2nd_wave_of_World_Financial_Crisis.pptx

- Количество слайдов: 13

2 nd wave of World Financial Crisis. What, where, when? Moscow State University Department of economics Gordeev V. Komarov K. Nikiforov I. Moscow, 2012

2 nd wave of World Financial Crisis. What, where, when? Moscow State University Department of economics Gordeev V. Komarov K. Nikiforov I. Moscow, 2012

INTRODUCTION • The world economy is still recovering from the severe meltdown in 2008. • European debt crisis. • US dept crisis. • Dramatic political changes in the Middle East and North Africa.

INTRODUCTION • The world economy is still recovering from the severe meltdown in 2008. • European debt crisis. • US dept crisis. • Dramatic political changes in the Middle East and North Africa.

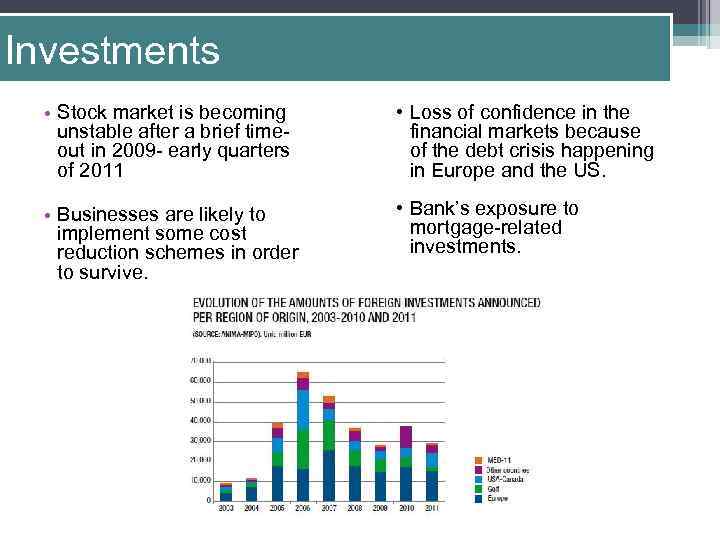

Investments • Stock market is becoming unstable after a brief timeout in 2009 - early quarters of 2011 • Loss of confidence in the financial markets because of the debt crisis happening in Europe and the US. • Businesses are likely to implement some cost reduction schemes in order to survive. • Bank’s exposure to mortgage-related investments.

Investments • Stock market is becoming unstable after a brief timeout in 2009 - early quarters of 2011 • Loss of confidence in the financial markets because of the debt crisis happening in Europe and the US. • Businesses are likely to implement some cost reduction schemes in order to survive. • Bank’s exposure to mortgage-related investments.

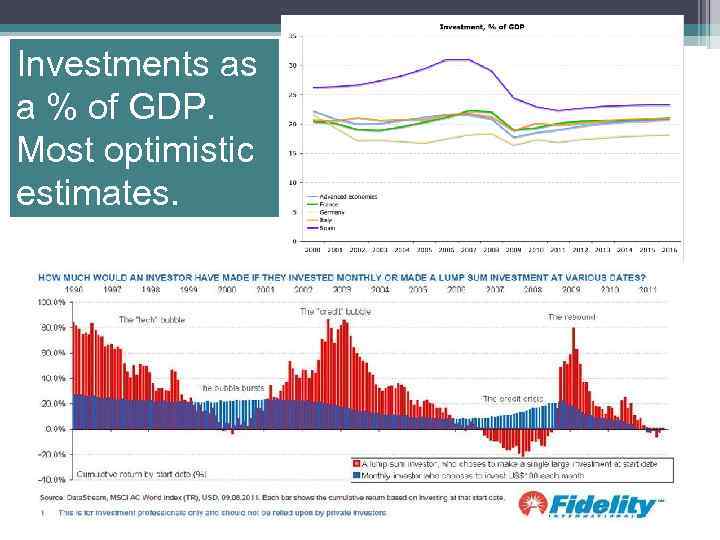

Investments as a % of GDP. Most optimistic estimates.

Investments as a % of GDP. Most optimistic estimates.

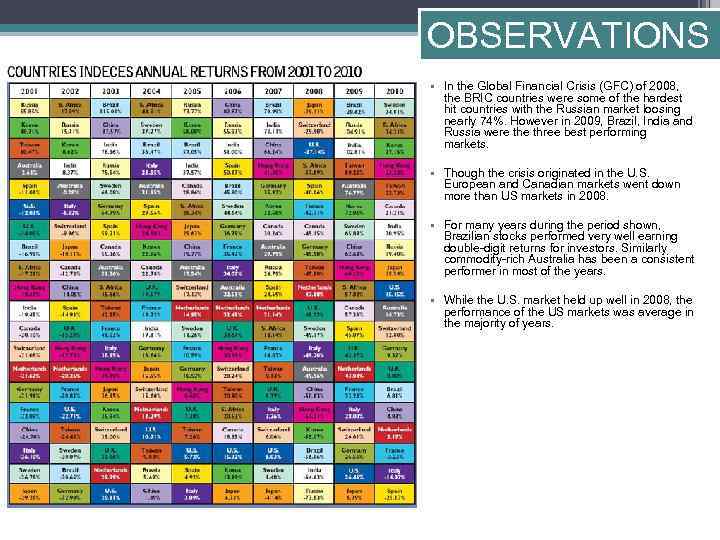

OBSERVATIONS : • In the Global Financial Crisis (GFC) of 2008, the BRIC countries were some of the hardest hit countries with the Russian market loosing nearly 74%. However in 2009, Brazil, India and Russia were three best performing markets. • Though the crisis originated in the U. S. European and Canadian markets went down more than US markets in 2008. • For many years during the period shown, Brazilian stocks performed very well earning double-digit returns for investors. Similarly commodity-rich Australia has been a consistent performer in most of the years. • While the U. S. market held up well in 2008, the performance of the US markets was average in the majority of years.

OBSERVATIONS : • In the Global Financial Crisis (GFC) of 2008, the BRIC countries were some of the hardest hit countries with the Russian market loosing nearly 74%. However in 2009, Brazil, India and Russia were three best performing markets. • Though the crisis originated in the U. S. European and Canadian markets went down more than US markets in 2008. • For many years during the period shown, Brazilian stocks performed very well earning double-digit returns for investors. Similarly commodity-rich Australia has been a consistent performer in most of the years. • While the U. S. market held up well in 2008, the performance of the US markets was average in the majority of years.

Currency • One of the • Currency crisis can dangerous problems be transmitted with currency crisis through real sector, is that they used to trade, capital flows, be so-called “a twin that influence crisis” exchange rate • Currency problems usually accompany debt, liquidity and stock-market crisis • There is a possibility of creating a new international reserve currency

Currency • One of the • Currency crisis can dangerous problems be transmitted with currency crisis through real sector, is that they used to trade, capital flows, be so-called “a twin that influence crisis” exchange rate • Currency problems usually accompany debt, liquidity and stock-market crisis • There is a possibility of creating a new international reserve currency

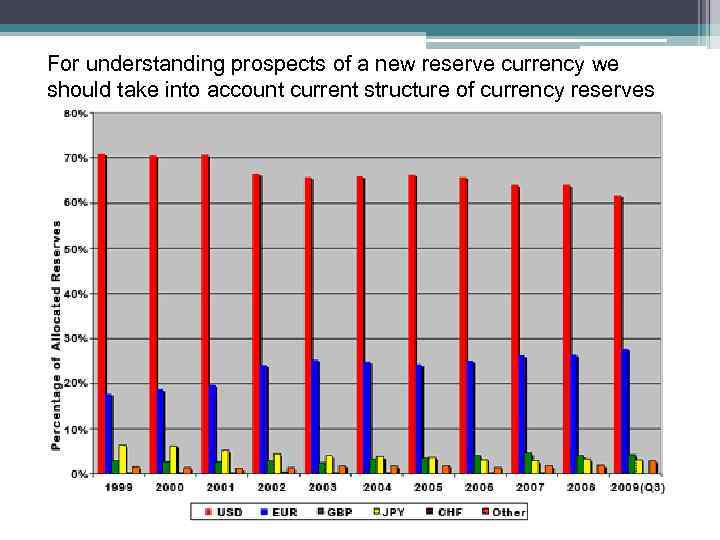

For understanding prospects of a new reserve currency we should take into account current structure of currency reserves

For understanding prospects of a new reserve currency we should take into account current structure of currency reserves

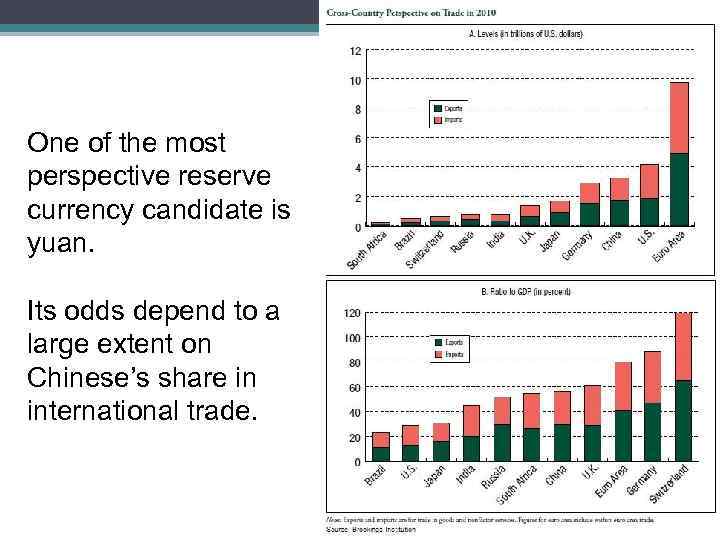

One of the most perspective reserve currency candidate is yuan. Its odds depend to a large extent on Chinese’s share in international trade.

One of the most perspective reserve currency candidate is yuan. Its odds depend to a large extent on Chinese’s share in international trade.

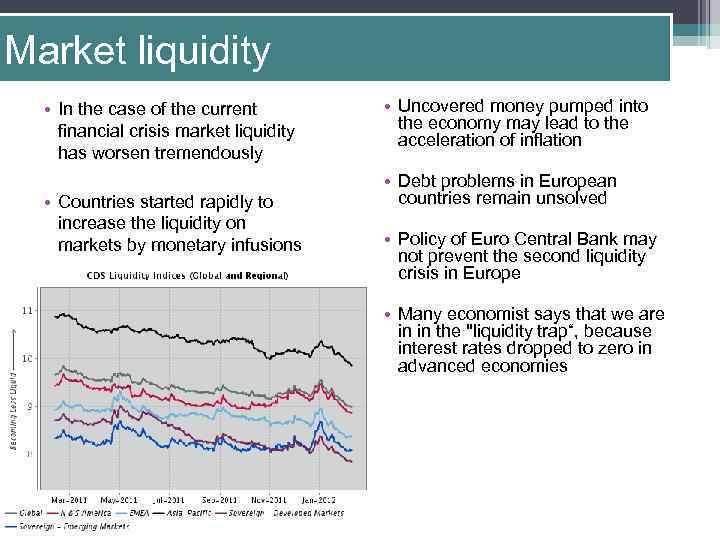

Market liquidity • In the case of the current financial crisis market liquidity has worsen tremendously • Countries started rapidly to increase the liquidity on markets by monetary infusions • Uncovered money pumped into the economy may lead to the acceleration of inflation • Debt problems in European countries remain unsolved • Policy of Euro Central Bank may not prevent the second liquidity crisis in Europe • Many economist says that we are in in the "liquidity trap“, because interest rates dropped to zero in advanced economies

Market liquidity • In the case of the current financial crisis market liquidity has worsen tremendously • Countries started rapidly to increase the liquidity on markets by monetary infusions • Uncovered money pumped into the economy may lead to the acceleration of inflation • Debt problems in European countries remain unsolved • Policy of Euro Central Bank may not prevent the second liquidity crisis in Europe • Many economist says that we are in in the "liquidity trap“, because interest rates dropped to zero in advanced economies

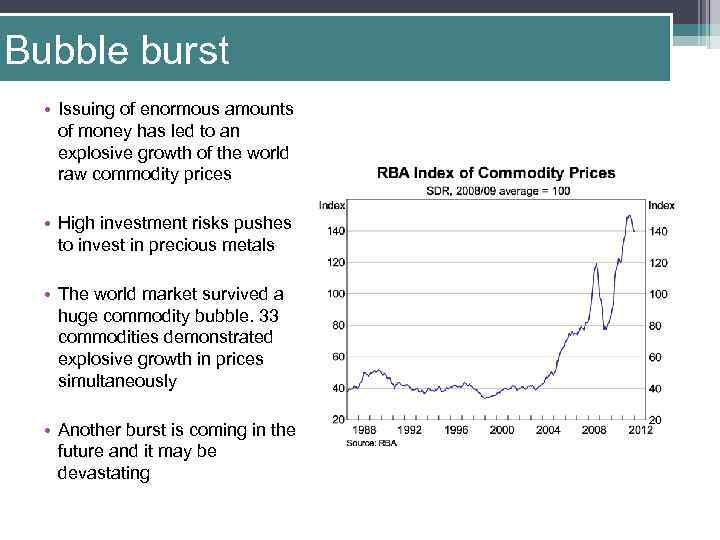

Bubble burst • Issuing of enormous amounts of money has led to an explosive growth of the world raw commodity prices • High investment risks pushes to invest in precious metals • The world market survived a huge commodity bubble. 33 commodities demonstrated explosive growth in prices simultaneously • Another burst is coming in the future and it may be devastating

Bubble burst • Issuing of enormous amounts of money has led to an explosive growth of the world raw commodity prices • High investment risks pushes to invest in precious metals • The world market survived a huge commodity bubble. 33 commodities demonstrated explosive growth in prices simultaneously • Another burst is coming in the future and it may be devastating

Summary • BRIC countries are more likely to pull the world economy up from the future recession and therefore will dictate the new rules. • The investment portion in GDP of many economies is shrinking once again which will lead to amplification of the global imbalances soon. • There is a strong probability that euro and US dollar will lose caste and new reserve currency will appear • One of the most menacing threat is that the second liquidity crisis is coming from the Europe now • The commodity bubble’s burst is likely to happen in the nearest future which could trigger another wave of the global economic crisis just like the US mortgage crisis in 2008.

Summary • BRIC countries are more likely to pull the world economy up from the future recession and therefore will dictate the new rules. • The investment portion in GDP of many economies is shrinking once again which will lead to amplification of the global imbalances soon. • There is a strong probability that euro and US dollar will lose caste and new reserve currency will appear • One of the most menacing threat is that the second liquidity crisis is coming from the Europe now • The commodity bubble’s burst is likely to happen in the nearest future which could trigger another wave of the global economic crisis just like the US mortgage crisis in 2008.

Thank you for your attention.

Thank you for your attention.