Consumption tax of Japan

Consumption tax of Japan

Contents Consumption tax increase The tax system of Japan What’s consumption tax The reason why raising consumption tax The effect of consumption tax increase

Contents Consumption tax increase The tax system of Japan What’s consumption tax The reason why raising consumption tax The effect of consumption tax increase

Consumption tax increase October 1 st , 2013, the Prime Minister Shinzo Abe decided to raise consumption tax from 5% to 8% from 1, 2014. And it may be up to 10% from April, 2015.

Consumption tax increase October 1 st , 2013, the Prime Minister Shinzo Abe decided to raise consumption tax from 5% to 8% from 1, 2014. And it may be up to 10% from April, 2015.

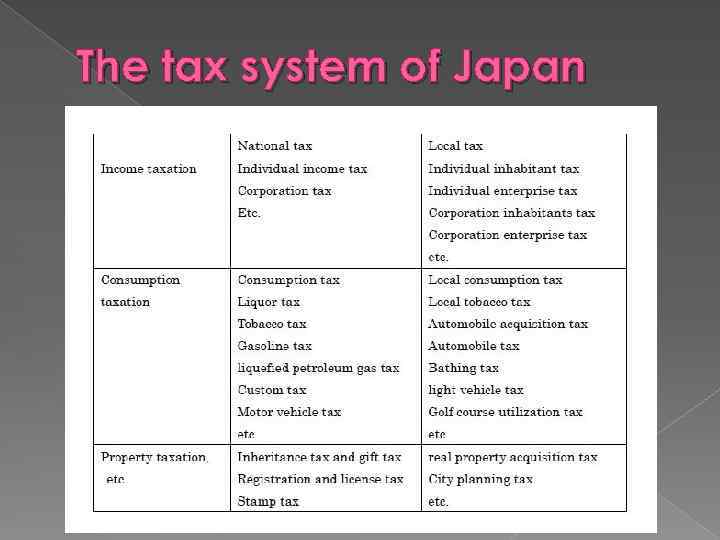

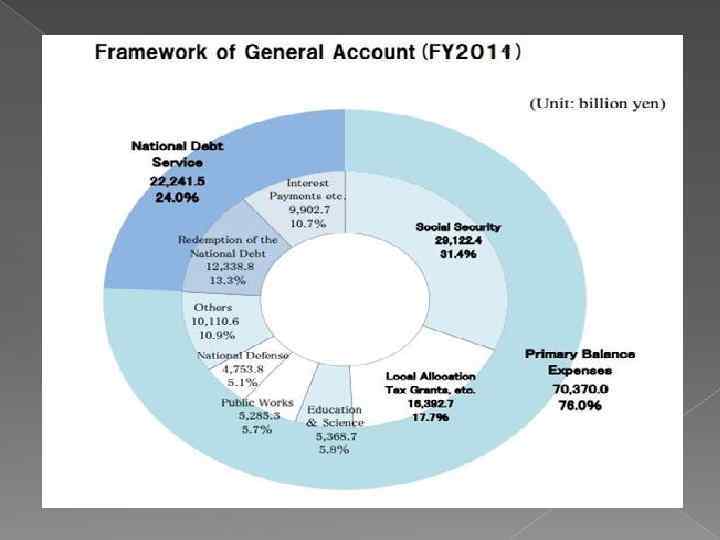

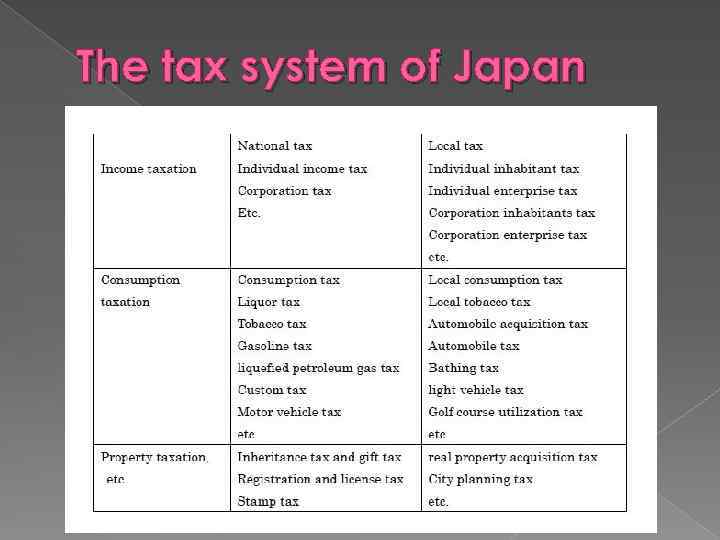

The tax system of Japan

The tax system of Japan

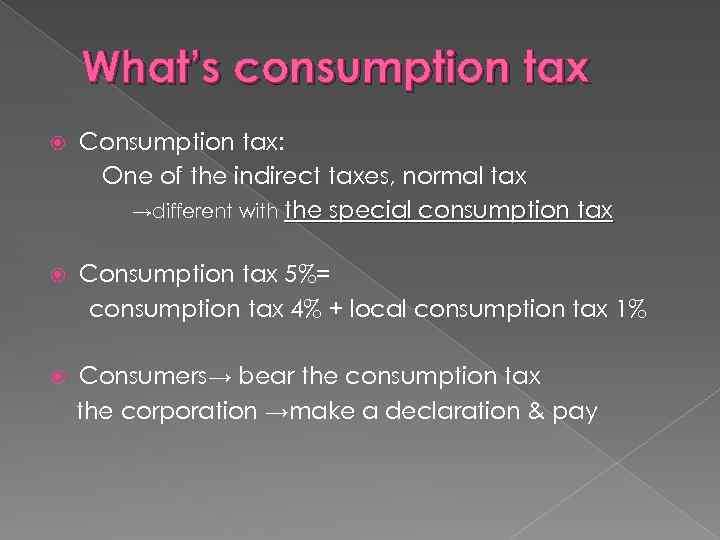

What’s consumption tax Consumption tax: One of the indirect taxes, normal tax →different with the special consumption tax Consumption tax 5%= consumption tax 4% + local consumption tax 1% Consumers→ bear the consumption tax the corporation →make a declaration & pay

What’s consumption tax Consumption tax: One of the indirect taxes, normal tax →different with the special consumption tax Consumption tax 5%= consumption tax 4% + local consumption tax 1% Consumers→ bear the consumption tax the corporation →make a declaration & pay

*special consumption tax Only be taxed for the particular goods and services Ex. Tobacco tax, Gasoline tax, Liquor tax, Golf course utilization tax Type: ①the tax is included in the selling price → Ex. Tobacco tax, Gasoline tax, Liquor tax >>Double taxation The selling Price = manufacturing cost + Specific tax General Consumption Tax =the selling Price * tax rate (%) ②the tax is included in the price → Ex. Bathing tax, Golf course utilization tax >> Specific consumption tax =the selling Price * tax rate (%)

*special consumption tax Only be taxed for the particular goods and services Ex. Tobacco tax, Gasoline tax, Liquor tax, Golf course utilization tax Type: ①the tax is included in the selling price → Ex. Tobacco tax, Gasoline tax, Liquor tax >>Double taxation The selling Price = manufacturing cost + Specific tax General Consumption Tax =the selling Price * tax rate (%) ②the tax is included in the price → Ex. Bathing tax, Golf course utilization tax >> Specific consumption tax =the selling Price * tax rate (%)

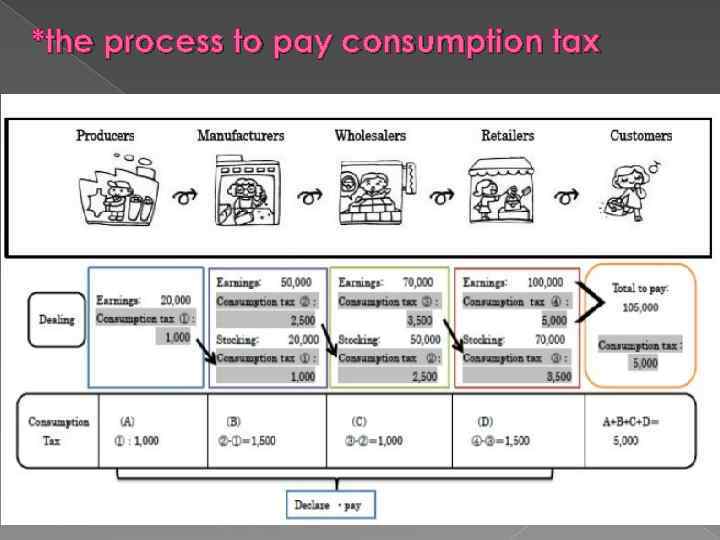

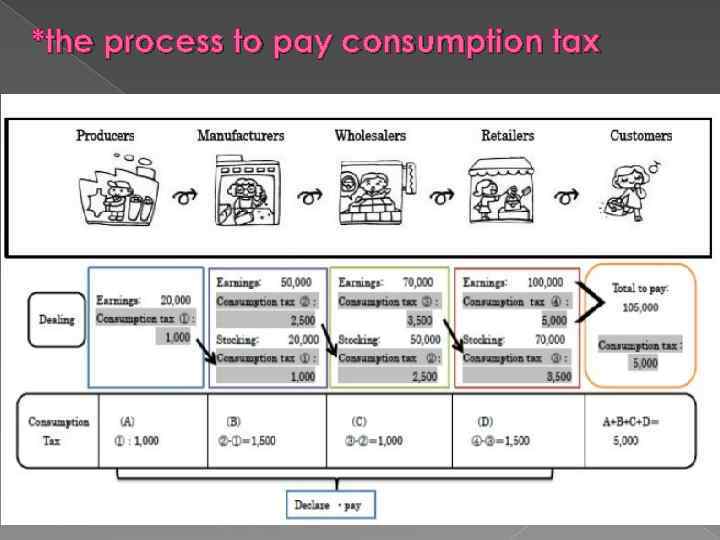

*the process to pay consumption tax

*the process to pay consumption tax

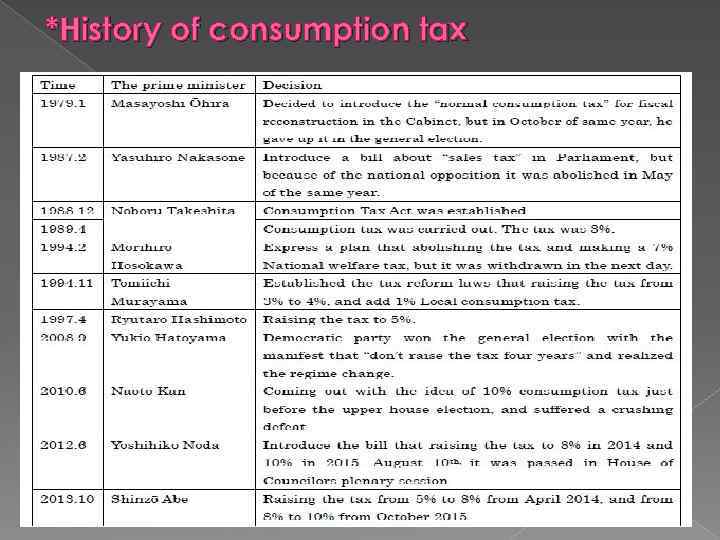

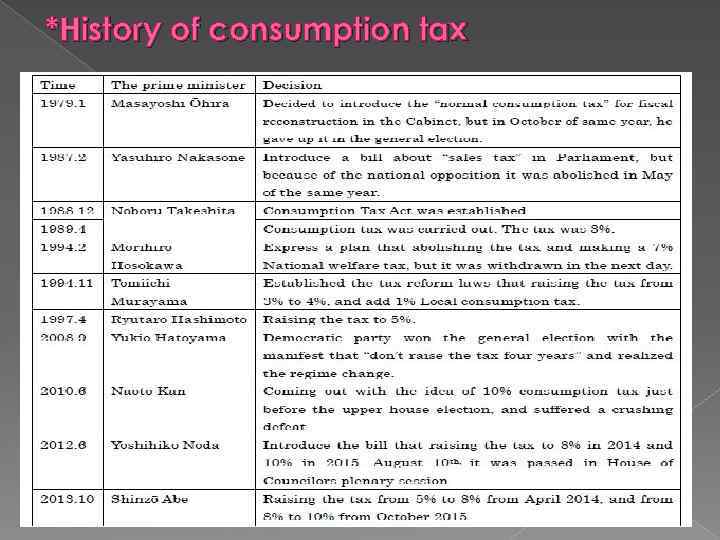

*History of consumption tax

*History of consumption tax

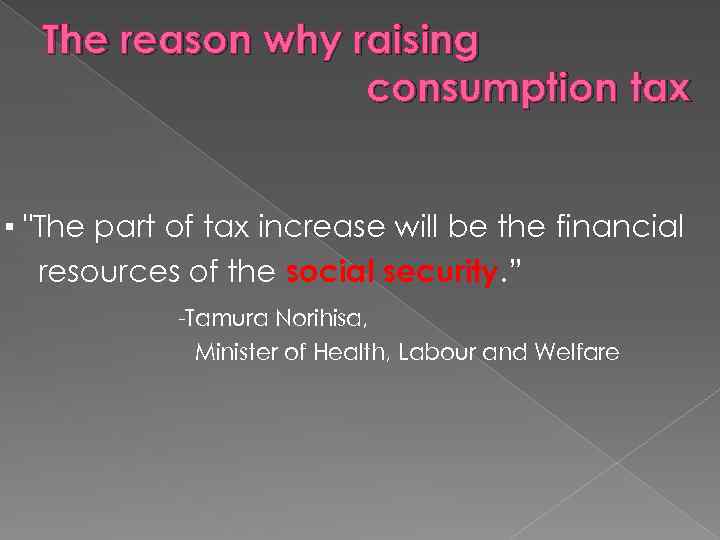

The reason why raising consumption tax ▪ "The part of tax increase will be the financial resources of the social security. ” -Tamura Norihisa, Minister of Health, Labour and Welfare

The reason why raising consumption tax ▪ "The part of tax increase will be the financial resources of the social security. ” -Tamura Norihisa, Minister of Health, Labour and Welfare

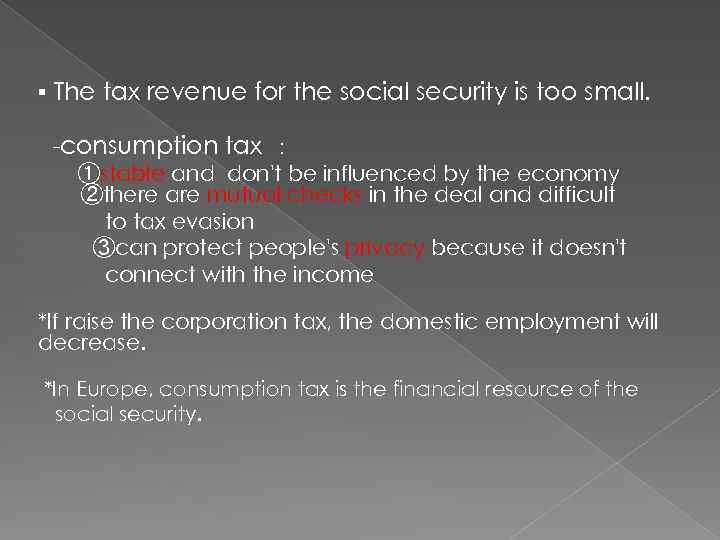

▪ The tax revenue for the social security is too small. -consumption tax : ①stable and don't be influenced by the economy ②there are mutual checks in the deal and difficult to tax evasion ③can protect people's privacy because it doesn't connect with the income *If raise the corporation tax, the domestic employment will decrease. *In Europe, consumption tax is the financial resource of the social security.

▪ The tax revenue for the social security is too small. -consumption tax : ①stable and don't be influenced by the economy ②there are mutual checks in the deal and difficult to tax evasion ③can protect people's privacy because it doesn't connect with the income *If raise the corporation tax, the domestic employment will decrease. *In Europe, consumption tax is the financial resource of the social security.

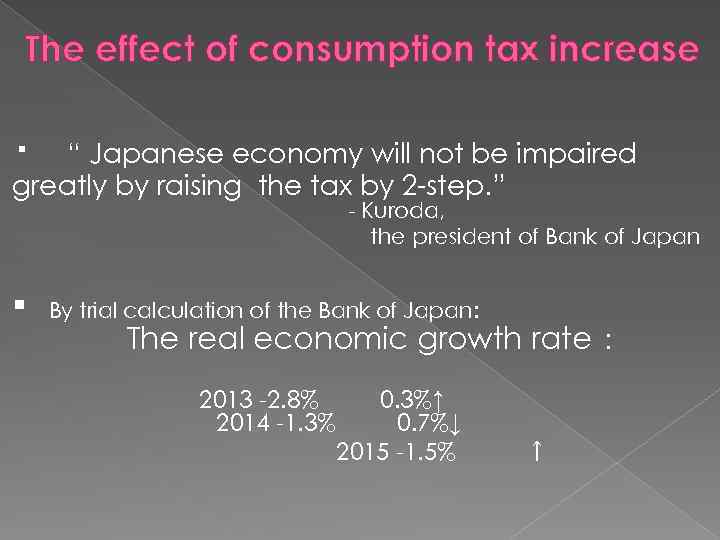

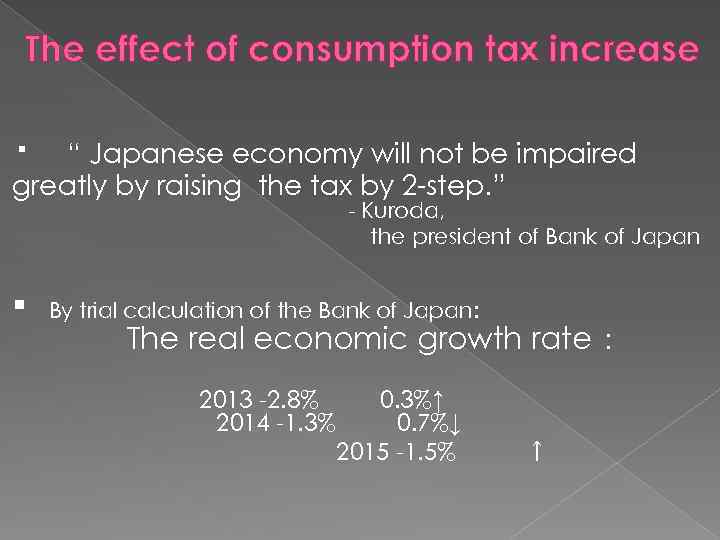

The effect of consumption tax increase ▪ “ Japanese economy will not be impaired greatly by raising the tax by 2 -step. ” - Kuroda, the president of Bank of Japan ▪ By trial calculation of the Bank of Japan: The real economic growth rate: 2013 -2. 8% 0. 3%↑ 2014 -1. 3% 0. 7%↓ 2015 -1. 5% ↑

The effect of consumption tax increase ▪ “ Japanese economy will not be impaired greatly by raising the tax by 2 -step. ” - Kuroda, the president of Bank of Japan ▪ By trial calculation of the Bank of Japan: The real economic growth rate: 2013 -2. 8% 0. 3%↑ 2014 -1. 3% 0. 7%↓ 2015 -1. 5% ↑

The merit: ①the social service will be better. ②Everyone must to pay the tax, so there are little complaints ③Can be a measure of tax evasion. ④Because the consumption tax revenue is stable, good to make the social service better. The demerit: ①Economy deteriorates. ②The gap will be expand because of the increase of the tax burden to the low income people. ③there are maybe adverse effects on small business.

The merit: ①the social service will be better. ②Everyone must to pay the tax, so there are little complaints ③Can be a measure of tax evasion. ④Because the consumption tax revenue is stable, good to make the social service better. The demerit: ①Economy deteriorates. ②The gap will be expand because of the increase of the tax burden to the low income people. ③there are maybe adverse effects on small business.

THANK YOU FOR YOUR ATTENTION

THANK YOU FOR YOUR ATTENTION