countries, rather than on the individual tax laws of different countries. An important factor in achieving these results is efficient interaction between tax systems. Each country individually establishes its own tax laws, which inevitably affect international flows of capital and can result in overtaxation or the absence of taxation, thereby creating a competitive tax environment.

Irina G. Rousakova, PhD in Economics International tax planning Topic 2 Tax jurisdiction criteria. Tax evasion January 2012

Irina G. Rousakova, PhD in Economics International tax planning Topic 2 Tax jurisdiction criteria. Tax evasion January 2012

11/25/2017 Topic 2 Slide 17 Determining the tax jurisdiction for income tax purposes (1) The national tax jurisdiction for different taxes is determined based on two criteria: residency and territoriality. The residency criterion stipulates that residents of a country will pay tax on all their income derived in and and outside the country (so called unlimited tax liability) and non-residents pay tax only on income from sources in this country (limited tax liability).

11/25/2017 Topic 2 Slide 17 Determining the tax jurisdiction for income tax purposes (1) The national tax jurisdiction for different taxes is determined based on two criteria: residency and territoriality. The residency criterion stipulates that residents of a country will pay tax on all their income derived in and and outside the country (so called unlimited tax liability) and non-residents pay tax only on income from sources in this country (limited tax liability).

11/25/2017 Topic 2 Slide 18 Determining the tax jurisdiction for income tax purposes (2) The territoriality criterion stipulates that only income derived in the country will be taxed; accordingly, any income received or derived abroad shall be tax exempt in this country. Either of these criteria, provided that it is applied consistently in all countries, would exclude any potential violation of the tax equality principle or potential international double taxation, i.e., the taxation of the same item (income, property, a transaction etc.) in the same tax period by similar taxes in two or possibly more countries.

11/25/2017 Topic 2 Slide 18 Determining the tax jurisdiction for income tax purposes (2) The territoriality criterion stipulates that only income derived in the country will be taxed; accordingly, any income received or derived abroad shall be tax exempt in this country. Either of these criteria, provided that it is applied consistently in all countries, would exclude any potential violation of the tax equality principle or potential international double taxation, i.e., the taxation of the same item (income, property, a transaction etc.) in the same tax period by similar taxes in two or possibly more countries.

11/25/2017 Topic 2 Slide 19 Determining the tax jurisdiction for income tax purposes (3) Nevertheless the issue as to whether double taxation is eliminated based on the first or second criterion is far from neutral from the point of view of the national interests of every country. Accordingly, countries where individuals and companies receive considerable income from their operations and capital abroad undoubtedly prefer to globally distinguish between tax jurisdictions based on the residency criterion. Countries where a considerable portion of the economy is made up of foreign capital are particularly interested in advocating the territoriality criterion.

11/25/2017 Topic 2 Slide 19 Determining the tax jurisdiction for income tax purposes (3) Nevertheless the issue as to whether double taxation is eliminated based on the first or second criterion is far from neutral from the point of view of the national interests of every country. Accordingly, countries where individuals and companies receive considerable income from their operations and capital abroad undoubtedly prefer to globally distinguish between tax jurisdictions based on the residency criterion. Countries where a considerable portion of the economy is made up of foreign capital are particularly interested in advocating the territoriality criterion.

11/25/2017 Topic 2 Slide 20 Determining the tax jurisdiction for income tax purposes (4) It is apparent that developed countries prefer to establish their tax relations with other countries based on the residency criterion. Developing countries protect their right to tax foreign companies and individuals based on the territoriality criterion. In practice, the majority of countries apply various combinations of these two criteria.

11/25/2017 Topic 2 Slide 20 Determining the tax jurisdiction for income tax purposes (4) It is apparent that developed countries prefer to establish their tax relations with other countries based on the residency criterion. Developing countries protect their right to tax foreign companies and individuals based on the territoriality criterion. In practice, the majority of countries apply various combinations of these two criteria.

Eliminating international double taxation (1) Because in practice countries apply both principles strictly according to national interests, legal double taxation remains the main problem in international tax relations. At the same time, developed countries have acknowledged that modern intense migration flows of capital, assets and work force together with serious tax competition between countries for investors make isolation impossible, and that it is only together with neighbouring countries that they can build truly attractive tax environments which will on the one hand attract business (and accordingly raise budget revenues), and on the other hand allow tax evasion to be effectively counteracted. 11/25/2017 Topic 2 Slide 21

Eliminating international double taxation (1) Because in practice countries apply both principles strictly according to national interests, legal double taxation remains the main problem in international tax relations. At the same time, developed countries have acknowledged that modern intense migration flows of capital, assets and work force together with serious tax competition between countries for investors make isolation impossible, and that it is only together with neighbouring countries that they can build truly attractive tax environments which will on the one hand attract business (and accordingly raise budget revenues), and on the other hand allow tax evasion to be effectively counteracted. 11/25/2017 Topic 2 Slide 21

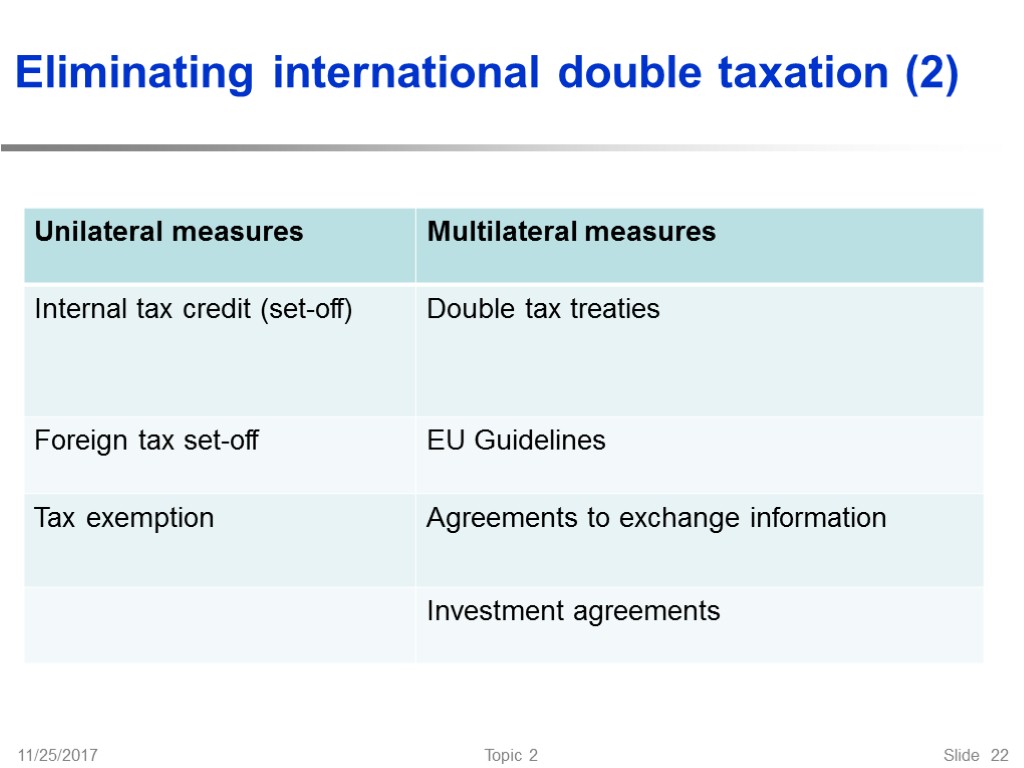

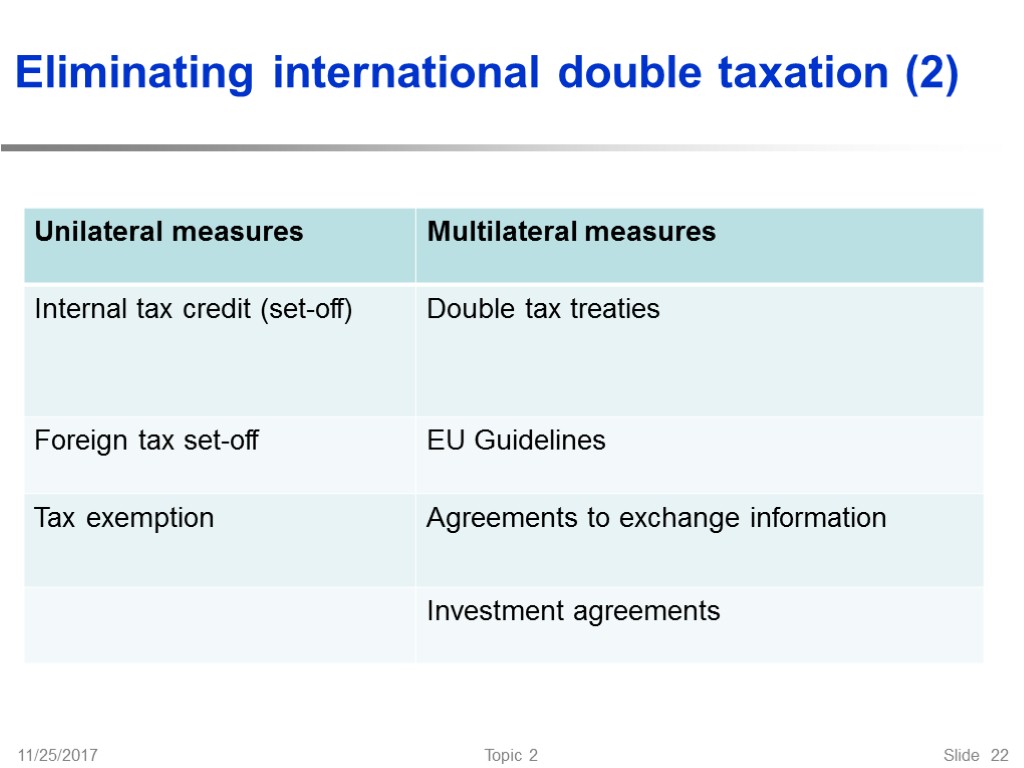

11/25/2017 Topic 2 Slide 22 Eliminating international double taxation (2)

11/25/2017 Topic 2 Slide 22 Eliminating international double taxation (2)

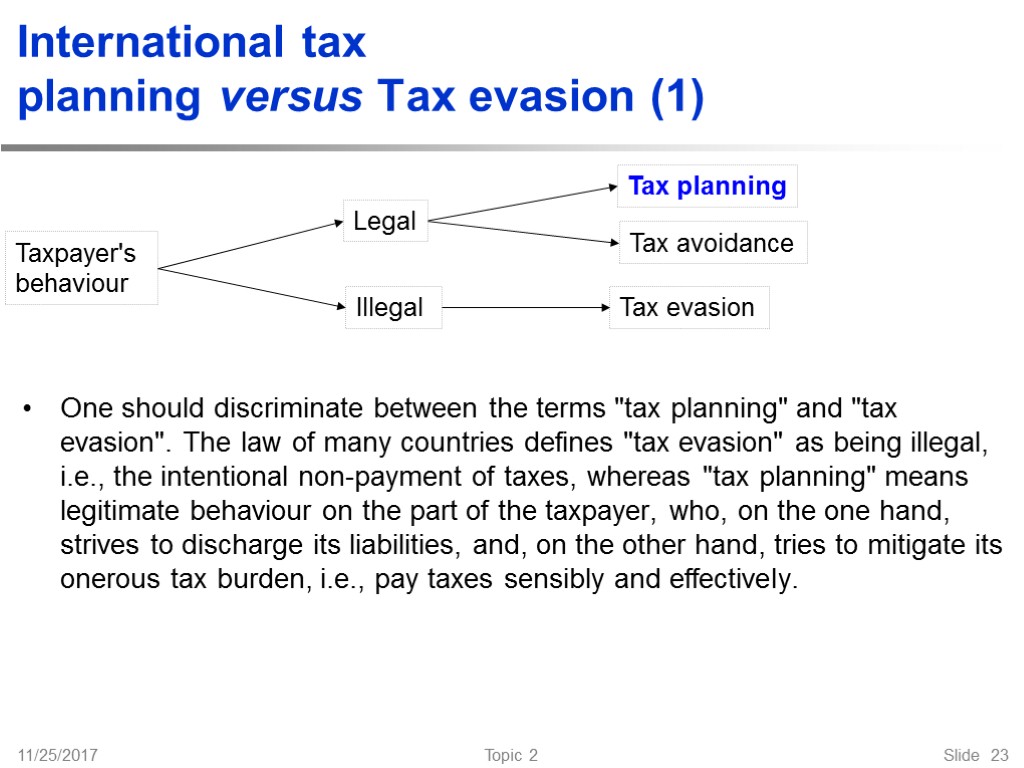

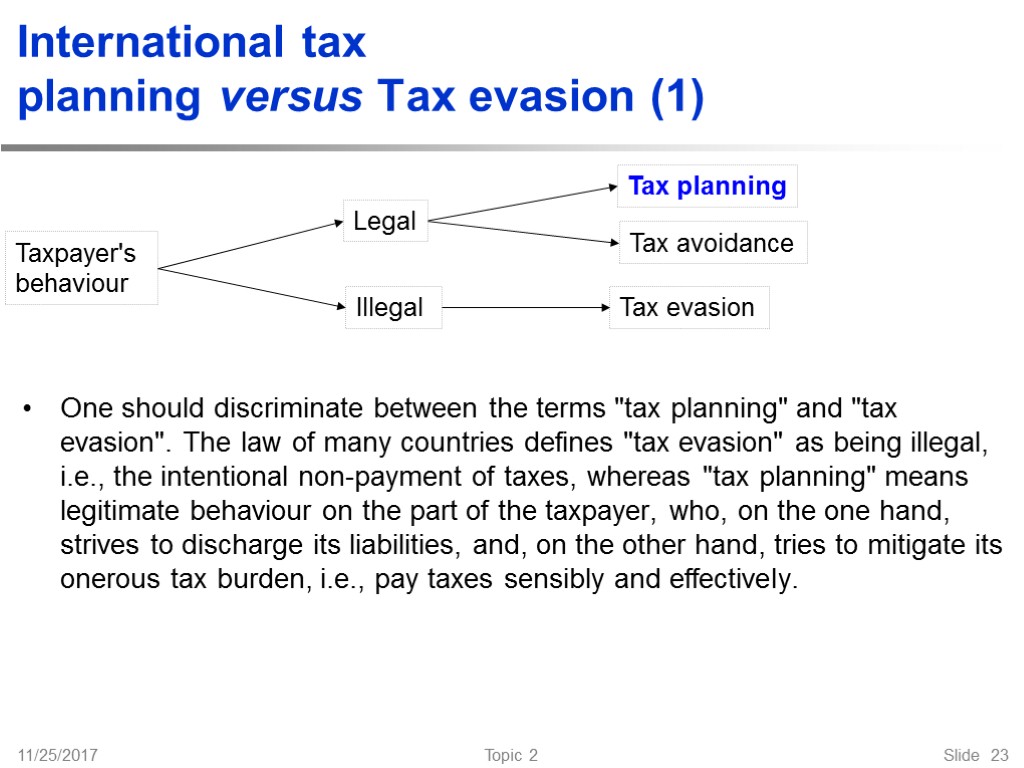

11/25/2017 Topic 2 Slide 23 International tax planning versus Tax evasion (1) One should discriminate between the terms "tax planning" and "tax evasion". The law of many countries defines "tax evasion" as being illegal, i.e., the intentional non-payment of taxes, whereas "tax planning" means legitimate behaviour on the part of the taxpayer, who, on the one hand, strives to discharge its liabilities, and, on the other hand, tries to mitigate its onerous tax burden, i.e., pay taxes sensibly and effectively. Taxpayer's behaviour Legal Illegal Tax planning Tax avoidance Tax evasion

11/25/2017 Topic 2 Slide 23 International tax planning versus Tax evasion (1) One should discriminate between the terms "tax planning" and "tax evasion". The law of many countries defines "tax evasion" as being illegal, i.e., the intentional non-payment of taxes, whereas "tax planning" means legitimate behaviour on the part of the taxpayer, who, on the one hand, strives to discharge its liabilities, and, on the other hand, tries to mitigate its onerous tax burden, i.e., pay taxes sensibly and effectively. Taxpayer's behaviour Legal Illegal Tax planning Tax avoidance Tax evasion

Let us assume that a taxpayer wants to reduce its tax burden and in doing so violates tax law, forming its own tax policy which is based on non-compliance with tax law requirements (for example, the taxpayer decides to evade taxes). Some of the means of tax evasion through non-compliance with the law are obvious, including failure to record received income, falsifying expense reports, and intentionally including false information in tax returns. All of these actions are obvious examples of non-compliance with tax law. International tax planning versus Tax evasion (2) 11/25/2017 Topic 2 Slide 24

Let us assume that a taxpayer wants to reduce its tax burden and in doing so violates tax law, forming its own tax policy which is based on non-compliance with tax law requirements (for example, the taxpayer decides to evade taxes). Some of the means of tax evasion through non-compliance with the law are obvious, including failure to record received income, falsifying expense reports, and intentionally including false information in tax returns. All of these actions are obvious examples of non-compliance with tax law. International tax planning versus Tax evasion (2) 11/25/2017 Topic 2 Slide 24

International tax planning versus Tax evasion (3) More complex situations arise when a taxpayer intends to operate in a manner which enables him to comply with statutory requirements according to his own interpretation and yet reduce his tax liabilities (for example, by taking action to avoid taxes). Tax authorities can interpret the tax law differently and deem that the taxpayer's operations are in violation of the law. 11/25/2017 Topic 2 Slide 25

International tax planning versus Tax evasion (3) More complex situations arise when a taxpayer intends to operate in a manner which enables him to comply with statutory requirements according to his own interpretation and yet reduce his tax liabilities (for example, by taking action to avoid taxes). Tax authorities can interpret the tax law differently and deem that the taxpayer's operations are in violation of the law. 11/25/2017 Topic 2 Slide 25

International tax planning versus Tax evasion (4) There are a number of reasons for a different interpretation of legal provisions by taxpayers and tax authorities. First of all, a taxpayer may follow ambiguously formulated provisions of tax law or apply its provisions in situations that are not fully covered by the law (i.e., due to existing errors, gaps and discrepancies). Secondly, a taxpayer can technically operate in compliance with the requirements of tax law; however, such operations will not meet the goals and concepts that lawmakers intended when creating the statutory provisions. 11/25/2017 Topic 2 Slide 26

International tax planning versus Tax evasion (4) There are a number of reasons for a different interpretation of legal provisions by taxpayers and tax authorities. First of all, a taxpayer may follow ambiguously formulated provisions of tax law or apply its provisions in situations that are not fully covered by the law (i.e., due to existing errors, gaps and discrepancies). Secondly, a taxpayer can technically operate in compliance with the requirements of tax law; however, such operations will not meet the goals and concepts that lawmakers intended when creating the statutory provisions. 11/25/2017 Topic 2 Slide 26

International tax planning versus Tax evasion (5) The majority of situations under dispute in this area relate to one of three categories: The first category includes transactions whose conditions are technically in compliance with the Tax Code; however, they lack substance, a profit earning motive, a business purpose or all of these elements. The second category includes transactions that have substance, a profit earning motive, and a business purpose or even all of these elements, but their performance creates a tax benefit that is not provided for them in tax law. Transactions that fall into the third category apply aggressive methods of transfer pricing to transfer taxable profits from a jurisdiction with high taxes to a jurisdiction with low taxes. 11/25/2017 Topic 2 Slide 27

International tax planning versus Tax evasion (5) The majority of situations under dispute in this area relate to one of three categories: The first category includes transactions whose conditions are technically in compliance with the Tax Code; however, they lack substance, a profit earning motive, a business purpose or all of these elements. The second category includes transactions that have substance, a profit earning motive, and a business purpose or even all of these elements, but their performance creates a tax benefit that is not provided for them in tax law. Transactions that fall into the third category apply aggressive methods of transfer pricing to transfer taxable profits from a jurisdiction with high taxes to a jurisdiction with low taxes. 11/25/2017 Topic 2 Slide 27