France. Financial system Made by Klemeshova K. ,

finance2.pptx

- Размер: 4.2 Мб

- Автор:

- Количество слайдов: 18

Описание презентации France. Financial system Made by Klemeshova K. , по слайдам

France. Financial system Made by Klemeshova K. , Tashpulatov A. , Ereschenko A. , Livinets M.

France. Financial system Made by Klemeshova K. , Tashpulatov A. , Ereschenko A. , Livinets M.

Table of content Taxes on Income Pensions Some other points about France pensions. Corporation tax & Security paper tax Business tax Real Estate tax VAT Professionaltax Succession and gift taxes Trends for 2017 Future developments Sources

Table of content Taxes on Income Pensions Some other points about France pensions. Corporation tax & Security paper tax Business tax Real Estate tax VAT Professionaltax Succession and gift taxes Trends for 2017 Future developments Sources

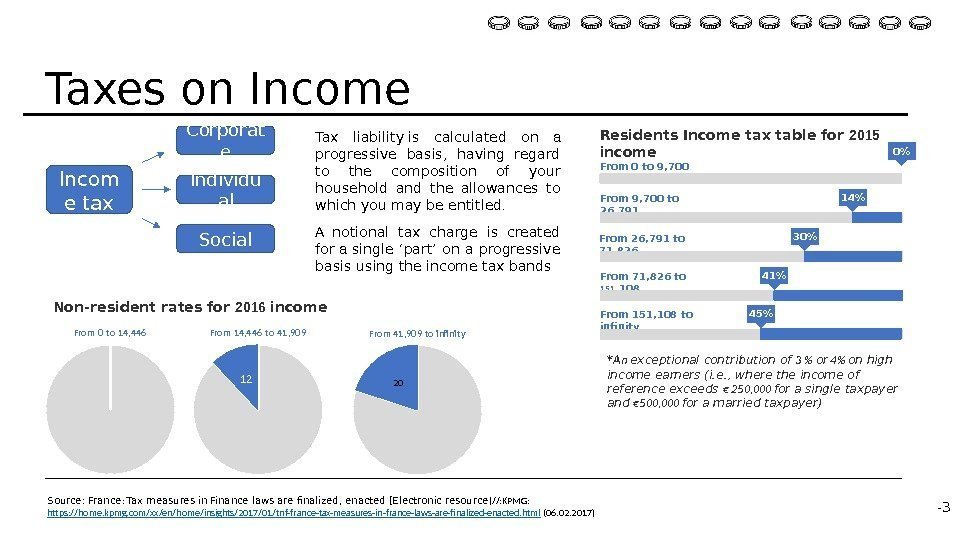

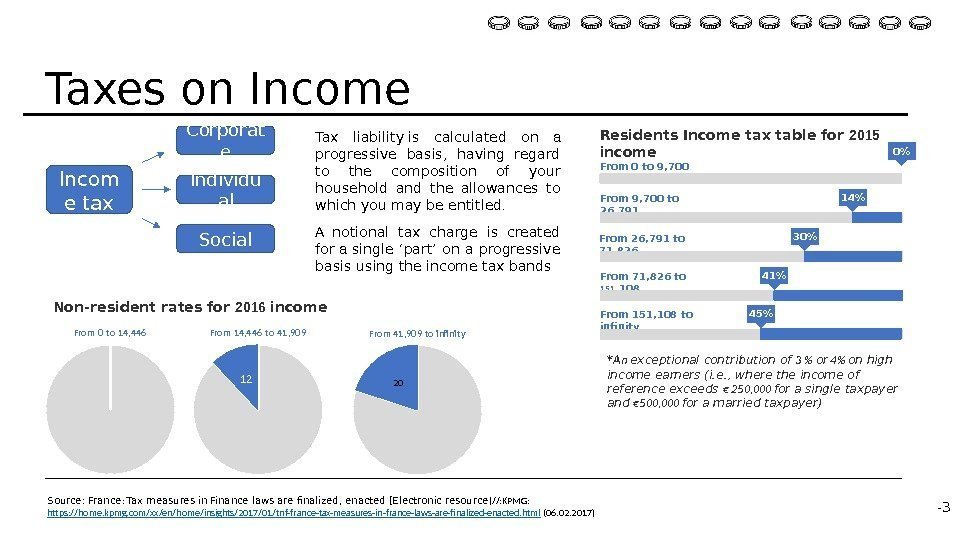

Taxes on Income Tax liabilityis calculated on a progressive basis, having regard to the composition of your household and the allowances to which you may be entitled. A notional tax charge is created for a single ‘part’ on a progressive basis using the income tax bands Residents Income tax table for 2015 income Non-resident rates for 2016 income *A n exceptional contribution of 3 % or 4% on high income earners (i. e. , where the income of reference exceeds € 250, 000 for a single taxpayer and € 500, 000 for a married taxpayer)From 9, 700 to 26, 791 14% From 26, 791 to 71, 826 From 71, 826 to 151 , 108 From 151, 108 to infinity 30% 41% 45%From 0 to 9, 700 0% Fro m 0 to 14, 446 12 Fro m 14, 446 to 41, 90 9 20 Fro m 41, 90 9 to infinit y Source: France : Tax measures in Finance laws are finalized, enacted [Electronic resource ]//: KPMG: https: //home. kpmg. com/xx/en/home/insights/2017/01/tnf-france-tax-measures-in-france-laws-are-finalized-enacted. html (06. 02. 2017)Incom e tax Corporat e Individu al Social —

Taxes on Income Tax liabilityis calculated on a progressive basis, having regard to the composition of your household and the allowances to which you may be entitled. A notional tax charge is created for a single ‘part’ on a progressive basis using the income tax bands Residents Income tax table for 2015 income Non-resident rates for 2016 income *A n exceptional contribution of 3 % or 4% on high income earners (i. e. , where the income of reference exceeds € 250, 000 for a single taxpayer and € 500, 000 for a married taxpayer)From 9, 700 to 26, 791 14% From 26, 791 to 71, 826 From 71, 826 to 151 , 108 From 151, 108 to infinity 30% 41% 45%From 0 to 9, 700 0% Fro m 0 to 14, 446 12 Fro m 14, 446 to 41, 90 9 20 Fro m 41, 90 9 to infinit y Source: France : Tax measures in Finance laws are finalized, enacted [Electronic resource ]//: KPMG: https: //home. kpmg. com/xx/en/home/insights/2017/01/tnf-france-tax-measures-in-france-laws-are-finalized-enacted. html (06. 02. 2017)Incom e tax Corporat e Individu al Social —

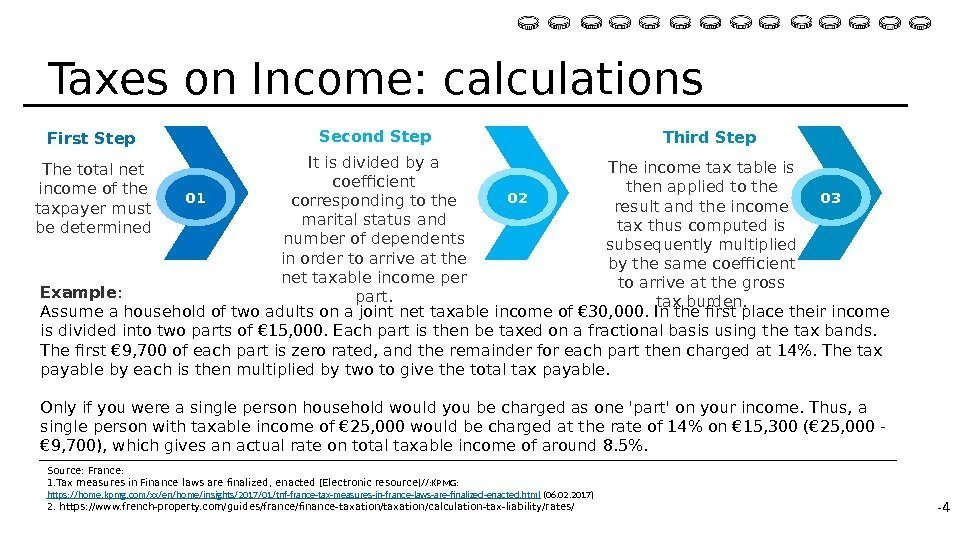

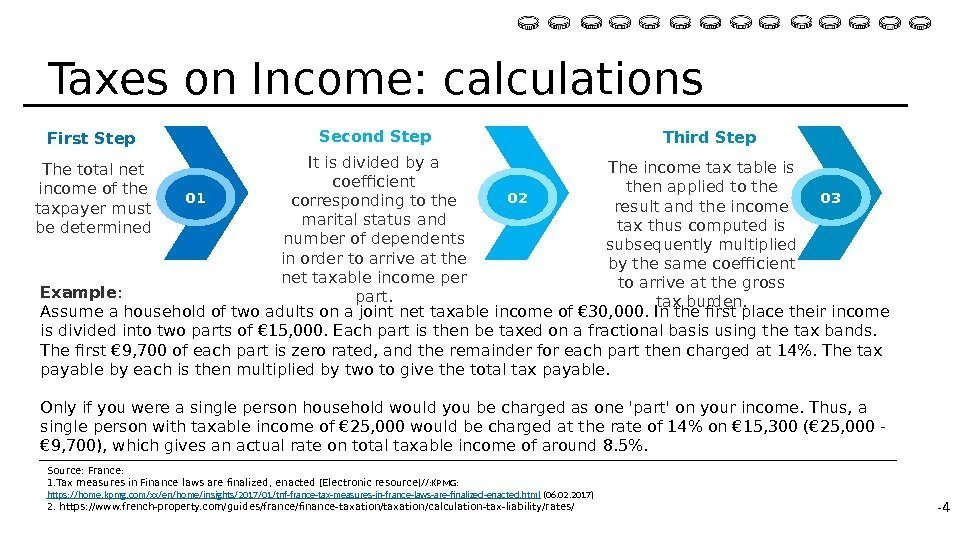

First Step The total net income of the taxpayer must be determined Second Step It is divided by a coefficient corresponding to the marital status and number of dependents in order to arrive at the net taxable income per part. Third Step The income tax table is then applied to the result and the income tax thus computed is subsequently multiplied by the same coefficient to arrive at the gross tax burden. 01 02 03 Taxes on Income: calculations Source: France : 1. Tax measures in Finance laws are finalized, enacted [ Electronic resource ]//: KPMG: https: //home. kpmg. com/xx/en/home/insights/2017/01/tnf-france-tax-measures-in-france-laws-are-finalized-enacted. html (06. 02. 2017) 2. https: //www. french-property. com/guides/france/finance-taxation/calculation-tax-liability/rates/Example : Assume a household of two adults on a joint net taxable income of € 30, 000. In the first place their income is divided into two parts of € 15, 000. Each part is then be taxed on a fractional basis using the tax bands. The first € 9, 700 of each part is zero rated, and the remainder for each part then charged at 14%. The tax payable by each is then multiplied by two to give the total tax payable. Only if you were a single person household would you be charged as one ‘part’ on your income. Thus, a single person with taxable income of € 25, 000 would be charged at the rate of 14% on € 15, 300 (€ 25, 000 — € 9, 700), which gives an actual rate on total taxable income of around 8. 5%. —

First Step The total net income of the taxpayer must be determined Second Step It is divided by a coefficient corresponding to the marital status and number of dependents in order to arrive at the net taxable income per part. Third Step The income tax table is then applied to the result and the income tax thus computed is subsequently multiplied by the same coefficient to arrive at the gross tax burden. 01 02 03 Taxes on Income: calculations Source: France : 1. Tax measures in Finance laws are finalized, enacted [ Electronic resource ]//: KPMG: https: //home. kpmg. com/xx/en/home/insights/2017/01/tnf-france-tax-measures-in-france-laws-are-finalized-enacted. html (06. 02. 2017) 2. https: //www. french-property. com/guides/france/finance-taxation/calculation-tax-liability/rates/Example : Assume a household of two adults on a joint net taxable income of € 30, 000. In the first place their income is divided into two parts of € 15, 000. Each part is then be taxed on a fractional basis using the tax bands. The first € 9, 700 of each part is zero rated, and the remainder for each part then charged at 14%. The tax payable by each is then multiplied by two to give the total tax payable. Only if you were a single person household would you be charged as one ‘part’ on your income. Thus, a single person with taxable income of € 25, 000 would be charged at the rate of 14% on € 15, 300 (€ 25, 000 — € 9, 700), which gives an actual rate on total taxable income of around 8. 5%. —

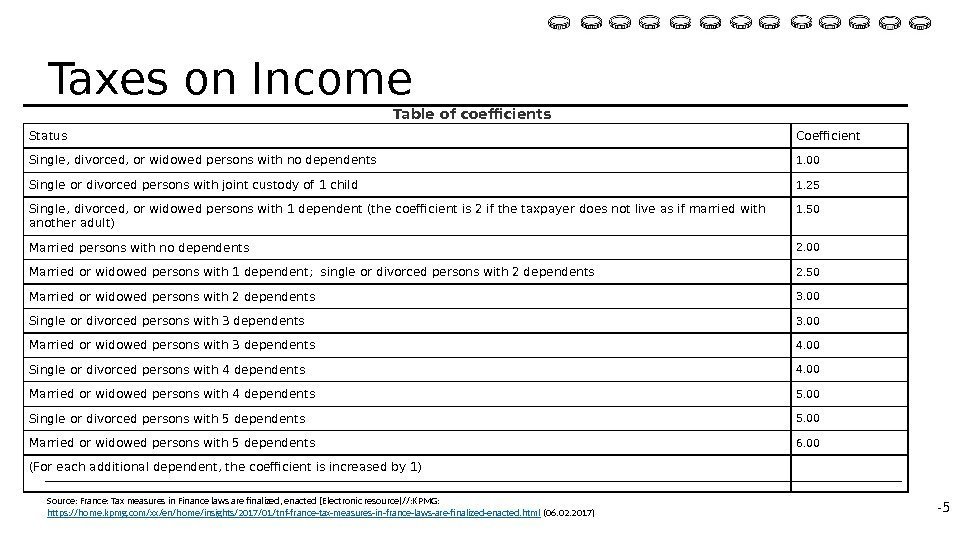

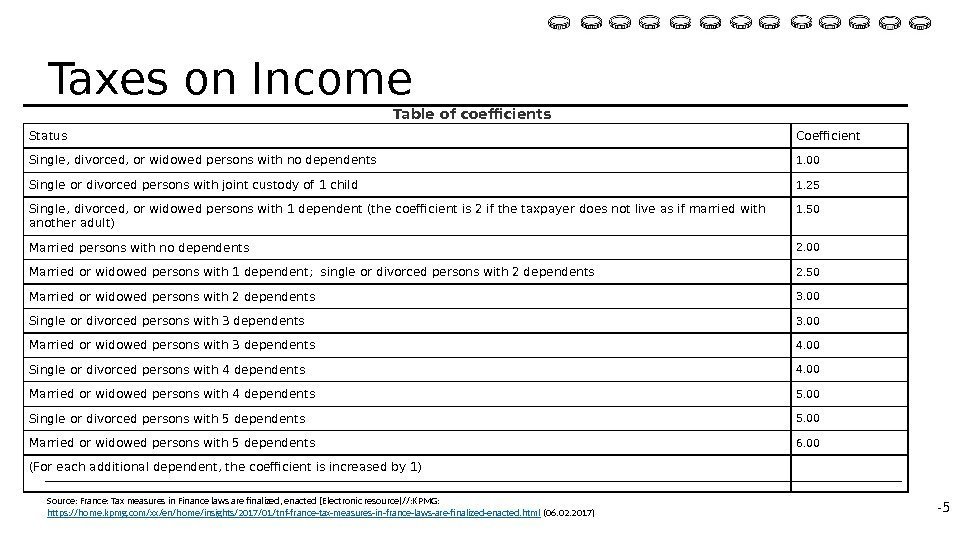

Status Coefficient Single, divorced, or widowed persons with no dependents 1. 00 Single or divorced persons with joint custody of 1 child 1. 25 Single, divorced, or widowed persons with 1 dependent (the coefficient is 2 if the taxpayer does not live as if married with another adult) 1. 50 Married persons with no dependents 2. 00 Married or widowed persons with 1 dependent; single or divorced persons with 2 dependents 2. 50 Married or widowed persons with 2 dependents 3. 00 Single or divorced persons with 3 dependents 3. 00 Married or widowed persons with 3 dependents 4. 00 Single or divorced persons with 4 dependents 4. 00 Married or widowed persons with 4 dependents 5. 00 Single or divorced persons with 5 dependents 5. 00 Married or widowed persons with 5 dependents 6. 00 (For each additional dependent, the coefficient is increased by 1) Table of coefficients. Taxes on Income Source: France: Tax measures in Finance laws are finalized, enacted [Electronic resource]//: KPMG: https: //home. kpmg. com/xx/en/home/insights/2017/01/tnf-france-tax-measures-in-france-laws-are-finalized-enacted. html (06. 02. 2017) —

Status Coefficient Single, divorced, or widowed persons with no dependents 1. 00 Single or divorced persons with joint custody of 1 child 1. 25 Single, divorced, or widowed persons with 1 dependent (the coefficient is 2 if the taxpayer does not live as if married with another adult) 1. 50 Married persons with no dependents 2. 00 Married or widowed persons with 1 dependent; single or divorced persons with 2 dependents 2. 50 Married or widowed persons with 2 dependents 3. 00 Single or divorced persons with 3 dependents 3. 00 Married or widowed persons with 3 dependents 4. 00 Single or divorced persons with 4 dependents 4. 00 Married or widowed persons with 4 dependents 5. 00 Single or divorced persons with 5 dependents 5. 00 Married or widowed persons with 5 dependents 6. 00 (For each additional dependent, the coefficient is increased by 1) Table of coefficients. Taxes on Income Source: France: Tax measures in Finance laws are finalized, enacted [Electronic resource]//: KPMG: https: //home. kpmg. com/xx/en/home/insights/2017/01/tnf-france-tax-measures-in-france-laws-are-finalized-enacted. html (06. 02. 2017) —

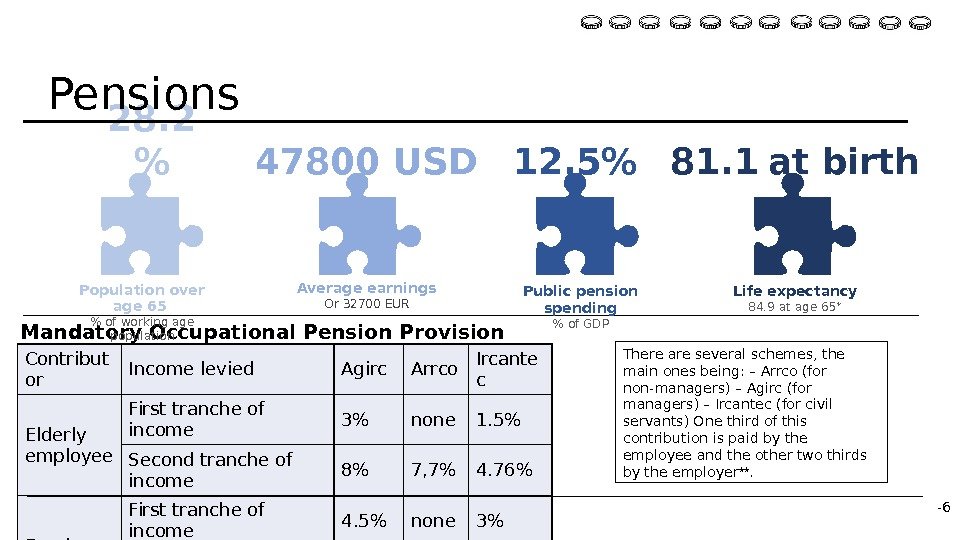

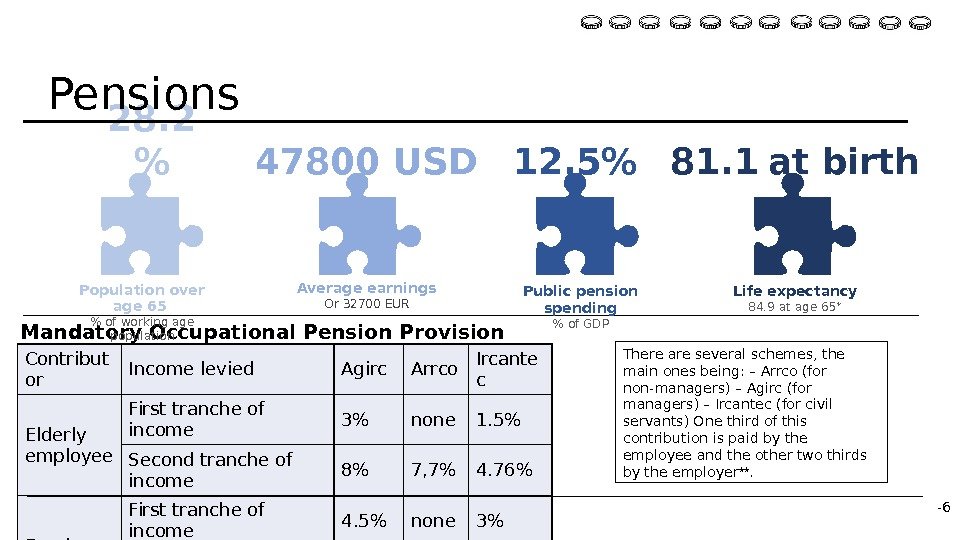

* http: //www. oecd. org/france/47272404. pdf ** https: //en. wikipedia. org/wiki/Pensions_in_France Contribut or Income levied Agirc Arrco Ircante c Elderly employee First tranche of income 3% none 1. 5% Second tranche of income 8% 7, 7% 4. 76% Employer First tranche of income 4. 5% none 3% Second tranche of income 12% 12. 6 % 9. 24% There are several schemes, the main ones being: – Arrco (for non-managers) – Agirc (for managers) – Ircantec (for civil servants) One third of this contribution is paid by the employee and the other two thirds by the employer **. Mandatory Occupational Pension Provision Population over age 65 % of working age population Public pension spending % of GDPAverage earnings Or 32700 EUR Life expectancy 84. 9 at age 65 *47800 USD 81. 1 at birth 12. 5%28. 2 %Pensions —

* http: //www. oecd. org/france/47272404. pdf ** https: //en. wikipedia. org/wiki/Pensions_in_France Contribut or Income levied Agirc Arrco Ircante c Elderly employee First tranche of income 3% none 1. 5% Second tranche of income 8% 7, 7% 4. 76% Employer First tranche of income 4. 5% none 3% Second tranche of income 12% 12. 6 % 9. 24% There are several schemes, the main ones being: – Arrco (for non-managers) – Agirc (for managers) – Ircantec (for civil servants) One third of this contribution is paid by the employee and the other two thirds by the employer **. Mandatory Occupational Pension Provision Population over age 65 % of working age population Public pension spending % of GDPAverage earnings Or 32700 EUR Life expectancy 84. 9 at age 65 *47800 USD 81. 1 at birth 12. 5%28. 2 %Pensions —

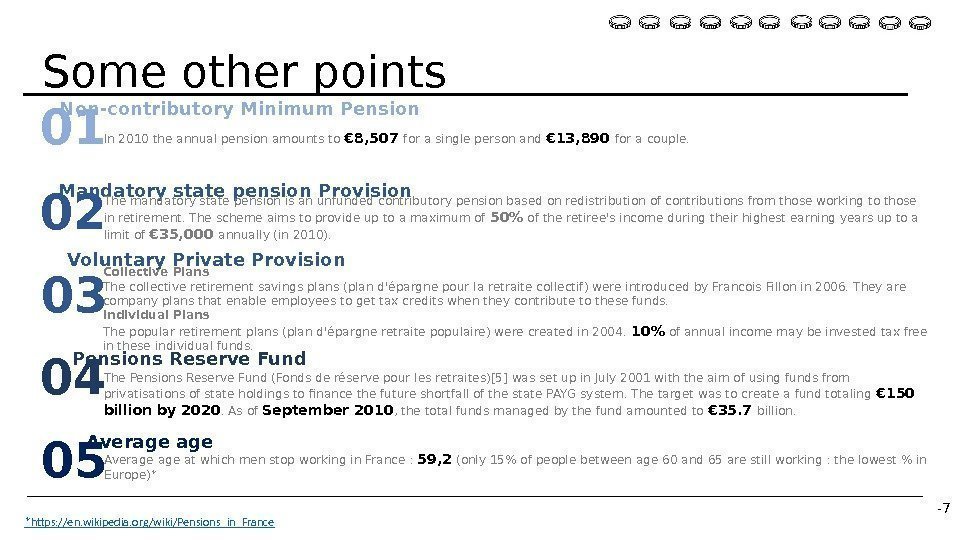

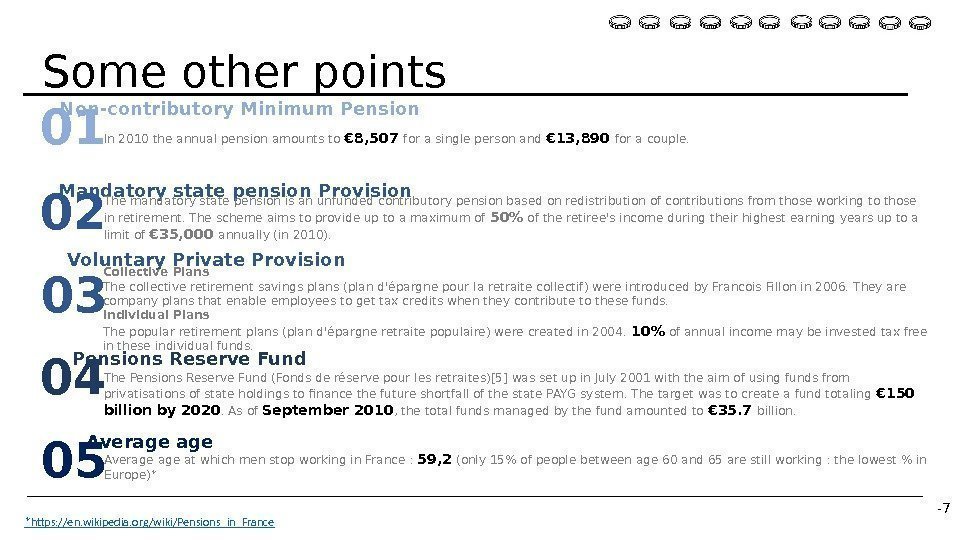

01 02 03 04 Non-contributory Minimum Pension In 2010 the annual pension amounts to € 8, 507 for a single person and € 13, 890 for a couple. Mandatory state pension Provision The mandatory state pension is an unfunded contributory pension based on redistribution of contributions from those working to those in retirement. The scheme aims to provide up to a maximum of 50% of the retiree’s income during their highest earning years up to a limit of € 35, 000 annually (in 2010). Voluntary Private Provision Collective Plans The collective retirement savings plans (plan d’épargne pour la retraite collectif) were introduced by Francois Fillon in 2006. They are company plans that enable employees to get tax credits when they contribute to these funds. Individual Plans The popular retirement plans (plan d’épargne retraite populaire) were created in 2004. 10% of annual income may be invested tax free in these individual funds. Pensions Reserve Fund The Pensions Reserve Fund (Fonds de réserve pour les retraites)[5] was set up in July 2001 with the aim of using funds from privatisations of state holdings to finance the future shortfall of the state PAYG system. The target was to create a fund totaling € 150 billion by 2020. As of September 2010 , the total funds managed by the fund amounted to € 35. 7 billion. 05 Average age at which men stop working in France : 59, 2 (only 15% of people between age 60 and 65 are still working : the lowest % in Europe) *Some other points * https: //en. wikipedia. org/wiki/Pensions_in_France —

01 02 03 04 Non-contributory Minimum Pension In 2010 the annual pension amounts to € 8, 507 for a single person and € 13, 890 for a couple. Mandatory state pension Provision The mandatory state pension is an unfunded contributory pension based on redistribution of contributions from those working to those in retirement. The scheme aims to provide up to a maximum of 50% of the retiree’s income during their highest earning years up to a limit of € 35, 000 annually (in 2010). Voluntary Private Provision Collective Plans The collective retirement savings plans (plan d’épargne pour la retraite collectif) were introduced by Francois Fillon in 2006. They are company plans that enable employees to get tax credits when they contribute to these funds. Individual Plans The popular retirement plans (plan d’épargne retraite populaire) were created in 2004. 10% of annual income may be invested tax free in these individual funds. Pensions Reserve Fund The Pensions Reserve Fund (Fonds de réserve pour les retraites)[5] was set up in July 2001 with the aim of using funds from privatisations of state holdings to finance the future shortfall of the state PAYG system. The target was to create a fund totaling € 150 billion by 2020. As of September 2010 , the total funds managed by the fund amounted to € 35. 7 billion. 05 Average age at which men stop working in France : 59, 2 (only 15% of people between age 60 and 65 are still working : the lowest % in Europe) *Some other points * https: //en. wikipedia. org/wiki/Pensions_in_France —

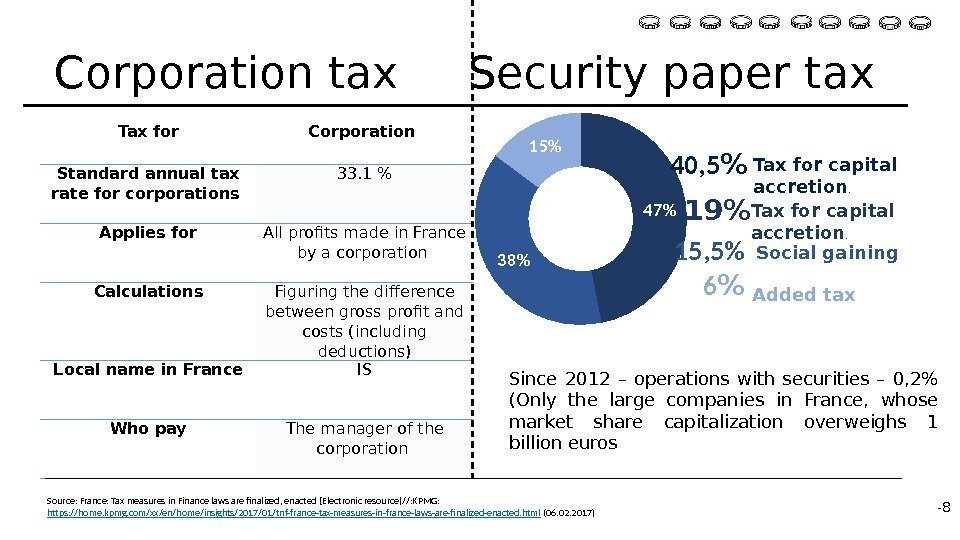

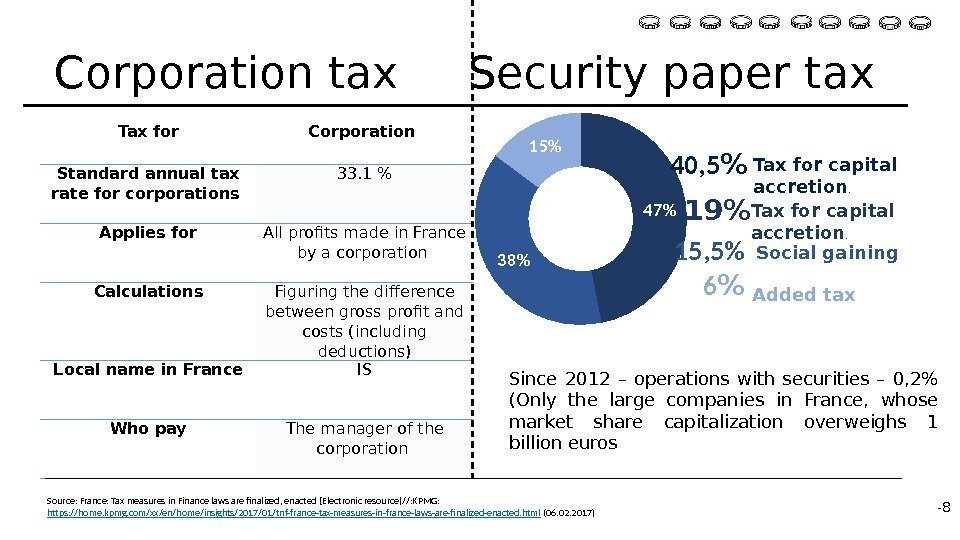

Tax for Corporation Standard annual tax rate for corporations 33. 1 % Applies for All profits made in France by a corporation Calculations Figuring the difference between gross profit and costs (including deductions) Local name in France IS Who pay The manager of the corporation Corporation tax Security paper tax Source: France: Tax measures in Finance laws are finalized, enacted [Electronic resource]//: KPMG: https: //home. kpmg. com/xx/en/home/insights/2017/01/tnf-france-tax-measures-in-france-laws-are-finalized-enacted. html (06. 02. 2017) 47% 38% 15% Tax for capital accretion. Social gaining Added tax 19% 15, 5% 6 % Tax for capital accretion. 40, 5 % Since 2012 – operations with securities – 0, 2% (Only the large companies in France, whose market share capitalization overweighs 1 billion euros —

Tax for Corporation Standard annual tax rate for corporations 33. 1 % Applies for All profits made in France by a corporation Calculations Figuring the difference between gross profit and costs (including deductions) Local name in France IS Who pay The manager of the corporation Corporation tax Security paper tax Source: France: Tax measures in Finance laws are finalized, enacted [Electronic resource]//: KPMG: https: //home. kpmg. com/xx/en/home/insights/2017/01/tnf-france-tax-measures-in-france-laws-are-finalized-enacted. html (06. 02. 2017) 47% 38% 15% Tax for capital accretion. Social gaining Added tax 19% 15, 5% 6 % Tax for capital accretion. 40, 5 % Since 2012 – operations with securities – 0, 2% (Only the large companies in France, whose market share capitalization overweighs 1 billion euros —

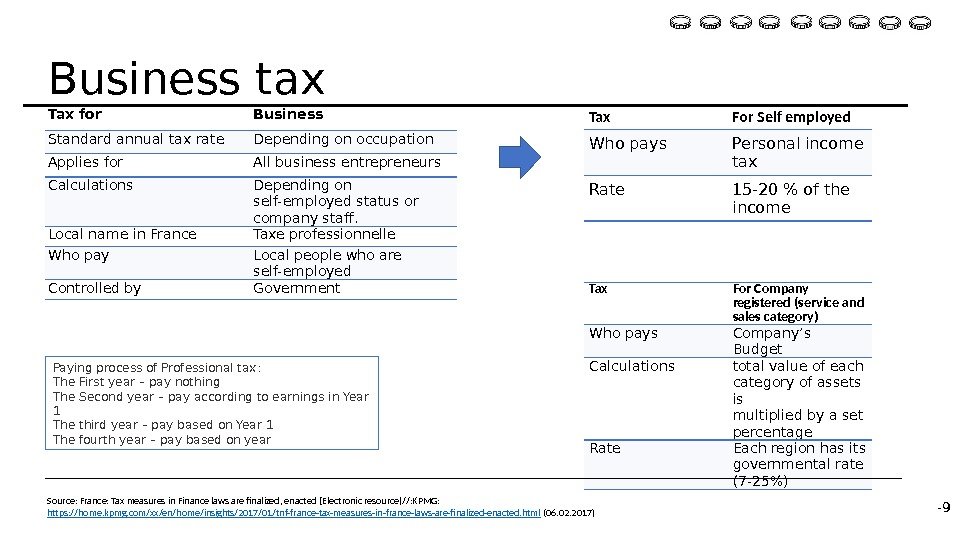

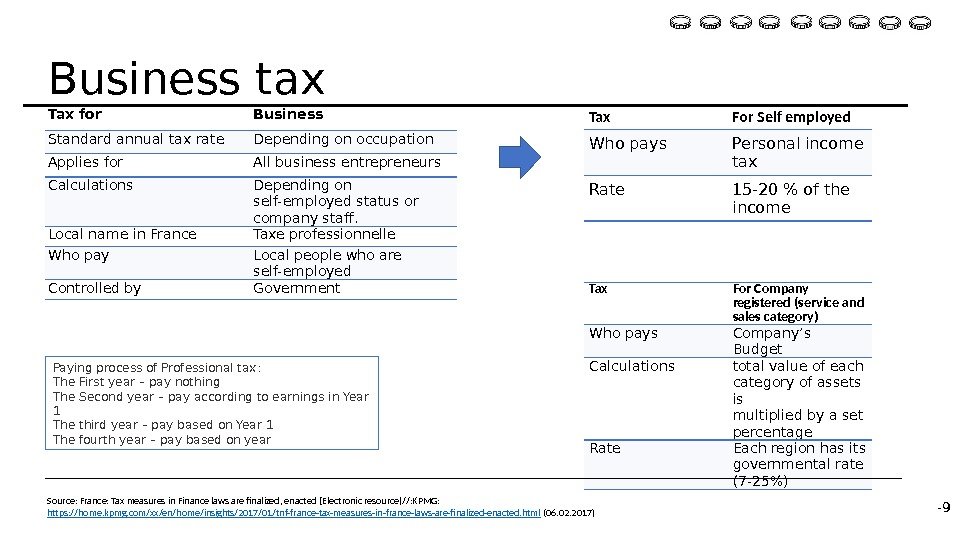

Tax for Business Standard annual tax rate Depending on occupation Applies for All business entrepreneurs Calculations Depending on self-employed status or company staff. Local name in France Taxe professionnelle Who pay Local people who are self-employed Controlled by Government Tax For Self employed Who pays Personal income tax Rate 15 -20 % of the income Tax For Company registered (service and sales category) Who pays Company’s Budget Calculations total value of each category of assets is multiplied by a set percentage Rate Each region has its governmental rate (7 -25%)Paying process of Professional tax: The First year – pay nothing The Second year – pay according to earnings in Year 1 The third year – pay based on Year 1 The fourth year – pay based on year. Business tax Source: France: Tax measures in Finance laws are finalized, enacted [Electronic resource]//: KPMG: https: //home. kpmg. com/xx/en/home/insights/2017/01/tnf-france-tax-measures-in-france-laws-are-finalized-enacted. html (06. 02. 2017) —

Tax for Business Standard annual tax rate Depending on occupation Applies for All business entrepreneurs Calculations Depending on self-employed status or company staff. Local name in France Taxe professionnelle Who pay Local people who are self-employed Controlled by Government Tax For Self employed Who pays Personal income tax Rate 15 -20 % of the income Tax For Company registered (service and sales category) Who pays Company’s Budget Calculations total value of each category of assets is multiplied by a set percentage Rate Each region has its governmental rate (7 -25%)Paying process of Professional tax: The First year – pay nothing The Second year – pay according to earnings in Year 1 The third year – pay based on Year 1 The fourth year – pay based on year. Business tax Source: France: Tax measures in Finance laws are finalized, enacted [Electronic resource]//: KPMG: https: //home. kpmg. com/xx/en/home/insights/2017/01/tnf-france-tax-measures-in-france-laws-are-finalized-enacted. html (06. 02. 2017) —

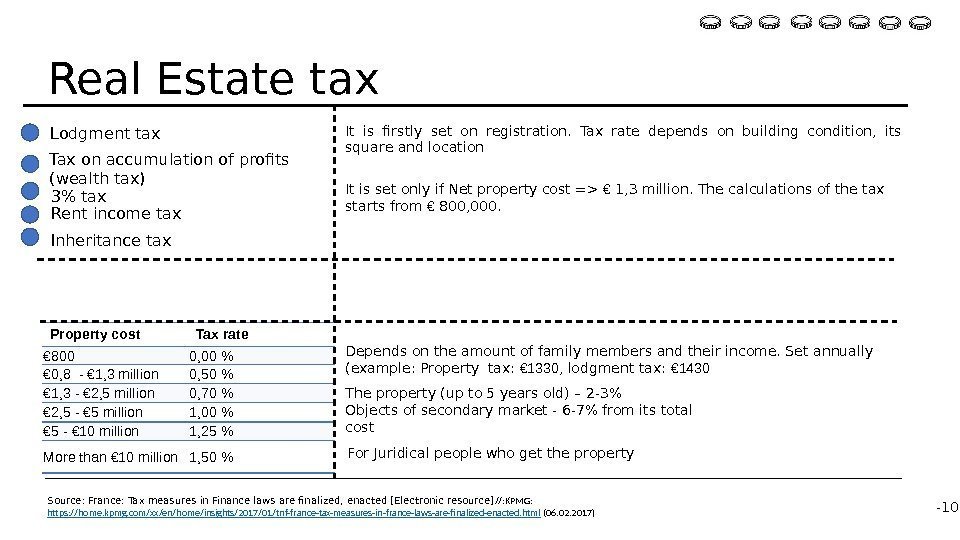

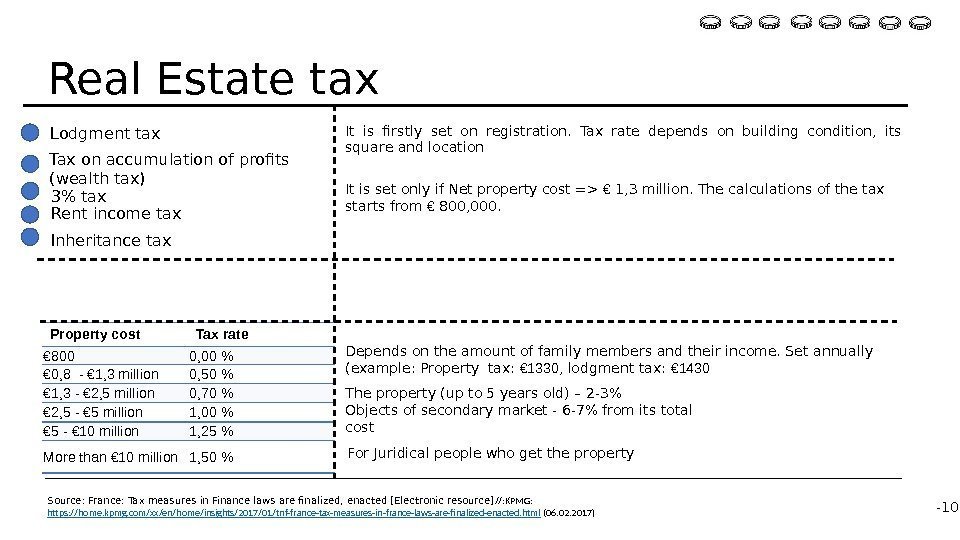

Inheritance tax It is firstly set on registration. Tax rate depends on building condition, its square and location The property (up to 5 years old) – 2 -3% Objects of secondary market — 6 -7% from its total cost. Depends on the amount of family members and their income. Set annually (example: Property tax: € 1330 , lodgment tax: € 1430 It is set only if Net property cost => € 1, 3 million. The calculations of the tax starts from € 800, 000. Property cost Tax rate € 800 0, 00 % € 0, 8 — € 1, 3 million 0, 50 % € 1, 3 — € 2, 5 million 0, 70 % € 2, 5 — € 5 million 1, 00 % € 5 — € 10 million 1, 25 % More than € 10 million 1, 50 % For Juridical people who get the property Real Estate tax Lodgment tax Tax on accumulation of profits (wealth tax) 3% tax Rent income tax Source: France: Tax measures in Finance laws are finalized, enacted [Electronic resource] //: KPMG: https: //home. kpmg. com/xx/en/home/insights/2017/01/tnf-france-tax-measures-in-france-laws-are-finalized-enacted. html (06. 02. 2017) —

Inheritance tax It is firstly set on registration. Tax rate depends on building condition, its square and location The property (up to 5 years old) – 2 -3% Objects of secondary market — 6 -7% from its total cost. Depends on the amount of family members and their income. Set annually (example: Property tax: € 1330 , lodgment tax: € 1430 It is set only if Net property cost => € 1, 3 million. The calculations of the tax starts from € 800, 000. Property cost Tax rate € 800 0, 00 % € 0, 8 — € 1, 3 million 0, 50 % € 1, 3 — € 2, 5 million 0, 70 % € 2, 5 — € 5 million 1, 00 % € 5 — € 10 million 1, 25 % More than € 10 million 1, 50 % For Juridical people who get the property Real Estate tax Lodgment tax Tax on accumulation of profits (wealth tax) 3% tax Rent income tax Source: France: Tax measures in Finance laws are finalized, enacted [Electronic resource] //: KPMG: https: //home. kpmg. com/xx/en/home/insights/2017/01/tnf-france-tax-measures-in-france-laws-are-finalized-enacted. html (06. 02. 2017) —

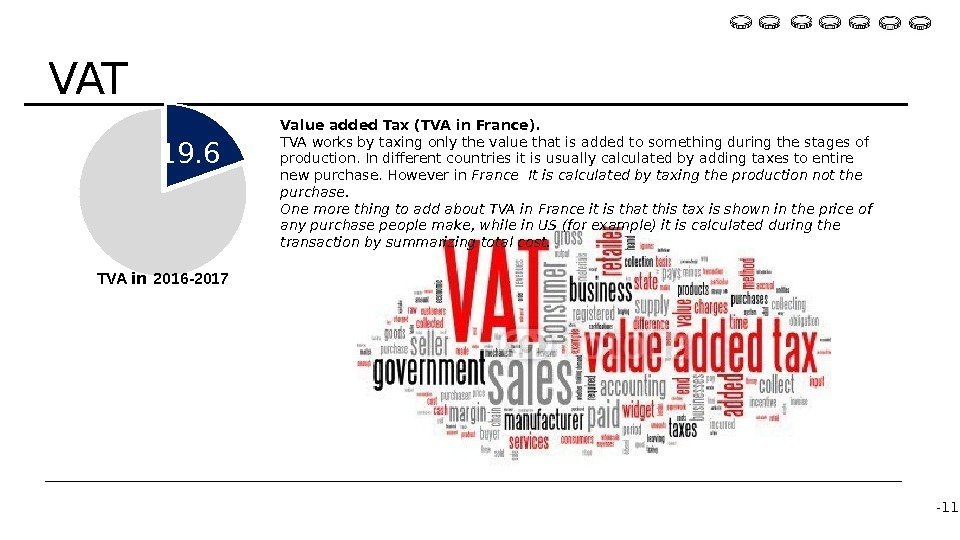

Value added Tax (TVA in France). TVA works by taxing only the value that is added to something during the stages of production. In different countries it is usually calculated by adding taxes to entire new purchase. However in France It is calculated by taxing the production not the purchase. One more thing to add about TVA in France it is that this tax is shown in the price of any purchase people make, while in US (for example) it is calculated during the transaction by summarizing total cost. VAT 19. 6 TVA in 2016 -2017 —

Value added Tax (TVA in France). TVA works by taxing only the value that is added to something during the stages of production. In different countries it is usually calculated by adding taxes to entire new purchase. However in France It is calculated by taxing the production not the purchase. One more thing to add about TVA in France it is that this tax is shown in the price of any purchase people make, while in US (for example) it is calculated during the transaction by summarizing total cost. VAT 19. 6 TVA in 2016 -2017 —

The main purpose of this tax — to find funding for technical and vocational education in the country. It is charged from the wage fund at the rate of 0. 5% of the annual wage fund of the enterprise as a whole , plus 0. 1%. If the company uses a temporary labor force , the rate rises to 2%. Professionaltax Source: France: Tax measures in Finance laws are finalized, enacted [Electronic resource] //: KPMG: https: //home. kpmg. com/xx/en/home/insights/2017/01/tnf-france-tax-measures-in-france-laws-are-finalized-enacted. html (06. 02. 2017) —

The main purpose of this tax — to find funding for technical and vocational education in the country. It is charged from the wage fund at the rate of 0. 5% of the annual wage fund of the enterprise as a whole , plus 0. 1%. If the company uses a temporary labor force , the rate rises to 2%. Professionaltax Source: France: Tax measures in Finance laws are finalized, enacted [Electronic resource] //: KPMG: https: //home. kpmg. com/xx/en/home/insights/2017/01/tnf-france-tax-measures-in-france-laws-are-finalized-enacted. html (06. 02. 2017) —

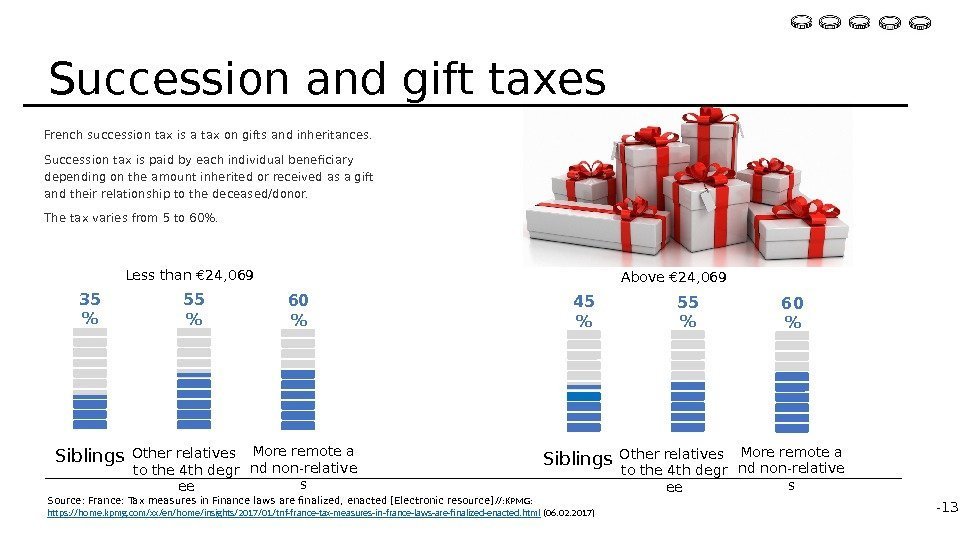

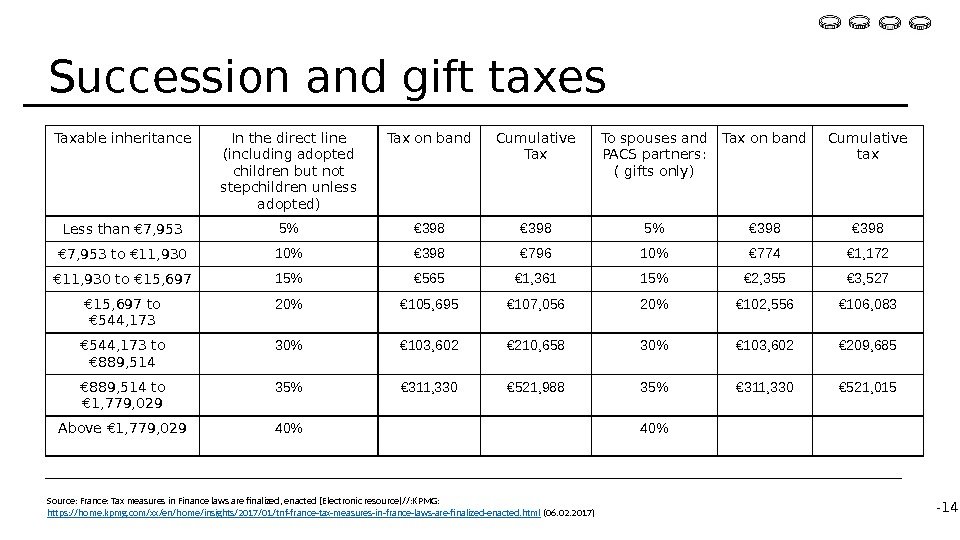

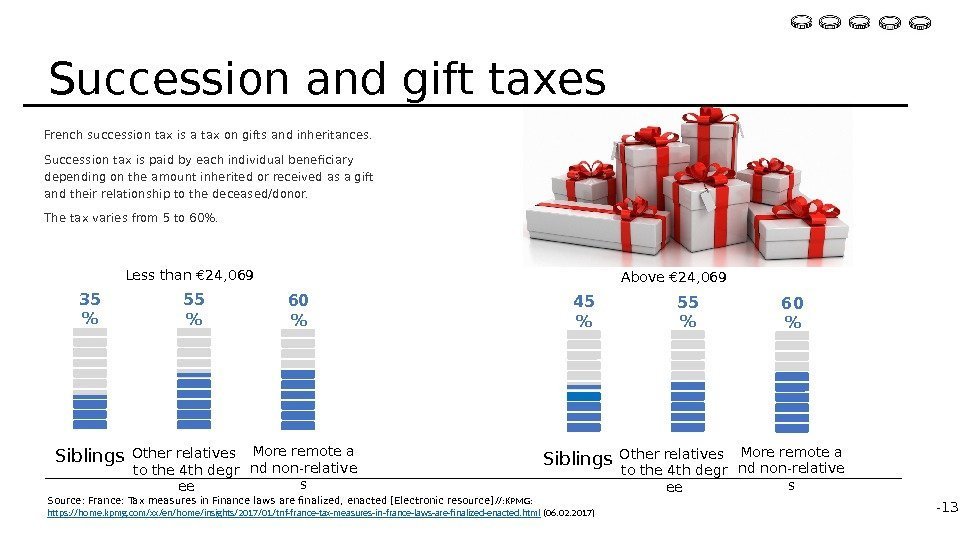

French succession tax is a tax on gifts and inheritances. Succession tax is paid by each individual beneficiary depending on the amount inherited or received as a gift and their relationship to the deceased/donor. The tax varies from 5 to 60%. Succession and gift taxes Source: France: Tax measures in Finance laws are finalized, enacted [Electronic resource] //: KPMG: https: //home. kpmg. com/xx/en/home/insights/2017/01/tnf-france-tax-measures-in-france-laws-are-finalized-enacted. html (06. 02. 2017)Lessthan€ 24, 069 Above€ 24, 069 Siblings Otherrelatives tothe 4 thdegr ee Moreremotea ndnon-relative s 35 % 55 % 60 % Siblings Otherrelatives tothe 4 thdegr ee Moreremotea ndnon-relative s 45 % 55 % 60 % —

French succession tax is a tax on gifts and inheritances. Succession tax is paid by each individual beneficiary depending on the amount inherited or received as a gift and their relationship to the deceased/donor. The tax varies from 5 to 60%. Succession and gift taxes Source: France: Tax measures in Finance laws are finalized, enacted [Electronic resource] //: KPMG: https: //home. kpmg. com/xx/en/home/insights/2017/01/tnf-france-tax-measures-in-france-laws-are-finalized-enacted. html (06. 02. 2017)Lessthan€ 24, 069 Above€ 24, 069 Siblings Otherrelatives tothe 4 thdegr ee Moreremotea ndnon-relative s 35 % 55 % 60 % Siblings Otherrelatives tothe 4 thdegr ee Moreremotea ndnon-relative s 45 % 55 % 60 % —

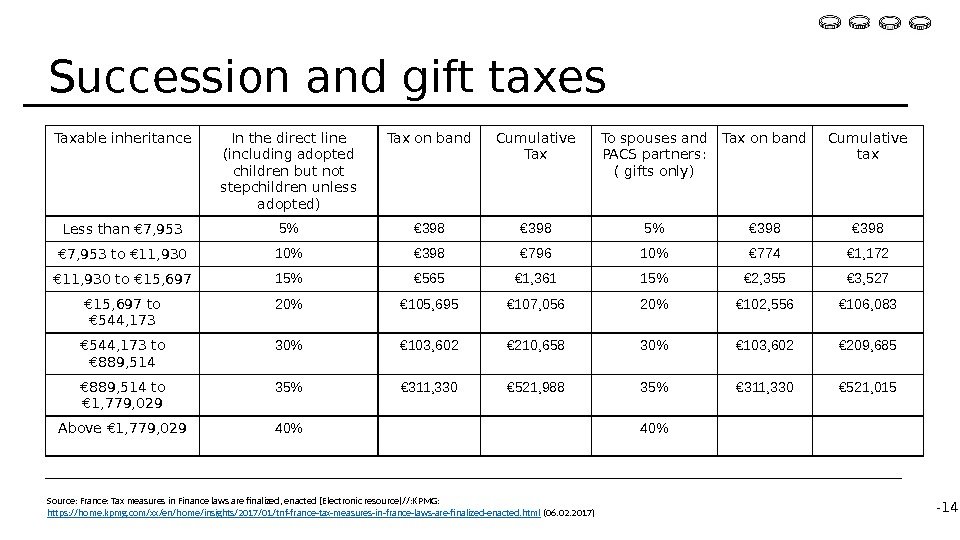

Taxable inheritance In the direct line (including adopted children but not stepchildren unless adopted) Tax on band Cumulative Tax To spouses and PACS partners: ( gifts only) Tax on band Cumulative tax Less than € 7, 953 5% € 398 € 7, 953 to € 11, 930 10% € 398 € 796 10% € 774 € 1, 172 € 11, 930 to € 15, 697 15% € 565 € 1, 361 15% € 2, 355 € 3, 527 € 15, 697 to € 544, 173 20% € 105, 695 € 107, 056 20% € 102, 556 € 106, 083 € 544, 173 to € 889, 514 30% € 103, 602 € 210, 658 30% € 103, 602 € 209, 685 € 889, 514 to € 1, 779, 029 35% € 311, 330 € 521, 988 35% € 311, 330 € 521, 015 Above € 1, 779, 029 40%Succession and gift taxes Source: France: Tax measures in Finance laws are finalized, enacted [Electronic resource]//: KPMG: https: //home. kpmg. com/xx/en/home/insights/2017/01/tnf-france-tax-measures-in-france-laws-are-finalized-enacted. html (06. 02. 2017) —

Taxable inheritance In the direct line (including adopted children but not stepchildren unless adopted) Tax on band Cumulative Tax To spouses and PACS partners: ( gifts only) Tax on band Cumulative tax Less than € 7, 953 5% € 398 € 7, 953 to € 11, 930 10% € 398 € 796 10% € 774 € 1, 172 € 11, 930 to € 15, 697 15% € 565 € 1, 361 15% € 2, 355 € 3, 527 € 15, 697 to € 544, 173 20% € 105, 695 € 107, 056 20% € 102, 556 € 106, 083 € 544, 173 to € 889, 514 30% € 103, 602 € 210, 658 30% € 103, 602 € 209, 685 € 889, 514 to € 1, 779, 029 35% € 311, 330 € 521, 988 35% € 311, 330 € 521, 015 Above € 1, 779, 029 40%Succession and gift taxes Source: France: Tax measures in Finance laws are finalized, enacted [Electronic resource]//: KPMG: https: //home. kpmg. com/xx/en/home/insights/2017/01/tnf-france-tax-measures-in-france-laws-are-finalized-enacted. html (06. 02. 2017) —

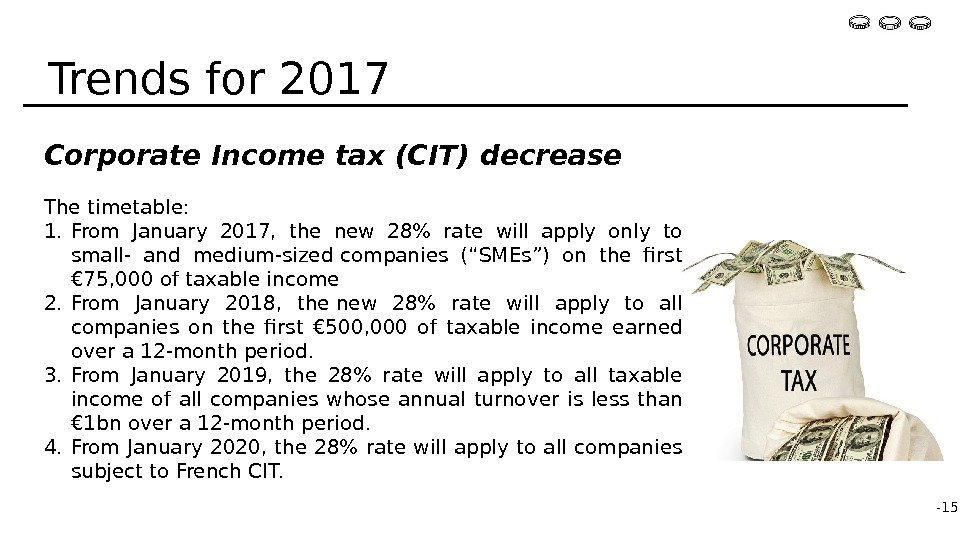

Corporate Income tax (CIT) decrease The timetable: 1. From January 2017, the new 28% rate will apply only to small- and medium-sizedcompanies (“SMEs”) on the first € 75, 000 of taxable income 2. From January 2018, thenew 28% rate will apply to all companies on the first € 500, 000 of taxable income earned over a 12 -month period. 3. From January 2019, the 28% rate will apply to all taxable income of all companies whose annual turnover is less than € 1 bn over a 12 -month period. 4. From January 2020, the 28% rate will apply to all companies subject to French. CIT. Trends for 2017 —

Corporate Income tax (CIT) decrease The timetable: 1. From January 2017, the new 28% rate will apply only to small- and medium-sizedcompanies (“SMEs”) on the first € 75, 000 of taxable income 2. From January 2018, thenew 28% rate will apply to all companies on the first € 500, 000 of taxable income earned over a 12 -month period. 3. From January 2019, the 28% rate will apply to all taxable income of all companies whose annual turnover is less than € 1 bn over a 12 -month period. 4. From January 2020, the 28% rate will apply to all companies subject to French. CIT. Trends for 2017 —

CIT installments by large companies Companies with revenue more than € 250 million must pay their CIT in 4 installments per year. Currently, the amount of the fourth and final installment is equal to the difference between: (1) 75%, 85% or 95%. The new law replaces and increases the percentages of 75%, 85% or 95% with 80%, 90% or 98%, respectively. Specific regime for “impatriats » The “impatriate” regime, to encourage foreign investments and relocations in France, provides an exemption from incometax to executives moving to France and from imposition of thewealth tax on foreign assets. Tax on financial transactions The rateincreased to 0. 3% (up from 0. 2%). Trends for 2017 —

CIT installments by large companies Companies with revenue more than € 250 million must pay their CIT in 4 installments per year. Currently, the amount of the fourth and final installment is equal to the difference between: (1) 75%, 85% or 95%. The new law replaces and increases the percentages of 75%, 85% or 95% with 80%, 90% or 98%, respectively. Specific regime for “impatriats » The “impatriate” regime, to encourage foreign investments and relocations in France, provides an exemption from incometax to executives moving to France and from imposition of thewealth tax on foreign assets. Tax on financial transactions The rateincreased to 0. 3% (up from 0. 2%). Trends for 2017 —

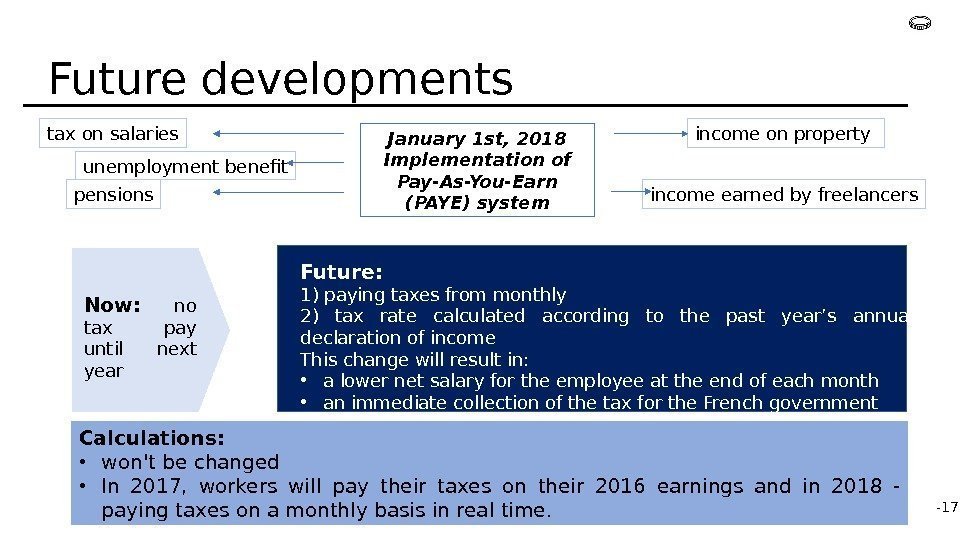

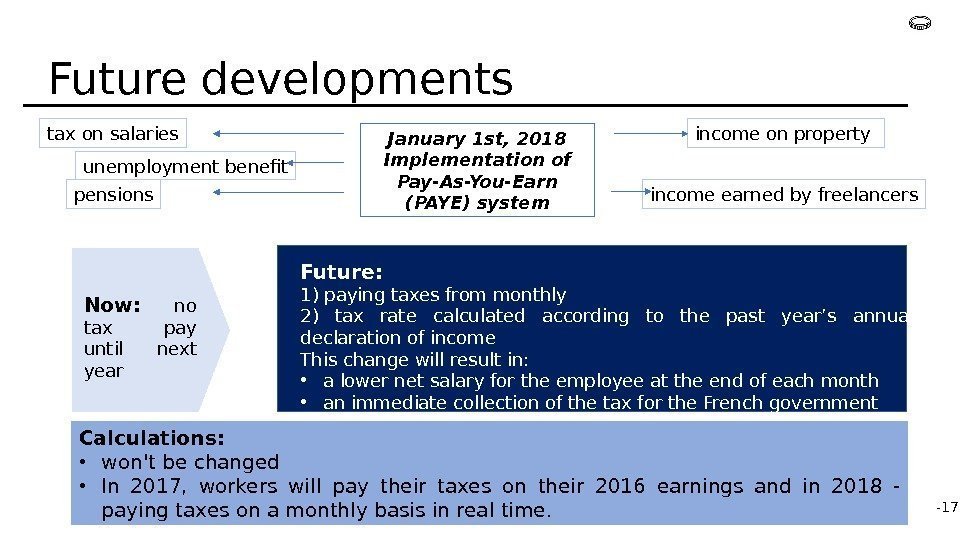

Calculations: • won’t be changed • In 2017, workers will pay their taxes on their 2016 earnings and in 2018 — paying taxes on a monthly basis in real time. Future developments January 1 st, 2018 Implementation of Pay-As-You-Earn (PAYE) systemtax on salaries pensions unemployment benefit income earned by freelancers income on property Now: no tax pay until next year Future: 1) paying taxes from monthly 2) tax rate calculated according to the past year’s annual declaration of income This change will result in: • a lower net salary for the employee at the end of each month • an immediate collection of the tax for the French government —

Calculations: • won’t be changed • In 2017, workers will pay their taxes on their 2016 earnings and in 2018 — paying taxes on a monthly basis in real time. Future developments January 1 st, 2018 Implementation of Pay-As-You-Earn (PAYE) systemtax on salaries pensions unemployment benefit income earned by freelancers income on property Now: no tax pay until next year Future: 1) paying taxes from monthly 2) tax rate calculated according to the past year’s annual declaration of income This change will result in: • a lower net salary for the employee at the end of each month • an immediate collection of the tax for the French government —

1. https: //home. kpmg. com/xx/en/home/insights/2011/12/france-income-tax. html 2. France: Tax measures in Finance laws are finalized, enacted [Electronic resource]//: KPMG: https: //home. kpmg. com/xx/en/home/insights/2017/01/tnf-france-tax-measures-in-france-laws-are-finaliz ed-enacted. html (06. 02. 2017) 3. https: //www. french-property. com/guides/france/finance-taxation/calculation-tax -liability/rates/ 4. https: //en. wikipedia. org/wiki/Pensions_in_France 5. http: //www. oecd. org/france/47272404. pdf. Bibliography —

1. https: //home. kpmg. com/xx/en/home/insights/2011/12/france-income-tax. html 2. France: Tax measures in Finance laws are finalized, enacted [Electronic resource]//: KPMG: https: //home. kpmg. com/xx/en/home/insights/2017/01/tnf-france-tax-measures-in-france-laws-are-finaliz ed-enacted. html (06. 02. 2017) 3. https: //www. french-property. com/guides/france/finance-taxation/calculation-tax -liability/rates/ 4. https: //en. wikipedia. org/wiki/Pensions_in_France 5. http: //www. oecd. org/france/47272404. pdf. Bibliography —