289bd8a1d27b7986b6d15be2f8127070.ppt

- Количество слайдов: 14

Are You Totally Protected?

Are You Totally Protected?

Who is USA Benefits Group? About the Company § USA Benefits Group is a nationwide network of health and life insurance professionals that have been serving small business owners and the self-employed since 1988 § Non-captive agents working for you, not the insurance company Stability § 26 years of Health and Life Insurance Specialization § A+ rating with the Better Business Bureau Security § Representing top-rated companies as determined by A. M. Best § Totally secure online platform and HIPAA compliant Superior Customer Service § Available when you need us § Promptness in handling your requests

Who is USA Benefits Group? About the Company § USA Benefits Group is a nationwide network of health and life insurance professionals that have been serving small business owners and the self-employed since 1988 § Non-captive agents working for you, not the insurance company Stability § 26 years of Health and Life Insurance Specialization § A+ rating with the Better Business Bureau Security § Representing top-rated companies as determined by A. M. Best § Totally secure online platform and HIPAA compliant Superior Customer Service § Available when you need us § Promptness in handling your requests

Enrollment Procedure Getting Started § Although ACA Plans are Guaranteed Issue you still have to go through an enrollment procedure. We must submit personal information to the insurance company including your income and whether you are a smoker or non-smoker. Some Non-ACA Plans have a short list of health questions. Initial Deposit § Most plans require that you submit your first months premium up front as a good faith deposit. Some plans have a one-time application fee in addition to that. Your New Policy is Issued § When your enrollment is approved you will be given an effective date of coverage. Of course, your first month’s premium will be paid up. Future Premium Payments § Starting the second month your premium will be paid through a monthly bank draft. This guarantees that your policy will be in force if and when you need it in the future.

Enrollment Procedure Getting Started § Although ACA Plans are Guaranteed Issue you still have to go through an enrollment procedure. We must submit personal information to the insurance company including your income and whether you are a smoker or non-smoker. Some Non-ACA Plans have a short list of health questions. Initial Deposit § Most plans require that you submit your first months premium up front as a good faith deposit. Some plans have a one-time application fee in addition to that. Your New Policy is Issued § When your enrollment is approved you will be given an effective date of coverage. Of course, your first month’s premium will be paid up. Future Premium Payments § Starting the second month your premium will be paid through a monthly bank draft. This guarantees that your policy will be in force if and when you need it in the future.

Fact Finding Questions § How old are you? What is your spouse’s name and age? § How many dependent children will be covered? § Does anyone currently smoke? § Does anyone have any pre-existing health conditions? § Has anyone been hospitalized in the last 5 years? § Is anyone taking any prescription drugs regularly? § How much do you spend on prescriptions per year? § How many times a year do you go to the doctor? § Do you currently have health insurance? What company? § What is your current monthly cost? § What is your current annual household income? § What do you like about your current plan? § What do you dislike about your current plan? § What is the main reason that you buy health insurance?

Fact Finding Questions § How old are you? What is your spouse’s name and age? § How many dependent children will be covered? § Does anyone currently smoke? § Does anyone have any pre-existing health conditions? § Has anyone been hospitalized in the last 5 years? § Is anyone taking any prescription drugs regularly? § How much do you spend on prescriptions per year? § How many times a year do you go to the doctor? § Do you currently have health insurance? What company? § What is your current monthly cost? § What is your current annual household income? § What do you like about your current plan? § What do you dislike about your current plan? § What is the main reason that you buy health insurance?

Over the last 20+ years there has been a trend in the health insurance industry § Premiums have been increasing. § Deductibles have been increasing. § Co-insurance has been increasing. § Even though it was not a planned outcome of the Affordable Care Act (ACA) this trend will continue in the future.

Over the last 20+ years there has been a trend in the health insurance industry § Premiums have been increasing. § Deductibles have been increasing. § Co-insurance has been increasing. § Even though it was not a planned outcome of the Affordable Care Act (ACA) this trend will continue in the future.

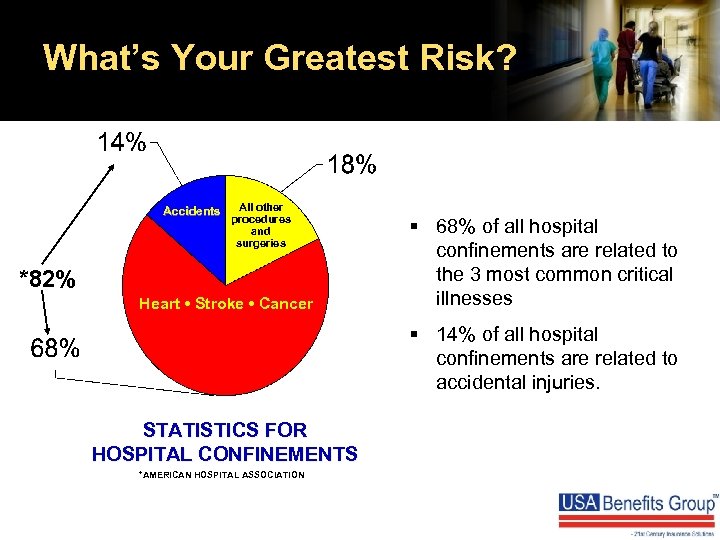

What’s Your Greatest Risk? Accidents All other procedures and surgeries *82% Heart • Stroke • Cancer § 68% of all hospital confinements are related to the 3 most common critical illnesses § 14% of all hospital confinements are related to accidental injuries. STATISTICS FOR HOSPITAL CONFINEMENTS *AMERICAN HOSPITAL ASSOCIATION

What’s Your Greatest Risk? Accidents All other procedures and surgeries *82% Heart • Stroke • Cancer § 68% of all hospital confinements are related to the 3 most common critical illnesses § 14% of all hospital confinements are related to accidental injuries. STATISTICS FOR HOSPITAL CONFINEMENTS *AMERICAN HOSPITAL ASSOCIATION

Important Statistics § Heart Attacks & Strokes – Every 16 seconds someone in the U. S. has a coronary event. – That’s more than 5, 600 people per day! – In the last 10 years survival rates have gone up over 20%. § Cancer – Every 24 seconds someone in the U. S. is diagnosed with cancer. – That’s more than 3, 400 people per day! – 1 in 2 males and 1 in 3 females will develop some sort of cancer in their lifetime. – In the last 10 years the survival rates have gone up over 30%. § 70% of families that have a member diagnosed with cancer will use up all or most of their life savings.

Important Statistics § Heart Attacks & Strokes – Every 16 seconds someone in the U. S. has a coronary event. – That’s more than 5, 600 people per day! – In the last 10 years survival rates have gone up over 20%. § Cancer – Every 24 seconds someone in the U. S. is diagnosed with cancer. – That’s more than 3, 400 people per day! – 1 in 2 males and 1 in 3 females will develop some sort of cancer in their lifetime. – In the last 10 years the survival rates have gone up over 30%. § 70% of families that have a member diagnosed with cancer will use up all or most of their life savings.

Your Financial Risk § Critical Illnesses like Heart Attack, Stroke and Cancer are very prevalent. § More people than ever before are “physically” surviving these illnesses. § Many families will not survive “financially” if they are stricken with a critical illness. § How would you pay for: – Deductible and co-insurance? – Uncovered medical expenses? – Expenses for experimental treatment? – Travel expenses? – Child care expenses? – Lost income for patient and/or spouse?

Your Financial Risk § Critical Illnesses like Heart Attack, Stroke and Cancer are very prevalent. § More people than ever before are “physically” surviving these illnesses. § Many families will not survive “financially” if they are stricken with a critical illness. § How would you pay for: – Deductible and co-insurance? – Uncovered medical expenses? – Expenses for experimental treatment? – Travel expenses? – Child care expenses? – Lost income for patient and/or spouse?

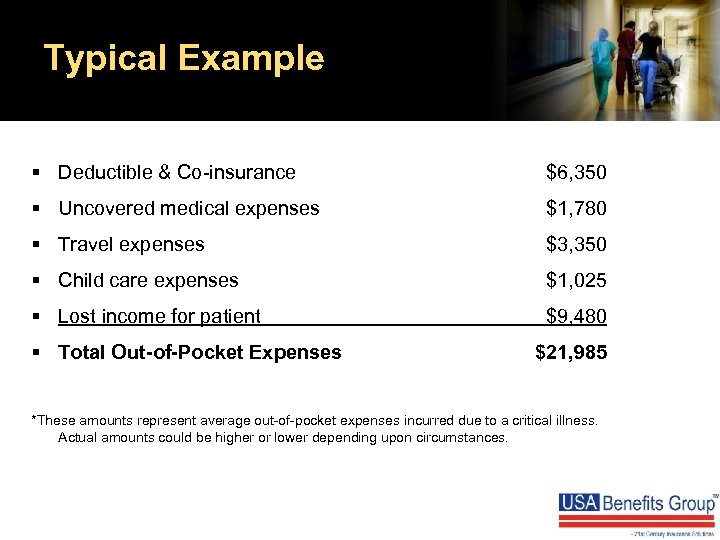

Typical Example § Deductible & Co-insurance $6, 350 § Uncovered medical expenses $1, 780 § Travel expenses $3, 350 § Child care expenses $1, 025 § Lost income for patient $9, 480 § Total Out-of-Pocket Expenses $21, 985 *These amounts represent average out-of-pocket expenses incurred due to a critical illness. Actual amounts could be higher or lower depending upon circumstances.

Typical Example § Deductible & Co-insurance $6, 350 § Uncovered medical expenses $1, 780 § Travel expenses $3, 350 § Child care expenses $1, 025 § Lost income for patient $9, 480 § Total Out-of-Pocket Expenses $21, 985 *These amounts represent average out-of-pocket expenses incurred due to a critical illness. Actual amounts could be higher or lower depending upon circumstances.

Statistics About Accidental Injuries § There is an accident every minute in the U. S. that requires ER treatment. § There are 2 million hospital stays per year resulting from accidents. § There are 30 million ER visits per year and an additional 30 million doctor’s visits due to accidents in the U. S. § Accidents are an additional threat to your family’s financial well being.

Statistics About Accidental Injuries § There is an accident every minute in the U. S. that requires ER treatment. § There are 2 million hospital stays per year resulting from accidents. § There are 30 million ER visits per year and an additional 30 million doctor’s visits due to accidents in the U. S. § Accidents are an additional threat to your family’s financial well being.

Bottom Line § Even the best major medical policy can still leave large out-of-pocket medical expenses that you are responsible for. § You can also incur additional non-medical or “indirect” expenses associated with a critical illness or an accidental injury. § You may want to consider protecting you and your family against these potential expenses. § The best time to think about your family’s protection is now because once a critical illness or accident occurs it will be too late.

Bottom Line § Even the best major medical policy can still leave large out-of-pocket medical expenses that you are responsible for. § You can also incur additional non-medical or “indirect” expenses associated with a critical illness or an accidental injury. § You may want to consider protecting you and your family against these potential expenses. § The best time to think about your family’s protection is now because once a critical illness or accident occurs it will be too late.

There are 2 options available § Standard Protection – Includes only a health insurance plan § Total Protection Plan – In addition to the health insurance plan it includes coverage that pays a large lump sum cash payment in the event of a critical illness and provides supplemental accidental coverage – This option also includes a life insurance death benefit for your family!

There are 2 options available § Standard Protection – Includes only a health insurance plan § Total Protection Plan – In addition to the health insurance plan it includes coverage that pays a large lump sum cash payment in the event of a critical illness and provides supplemental accidental coverage – This option also includes a life insurance death benefit for your family!

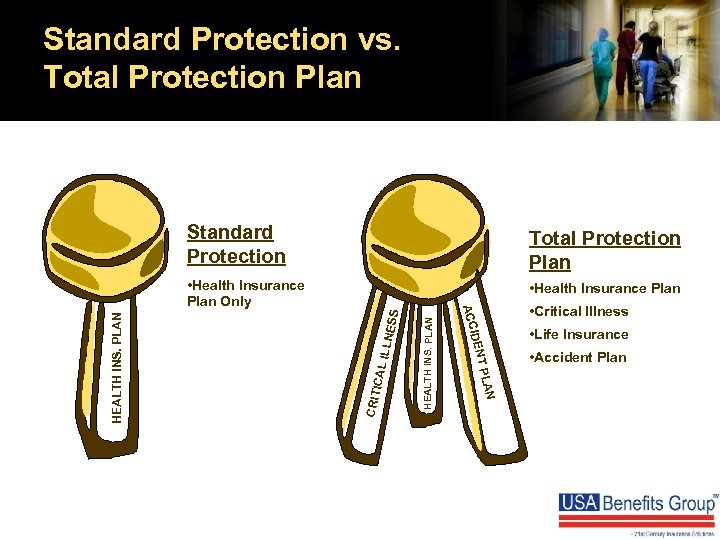

Standard Protection vs. Total Protection Plan ILLNE CRIT ICAL AN HEALTH INS. PLAN • Health Insurance Plan SS • Health Insurance Plan Only HEALTH INS. PLAN Total Protection Plan T PL IDEN ACC Standard Protection • Critical Illness • Life Insurance • Accident Plan

Standard Protection vs. Total Protection Plan ILLNE CRIT ICAL AN HEALTH INS. PLAN • Health Insurance Plan SS • Health Insurance Plan Only HEALTH INS. PLAN Total Protection Plan T PL IDEN ACC Standard Protection • Critical Illness • Life Insurance • Accident Plan

Conclusion § Let’s take a look at the 2 options so you can decide which makes most sense for you and your family. Total Protection Worksheet

Conclusion § Let’s take a look at the 2 options so you can decide which makes most sense for you and your family. Total Protection Worksheet