8b9744dc6b498049acba4146d36ed56c.ppt

- Количество слайдов: 15

Customs Reform and Modernization Program José Eduardo Gutiérrez Geneva, May 2001 1

Customs Reform and Modernization Program José Eduardo Gutiérrez Geneva, May 2001 1

Index 1. Background 2. Customs Reform 3. Technical Cooperation 4. Capacity Building related to Trade facilitation 5. Main Results 6. Conclusions 2

Index 1. Background 2. Customs Reform 3. Technical Cooperation 4. Capacity Building related to Trade facilitation 5. Main Results 6. Conclusions 2

1. Background q In the last 10 years, Bolivian Customs had received US$5. 6 millions to support five programs for the modernization of customs administration. However, progress was scant and customs was regarded corrupted, politicized and inefficient. q In 1997, the Bolivian Government required assistance from the IMF to elaborate a Reform Program. A IMF mission concluded that the Bolivian Customs Administration was not able: to improve its service to facilitate trade to establish adequate control over the private sector that is involved in the customs procedures to reduce the physical inspection of goods, which were mainly based on discretional criteria of the customs officials to eliminate “ad honorem” personnel to improve general equipment to improve the legal and normative structure, (Customs Law of 1929) to have an integrated customs information system 3

1. Background q In the last 10 years, Bolivian Customs had received US$5. 6 millions to support five programs for the modernization of customs administration. However, progress was scant and customs was regarded corrupted, politicized and inefficient. q In 1997, the Bolivian Government required assistance from the IMF to elaborate a Reform Program. A IMF mission concluded that the Bolivian Customs Administration was not able: to improve its service to facilitate trade to establish adequate control over the private sector that is involved in the customs procedures to reduce the physical inspection of goods, which were mainly based on discretional criteria of the customs officials to eliminate “ad honorem” personnel to improve general equipment to improve the legal and normative structure, (Customs Law of 1929) to have an integrated customs information system 3

1. Background q The IMF recommended an strategy to improve the custom administration, based on: Modern legislation, and Simple procedures q In this context, a program lead by an international customs expert initiated his work at the beginning of 1999. q Despite, this new effort, customs administration did not change at all. q The Bolivian Government decided to give an additional and critical support to the reform process by enacting the new General Customs Law (No. 1990) in July of 1999. q The Law gives financial autonomy to the Bolivian Customs from the Ministry of Finance. 4

1. Background q The IMF recommended an strategy to improve the custom administration, based on: Modern legislation, and Simple procedures q In this context, a program lead by an international customs expert initiated his work at the beginning of 1999. q Despite, this new effort, customs administration did not change at all. q The Bolivian Government decided to give an additional and critical support to the reform process by enacting the new General Customs Law (No. 1990) in July of 1999. q The Law gives financial autonomy to the Bolivian Customs from the Ministry of Finance. 4

2. Customs Reform (PROMA) q q In this context, and based on IMF recommendations, the PROMA program was elaborated. Objectives To facilitate trade To improve collection of trade taxes To reduce corruption q Following the IMF recommendations PROMA: Executed a Contingency Plan financed by NN. UU. , with a cost of US$2. 4 millions, used for: implementation of a customs police force (COA) US$1. 8 millions implementation of a special inspection unit (UTISA) US$0. 4 millions improvement of customs administrations equipment US$0. 2 millions Elaborated a general 5 -year Plan 5

2. Customs Reform (PROMA) q q In this context, and based on IMF recommendations, the PROMA program was elaborated. Objectives To facilitate trade To improve collection of trade taxes To reduce corruption q Following the IMF recommendations PROMA: Executed a Contingency Plan financed by NN. UU. , with a cost of US$2. 4 millions, used for: implementation of a customs police force (COA) US$1. 8 millions implementation of a special inspection unit (UTISA) US$0. 4 millions improvement of customs administrations equipment US$0. 2 millions Elaborated a general 5 -year Plan 5

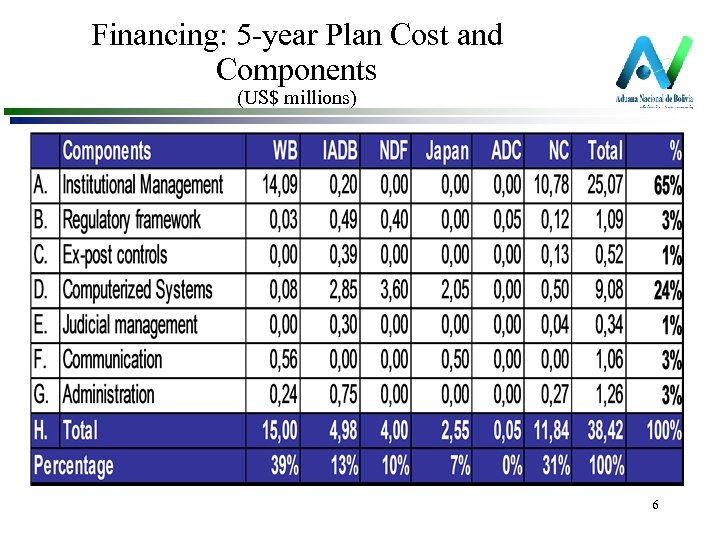

Financing: 5 -year Plan Cost and Components (US$ millions) 6

Financing: 5 -year Plan Cost and Components (US$ millions) 6

3. Technical Cooperation q Technical cooperation of IMF, WB, IADB, NDF, Japanese Cooperation and Andean Corporation is mainly for: Implementation of the Civil Service Program in the customs administration Institutional strengthening Automation of customs procedures (Automated System for Customs Data-ASYCUDA) Implementation of Ex post control Implementation of customs valuation in accordance of the WTO valuation Agreement q Once the personnel selection process is concluded, the Bolivian Customs Administration is going to need assistance in establishing a permanent customs training program to ensure the sustainability of the reform process. 7

3. Technical Cooperation q Technical cooperation of IMF, WB, IADB, NDF, Japanese Cooperation and Andean Corporation is mainly for: Implementation of the Civil Service Program in the customs administration Institutional strengthening Automation of customs procedures (Automated System for Customs Data-ASYCUDA) Implementation of Ex post control Implementation of customs valuation in accordance of the WTO valuation Agreement q Once the personnel selection process is concluded, the Bolivian Customs Administration is going to need assistance in establishing a permanent customs training program to ensure the sustainability of the reform process. 7

4. Capacity Building q Prerequisites—developed with the international cooperation: Simple, transparent customs procedures Computerized transactions, on-line Simple ex post controls Highly qualified personnel Appropriate equipment and infrastructure 8

4. Capacity Building q Prerequisites—developed with the international cooperation: Simple, transparent customs procedures Computerized transactions, on-line Simple ex post controls Highly qualified personnel Appropriate equipment and infrastructure 8

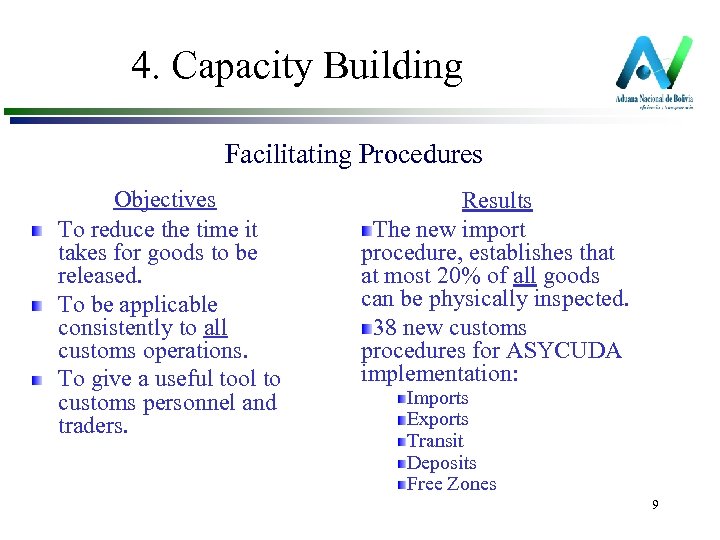

4. Capacity Building Facilitating Procedures Objectives To reduce the time it takes for goods to be released. To be applicable consistently to all customs operations. To give a useful tool to customs personnel and traders. Results The new import procedure, establishes that at most 20% of all goods can be physically inspected. 38 new customs procedures for ASYCUDA implementation: Imports Exports Transit Deposits Free Zones 9

4. Capacity Building Facilitating Procedures Objectives To reduce the time it takes for goods to be released. To be applicable consistently to all customs operations. To give a useful tool to customs personnel and traders. Results The new import procedure, establishes that at most 20% of all goods can be physically inspected. 38 new customs procedures for ASYCUDA implementation: Imports Exports Transit Deposits Free Zones 9

4. Capacity Building Ex-post controls Objectives To determine noncompliance with customs procedures. To recommend sanctions against evaders in order to deter non-compliance To introduce risk Results Ex post control procedures 10

4. Capacity Building Ex-post controls Objectives To determine noncompliance with customs procedures. To recommend sanctions against evaders in order to deter non-compliance To introduce risk Results Ex post control procedures 10

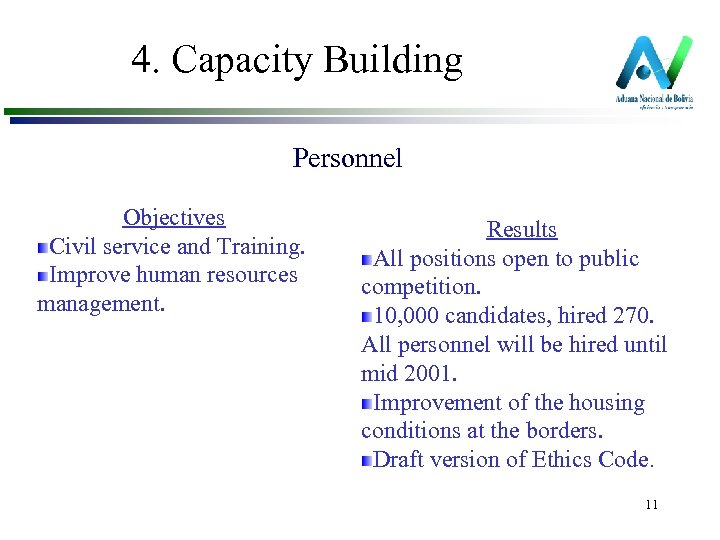

4. Capacity Building Personnel Objectives Civil service and Training. Improve human resources management. Results All positions open to public competition. 10, 000 candidates, hired 270. All personnel will be hired until mid 2001. Improvement of the housing conditions at the borders. Draft version of Ethics Code. 11

4. Capacity Building Personnel Objectives Civil service and Training. Improve human resources management. Results All positions open to public competition. 10, 000 candidates, hired 270. All personnel will be hired until mid 2001. Improvement of the housing conditions at the borders. Draft version of Ethics Code. 11

4. Capacity Building Appropriate infrastructure and equipment Objectives To facilitate trade operations To improve trade controls To help traders Results New privatization of customs deposits strategy, based in the improvement of the infrastructure. Bits out until end 2001. Investment bank hired for new privatization 12

4. Capacity Building Appropriate infrastructure and equipment Objectives To facilitate trade operations To improve trade controls To help traders Results New privatization of customs deposits strategy, based in the improvement of the infrastructure. Bits out until end 2001. Investment bank hired for new privatization 12

5. Main results Customs collections up 11% in nominal terms, 25% in efficiency terms (i. e. taking into account decrease in tariff rates) in 2000. Implementation of ASYCUDA, export module until end of may 2001. New, shorter judicial procedure has resulted in 70 jail sentences (none is serving time in jail, due to judicial system), 20 people in preventive detention. New customs police highly credible: 1, 710 operations since October 1999. UTISA: 18 inspections since August 1999 allowed recuperations of approximately US$12. 0 millions. Training in customs administration for judges, prosecutors and lawyers. 13

5. Main results Customs collections up 11% in nominal terms, 25% in efficiency terms (i. e. taking into account decrease in tariff rates) in 2000. Implementation of ASYCUDA, export module until end of may 2001. New, shorter judicial procedure has resulted in 70 jail sentences (none is serving time in jail, due to judicial system), 20 people in preventive detention. New customs police highly credible: 1, 710 operations since October 1999. UTISA: 18 inspections since August 1999 allowed recuperations of approximately US$12. 0 millions. Training in customs administration for judges, prosecutors and lawyers. 13

6. Conclusions q Lessons learnt Institutional reform efforts need time to produce results. During that time, these types of reforms need constant support from several public and private institutions, since institutional reforms touch many vested interests. The success of one institutional reform depends on the success of other institutional reforms: positive reinforcement. Besides these difficulties, institutional reforms are possible. Without political consensus it is difficult to implement a institutional reform. 14

6. Conclusions q Lessons learnt Institutional reform efforts need time to produce results. During that time, these types of reforms need constant support from several public and private institutions, since institutional reforms touch many vested interests. The success of one institutional reform depends on the success of other institutional reforms: positive reinforcement. Besides these difficulties, institutional reforms are possible. Without political consensus it is difficult to implement a institutional reform. 14

6. Conclusions q Lessons learnt Credibility is a necessary condition to ensure successful of a reform program and transparency is a key element. Economic agents adjust their behavior to the new rules, taking in account the credibility of the reform program. It is necessary to analyze the consequences of penalizing customs offences, specially, when the judicial power is weak. It is dangerous to give to a weak judicial system, the last say about the grade of punishment of tax evaders. 15

6. Conclusions q Lessons learnt Credibility is a necessary condition to ensure successful of a reform program and transparency is a key element. Economic agents adjust their behavior to the new rules, taking in account the credibility of the reform program. It is necessary to analyze the consequences of penalizing customs offences, specially, when the judicial power is weak. It is dangerous to give to a weak judicial system, the last say about the grade of punishment of tax evaders. 15