Continental case study-Group 1.pptx

- Количество слайдов: 51

EVALUATION OF EUROPEAN PRICE POTENTIALS THROUGH PRICE HARMONIZATION AND PORTFOLIO MANAGEMENT Group members: Beibei Gu Alisa Tyagunova Elena Rogova Artem Perepelytsyn 1

EVALUATION OF EUROPEAN PRICE POTENTIALS THROUGH PRICE HARMONIZATION AND PORTFOLIO MANAGEMENT Group members: Beibei Gu Alisa Tyagunova Elena Rogova Artem Perepelytsyn 1

AGENDA 1. Problem definition 2. SWOT analysis 3. Possible solutions • Price harmonization • Portfolio Management 4. Feasibility of the solutions and suggestions 5. Other suggestions and financial scenario 6. Conclusions 2

AGENDA 1. Problem definition 2. SWOT analysis 3. Possible solutions • Price harmonization • Portfolio Management 4. Feasibility of the solutions and suggestions 5. Other suggestions and financial scenario 6. Conclusions 2

BACKGROUND The rising price of raw materials Grey market Parallel imports Centralized purchasing Homogeneous demand expectation in EU Free and fast flow of goods High information transparency 3

BACKGROUND The rising price of raw materials Grey market Parallel imports Centralized purchasing Homogeneous demand expectation in EU Free and fast flow of goods High information transparency 3

PROBLEM DEFINITION Identification of price increase potentials for Continental commercial vehicle tires 4

PROBLEM DEFINITION Identification of price increase potentials for Continental commercial vehicle tires 4

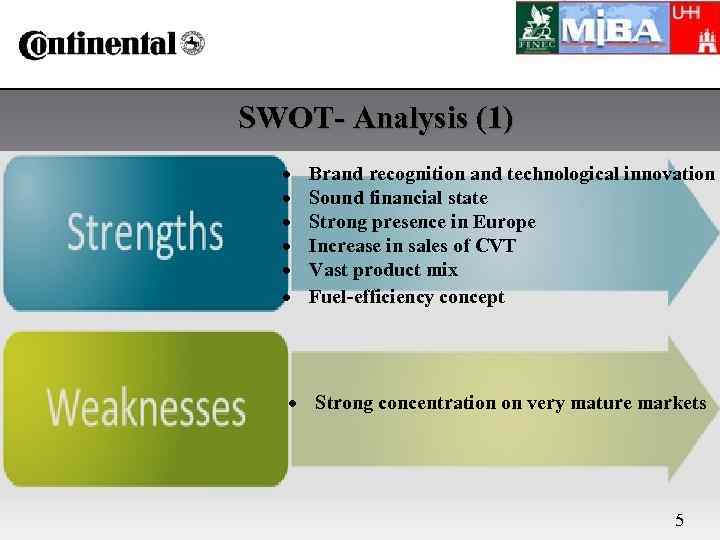

SWOT- Analysis (1) Brand recognition and technological innovation Sound financial state Strong presence in Europe Increase in sales of CVT Vast product mix Fuel-efficiency concept Strong concentration on very mature markets 5

SWOT- Analysis (1) Brand recognition and technological innovation Sound financial state Strong presence in Europe Increase in sales of CVT Vast product mix Fuel-efficiency concept Strong concentration on very mature markets 5

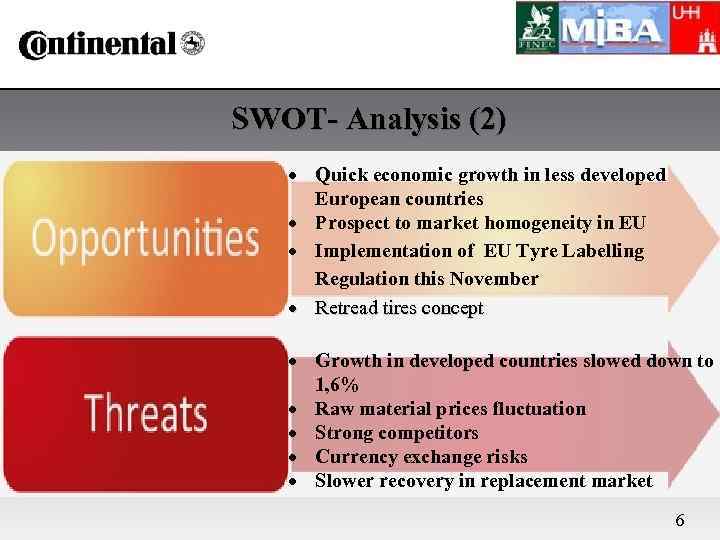

SWOT- Analysis (2) Quick economic growth in less developed European countries Prospect to market homogeneity in EU Implementation of EU Tyre Labelling Regulation this November Retread tires concept Growth in developed countries slowed down to 1, 6% Raw material prices fluctuation Strong competitors Currency exchange risks Slower recovery in replacement market 6

SWOT- Analysis (2) Quick economic growth in less developed European countries Prospect to market homogeneity in EU Implementation of EU Tyre Labelling Regulation this November Retread tires concept Growth in developed countries slowed down to 1, 6% Raw material prices fluctuation Strong competitors Currency exchange risks Slower recovery in replacement market 6

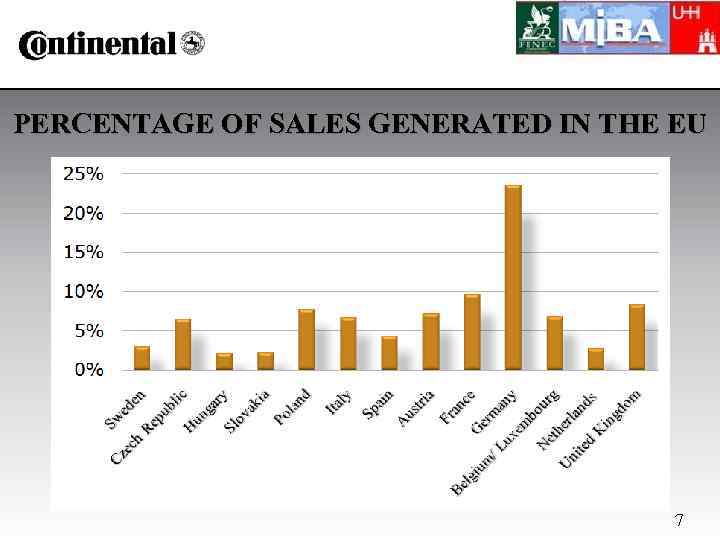

PERCENTAGE OF SALES GENERATED IN THE EU 7

PERCENTAGE OF SALES GENERATED IN THE EU 7

POSSIBLE SOLUTIONS üPrice harmonization üPortfolio management 8

POSSIBLE SOLUTIONS üPrice harmonization üPortfolio management 8

PRICE HARMONIZATION 9

PRICE HARMONIZATION 9

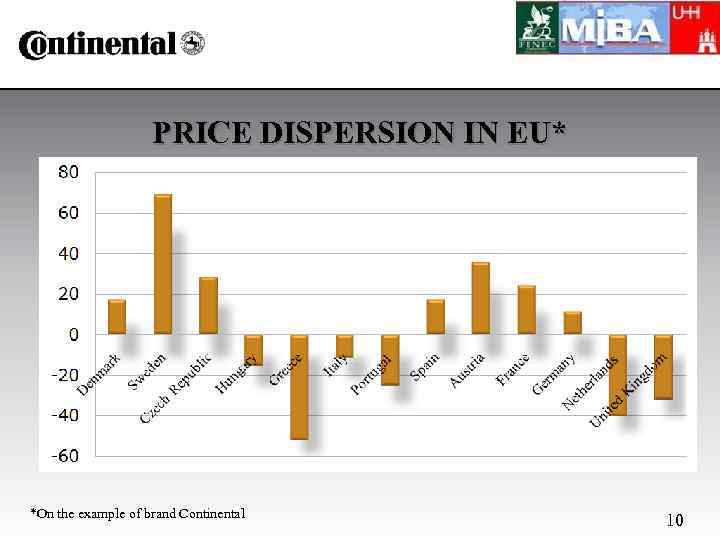

PRICE DISPERSION IN EU* *On the example of brand Continental 10

PRICE DISPERSION IN EU* *On the example of brand Continental 10

POSSIBLE REASONS FOR DISPERSION i. iii. iv. v. vi. Different competition Volatile Exchange rate Preference for national brand VAT tax rate Levels of income Margins for intermediates 11

POSSIBLE REASONS FOR DISPERSION i. iii. iv. v. vi. Different competition Volatile Exchange rate Preference for national brand VAT tax rate Levels of income Margins for intermediates 11

CHANCES AND RISKS OF PRICE HARMONIZATION Risks • Different margins for dealers • Thinner profit margin in higher-price countries • Less market share in lower-price countries Chances • Easier to control price • Unified brand image • Easier for pricing • Avoid parallel imports 12

CHANCES AND RISKS OF PRICE HARMONIZATION Risks • Different margins for dealers • Thinner profit margin in higher-price countries • Less market share in lower-price countries Chances • Easier to control price • Unified brand image • Easier for pricing • Avoid parallel imports 12

CONCLUSIONS ON PRICE HARMONIZATION 1. Harmonize the prices throughout the whole European Union is impossible (very heterogeneous) 2. Harmonization within 4 regions: Western, Southern, Northern, Eastern Europe however: • Western Europe is less favorable due to high saturation and tough competition • Southern Europe isn’t an option because of instability and clear prospects • Northern Europe has quite a small percentage of Continental CVT, thus there is a need to increase market share first • Eastern Europe has the most potential in terms of harmonization! 13

CONCLUSIONS ON PRICE HARMONIZATION 1. Harmonize the prices throughout the whole European Union is impossible (very heterogeneous) 2. Harmonization within 4 regions: Western, Southern, Northern, Eastern Europe however: • Western Europe is less favorable due to high saturation and tough competition • Southern Europe isn’t an option because of instability and clear prospects • Northern Europe has quite a small percentage of Continental CVT, thus there is a need to increase market share first • Eastern Europe has the most potential in terms of harmonization! 13

PORTFOLIO MANAGEMENT Product mix 14

PORTFOLIO MANAGEMENT Product mix 14

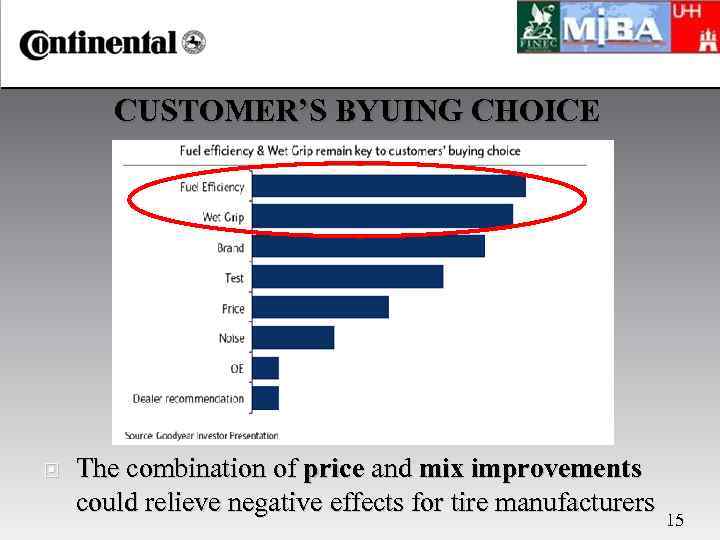

CUSTOMER’S BYUING CHOICE The combination of price and mix improvements could relieve negative effects for tire manufacturers 15

CUSTOMER’S BYUING CHOICE The combination of price and mix improvements could relieve negative effects for tire manufacturers 15

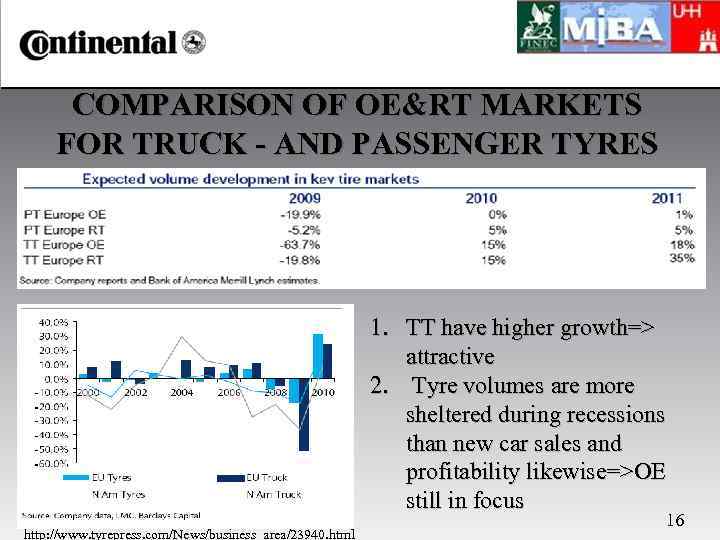

COMPARISON OF OE&RT MARKETS FOR TRUCK - AND PASSENGER TYRES 1. TT have higher growth=> attractive 2. Tyre volumes are more sheltered during recessions than new car sales and profitability likewise=>OE still in focus http: //www. tyrepress. com/News/business_area/23940. html 16

COMPARISON OF OE&RT MARKETS FOR TRUCK - AND PASSENGER TYRES 1. TT have higher growth=> attractive 2. Tyre volumes are more sheltered during recessions than new car sales and profitability likewise=>OE still in focus http: //www. tyrepress. com/News/business_area/23940. html 16

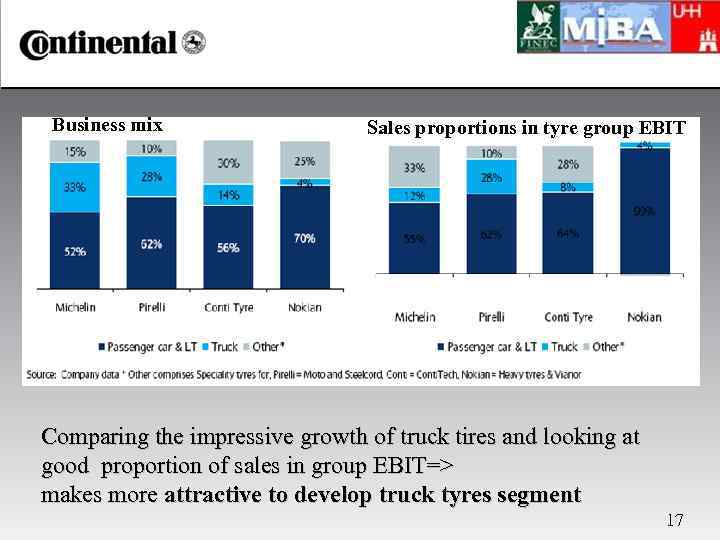

Business mix Sales proportions in tyre group EBIT Comparing the impressive growth of truck tires and looking at good proportion of sales in group EBIT=> makes more attractive to develop truck tyres segment 17

Business mix Sales proportions in tyre group EBIT Comparing the impressive growth of truck tires and looking at good proportion of sales in group EBIT=> makes more attractive to develop truck tyres segment 17

PORTFOLIO MANAGEMENT Geographic mix 18

PORTFOLIO MANAGEMENT Geographic mix 18

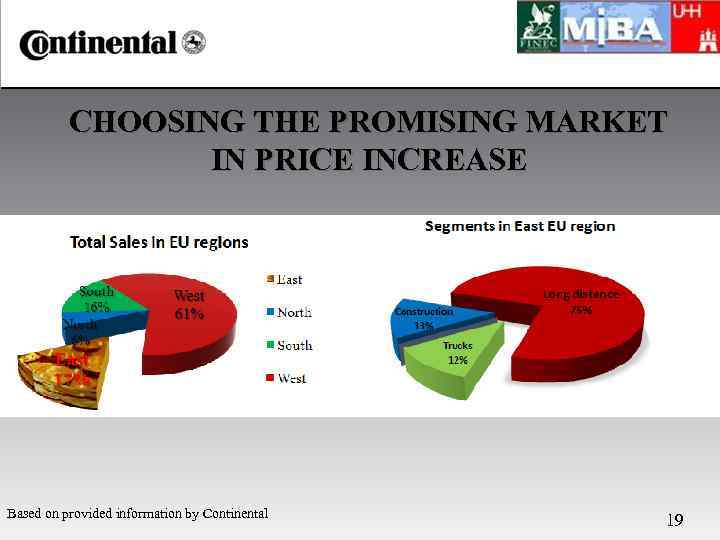

CHOOSING THE PROMISING MARKET IN PRICE INCREASE Based on provided information by Continental 19

CHOOSING THE PROMISING MARKET IN PRICE INCREASE Based on provided information by Continental 19

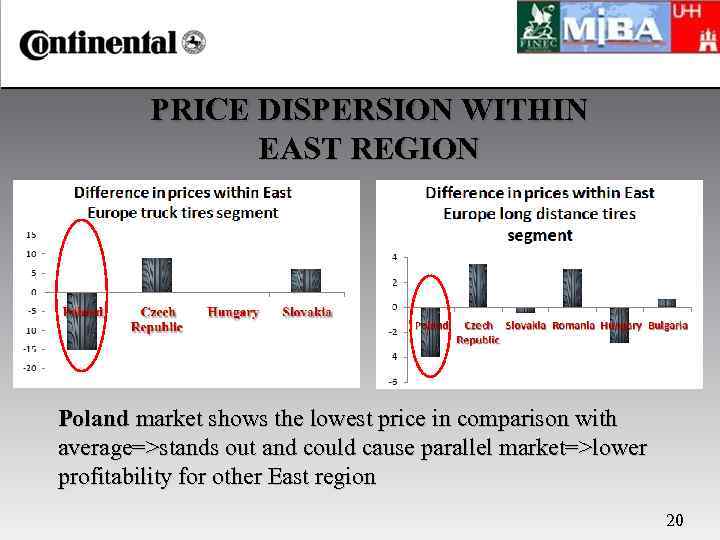

PRICE DISPERSION WITHIN EAST REGION Poland market shows the lowest price in comparison with average=>stands out and could cause parallel market=>lower profitability for other East region 20

PRICE DISPERSION WITHIN EAST REGION Poland market shows the lowest price in comparison with average=>stands out and could cause parallel market=>lower profitability for other East region 20

![http: //viewswire. eiu. com/index. asp? layout=VWCountry. VW 3&country_id=1730000173 [1] http: //rru. worldbank. org/BESnapshots/Poland/default. aspx http: //viewswire. eiu. com/index. asp? layout=VWCountry. VW 3&country_id=1730000173 [1] http: //rru. worldbank. org/BESnapshots/Poland/default. aspx](https://present5.com/presentation/29634_88285456/image-21.jpg) http: //viewswire. eiu. com/index. asp? layout=VWCountry. VW 3&country_id=1730000173 [1] http: //rru. worldbank. org/BESnapshots/Poland/default. aspx [1] POLAND: OPPORTUNITIES • • 1. GDP growth. In 2012 -2016: 3, 4% despite the overall decline in EU=> Increase in truck sales => increase in demand for quality truck tyres 2. Stabile political environment 3. Improvements in investment freedom, property rights, and freedom from corruption 4. Low-cost production=> better operating leverage http: //viewswire. eiu. com/index. asp? layout=VWCountry. VW 3&country_id=1730000173 http: //rru. worldbank. org/BESnapshots/Poland/default. aspx 21

http: //viewswire. eiu. com/index. asp? layout=VWCountry. VW 3&country_id=1730000173 [1] http: //rru. worldbank. org/BESnapshots/Poland/default. aspx [1] POLAND: OPPORTUNITIES • • 1. GDP growth. In 2012 -2016: 3, 4% despite the overall decline in EU=> Increase in truck sales => increase in demand for quality truck tyres 2. Stabile political environment 3. Improvements in investment freedom, property rights, and freedom from corruption 4. Low-cost production=> better operating leverage http: //viewswire. eiu. com/index. asp? layout=VWCountry. VW 3&country_id=1730000173 http: //rru. worldbank. org/BESnapshots/Poland/default. aspx 21

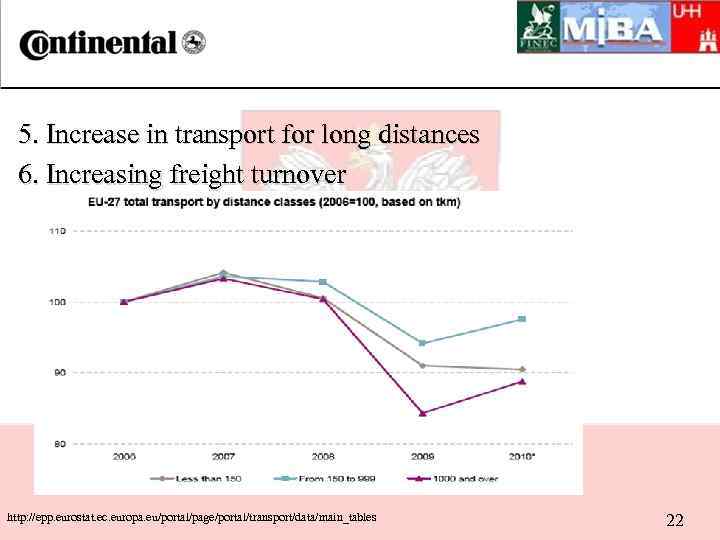

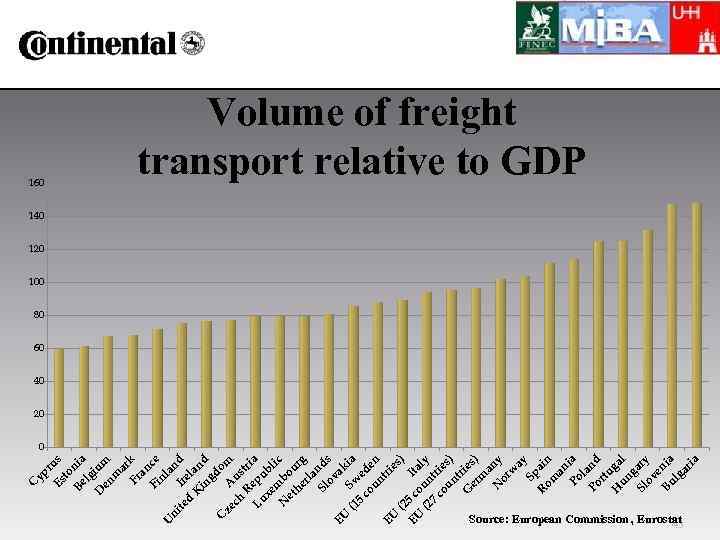

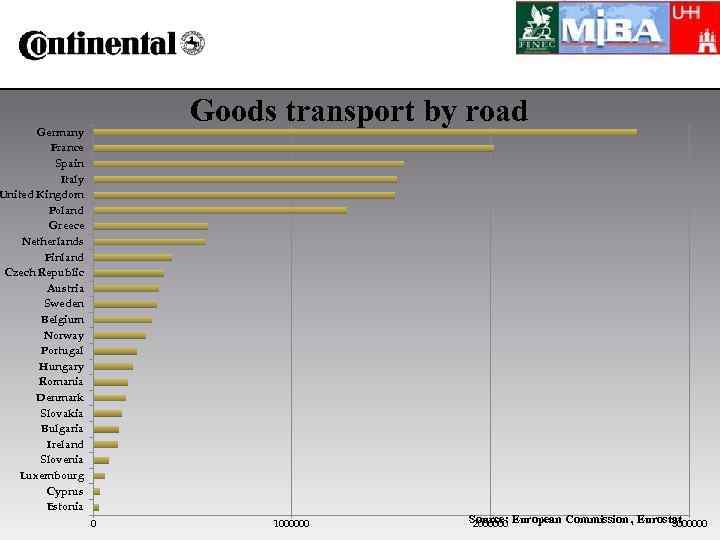

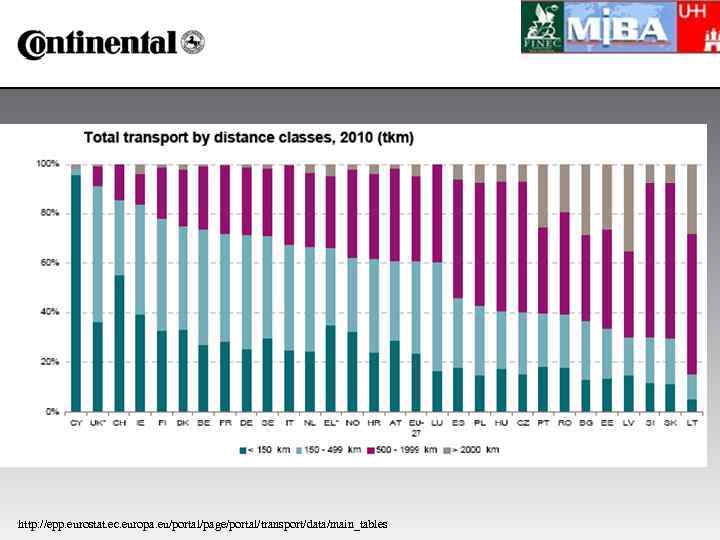

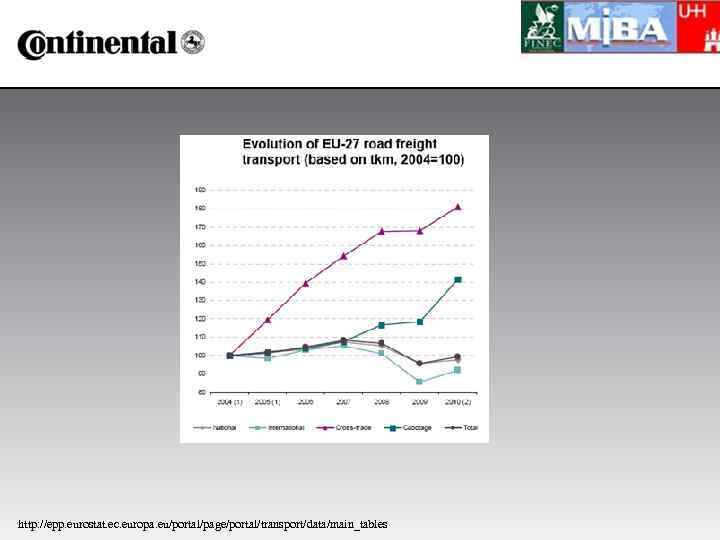

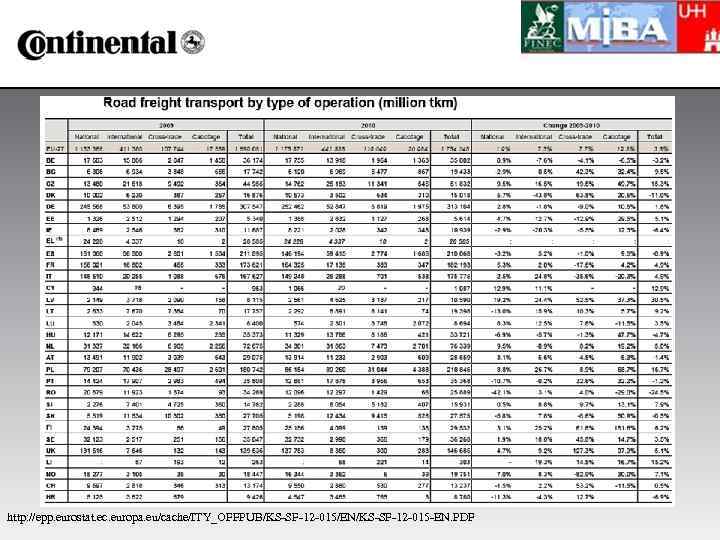

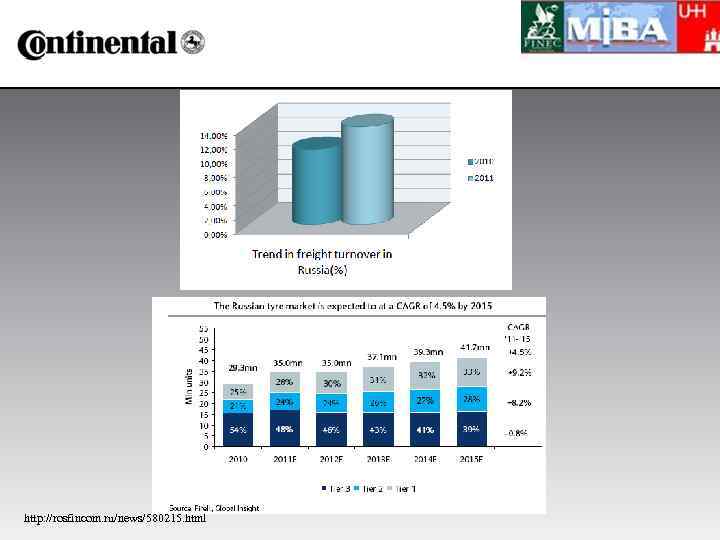

5. Increase in transport for long distances 6. Increasing freight turnover http: //epp. eurostat. ec. europa. eu/portal/page/portal/transport/data/main_tables 22

5. Increase in transport for long distances 6. Increasing freight turnover http: //epp. eurostat. ec. europa. eu/portal/page/portal/transport/data/main_tables 22

PRICE INCREASE IS POSSIBLE DUE TO: 1. Raw material inflation 2. Labelling regulations=> high CAPEX& higher costs of R&D => overall increase in price 3. Reduce competition from low-cost imports 4. Competitors intention to lift up prices especially in East Europe 5. Poland is expected to remain committed to adopting the euro 23

PRICE INCREASE IS POSSIBLE DUE TO: 1. Raw material inflation 2. Labelling regulations=> high CAPEX& higher costs of R&D => overall increase in price 3. Reduce competition from low-cost imports 4. Competitors intention to lift up prices especially in East Europe 5. Poland is expected to remain committed to adopting the euro 23

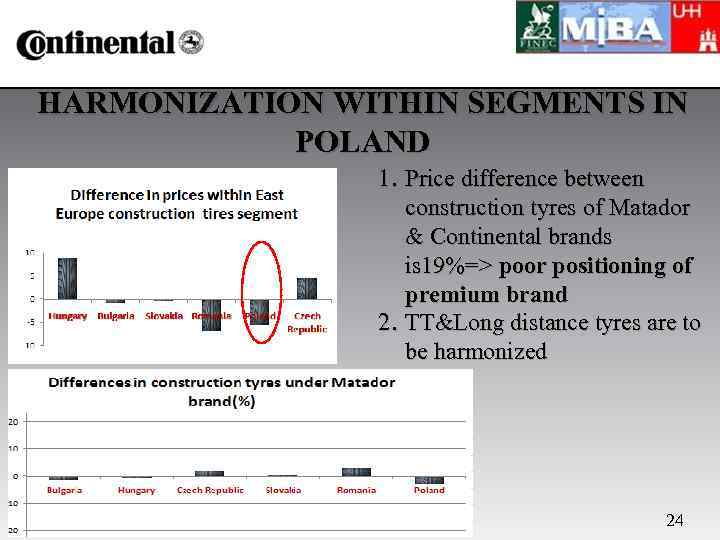

HARMONIZATION WITHIN SEGMENTS IN POLAND 1. Price difference between construction tyres of Matador & Continental brands is 19%=> poor positioning of premium brand 2. TT&Long distance tyres are to be harmonized 24

HARMONIZATION WITHIN SEGMENTS IN POLAND 1. Price difference between construction tyres of Matador & Continental brands is 19%=> poor positioning of premium brand 2. TT&Long distance tyres are to be harmonized 24

POSSIBLE JEOPARDY • Ukraine lower prices on a range of products Ukraine lower prices • The relationship between the two countries experiences a recession+ boycott of EU recession countries • =>no inflow from Ukraine to Poland 25

POSSIBLE JEOPARDY • Ukraine lower prices on a range of products Ukraine lower prices • The relationship between the two countries experiences a recession+ boycott of EU recession countries • =>no inflow from Ukraine to Poland 25

SUGGESTIONS Increase price on TT, Long Distance T& Construction under Continental brand in Poland 26

SUGGESTIONS Increase price on TT, Long Distance T& Construction under Continental brand in Poland 26

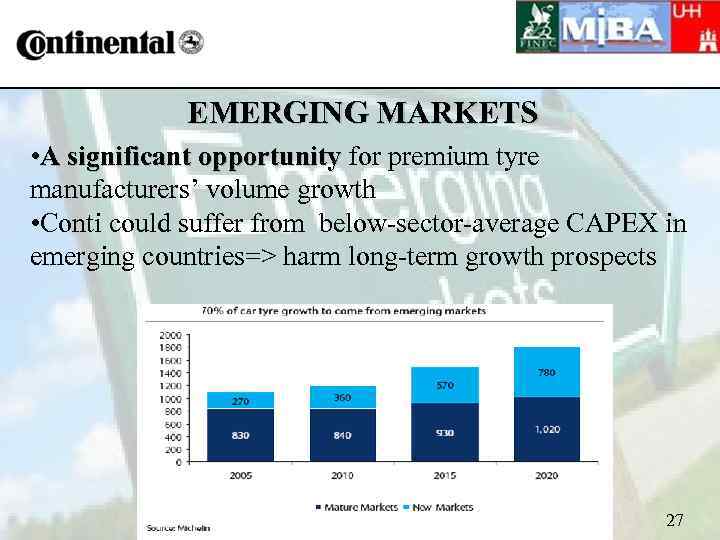

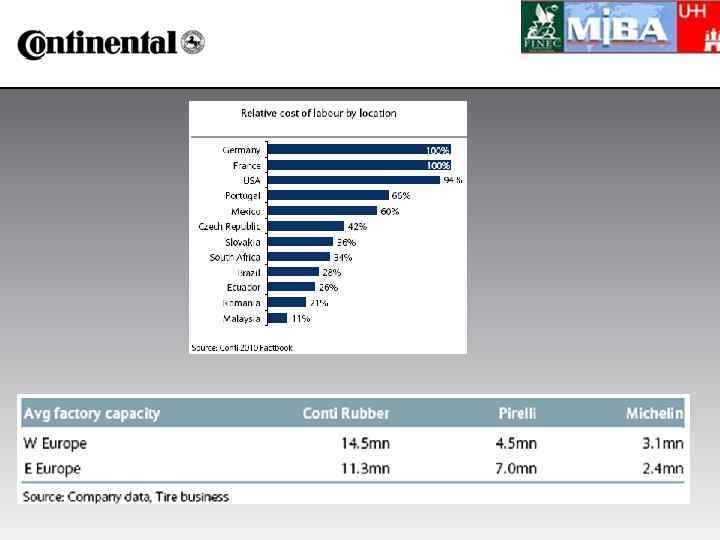

EMERGING MARKETS • A significant opportunity for premium tyre A significant opportunity manufacturers’ volume growth • Conti could suffer from below-sector-average CAPEX in emerging countries=> harm long-term growth prospects 27

EMERGING MARKETS • A significant opportunity for premium tyre A significant opportunity manufacturers’ volume growth • Conti could suffer from below-sector-average CAPEX in emerging countries=> harm long-term growth prospects 27

28

28

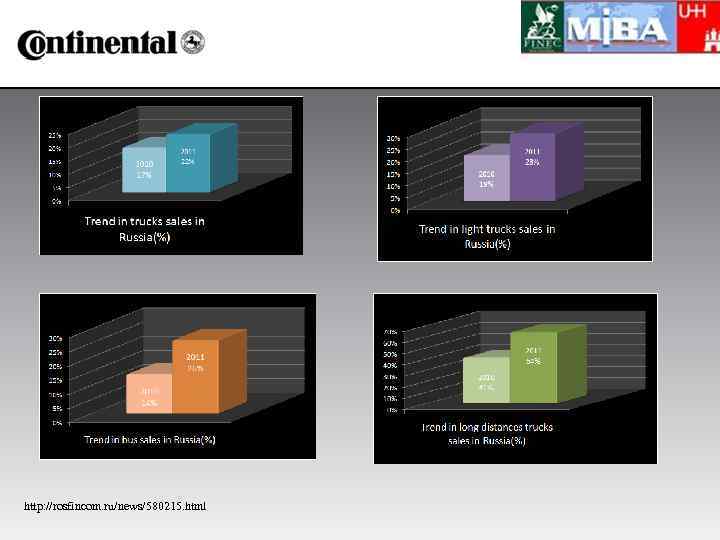

![http: //viewswire. eiu. com/index. asp? layout=VWCountry. VW 3&country_id=1730000173 [1] http: //rru. worldbank. org/BESnapshots/Poland/default. aspx http: //viewswire. eiu. com/index. asp? layout=VWCountry. VW 3&country_id=1730000173 [1] http: //rru. worldbank. org/BESnapshots/Poland/default. aspx](https://present5.com/presentation/29634_88285456/image-29.jpg) http: //viewswire. eiu. com/index. asp? layout=VWCountry. VW 3&country_id=1730000173 [1] http: //rru. worldbank. org/BESnapshots/Poland/default. aspx [1] RUSSIA: PROMISING MARKET IN VOLUMES 1. 2. 3. 4. 5. 6. 7. 8. 1. RT &Winter tyres growth 2. Duties on TT 15%=> cheaper to have facilities there 3. Time availability of tyres is crucial 4. The competition in premium brand is mild 5. Russian car park will grow by 5. 5%; 6. The replacement tyre market will grow 4. 5% 7. Increase in traffic volumes, freight volumes =>’Greatest tyres market’ http: //www. rbcdaily. ru/2012/01/10/industry/562949982483124 29

http: //viewswire. eiu. com/index. asp? layout=VWCountry. VW 3&country_id=1730000173 [1] http: //rru. worldbank. org/BESnapshots/Poland/default. aspx [1] RUSSIA: PROMISING MARKET IN VOLUMES 1. 2. 3. 4. 5. 6. 7. 8. 1. RT &Winter tyres growth 2. Duties on TT 15%=> cheaper to have facilities there 3. Time availability of tyres is crucial 4. The competition in premium brand is mild 5. Russian car park will grow by 5. 5%; 6. The replacement tyre market will grow 4. 5% 7. Increase in traffic volumes, freight volumes =>’Greatest tyres market’ http: //www. rbcdaily. ru/2012/01/10/industry/562949982483124 29

POSSIBLE JEOPARDY 1. Low-cost brands take 60% of the market 2. Ukraine lower prices on a range of products 3. Harm to Finnish market 30

POSSIBLE JEOPARDY 1. Low-cost brands take 60% of the market 2. Ukraine lower prices on a range of products 3. Harm to Finnish market 30

SUGGESTIONS 1. Slow down the export to Russia=>Preparing the Kaluga manufacture to open the second line for industrial tyres to gain better EBIT performance 2. Due to export( Michelin), we can keep prices increasing http: //www. autofrancorusse. fr/AFR 10 en. html 31

SUGGESTIONS 1. Slow down the export to Russia=>Preparing the Kaluga manufacture to open the second line for industrial tyres to gain better EBIT performance 2. Due to export( Michelin), we can keep prices increasing http: //www. autofrancorusse. fr/AFR 10 en. html 31

CONCLUSIONS ON PORTFOLIO MANAGEMENT 1. Both markets OE&RT are in focus 2. Attractive TT 3. High volumes in Poland & relative low price for several types of tyres=>attractiveness of lifting up prices 4. Increase presence in industrial segment in Russia 32

CONCLUSIONS ON PORTFOLIO MANAGEMENT 1. Both markets OE&RT are in focus 2. Attractive TT 3. High volumes in Poland & relative low price for several types of tyres=>attractiveness of lifting up prices 4. Increase presence in industrial segment in Russia 32

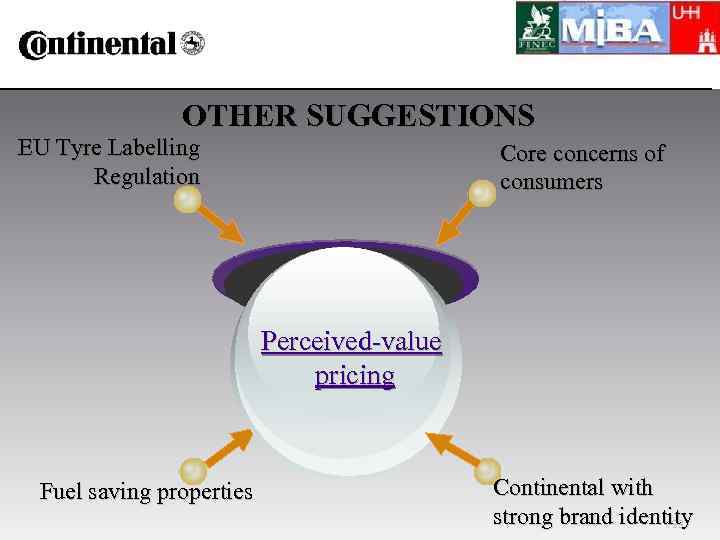

OTHER SUGGESTIONS EU Tyre Labelling Regulation Core concerns of consumers Perceived-value pricing Fuel saving properties Continental with strong brand identity 33

OTHER SUGGESTIONS EU Tyre Labelling Regulation Core concerns of consumers Perceived-value pricing Fuel saving properties Continental with strong brand identity 33

OTHER SUGGESTIONS Perceived-value pricing Price of Comparable competitors + fuel saving potential during the service life * reasonable percentage Matching market promotions 34

OTHER SUGGESTIONS Perceived-value pricing Price of Comparable competitors + fuel saving potential during the service life * reasonable percentage Matching market promotions 34

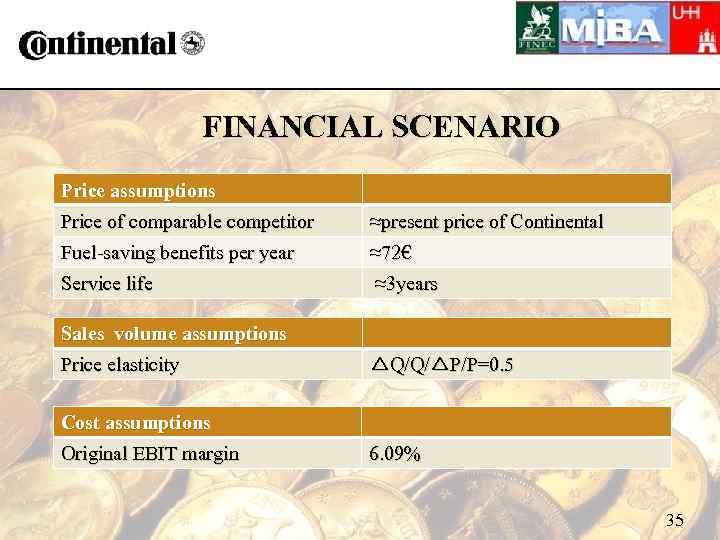

FINANCIAL SCENARIO Price assumptions Price of comparable competitor ≈present price of Continental Fuel-saving benefits per year ≈72€ Service life ≈3 years Sales volume assumptions Price elasticity △Q/Q/△P/P=0. 5 Cost assumptions Original EBIT margin 6. 09% 35

FINANCIAL SCENARIO Price assumptions Price of comparable competitor ≈present price of Continental Fuel-saving benefits per year ≈72€ Service life ≈3 years Sales volume assumptions Price elasticity △Q/Q/△P/P=0. 5 Cost assumptions Original EBIT margin 6. 09% 35

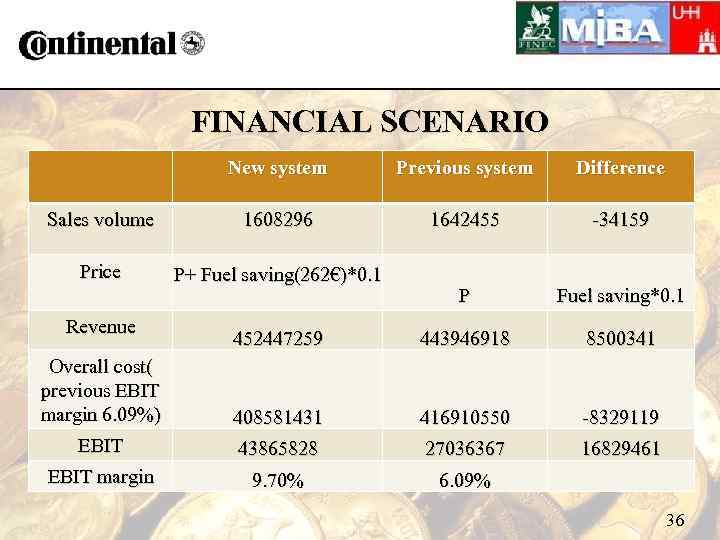

FINANCIAL SCENARIO New system Previous system Difference Sales volume 1608296 1642455 -34159 Price P+ Fuel saving(262€)*0. 1 P Fuel saving*0. 1 452447259 443946918 8500341 Overall cost( previous EBIT margin 6. 09%) 408581431 416910550 -8329119 EBIT 43865828 27036367 16829461 EBIT margin 9. 70% 6. 09% Revenue 36

FINANCIAL SCENARIO New system Previous system Difference Sales volume 1608296 1642455 -34159 Price P+ Fuel saving(262€)*0. 1 P Fuel saving*0. 1 452447259 443946918 8500341 Overall cost( previous EBIT margin 6. 09%) 408581431 416910550 -8329119 EBIT 43865828 27036367 16829461 EBIT margin 9. 70% 6. 09% Revenue 36

CONCLUSIONS 1. Price harmonization throughout EU is too risky. 2. Eastern Europe, compared to other European regions is promising. Poland Russia could be seen as the most promising market. 3. The enaction of EU tyre labelling regulation and preference of client create a conducive environment for perceived-value pricing. 37

CONCLUSIONS 1. Price harmonization throughout EU is too risky. 2. Eastern Europe, compared to other European regions is promising. Poland Russia could be seen as the most promising market. 3. The enaction of EU tyre labelling regulation and preference of client create a conducive environment for perceived-value pricing. 37

SOURCES (1) Internet resources: 1. 2. 3. 4. http: //www. conti-online. com ec. europa. eu/eurostat http: //vlasti. net/news/131383 http: //viewswire. eiu. com/index. asp? layout=VWCountry. VW 3&country_id=1730000 173 5. http: //rru. worldbank. org/BESnapshots/Poland/default. aspx 6. http: //www. tyrepress. com/News/business_area/23940. html 7. http: //www. rbcdaily. ru/2012/01/10/industry/562949982483124 8. http: //www. articleclick. com/Article/Research-Report-On-Global-Tire-Industry-2010 -2011/1358510 9. http: //www. tirereview. com/Article/89221/tires_assets_or_expense. aspx 10. http: //www. inautonews. com/europe-michelin-to-raise-tire-prices 11. http: //www. tyrepress. com/News/business_area/Manufacturing/19437. html 38

SOURCES (1) Internet resources: 1. 2. 3. 4. http: //www. conti-online. com ec. europa. eu/eurostat http: //vlasti. net/news/131383 http: //viewswire. eiu. com/index. asp? layout=VWCountry. VW 3&country_id=1730000 173 5. http: //rru. worldbank. org/BESnapshots/Poland/default. aspx 6. http: //www. tyrepress. com/News/business_area/23940. html 7. http: //www. rbcdaily. ru/2012/01/10/industry/562949982483124 8. http: //www. articleclick. com/Article/Research-Report-On-Global-Tire-Industry-2010 -2011/1358510 9. http: //www. tirereview. com/Article/89221/tires_assets_or_expense. aspx 10. http: //www. inautonews. com/europe-michelin-to-raise-tire-prices 11. http: //www. tyrepress. com/News/business_area/Manufacturing/19437. html 38

SOURCES (2) Reports: 1. Continental Annual Report 2011 2. Barclays Capital equity research. European Autos& Auto Parts 3. Research and Markets. Research Report on Europe Tire Industry - 2011 -2012 4. Global quarterly Tire review. Bank of America Merrill Lynch Continental presentations for investors 39

SOURCES (2) Reports: 1. Continental Annual Report 2011 2. Barclays Capital equity research. European Autos& Auto Parts 3. Research and Markets. Research Report on Europe Tire Industry - 2011 -2012 4. Global quarterly Tire review. Bank of America Merrill Lynch Continental presentations for investors 39

THANK YOU FOR YOUR ATTENTION 40

THANK YOU FOR YOUR ATTENTION 40

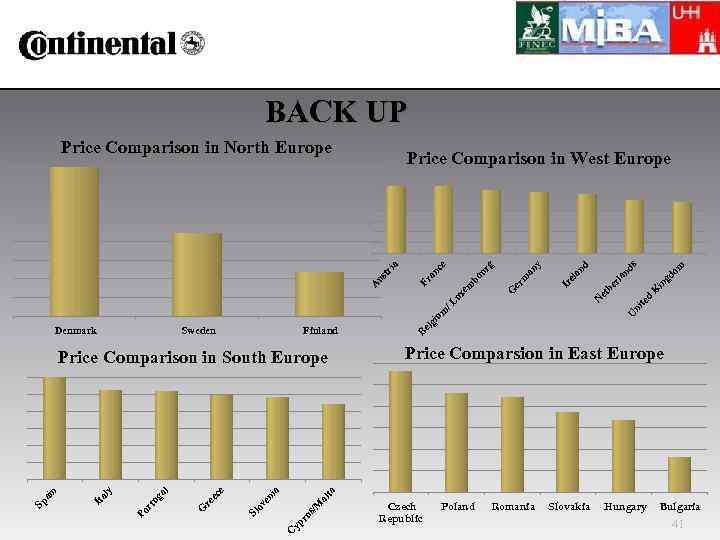

BACK UP Price Comparison in North Europe in K te d ni U Price Comparsion in East Europe C yp ru s/M al ta ia en ov S l re ec G rt u Po e l ga y al It Sp ai n Price Comparison in South Europe gd om an rl he et N m iu Finland lg Sweden Be Denmark ds d an Ir el y er G bo em / L ux m ur an g e nc ra F A us tr ia Price Comparison in West Europe Czech Republic Poland Romania Slovakia Hungary Bulgaria 41

BACK UP Price Comparison in North Europe in K te d ni U Price Comparsion in East Europe C yp ru s/M al ta ia en ov S l re ec G rt u Po e l ga y al It Sp ai n Price Comparison in South Europe gd om an rl he et N m iu Finland lg Sweden Be Denmark ds d an Ir el y er G bo em / L ux m ur an g e nc ra F A us tr ia Price Comparison in West Europe Czech Republic Poland Romania Slovakia Hungary Bulgaria 41

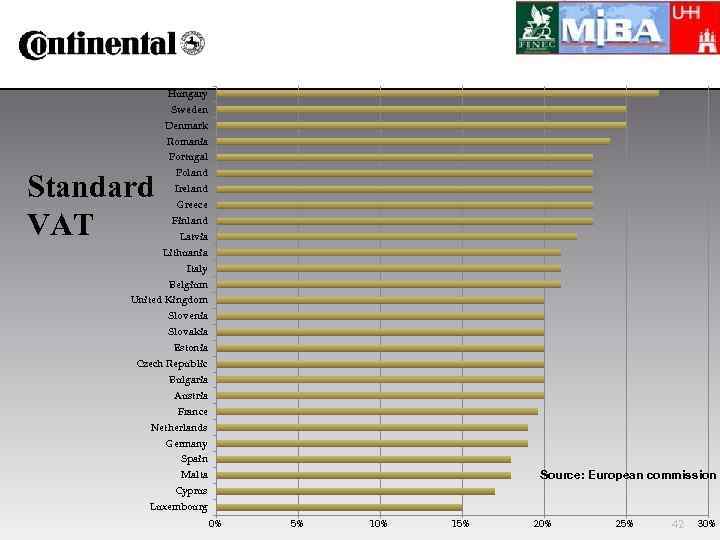

Hungary Sweden Denmark Romania Portugal Standard VAT Poland Ireland Greece Finland Latvia Lithuania Italy Belgium United Kingdom Slovenia Slovakia Estonia Czech Republic Bulgaria Austria France Netherlands Germany Spain Source: European commission Malta Cyprus Luxembourg 0% 5% 10% 15% 20% 25% 42 30%

Hungary Sweden Denmark Romania Portugal Standard VAT Poland Ireland Greece Finland Latvia Lithuania Italy Belgium United Kingdom Slovenia Slovakia Estonia Czech Republic Bulgaria Austria France Netherlands Germany Spain Source: European commission Malta Cyprus Luxembourg 0% 5% 10% 15% 20% 25% 42 30%

r Es us to Be nia lg D ium en m ar Fr k an Fi ce nl U an ni te Ire d d K lan in d gd o C ze A m us ch R tri Lu epu a xe bl m i N bo c et he urg rl a Sl nds ov EU a Sw kia (1 5 co ede un n tr EU ie s) (2 5 It EU c a o (2 un ly 7 co trie un s) t G ries er m ) a N ny or w ay Sp R ain om an Po ia la Po nd rt u H ga un l g Sl ary ov e Bu nia lg ar ia yp C 160 Volume of freight transport relative to GDP 140 120 100 80 60 40 20 0 Source: European Commission , Eurostat 43

r Es us to Be nia lg D ium en m ar Fr k an Fi ce nl U an ni te Ire d d K lan in d gd o C ze A m us ch R tri Lu epu a xe bl m i N bo c et he urg rl a Sl nds ov EU a Sw kia (1 5 co ede un n tr EU ie s) (2 5 It EU c a o (2 un ly 7 co trie un s) t G ries er m ) a N ny or w ay Sp R ain om an Po ia la Po nd rt u H ga un l g Sl ary ov e Bu nia lg ar ia yp C 160 Volume of freight transport relative to GDP 140 120 100 80 60 40 20 0 Source: European Commission , Eurostat 43

Goods transport by road Germany France Spain Italy United Kingdom Poland Greece Netherlands Finland Czech Republic Austria Sweden Belgium Norway Portugal Hungary Romania Denmark Slovakia Bulgaria Ireland Slovenia Luxembourg Cyprus Estonia 0 1000000 Source: European Commission , Eurostat 2000000 3000000 44

Goods transport by road Germany France Spain Italy United Kingdom Poland Greece Netherlands Finland Czech Republic Austria Sweden Belgium Norway Portugal Hungary Romania Denmark Slovakia Bulgaria Ireland Slovenia Luxembourg Cyprus Estonia 0 1000000 Source: European Commission , Eurostat 2000000 3000000 44

http: //epp. eurostat. ec. europa. eu/portal/page/portal/transport/data/main_tables

http: //epp. eurostat. ec. europa. eu/portal/page/portal/transport/data/main_tables

http: //epp. eurostat. ec. europa. eu/portal/page/portal/transport/data/main_tables

http: //epp. eurostat. ec. europa. eu/portal/page/portal/transport/data/main_tables

http: //epp. eurostat. ec. europa. eu/cache/ITY_OFFPUB/KS-SF-12 -015/EN/KS-SF-12 -015 -EN. PDF

http: //epp. eurostat. ec. europa. eu/cache/ITY_OFFPUB/KS-SF-12 -015/EN/KS-SF-12 -015 -EN. PDF

http: //rosfincom. ru/news/580215. html

http: //rosfincom. ru/news/580215. html

http: //rosfincom. ru/news/580215. html

http: //rosfincom. ru/news/580215. html

http: //www. conti-online. com/generator/www/au/en/continental/transport/general/downloads/hidden/wallpaper_people_en. html

http: //www. conti-online. com/generator/www/au/en/continental/transport/general/downloads/hidden/wallpaper_people_en. html