International Economic Relation Topic 2. International Trade Theory:

14274-ier_topic_2.ppt

- Количество слайдов: 34

International Economic Relation Topic 2. International Trade Theory:

International Economic Relation Topic 2. International Trade Theory:

Overview Mercantilism Absolute Advantage Comparative Advantage Factor Proportions Theory (Heckscher-Olin) Product Life Cycle Theory New Trade Theory Porter’s Diamond International Trade Theory

Overview Mercantilism Absolute Advantage Comparative Advantage Factor Proportions Theory (Heckscher-Olin) Product Life Cycle Theory New Trade Theory Porter’s Diamond International Trade Theory

Free Trade occurs when a government does not attempt to influence, through quotas or duties, what its citizens can buy from another country or what they can produce and sell to another country. The Benefits of Trade allow a country to specialize in the manufacture and export of products that can be produced most efficiently in that country. The Pattern of International Trade displays patterns that are easy to understand (Saudi Arabia/oil or Mexico/labor intensive goods). Others are not so easy to understand (Why does Japan export cars? Why does Switzerland export chemicals, pharmaceuticals, watches, and jewelry? ). An Overview of Trade Theory

Free Trade occurs when a government does not attempt to influence, through quotas or duties, what its citizens can buy from another country or what they can produce and sell to another country. The Benefits of Trade allow a country to specialize in the manufacture and export of products that can be produced most efficiently in that country. The Pattern of International Trade displays patterns that are easy to understand (Saudi Arabia/oil or Mexico/labor intensive goods). Others are not so easy to understand (Why does Japan export cars? Why does Switzerland export chemicals, pharmaceuticals, watches, and jewelry? ). An Overview of Trade Theory

A nation’s wealth depends on accumulated treasure Gold and silver are the currency of trade. Theory says you should have a trade surplus. Maximize exports through subsidies. Minimize imports through tariffs and quotas. “Zero-sum game”? Mercantilism: mid-16th century

A nation’s wealth depends on accumulated treasure Gold and silver are the currency of trade. Theory says you should have a trade surplus. Maximize exports through subsidies. Minimize imports through tariffs and quotas. “Zero-sum game”? Mercantilism: mid-16th century

Theory of Absolute Advantage Adam Smith: Wealth of Nations (1776). Capability of one country to produce more of a product with the same amount of input than another country. Produce only goods where you are most efficient, trade for those where you are not efficient. The concept of specialization is introduced Trade between countries is, therefore, beneficial. Assumes there is an absolute advantage balance among nations.

Theory of Absolute Advantage Adam Smith: Wealth of Nations (1776). Capability of one country to produce more of a product with the same amount of input than another country. Produce only goods where you are most efficient, trade for those where you are not efficient. The concept of specialization is introduced Trade between countries is, therefore, beneficial. Assumes there is an absolute advantage balance among nations.

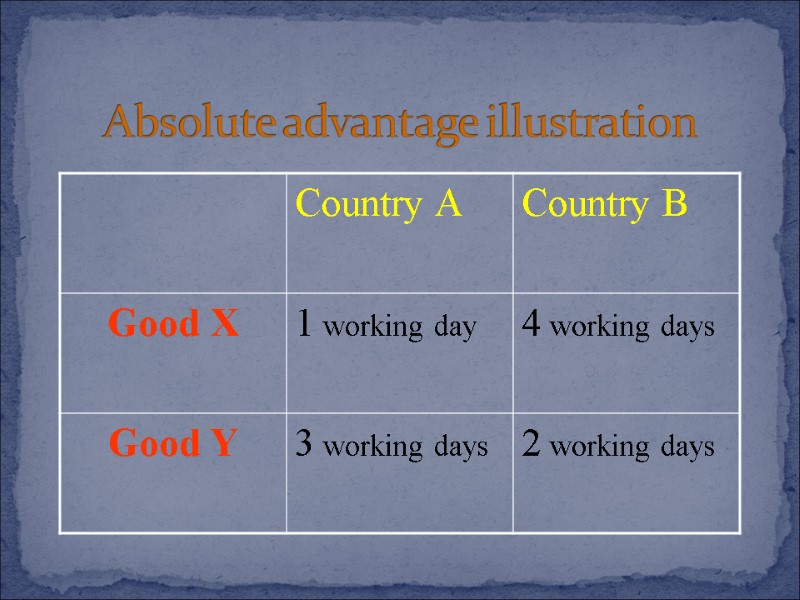

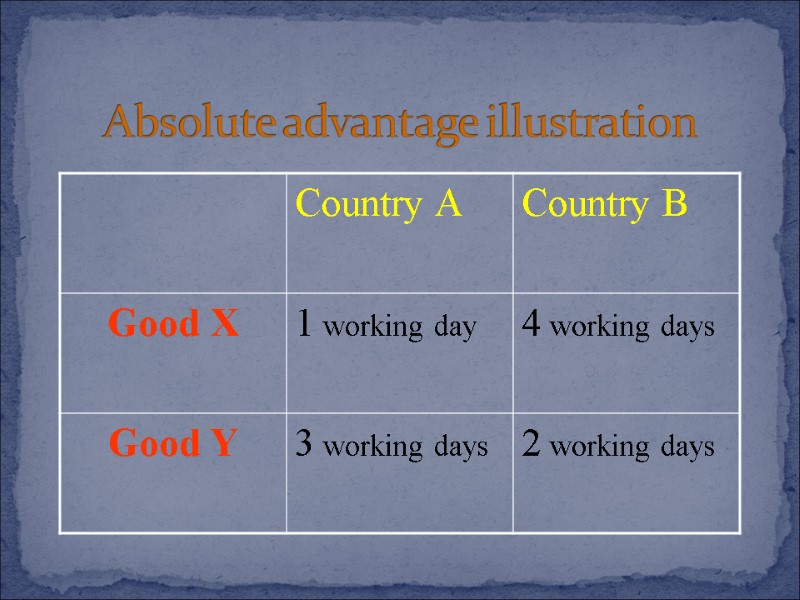

Absolute advantage illustration

Absolute advantage illustration

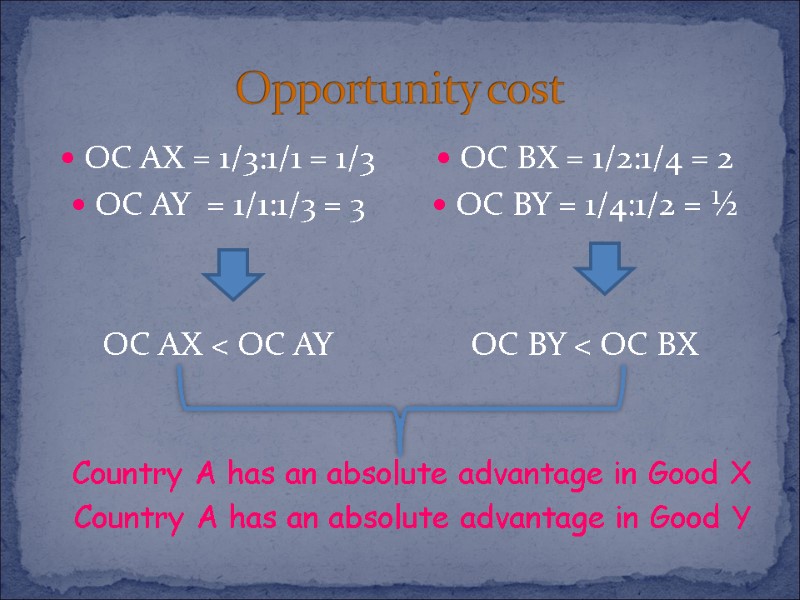

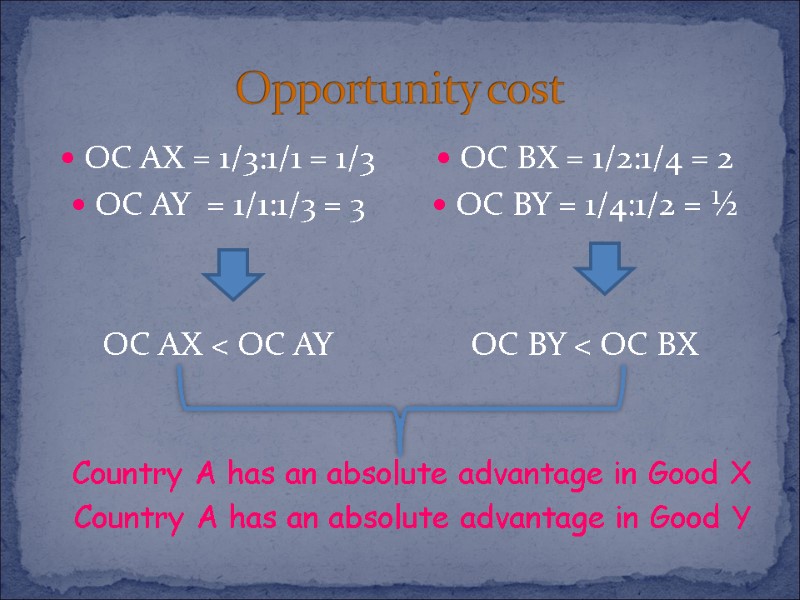

Opportunity cost OC AX = 1/3:1/1 = 1/3 OC AY = 1/1:1/3 = 3 OC AX < OC AY OC BX = 1/2:1/4 = 2 OC BY = 1/4:1/2 = ½ OC BY < OC BX Country A has an absolute advantage in Good X Country A has an absolute advantage in Good Y

Opportunity cost OC AX = 1/3:1/1 = 1/3 OC AY = 1/1:1/3 = 3 OC AX < OC AY OC BX = 1/2:1/4 = 2 OC BY = 1/4:1/2 = ½ OC BY < OC BX Country A has an absolute advantage in Good X Country A has an absolute advantage in Good Y

Absolute Advantage Natural Advantage: a country may have a natural advantage in producing a product because of climatic conditions, access to a certain natural resources, or availability of an abundant labour force Ghana/cocoa. Acquired Advantage: industrial policy

Absolute Advantage Natural Advantage: a country may have a natural advantage in producing a product because of climatic conditions, access to a certain natural resources, or availability of an abundant labour force Ghana/cocoa. Acquired Advantage: industrial policy

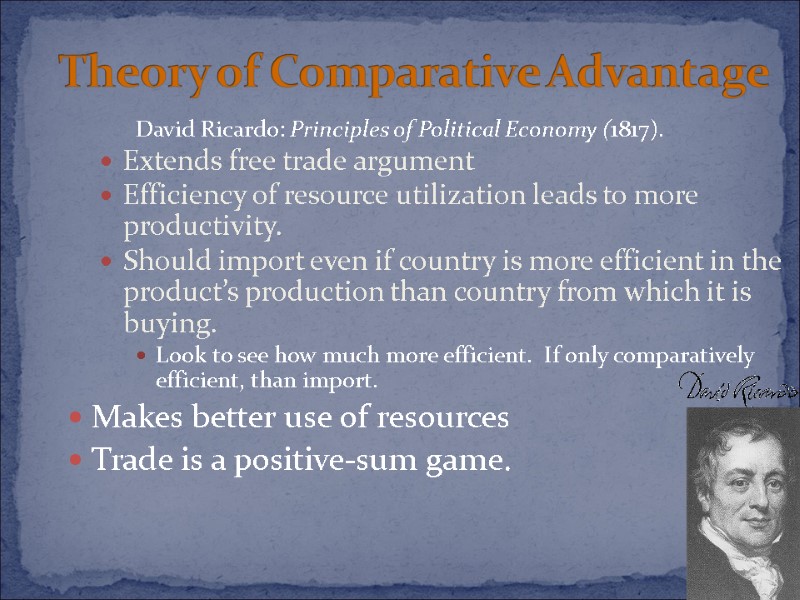

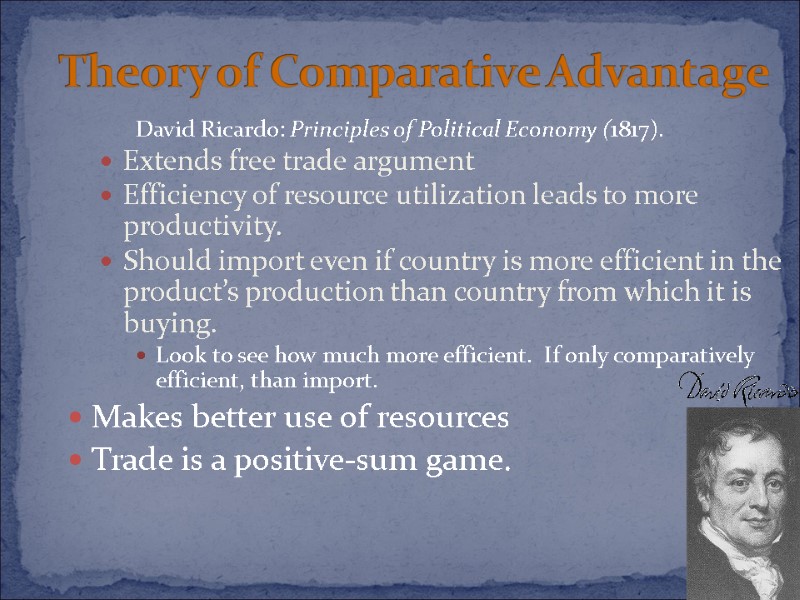

David Ricardo: Principles of Political Economy (1817). Extends free trade argument Efficiency of resource utilization leads to more productivity. Should import even if country is more efficient in the product’s production than country from which it is buying. Look to see how much more efficient. If only comparatively efficient, than import. Makes better use of resources Trade is a positive-sum game. Theory of Comparative Advantage

David Ricardo: Principles of Political Economy (1817). Extends free trade argument Efficiency of resource utilization leads to more productivity. Should import even if country is more efficient in the product’s production than country from which it is buying. Look to see how much more efficient. If only comparatively efficient, than import. Makes better use of resources Trade is a positive-sum game. Theory of Comparative Advantage

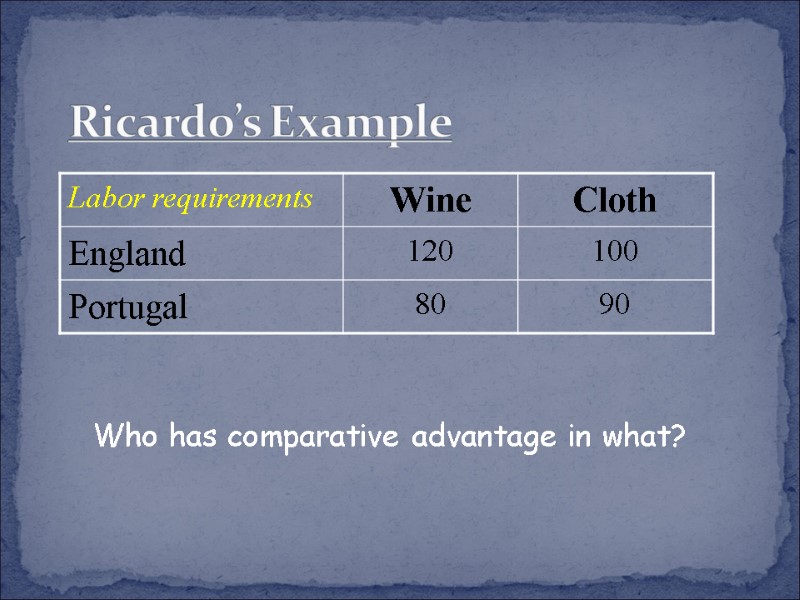

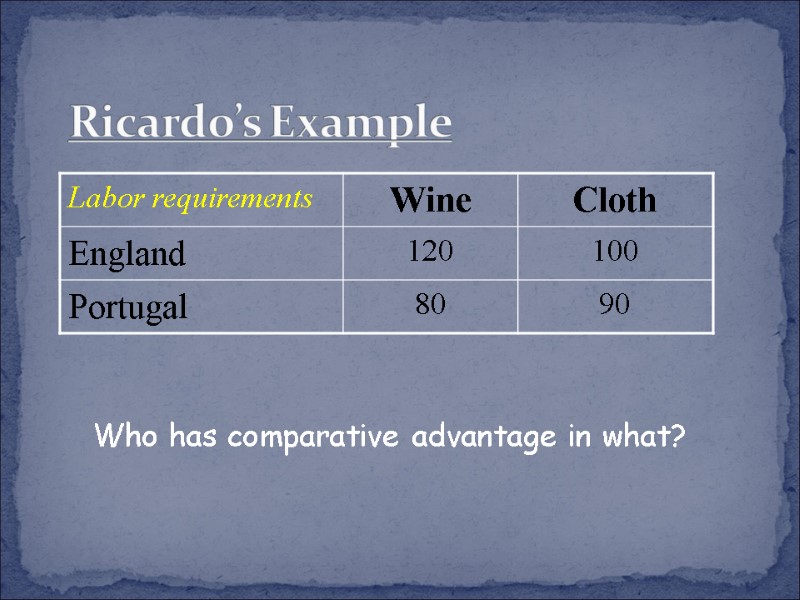

Ricardo’s Example Who has comparative advantage in what?

Ricardo’s Example Who has comparative advantage in what?

Comparative Advantage example from htpp://www.bized.co.uk One unit of labour in each country can produce either oil OR whisky. A unit of labour in Russia can produce either 10 barrels of oil per period OR 5 litres of whisky. A unit of labour in Scotland can produce either 20 barrels of oil OR 40 litres of whisky.

Comparative Advantage example from htpp://www.bized.co.uk One unit of labour in each country can produce either oil OR whisky. A unit of labour in Russia can produce either 10 barrels of oil per period OR 5 litres of whisky. A unit of labour in Scotland can produce either 20 barrels of oil OR 40 litres of whisky.

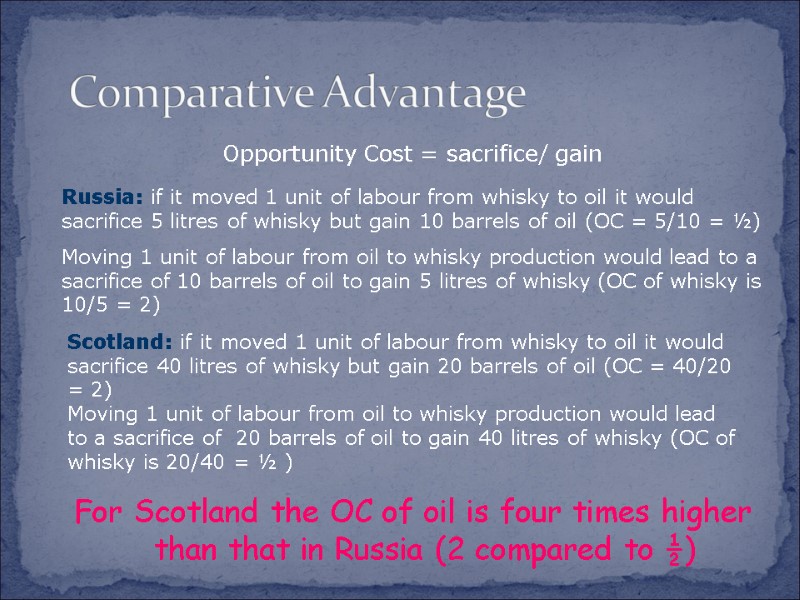

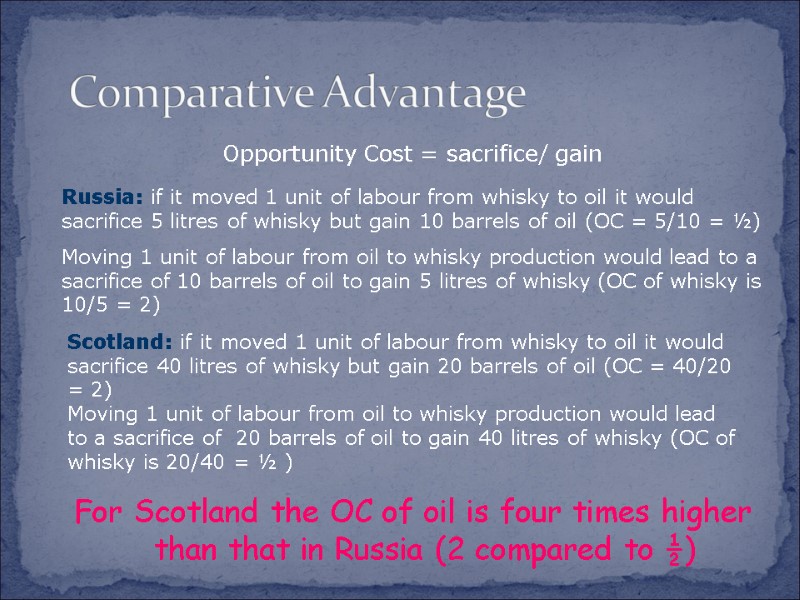

Comparative Advantage Opportunity Cost = sacrifice/ gain Russia: if it moved 1 unit of labour from whisky to oil it would sacrifice 5 litres of whisky but gain 10 barrels of oil (OC = 5/10 = ½) Moving 1 unit of labour from oil to whisky production would lead to a sacrifice of 10 barrels of oil to gain 5 litres of whisky (OC of whisky is 10/5 = 2) Scotland: if it moved 1 unit of labour from whisky to oil it would sacrifice 40 litres of whisky but gain 20 barrels of oil (OC = 40/20 = 2) Moving 1 unit of labour from oil to whisky production would lead to a sacrifice of 20 barrels of oil to gain 40 litres of whisky (OC of whisky is 20/40 = ½ ) For Scotland the OC of oil is four times higher than that in Russia (2 compared to ½)

Comparative Advantage Opportunity Cost = sacrifice/ gain Russia: if it moved 1 unit of labour from whisky to oil it would sacrifice 5 litres of whisky but gain 10 barrels of oil (OC = 5/10 = ½) Moving 1 unit of labour from oil to whisky production would lead to a sacrifice of 10 barrels of oil to gain 5 litres of whisky (OC of whisky is 10/5 = 2) Scotland: if it moved 1 unit of labour from whisky to oil it would sacrifice 40 litres of whisky but gain 20 barrels of oil (OC = 40/20 = 2) Moving 1 unit of labour from oil to whisky production would lead to a sacrifice of 20 barrels of oil to gain 40 litres of whisky (OC of whisky is 20/40 = ½ ) For Scotland the OC of oil is four times higher than that in Russia (2 compared to ½)

In Russia, oil can be produced cheaper than in Scotland (Russia only sacrifices 1 litre of whisky to produce 2 extra barrels of oil whereas Scotland would have to sacrifice 2 litres of whisky to produce 1 barrel of oil. Comparative Advantage There can be gains from trade if each country specialises in the production of the product in which it has the lower opportunity cost – Russia should produce oil; Scotland, whisky.

In Russia, oil can be produced cheaper than in Scotland (Russia only sacrifices 1 litre of whisky to produce 2 extra barrels of oil whereas Scotland would have to sacrifice 2 litres of whisky to produce 1 barrel of oil. Comparative Advantage There can be gains from trade if each country specialises in the production of the product in which it has the lower opportunity cost – Russia should produce oil; Scotland, whisky.

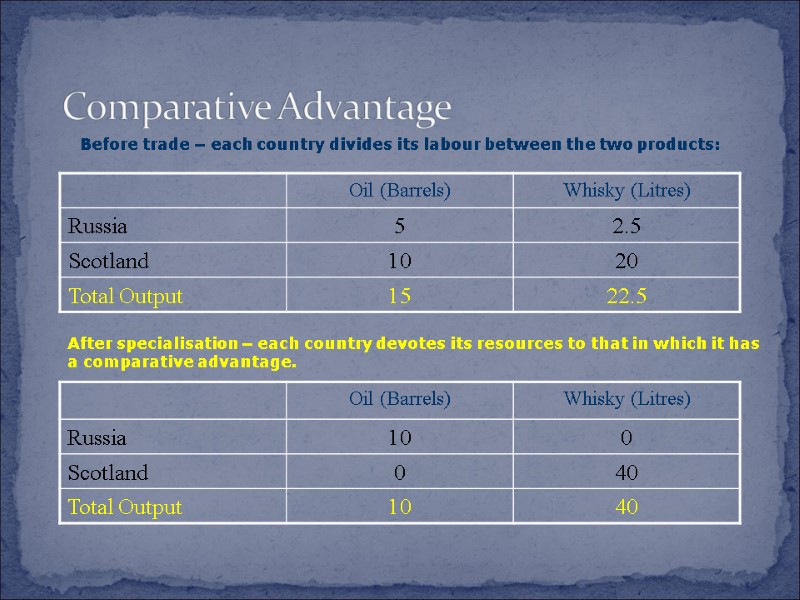

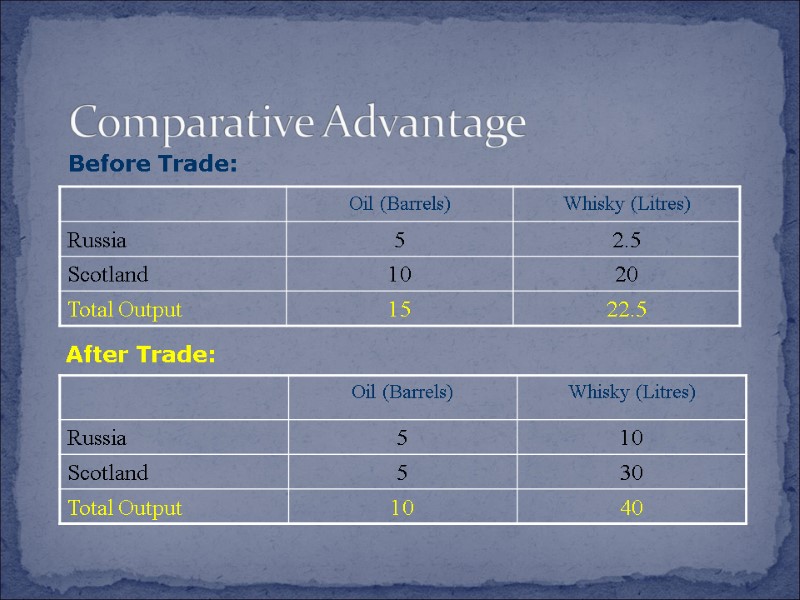

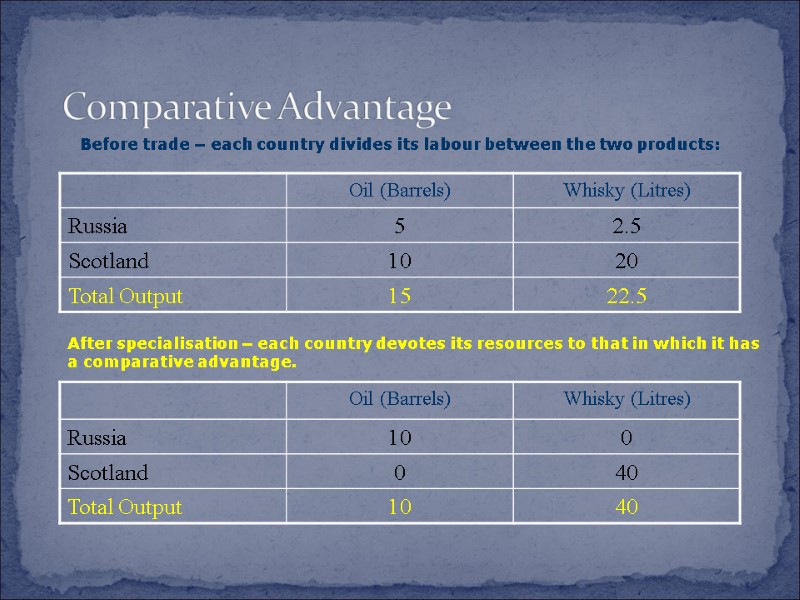

Comparative Advantage Before trade – each country divides its labour between the two products: After specialisation – each country devotes its resources to that in which it has a comparative advantage.

Comparative Advantage Before trade – each country divides its labour between the two products: After specialisation – each country devotes its resources to that in which it has a comparative advantage.

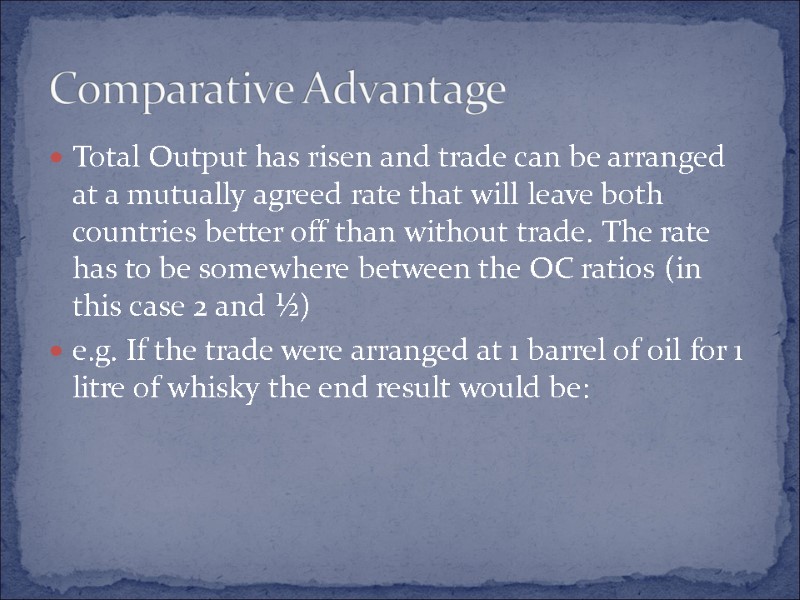

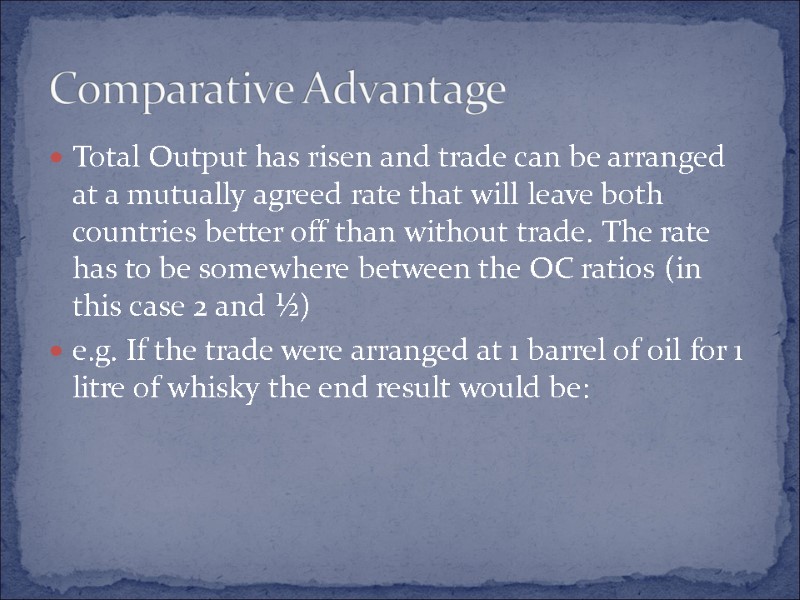

Total Output has risen and trade can be arranged at a mutually agreed rate that will leave both countries better off than without trade. The rate has to be somewhere between the OC ratios (in this case 2 and ½) e.g. If the trade were arranged at 1 barrel of oil for 1 litre of whisky the end result would be: Comparative Advantage

Total Output has risen and trade can be arranged at a mutually agreed rate that will leave both countries better off than without trade. The rate has to be somewhere between the OC ratios (in this case 2 and ½) e.g. If the trade were arranged at 1 barrel of oil for 1 litre of whisky the end result would be: Comparative Advantage

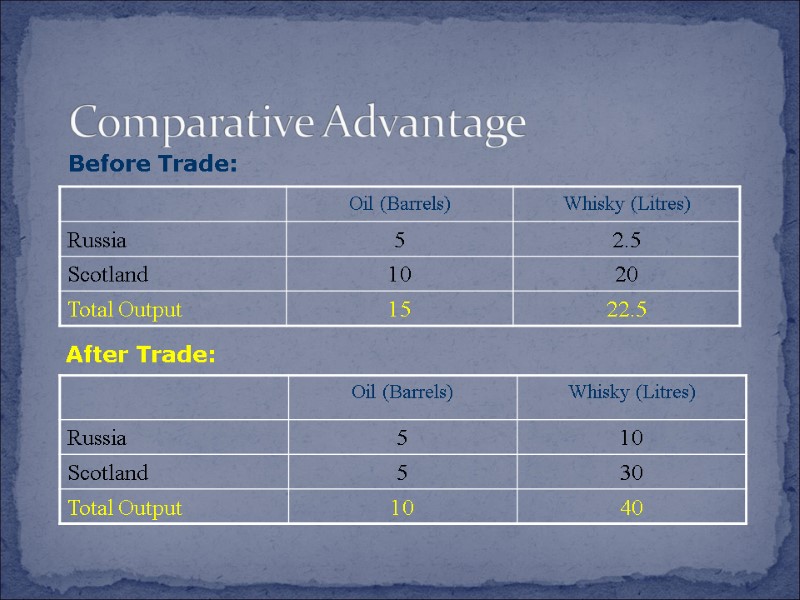

Comparative Advantage Before Trade: After Trade:

Comparative Advantage Before Trade: After Trade:

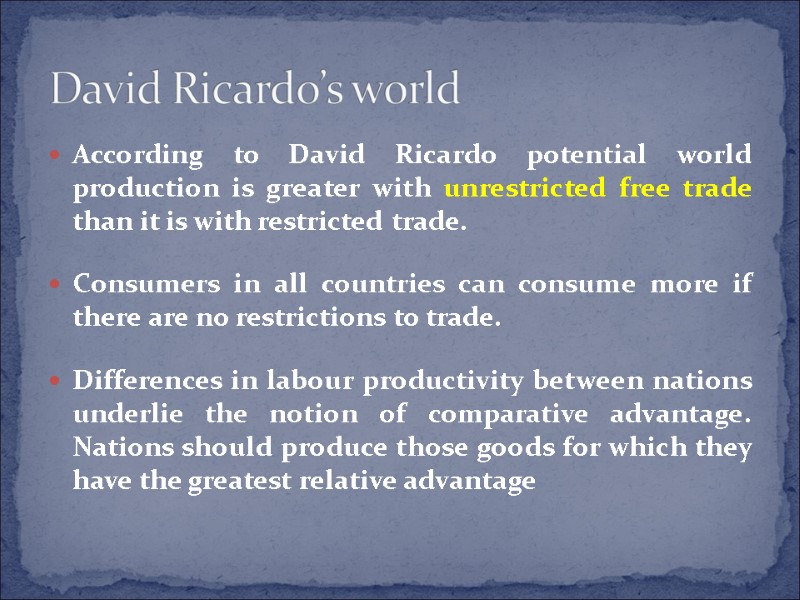

According to David Ricardo potential world production is greater with unrestricted free trade than it is with restricted trade. Consumers in all countries can consume more if there are no restrictions to trade. Differences in labour productivity between nations underlie the notion of comparative advantage. Nations should produce those goods for which they have the greatest relative advantage David Ricardo’s world

According to David Ricardo potential world production is greater with unrestricted free trade than it is with restricted trade. Consumers in all countries can consume more if there are no restrictions to trade. Differences in labour productivity between nations underlie the notion of comparative advantage. Nations should produce those goods for which they have the greatest relative advantage David Ricardo’s world

Factor Proportions Trade Theory: 1930s, Swedish professors Developed by Eli Heckscher Expanded by Bertil Ohlin

Factor Proportions Trade Theory: 1930s, Swedish professors Developed by Eli Heckscher Expanded by Bertil Ohlin

Factor Proportions Trade Theory Considers Two Factors of Production Labor Capital

Factor Proportions Trade Theory Considers Two Factors of Production Labor Capital

Export goods that intensively use factor endowments which are locally abundant. import goods made from locally scarce factors. Patterns of trade are determined by differences in factor endowments - not productivity. Remember, focus on relative advantage, not absolute advantage. Heckscher (1919)-Olin (1933) Theory

Export goods that intensively use factor endowments which are locally abundant. import goods made from locally scarce factors. Patterns of trade are determined by differences in factor endowments - not productivity. Remember, focus on relative advantage, not absolute advantage. Heckscher (1919)-Olin (1933) Theory

The Leontief Paradox, 1953 Disputes Heckscher-Olin in some instances. Factor endowments can be impacted by government policy - minimum wage. US tends to export labor-intensive products, but is regarded as a capital intensive country.

The Leontief Paradox, 1953 Disputes Heckscher-Olin in some instances. Factor endowments can be impacted by government policy - minimum wage. US tends to export labor-intensive products, but is regarded as a capital intensive country.

Product Life Cycle Theory Raymond Vernon, 1966 Article in the Quarterly Journal of Economics Focus on the product, not its factor proportions

Product Life Cycle Theory Raymond Vernon, 1966 Article in the Quarterly Journal of Economics Focus on the product, not its factor proportions

Product Life Cycle Theory: Vernon’s Premises Technical innovations leading to new and profitable products require large quantities of capital and skilled labor The product and the methods for manufacture go through three stages of maturation, with competitive advantage shifting each time As products mature, both location of sales and optimal production changes. Affects the direction and flow of imports and exports.

Product Life Cycle Theory: Vernon’s Premises Technical innovations leading to new and profitable products require large quantities of capital and skilled labor The product and the methods for manufacture go through three stages of maturation, with competitive advantage shifting each time As products mature, both location of sales and optimal production changes. Affects the direction and flow of imports and exports.

Stages of the Product Cycle The New Product Flexible production Innovator Monopoly Concentration The Maturing Product Intl market & competition More standardized production The Standardized Product Low-margin cost-based production Highly competitive

Stages of the Product Cycle The New Product Flexible production Innovator Monopoly Concentration The Maturing Product Intl market & competition More standardized production The Standardized Product Low-margin cost-based production Highly competitive

Increased emphasis on technology’s impact on product cost Explained international investment Limitations Most appropriate for technology-based products Some products not easily characterized by stages of maturity Most relevant to products produced through mass production The Product Cycle and Trade Implications

Increased emphasis on technology’s impact on product cost Explained international investment Limitations Most appropriate for technology-based products Some products not easily characterized by stages of maturity Most relevant to products produced through mass production The Product Cycle and Trade Implications

Two New Contributions Paul Krugman - How trade is altered when markets are not perfectly competitive Michael Porter-Examined competitiveness of industries on a global basis The New Trade Theory: Strategic Trade

Two New Contributions Paul Krugman - How trade is altered when markets are not perfectly competitive Michael Porter-Examined competitiveness of industries on a global basis The New Trade Theory: Strategic Trade

Began to be recognized in the 1970s. Deals with the returns on specialization where substantial economies of scale are present. Specialization increases output, ability to enhance economies of scale increase. First mover advantages (economies of scale such that barrier to entry crated for second or third company) Luck... first mover may be simply lucky. Government intervention: strategic trade policy The New Trade Theory

Began to be recognized in the 1970s. Deals with the returns on specialization where substantial economies of scale are present. Specialization increases output, ability to enhance economies of scale increase. First mover advantages (economies of scale such that barrier to entry crated for second or third company) Luck... first mover may be simply lucky. Government intervention: strategic trade policy The New Trade Theory

Increasing returns of specialization due to economies of scale (unit costs of production decrease) First mover advantages (economies of scale such that barrier to entry crated for second or third company) Luck... first mover may be simply lucky. Government intervention: strategic trade policy New Trade Theory

Increasing returns of specialization due to economies of scale (unit costs of production decrease) First mover advantages (economies of scale such that barrier to entry crated for second or third company) Luck... first mover may be simply lucky. Government intervention: strategic trade policy New Trade Theory

Strategic Trade Krugman’s Economics of Scale: Internal Economies of Scale External Economies of Scale

Strategic Trade Krugman’s Economics of Scale: Internal Economies of Scale External Economies of Scale

Porter’s Diamond (Harvard Business School, 1990) The Competitive Advantage of Nations. Looked at 100 industries in 10 nations. Thought existing theories didn’t go far enough. Question: “Why does a nation achieve international success in a particular industry?”

Porter’s Diamond (Harvard Business School, 1990) The Competitive Advantage of Nations. Looked at 100 industries in 10 nations. Thought existing theories didn’t go far enough. Question: “Why does a nation achieve international success in a particular industry?”

Porter’s Diamond Determinants of National Competitive Advantage 4-30

Porter’s Diamond Determinants of National Competitive Advantage 4-30

Innovation is what drives and sustains competitiveness Four components of competition: Factor conditions – created by sustainable, heavy investments in specialized production factors: skilled labor, capital, infrastructure Demand – domestic pressures for quality Related & supporting industries – facilitate continuous info exchanges promoting innovation Firm strategy, structure & rivalry – firm organization & nature of domestic rivalries Porter’s Diamond of National Advantage

Innovation is what drives and sustains competitiveness Four components of competition: Factor conditions – created by sustainable, heavy investments in specialized production factors: skilled labor, capital, infrastructure Demand – domestic pressures for quality Related & supporting industries – facilitate continuous info exchanges promoting innovation Firm strategy, structure & rivalry – firm organization & nature of domestic rivalries Porter’s Diamond of National Advantage

Main argument: “Nations are most likely to succeed in industries or industry segments where the national ‘diamond’ is most favorable” Pro-active governments can stimulate these factors, but they’re very difficult for firms to duplicate, resulting in national competitive advantages. For example, outsourcing occurs because cheap labor is unavailable inside advanced economies. Ease of technology flows undermine any absolute and comparative advantages they may have over Third World. Porter’s Diamond of National Advantage

Main argument: “Nations are most likely to succeed in industries or industry segments where the national ‘diamond’ is most favorable” Pro-active governments can stimulate these factors, but they’re very difficult for firms to duplicate, resulting in national competitive advantages. For example, outsourcing occurs because cheap labor is unavailable inside advanced economies. Ease of technology flows undermine any absolute and comparative advantages they may have over Third World. Porter’s Diamond of National Advantage

Location implications:makes sense to disperse production activities to countries where they can be performed most efficiently. First-mover implications:It pays to invest substantial financial resources in building a first-mover, or early-mover, advantage. Policy implications:promoting free trade is generally in the best interests of the home-country, although not always in the best interests of the firm. Even though, many firms promote open markets. Implications for Business

Location implications:makes sense to disperse production activities to countries where they can be performed most efficiently. First-mover implications:It pays to invest substantial financial resources in building a first-mover, or early-mover, advantage. Policy implications:promoting free trade is generally in the best interests of the home-country, although not always in the best interests of the firm. Even though, many firms promote open markets. Implications for Business