Financial Markets and Institutions 1. Role of

3._financial_markets_and_institutions.pptx

- Размер: 101.6 Кб

- Автор:

- Количество слайдов: 26

Описание презентации Financial Markets and Institutions 1. Role of по слайдам

Financial Markets and Institutions

Financial Markets and Institutions

1. Role of Financial Markets and Institutions

1. Role of Financial Markets and Institutions

Objectives Describe the types of financial markets Describe the role of financial institutions with financial markets Identify the types of financial institutions that facilitate transactions

Objectives Describe the types of financial markets Describe the role of financial institutions with financial markets Identify the types of financial institutions that facilitate transactions

Overview of Financial Markets Financial markets provide for financial intermediation—financial savings (Surplus Units) to investment (Deficit Units) Financial markets provide payments system Financial markets provide means to manage risk To position risk and return for financial tools(the nature of financial market)

Overview of Financial Markets Financial markets provide for financial intermediation—financial savings (Surplus Units) to investment (Deficit Units) Financial markets provide payments system Financial markets provide means to manage risk To position risk and return for financial tools(the nature of financial market)

Overview of Financial Markets Broad Classifications of Financial Markets Money versus Capital Markets Primary versus Secondary Markets Organized versus Over-the-Counter Markets

Overview of Financial Markets Broad Classifications of Financial Markets Money versus Capital Markets Primary versus Secondary Markets Organized versus Over-the-Counter Markets

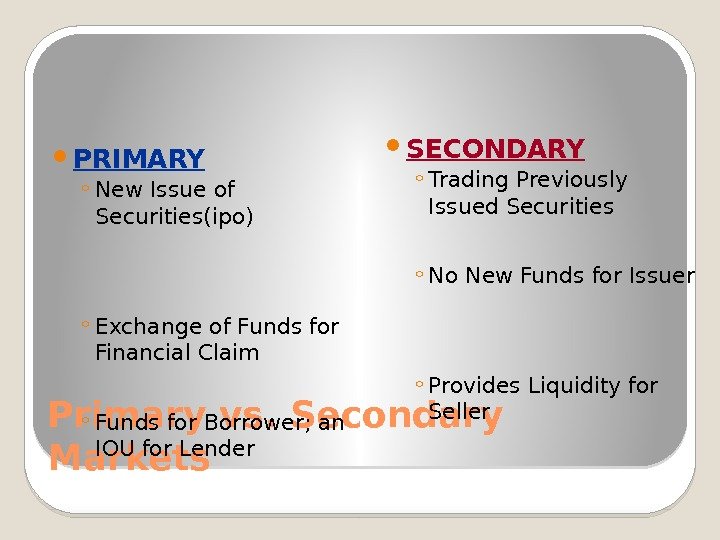

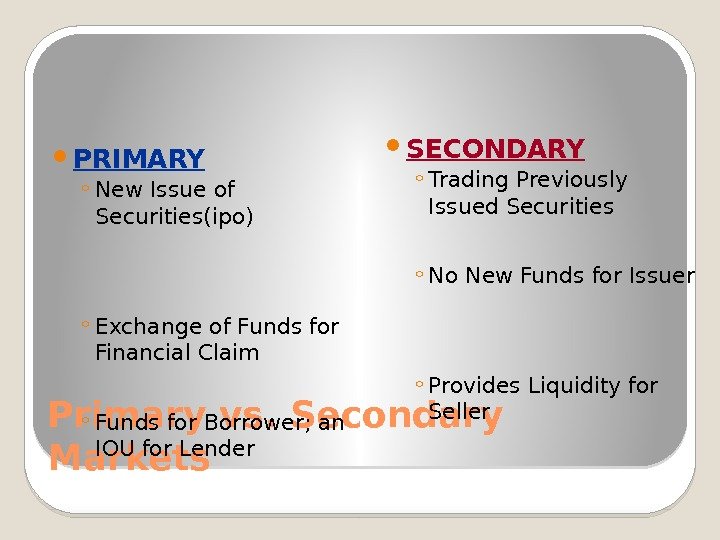

Primary vs. Secondary Markets PRIMARY ◦ New Issue of Securities(ipo) ◦ Exchange of Funds for Financial Claim ◦ Funds for Borrower; an IOU for Lender SECONDARY ◦ Trading Previously Issued Securities ◦ No New Funds for Issuer ◦ Provides Liquidity for Seller

Primary vs. Secondary Markets PRIMARY ◦ New Issue of Securities(ipo) ◦ Exchange of Funds for Financial Claim ◦ Funds for Borrower; an IOU for Lender SECONDARY ◦ Trading Previously Issued Securities ◦ No New Funds for Issuer ◦ Provides Liquidity for Seller

Money vs. Capital Markets Money ◦ Short-Term, 1 Yr ◦ Range of Issuer Quality ◦ Debt and Equity ◦ Secondary Market Focus ◦ Financing Investment—Higher Returns

Money vs. Capital Markets Money ◦ Short-Term, 1 Yr ◦ Range of Issuer Quality ◦ Debt and Equity ◦ Secondary Market Focus ◦ Financing Investment—Higher Returns

Organized vs. Over-the-Counter Markets Organized ◦ Visible Marketplace ◦ Members Trade ◦ Securities Listed ◦ New York Stock Exchange OTC ◦ Wired Network of Dealers ◦ No Central, Physical Location ◦ All Securities Traded off the Exchanges

Organized vs. Over-the-Counter Markets Organized ◦ Visible Marketplace ◦ Members Trade ◦ Securities Listed ◦ New York Stock Exchange OTC ◦ Wired Network of Dealers ◦ No Central, Physical Location ◦ All Securities Traded off the Exchanges

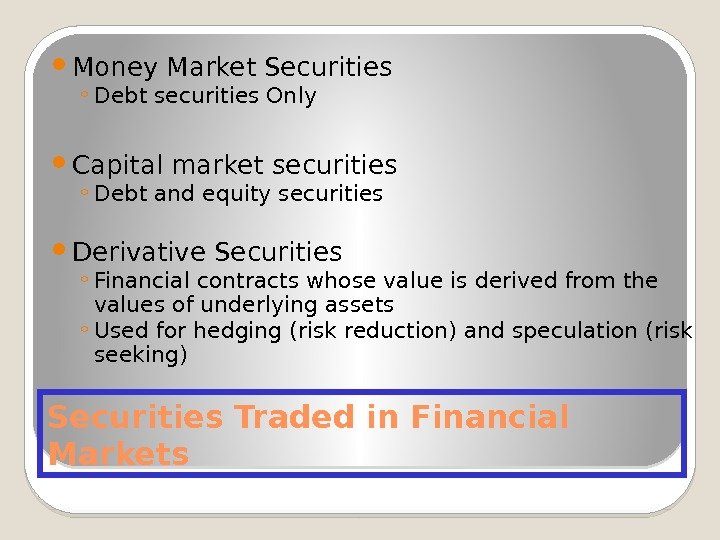

Securities Traded in Financial Markets Money Market Securities ◦ Debt securities Only Capital market securities ◦ Debt and equity securities Derivative Securities ◦ Financial contracts whose value is derived from the values of underlying assets ◦ Used for hedging (risk reduction) and speculation (risk seeking)

Securities Traded in Financial Markets Money Market Securities ◦ Debt securities Only Capital market securities ◦ Debt and equity securities Derivative Securities ◦ Financial contracts whose value is derived from the values of underlying assets ◦ Used for hedging (risk reduction) and speculation (risk seeking)

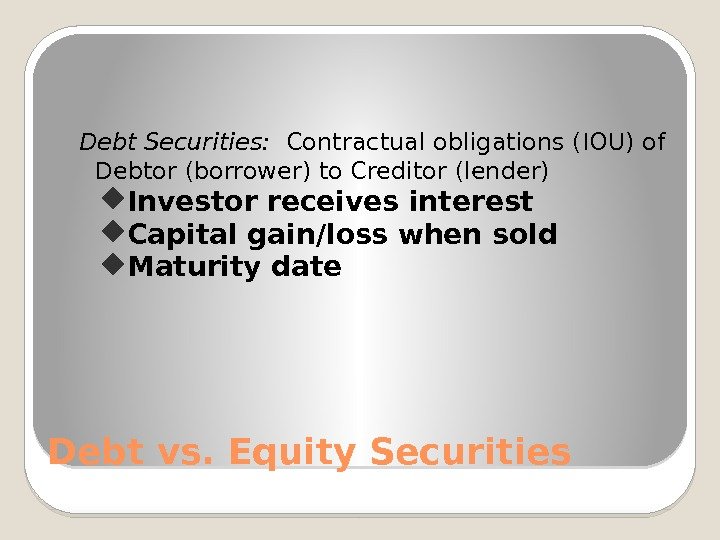

Debt vs. Equity Securities Debt Securities: Contractual obligations (IOU) of Debtor (borrower) to Creditor (lender) Investor receives interest Capital gain/loss when sold Maturity date

Debt vs. Equity Securities Debt Securities: Contractual obligations (IOU) of Debtor (borrower) to Creditor (lender) Investor receives interest Capital gain/loss when sold Maturity date

What it is: The term IOU is the phonetic spelling of the phrase «I Owe You. » In bookkeeping, it signifies an outstanding debt.

What it is: The term IOU is the phonetic spelling of the phrase «I Owe You. » In bookkeeping, it signifies an outstanding debt.

How it works (Example): Usually, an IOU is a signed informal notice of an unpaid debt, sometimes because of partial payment and an outstanding balance due. For example, Company XYZ may buy raw materials for its production but until it sells the finished product, it does not have sufficient cash flow to pay for the raw materials in full. In good faith, Company XYZ makes a partial payment for the materials and issues an IOU for the balance. Sometimes, a bond contract, the obligation of a bond issuer to repay bondholders, is referred to as an IOU. However, in that case, the IOU or bond contract is a formal legal agreement with specific terms, conditions, and penalties. An IOU may also be the uncomplicated method of documenting small debts between employees, friends or even family.

How it works (Example): Usually, an IOU is a signed informal notice of an unpaid debt, sometimes because of partial payment and an outstanding balance due. For example, Company XYZ may buy raw materials for its production but until it sells the finished product, it does not have sufficient cash flow to pay for the raw materials in full. In good faith, Company XYZ makes a partial payment for the materials and issues an IOU for the balance. Sometimes, a bond contract, the obligation of a bond issuer to repay bondholders, is referred to as an IOU. However, in that case, the IOU or bond contract is a formal legal agreement with specific terms, conditions, and penalties. An IOU may also be the uncomplicated method of documenting small debts between employees, friends or even family.

Why it Matters: An IOU does not have the same legal requirements or standing as a promissory note or other financial contract. It is usually not witnessed or signed by the lender, nor does it include specific provisions for how or even when it will be repaid. Because of the limited recourse to recover debts under IOUs, they are not usually helpful in securing financing or enforceable in court.

Why it Matters: An IOU does not have the same legal requirements or standing as a promissory note or other financial contract. It is usually not witnessed or signed by the lender, nor does it include specific provisions for how or even when it will be repaid. Because of the limited recourse to recover debts under IOUs, they are not usually helpful in securing financing or enforceable in court.

Debt vs. Equity Securities: Claim with ownership rights and responsibilities Investor receives dividends if declared Capital gain/loss when sold No maturity date — need market to sell

Debt vs. Equity Securities: Claim with ownership rights and responsibilities Investor receives dividends if declared Capital gain/loss when sold No maturity date — need market to sell

Valuation of Securities Value a function of: ◦ Future cash flows ◦ When cash flows are received ◦ Risk of cash flows Present value of cash flows discounted at the market required rate of return(CAPM) Value determined by market demand/supply Value changes with new information

Valuation of Securities Value a function of: ◦ Future cash flows ◦ When cash flows are received ◦ Risk of cash flows Present value of cash flows discounted at the market required rate of return(CAPM) Value determined by market demand/supply Value changes with new information

Financial Market Efficiency Security prices reflect available information New information is quickly included in security prices Investors balance liquidity, risk, and return needs

Financial Market Efficiency Security prices reflect available information New information is quickly included in security prices Investors balance liquidity, risk, and return needs

Financial Market Regulation ◦ To Promote Efficiency High level of competition Efficient payments mechanism Low cost risk management contracts Why Government Regulation?

Financial Market Regulation ◦ To Promote Efficiency High level of competition Efficient payments mechanism Low cost risk management contracts Why Government Regulation?

Financial Market Regulation ◦ To Maintain Financial Market Stability Prevent market crashes ◦ Circuit breakers ◦ Federal Reserve discount window Prevent Inflation—Monetary policy Prevent Excessive Risk Taking by Financial Institutions Why Government Regulation?

Financial Market Regulation ◦ To Maintain Financial Market Stability Prevent market crashes ◦ Circuit breakers ◦ Federal Reserve discount window Prevent Inflation—Monetary policy Prevent Excessive Risk Taking by Financial Institutions Why Government Regulation?

Financial Market Regulation ◦ To Provide Consumer Protection Provide adequate disclosure Set rules for business conduct ◦ To Pursue Social Policies Transfer income and wealth Allocate saving to socially desirable areas ◦ Housing ◦ Student loans Why Government Regulation?

Financial Market Regulation ◦ To Provide Consumer Protection Provide adequate disclosure Set rules for business conduct ◦ To Pursue Social Policies Transfer income and wealth Allocate saving to socially desirable areas ◦ Housing ◦ Student loans Why Government Regulation?

Financial Market Globalization Increased international funds flow ◦ Increased disclosure of information ◦ Reduced transaction costs ◦ Reduced foreign regulation on capital flows ◦ Increased privatization Results: Increased financial integration—capital flows to highest expected risk-adjusted return

Financial Market Globalization Increased international funds flow ◦ Increased disclosure of information ◦ Reduced transaction costs ◦ Reduced foreign regulation on capital flows ◦ Increased privatization Results: Increased financial integration—capital flows to highest expected risk-adjusted return

Role of Financial Institutions in Financial Markets Information processing Serve special needs of lenders (liabilities) and borrowers (assets) ◦ By denomination and term ◦ By risk and return Lower transaction cost Serve to resolve problems of market imperfection

Role of Financial Institutions in Financial Markets Information processing Serve special needs of lenders (liabilities) and borrowers (assets) ◦ By denomination and term ◦ By risk and return Lower transaction cost Serve to resolve problems of market imperfection

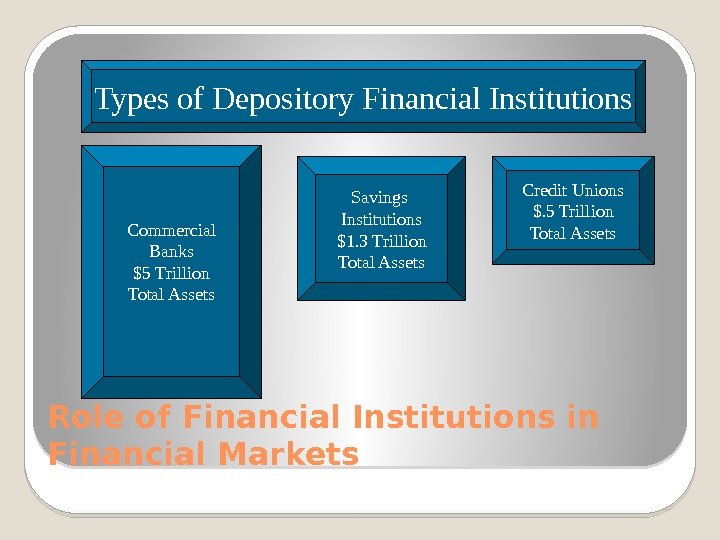

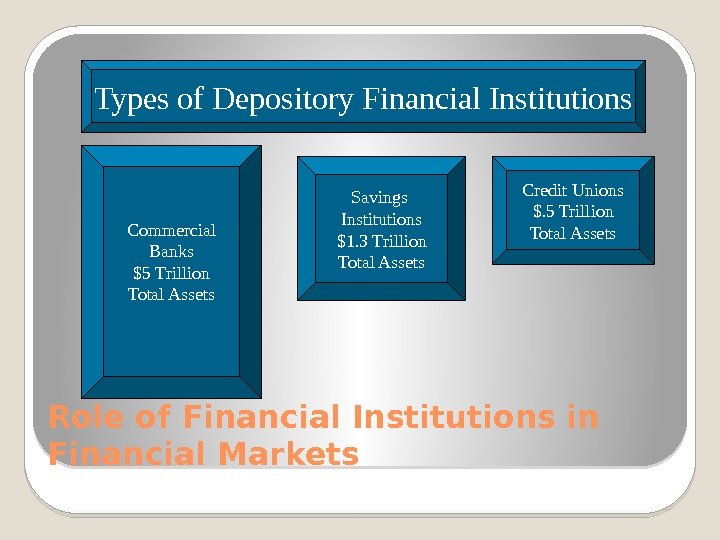

Role of Financial Institutions in Financial Markets Types of Depository Financial Institutions Commercial Banks $5 Trillion Total Assets Savings Institutions $1. 3 Trillion Total Assets Credit Unions $. 5 Trillion Total Assets

Role of Financial Institutions in Financial Markets Types of Depository Financial Institutions Commercial Banks $5 Trillion Total Assets Savings Institutions $1. 3 Trillion Total Assets Credit Unions $. 5 Trillion Total Assets

Types of Non-depository Financial Institutions Insurance companies Mutual funds Pension funds Securities companies Finance companies Security pools

Types of Non-depository Financial Institutions Insurance companies Mutual funds Pension funds Securities companies Finance companies Security pools

Role of Non-depository Financial Institutions Focused on capital market Longer-term, higher risk intermediation Less focus on liquidity Less regulation Greater focus on equity investments

Role of Non-depository Financial Institutions Focused on capital market Longer-term, higher risk intermediation Less focus on liquidity Less regulation Greater focus on equity investments

Trends in Financial Institutions Rapid growth of mutual funds and pension funds Increased consolidation of financial institutions via mergers Increased competition between financial Institutions Growth of financial conglomerates

Trends in Financial Institutions Rapid growth of mutual funds and pension funds Increased consolidation of financial institutions via mergers Increased competition between financial Institutions Growth of financial conglomerates

Global Expansion by Financial Institutions International expansion International mergers Impact of the single European currency Emerging markets

Global Expansion by Financial Institutions International expansion International mergers Impact of the single European currency Emerging markets