Пред-релизная-2.pptx

- Количество слайдов: 31

CFA Institute Research Challenge Industry Overview Company Profile KNU Students Research • • • Andriy Bozhko Dmytro Kaptsan Olha Antropova Vitalii Ihnatiuk Dmytro Holovchuk Financial Whether the market’s optimism is reasonable analysis Valuation Investment Risks Summary

CFA Institute Research Challenge Industry Overview Company Profile KNU Students Research • • • Andriy Bozhko Dmytro Kaptsan Olha Antropova Vitalii Ihnatiuk Dmytro Holovchuk Financial Whether the market’s optimism is reasonable analysis Valuation Investment Risks Summary

Sales drivers • Favorable climate • Access to the Black Sea and good transport infrastructure • Geographic location • Expected growth of population • Diet changes in the developing countries • Relatively lower prime cost of goods Ukraine will provide 50% of the world sunflower oil exports and 10% of crops in FY 2012 Industry Overview

Sales drivers • Favorable climate • Access to the Black Sea and good transport infrastructure • Geographic location • Expected growth of population • Diet changes in the developing countries • Relatively lower prime cost of goods Ukraine will provide 50% of the world sunflower oil exports and 10% of crops in FY 2012 Industry Overview

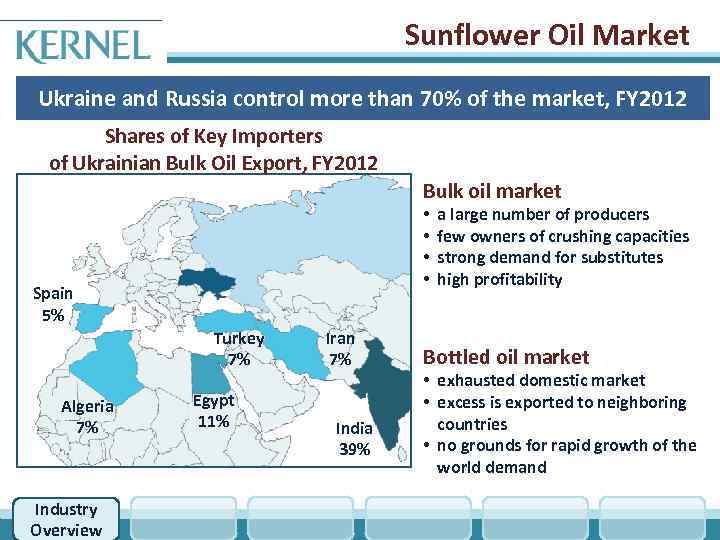

Sunflower Oil Market Ukraine and Russia control more than 70% of the market, FY 2012 Shares of Key Importers of Ukrainian Bulk Oil Export, FY 2012 Bulk oil market • • Spain 5% Turkey 7% Algeria 7% Industry Overview Egypt 11% Iran 7% India 39% a large number of producers few owners of crushing capacities strong demand for substitutes high profitability Bottled oil market • exhausted domestic market • excess is exported to neighboring countries • no grounds for rapid growth of the world demand

Sunflower Oil Market Ukraine and Russia control more than 70% of the market, FY 2012 Shares of Key Importers of Ukrainian Bulk Oil Export, FY 2012 Bulk oil market • • Spain 5% Turkey 7% Algeria 7% Industry Overview Egypt 11% Iran 7% India 39% a large number of producers few owners of crushing capacities strong demand for substitutes high profitability Bottled oil market • exhausted domestic market • excess is exported to neighboring countries • no grounds for rapid growth of the world demand

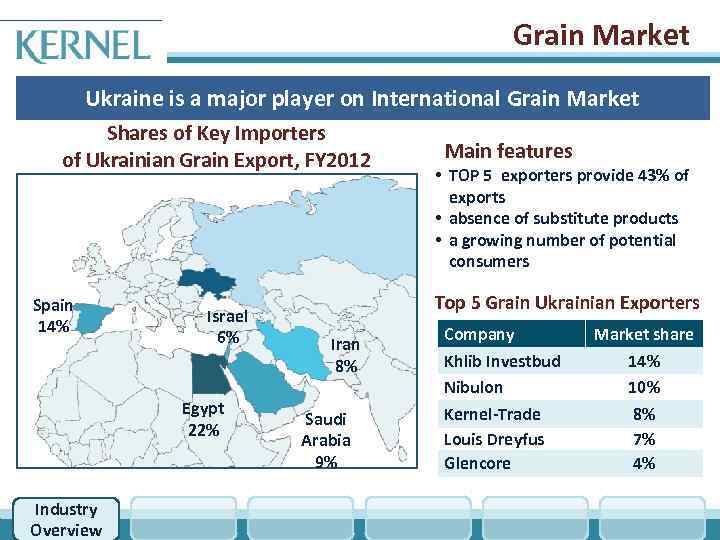

Grain Market Ukraine is a major player on International Grain Market Shares of Key Importers of Ukrainian Grain Export, FY 2012 Spain 14% Israel 6% Egypt 22% Industry Overview Main features • TOP 5 exporters provide 43% of exports • absence of substitute products • a growing number of potential consumers Top 5 Grain Ukrainian Exporters Iran 8% Saudi Arabia 9% Company Khlib Investbud Nibulon Kernel-Trade Louis Dreyfus Glencore Market share 14% 10% 8% 7% 4%

Grain Market Ukraine is a major player on International Grain Market Shares of Key Importers of Ukrainian Grain Export, FY 2012 Spain 14% Israel 6% Egypt 22% Industry Overview Main features • TOP 5 exporters provide 43% of exports • absence of substitute products • a growing number of potential consumers Top 5 Grain Ukrainian Exporters Iran 8% Saudi Arabia 9% Company Khlib Investbud Nibulon Kernel-Trade Louis Dreyfus Glencore Market share 14% 10% 8% 7% 4%

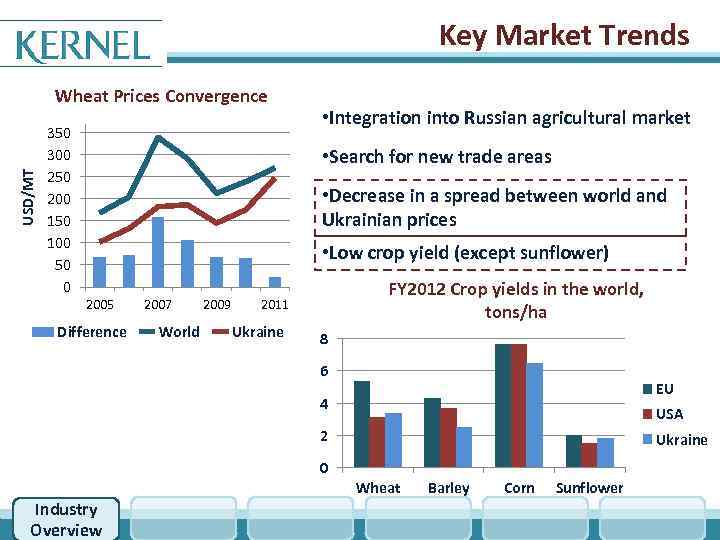

Key Market Trends USD/MT Wheat Prices Convergence 350 300 250 200 150 100 50 0 • Integration into Russian agricultural market • Search for new trade areas • Decrease in a spread between world and Ukrainian prices • Low crop yield (except sunflower) 2005 Difference 2007 World 2009 FY 2012 Crop yields in the world, tons/ha 2011 Ukraine 8 6 EU 4 USA 2 Ukraine 0 Wheat Industry Overview Barley Corn Sunflower

Key Market Trends USD/MT Wheat Prices Convergence 350 300 250 200 150 100 50 0 • Integration into Russian agricultural market • Search for new trade areas • Decrease in a spread between world and Ukrainian prices • Low crop yield (except sunflower) 2005 Difference 2007 World 2009 FY 2012 Crop yields in the world, tons/ha 2011 Ukraine 8 6 EU 4 USA 2 Ukraine 0 Wheat Industry Overview Barley Corn Sunflower

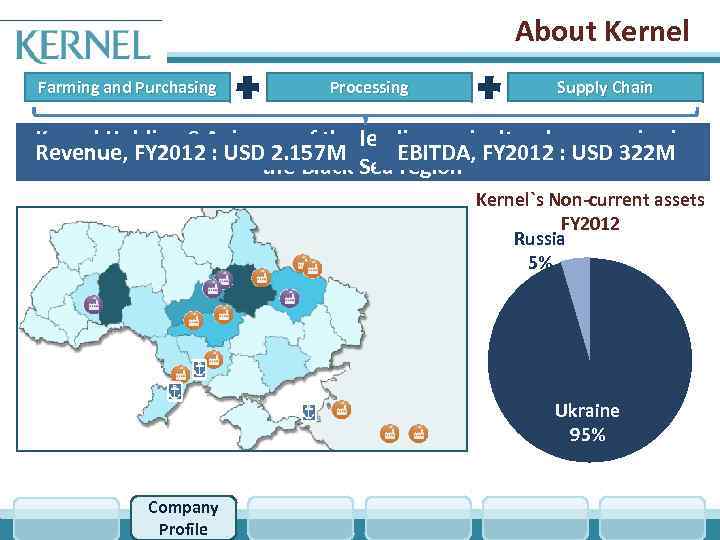

About Kernel Farming and Purchasing Processing Supply Chain Kernel Holding S. A. is one of the leading agricultural companies in Revenue, FY 2012 : USD 2. 157 M EBITDA, FY 2012 : USD 322 M the Black Sea region Kernel`s Non-current assets FY 2012 Russia 5% Ukraine 95% Company Profile

About Kernel Farming and Purchasing Processing Supply Chain Kernel Holding S. A. is one of the leading agricultural companies in Revenue, FY 2012 : USD 2. 157 M EBITDA, FY 2012 : USD 322 M the Black Sea region Kernel`s Non-current assets FY 2012 Russia 5% Ukraine 95% Company Profile

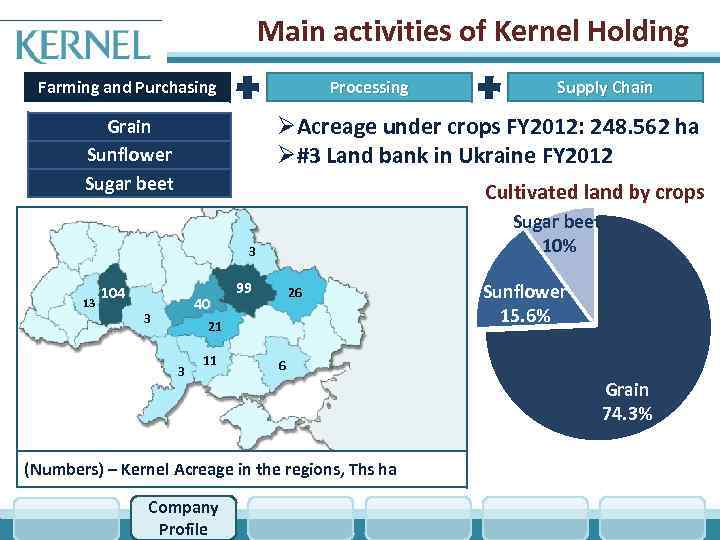

Main activities of Kernel Holding Farming and Purchasing Processing ØAcreage under crops FY 2012: 248. 562 ha Ø#3 Land bank in Ukraine FY 2012 Grain Sunflower Sugar beet Cultivated land by crops Sugar beet 10% 3 13 Supply Chain 104 40 3 99 26 21 3 11 6 (Numbers) – Kernel Acreage in the regions, Ths ha Company Profile Sunflower 15. 6% Grain 74. 3%

Main activities of Kernel Holding Farming and Purchasing Processing ØAcreage under crops FY 2012: 248. 562 ha Ø#3 Land bank in Ukraine FY 2012 Grain Sunflower Sugar beet Cultivated land by crops Sugar beet 10% 3 13 Supply Chain 104 40 3 99 26 21 3 11 6 (Numbers) – Kernel Acreage in the regions, Ths ha Company Profile Sunflower 15. 6% Grain 74. 3%

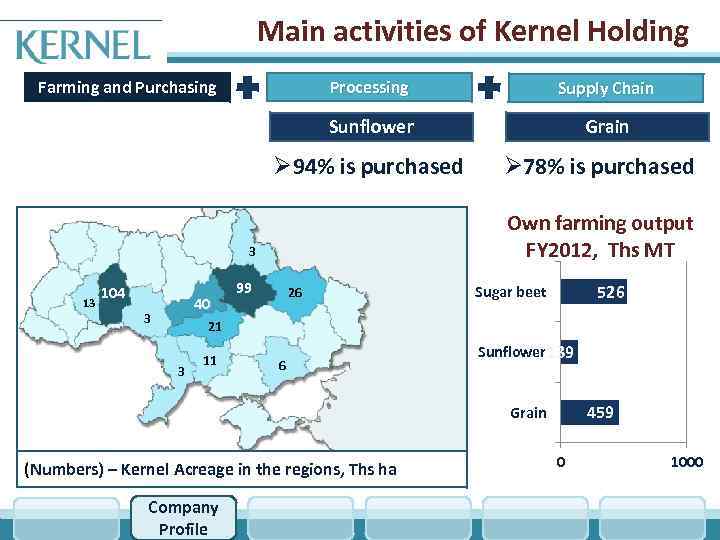

Main activities of Kernel Holding Farming and Purchasing Processing Supply Chain Sunflower Grain Ø 94% is purchased Own farming output FY 2012, Ths MT 3 13 104 40 3 99 26 21 3 11 Ø 78% is purchased 6 526 Sugar beet Sunflower 15, 6% Sunflower 139 459 Grain (Numbers) – Kernel Acreage in the regions, Ths ha Company Profile 0 1000

Main activities of Kernel Holding Farming and Purchasing Processing Supply Chain Sunflower Grain Ø 94% is purchased Own farming output FY 2012, Ths MT 3 13 104 40 3 99 26 21 3 11 Ø 78% is purchased 6 526 Sugar beet Sunflower 15, 6% Sunflower 139 459 Grain (Numbers) – Kernel Acreage in the regions, Ths ha Company Profile 0 1000

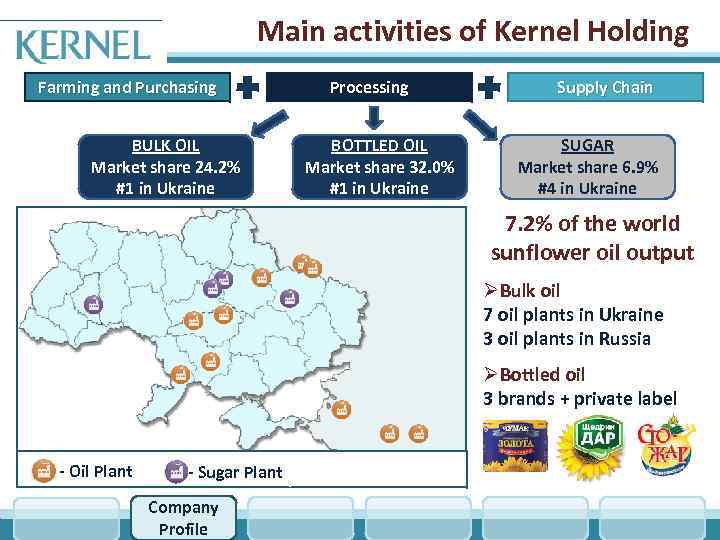

Main activities of Kernel Holding Farming and Purchasing BULK OIL Market share 24. 2% #1 in Ukraine Processing BOTTLED OIL Market share 32. 0% #1 in Ukraine Supply Chain SUGAR Market share 6. 9% #4 in Ukraine 7. 2% of the world sunflower oil output ØBulk oil 7 oil plants in Ukraine 3 oil plants in Russia ØBottled oil 3 brands + private label - Oil Plant - Sugar Plant Company Profile

Main activities of Kernel Holding Farming and Purchasing BULK OIL Market share 24. 2% #1 in Ukraine Processing BOTTLED OIL Market share 32. 0% #1 in Ukraine Supply Chain SUGAR Market share 6. 9% #4 in Ukraine 7. 2% of the world sunflower oil output ØBulk oil 7 oil plants in Ukraine 3 oil plants in Russia ØBottled oil 3 brands + private label - Oil Plant - Sugar Plant Company Profile

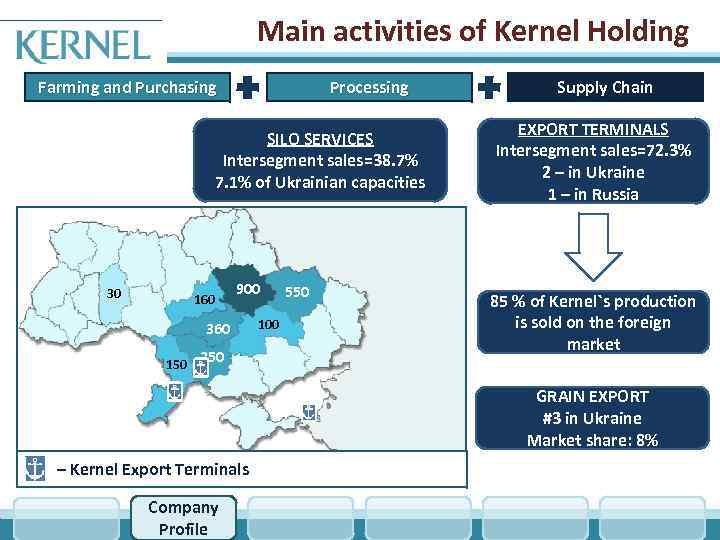

Main activities of Kernel Holding Farming and Purchasing Processing SILO SERVICES Intersegment sales=38. 7% 7. 1% of Ukrainian capacities 30 160 360 150 900 550 100 250 Supply Chain EXPORT TERMINALS Intersegment sales=72. 3% 2 – in Ukraine 1 – in Russia 85 % of Kernel`s production is sold on the foreign market GRAIN EXPORT #3 in Ukraine Market share: 8% – Kernel Export Terminals numbers – Kernel silos capacity in the regions, Ths tons Company Profile

Main activities of Kernel Holding Farming and Purchasing Processing SILO SERVICES Intersegment sales=38. 7% 7. 1% of Ukrainian capacities 30 160 360 150 900 550 100 250 Supply Chain EXPORT TERMINALS Intersegment sales=72. 3% 2 – in Ukraine 1 – in Russia 85 % of Kernel`s production is sold on the foreign market GRAIN EXPORT #3 in Ukraine Market share: 8% – Kernel Export Terminals numbers – Kernel silos capacity in the regions, Ths tons Company Profile

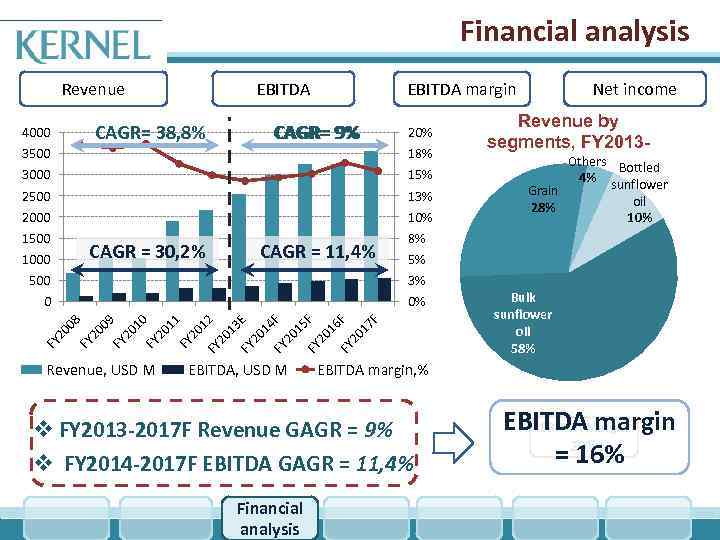

Financial analysis Revenue EBITDA CAGR= 38, 8% 4000 EBITDA margin CAGR= 9% 20% 3500 18% 3000 15% 2500 13% 2000 10% 1500 Net income Revenue by segments, FY 2013 - 8% CAGR = 30, 2% 1000 CAGR = 11, 4% Others Bottled 4% sunflower Grain oil 28% 10% 5% Revenue, USD M EBITDA, USD M F 17 20 FY FY 20 16 F F 15 20 F 14 FY 20 3 E FY 01 12 FY 2 20 FY 20 FY 11 0% 10 0 09 3% 08 500 EBITDA margin, % v FY 2013 -2017 F Revenue GAGR = 9% v FY 2014 -2017 F EBITDA GAGR = 11, 4% Financial analysis Bulk sunflower oil 58% EBITDA margin EBITDA Margin 20% 17% 8% = 16%

Financial analysis Revenue EBITDA CAGR= 38, 8% 4000 EBITDA margin CAGR= 9% 20% 3500 18% 3000 15% 2500 13% 2000 10% 1500 Net income Revenue by segments, FY 2013 - 8% CAGR = 30, 2% 1000 CAGR = 11, 4% Others Bottled 4% sunflower Grain oil 28% 10% 5% Revenue, USD M EBITDA, USD M F 17 20 FY FY 20 16 F F 15 20 F 14 FY 20 3 E FY 01 12 FY 2 20 FY 20 FY 11 0% 10 0 09 3% 08 500 EBITDA margin, % v FY 2013 -2017 F Revenue GAGR = 9% v FY 2014 -2017 F EBITDA GAGR = 11, 4% Financial analysis Bulk sunflower oil 58% EBITDA margin EBITDA Margin 20% 17% 8% = 16%

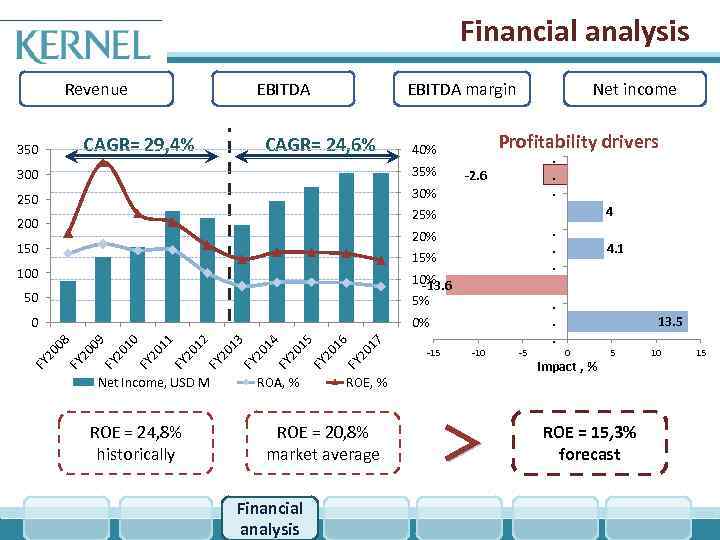

Financial analysis Revenue EBITDA CAGR= 29, 4% 350 EBITDA margin CAGR= 24, 6% Profitability drivers 40% 300 35% 250 Net income . . . 30% -2. 6 4 25% 200 . . . 20% 150 15% 100 10% -13. 6 5% 50 Net Income, USD M ROE = 24, 8% historically ROA, % 17 20 -10 ROE, % ROE = 20, 8% market average Financial analysis -15 FY 16 FY 20 15 20 14 FY FY 20 13 20 FY 12 20 11 FY FY 20 10 20 FY 09 0% 08 0 > -5 . . . 4. 1 13. 5 0 impact , % 5 ROE = 15, 3% forecast 10 15

Financial analysis Revenue EBITDA CAGR= 29, 4% 350 EBITDA margin CAGR= 24, 6% Profitability drivers 40% 300 35% 250 Net income . . . 30% -2. 6 4 25% 200 . . . 20% 150 15% 100 10% -13. 6 5% 50 Net Income, USD M ROE = 24, 8% historically ROA, % 17 20 -10 ROE, % ROE = 20, 8% market average Financial analysis -15 FY 16 FY 20 15 20 14 FY FY 20 13 20 FY 12 20 11 FY FY 20 10 20 FY 09 0% 08 0 > -5 . . . 4. 1 13. 5 0 impact , % 5 ROE = 15, 3% forecast 10 15

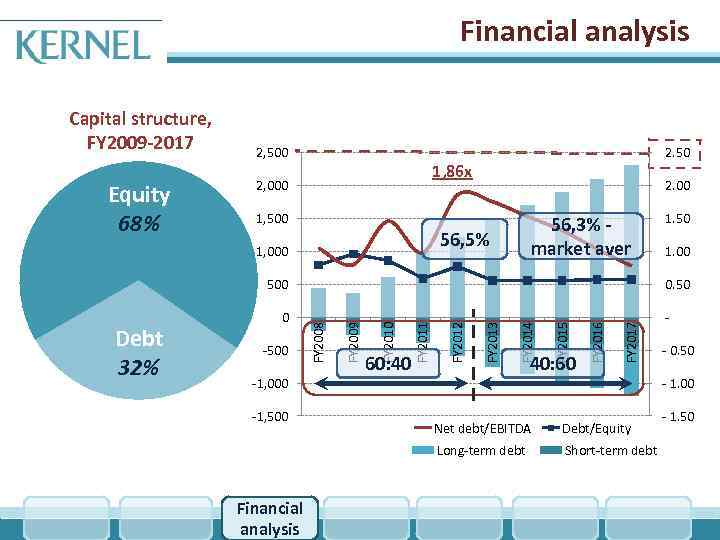

Financial analysis Capital structure, FY 2009 -2017 Equity 68% 2, 500 2. 50 1, 86 x 2, 000 1, 500 2. 00 56, 3% - market aver 56, 5% 1, 000 -1, 500 FY 2017 40: 60 FY 2016 FY 2015 FY 2014 FY 2013 FY 2012 60: 40 FY 2011 FY 2010 32% -500 FY 2009 Debt 0 Net debt/EBITDA Debt/Equity Long-term debt Financial analysis 1. 00 0. 50 FY 2008 500 1. 50 Short-term debt - 0. 50 - 1. 00 - 1. 50

Financial analysis Capital structure, FY 2009 -2017 Equity 68% 2, 500 2. 50 1, 86 x 2, 000 1, 500 2. 00 56, 3% - market aver 56, 5% 1, 000 -1, 500 FY 2017 40: 60 FY 2016 FY 2015 FY 2014 FY 2013 FY 2012 60: 40 FY 2011 FY 2010 32% -500 FY 2009 Debt 0 Net debt/EBITDA Debt/Equity Long-term debt Financial analysis 1. 00 0. 50 FY 2008 500 1. 50 Short-term debt - 0. 50 - 1. 00 - 1. 50

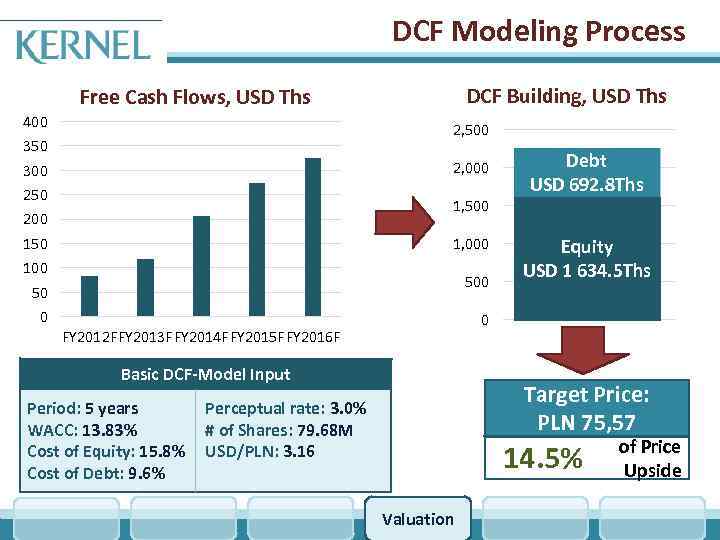

DCF Modeling Process DCF Building, USD Ths Free Cash Flows, USD Ths 400 2, 500 350 2, 000 300 250 1, 500 200 150 1, 000 100 50 0 0 FY 2012 FFY 2013 FFY 2014 FFY 2015 FFY 2016 F Basic DCF-Model Input Period: 5 years WACC: 13. 83% Cost of Equity: 15. 8% Cost of Debt: 9. 6% Debt USD 692. 8 Ths PV TV EV USD 1 641. 9 Ths USD 2 275. 8 Ths Equity USD 1 634. 5 Ths PV FCFF USD 633. 9 Ths Target Price: PLN 75, 57 Perceptual rate: 3. 0% # of Shares: 79. 68 M USD/PLN: 3. 16 of Price 14. 5% Upside Valuation

DCF Modeling Process DCF Building, USD Ths Free Cash Flows, USD Ths 400 2, 500 350 2, 000 300 250 1, 500 200 150 1, 000 100 50 0 0 FY 2012 FFY 2013 FFY 2014 FFY 2015 FFY 2016 F Basic DCF-Model Input Period: 5 years WACC: 13. 83% Cost of Equity: 15. 8% Cost of Debt: 9. 6% Debt USD 692. 8 Ths PV TV EV USD 1 641. 9 Ths USD 2 275. 8 Ths Equity USD 1 634. 5 Ths PV FCFF USD 633. 9 Ths Target Price: PLN 75, 57 Perceptual rate: 3. 0% # of Shares: 79. 68 M USD/PLN: 3. 16 of Price 14. 5% Upside Valuation

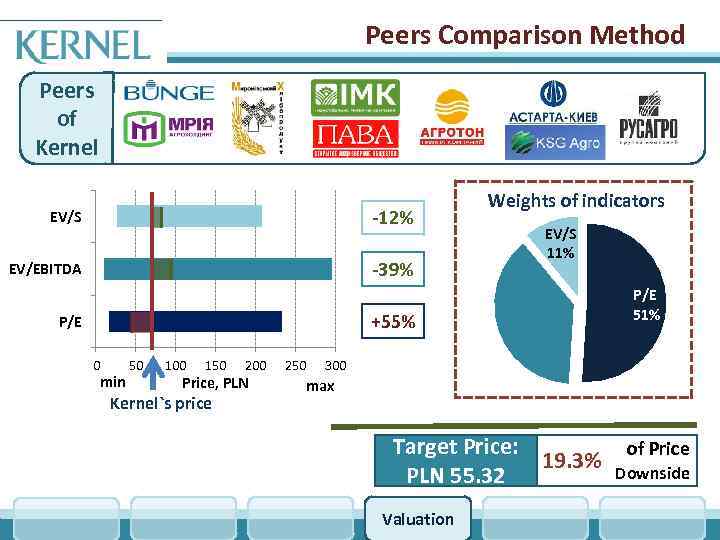

Peers Comparison Method Peers of Kernel EV/S -12% EV/EBITDA Weights of indicators -39% EV/S 11% +55% EV/EBITDA P/E 51% 38% 0 min 50 100 150 200 Price, PLN Kernel`s price 250 300 max Target Price: of Price 19. 3% Downside PLN 55. 32 Valuation

Peers Comparison Method Peers of Kernel EV/S -12% EV/EBITDA Weights of indicators -39% EV/S 11% +55% EV/EBITDA P/E 51% 38% 0 min 50 100 150 200 Price, PLN Kernel`s price 250 300 max Target Price: of Price 19. 3% Downside PLN 55. 32 Valuation

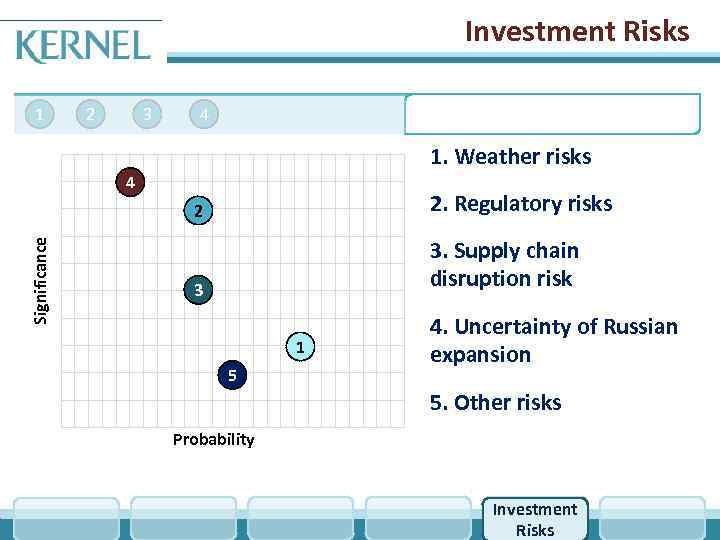

Investment Risks 1 2 3 4 1. Weather risks 4 Significance 2 2. Regulatory risks 3 3. Supply chain disruption risk 1 5 4. Uncertainty of Russian expansion 5. Other risks Probability Investment Risks

Investment Risks 1 2 3 4 1. Weather risks 4 Significance 2 2. Regulatory risks 3 3. Supply chain disruption risk 1 5 4. Uncertainty of Russian expansion 5. Other risks Probability Investment Risks

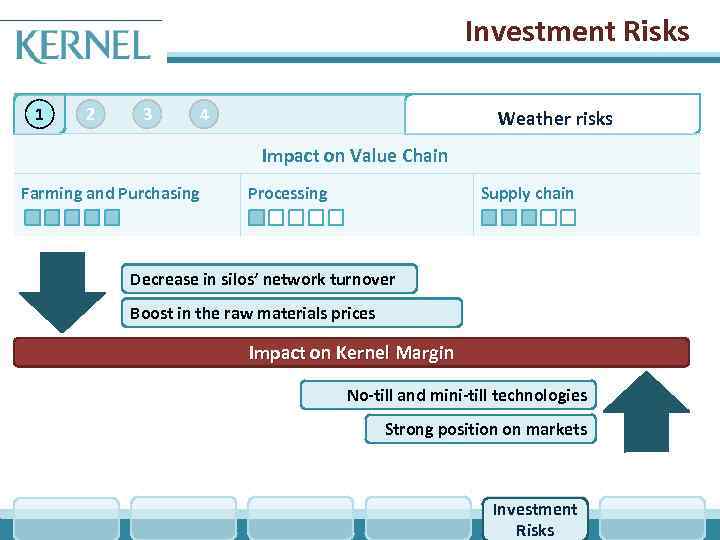

Investment Risks 1 2 3 4 Weather risks Impact on Value Chain Farming and Purchasing Processing Supply chain Decrease in silos’ network turnover Boost in the raw materials prices Impact on Kernel Margin No-till and mini-till technologies Strong position on markets Investment Risks

Investment Risks 1 2 3 4 Weather risks Impact on Value Chain Farming and Purchasing Processing Supply chain Decrease in silos’ network turnover Boost in the raw materials prices Impact on Kernel Margin No-till and mini-till technologies Strong position on markets Investment Risks

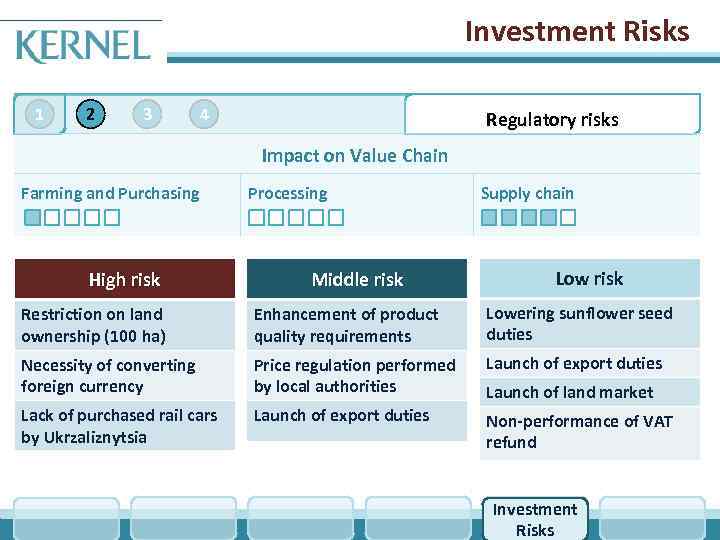

Investment Risks 1 2 3 4 Regulatory risks Impact on Value Chain Farming and Purchasing High risk Processing Middle risk Supply chain Low risk Restriction on land ownership (100 ha) Enhancement of product quality requirements Lowering sunflower seed duties Necessity of converting foreign currency Price regulation performed by local authorities Launch of export duties Lack of purchased rail cars by Ukrzaliznytsia Launch of export duties Non-performance of VAT refund Launch of land market Investment Risks

Investment Risks 1 2 3 4 Regulatory risks Impact on Value Chain Farming and Purchasing High risk Processing Middle risk Supply chain Low risk Restriction on land ownership (100 ha) Enhancement of product quality requirements Lowering sunflower seed duties Necessity of converting foreign currency Price regulation performed by local authorities Launch of export duties Lack of purchased rail cars by Ukrzaliznytsia Launch of export duties Non-performance of VAT refund Launch of land market Investment Risks

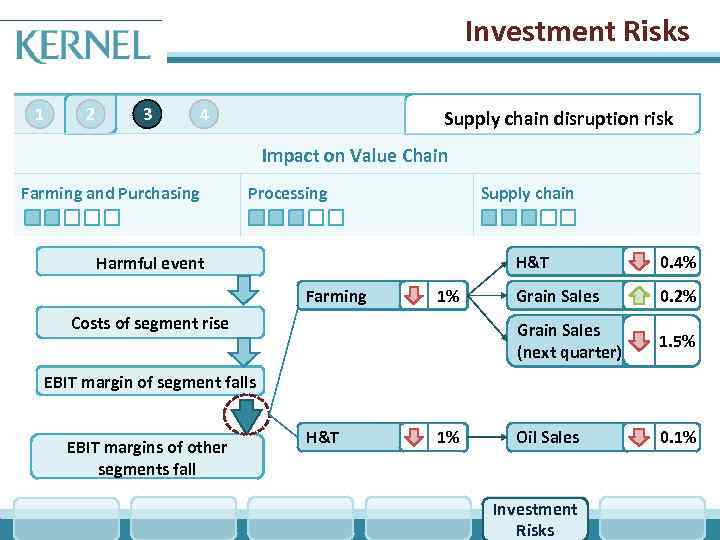

Investment Risks 1 2 3 4 Supply chain disruption risk Impact on Value Chain Farming and Purchasing Processing Supply chain H&T Farming 1% Costs of segment rise 0. 4% Grain Sales 0. 2% Grain Sales (next quarter) Harmful event 1. 5% Oil Sales 0. 1% EBIT margin of segment falls EBIT margins of other segments fall H&T 1% Investment Risks

Investment Risks 1 2 3 4 Supply chain disruption risk Impact on Value Chain Farming and Purchasing Processing Supply chain H&T Farming 1% Costs of segment rise 0. 4% Grain Sales 0. 2% Grain Sales (next quarter) Harmful event 1. 5% Oil Sales 0. 1% EBIT margin of segment falls EBIT margins of other segments fall H&T 1% Investment Risks

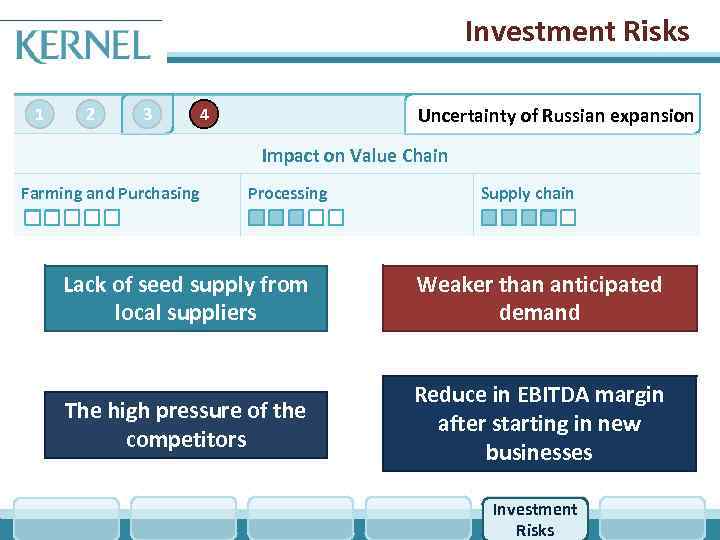

Investment Risks 1 2 3 4 Uncertainty of Russian expansion Impact on Value Chain Farming and Purchasing Processing Supply chain Lack of seed supply from local suppliers Weaker than anticipated demand The high pressure of the competitors Reduce in EBITDA margin after starting in new businesses Investment Risks

Investment Risks 1 2 3 4 Uncertainty of Russian expansion Impact on Value Chain Farming and Purchasing Processing Supply chain Lack of seed supply from local suppliers Weaker than anticipated demand The high pressure of the competitors Reduce in EBITDA margin after starting in new businesses Investment Risks

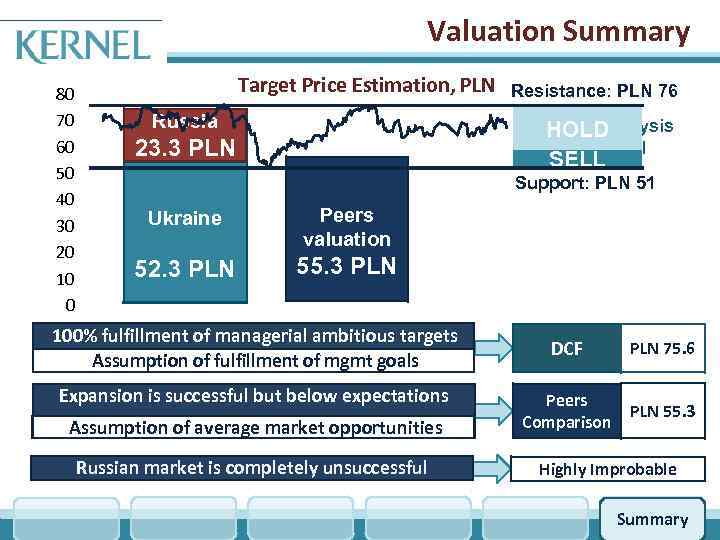

Valuation Summary 80 70 60 50 40 30 20 10 0 Target Price Estimation, PLN Resistance: PLN 76 Russia Technical analysis HOLD price tunnel 23. 3 PLN DCF target price Ukraine PLN 75. 6 52. 3 PLN SELL Support: PLN 51 Peers valuation 55. 3 PLN DCF Peers Valuation 100% fulfillment of managerial ambitious targets Assumption of fulfillment of mgmt goals Expansion is successful but below expectations Assumption of average market opportunities Russian market is completely unsuccessful DCF PLN 75. 6 Peers Comparison PLN 55. 3 Highly Improbable Summary

Valuation Summary 80 70 60 50 40 30 20 10 0 Target Price Estimation, PLN Resistance: PLN 76 Russia Technical analysis HOLD price tunnel 23. 3 PLN DCF target price Ukraine PLN 75. 6 52. 3 PLN SELL Support: PLN 51 Peers valuation 55. 3 PLN DCF Peers Valuation 100% fulfillment of managerial ambitious targets Assumption of fulfillment of mgmt goals Expansion is successful but below expectations Assumption of average market opportunities Russian market is completely unsuccessful DCF PLN 75. 6 Peers Comparison PLN 55. 3 Highly Improbable Summary

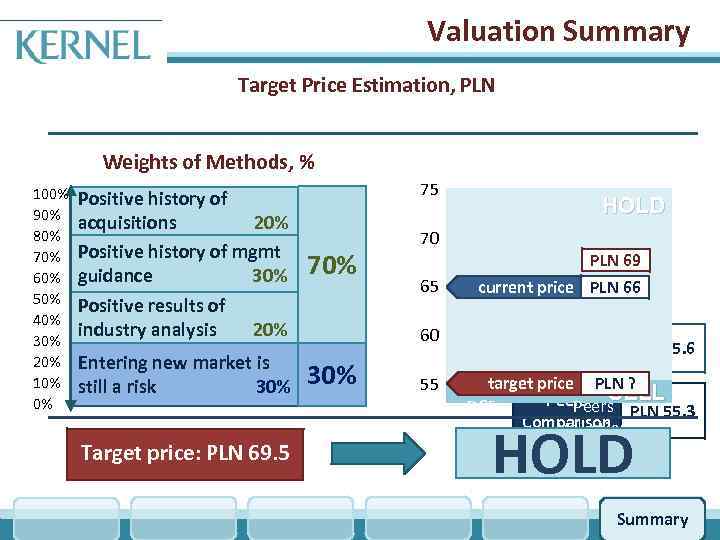

Valuation Summary Target Price Estimation, PLN Weights of Methods, % 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 75 Positive history of acquisitions 20% Positive history of mgmt guidance 30% Positive results of industry analysis 20% 70% Entering new market is still a risk 30% Target price: PLN 69. 5 HOLD 70 65 60 55 PLN 69 current price PLN 66 DCF PLN 75. 6 target price PLN ? Peers SELL DCF Peers PLN 55. 3 Comparison Valuation HOLD Summary

Valuation Summary Target Price Estimation, PLN Weights of Methods, % 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 75 Positive history of acquisitions 20% Positive history of mgmt guidance 30% Positive results of industry analysis 20% 70% Entering new market is still a risk 30% Target price: PLN 69. 5 HOLD 70 65 60 55 PLN 69 current price PLN 66 DCF PLN 75. 6 target price PLN ? Peers SELL DCF Peers PLN 55. 3 Comparison Valuation HOLD Summary

Appendixes

Appendixes

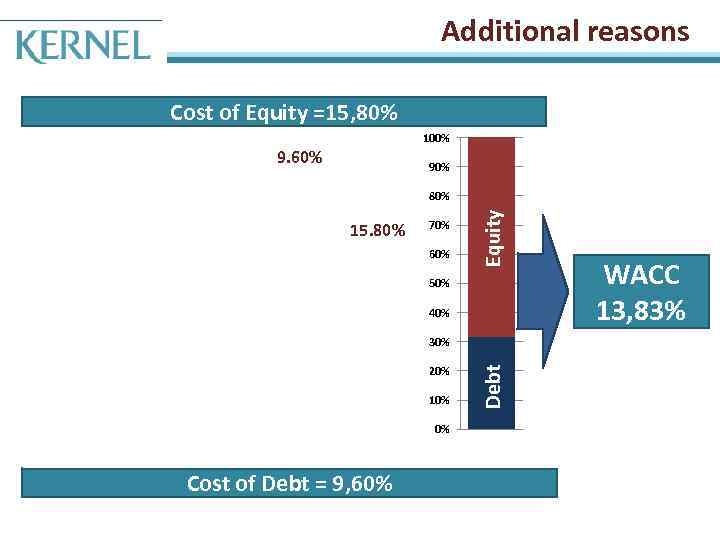

Additional reasons Cost of Equity =15, 80% 100% Cost of Debt 9. 60% 90% 15. 80% 70% 60% Equity 80% 50% 40% 20% 10% 0% Cost of Debt = 9, 60% Debt 30% WACC 13, 83%

Additional reasons Cost of Equity =15, 80% 100% Cost of Debt 9. 60% 90% 15. 80% 70% 60% Equity 80% 50% 40% 20% 10% 0% Cost of Debt = 9, 60% Debt 30% WACC 13, 83%

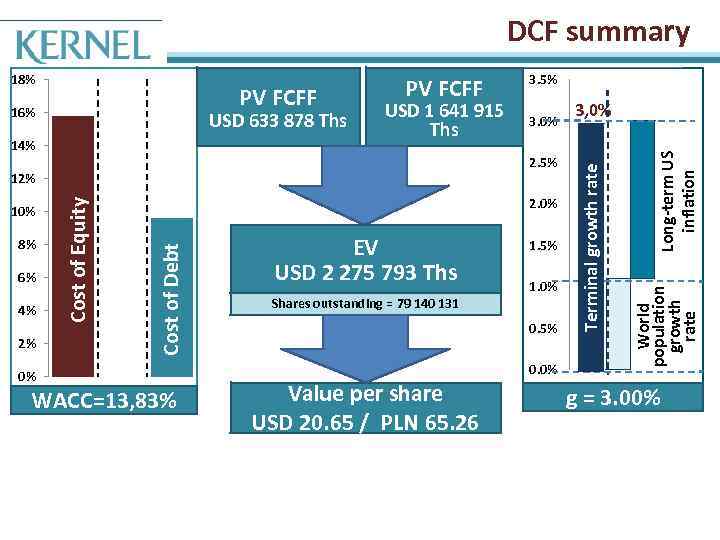

DCF summary 14% USD 1 641 915 Ths 2. 5% 6% 4% 2% 2. 0% Cost of Debt 8% Cost of Equity 12% 10% 3. 0% 0% WACC=13, 83% EV USD 2 275 793 Ths Shares outstanding = 79 140 131 1. 5% 1. 0% 0. 5% 0. 0% Value per share USD 20. 65 / PLN 65. 26 3, 0% Long-term US inflation USD 633 878 Ths 3. 5% World population growth rate PV FCFF 16% PV FCFF Terminal growth rate 18% g = 3. 00%

DCF summary 14% USD 1 641 915 Ths 2. 5% 6% 4% 2% 2. 0% Cost of Debt 8% Cost of Equity 12% 10% 3. 0% 0% WACC=13, 83% EV USD 2 275 793 Ths Shares outstanding = 79 140 131 1. 5% 1. 0% 0. 5% 0. 0% Value per share USD 20. 65 / PLN 65. 26 3, 0% Long-term US inflation USD 633 878 Ths 3. 5% World population growth rate PV FCFF 16% PV FCFF Terminal growth rate 18% g = 3. 00%

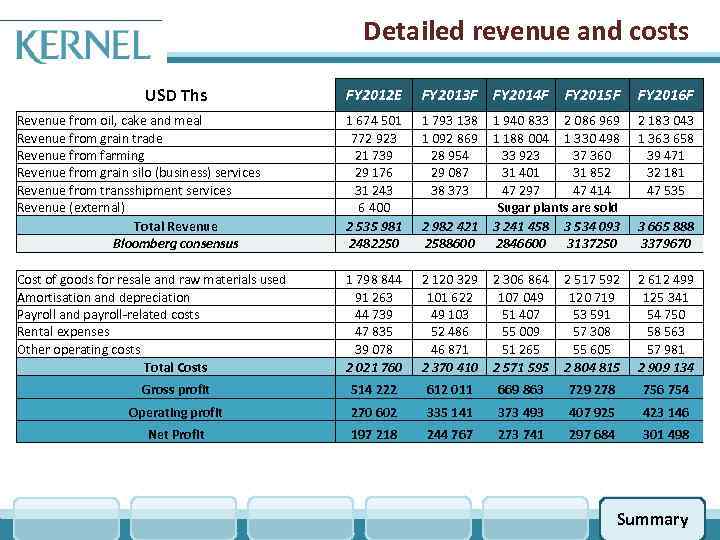

Detailed revenue and costs USD Ths FY 2012 E FY 2013 F FY 2014 F FY 2015 F FY 2016 F Revenue from oil, cake and meal Revenue from grain trade Revenue from farming Revenue from grain silo (business) services Revenue from transshipment services Revenue (external) Total Revenue Bloomberg consensus 1 674 501 772 923 21 739 29 176 31 243 6 400 2 535 981 2482250 1 793 138 1 092 869 28 954 29 087 38 373 2 183 043 1 363 658 39 471 32 181 47 535 2 982 421 2588600 1 940 833 2 086 969 1 188 004 1 330 498 33 923 37 360 31 401 31 852 47 297 47 414 Sugar plants are sold 3 241 458 3 534 093 2846600 3137250 Cost of goods for resale and raw materials used Amortisation and depreciation Payroll and payroll-related costs Rental expenses Other operating costs Total Costs 1 798 844 91 263 44 739 47 835 39 078 2 021 760 2 120 329 101 622 49 103 52 486 46 871 2 370 410 2 306 864 107 049 51 407 55 009 51 265 2 571 595 2 517 592 120 719 53 591 57 308 55 605 2 804 815 2 612 499 125 341 54 750 58 563 57 981 2 909 134 Gross profit 514 222 612 011 669 863 729 278 756 754 Operating profit 270 602 335 141 373 493 407 925 423 146 Net Profit 197 218 244 767 273 741 297 684 301 498 3 665 888 3379670 Summary

Detailed revenue and costs USD Ths FY 2012 E FY 2013 F FY 2014 F FY 2015 F FY 2016 F Revenue from oil, cake and meal Revenue from grain trade Revenue from farming Revenue from grain silo (business) services Revenue from transshipment services Revenue (external) Total Revenue Bloomberg consensus 1 674 501 772 923 21 739 29 176 31 243 6 400 2 535 981 2482250 1 793 138 1 092 869 28 954 29 087 38 373 2 183 043 1 363 658 39 471 32 181 47 535 2 982 421 2588600 1 940 833 2 086 969 1 188 004 1 330 498 33 923 37 360 31 401 31 852 47 297 47 414 Sugar plants are sold 3 241 458 3 534 093 2846600 3137250 Cost of goods for resale and raw materials used Amortisation and depreciation Payroll and payroll-related costs Rental expenses Other operating costs Total Costs 1 798 844 91 263 44 739 47 835 39 078 2 021 760 2 120 329 101 622 49 103 52 486 46 871 2 370 410 2 306 864 107 049 51 407 55 009 51 265 2 571 595 2 517 592 120 719 53 591 57 308 55 605 2 804 815 2 612 499 125 341 54 750 58 563 57 981 2 909 134 Gross profit 514 222 612 011 669 863 729 278 756 754 Operating profit 270 602 335 141 373 493 407 925 423 146 Net Profit 197 218 244 767 273 741 297 684 301 498 3 665 888 3379670 Summary

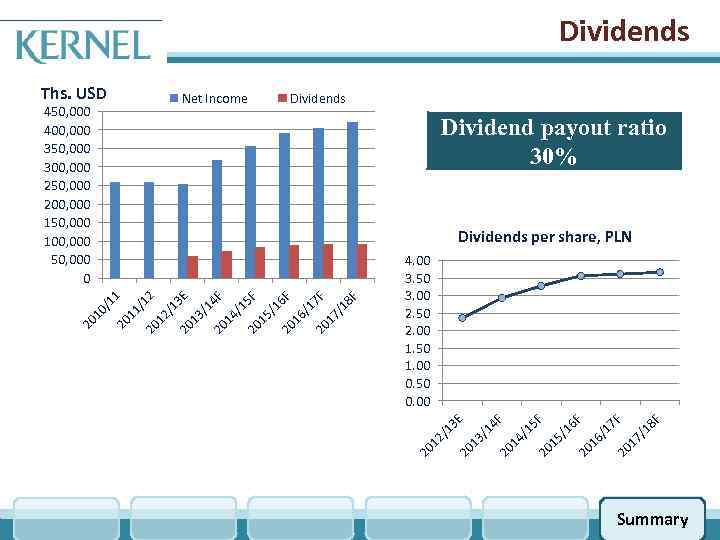

Dividends Ths. USD Net Income 450, 000 400, 000 350, 000 300, 000 250, 000 200, 000 150, 000 100, 000 50, 000 0 Dividends Dividend payout ratio 30% 8 F 17 /1 7 F 20 /1 16 20 15 /1 6 F 5 F 20 14 /1 4 F 20 /1 13 20 12 /1 3 E 4. 00 3. 50 3. 00 2. 50 2. 00 1. 50 1. 00 0. 50 0. 00 20 8 F 17 /1 7 F 20 /1 16 20 15 /1 6 F 5 F 20 14 /1 4 F /1 20 13 20 /1 3 E 2 12 /1 20 11 20 20 10 /1 1 Dividends per share, PLN Summary

Dividends Ths. USD Net Income 450, 000 400, 000 350, 000 300, 000 250, 000 200, 000 150, 000 100, 000 50, 000 0 Dividends Dividend payout ratio 30% 8 F 17 /1 7 F 20 /1 16 20 15 /1 6 F 5 F 20 14 /1 4 F 20 /1 13 20 12 /1 3 E 4. 00 3. 50 3. 00 2. 50 2. 00 1. 50 1. 00 0. 50 0. 00 20 8 F 17 /1 7 F 20 /1 16 20 15 /1 6 F 5 F 20 14 /1 4 F /1 20 13 20 /1 3 E 2 12 /1 20 11 20 20 10 /1 1 Dividends per share, PLN Summary

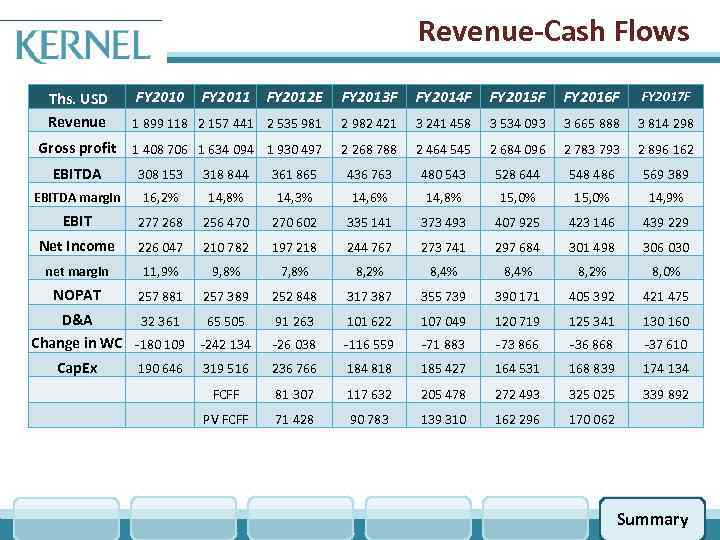

Revenue-Cash Flows Ths. USD Revenue FY 2010 FY 2011 FY 2012 E FY 2013 F FY 2014 F FY 2015 F FY 2016 F FY 2017 F 1 899 118 2 157 441 2 535 981 2 982 421 3 241 458 3 534 093 3 665 888 3 814 298 Gross profit 1 408 706 1 634 094 1 930 497 2 268 788 2 464 545 2 684 096 2 783 793 2 896 162 EBITDA 308 153 318 844 361 865 436 763 480 543 528 644 548 486 569 389 EBITDA margin 16, 2% 14, 8% 14, 3% 14, 6% 14, 8% 15, 0% 14, 9% EBIT 277 268 256 470 270 602 335 141 373 493 407 925 423 146 439 229 Net Income 226 047 210 782 197 218 244 767 273 741 297 684 301 498 306 030 net margin 11, 9% 9, 8% 7, 8% 8, 2% 8, 4% 8, 2% 8, 0% NOPAT 257 881 257 389 252 848 317 387 355 739 390 171 405 392 421 475 D&A 32 361 65 505 Change in WC -180 109 -242 134 Cap. Ex 190 646 319 516 91 263 101 622 107 049 120 719 125 341 130 160 -26 038 -116 559 -71 883 -73 866 -36 868 -37 610 236 766 184 818 185 427 164 531 168 839 174 134 FCFF 81 307 117 632 205 478 272 493 325 025 339 892 PV FCFF 71 428 90 783 139 310 162 296 170 062 Summary

Revenue-Cash Flows Ths. USD Revenue FY 2010 FY 2011 FY 2012 E FY 2013 F FY 2014 F FY 2015 F FY 2016 F FY 2017 F 1 899 118 2 157 441 2 535 981 2 982 421 3 241 458 3 534 093 3 665 888 3 814 298 Gross profit 1 408 706 1 634 094 1 930 497 2 268 788 2 464 545 2 684 096 2 783 793 2 896 162 EBITDA 308 153 318 844 361 865 436 763 480 543 528 644 548 486 569 389 EBITDA margin 16, 2% 14, 8% 14, 3% 14, 6% 14, 8% 15, 0% 14, 9% EBIT 277 268 256 470 270 602 335 141 373 493 407 925 423 146 439 229 Net Income 226 047 210 782 197 218 244 767 273 741 297 684 301 498 306 030 net margin 11, 9% 9, 8% 7, 8% 8, 2% 8, 4% 8, 2% 8, 0% NOPAT 257 881 257 389 252 848 317 387 355 739 390 171 405 392 421 475 D&A 32 361 65 505 Change in WC -180 109 -242 134 Cap. Ex 190 646 319 516 91 263 101 622 107 049 120 719 125 341 130 160 -26 038 -116 559 -71 883 -73 866 -36 868 -37 610 236 766 184 818 185 427 164 531 168 839 174 134 FCFF 81 307 117 632 205 478 272 493 325 025 339 892 PV FCFF 71 428 90 783 139 310 162 296 170 062 Summary

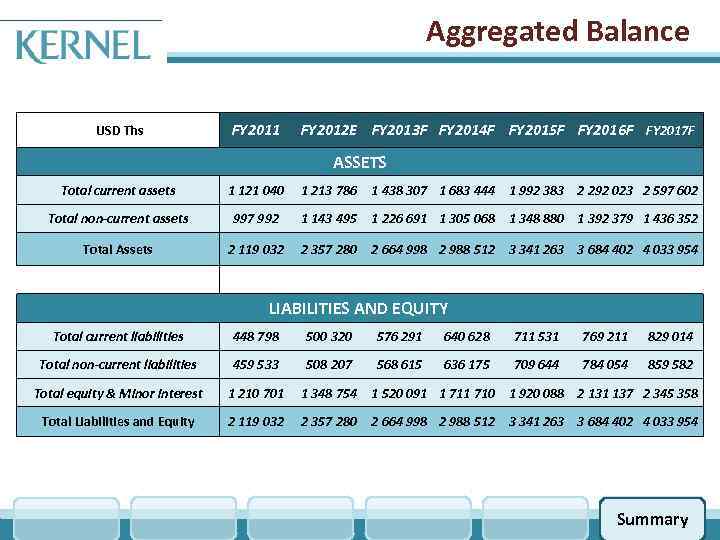

Aggregated Balance USD Ths FY 2011 FY 2012 E FY 2013 F FY 2014 F FY 2015 F FY 2016 F FY 2017 F ASSETS Total current assets 1 121 040 1 213 786 1 438 307 1 683 444 1 992 383 2 292 023 2 597 602 Total non-current assets 997 992 1 143 495 1 226 691 1 305 068 1 348 880 1 392 379 1 436 352 Total Assets 2 119 032 2 357 280 2 664 998 2 988 512 3 341 263 3 684 402 4 033 954 LIABILITIES AND EQUITY Total current liabilities 448 798 500 320 576 291 640 628 711 531 769 211 829 014 Total non-current liabilities 459 533 508 207 568 615 636 175 709 644 784 054 859 582 Total equity & Minor interest 1 210 701 1 348 754 1 520 091 1 710 1 920 088 2 131 137 2 345 358 Total Liabilities and Equity 2 119 032 2 357 280 2 664 998 2 988 512 3 341 263 3 684 402 4 033 954 Summary

Aggregated Balance USD Ths FY 2011 FY 2012 E FY 2013 F FY 2014 F FY 2015 F FY 2016 F FY 2017 F ASSETS Total current assets 1 121 040 1 213 786 1 438 307 1 683 444 1 992 383 2 292 023 2 597 602 Total non-current assets 997 992 1 143 495 1 226 691 1 305 068 1 348 880 1 392 379 1 436 352 Total Assets 2 119 032 2 357 280 2 664 998 2 988 512 3 341 263 3 684 402 4 033 954 LIABILITIES AND EQUITY Total current liabilities 448 798 500 320 576 291 640 628 711 531 769 211 829 014 Total non-current liabilities 459 533 508 207 568 615 636 175 709 644 784 054 859 582 Total equity & Minor interest 1 210 701 1 348 754 1 520 091 1 710 1 920 088 2 131 137 2 345 358 Total Liabilities and Equity 2 119 032 2 357 280 2 664 998 2 988 512 3 341 263 3 684 402 4 033 954 Summary

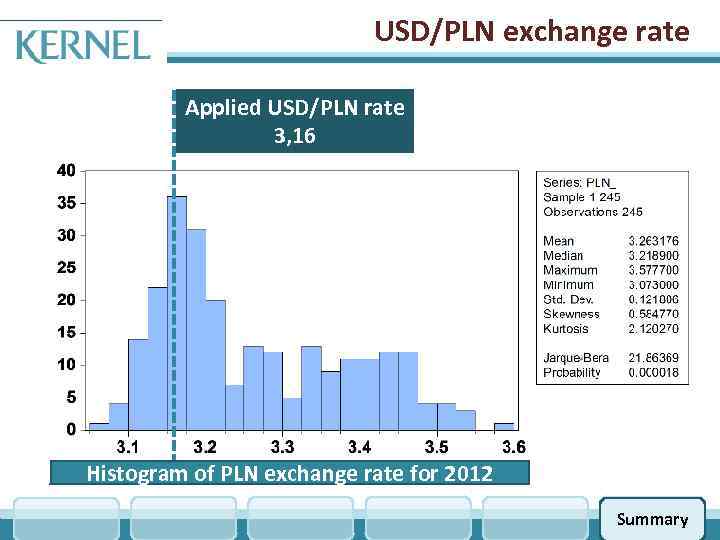

USD/PLN exchange rate Applied USD/PLN rate 3, 16 Histogram of PLN exchange rate for 2012 Summary

USD/PLN exchange rate Applied USD/PLN rate 3, 16 Histogram of PLN exchange rate for 2012 Summary

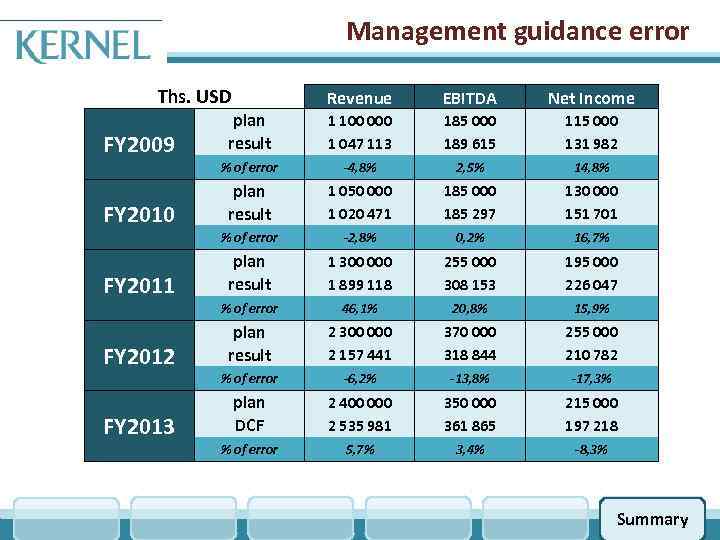

Management guidance error Ths. USD FY 2013 1 100 000 1 047 113 185 000 189 615 115 000 131 982 -4, 8% 2, 5% 14, 8% plan result 1 050 000 1 020 471 185 000 185 297 130 000 151 701 -2, 8% 0, 2% 16, 7% plan result 1 300 000 1 899 118 255 000 308 153 195 000 226 047 46, 1% 20, 8% 15, 9% plan result 2 300 000 2 157 441 370 000 318 844 255 000 210 782 % of error FY 2012 plan result % of error FY 2011 Net Income % of error FY 2010 EBITDA % of error FY 2009 Revenue -6, 2% -13, 8% -17, 3% plan DCF 2 400 000 2 535 981 350 000 361 865 215 000 197 218 % of error 5, 7% 3, 4% -8, 3% Summary

Management guidance error Ths. USD FY 2013 1 100 000 1 047 113 185 000 189 615 115 000 131 982 -4, 8% 2, 5% 14, 8% plan result 1 050 000 1 020 471 185 000 185 297 130 000 151 701 -2, 8% 0, 2% 16, 7% plan result 1 300 000 1 899 118 255 000 308 153 195 000 226 047 46, 1% 20, 8% 15, 9% plan result 2 300 000 2 157 441 370 000 318 844 255 000 210 782 % of error FY 2012 plan result % of error FY 2011 Net Income % of error FY 2010 EBITDA % of error FY 2009 Revenue -6, 2% -13, 8% -17, 3% plan DCF 2 400 000 2 535 981 350 000 361 865 215 000 197 218 % of error 5, 7% 3, 4% -8, 3% Summary