Berkishire-Hathaway.pptx

- Количество слайдов: 16

from textile to money making instrument

from textile to money making instrument

HATHAWAY • The Hathaway Manufacturing Company • 1888 • Horatio Hathaway BERKSHIRE • Berkshire Fine Spinning Associated Inc. 1889 • Seabury Stanton

HATHAWAY • The Hathaway Manufacturing Company • 1888 • Horatio Hathaway BERKSHIRE • Berkshire Fine Spinning Associated Inc. 1889 • Seabury Stanton

BERKSHIRE was founded 1889 By 1917 contained over 260 000 ring and mule spindles and 6500 looms HATHAWAY was founded 1888 By 1917 contained over 108 000 ring and mule spindles and 3400 looms

BERKSHIRE was founded 1889 By 1917 contained over 260 000 ring and mule spindles and 6500 looms HATHAWAY was founded 1888 By 1917 contained over 108 000 ring and mule spindles and 3400 looms

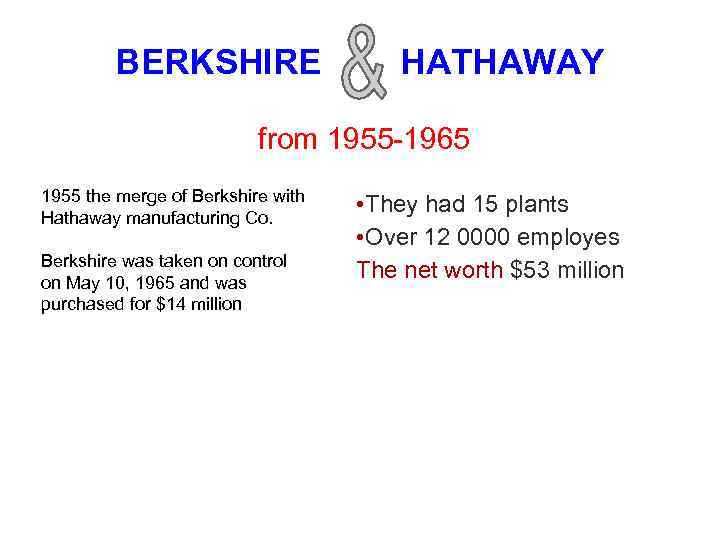

BERKSHIRE HATHAWAY from 1955 -1965 1955 the merge of Berkshire with Hathaway manufacturing Co. Berkshire was taken on control on May 10, 1965 and was purchased for $14 million • They had 15 plants • Over 12 0000 employes The net worth $53 million

BERKSHIRE HATHAWAY from 1955 -1965 1955 the merge of Berkshire with Hathaway manufacturing Co. Berkshire was taken on control on May 10, 1965 and was purchased for $14 million • They had 15 plants • Over 12 0000 employes The net worth $53 million

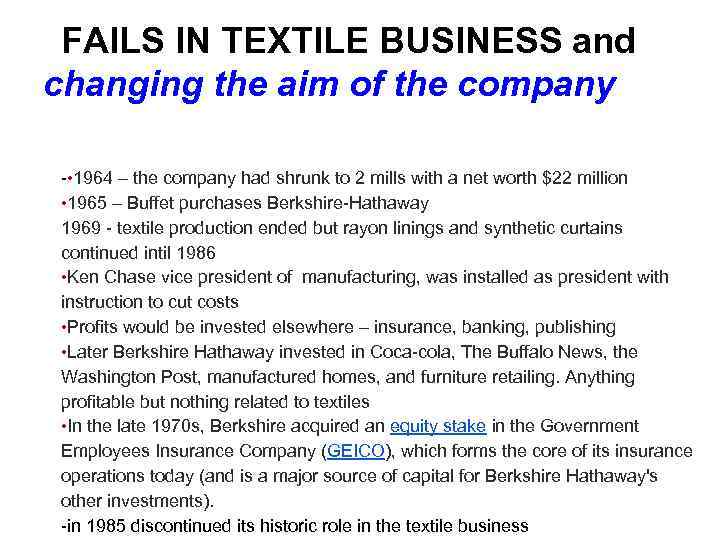

FAILS IN TEXTILE BUSINESS and changing the aim of the company - • 1964 – the company had shrunk to 2 mills with a net worth $22 million • 1965 – Buffet purchases Berkshire-Hathaway 1969 - textile production ended but rayon linings and synthetic curtains continued intil 1986 • Ken Chase vice president of manufacturing, was installed as president with instruction to cut costs • Profits would be invested elsewhere – insurance, banking, publishing • Later Berkshire Hathaway invested in Coca-cola, The Buffalo News, the Washington Post, manufactured homes, and furniture retailing. Anything profitable but nothing related to textiles • In the late 1970 s, Berkshire acquired an equity stake in the Government Employees Insurance Company (GEICO), which forms the core of its insurance operations today (and is a major source of capital for Berkshire Hathaway's other investments). -in 1985 discontinued its historic role in the textile business

FAILS IN TEXTILE BUSINESS and changing the aim of the company - • 1964 – the company had shrunk to 2 mills with a net worth $22 million • 1965 – Buffet purchases Berkshire-Hathaway 1969 - textile production ended but rayon linings and synthetic curtains continued intil 1986 • Ken Chase vice president of manufacturing, was installed as president with instruction to cut costs • Profits would be invested elsewhere – insurance, banking, publishing • Later Berkshire Hathaway invested in Coca-cola, The Buffalo News, the Washington Post, manufactured homes, and furniture retailing. Anything profitable but nothing related to textiles • In the late 1970 s, Berkshire acquired an equity stake in the Government Employees Insurance Company (GEICO), which forms the core of its insurance operations today (and is a major source of capital for Berkshire Hathaway's other investments). -in 1985 discontinued its historic role in the textile business

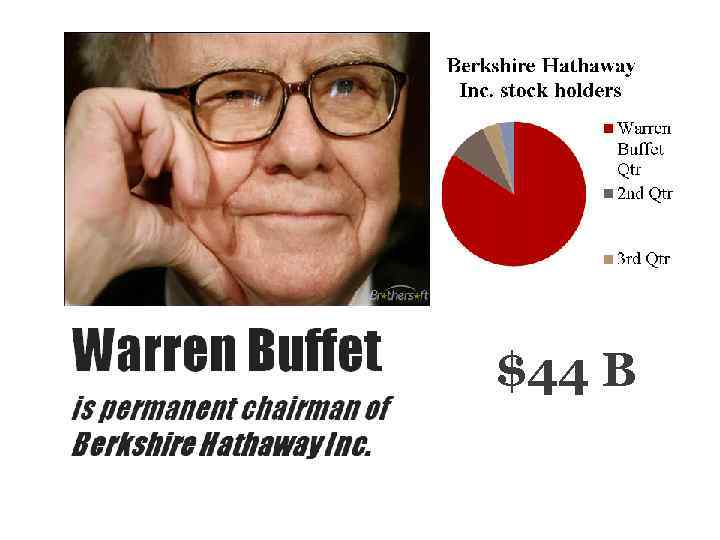

Berkshire after coming this person SECTOR: Fiancial Industry: Property&Casualty Insurance Full time employees: 271 000

Berkshire after coming this person SECTOR: Fiancial Industry: Property&Casualty Insurance Full time employees: 271 000

Turning to investment Businesses • Insurance group • Utilities and energy group • Manufacturing, service, and retailing • Clothing • Building products • Flight services • Retail • Other non-insurance • Finance and financial products Investments

Turning to investment Businesses • Insurance group • Utilities and energy group • Manufacturing, service, and retailing • Clothing • Building products • Flight services • Retail • Other non-insurance • Finance and financial products Investments

Investments Equities – beneficial ownership This includes some of the companies where a Berkshire Hathaway stake is more than $1 billion market value at the end of the year, as reported in the 2011 annual report. In alphabetical order: • American Express Co. (13. 0%) • BYD (9. 9%) regarchable batteries and automobile manufacturing • The Coca-Cola Company (8. 8%) • IBM (5. 5%) Computer system • Kraft Foods (4. 5%) Food processing • Moody's Corporation, owner of Moody's Analytics (12. 5%) Financial services • Wells Fargo (7. 6%) Banking, Financial services • Munich Re (10. 5%) • Wal-Mart (1. 1%) • Bonds • As of 2008, Berkshire owns $27 billion in fixed income securities, mainly foreign government bonds and corporate bonds.

Investments Equities – beneficial ownership This includes some of the companies where a Berkshire Hathaway stake is more than $1 billion market value at the end of the year, as reported in the 2011 annual report. In alphabetical order: • American Express Co. (13. 0%) • BYD (9. 9%) regarchable batteries and automobile manufacturing • The Coca-Cola Company (8. 8%) • IBM (5. 5%) Computer system • Kraft Foods (4. 5%) Food processing • Moody's Corporation, owner of Moody's Analytics (12. 5%) Financial services • Wells Fargo (7. 6%) Banking, Financial services • Munich Re (10. 5%) • Wal-Mart (1. 1%) • Bonds • As of 2008, Berkshire owns $27 billion in fixed income securities, mainly foreign government bonds and corporate bonds.

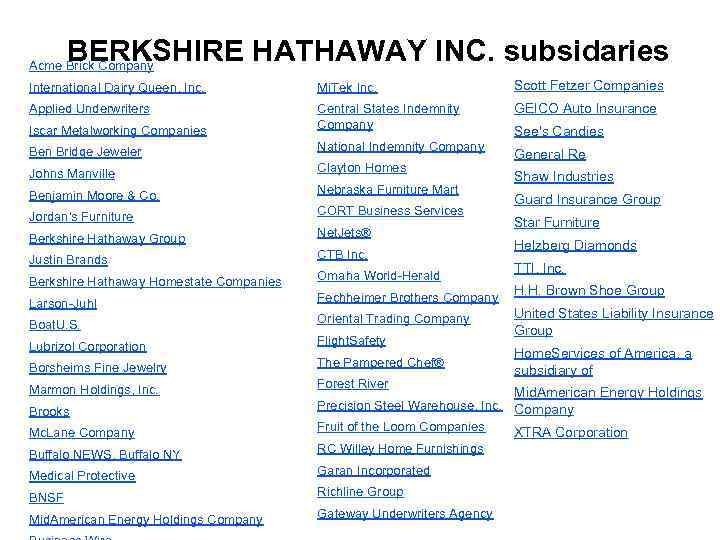

BERKSHIRE HATHAWAY INC. subsidaries Acme Brick Company International Dairy Queen, Inc. Mi. Tek Inc. Scott Fetzer Companies Applied Underwriters GEICO Auto Insurance Iscar Metalworking Companies Central States Indemnity Company Ben Bridge Jeweler National Indemnity Company Johns Manville Clayton Homes Benjamin Moore & Co. Nebraska Furniture Mart Jordan's Furniture CORT Business Services Berkshire Hathaway Group Net. Jets® Justin Brands CTB Inc. Berkshire Hathaway Homestate Companies Omaha World-Herald Larson-Juhl Fechheimer Brothers Company Boat. U. S. Oriental Trading Company Lubrizol Corporation Flight. Safety Borsheims Fine Jewelry The Pampered Chef® Marmon Holdings, Inc. Forest River Brooks Mc. Lane Company Precision Steel Warehouse, Inc. Company Fruit of the Loom Companies XTRA Corporation Buffalo NEWS, Buffalo NY RC Willey Home Furnishings Medical Protective Garan Incorporated BNSF Richline Group Mid. American Energy Holdings Company Gateway Underwriters Agency See's Candies General Re Shaw Industries Guard Insurance Group Star Furniture Helzberg Diamonds TTI, Inc. H. H. Brown Shoe Group United States Liability Insurance Group Home. Services of America, a subsidiary of Mid. American Energy Holdings

BERKSHIRE HATHAWAY INC. subsidaries Acme Brick Company International Dairy Queen, Inc. Mi. Tek Inc. Scott Fetzer Companies Applied Underwriters GEICO Auto Insurance Iscar Metalworking Companies Central States Indemnity Company Ben Bridge Jeweler National Indemnity Company Johns Manville Clayton Homes Benjamin Moore & Co. Nebraska Furniture Mart Jordan's Furniture CORT Business Services Berkshire Hathaway Group Net. Jets® Justin Brands CTB Inc. Berkshire Hathaway Homestate Companies Omaha World-Herald Larson-Juhl Fechheimer Brothers Company Boat. U. S. Oriental Trading Company Lubrizol Corporation Flight. Safety Borsheims Fine Jewelry The Pampered Chef® Marmon Holdings, Inc. Forest River Brooks Mc. Lane Company Precision Steel Warehouse, Inc. Company Fruit of the Loom Companies XTRA Corporation Buffalo NEWS, Buffalo NY RC Willey Home Furnishings Medical Protective Garan Incorporated BNSF Richline Group Mid. American Energy Holdings Company Gateway Underwriters Agency See's Candies General Re Shaw Industries Guard Insurance Group Star Furniture Helzberg Diamonds TTI, Inc. H. H. Brown Shoe Group United States Liability Insurance Group Home. Services of America, a subsidiary of Mid. American Energy Holdings

Berkshire Hathaway Inc.

Berkshire Hathaway Inc.

BRK. A BRK. B Berkshire Hathaway Inc.

BRK. A BRK. B Berkshire Hathaway Inc.

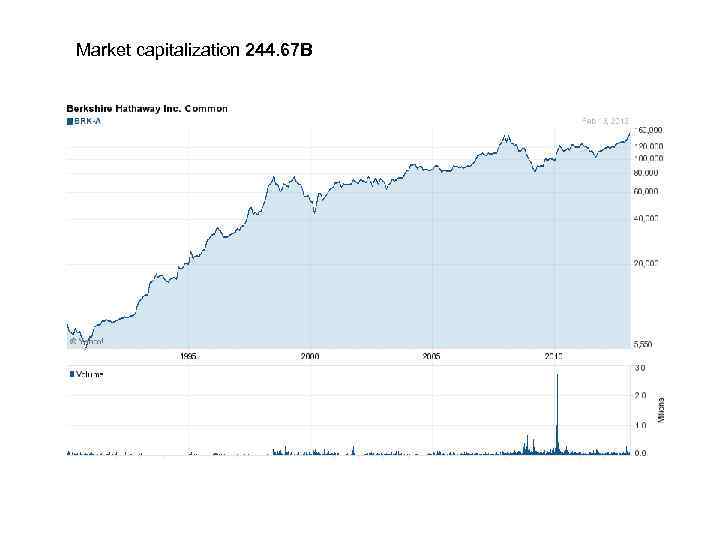

Market capitalization 244. 67 B

Market capitalization 244. 67 B

CLAIMS OF WARREN BUFFET In 2010 Buffet claimed that purchasing Berkshire hathaway was the Biggest investment mistake he had ever made. And claimed that it had denied him compounded investment return of about $200 billions over the previous 45 year. Buffet claimed that had he invested that money to directly in incurance bussiness instead of buying out Berkshire hathaway those investment would have paid off several hundredfold

CLAIMS OF WARREN BUFFET In 2010 Buffet claimed that purchasing Berkshire hathaway was the Biggest investment mistake he had ever made. And claimed that it had denied him compounded investment return of about $200 billions over the previous 45 year. Buffet claimed that had he invested that money to directly in incurance bussiness instead of buying out Berkshire hathaway those investment would have paid off several hundredfold

$44 B

$44 B