4a16923777b55ce0727df25bc00c76b3.ppt

- Количество слайдов: 43

Cost Analysis Techniques 1

Cost Analysis Techniques 1

Project è something related to purchasing è how the purchasing function affects a company? è how can a company improve its purchasing functions? è possible forms è a case study on a company è literature review on a topic related to purchasing è methodology è management principle 2

Project è something related to purchasing è how the purchasing function affects a company? è how can a company improve its purchasing functions? è possible forms è a case study on a company è literature review on a topic related to purchasing è methodology è management principle 2

Project Proposal a 15 -minute presentation è what is it about? è why is the project important? Useful? Interesting? è how will you proceed? è what are the expected results? Expected challenges? è examples è 3

Project Proposal a 15 -minute presentation è what is it about? è why is the project important? Useful? Interesting? è how will you proceed? è what are the expected results? Expected challenges? è examples è 3

Outline è collaborative cost management è total cost ownership model è Kazuo Inamori’s idea on pricing and costing è activity-based costing è value analysis and value engineering engineerin è process mapping è learning curve è quantity discount 4

Outline è collaborative cost management è total cost ownership model è Kazuo Inamori’s idea on pricing and costing è activity-based costing è value analysis and value engineering engineerin è process mapping è learning curve è quantity discount 4

Collaborative Cost Management 5

Collaborative Cost Management 5

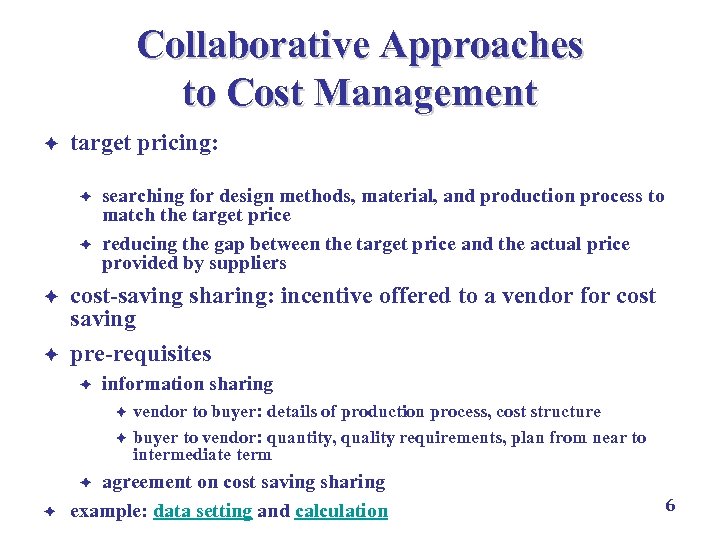

Collaborative Approaches to Cost Management è target pricing: price acceptable by market, or price for competition è è searching for design methods, material, and production process to match the target price reducing the gap between the target price and the actual price provided by suppliers cost-saving sharing: incentive offered to a vendor for cost saving pre-requisites è information sharing è è vendor to buyer: details of production process, cost structure buyer to vendor: quantity, quality requirements, plan from near to intermediate term agreement on cost saving sharing example: data setting and calculation è è 6

Collaborative Approaches to Cost Management è target pricing: price acceptable by market, or price for competition è è searching for design methods, material, and production process to match the target price reducing the gap between the target price and the actual price provided by suppliers cost-saving sharing: incentive offered to a vendor for cost saving pre-requisites è information sharing è è vendor to buyer: details of production process, cost structure buyer to vendor: quantity, quality requirements, plan from near to intermediate term agreement on cost saving sharing example: data setting and calculation è è 6

Total Cost Ownership Model 7

Total Cost Ownership Model 7

Total Cost Ownership Model è costs throughout the life cycle of an item è hidden cost in purchasing#1 è payment method, inflation, life, salvage value, auxiliary charge, packaging, transportation, installation, service support, training, maintenance, service parts, etc. è example: cost structure and calculation #1 Zeger Degraeve and Filip Roodhooft (2001) A Smarter Way to Buy, Harvard Business Review. 8

Total Cost Ownership Model è costs throughout the life cycle of an item è hidden cost in purchasing#1 è payment method, inflation, life, salvage value, auxiliary charge, packaging, transportation, installation, service support, training, maintenance, service parts, etc. è example: cost structure and calculation #1 Zeger Degraeve and Filip Roodhooft (2001) A Smarter Way to Buy, Harvard Business Review. 8

『 稲盛和夫の実学 経営と会計 』 稻盛和夫的實學 : 會計與經營 Kazuo Inamori's Pragmatic Studies: Management and Accounting いなもり かずお 稲盛 和夫 Kazuo Inamori 9

『 稲盛和夫の実学 経営と会計 』 稻盛和夫的實學 : 會計與經營 Kazuo Inamori's Pragmatic Studies: Management and Accounting いなもり かずお 稲盛 和夫 Kazuo Inamori 9

Some Ideas in the Book è è è è core of business: divine doctrine(天道)、 self-evident truth (公理)、 consensus and concord (人心) cash-basis management: a grip on true cash flow of company fair accounting: one-to-one correspondence between orders and items muscular management: the cheapest method for a given task perfectionism transparency amoeba management double-checking system with shared responsibility 10

Some Ideas in the Book è è è è core of business: divine doctrine(天道)、 self-evident truth (公理)、 consensus and concord (人心) cash-basis management: a grip on true cash flow of company fair accounting: one-to-one correspondence between orders and items muscular management: the cheapest method for a given task perfectionism transparency amoeba management double-checking system with shared responsibility 10

Some Glimpses of Pragmatic Studies: Management and Accounting è the difference between reality and accounting rules è standard accounting rules for depreciation of machines è difference between actual working life of a machine and its depreciation life by rules 11

Some Glimpses of Pragmatic Studies: Management and Accounting è the difference between reality and accounting rules è standard accounting rules for depreciation of machines è difference between actual working life of a machine and its depreciation life by rules 11

Some Glimpses of Pragmatic Studies: Management and Accounting è asset or cost? è would equipment for production an asset or cost? è example: a stall selling banana èa box of ¥ 300; a table cloth of ¥ 1, 000; a stick of ¥ 200 è buying 20 hands of banana, ¥ 50 per hand, selling at ¥ 150 per hand è all sold out è how much profit ¥ 2, 000 or ¥ 500? TAX!!! è getting rid of excess production with small probability of future use 12

Some Glimpses of Pragmatic Studies: Management and Accounting è asset or cost? è would equipment for production an asset or cost? è example: a stall selling banana èa box of ¥ 300; a table cloth of ¥ 1, 000; a stick of ¥ 200 è buying 20 hands of banana, ¥ 50 per hand, selling at ¥ 150 per hand è all sold out è how much profit ¥ 2, 000 or ¥ 500? TAX!!! è getting rid of excess production with small probability of future use 12

Some Glimpses of Pragmatic Studies: Management and Accounting è difference among book profit, actual profit, and cash flow è distortion of actual profit by accounting rules, classification of asset cost, account payable and account receivable at different dates, etc. 13

Some Glimpses of Pragmatic Studies: Management and Accounting è difference among book profit, actual profit, and cash flow è distortion of actual profit by accounting rules, classification of asset cost, account payable and account receivable at different dates, etc. 13

Questions è Pricing and costing of an item are always important issues in purchasing. Discuss what you have learnt about these two issues from the book “Kazuo Inamori's Pragmatic Studies: Management and Accounting” by Dr. 稻盛和夫. 14

Questions è Pricing and costing of an item are always important issues in purchasing. Discuss what you have learnt about these two issues from the book “Kazuo Inamori's Pragmatic Studies: Management and Accounting” by Dr. 稻盛和夫. 14

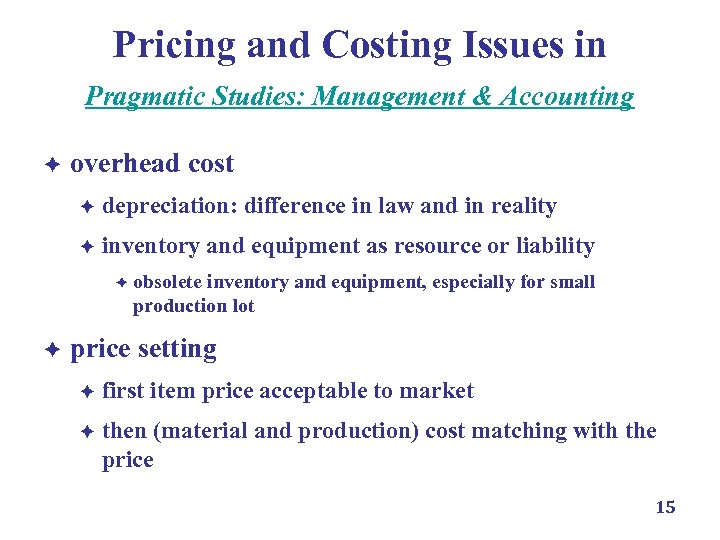

Pricing and Costing Issues in Pragmatic Studies: Management & Accounting è overhead cost è depreciation: difference in law and in reality è inventory and equipment as resource or liability è obsolete inventory and equipment, especially for small production lot è price setting è first item price acceptable to market è then (material and production) cost matching with the price 15

Pricing and Costing Issues in Pragmatic Studies: Management & Accounting è overhead cost è depreciation: difference in law and in reality è inventory and equipment as resource or liability è obsolete inventory and equipment, especially for small production lot è price setting è first item price acceptable to market è then (material and production) cost matching with the price 15

Activity-Based Costing 16

Activity-Based Costing 16

Activity-Based Costing (ABC) è assigning overhead of a product or service è traditional cost accounting è based on fixed percentage of direct labor, direct material, or both direct labor and material è more overhead for high volume items è ABC è trace the cause and effect of overhead è cost drivers: activities in the overhead for the product or service 17

Activity-Based Costing (ABC) è assigning overhead of a product or service è traditional cost accounting è based on fixed percentage of direct labor, direct material, or both direct labor and material è more overhead for high volume items è ABC è trace the cause and effect of overhead è cost drivers: activities in the overhead for the product or service 17

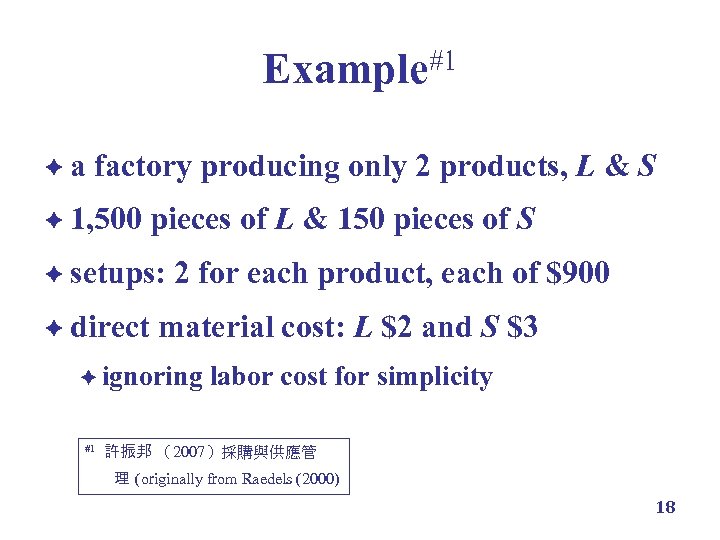

Example#1 èa factory producing only 2 products, L & S è 1, 500 pieces of L & 150 pieces of S è setups: è direct 2 for each product, each of $900 material cost: L $2 and S $3 è ignoring #1 許振邦 labor cost for simplicity (2007)採購與供應管 理 (originally from Raedels (2000) 18

Example#1 èa factory producing only 2 products, L & S è 1, 500 pieces of L & 150 pieces of S è setups: è direct 2 for each product, each of $900 material cost: L $2 and S $3 è ignoring #1 許振邦 labor cost for simplicity (2007)採購與供應管 理 (originally from Raedels (2000) 18

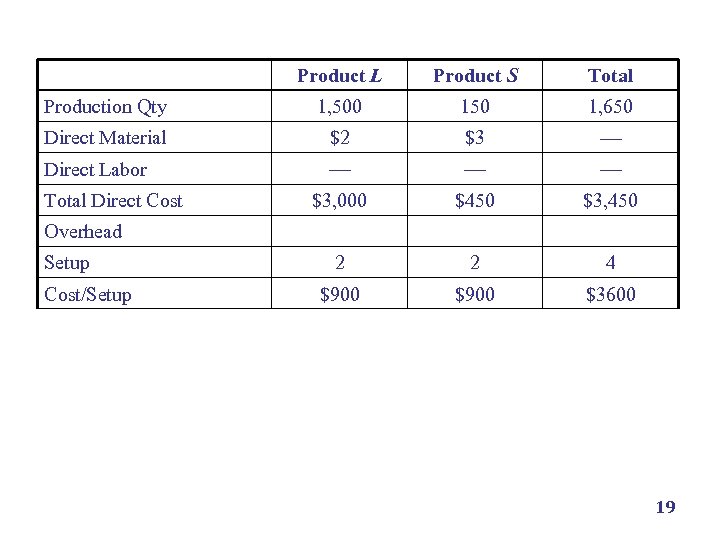

Product L Product S Total Production Qty 1, 500 150 1, 650 Direct Material $2 $3 Direct Labor $3, 000 $450 $3, 450 2 2 4 $900 $3600 Total Direct Cost Overhead Setup Cost/Setup Traditional Costing Method Overhead cost/item $2. 08 $3. 14 Cost/Item $4. 08 $6. 14 ABC Method ABC $1. 2 $12 Cost/Item $3. 2 $15 19

Product L Product S Total Production Qty 1, 500 150 1, 650 Direct Material $2 $3 Direct Labor $3, 000 $450 $3, 450 2 2 4 $900 $3600 Total Direct Cost Overhead Setup Cost/Setup Traditional Costing Method Overhead cost/item $2. 08 $3. 14 Cost/Item $4. 08 $6. 14 ABC Method ABC $1. 2 $12 Cost/Item $3. 2 $15 19

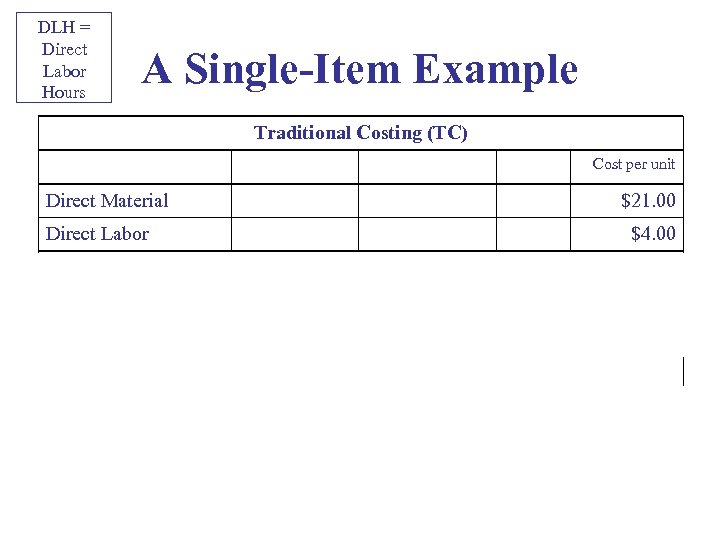

DLH = Direct Labor Hours A Single-Item Example Traditional Costing (TC) Cost per unit Direct Material $21. 00 Direct Labor $4. 00 Manufacturing Overhead Component Burden Rate Activity per Unit Fixed $64. 50/DLH × 0. 4 DLH/unit $25. 80 Variable $11. 90/DLH × 0. 4 DLH/unit $4. 76 Manufacturing Overhead per Unit $30. 56 Manufacturing Cost per Unit $55. 56 Fixed Burden Rate (TC) = Estimated Annual Factory Fixed Manufacturing Overhead/Estimated Annual Factory DLH = $967, 500/15, 000 DLH = $64. 50/DLH 20

DLH = Direct Labor Hours A Single-Item Example Traditional Costing (TC) Cost per unit Direct Material $21. 00 Direct Labor $4. 00 Manufacturing Overhead Component Burden Rate Activity per Unit Fixed $64. 50/DLH × 0. 4 DLH/unit $25. 80 Variable $11. 90/DLH × 0. 4 DLH/unit $4. 76 Manufacturing Overhead per Unit $30. 56 Manufacturing Cost per Unit $55. 56 Fixed Burden Rate (TC) = Estimated Annual Factory Fixed Manufacturing Overhead/Estimated Annual Factory DLH = $967, 500/15, 000 DLH = $64. 50/DLH 20

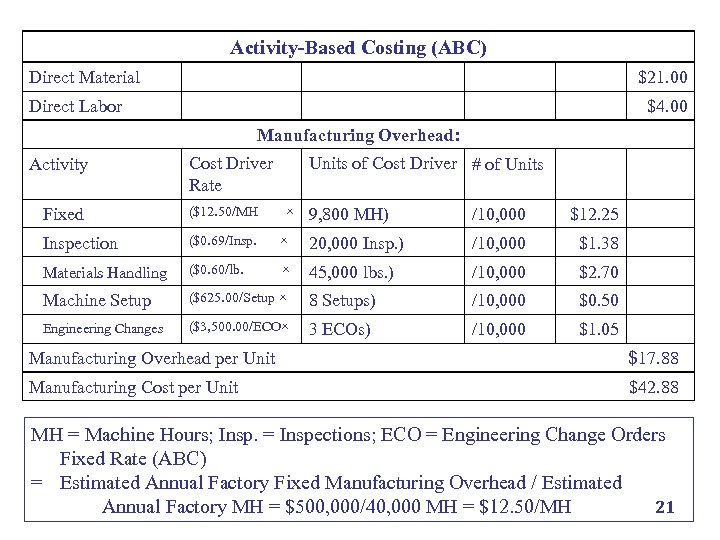

Activity-Based Costing (ABC) Direct Material $21. 00 Direct Labor $4. 00 Manufacturing Overhead: Activity Cost Driver Rate Fixed ($12. 50/MH Inspection ($0. 69/Insp. Materials Handling ($0. 60/lb. Machine Setup Engineering Changes Units of Cost Driver # of Units × 9, 800 MH) /10, 000 $12. 25 × 20, 000 Insp. ) /10, 000 $1. 38 × 45, 000 lbs. ) /10, 000 $2. 70 ($625. 00/Setup × 8 Setups) /10, 000 $0. 50 ($3, 500. 00/ECO× 3 ECOs) /10, 000 $1. 05 Manufacturing Overhead per Unit $17. 88 Manufacturing Cost per Unit $42. 88 MH = Machine Hours; Insp. = Inspections; ECO = Engineering Change Orders Fixed Rate (ABC) = Estimated Annual Factory Fixed Manufacturing Overhead / Estimated Annual Factory MH = $500, 000/40, 000 MH = $12. 50/MH 21

Activity-Based Costing (ABC) Direct Material $21. 00 Direct Labor $4. 00 Manufacturing Overhead: Activity Cost Driver Rate Fixed ($12. 50/MH Inspection ($0. 69/Insp. Materials Handling ($0. 60/lb. Machine Setup Engineering Changes Units of Cost Driver # of Units × 9, 800 MH) /10, 000 $12. 25 × 20, 000 Insp. ) /10, 000 $1. 38 × 45, 000 lbs. ) /10, 000 $2. 70 ($625. 00/Setup × 8 Setups) /10, 000 $0. 50 ($3, 500. 00/ECO× 3 ECOs) /10, 000 $1. 05 Manufacturing Overhead per Unit $17. 88 Manufacturing Cost per Unit $42. 88 MH = Machine Hours; Insp. = Inspections; ECO = Engineering Change Orders Fixed Rate (ABC) = Estimated Annual Factory Fixed Manufacturing Overhead / Estimated Annual Factory MH = $500, 000/40, 000 MH = $12. 50/MH 21

Value Analysis and Value Engineering Engineerin 22

Value Analysis and Value Engineering Engineerin 22

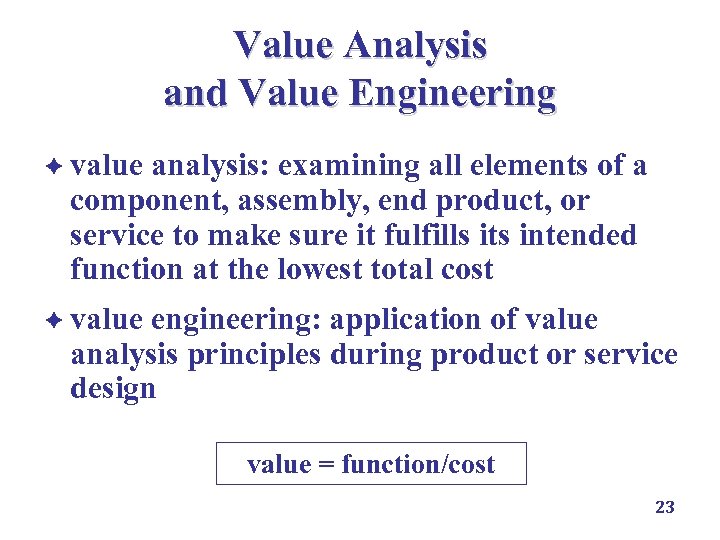

Value Analysis and Value Engineering è value analysis: examining all elements of a component, assembly, end product, or service to make sure it fulfills its intended function at the lowest total cost è value engineering: application of value analysis principles during product or service design value = function/cost 23

Value Analysis and Value Engineering è value analysis: examining all elements of a component, assembly, end product, or service to make sure it fulfills its intended function at the lowest total cost è value engineering: application of value analysis principles during product or service design value = function/cost 23

Personnel in Value Analysis è everyone: executive management, suppliers, supply management, design engineering, marketing, production, industrial/process, engineering, quality control 24

Personnel in Value Analysis è everyone: executive management, suppliers, supply management, design engineering, marketing, production, industrial/process, engineering, quality control 24

Typical Questions to Ask in VA è Does the use of this product contribute value to our customers? è Is the cost of the final product proportionate to its usefulness? è Are there additional uses for this product? è Does the product need all its features or internal parts? è Are product weight reductions possible? è Is there anything else available to our customers given the intended use of the product? è Is there a better production method to produce the item or product? è Can a lower cost standard part replace a customized part? è Are we using the proper tooling considering the quantities required? 25

Typical Questions to Ask in VA è Does the use of this product contribute value to our customers? è Is the cost of the final product proportionate to its usefulness? è Are there additional uses for this product? è Does the product need all its features or internal parts? è Are product weight reductions possible? è Is there anything else available to our customers given the intended use of the product? è Is there a better production method to produce the item or product? è Can a lower cost standard part replace a customized part? è Are we using the proper tooling considering the quantities required? 25

Typical Questions to Ask in VA è Will another dependable supplier provide materials, components, or subassemblies for less? è Is anyone currently purchasing required materials, components, or subassemblies for less? è Are there equally effective but lower cost materials available? è Do material, labor, overhead, and profit equal the product’s cost? è Are packaging reductions possible? è Is the item properly classified for shipping purposes to receive the lowest transportation rates? è Are design or quality specification too tight given customer requirements? è If we are making the item now, can we buy it for less? Or vice versa? 26

Typical Questions to Ask in VA è Will another dependable supplier provide materials, components, or subassemblies for less? è Is anyone currently purchasing required materials, components, or subassemblies for less? è Are there equally effective but lower cost materials available? è Do material, labor, overhead, and profit equal the product’s cost? è Are packaging reductions possible? è Is the item properly classified for shipping purposes to receive the lowest transportation rates? è Are design or quality specification too tight given customer requirements? è If we are making the item now, can we buy it for less? Or vice versa? 26

Value Analysis Process è gather information è speculate è analyze è recommend è summarize and execute and follow up 27

Value Analysis Process è gather information è speculate è analyze è recommend è summarize and execute and follow up 27

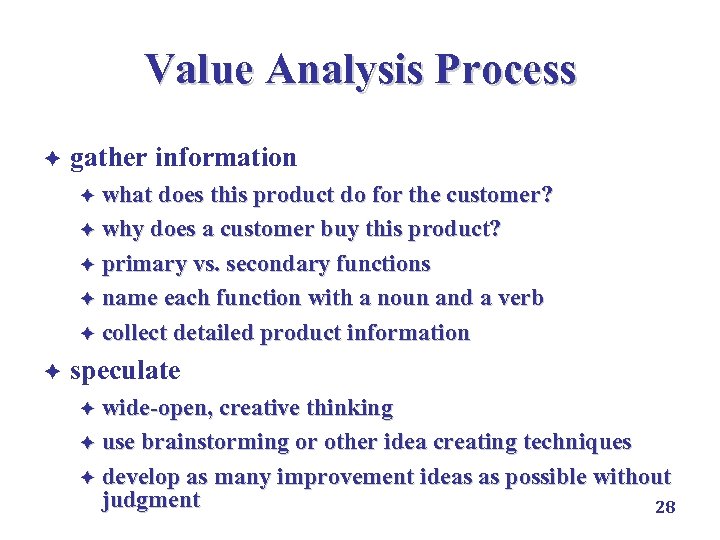

Value Analysis Process è gather information è what does this product do for the customer? è why does a customer buy this product? è primary vs. secondary functions è name each function with a noun and a verb è collect detailed product information è speculate è wide-open, creative thinking è use brainstorming or other idea creating techniques è develop as many improvement ideas as possible without judgment 28

Value Analysis Process è gather information è what does this product do for the customer? è why does a customer buy this product? è primary vs. secondary functions è name each function with a noun and a verb è collect detailed product information è speculate è wide-open, creative thinking è use brainstorming or other idea creating techniques è develop as many improvement ideas as possible without judgment 28

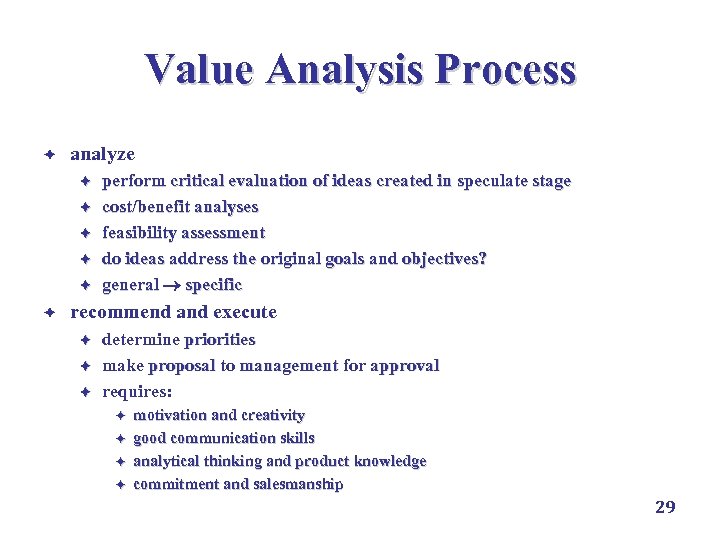

Value Analysis Process è analyze è è è perform critical evaluation of ideas created in speculate stage cost/benefit analyses feasibility assessment do ideas address the original goals and objectives? general specific recommend and execute è è è determine priorities make proposal to management for approval requires: è è motivation and creativity good communication skills analytical thinking and product knowledge commitment and salesmanship 29

Value Analysis Process è analyze è è è perform critical evaluation of ideas created in speculate stage cost/benefit analyses feasibility assessment do ideas address the original goals and objectives? general specific recommend and execute è è è determine priorities make proposal to management for approval requires: è è motivation and creativity good communication skills analytical thinking and product knowledge commitment and salesmanship 29

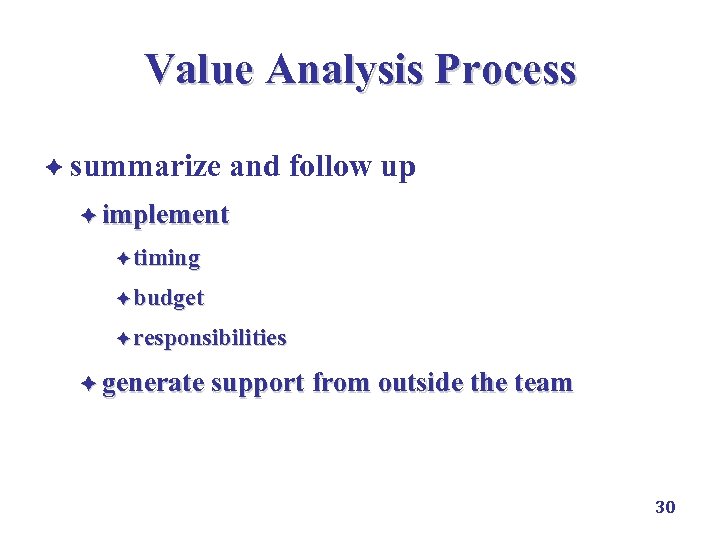

Value Analysis Process è summarize and follow up è implement è timing è budget è responsibilities è generate support from outside the team 30

Value Analysis Process è summarize and follow up è implement è timing è budget è responsibilities è generate support from outside the team 30

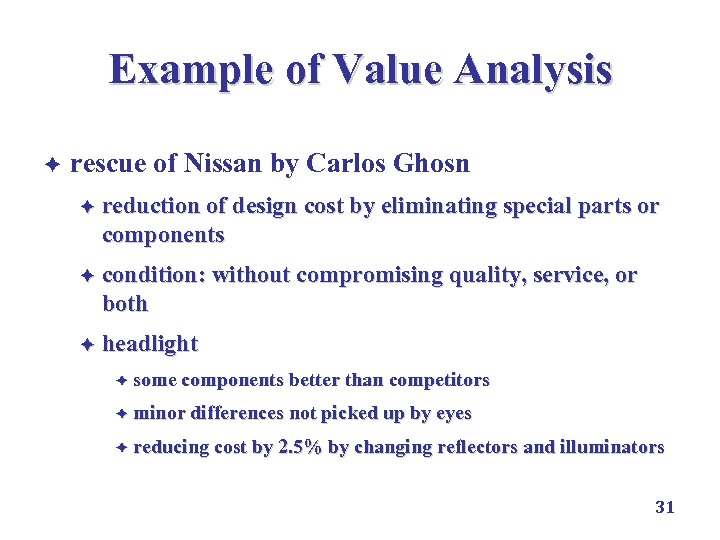

Example of Value Analysis è rescue of Nissan by Carlos Ghosn è reduction of design cost by eliminating special parts or components è condition: without compromising quality, service, or both è headlight è some components better than competitors è minor differences not picked up by eyes è reducing cost by 2. 5% by changing reflectors and illuminators 31

Example of Value Analysis è rescue of Nissan by Carlos Ghosn è reduction of design cost by eliminating special parts or components è condition: without compromising quality, service, or both è headlight è some components better than competitors è minor differences not picked up by eyes è reducing cost by 2. 5% by changing reflectors and illuminators 31

Example of Value Analysis è rescue of Chrysler by Lee Iacocca è design of K-car: no more than 176” to pack more car in transportation 32

Example of Value Analysis è rescue of Chrysler by Lee Iacocca è design of K-car: no more than 176” to pack more car in transportation 32

Example of Value Analysis è experience of 4 first-tier suppliers of automobiles è benefits and challenges to leverage their suppliers’ expertise in collaborative VA è process è benefits and barriers Hartley, J. L. (2000) Collaborative Value Analysis: Experiences from the Automotive Industry, The Journal of Supply Chain Management, Fall, 2732. 33

Example of Value Analysis è experience of 4 first-tier suppliers of automobiles è benefits and challenges to leverage their suppliers’ expertise in collaborative VA è process è benefits and barriers Hartley, J. L. (2000) Collaborative Value Analysis: Experiences from the Automotive Industry, The Journal of Supply Chain Management, Fall, 2732. 33

Process Mapping 34

Process Mapping 34

Process Mapping è process: an outcome of a set of tasks, activities, or steps è expressing processes as their component parts or activities by a cross-functional team è identifying and eliminating non-value-added activities 35

Process Mapping è process: an outcome of a set of tasks, activities, or steps è expressing processes as their component parts or activities by a cross-functional team è identifying and eliminating non-value-added activities 35

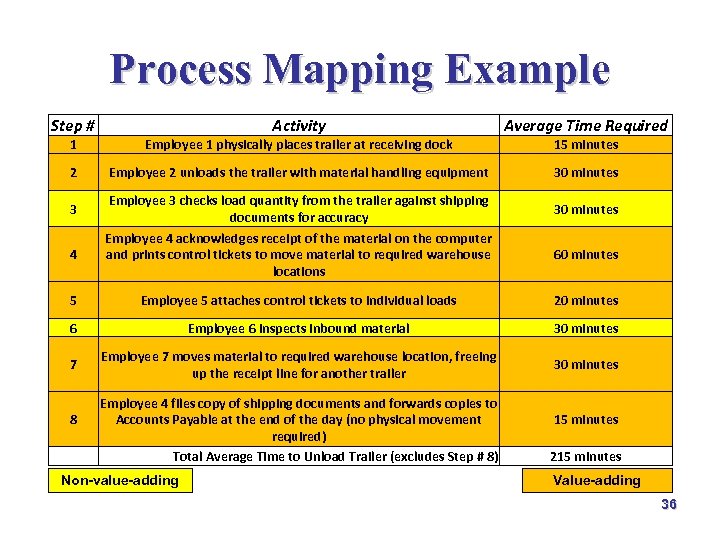

Process Mapping Example Step # Activity Average Time Required 1 Employee 1 physically places trailer at receiving dock 15 minutes 2 Employee 2 unloads the trailer with material handling equipment 30 minutes 3 4 Employee 3 checks load quantity from the trailer against shipping documents for accuracy Employee 4 acknowledges receipt of the material on the computer and prints control tickets to move material to required warehouse locations 30 minutes 60 minutes 5 Employee 5 attaches control tickets to individual loads 20 minutes 6 Employee 6 inspects inbound material 30 minutes 7 Employee 7 moves material to required warehouse location, freeing up the receipt line for another trailer 30 minutes 8 Employee 4 files copy of shipping documents and forwards copies to Accounts Payable at the end of the day (no physical movement required) Total Average Time to Unload Trailer (excludes Step # 8) Non-value-adding 15 minutes 215 minutes Value-adding 36

Process Mapping Example Step # Activity Average Time Required 1 Employee 1 physically places trailer at receiving dock 15 minutes 2 Employee 2 unloads the trailer with material handling equipment 30 minutes 3 4 Employee 3 checks load quantity from the trailer against shipping documents for accuracy Employee 4 acknowledges receipt of the material on the computer and prints control tickets to move material to required warehouse locations 30 minutes 60 minutes 5 Employee 5 attaches control tickets to individual loads 20 minutes 6 Employee 6 inspects inbound material 30 minutes 7 Employee 7 moves material to required warehouse location, freeing up the receipt line for another trailer 30 minutes 8 Employee 4 files copy of shipping documents and forwards copies to Accounts Payable at the end of the day (no physical movement required) Total Average Time to Unload Trailer (excludes Step # 8) Non-value-adding 15 minutes 215 minutes Value-adding 36

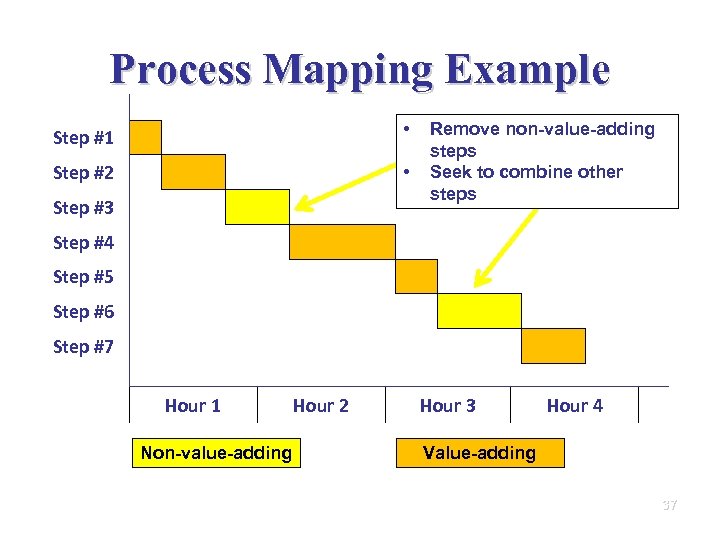

Process Mapping Example • Step #1 • Step #2 Step #3 Step #4 Step #5 Step #6 Remove non-value-adding steps Seek to combine other steps Step #7 Hour 1 Non-value-adding Hour 2 Hour 3 Hour 4 Value-adding 37

Process Mapping Example • Step #1 • Step #2 Step #3 Step #4 Step #5 Step #6 Remove non-value-adding steps Seek to combine other steps Step #7 Hour 1 Non-value-adding Hour 2 Hour 3 Hour 4 Value-adding 37

Learning Curve 38

Learning Curve 38

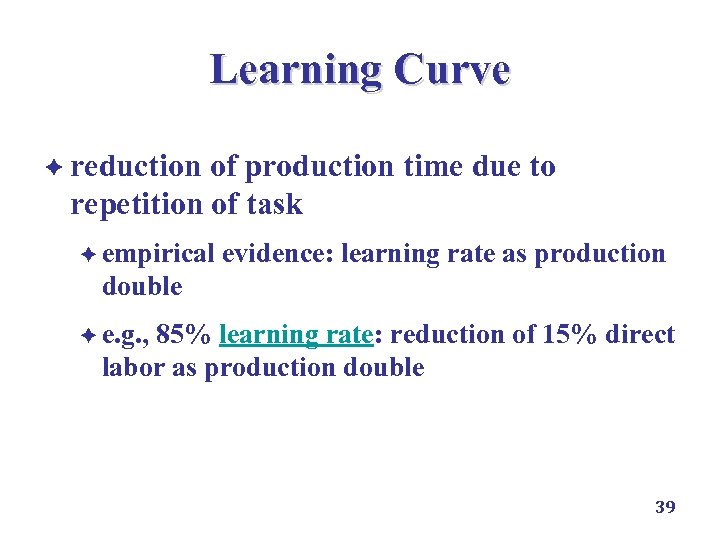

Learning Curve è reduction of production time due to repetition of task è empirical evidence: learning rate as production double è e. g. , 85% learning rate: reduction of 15% direct labor as production double 39

Learning Curve è reduction of production time due to repetition of task è empirical evidence: learning rate as production double è e. g. , 85% learning rate: reduction of 15% direct labor as production double 39

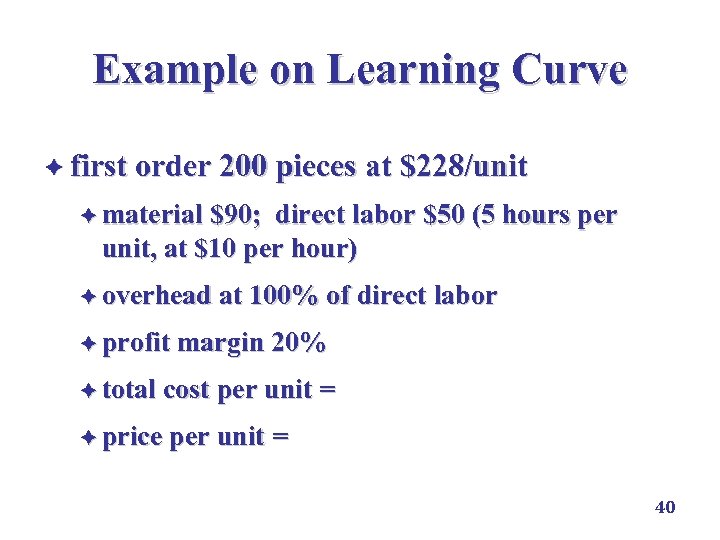

Example on Learning Curve è first order 200 pieces at $228/unit è material $90; direct labor $50 (5 hours per unit, at $10 per hour) è overhead at 100% of direct labor è profit margin 20% è total cost per unit = ($90+$50) = $190 è price per unit = ($190)(120%) = $228 40

Example on Learning Curve è first order 200 pieces at $228/unit è material $90; direct labor $50 (5 hours per unit, at $10 per hour) è overhead at 100% of direct labor è profit margin 20% è total cost per unit = ($90+$50) = $190 è price per unit = ($190)(120%) = $228 40

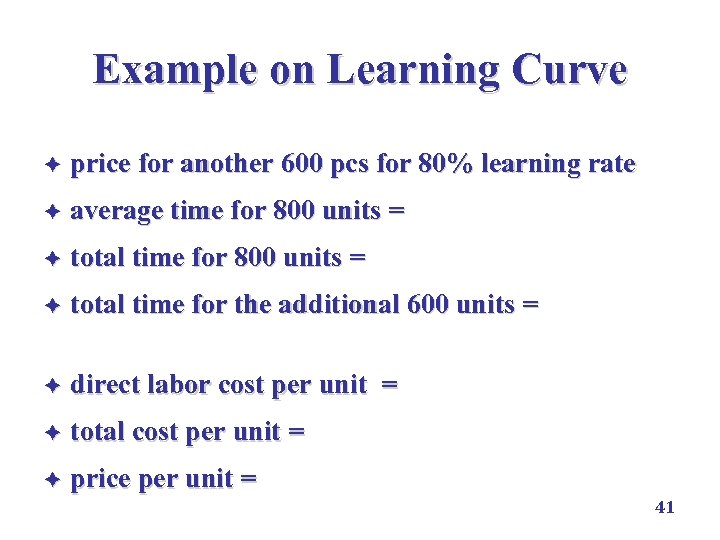

Example on Learning Curve è price for another 600 pcs for 80% learning rate è average time for 800 units = 5(0. 8)2 = 3. 2 hr è total time for 800 units = (3. 2)(800) = 2, 560 hr è total time for the additional 600 units = 2, 560 1, 000 = 1, 560 hr è direct labor cost per unit = $(10)(1560)/600 = $26 è total cost per unit = ($90+$26) = $142 è price per unit = ($142)(120%) = $170. 4 41

Example on Learning Curve è price for another 600 pcs for 80% learning rate è average time for 800 units = 5(0. 8)2 = 3. 2 hr è total time for 800 units = (3. 2)(800) = 2, 560 hr è total time for the additional 600 units = 2, 560 1, 000 = 1, 560 hr è direct labor cost per unit = $(10)(1560)/600 = $26 è total cost per unit = ($90+$26) = $142 è price per unit = ($142)(120%) = $170. 4 41

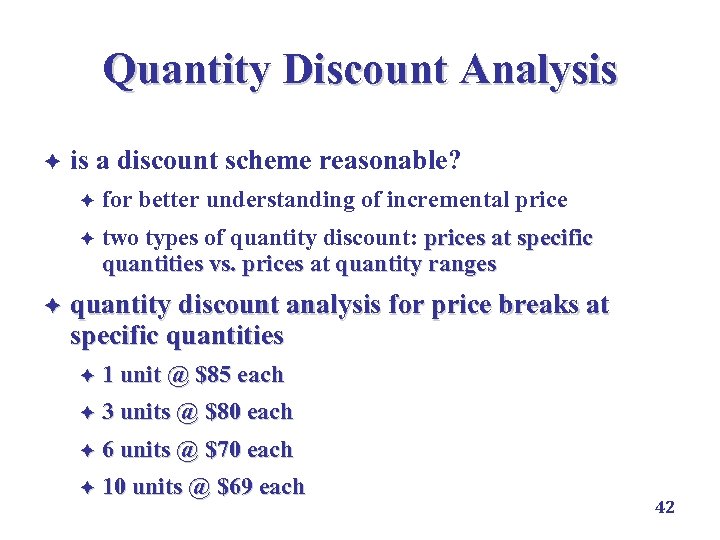

Quantity Discount Analysis è is a discount scheme reasonable? è è è for better understanding of incremental price two types of quantity discount: prices at specific quantities vs. prices at quantity ranges quantity discount analysis for price breaks at specific quantities è 1 unit @ $85 each è 3 units @ $80 each è 6 units @ $70 each è 10 units @ $69 each 42

Quantity Discount Analysis è is a discount scheme reasonable? è è è for better understanding of incremental price two types of quantity discount: prices at specific quantities vs. prices at quantity ranges quantity discount analysis for price breaks at specific quantities è 1 unit @ $85 each è 3 units @ $80 each è 6 units @ $70 each è 10 units @ $69 each 42

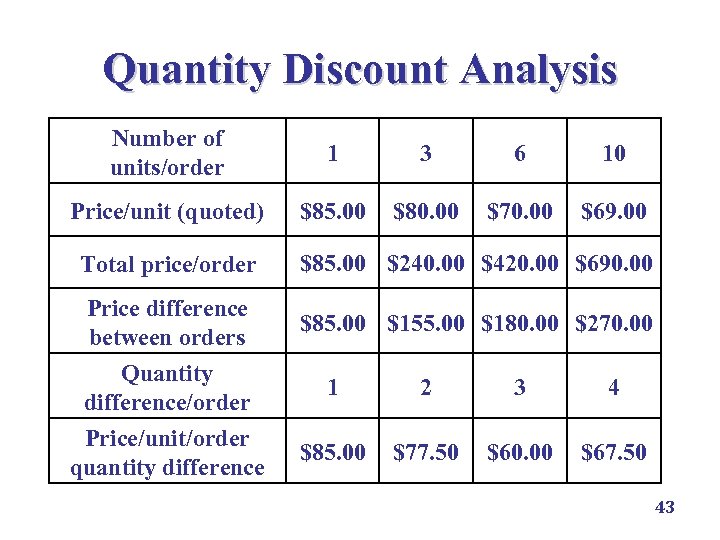

Quantity Discount Analysis Number of units/order 1 3 6 10 Price/unit (quoted) $85. 00 $80. 00 $70. 00 $69. 00 Total price/order Price difference between orders Quantity difference/order Price/unit/order quantity difference $85. 00 $240. 00 $420. 00 $690. 00 $85. 00 $155. 00 $180. 00 $270. 00 1 2 3 4 $85. 00 $77. 50 $60. 00 $67. 50 43

Quantity Discount Analysis Number of units/order 1 3 6 10 Price/unit (quoted) $85. 00 $80. 00 $70. 00 $69. 00 Total price/order Price difference between orders Quantity difference/order Price/unit/order quantity difference $85. 00 $240. 00 $420. 00 $690. 00 $85. 00 $155. 00 $180. 00 $270. 00 1 2 3 4 $85. 00 $77. 50 $60. 00 $67. 50 43